Introduction

Caterpillar Inc. is a leading global manufacturer of construction and mining equipment and industrial engines. The company lacks immunity from the supply chain disruptions and global economic problems that complicate the heavy equipment industry. This paper discusses how Caterpillar responds to inflation, problems in its supply chain, and demand swings caused by external factors. It also explores the price elasticity of demand and supply. Sustainability in the heavy engineering market is a priority goal of the company, which it has achieved quite successfully.

Market Structure

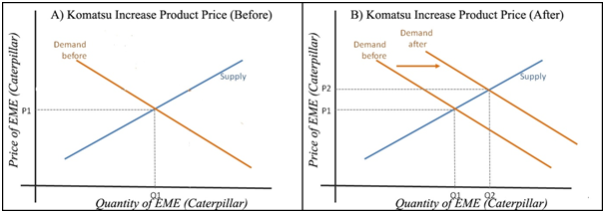

Caterpillar Inc. is a member of an oligopolistic market structure where only a few firms dominate the market. As can be seen from Figure 1, demand in the heavy engineering sector is constantly increasing, which necessitates Caterpillar to increase its production capabilities. Caterpillar reported a significant increase in first-quarter sales because of solid demand for construction equipment (Caterpillar Inc., 2022). This has pushed up costs for consumers and companies due to increasing demand, higher production costs caused by supply chain disturbances, and rising inflation levels. In response to inflationary pressures, Caterpillar increased its prices twice yearly to cushion its earnings from the harmful effects.

Regarding supply and demand, these growing costs are reflected in the company’s increased expenses, particularly in manufacturing, owing to more costly inputs such as materials and freight charges. The company’s operating profit margin dropped from 15.3% in Q1 2021 to 13.7% in Q1 2022 (Caterpillar Inc., 2022). Despite the setbacks noted above, global sales turnover for caterpillars rose by 14%, amounting to $13.59 billion for the first quarter, surpassing analysts’ expectations (Caterpillar Inc., 2022).

With increased demand accompanied by higher production costs since raw materials become expensive with time, the Supply curve shifts leftwards, resulting in a new equilibrium with higher prices and lower quantity. Caterpillar had poor sales performance in China, mainly due to COVID-19 and weak residential construction. This may be represented as the decrease in demand for the Chinese market prompting a shift of the demand curve to the left.

Price Elasticity of Demand

Caterpillar Inc., a worldwide leader in the production of mining equipment and techniques, operates within a market characterized by a relatively elastic supply on one side and an inelastic demand for its products on the other. The price elasticity of the demand (PED) of Caterpillar’s heavy machinery and industrial equipment is inelastic because these commodities are generally expensive (Tita, 2022). In some cases, construction projects or mining operations may require particular types of machines that are not flexible to short-term changes in price. For example, clients prefer strong Caterpillar machines that work correctly all the time, depending on the type of project at hand, rather than cost variations at a given moment (Tita, 2022).

However, Caterpillar’s Price Elasticity of Supply (PES) is probably more elastic due to the fact that the company has different offers in all ranges. As a significant player in the industry in the manufacturing of heavy equipment, the company can adjust its output levels when circumstances change. Though constructing heavy machinery involves intricate processes and may necessitate specific kinds of parts, it has found ways to manage changes in its supply chain.

Elasticities

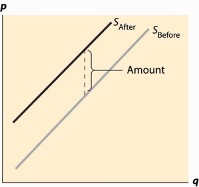

Changes in consumer behavior, market dynamics, and production capacities affect the long-term demand elasticity. Figure 1 shows elasticities change in the short and long run Caterpillar in comparison with a competitive company. Equally important, suppliers will have difficulties in making rapid adjustments to production quantities or finding alternative inputs (Tita, 2022). Figure 1 shows the initial equilibrium before tax increment. The effect in the shorter run is characterized by a slightly lower quantity demanded and increased quantity supplied, which shows an inelasticity aspect (Waleedeco, n. d.).

The elasticity of both supply and demand might rise over time. As the higher prices become more noticeable, customers may get ample time to change their habits, find substitutes for everything, or reduce demand for these commodities. Nevertheless, another option would be for producers to find alternatives, adjust their modes of production, or discover new technological advancements that will render supply more elastic than before.

Government Intervention

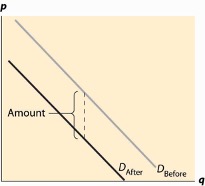

The government may raise the Goods and Services Tax (GST) on the products or services provided by the company if it decides to intervene in the market. Figures 2 and 3 show the relationship of taxation with the supply and consumption of goods. The objective of raising GST is mainly to increase government revenue through heavy taxing on the consumption of particular goods or services (Tita, 2022).

Ultimately, this could lead to higher prices generally paid by buyers, but it may not necessarily be for the well-being that the government aims for. By increasing its financial resources for public services infrastructure development, it does not expect to chart the buyer’s direction only. Conversely, increased consumer prices may reduce customer demand and sales for sellers. Nevertheless, in such a situation, the government wants most to have a more robust fiscal capacity instead of siding with buyers or sellers.

Conclusion

Caterpillar’s adaptability during supply chain challenges and changing market dynamics reflects its strategy. The heavyweight equipment industry exhibits an inelastic demand because it is used for specified purposes essential in the building and mining industry; hence, this indicates that Caterpillar can maneuver through economic uncertainties globally. However, when the government introduces a GST tax increase, this immediately affects price and quantity, which is limited by inelasticities that underline the first consumer and producer issues faced.

References

Caterpillar Inc. (2022). Caterpillar reports first-quarter 2022 results. Cision PR Newswire. Web.

Government interventions. (n. d.). Saylordotorg. Web.

Tita, B. (2022). Caterpillar says construction equipment remains in demand, boosting sales, profit. The Wall Street Journal. Web.

Waleedeco. (n. d.). Findings. Web.