Foreword

Analysis of family businesses, as well as research into issues that may not only be unique to the family business concept such as diversification, succession and corporate governance, to name a few is not a new practice, but rather a well established practice from both, an academic as well as a practical perspective. Within this study, the main aim is to establish the effect of previously mentioned processes with specific emphasis upon diversification in the family businesses, as well as the resulting effect or effects, brought about by such strategic decision making and diversification processes.

A combination of primary and secondary research helped assessing these effects, as well as the consequences whether based on a positive or negative outcome, in addition to the various findings or inactions that were brought about by the primary research sampling, on the managerial level and the strategic direction of the companies concerned.

Based upon the fact that a family business concept is quite often a private or closely held affair, market research proves to be somewhat difficult in obtaining adequate contribution and clear responses in certain areas. However, the sampling within the primary research data is deemed to be sufficient in establishing an overall commonality or differences where applicable.

Specific issues pertaining to the sampling laid out according to the findings, with the summary providing an insight into lessons learned from the diversification process, as well as processes that become necessary on a post-diversification basis, have had to be implemented by the companies concerned to ensure continuity, succession, governance and adherence to the legal and operational frameworks where applicable.

Executive Summary

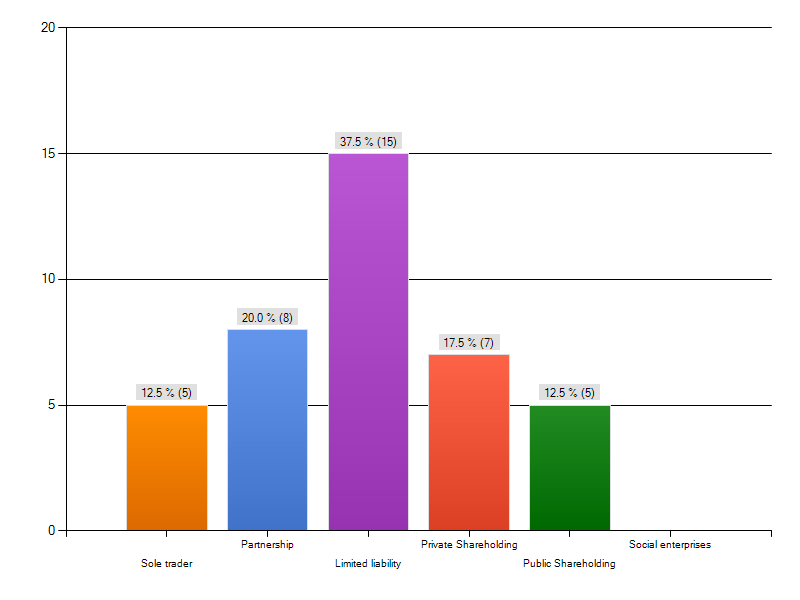

The rationale of the study was to analyze how does the decision to diversify family businesses impact the long-standing family business, providing the current formation/structure of the business from a legal perspective, as well as thoughts and impressions of the business ownership to the process of diversification, based upon the overall negative or positive result of pursuing such strategic decisions.

Although an average market response was received, the size and response of the sampling is sufficient to establish a certain median within the questions posed, and in turn, displaying sufficient results and patterns.

On the basis of post-analysis, a number of interesting issues surfaced which could have been included within the primary data collection phase, such as that of succession. However, a significant amount of research has already been conducted on this topic and is expanded upon both in the secondary data discussion, as well as the lessons learned, which can, furthermore, be stressed and considered by family businesses in their planning, not only for continuity but to achieve sustainability as well. These issues are further investigated by that of corporate governance or the lack thereof, of which is highlighted within the document in hand.

Hypothesis Statement

What are the effects of the previously mentioned processes with specific emphasis upon diversification in family businesses and the effects due to the strategic decision making and diversification processes?

Tools Used in Research

For this study, a web based survey has been designed using Survey Monkey. Survey Monkey helps not only in designing a survey with multiple options, but it also allows the user to send the survey to respondents by email. User can also publish the designed survey on networking sites like Facebook, etc. Another good feature offered by Survey Monkey is the result evaluation by the mean of graphical presentation and charts. These features helped a lot in evaluating survey results in the best possible way.

Introduction

This study involves analysis of family businesses, as well as the research over the issues that may not only be unique to the family business concept such as diversification, succession and corporate governance. Investigation not only involves the academic aspect of the topic but would also explore the practical perspective of the same. This study aims to establish the effects of previously mentioned processes with specific emphasis upon the diversification in family businesses, as well as the resulting effect or effects of the strategic decision making and the diversification processes.

The research side of this paper involves both, the primary and secondary data so that the effects of research and its implementation are assessed in the best possible way. This study also involves analysis of the consequences for the companies to rectify the managerial level and strategic direction of the companies concerned.

Literature Review

This section of the dissertation involves review of several term papers, researches, articles and journal, etc. As discussed above, this study involves primary and secondary data. Primary data is the unprocessed data, obtained via research. While secondary data is processed data, this could be a term paper, dissertation, article, journal, blog or any other piece of work that is written by someone and is based on some research. Methodology of any study involves two main sections. The first one is the literature review while the other one is the real research.

Summary of the Secondary Data

Secondary data of this study involves the relevant literature that is obtained and accessed via published journal articles, books and other available media items. All papers that have been utilized in this study are not only relevant to the diversification process and its impact upon the family business, but also to numerous other factors that come into play, as the business progresses in the form of growth, expansion, as well as the resource management and ultimate issues that affect the continuity of the business, which is somewhat more prevalent within the family business circumstances.

Additional factors that also engage a role within the business itself is the family relationship dynamic and how these dynamics play out within a business environment, whereby the family members may or may not associate their familial relationships within the business environment.

These factors are mostly discussed and investigated in the analysis, however, the literature has been analyzed with certain elements and conditions that came into light which require further exploration as they play a role within the specifics of the family owned and or controlled businesses under scrutiny.

Additional research possibilities and opportunities exist albeit on a secondary basis, via the internet, as well as published sources. The information that is highlighted here is selected in accordance with boundaries of the diversification process and the impact upon a family owned company, more importantly on well established family businesses, as per the research subject matter. One has to furthermore bear in mind that the family business is subject to additional “phenomena”, that may not be relevant to other companies, such as succession strategies, as well as the handling of internal family affairs and the resulting benefits or disadvantages thereof.

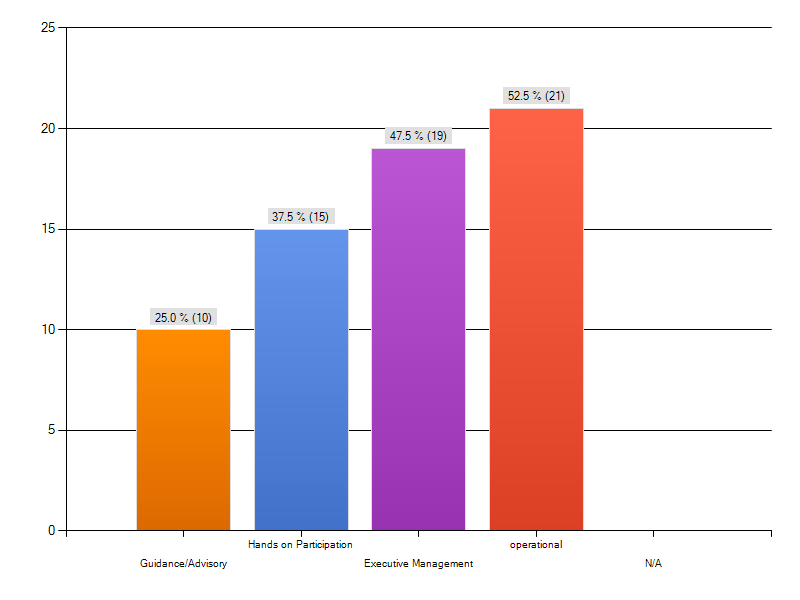

A number of statistics regarding the family business are well worth mentioning here, in order that one may gain an understanding of the large contribution that family businesses across the world actually provide within their respective locations. With respect to the additional research into the family business or organization, the family owned and controlled businesses are in fact the predominant form of business within the United States, yet a remarkably low level of research into these entities has been conducted, and furthermore, the authors claim that the ownership and management of the firms are widely separated (Phan & Butler 2008), which as revealed within the primary market research is not the case. The respondents within the study revealed that some sort of involvement whether via management or leadership had continued within the organization in one form or another.

A Look at “The Top One Hundred Oldest Family Businesses”

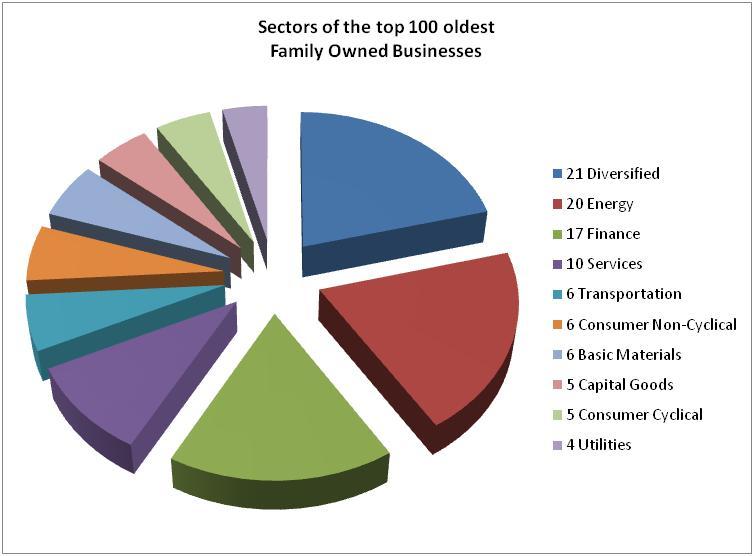

A closer look at the family business reveals that many companies that are now publicly listed may well have started off as a family business. O’Hara provides in his analysis of the top one hundred oldest family businesses, a variety of geographically located companies that operate in just diverse sectors and fields. In terms of these companies many internationally recognized brands and names are represented, the likes of which include that of Reidel Glassmakers, Villeroy & Boch, Taittanger, and Antinori. Interestingly, analysis of the descriptions of the companies as well as their development reveals that many of these companies underwent some sort of diversification from product offering expansion, to geographical diversification to that of mergers and acquisitions, to create companies that are established in modern day economies. A brief analysis of O’Hara’s data and research is pertinent due to the relevancy of the topic at hand; it further provides an insight into the international viewpoint of the family business as well as location and subsequent developments of these very old family owned businesses (O’Hara n.d).

