Executive summary

Stakeholders can be defined as people who are interested and directed by a business’ actions. They stand to either lose or gain from a business’ operations and many times influence its decisions. A business’ stakeholders include preferred and common shareholders, creditors, manufactures of its products, employees, suppliers, customers, its software developers, the society and environment. A business’ strategy must work for the benefit of all the people linked to it, including the community in which the business is operating in.

This paper briefly looks at theories that explain a business relationship with its stakeholders. It then discusses stakeholders in the banking industry, their influence and how they are treated to ensure a profitable relationship with the bank. Using diagrams, the paper will illustrate their relationships with each other and their level of influence in bank.

Introduction

“A project can be defined as a collaborative enterprise, frequently involving research or design, that is carefully planned to achieve a particular aim” (Pommerening, 2007). Every business project must have end results and is aimed at providing unique services or products to people or institutions. A project’s objectives will determine how it is run and the end results. Several parameters must be in place for a project to be complete. They include people, time, resources and different stakeholders.

Stakeholders are people or groups of people who have invested in a business or have an interest in it (Wienen, 2000). One does not have to be a shareholder to be a stakeholder in a business. A business’ stakeholders include preferred and common shareholders, creditors, manufactures of its products, employees, suppliers, customers, product developers, the society and environment.

Stakeholders play an important role in determining how a business implements selected strategies. A business’ strategy must work for the benefit of all the people linked to it, including the community in which the business is operating in. It is important for a business to gain stakeholders buy-in when implementing a strategy to ensure that it benefits from a good relationship with them and is in agreement with them. When stakeholders are in a disagreement, suppliers may not be consistent, employees may not be loyal, shareholders may not support various investments and customers may shift their loyalty.

Business ethics demand that all stakeholders be treated fairly and equally. Conflict of interest arises when an individual decides to consider their own personal interests rather than considering the good of the business, or when a business chooses to consider their own interest without any regard to the interests of employees and other stakeholders. Fairness and honesty which is considered the heart of every business measures the general values of decision makers in the business. Communication on the other hand is more concerned with how true or misleading sources of information are. Business ethics call for relations that are ethical towards suppliers, customers and every other involved person.

Project background

Stakeholders play in important role in how businesses are managed and how they perform. A business’ industry determines who its stakeholders are and what their influences are. The size of a business also determines stakeholder’s influence and a business’ obligations towards them. Making sure that all stakeholders are satisfied is a hard task which many businesses are yet to perfect, but one that is becoming a key measure of success. As an employee in a bank, I will use the banking industry as a case study to explain different theories and parameters in stake holding.

Stakeholders in the banking industry

There are different theories explaining the concept of stake holding. “Enlightened value maximization theory recognizes that communication with and motivation of an organizations’ stakeholders is extremely difficult” (Jensen, 2000). The theory proposes that not all stakeholders should have the sole value of maximizing a business value. Different stakeholder should influence a business differently and in different proportions. The enlightened stakeholder theory on the other hand proposes measurement and evaluation of the management’s relationship with different stakeholders with equal importance.

“The banking industry attaches tremendous importance to protecting the rights of all stakeholders, whether they are shareholders, the board of directors, executives, employees of the bank and its subsidiaries or other external stakeholders” (Sharjah Islamic Bank, 2009). Most banks have put in place policies that bind internal and external stakeholders to ensure consistent relationships between every person who is involved in the industry. According to Fuller (2007), a bank’s success is dependent on fair and equitable treatment of its stakeholders. Such a treatment is assured by adhering to the highest levels of professional, legal and ethical standards.

One way through which stakeholders are served is ensuring quality and standard communication procedures and channels. Responding to the needs of stakeholders needs in such a changing economic environment requires constant communication between the bank and its stakeholders on any changes that may occur. Call centers and other communication mechanisms are therefore a key aspect of banks today.

A bank’s stakeholders can be classified into two categories; internal and external. According to Harrison and Edward (2007), “internal stakeholders are those people who are easily committed to serving an organization such as staff, volunteers, board members and/or donors”. External stakeholders or the other hand “are people who are impacted by the bank’s work such as clients/customers, community partners, suppliers, creditors and other banking and financial institutions” (Cleland and Lewis, 2006). They can be further classified into primary, secondary, active or passive stakeholders. The roles, power and measures adopted for dealing with its stakeholders are discussed below:

Internal stakeholders

Shareholders

Shareholders or owners of a bank have a big influence on how its aims and objectives are decided and implemented. They are involved in major decision-making processes and some of them are involved in the day-to-day management of a bank’s affairs. They are driven by growth and profits. The bank understands their importance and has put in place measures to treat them fairly and equitably (Hudson, 2010). They are entrusted with the responsibility of making decisions that allow the bank to grow, increase revenues and compete on an international scale.

