Abstract

The first part of the paper provides an analysis of different business ownership structures that can be used for starting a business with the joint contribution of capital for two partners. The differentiation between a public organization and a partnership that was selected as an organization type for new business is provided. The second part is dedicated to the analytical discussion of the notions of marginal utility and the law of diminishing marginal utility. The discussion of the term Price Elasticity of Demand is given and its examples are provided.

Introduction

Starting a business is usually a challenging intervention. The partners have to be careful when choosing the type of organization for the future company. Such forms of business ownership structures as the sole proprietorship, partnership, and corporations are the most frequent at present. However, it is important to consider advantages and disadvantages of each type before the final decision. Moreover, it is necessary to make a distinction between business and public organizations because they have different objectives. Also, people who start business should be aware of some key economic concepts such as marginal utility and price elasticity of demand. Knowledge and appropriate application of these concepts will help to manage the business and determine proper objectives of the company.

Suitable Type of Organization

The most common forms of business ownership structures are the sole proprietorship, partnership, and corporations. Other less common examples are trust, non-profit organizations, and joint ventures among others. These organizations differ in structure, the number of owners, formality requirements, the liability of the owners, and ease of attribute formations. For instance, a sole proprietorship is owned by one person. The business is easy to set up and less costly as compared to the others. A company is a separate legal entity that is not specifically attached to its owners. In addition, ownership in a stock entity is symbolized by shares of stock. A limited company has a legal life of its own. It can enter into contracts and own properties. A limited company can either be private or public. A private limited company is a small business, which shares are not traded on a stock exchange market. On the other hand, a public limited company is a large entity, which shares are transacted on a stock exchange market (Goyal & Goyal 2013). Out of the three most common business structures, the most suitable form of business organization for Becky and Becker is a partnership.

A partnership is made up of two or more people who agree to raise capital, skills, and labor in order to start a business. The partners also share losses, profit, and the management of the enterprise. The partners often decide on profit/loss sharing ratios, management rights, and personal liability at the commencement of the venture. However, they vary depending on the type of partnership. The three most common types of partnership are general, limited, and limited liability partnership. Under a general partnership, all the partners share equal right and responsibilities that relate to the management of the business. The partners also assume full responsibility for the debts and obligations of the enterprise. There are no taxes calculated for the company because they are shared among the partners. In the case of a limited partnership, the personal liability of a partner is restricted to the amount of investment they have made in the business. This benefit is not for all partners. There must be at least one general partner. Apart from taking the full personal liability for the debts and obligations, they also retain the right to control the company. In a limited liability partnership, the partners enjoy personal liability protection. Thus, they will not be liable for the wrongful acts of other partners and obligations of the company. This form of partnership also enjoys tax advantages (Horner 2013).

Advantages and Disadvantages of Partnership

The first advantage of a partnership business is the ability to raise a large amount of capital than a sole proprietorship because there are many partners. Secondly, there is no double taxation as in the case of corporations. Only the partners are taxed and not the company. Thirdly, the partnership has minimal tax filings as compared to companies. Also, if there are numerous general partners, the business may benefit from a wide variety of skill sets, thus improving performance, unlike the case of a sole proprietorship. Another advantage is that the enterprise is easy to set up and it requires fewer formalities as compared to corporations. A disadvantage of a partnership is that the general partners have unlimited personal liability. This implies that a creditor can pursue a general partner for the amounts due. Secondly, the business may collapse in the event that the partners disagree. Thirdly, each partner is liable for the actions of other partners. This implies that the wrongs that are committed by one partner will be borne by the other partners (Shapiro & Moles 2014).

Differences between Public Organizations and Partnership

A public organization differs from a partnership in various aspects. First, the main objective of a public organization is to serve the citizens. Therefore, it is service oriented. On the other hand, the main motive of a partnership business is to maximize profit. Secondly, the profit that is earned in a public organization is invested back into the business. Thus, profit is not shared. In the case of a partnership, the profit is distributed among the partners. The probability of investing the profit back in the business is low because of the arrangement of capital contribution. The two organizations also differ on the risks that are taken by the owners. In a partnership, the general partners do not have limited liability. Therefore, they are expected to take full responsibility for the debts and obligations of the business. This does apply in the case of a public organization. Another difference is the ways through which the companies raise funds. Public organizations raise capital through government grants, public contribution, and public revenues. In a partnership enterprise, capital is raised through contributions by the partners and borrowing from financial institutions among others. Further, the ratio of sharing profits in a partnership is based on the capital contribution. This does not apply in the case of a public organization (Warren, Reeve & Duchac 2013).

Marginal Utility

The marginal utility comes from the customers being satisfied with purchasing one or several items or services of superior quality. Satisfaction also comes in the form of utility, when the customer finds the performance of an item or a service as worthy of praise. Positive margin utility arises if the consumption of an extra unit of a commodity leads to an increase in total utility. On the other hand, negative marginal utility arises if consumption of extra units reduces the total utility. Marginal utility is best measured when the good or service is consumed at regular intervals (Bade & Parkin 2014). This makes it possible to measure the level of satisfaction when additional units of a product are consumed. It is worth mentioning that utility is the usefulness of a commodity. However, in economic utility, the usefulness is not quality. For instance, essential goods such as water may not have much utility for a majority of the people. However, non-essential goods such as gold and diamond have abundant utility for a section of the population (Bade & Parkin 2014).