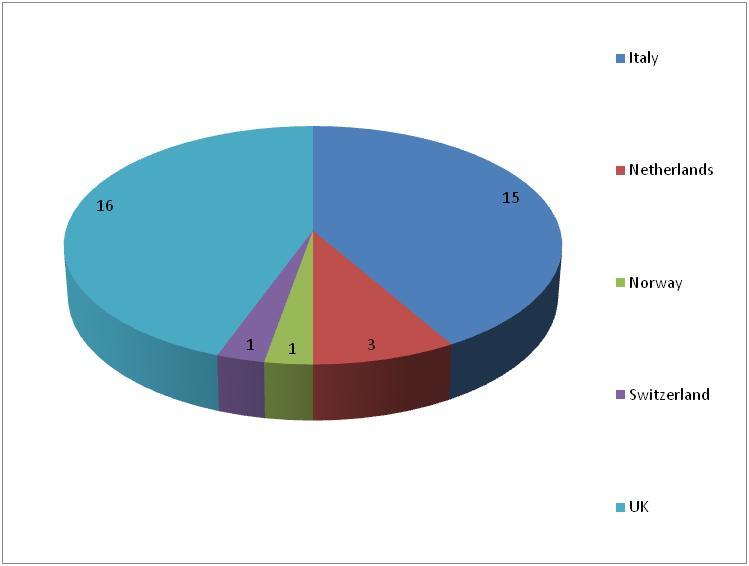

The geographic dispersion of these companies is interesting as one will realize a trend in countries which have the most representation of these companies. The illustration below reflects the geo-location, by country of some of the world’s oldest family owned companies.

The top position in terms of location is jointly held at Sixteen percent of the top one hundred, and represented by France, the United Kingdom and the United States, which are each represented by sixteen companies each. The fourth and fifth countries in terms of representation within the data are those of Italy and Germany, making up fifteen and fourteen percent or companies respectively. Hence the top five countries, in terms of the world’s top one hundred oldest family businesses make up no less than seventy seven percent of the top one hundred.

The average age of the top one hundred oldest family businesses is calculated at 383.1 years old, of which only 32% of the companies is in fact older than that median. The oldest known family business is one thousand four hundred and 31 years old, and remains within their core business of construction to this very day. The business is currently run by the fortieth generation, with involvement of later generations currently working within the company.

In terms of analyzing these companies who have or have not undergone some sort of diversification over long histories, it reveals that 31 percent of the selection has undergone a process or strategy decision that meets with the broader definition of diversification. The figure below represents the makeup of the percentages of the companies which have undergone such strategic processes.

What the above figure may reveal is that a non diversification strategy may well provide the basis for longevity of the company concerned, as the proof lies literally within the figures represented above. This may be seen as those companies retaining focus have survived both issues of market and economy volatility as well as the issues of succession, which play a vital role within family business. In the case of the remaining thirty one percent that have revealed some sort of diversification, include the processes of acquisitions, mergers, product line expansion as well as complete product differentiation into different sectors completely. Although the complete diversification out of their core business area and expertise was limited to less than five percent of the entire top one hundred list, which was represented by companies leaving a specific sector and entering into a completely new sector.

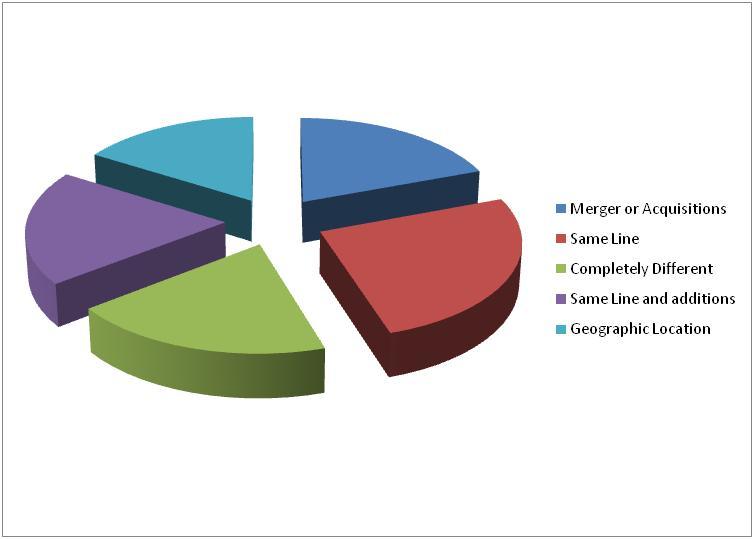

In terms of the analysis of the actual diversification process, and whether the business remained within their core business activities, compared to that of mergers and geo-location and so forth the following figure represents a breakdown of the variety of diversification decisions.

The areas into which the companies chose to diversify in terms of the above named classifications were led by that of diversifying within the same line via product expansion or service offering within the original core business activities, represented by no less than 25,81% of the analyzed 31% of top one hundred oldest family owned companies. The merger/acquisition, complete different activity and same line/with additions all shared the second top classification at 19.35% each, whilst the geographic location was the least represented process, at 16.13% or 5 companies of the thirty one diversifying companies analyzed.

Based on the fact that the companies chose to expand upon or diversify within their core business operations lead one to believe that this may well be the most popular choice within this specific data. However, as will be revealed by specific authors, this follows the academic thought of remaining within the company’s core business activity to ensure success within the diversification process. However, the fact that a large majority of the analyzed data here, shared by the second position in terms of diversification processes or options, leads one to believe that this practice in all intensive purposes negates the writings and thoughts of authors, as per a saying, “innovative efforts that take the existing business out of its own field are rarely successful” (Druker 1985, p. 160); and by considering the data above and as per the Appendices attached, the proof lies in proven ability of these top one hundred oldest family companies proving this may be challenged and is not necessarily as accurate as one might be led to believe.

Although the oldest company to have elected the strategic diversification, only did so in 1936, in which instance, they elected to merge with a competing company. At that time, the company concerned, being that of Baroviers, had attained the age of six hundred and 41 years old. The merger took place between two families, being the Barovier and the Toso families, in Italy, to create the Barovier & Taso who are the creators of magnificent glass products and decorative pieces. Though, this could be seen as diversification within the same business sector the most notable of these top one hundred companies and specifically those that have diversified might be the Italian company of Torrini Firenze which diversified from an armory or armor producer to that of a goldsmith. One of the most diverse companies that are well worth mentioning is that of John Brooke & Sons, which is now four hundred and sixty eight years old, and having started in the fabric business is now currently involved entrepreneurial development, something of a far cry from their founding activities.

The basis for analysis of these figures was to provide an insight into what one might view as the very long standing business, highlighting the diversified companies versus those that did not diversify, and whilst the majority did not elect to take this route, all of these companies are still in operation.

Considering the various academic views of diversification, such as that of Drucker (1985) who claim that broad diversification may lead to an unfocused business model that may well not ensure success to the business concerned, one has to consider the research presented here, in that respect, quite a few of the respondents diversified outside their core business interests, and yet achieved success and what appears to be sustainability based upon the average age of the business (Chandler 2003). This fact taken in conjunction with the views of Rumelt in Strategy, structure, and economic performance (Rumelt 1974), who suggested that the “broadly diversified corporation was a superior strategy to being more focused” (Thomas, Pettigrew & Whittington 2000, p. 79), who further stated that from a financial perspective.

The more closely diversified business, displayed higher profitability (Thomas, Pettigrew & Whittington 2000, p. 80). These views are essentially contradictory, yet the factual results, as presented within the study, reveal that the element of both financial performance, as well as business survival, within the sampling was achieved in both the closely and wider diversified businesses analyzed. Moores & Barrett provide that the diversification concern is in fact one of the most important strategies or part thereof within a company’s development (Moores & Barrett 2002, p. 158). And furthermore, will lead to increase participation by management, in this case mostly family members, in budgetary control and preparation (Moores & Barrett 2002, p. 100).

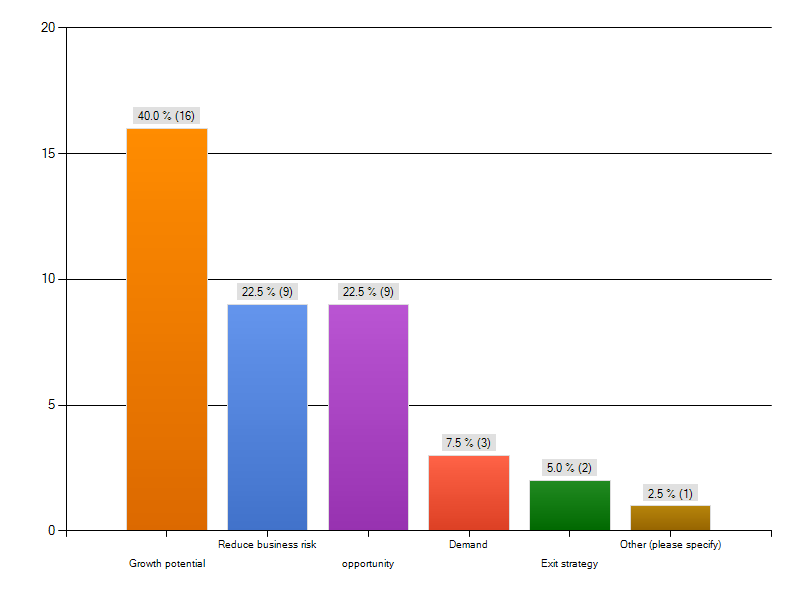

The larger proportion of the sampling further states that their initial decisions regarding the diversification was based on opportunities that were available within the marketplace at the time, with many taking advantage of such opportunity to contribute more towards the company and the family’s revenue streams at the time.

Academic theory inclusively related to the writings of the authors mentioned above seems to be somewhat ambiguous. Their contradictory views are held with the diversification that it should be in a more focused or closer role in relation to the businesses core activities, in which it is claimed that higher profitability will ensue the closer such diversification is. However, from a strategic perspective, as stated above, it has been suggested that a wider diversification is in fact a superior strategy (Rumelt 1974). The sampling analyzed revealed that the majority of respondents pursue the wider diversification option, with those that diversified more closely also achieved success within their respective sectors. This is proven by the fact that companies surveyed are still in existence to this day, and continue with their diversified operations and most of the businesses are being controlled by the second generation already, some of which going on to the third even fourth generation involvement level. Therefore, provided the management strategies and leadership remain intact and suitable for the relevant business. It appears that success is not only achievable but, sustainable regardless of how closely or widely the business chooses to diversify within or outside their core business sector.

Diversification Process

According to Hess, the family and the business provide for an extremely dynamic environment, when operated together, in which the business and the family overlap, and based upon the fact that each is changing in its own right due to growth, or even within the instance of this analysis within the diversification process. The family dynamics make it in fact a lot more difficult to manage a family business, as compared to a non family business (Edward 2006, pp. 25-55). The result is that many issues are integrated into the business structure than would have been in a non family business environment, which creates the challenges and potential problems that come along with the family business management and subsequent analysis thereof. Hence regardless of whether or not the family business undergoes any diversification, one is forced to consider the familial factor that comes into play in the management of the business especially during times of change.

In analyzing diversification, there are two important trends in the diversification process, according to the significant historical events (Grant 2005). These events were seen as Post-War diversification and Post-1980s refocusing. The Post-War diversification process heralded an important phase within the corporate world and can be viewed as an “important source of corporate growth” across all sectors. Within this time, a period of significant decline in single business companies was revealed, whilst the number of diversified companies in both related and unrelated sectors increased steadily in a variety of geographical locations across the world, the 1960s and 1970s considered the height of the so-called diversification boom, which naturally led on to the post 1980s refocusing trend (Palmberg 2002, pp. 129-148). Many of the diversification processes came about due to an increase in that a variety of management techniques and processes, together with the newly found “science of management” which in all encouraged businesses to take on additional business units or divisions, which is nothing less than diversification.