Employees

“Human resources today are the most treasured asset for the long-term success of a business” (Werther and David, 2011). The banking industry today provides its employees with generous salary packages and other benefits such as allowances and opportunities for professional growth. As a way of encouraging them to develop their skills, most banks are today offering scholarships to their staff and flexible working hours for those who decide to further their studies. Training, education and conferences are increasingly becoming common in the industry.

Banks encourage employees to do their best by basing promotion and transfer on professional knowledge and performance. “To ensure fair judgment, staff are encouraged to show initiative and responsibility, and have regular opportunities to voice opinions and address their concerns to management” (Sharma and Mark, 2004). Employees’ responsibilities include running day-to-day affairs of a bank, serving customers, implementing decisions made by shareholders and coming up with development ideas, among others.

Management and those who appoint them

Management is comprised of the board of directors and the people trusted with the task of making day-to-day decisions of a bank. They have a big influence on how a business is run and many times determine how successful a business turns out. To ensure they work to their fullest potential, the bank has put in place measures that guarantee their freedom to express their opinions on major business issues. This group of people are among the highest earning people in a bank and are provided with the right training and learning opportunities to ensure they carry out their responsibilities effectively and in accordance with the set rules and law. The powers and number of the management team is dependent on the size of a business and its policies.

External stakeholders

Customers

“Customers are among the key stakeholders in a business and businesses that ignore them find themselves losing sales to rivals” (Freeman, 2007). The banking industry recognizes this and has put in place measures to ensure their welfare is taken care of. “Successful banks are built on honesty, integrity and a commitment to protect the interests of customers” (Tahir, 2008). The banking industry is considered amongst the most competitive today and as a result, offering unique and satisfactory products is paramount. If a bank’s products do not meet the customers’ present needs, it will easily lose to its competitors.

Customers play a significant role in how products are designed and sold. It is customers’ needs that determine how a bank is run, what it offers and when. The banking industry’s commitment to customer satisfaction is evident through its dedication to excellence, personnel dedication to customer service, technological innovations meant to ensure customers more convenient services and recognition of quality.

Suppliers

“Suppliers play a significant role in a business through meeting their contractual obligations and doing so in a timely manner” (Shonfield, 2001). They influence availability and price of materials, their quality and the cost of doing business. They determine the cost of supplies, which is a key cost in the balance sheets. Banks on their part are obligated to fulfill their contractual obligations through honoring deals signed with them, making payments on time and paying them what their services are worth. Dealing with suppliers is another test of integrity, which is key to long-term success of a business.

Creditors

Just like it is with suppliers, creditors influence a banks operations by how well and accurately they honor their contractual obligations. They influence interest rates, availability of funds and consequently, profitability. “Likewise, the bank is also pledged to fulfilling its contractual obligations to all its creditors, debenture holders, and depositors” (Hage, 2007). As a way to maintain a good working relationship with its creditor, banks are supposed to provide enough information about risks related to what they are involved in.

Other banking and financial institutions

“The bank actively participates in the exchange of business-related information with other commercial banks and financial institutions as a means of protecting the interests and stability of the banking industry as a whole” (Oxford Business Group, 2008). A banks relationship with its rivals and competitors contributes to its ability to reduce costs. Other banking and financial institutions influence the markets’ interest rates, products’ designs and competition.

Society and environment

The bank has an obligation to the communities it serves and has a responsibility to help them achieve sustainable development. Most banks have put in place measures that promote the private-sector programs aimed at improving the livelihood of communities near them. They offer jobs to local residents and provide a market for the local supplies. Environmentally, ethics require that businesses are obligated to protect the environment and minimize negative effects to it. Businesses are not supposed to oppress or oppose environmental legislation. Every business has the responsibility of protecting the environment as well as educating its customers about environmentally responsible choices.

Like many other industries, banks have been accused of paying little attention to environmental projects and not partnering with any environmental organizations in different regions (Abdelsalam 2). Through one of her research papers, Dr. Abdelsalam has accused the banking industry for showing very little interest in projects that benefit the environment and instead focusing and giving too much attention to projects which have potential to improve their profitability such as real estate which is picking up well in many region.

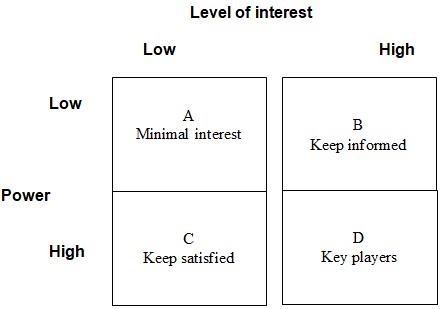

Categorizing stakeholders

- Group A: The business requires very little effort to impress or influence these stakeholders. Their interests have little influence on how the business operates. Society and environment fall in this category.

- Group B: This group of stakeholders have very high interests in a business but have very little power when it comes to exercising control. They include small shareholders and suppliers.

- Group C: This group of stakeholders have a high degree of influence but are not very much involved in day-to-day activities of the business. As a result, they have low interest in events as long as they are satisfied. They include investors and customers.