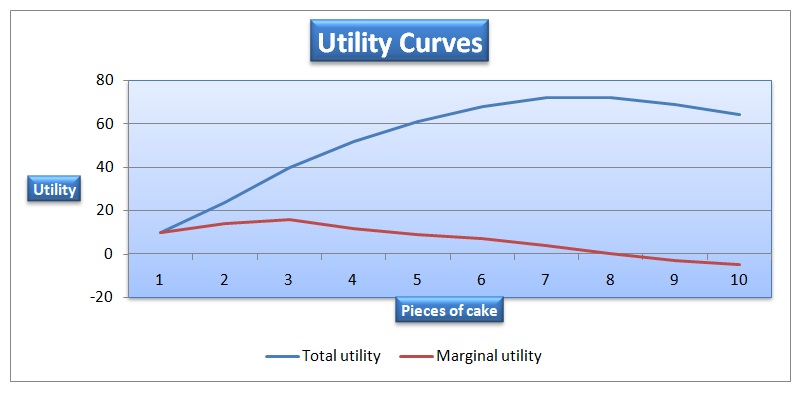

Marginal utility is calculated through the division of a change in total utility by a change in quantity consumed (Bade & Parkin 2014). The table presented below shows an example of how total and marginal utility change when additional units of cake are consumed.

In the table above, it can be observed that as the customer consumes additional units of cake, the total utility increases from 10 to 68, and reaches a maximum of 72. Thereafter, it starts to drop. The marginal utility increases and reaches its maximum at 16. Then, it starts to decline until 0. Thereafter, it turns negative. This resonates with the law of diminishing marginal utility, according to which it declines faster if the product or service is consumed on a regular basis, as high quality becomes the new standard for the customer. It can also be observed that as long as the total utility is increasing the marginal utility is positive. When the total utility is declining, the marginal utility becomes egative. The graph presented below shows the utility curves.

In the graph, the total utility is increasing at an increasing rate, then at a decreasing rate, and it starts to decline. The marginal utility is increasing, starts to decline, and then turns negative.

Price Elasticity of Demand

Price elasticity of demand is an estimate of the association between a change in the quantity demanded for a specific product and changes in its price. Thus, it shows the sensitivity of changes in the quantity demanded when the price of the commodity changes, while holding other factors that affect demand constant. The formula price elasticity of demand is calculated by dividing the difference between the percentages in the demanded quantity of the products by percentage change in price. If the estimated price elasticity of demand is 1, then it is called unitary elasticity. This implies that a unit change in price leads to a unit change in quantity demanded. In the case of an inelastic demand, the coefficient of elasticity is less than 1. This implies that if the price changes by one unit, then the quantity demanded will change by less than one unit. Finally, elastic demand is a scenario where if the price changes by one unit, then the quantity demanded will change by more than one unit (Moon 2013).

The concept of price elasticity of demand is used by businesses in a number of ways. First, the concept helps companies understand the internal operations and the products. The concept helps companies to understand how the market will respond to price fluctuations. If a company understands how the consumers will respond to changes in demand when prices vary, then it will be in a better position to minimize risks and uncertainties. The concept also helps businesses in sales forecasting and setting prices. Further, the price elasticity of demand can also help companies to come up with non-pricing policies such as advertising and promotional activities (Bade & Parkin 2014). An example of how price elasticity of demand is applied in real life is the case of Uber Company. The company makes use of surge pricing. For instance, during peak hours, the demand is less sensitive to price changes. Therefore, the company raises the average fare on their app during these hours because demand is less responsive to price. Consider a scenario where a company is making suitcases that target tourists decided to increase its price by 10%. As a consequence, the sales have dropped by 30%. The calculation of price elasticity is presented below.

Coefficient of price elasticity = % change in quantity demanded / % change in price = -30% / +10% = -3%

The value is greater than 1. This implies that the demand for suitcases is elastic. The increase in price will cause a decline in revenue.

Conclusion

On the whole, any business intervention should be preceded with a thorough preparatory work. It is crucial to consider both benefits and the possible disadvantages of the selected company type. Different business ideas can be realized through various forms of business ownership structures. Moreover, some basic economic knowledge can be useful to plan the activity of the company and assess its achievements to provide the sustainable development.

Reference List

Bade, R & Parkin, M 2014, Essential foundations of economics, Pearson Education, New York, NY.

Goyal, V & Goyal, R 2013, Financial accounting, PHI Learning Private Limited, New Delhi.

Horner, D 2013, Accounting for non-accountants, Kogan Page Limited, Philadelphia, PA.

Moon, M 2013, Demand and supply integration: the key to world-class demand forecasting, Pearson Education Inc., New York, NY.

Shapiro, A & Moles, P 2014, International financial management, John Wiley & Sons, Limited, New Jersey, NJ.

Warren, C, Reeve, J & Duchac, J 2013, Financial and management accounting, Cengage Learning, Boston.