The issue of growth of companies, rather than that of significant profitability was another contributing factor of this diversification trend (Palepu 1981, p. 19). But in the 1980s, the realization for the necessity of profitability became prevalent and although the diversification trend of the preceding decades slowed down significantly, but practice of acquisitions continued which meets with the definition of diversification, although according to Grant, this represented an unrelated diversification (Grant 2005, pp. 447-448). Considering the average age of the respondent companies surveyed, this period coincides with many of the companies’ strategic diversification efforts, and is further confirmed by many of the various sectors within which these businesses now operate, and are truly diverse as detailed.

The refocusing efforts of the 1980s as well as the resultant affects upon performance of the company (Cantwell, Gambardella & Granstrand 2004, p. 33). Their studies indicated that manufacturing productivity increased within the United States in this time, whilst analysis within the stock market returns of companies that had diversified, had revealed a positive growth within the stock returns and market sentiment of these companies, and more specific to the sampling within this study was that “other studies also show that internally controlled firms with large-block ownership by corporate insiders show a better performance” (Cantwell, Gambardella & Granstrand 2004, pp. 28-30). This correlates with the sampling within which those companies that had chosen to go the public listed company route, whilst retaining majority ownership and control would be viewed within this sector and would show positive market sentiment as described above.

As stated, the process of diversification is often a strategic decision within which the company stands to not only reduce their exposure to a specific market, but may consider such diversification as an additional form of revenue, which was clearly indicated by the researched and surveyed companies. The choice of which route to follow and how exactly to go about such diversification is arguably as diverse as the sectors within which the companies that were surveyed operate. Hess further provides that motivating factors behind the diversification process include that of consolidation of industry, market shrinkage or shareholders, or the company itself requiring additional capital for further expansion opportunities. These expansion opportunities may take the form of a variety of different strategies from investments, to acquisitions or mergers, geographical expansion or that of product line expansion. Although diversification process should, in fact, focus upon the addition of product lines within the business current area of expertise to maximize existing infrastructure and expertise within their field of operation, this will in effect avoid any dilution of any positive traits of the organization concerned (Chandler 2003).

Primary research indicated that although a small amount of respondents remain specifically within their niches, those that did remain there in sought to add value in their immediate supply chain; the balance of respondents diversified away from their core business, and in one specific instance even ceased to operate within their initial core business area. The precious studies imply that the diversifying business, going away from the original core activities will in all likelihood not succeed compared to those remaining close to their fields of expertise (Druker 1985). To the contrary, the research has revealed the opposite of be true, where companies diversified into a variety of specialized fields and continue to function to this very day. An individual, as with a closely held family business is in a vulnerable position without seeking out a diversification strategy (Jurinski & Zwick 2002).

However, in the face of volatility, as provided by Grant, should a business elect to diversify from such volatility to escape these market conditions, they would be foolish to believe that any business operates within an ideal world situation or environment. The strategies of the company concerned should rather be seen as a guidance of what the business wishes to achieve, as well as an aide in achieving those goals and objectives, whilst providing for sufficient preparation to face adversity, volatility and risk. The only guarantee that exists is that of the calculated risk of such product or geographical analysis and market research in planning for the diversification process and activities (Grant 2005, pp. 147-148). Hence the volatility issue does not really appear to be a feasible factor in the decision making process, but rather an informed acceptance and resultant exposure to the risk thereof that has the accompanying reward of the diversification strategy and implementation thereto associated.

From the perspective of geographical diversification, the company has the opportunity of alternative geo-targeting, in terms of existing product lines, as well as new product offerings, and the election of such a strategy will, furthermore, result in growth within the company itself (Channon 1999, p. 78). Hence, by venturing away from where the company originally started operation, the company stands to realize additional growth opportunities, by virtue of the increased size of the market being sought after. This does not ever take away from the added cost in terms of logistics that will be required to deliver such product to these new geographical locations, which needs to be analyzed prior to undertaking such a strategic direction. The company may seek to establish representation in the alternative geographic areas, which in all likelihood would represent a significant capital investment, realizing the issue of whether or not to seek internal or external funding or financing for such growth.

The geographic diversification is more often than not influenced by social and political factors that further need to be taken into account prior to undergoing such strategic processes. Regions that are influenced by religion may play a role in specific products, such as that of alcoholic beverages in predominantly Muslim countries as an example and would Therefore, require the specific analysis and investigation in terms the expansion into such a market that may be adversely affected thereby. Navarro provides that beyond the business unit diversification strategy, the geographical diversification strategy may not be solely motivated by that of any hedging initiative, but rather that of achieving greater economies of scale, whilst providing opportunity to “deploy core managerial and production skills across a broader range of opportunities” (Navarro 2006, p. 11), which in essence indicates the experience sought after by company leadership in providing to and dealing with alternative markets with respect to their products and services, gaining market share as well as invaluable experience in dealing within these varied geographical areas, each influenced by their respective socio-political infrastructure.

Financing of the diversification processes may well prove to be more of a challenge for the family business, due to the fact that it is not an exposure of risk to external shareholders, or stakeholders, but rather to that of the business owners which in this instance is represented by family members themselves (Poutziouris & Smyrnios 2006). Furthermore, research by the author suggests that issues of autonomy within the business will also play a determinant role, beyond that of the acceptance of the risk associated by such a strategy and to the family members themselves. It quite appropriately to add here that “there is typically no clear demarcation line between business concerns and family concerns since the family business is typically the vehicle that fuels the family’s current income and future wealth, and business results directly affect the family (Jurinski & Zwick 2002, p. 11), which concurs with Poutziouris in that the exposure may well be greater to the family business (Poutziouris & Smyrnios 2006), and the ownership as compared to that of the corporate or publicly listed company. Although within the primary research, some of the businesses were publicly listed companies, due to be allocated shareholding the family still retained large portions of ownership, if the majority share, in which case such exposure and the potential resultant effect upon the family and the business would still be realized in this instance.

The extent to which the business diversifies would be for all intensive purposes up to the risk tolerance level of the family concerned. Within the research, one of the respondents indicated that the family had diversified into no less than twenty-seven separate companies, and into a variety of different fields and disciplines. This may be construed as an undisciplined diversification strategy, in that once a company succeeds in a specific field the owners thereof would like to “try one’s talents in new industries or geographical areas” (Gersick & Davis 1997, p. p189), specifically under that of the holding company.

Although this methodology or strategy may provide many benefits to the family concerned, specifically, in terms of the extended family such as that of cousins, as well as providing a basis for internationalization, there are disadvantages to the specific strategy, as provided by the author in “if the process is not carefully evaluated and controlled” (Gersick & Davis 1997, p. 190) which has been represented in a number of studies in which “broad diversification can distract the company from its successful enterprises and dilutes needed investment in profitable ventures” (Gersick & Davis 1997, p. 198). Once again reiterating the diluting effect of a too broad a diversification strategy. Interestingly, enough Gersick further provides that business owners are often left at odds as to how to manage or deal with the original founding business, in which many instances the family is merely attached to this company for entirely sentimental reasons. In many instances, the original business has either passed its maturity stage, or is no longer profitable or viable to retain and the most prudent course of action would be to deal with it accordingly, Although this may prove to be somewhat of an emotional challenge, based upon the involvement by the family over the years.

An important aspect of analysis of the company, instead of post-diversification strategy and performance, which can be performance analyzed based upon sectors within which the businesses had become operational or having diversified into (Cantwell, Gambardella & Granstrand 2004). Although the interpretation of relationships between diversification and performance seem to be somewhat controversial, due to conflicting evidence, as well as diversification processes and timing which would naturally skew the results (Santalo & Becerra 2006). As revealed in the research a number of respondents took advantage of market opportunities, and Therefore, entering the market with the right time enabling a significant growth phase which was uninhibited by any major barriers to entry, that essentially did not exist at that time are prevalent today. This is confirmed by the ‘mixed response’ of the positive or negative nature of the diversification decision and process as revealed by the primary research data.

Additional factors of diversification, which may or may not be conscious decisions in terms of such a strategy include that of the technological diversification within a company, in the process within which the variety of sectors update their existing infrastructure in order to realize the benefits of improved technology and processes, regardless of the sector within which they operate. Within this process of modernization a large degree of training, as well as significant capital investment is more than often required in order to meet the investment requirements. This may not be considered as a strategic diversification, with in the initial phases thereof however, considering the overall impact upon the organization both from a capital intensive as well as productivity perspective such changes can very well be regarded as diversifying.

The controls of the diversification process is best described by Porter in terms of the competitive advantage analysis of the business, as provided in Porter’s “Better Off Test”, and specifically pertaining to that of business unit diversification (Grant 2005, p. 254), although this can be applied in essence to a geographical strategy too. In essence the better off analysis provides that the business stands to gain from such a strategy and is in a better off position, both financially and operationally than prior to undertaking any strategic decisions or movements within the desired direction, as identified by any market analysis or research. The consideration of suitability of pursuing any such move will be affected by the financial resources immediately available to the family business or family members involved within the company, alternatively the associated risk of seeking external funding will become apparent, with the potentiality of loss of autonomy becoming a determining factor.

In the event of survival of the business, as represented by the respondents the family members may be faced with the opportunistic options of increasing revenue streams, which is represented by the diversification of the business interests in terms of the fields and markets within which they operate, or the alternative of a quickly diminishing market, for whatever reason realizing the demise of the family business concern. The latter represented by one of the respondents within the study, in that failing the process of diversification, the company would no longer be viable or even in operation. In as far as the research panel goes, there were no specific mentions made of acquisitions or mergers in terms of the respondents and hence the optimization of any merged or acquired units does not come into play here but rather the efficiency within which the business unit diversification has taken place or been taken advantage of.

Facilitation of the diversification process can take place by means of a variety of financial means by which the family members will decide the loss of autonomy, in the case of a publicly listed company in which majority shares are not retained, or alternatively by means of internal funding by private fundraising. The private fundraising exercise will entail additional exposure of personal finance standings to financial institutions in the form of private loans or investments from personal sources, or the acquisition of financing based upon the financial standing of the family members themselves. This will increase the risk exposure to the personal members of the family at an opportunity cost of the consideration of the loss of autonomy, and hence careful thought and strategic planning is required in either of the routes under consideration in terms of the financing possibilities of such a strategic determination. Thereby the reduction of risk from a business exposure and operation perspective is transferred to the individual members of the family in the case of private financing, whilst the public listing of the company would in all likelihood result in sufficient capital for development, reduction of risk to personal family members but the loss in complete autonomy of control of the business.

Beyond the perspectives described above Navarro provides that the business leadership unit seek diversification, whether it be from a family business or publicly owned perspective, for the purposes of hedging against business cycle risks and associated elements, where outsourcing and ‘off shoring’ are factored into the business unit and geographical diversification possibilities or options, quite aptly quoted by Navarro in Jurgen Strube’s statement of “the challenge is not to avoid business cycles but to manage in such a way that [the business units] will perform, on average, well” (Navarro 2006, p. 151); which is in essence is what many businesses strive to achieve, this is represented by the fact that a business remains within operation by profiting from the business environment, despite the associated loss that may come along with the markets and business cycles, provided the business is profiting it remains a viable opportunity for the owners thereof.