- Group D: This group has power to effect a business’ operations. As a result, their needs must be satisfied first and foremost. They include management, employees and customers.

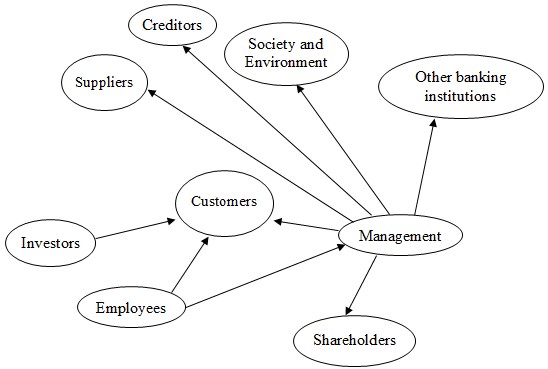

Interdependence network diagram

From the categories, employees are a big asset of a bank and their satisfaction plays an important role in ensuring growth and profitability. The management and owners of a bank also form a significant part of a bank’s foundation and determine its long-term success. From the network diagram, it is evident that the customer is the most dependent upon stakeholder of a bank. A good relationship with customers allows a bank build on its sales volumes, increase revenues and build on profitability. The management on the other hand is dependent on most of its stakeholders to implement its functions effectively. The employees are depend on the management and customers’ needs to exercise their responsibilities. It is also evident that every stakeholder is connected to the chain, proving their relevance in the overall relationship between a business and its stakeholders.

Conclusion

Stakeholders can be defined as people who are directed and affected by a business’ actions. Their interests in a business’ operations mean they may either lose or gain from its decisions. A business’ stakeholders include shareholders, creditors, employees, suppliers, the management, creditors, debtors, customers,the society and environment. A business’ strategy must work for the benefit of all the people linked to it, including the community in which the business is operating in.

There are different theories explaining the concept of stake-holding, among them being the enlightened value maximization theory and the enlightened stakeholder theory. “The banking industry attaches tremendous importance to protecting the rights of all stakeholders, whether they are shareholders, the board of directors, executives, employees of the bank and its subsidiaries or other external stakeholders” (Sharjah Islamic Bank, 2009). To prove this, most banks have put in place policies that bind internal and external stakeholders to ensure consistent relationships between them and their stakeholders.

Stakeholders in the banking industry can be classified into tow categories; internal and external. These categories are based on the stakeholders day-to-day level of interaction in the business and their interest in it. From the network diagram, it is evident that the customer is the most dependent upon stakeholder of a bank. A good relationship with customers therefore is a key driver in a bank’s sustainability and growth. A good relationship with customers allows a bank build on its sales volumes, increase revenues and build on profitability.

This analysis has been helpful in understanding how different parties affect the business and how they should be treated to ensure a business reaps maximum benefits from its relationship with them. As an employee in a bank’s call center, I understand more the relevance of my role to ensure all stakeholders are treated with utmost respect and have as much information as they require when they call for inquiries.

Reference list

Abdelsalam, O., 2010. Islamic Banking in the United Arab Emirates. Web.

Cleland, D. and Lewis, R.I., 2006. Project management; Strategic design and implementation. New York: McGraw-Hill Professional.

Freeman, P.R., 2007. Stakeholders and organizational ethics. New Jersey: Berrett Kohler Publishers.

Fuller, M.A., 2007. Sustainable stakeholder strategy: An investigation of stakeholder inclusion, strategic domains and competitive advantage. New York: Routledge.

Hage, M., 2007. A stakeholders concern: Towards an economic theory on stakeholders governance. Assen: Van Gorcum.

Harrison, J.S. and Edward, R.E., 2007. Management for stakeholders: Survival, reputation and success. New Haven: Yale University Press.

Hudson, E., 2010. Categories of stakeholders. Web.

Jensen, M.C., 2000. Value maximization and stakeholder theory.

Oxford Business Group, 2008. The Report: Abu Dhabi. Oxford: Oxford Business Group.

Pommerening, T., 2007. Strategic changes for business models in the German retail banking industry. Norderstedt: Druck Books.

Sharjah Islamic Bank, 2009. Sharjah Islamic Banking. Web.

Sharma, S. and Mark, S., 2004. Stakeholders, the environment, and society. Cheltenham: Elgar, cop.

Shonfield, D., 2001. The stakeholders. Huddersfield: Central Publishers.

Tahir, M., 2008. Marketing Strategy of Islamic Banking Sector in Pakistan. Pakistan: Blekinge University Publishers.

Werther, W. and David, C., 2011. Strategic corporate responsibility: Stakeholders in a global environment. Los Angeles: SAGE.

Wienen, I., 2000. Impact of Religion on Business Ethics in Europe and the Muslim World: Islamic Versus Christian Tradition. Frankfurt am Main [u.a]: Lang Publishers.