Introduction

The company chosen for monitoring was Caterpillar, which operates in the production of construction equipment and components. The organization invents and manufactures many mining equipment, such as engines, industrial gas turbines, diesel-electric locomotives, and other objects necessary for heavy engineering. The main point of this article is to consider the dynamics of shares and the company’s financial performance over a certain period.

In this regard, the study will analyze and interpret the main economic parameters of the organization’s activities. The paper will use a systematic approach to monitor the stock market over three months, starting in late August and ending in late November. Thus, studying relevant indicators can provide qualitative results regarding Caterpillar’s financial stability.

Description of Results

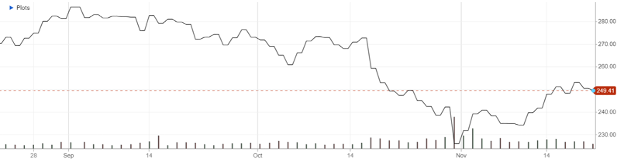

During the monitored period, the stock price tended to undergo constant sharp changes and relatively strong fluctuations. At the beginning of the period, the share price was 270 US dollars, and at the final tracked point, 249.41 (Caterpillar Inc). Thus, we can conclude how mobile the company’s shares were, since in Figure 1, one can trace moderate stability in value until the end of September, after which an insignificant decline began with rare pullbacks upward. The most significant drop occurred in early November when the price reached below 230 (Figure 1). After this, stabilization and price rollback to higher levels began. In this regard, the interpretation of the data obtained to determine the company’s financial condition is imperative.

Interpretation of Results

One of the most significant events in the monitored period in stock dynamics was their sharp decline, which reached their lowest point in early November. There are several reasons for this, one of which can be called investors’ concerns regarding the profitability of the company’s management policy (Flowers and Tiwary). This factor played a significant role in the flow of funds and affected how the organization’s stakeholders reacted to adverse events. The slowdown in the construction sector caused some concerns among investors, which led to demands on their part that were not met. To better understand the decline in demand, it will be necessary to analyze the construction industry.

Analysis of the Industry

An analysis of Caterpillar’s scope of activity can show how general trends could cause the stock to fall. In October, the construction industry began to adopt a downward trend, which manifested in the production of construction equipment. This is confirmed by the performance of Caterpillar’s closest competitor, Deere & Company, whose shares fell noticeably during the same period (Deere & Company). Thus, this proves the general nature of the crisis in the industry, which affected all competitors and will need to be analyzed more deeply.

Analysis of Competitors

Caterpillar’s two closest competitors are Komatsu and Deere & Company, which operate in the same business. The return on assets of the first competitor is 7.01%, comparable to the indicators of Deere & Company, which are indicated at 8.84% (Deere & Company; Komatsu Ltd.). However, Caterpillar has a more advantageous position and stable indicators in this area since its profitability value is 10.18%, which is superior to its competitors (Caterpillar Inc.). Considering this information, we can say that Caterpillar’s financial position is relatively stable and can be resilient in relation to external threats in the construction equipment market.

Conclusion

The economic fluctuations of Caterpillar shares were quite unstable over the period under review, as they showed a significant decline. This happened due to several factors, such as the crisis and decreased need for heavy construction equipment. The stock’s performance indicates a lack of financial management control. In this regard, the company’s shares cannot be recommended to potential investors since the resumption of growth may take considerable time.

Works Cited

“Caterpillar Inc.” CNBC. 2023. Web.

“Deere & Company.” Yahoo Finance. 2023. Web.

“Komatsu Ltd.” Yahoo Finance. 2023. Web.

Flowers, Bianca and Shivansh Tiwary. Caterpillar shares fall on equipment demand concerns despite earnings beat. Reuters. 2023. Web.