Scott provides further insight in his analysis of diversified firms versus those companies that did not diversify, on a so-called purposive basis, as well as the resultant behavior of the relevant companies (Scott 1993). In terms of purposive the author provides that the companies took advantage of opportunities within their core areas of expertise and the major differences revealed from the study revealed that the purposively diversified company conducted more research and development than that of the non diversified companies. This would result in an additional expenditure cost for the company, and whilst this research is consistently undertaken the diversified company would in all likelihood continue with such strategy based upon their research efforts (Malerba, Lissoni & Breschi 2002, pp. 69-87). This represents the issue that once the primary diversifying strategy is undertaken, this will lead to further diverse markets and product offerings (Scott 1993, p. 125).

This research is confirmed by the primary data within this study, specifically with the proportion of respondents that indicated additional opportunities that were undertaken by the companies, resulting widely diverse structures, mostly managed from a central holding company or the family unit itself. With a small percentage of the researched companies widely diversifying, the majority of respondents seemed to stay within their respective markets, in the broader sense of the sector concerned. To a large degree, this does confirm Scott’s research, in that once the initial diversification strategy has been undertaken the company continues to seek out opportunities, albeit by research and development or whichever means necessary in order to realize whether or not any competitive advantage can be established for the company, and whether such opportunity will represent growth potential for the company concerned. It appears that the risk associated with such strategic decisions is lessened, in the eyes of the diversifying business or family members, once the initial step has been taken in such a strategic decision.

In terms of further analysis on the research and development perspective, as provided by Scott, Villalonga & Amit provide the following “family and nonfamily firms also differ significantly in their investment policies. Family firms have relatively higher capital expenditures but slightly lower R&D expenditures (Yang 2010). They are also less prone to being diversified than are their nonfamily counterparts. Consistent with their diversification profile, family firms’ stock returns show higher levels of risk, both systematic and idiosyncratic. This pattern contrasts with the conventional wisdom that families may be inclined to diversify their firms to make up for their lack of personal diversification” (Villalonga & Amit 2004). This is somewhat contradictory to what Scott provides. However, this is not the only area of contradiction that has been revealed by the study and research within the family business and related diversification issues. The authors here provide that valuation studies by two separate groups, in terms of Tobin’s q was higher for family firms than non family firms in one study and in a separate study by different academics the opposite was found to be true. This arises as to which of the information or data is the more reliable and more importantly which is the more relevant or which should be taken as more accurate.

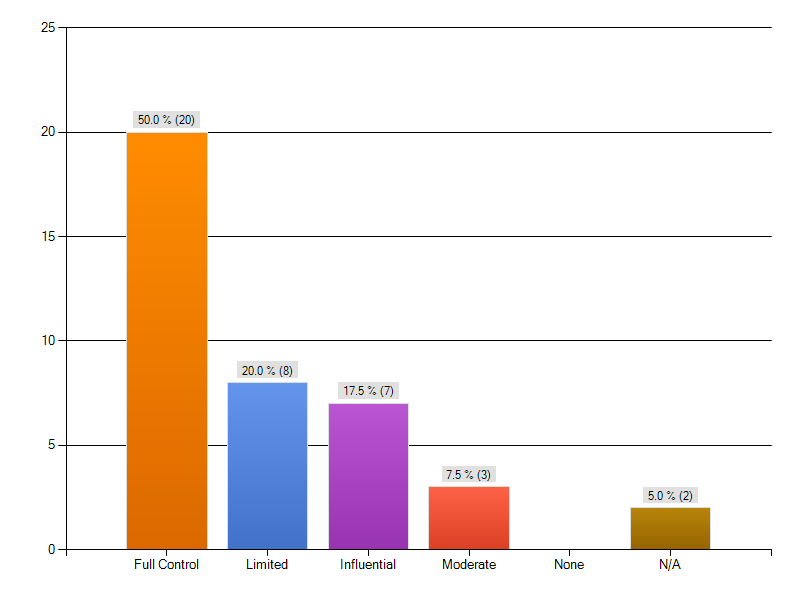

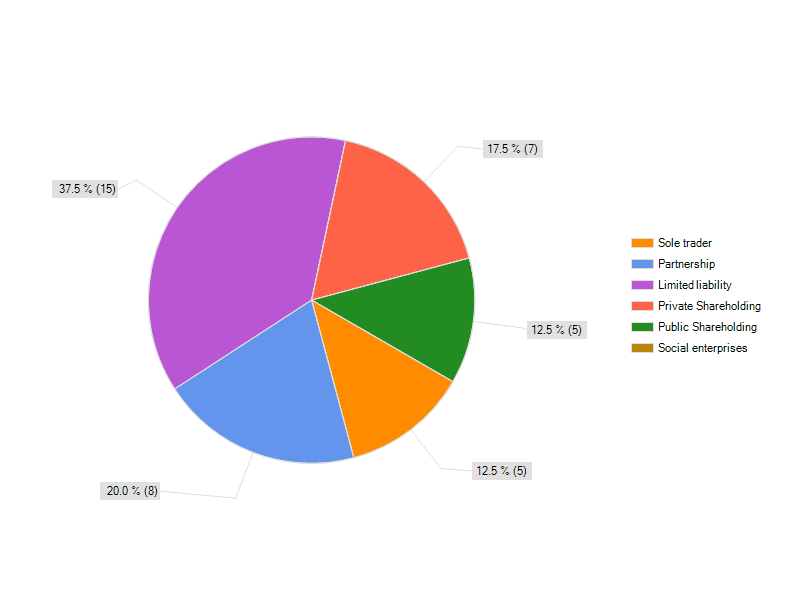

The consideration of company legal structure appears to be confirmed, within our study, with that of Phan & Butler who provide “alternative mechanisms of control over the governance of the firm often utilized to retain influence of critical strategic decisions and guide the firm during times of crisis” (Phan & Butler 2008, p. 7); in that regardless of whether the company with the sampling took on the legal structure of limited liability company or public company, it was done in such a way that control was in fact retained by the family via a mechanism of majority shareholding retention by the family within either form or structure of the companies, as mentioned. The authors furthermore confirm, together with the findings of the surveyed companies that the original family ethic is retained within the business, in terms of leadership and management of the company in “a strong culture of regard for the preference of the founder or founding family may be enough to influence the decision making process of hired managers and independent directors” (Phan & Butler 2008, p. 7). However, according to Moores & Barrett, the structure of the family firms affect both “the content and the form of controls” of the organization itself, inevitably when any structural change occurs, so well all the controls albeit from an operational, or profitability perspective, with many of the responsibilities vesting with management (Moores & Barrett 2002, p. 136).

Bearing in mind that family businesses account for between 80 and 90% of all businesses in the United States and 75% of businesses in the United Kingdom, as well as 80% of businesses in the Philippines (Johnston n.d.), to name but a few of the available geographical statistics; the realization, not only of the contribution of these businesses, but to the extent to which these businesses occur one has to consider the fact that such control as mentioned above is prevalent across these quoted statistics. This implies that such family values and ethics are carried through to these businesses which account for such a large percentage of economies across the world.

Tying in with that of Phan & Butler’s views, is that regardless of company legal structure or formation these companies are under the control of the founder or founding family and operate accordingly their terms of strategy and critical business decisions. In terms of analyzing the family business, one should also not consider the business to be that of a small operation, that may be working from home or a small office or warehouse somewhere, as provided by Johnson (2004) “37% of Fortune 500 companies or family owned while 60% of publicly listed companies are family controlled” (Gersick & Davis 1997). Study provides that on an international basis between 65 and 80% of all worldwide business enterprises are owned or managed by families (Gersick & Davis 1997, p. 2). Such control would arguably be in the form of majority shareholding, by the family concerned that has been confirmed within the sampling.

The above serves to confirm that regardless of company structure, within the sampling, control over the various diversified business units was ultimately retained by the family in concern.

The various motivational issues behind that of the diversification of family business, is confirmed by the sampling’s response of increasing business strength, which leads directly or indirectly to increase profitability, which ultimately provides a greater revenue stream to the business and family ownership unit. The academic measure of the diversification process while that of Michael Porter’s “essential tests” was not specifically and directly addressed with the sampling (Granados 2004, p. 8). However, two of Porter’s tests were revealed in the responses by the sampling, being that of the attractiveness test as well as the cost of entry test.

A large proportion of the sampling indicates that opportunities within the economic market presented themselves, which is a direct indication of the attractiveness test, as the management and ownership of the business that time realized inherent value in taking up such an opportunity at the time of diversification. One of the respondents specifically mentioned that entry into one of their diversified markets, would not be possible to date due to the cost of entry, and on a retrospective basis such diversification had not capitalized on the cost of entry into their chosen diversified field, and would therefore, be justified in terms of such strategic decision at the time. Grant (2005) specifically stated the company being “better off” based upon profit generation, either via mergers or acquisitions, this issue did not affect the sampling in this case, as no specific mention has been made of an acquisition or merger drive from any of the companies within the sampling. However, such diversification and strategic decisions were based upon a more generic and internal process than that described by Grant, Therefore, such theory not being applicable to the sampling surveyed.

The issue of resources of the family business from a financial perspective was not directly addressed by the respondents. However, from the provision of responses with respect to the company structure, one might assume that such financial resources were generated from internal sources or via traditional funding sources such as that of financing houses, or banks. This is with the exception of the publicly listed respondents, represented by just over 22.72% of the sampling, in that they had elected the public company route. In all likelihood the publicly traded company is a mechanism to generate sufficient financing to fund such expansion activities, and once again the control was retained via majority shareholding of the now publicly traded company, coinciding with that of the statistics as quoted by Johnson (2004) above.

The balance of the companies, within the sampling did not specifically claim internal funding or loans via banks or similar institutions. However, the inference of a limited liability company, being that of a privately owned company, is that of self or internal funding, in essence not wanting to open the company up to too much external influence. However, whilst protecting the interests of the family members via such a legal company structure, from a liability perspective. Rising of external capital may well be more expensive, as provided by Grant (2005). However, once again based on the fact that these businesses are still in operation, regardless of the means of how and where such financing was obtained, attests to the fact that the necessary funding was indeed obtained and allocated efficiently to ensure the apparent success presented within the study. For those respondents who elected the public company route, one may surmise that the capital requirements were too vast for self funding and therefore, the need for such listing was made in order to meet capital requirements within the diversification drive.

An alternative form of growth, being that of mergers and acquisitions was not highlighted in the primary data, which in fact coincides with Davies (2006) who provides that family firms preferred the organic growth aspect, based upon the fact that most families work within a family controlled businesses as a form of working on the inheritance factors, by implementing a merger or acquisition strategy the inherent risk is represented by the addition of an unwanted culture being brought into the business. Therefore, the issue of diversification or other alternative organic growth seems to be much preferable to the family owned and or controlled enterprise. This change in culture is neither desired by entrepreneurs nor family businesses (Ravensburg 2009, p. 13). Furthermore, based on the fact that the entire sampling seems to represent an entrepreneurial spirit, in addition to the fact that these are family owned businesses, such change in culture is ultimately undesirable (Davies 2006, p. 98).

Human resources requirements become important once the company begins to grow, and in the case of diversification, a number of elements have to be decided upon by the controlling family, who may well retain control will have to start delegating and so called letting go of certain functional activities within the business (Rowley & Abdul-Rahman 2007). Naturally the need for an increased workforce is presented upon such growth, and along with such an increase within the human resource element is the requirement of efficient and effective management according to the strategic goals of the company concerned. The sampling provided a number of possible solutions or elected procedures, which included the outsourcing of the human resource management function, as well as the establishment of specific specialized companies for each business unit, whilst retaining an oversight via the holding company, which in turn held the control in the various individual companies.

Beyond the management of human resources within the now diversified firm, as well as an aspect that touches upon the structure of the firm, business risk becomes inherent in the business environment, where something might go wrong within the delivery of a product or service to the end user or customer, in which instance the customer may sue the company (Sadgrove 2005). This insight provides for the formation of the limited liability company and the public company, which provides some protection for the shareholders. However, this is not the be all and end all of risk management, which filters through to the human resource element, as well as the issue of business continuity, in the event of legal action being brought against the company due to the action or inaction of employees, management or leadership of the company.

The human resource element of the family business is further extended to include the fact that the family dynamic as well as the corporate structure becomes intertwined within the corporation itself, with this being coupled with the concept of succession, a number of possibly difficult business decisions and issues may arise from this closely bound relationship (Raghavan et al. 2005, pp. 4235 – 4265).

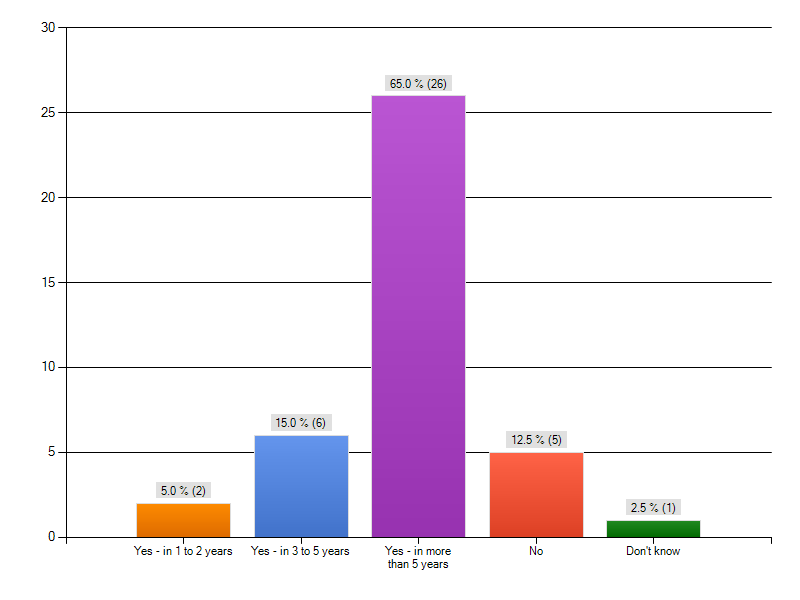

Succession planning, as provided by Gersick (1997), is often blamed and labeled as such in the event of family conflict within the business unit, it is furthermore a field of expertise that is more often sought than not to be dealt with on an external or consultancy based basis. Gersick (1997) and Poutziouris (2006) further provide that extensive literature exists on the succession planning and implementation phases, with two opposing forces becoming prevalent during both the planning and implementation phases. These forces include from the senior level, in not wanting to let go and from the junior level of not wanting to wait for the succession implementation. Gersick further provides that the distinction between succession and continuity must be drawn, with the senior generation more often than not becoming concerned with the issue of continuity rather than that of succession, with an amount of confusion being represented in this ‘senior opposing force’.

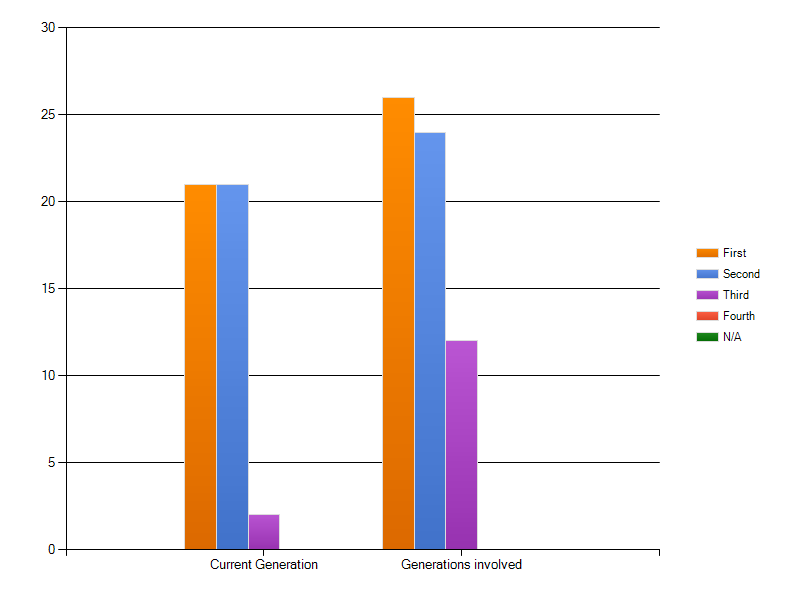

Specifically pertaining to the issue of succession, within our sampling it appears that all of the respondents involved seem to have dealt with the primary steps of succession with the involvement of the second, and in some instances the third generation. The median of generations within the sampling was slightly over the second-generation, represented by an average population of 1.6 generations that were involved in the family business. Therefore, one will notice that these primary steps have been taken, due to the involvement of additional generations, with the remaining issue of the senior generation having to “let go” when the time arises. However, due to the fact that the majority of the businesses within the sampling are relatively young, represented by a median of 15 to 17 years lifespan, one would expect that such specific “letting go” phase is yet to come. This is further confirmed by the sampling’s acknowledgement of the fact that numerous generations are currently still actively involved within the leadership structures of the relevant businesses.

Relevant research into family ownership of a business that has undergone the diversification process and publicly listed as a result, Villalonga & Amit (2006) have found via relevant data collected that the value of the company is enhanced in the event of the founding family member serving as the prime leader of the company, such as the Chairman or the Chief Executive Officer. In the event of descendants taking up such a position the value of the firm is reduced. This issue further raises the importance of the succession management and planning in order to retain the value of the firm, as well as retain investor confidence where applicable, as the founding member cannot serve the company in perpetuity and will have to at some point relinquish control of the company in question.

Another pertinent issue is that of the diversification of investments by the family business. Investments may refer to the reserve capital in the company, which may form the basis of income for the ownership or family in the case of volatile economic conditions or market slumps. According to Schmid, Ampenberger, Kaserer & Achleitner the research based upon family and non family business pertaining to the use of cash hedging instruments as a form of diversification revealed that the family owned business was less likely to use the cash hedging option than that of a non family business which provides that the company from a non family held basis may well be less risk conscious or possess a higher threshold for risk taking initiative than that of the family held or owned business (Schmid, Kaserer & Ann-Kristin 2008).

Methodology

Methodology of this study involves two phases. First phase is the literature review that has already been discussed above. Literature review involves taking help to bring all pros and cons of your topic in to light. It involves referring to the researches of others so that to assess and evaluate the findings of other papers (Kerr 2000, pp. 6-10). Literature review is the backbone of any dissertation as it discloses the clear picture of one’s topic. Researcher summarizes the points and then move on to the next stage, i.e. the real or practical side of any study. Therefore, the second phase of the methodology involves research. As discussed above, literature review involves secondary data that are also called the processed data. While the unprocessed data that a researcher collects himself using various methods while researching, is called the primary data.

Collection of Primary Data

Prior to the collection of data and submission of the question, specific definitions to which the surveyed sampling should adhere are provided below, as well as a description of the questionnaire design and submission process.

Definition of Terms

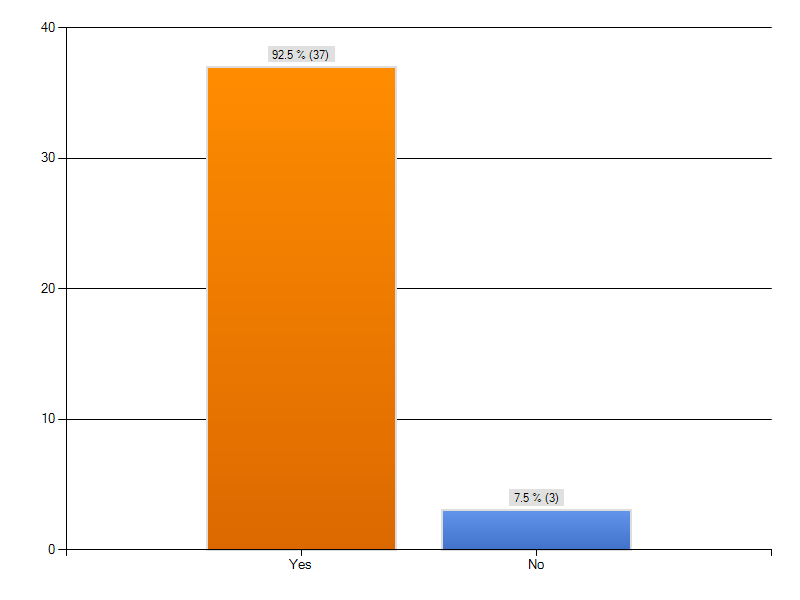

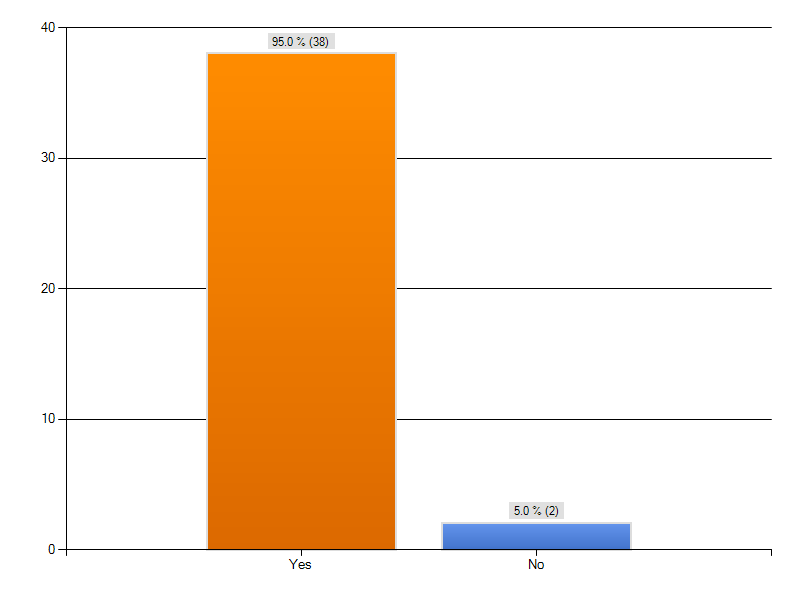

The following definitions are relevant to the subject being researched here, and for the purpose of clarity and understanding specific definitions must be accepted for the research and analysis of the diversification effect upon family businesses. The Family business is defined in a number of ways. However, there seems to be an overriding central theme, which is represented in the following definition, which will be accepted for the purpose of this study: “a business actively owned or managed by a member of a family, in which other family members may or may not actively participate in the management thereof. However, the majority ownership rests within the mentioned family.” This provides the starting point of analyzing how a family owned business is affected by the decision and process of diversification, duly defined below.

The definition of diversification that needs to be accepted here is based upon the fact that it is the very decision or process that is central to understanding what the changes are and which that are effected, how these changes affect the company, the stakeholders, as well as the strategic position and future of the company concerned. Therefore, for the purpose of this analysis the definition of diversification that will be accepted is as follows: “diversification is the decision, and resultant process, of risk reduction which can involve the addition of products, services, clients as well as markets and locations to the company undergoing or intending to undergo such diversification. This process can be motivated via both seasonal and economic fluctuations within the company’s sector, and may further be a strategic invasion into a specific and defined market.” This definition may also extend to the investment of surplus funds that may be available to the company as a form of income generation or security, generated in the times of substantial excess gains or profits made by the company.

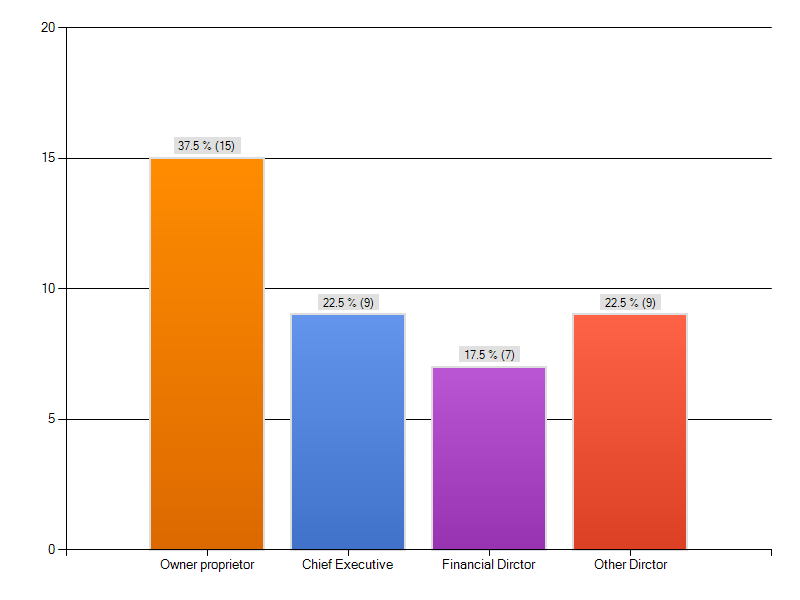

The analysis of the family owned business that intends to be undergoing or has undergone the diversification decision and process will be conducted via a primary and secondary research objective. Within this research a questionnaire has been designed and dispatched to numerous family owned companies, randomly selected and both geographically and sector differentiated, referring to their physical location and their primary or core business activity respectively. In order to obtain as wide a research result as possible, thirty questionnaires were forwarded to family owned businesses. The results and analysis are thereby provided within the following sections of this paper, together with the discussion of the questions contained within the questionnaire.

A number of issues regarding the results that have been highlighted from the research will be discussed with reference to theoretical or academic literature as well as to commercial or “real life” examples; this will be conducted due to the fact that within the so-called real world events, they do not necessarily occur in the way in which one may wish events to occur, or according to the ideal world scenarios that are often referred to within academic literature. Therefore, the analysis and findings will be able to provide an insight into the actual process, as well as highlight potential advantages, disadvantages and problems that companies may incur along the diversification journey.

The conclusion will be supported by the analysis of the research and will aim to identify possible routes or elements of success that are provided by the research, as well as possibly form a frame of reference for future companies, in which they may realize the true effects of diversification from both a negative and positive impact upon the family business.

Research – Questionnaire design

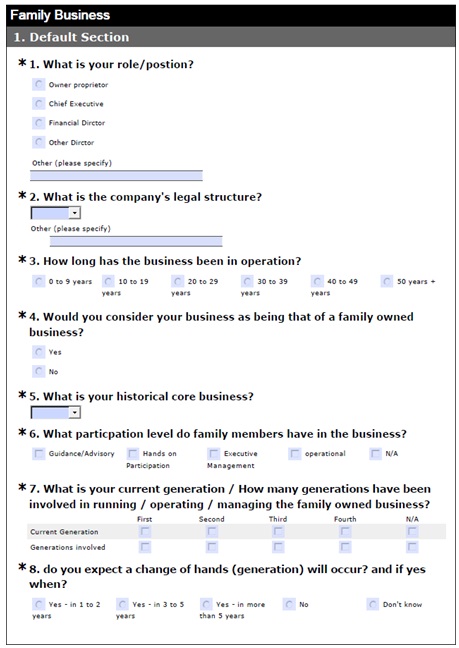

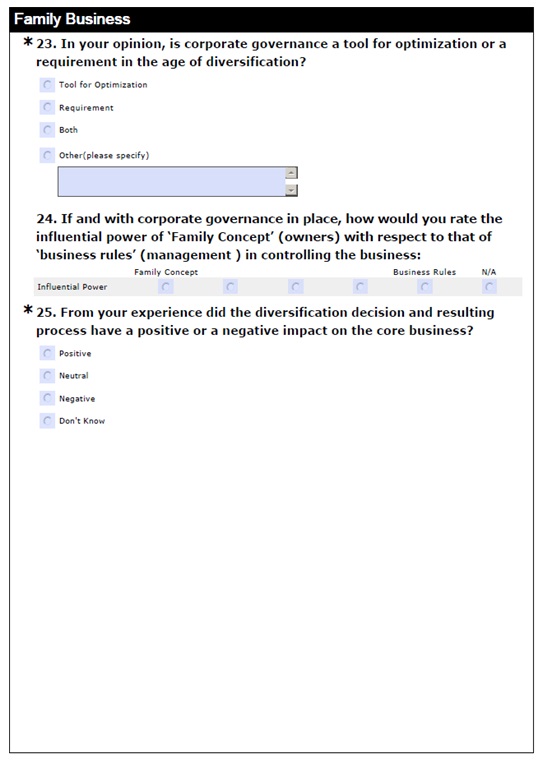

The questionnaire forwarded to the family business, which forms the basis for the primary research methodology, consists of total 25 questions; the entire questionnaire is attached to Annexure A.

The questionnaire was designed using a web based tool Survey Monkey and was sent on an anonymous basis, to a geographical diverse audience, to gauge whether the geographical location does or does not affect the family business in such a process, and if so to what extent such geographical positioning is relevant. This may be specific to country laws or practices, as well as any possible significant cultural influences that may well be relevant to the business itself.

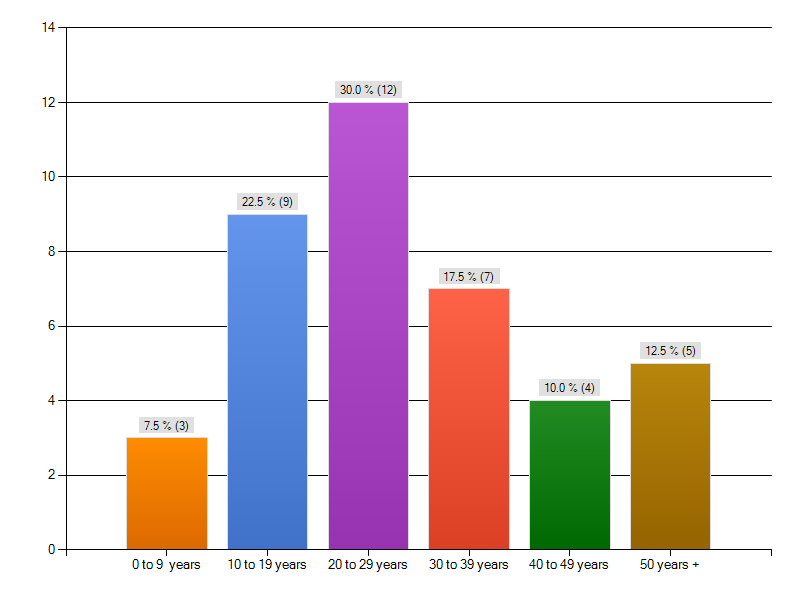

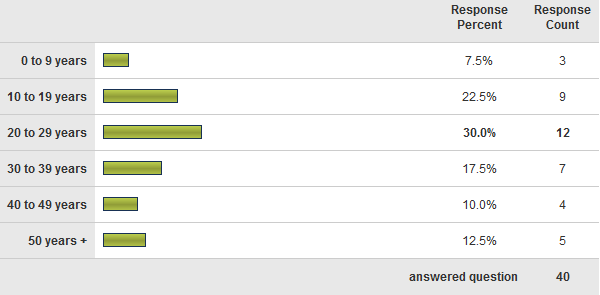

In order to establish the relevancy to the business being interviewed, the question is set to ascertain whether or not the respondent considered their business as being a family business. This is important in establishing the relevancy of the questionnaire to the business being interviewed, with another question confirming the level of ownership and / or control within a specific family or not. These questions serve to qualify the respondent businesses in accordance with the accepted definition, as highlighted above. The question pertains to the length of operation of the business, which is required to establish to what effect and extent the change was, which further serves to highlight the positive results of diversification in assuming that such a process or decision was in fact directly responsible for the company still being in operation to this day. The preceding question is supported by the question in establishing which generation is now running the family business, Therefore, supporting the length of operation of the company.

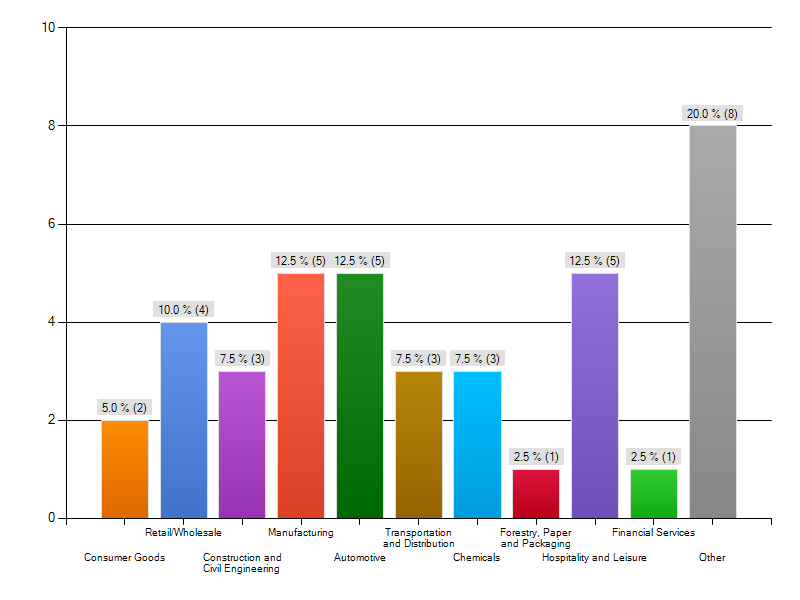

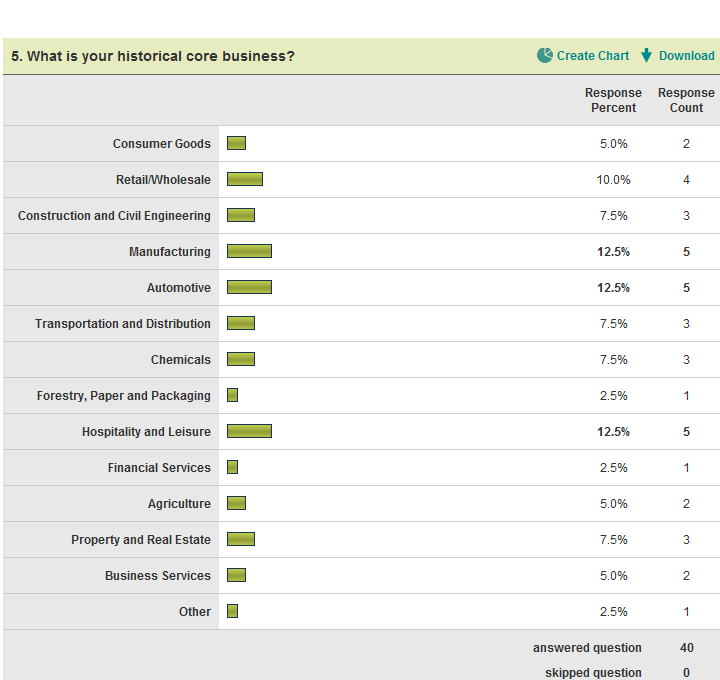

The core business or activities of the business in question serves to highlight or confirm the necessity of the diversification in terms of the current economy, or the state of the economy as it was in the instance of the decision or process being undertaken or initiated. This serves to establish how macro or micro economic factors are relevant to the business regardless of size or structure, with the question pertaining to the structure of the company serving to establish any unique issues or consistency in type of business structure relevant to the family business. This in line with the ‘international’ distribution of the questionnaire is to provide an underlying commonality of the formation and structure of the family business or the lack thereof.

Additional business interests on the part of the family in question may also be indicative of the diversification of the business, which may have come about to the need to extend or expand the business interest, in which instance the reduction of risk may have been deemed to be more effective on the establishment of an additional business, instead of changing the existing business or structure as well as the core competencies. This may be reflected in the alternative or additional business being wholly owned by the business in question, in which instance such a business entity could well be envisaged as a diversification effort on the part of the business. The 8th question serves as confirmation of the preceding statement, and determines the level of such diversification interest.

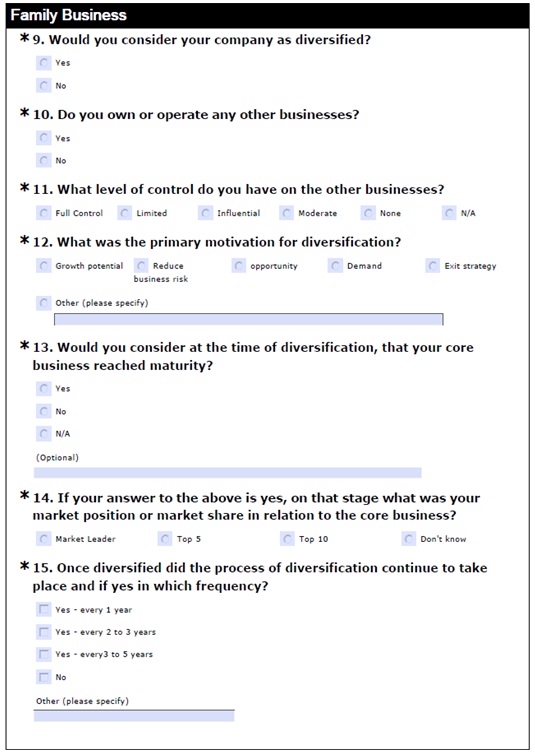

The primary motivation for the diversification process and the decision will provide an insight as to whether or not the company’s survival depends upon the process of diversification, or whether the company is seeking the mentioned invasion into profitable markets. Whether or not the company ownership made the diversification move due to market or product maturity will be reflected in the response of this question, which adds to the analysis of motivation of the process and decision. The following question extends further to analyze the market position of the company immediately prior to the extension of the company, in the form of their diversification process.

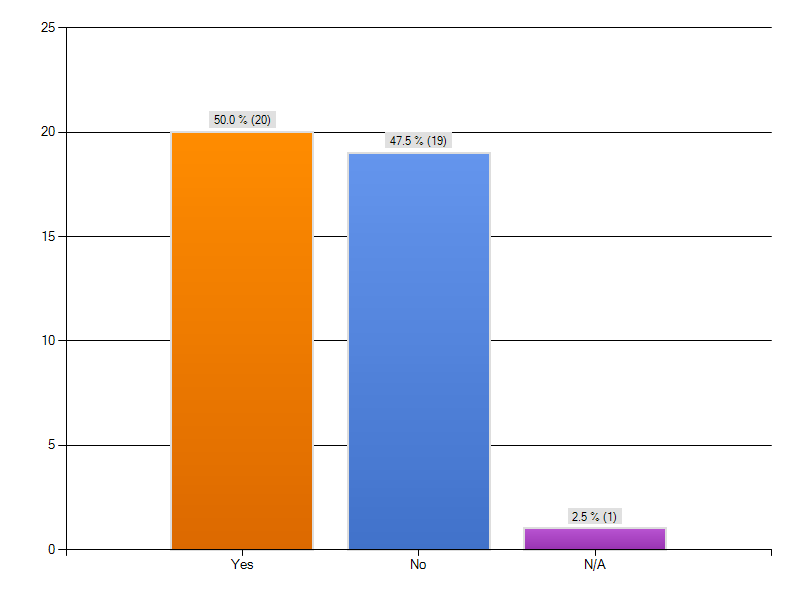

The next question seeks to establish whether or not the diversification process ceased after the initial process itself, or whether or not the company continued to evolve in line with its initial realization of diversification, which serves to prove whether or not the initial process served as a catalyst for the continued expansion of the company.

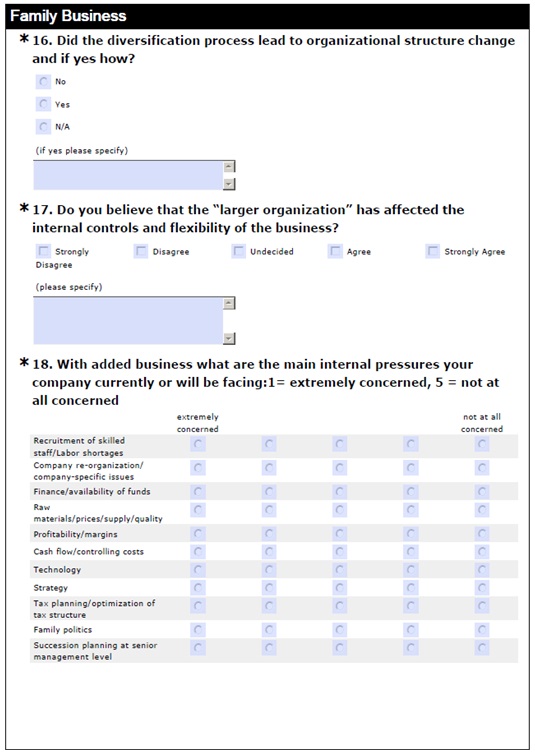

Organizational structure is analyzed from the perspective of whether or not the company would have had to take on additional financing or partners, which is represented in the twelfth question. Answers to this question will provide whether the majority of respondents in our sampling needed to facilitate structural change or not, as well as highlighting the need for external financing to enhance the process or even enable the company to conduct such changes as were necessary at the time of diversification. An important factor on both the structure and control of the company has been claimed by many authors, the questions pertaining to this is to establish whether or not such changes have occurred within respondent companies and to which extent. Responses within this area further motivate the concept of how drastically the decision impacted upon the company and to what extent these changes have impacted within the physical control and management of the company.

Many family owned businesses are often seen as more flexible due to the fact that any organizational changes or decisions pertaining thereto can be decided upon more quickly and with less so-called red tape or bureaucratic processes than that of the listed company. Hence, any changes within the business after the diversification will be reflected in the ability or inability of the company maintaining such flexibility or autonomy within the company during the decision making processes.

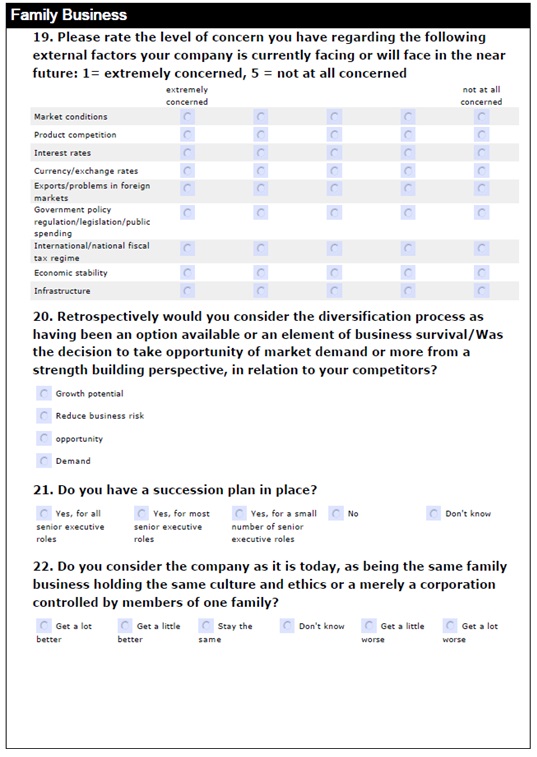

Ascertaining the impact of corporate governance is deemed to establish whether or not this issue was in fact considered at the time of diversification, and seeks to establish whether or not the management or ownership of the company has considered the impact thereof on the now diversified business. The distinction between whether or not such governance is a prerequisite or actually an asset to the business serves to establish the positive impact or benefits arising from the necessity of corporate governance, or whether the practice thereof is deemed to adversely affect the company. In many instances the corporate governance issue will be a new policy or practice for the family business, which would now in the post diversification phase have to implement this practice and these stipulated regulations.

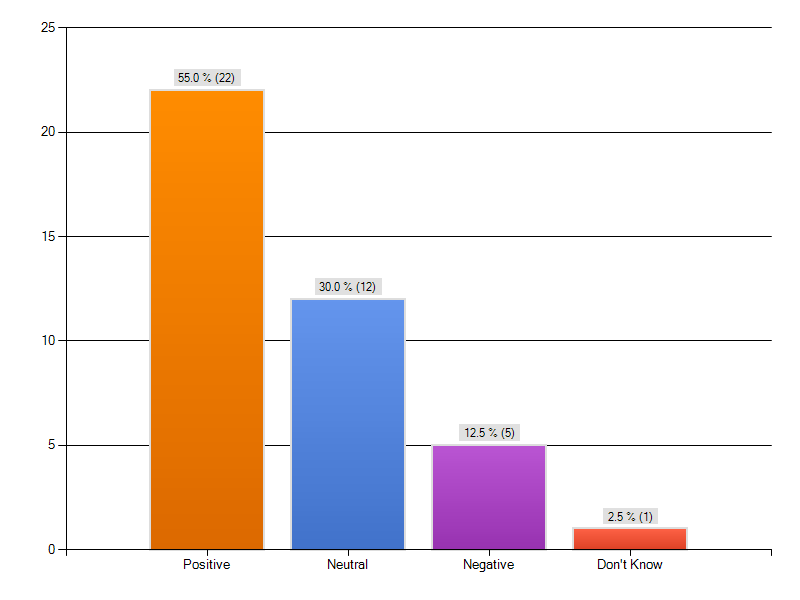

The view of overall negative or positive impact of the process must be established in order to retrospectively measure the success of such processes and decisions, in order to establish potential future strategic moves for the company, or within other family businesses. It may serve as a frame of reference for future business decisions in difficult markets or even those markets that are seen as saturated. The question regarding the core business perspective thereof may also serve to establish whether or not the company still maintains such core business, or perhaps if the decision to diversify may have led the business into a different product or service offering that leads them away completely or even partially from their original core business practice.

Quantitative vs. Qualitative within the research process

The process that has been undertaken in establishing a sampling within the family business ‘sector’ is based upon that of a quantitative approach in obtaining the insight as well as to the effects and what has led up to the mentioned process of diversification. Whilst one may determine that the actual diversification process, which is highlighted within the research forms part of a qualitative subject or process, as these decisions may or may not be guided by market forces with respect to diversifying.

The methodology of the surveys sent to the respondents can be classified as an online methodology, as the questionnaire was forwarded to the respondents via email, as per the format in Appendix A.

A total of thirty questionnaires were forwarded to known family businesses via colleagues, friends and family. The questionnaires contained the questions discussed above, and form the basis of analysis of how diversification affected the family owned businesses, and to what extent this process and decision affected the concern, as well as what has essentially become of the business on a post diversification basis. Further insight into the family business with respect to which trade sector the business belongs to, as well as issues such as age and generations involved within the business that serves to establish whether or not any sort of trends exist in regard to this process and decision.

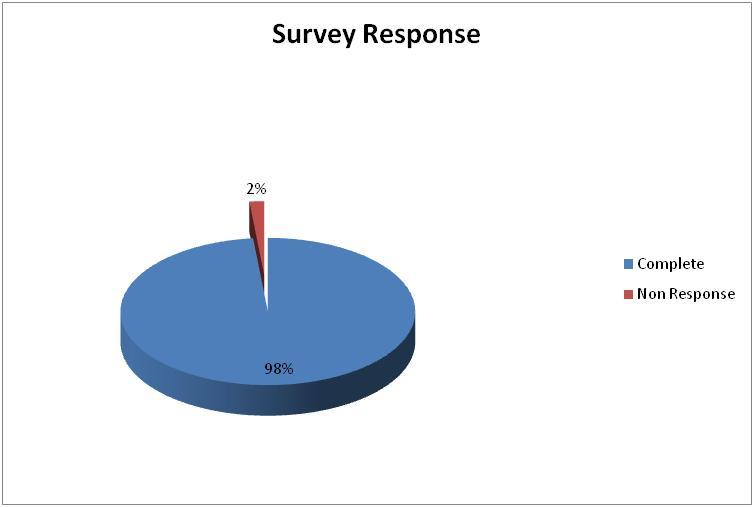

Of the submitted questionnaires only twenty two questionnaires were returned, which represents a 73.33% response ratio, the balance of questionnaires and the reasons for non completion were stated as the people who were approached were too busy with their daily management activities and obligations to complete the requested information. In addition to this, four respondents stated that they were not prepared to provide answers due to concerns of confidentiality issues, despite the assurance that none of the information would be published and was for analytical purposes only. The sentiment as previously described is confirmed by Poutziouris who provides that “given the private nature of most family businesses, accurate information about them is not readily available” (2006 p. 56), which provides some sort of confirmation as to the expressed wish to not participate within the presented study.

Yu & Cooper (1983) provide that although numerous research exercises have been undertaken to improve response rates in an attempt to reduce non-response bias. However, although these approaches have been suggested “little is known about their relative effectiveness” (Yu & Cooper 1983). Hence, based upon the reasons for non-response of the mentioned selected sampling, it is a suitable justification that the responses received are in fact sufficient for the analysis herein contained.

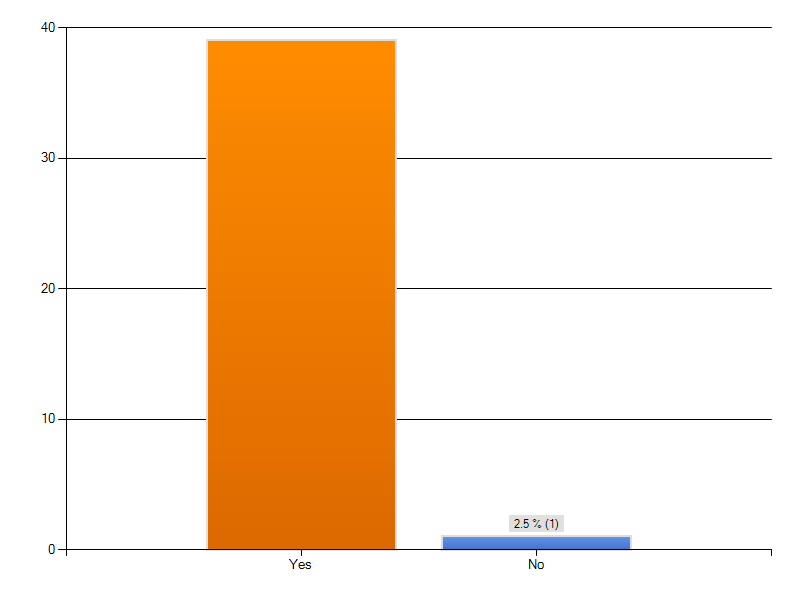

The 98% response rate is higher than the “market standard” of 50% and above, considering the nature and “niche” of this specific analysis, the representative sample is deemed to be sufficient, due to the variety of responses, sectors and structures as per the completed questionnaires that have been received. The sampling represents businesses that are deemed to satisfy the family business definition, as per the outlined definition of terms, as well as having undergone a diversification decision and resultant process, with the exception of one respondent. Therefore, for the purposes of this analysis the sampling is considered 98% within the family business definition and the respondents or the sampling have undergone some sort of diversification within their respective business life cycle.

Findings

Findings of this study are based on two phases, the literature review and the research part.

Analysis of Literature Review

The following discussion is based on analysis of academic, as well as statistical information specifically pertaining to the family businesses and their involvement within society and the economy in general, in order to get an understanding of how the family businesses impacted upon, via mentioned issues such as diversification, corporate governance and so forth.

Cater (2006) specifically provides that the duality of the success of a family business is dictated by both family life and business life, which is compounded by the family business unit, which in turn adds a degree of complexity, to the already complex nature of business with the possibility of family relationships affecting the work environment. Cater further provides that one of the leading topics in research and family businesses is that of succession, which may be confirmed by the degree of involvement by the number of generations as highlighted in the sampling collected. One of the key points highlighted by Cater is in fact that 70% of family businesses actually fail to successfully implement a succession of policy from the first to the second generation, representing a massive loss to the economy.

Considering the family business has survived the diversification process, but stands to fail in the succession process would truly represent such a loss, after many years of survival both pre-and post-diversification. In addition to the recent statistics provided, of the 70% of the failure rate, should the business reach the succession stage from second to third generation only 12% of these businesses successfully implement such a change over with succession from third generation to fourth possessing a mere 3% success rate. Cater’s research further coincides with that of the primary doctor represented here, in that the average lifespan of the family business is quoted as 25 years, less than the median of 33.41 years as represented in the research. This may indicate that the various businesses surveyed in the sampling may well not be around within the next few years, unless a concerted effort and well-managed succession plan is put into place.

Based upon the mentioned statistics, of 60 to 85% of all businesses on an international level being under family ownership or control the issue of succession suddenly appears to be of vital importance within this form of ownership and control. Regardless of successful leadership and strategic decisions a family that controls its business units should be in a position to implement a viable and sustainable succession within their ranks, all efforts within their business sectors regardless of whether diversification strategies were undertaken or not, it would in fact all be a waste of time.

Moores & Barrett (2002) not only confirm the issue of succession, as described by Cater, but further delve into the growth dynamic of the family business, which in essence is associated with that of diversification as it is described throughout the study. Such internal issues are further exasperated by that of external pressure, such as changing technology, government incentives (or the lack thereof), customer preferences and opinion which are then carried over to the structure of the firm; in that questions of workload management, structure and ownership begin arising placing added pressure on both the business and family unit respectively. Moores & Barrett claim this to be the context of the business, and further state that the company “whether family owned or not – needs to engineer its internal situation to best fit its external environment” (2002 p.13); these issues effectively referred to as contingency plans have been greatly researched by what the academic world refers to as organizational theorists.

Managing all through the internal situation, as well as the external environment and any business decisions pertaining to these elements are according to what the authors referred to as strategies, which in this study refers directly to the process and decision of diversification, the allocation of resources and the resultant business units and companies created from these processes. Kuratko & Hodgetts also make mention of what they term as, “Forcing Events” which can be likened to that of death, illness, abrupt departure, legal problems, business decline and financial difficulties. The authors furthermore claim that the family business, and the family itself “seldom has a contingency plan in dealing with” the aforementioned forcing events; these issues further exasperate the issue of succession, as well as the future efficacy of the leaders of the business (Kuratko 2008, p. 491). One will Therefore, realize that besides the “normal” succession of procedure within the family business, these contingency plans need to be incorporated in the event of the mentioned forcing events occurring, whilst furthermore implementing suitable succession programs or policies to ensure the continuity of the growing concern.

Coinciding with the some of the wider diversification examples contained sampling Moores & Barrett confirm that “these family firms operate in a greater number of markets and have to take account of more areas of development.” (Moores & Barrett 2002, p. 134). This may well represent an agreement with respondents from the survey, who stated that upon undergoing the diversification process focus was taken away from the original core business because of the need for attention on their respective ventures and opportunities that were taken at the time. The authors further provide that the strategy of diversification “represent distractions from their core business” which does in fact coincide with representative sampling within the data analysis.

In contrast to the issues of succession as already described Weidenbaum provides a perspective on the Chinese Family Business, which may well be represented by more of a private ownership than that of a publicly traded company, although this coincides with the sampling majority within the study; from a succession basis the author provides that “succession typically runs through the family group, rather than depending upon seniority.” (Weidenbaum 1996).

Further expanding upon the difference between the family business and the non-family business, Kuratko & Hodgetts (2008) provide that the overlap between family and business will vary between each family business concerned. However, this was not entirely revealed within the sampling, but rather the strengths of individual family members were deployed into specific areas where upon the content family member displayed sufficient skills in terms of the management and leadership of the sector concerned, no real evidence was provided that family issues were brought into the business and rather a more holistic process of leadership within the family seems to have been displayed by the sampling.

With further relevance to the succession issue, a number of strategies exist, as highlighted by Kuratko & Hodgetts and specifically that of early entry strategy and delayed entry strategy, with each strategy having their respective advantages and disadvantages. The fact that a secondary or tertiary generation has become involved in the business does not necessarily indicate that the business has proceeded successfully with a succession program, and has provided by the authors one of the main issues that the successor will have to address is that of gaining credibility amongst employees of the firm, and their ability or inability to do so. In addition to this the authors provide that the founding generation normally prefer a succeeding generation, or the succeeding leadership to actually work outside the firm where there may learn, and make mistakes prior to taking over the leadership of the company concerned. These issues were not confirmed by primary data, based upon current statistics of the family businesses that succumb to failure within the succession process, it is well worth noting, specifically with respect to the mentioned early and late entry strategies.