Executive Summary

This research paper seeks to explain the five forces as postulated by Michael Porter and how applicable they are in the modern industry. A case study of the cement industry in Saudi Arabia is used to shed light on the significance of Porter’s five forces. The fundamental competitive forces in the cement industry are also examined. Consequently, to understand Porter’s contribution to the field of strategic management, the generic strategies, and the value chain are also analyzed. Examples are used to enhance the understanding of the main items of the topic. The understanding of strategy according to Whittington and Porter are analyzed as well together with how significant they are to any business operation.

Introduction

In understanding the dynamics of competitiveness in an industry, it is always imperative that it is analyzed based on the five forces as was postulated by Michael Porter. It is understood that the more intense the forces are, the less the returns on investment and vice versa. Intense forces are found in industries like hotels, textiles and the airline sector, on the other hand, benign forces are found in industries like software, soft drinks, and toiletries and are more often profitable (Grant, 2005, p. 5).

Competition and profitability are driven by the structure of the industry irrespective of factors like whether the industry is service or product-oriented, regulated or unregulated and high or low tech, weather and business cycle are short term factors that affect the profitability and competitiveness of an industry. The knowledge of the industry is always important since it provides an opportunity for effective strategic positioning (Anon, 2002, p. 8).

Case Study

The cement industry in Saudi Arabia is one of the uncharted business territories and exemplary performing sectors in the Gulf Cooperation Council Cement (GCC) industry. This is necessitated by the construction boom that is being witnessed in the country’s construction sector. Despite the success that the industry is witnessing in growth and profitability, there are a lot of concerns that are imminent in the sector which may include the threat of oversupply and anticipated medium-term pricing. The cement industry in Saudi Arabia is, however, one of the strongest cement markets in the international market. This has been largely associated with the increased government expenditure on infrastructure and the flourishing real estate business in the country. This was evident in the year 2010 when the cement consumption increased by 17.1%.

There are twelve cement manufacturers and out of that eight of them are listed in the financial markets and also amount to two-third of the market capitalization of the GCC market and the third in the Middle East and the Maghreb region otherwise called MENA (Middle East and North Africa) market region. The combined cement production output of these eight companies is 47.3 million tons per annum (global research sector, 2007, 9) and it has been growing every year. The Saudi Arabian cement sector is a direct player on the country’s domestic infrastructure and real estate development. It is assumed that government spending is the major driving force in the cement industry.

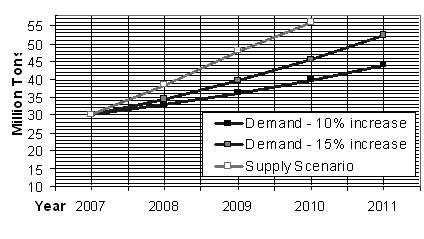

There is increasing interest in the industry, especially after the government announced the 9th development to develop some four economic cities under the Saudi Arabian General Investment Authority which is considered a wide and important source of market for the cement industry. The major factor that attracts interest in the Saudi cement industry is the void in the GCC regional market which makes them competitive and profitable since they benefit from subsidized energy costs (MENAinfocus, 2010, p. 5). The diagram below illustrates the projection of demand and the expected production.

Porter’s Competitive Forces

Porter’s competitive forces have been considered instrumental in defining the business strategy and also relevant in maximizing the utility of value creation and the company’s performance towards its competitors (Porter, 2008, p. 79).

The five forces that shape competition in any industry vary depending on the type of the industry. The five forces that were formulated by Porter in explaining the competitive strategy of an industry in the markets are;

Entry of competitors

This is concerned with how hard it is for a new industry to enter into the market. It also examines the barriers that might exist that can prevent the entry of another industry.

Several factors hinder the entry of other cement players into the industry, these factors are;

- High initial capital requirements: the initial capital required to establish a new cement company ranges between SAR 490 and SAR 600 per ton which is equal to an integrated USD 120 and UDS 160 million. This high costs that are required to initiate a cement plant and to put into operation a cement factory is high and thus deters any potential entry of new players into the industry(global research sector, 2007, 1).

- Supply capacity: the overcrowding of the cement industry may lead to a threat of excess in supply of the product; this makes players who would want to join the market disinterested since it is already overcrowded.

Threat of substitutes

This explains how easy it is for the product of an industry to be substituted; it is more so concentrates on how their products can be substituted for cheap products.

Cement is one of the rare commodities that lack substitute products despite it being a requisite commodity in infrastructure and civil works. This makes cement a prime product in the market.

The bargaining power of the buyers

This seeks to explain the purchasing power of the customers and also whether they can be in a position to come together to purchase goods in large quantities.

There is the high bargaining power of the buyers; this is largely due to the diluted market as a result of several market players which weakens their negotiating power for better price of their commodity. The market is characterized by perfect competition with price-sensitive buyers. There is also a possibility of potential government intervention to prevent the increase in cement prices.

Bargaining power of the suppliers

This explains the importance of the bargaining strength of the suppliers; it answers the questions of whether the supply system is monopolistic or whether the potential suppliers are few or many.

The cost of production of cement companies in Saudi Arabia is low; this is precisely because of the existing mining agreement for limestone between the industry players and the government and also the energy subsidies. The above incentives by the government present cost advantage to the players as compared to their global competitors. The government is the only supplier of limestone as provided for in the royalty agreement. The plenty limestone reserve and subsidized energy that can supply the current clinker and cement capacity; this is a clear indication that the government leaves the players without any alternative supplier.

Rivalry among the existing players

This examines whether the industry has a lot of players and explains if there is a strong competition between the players in the industry. It seeks an understanding of whether there is a dominant player or all the players are equal.

The fact that there are 12 market players in the cement industry is a clear indication of the existence of fierce competition. The availability of several players has led to divisions based on Zones to ensure that every company gets a share of the market. Upon inception of the industry, the entry of new players had an impact on the already existing players losing their share of the market.

Porter introduced the sixth force which he identified as the Government. This explained factors such as the government regulations governing the industry or rather whether the government has an interest in the industry (Value-based management, 2011, p. 1).

Forces to be considered by the cement industry players and why

The forces that shape an industry vary from one industry to another, for example in the airline industry, the rivalry between Boeing and airbus is shaped by the bargaining power of the airlines and issues like the threat of entry, threat of substitution and the powers of suppliers are considered peripheral. In the cement industry, the factors that are likely to shape competition in the industry are

Threat of entry

Despite the overcrowding cement market in Saudi Arabia, the favorable investment climate, the government support of the industry through subsidies and regulations and the booming construction and the real estate sectors can be some of the conditions that make the entry of new players imminent and unavoidable. The entry of new players will have an impact on the price of the commodity and the investment rate and costs. Other factors that may prevent the entry of other players are the incumbency advantages, unequal access to the distribution channels, expected retaliation and also restrictive government policy (Mcguigan et al., 2007, p. 142).

The power of suppliers

In the case of cement industry players in Saudi Arabia, suppliers have the greatest leverage to switch industry players. This is due to the large number of industry players and this has the effect of squeezing profits out of the industry and this can compromise the quality of the products (Porter, 1998, p. 89).

Power of the buyers

In any industry, cement companies included, powerful customers may force producers to cut down prices and they may also demand that the price of the commodity be brought down. Powerful consumers may also play down one industry against the other which can jeopardize the industry’s profitability. As in the case of Saudi Arabia, the major customers are a powerful clique who can dictate prices. The main customers are the government, civil contractors and real estate developers. Among the factors that increase the leverage customers are; when few buyers can purchase the commodity at a large quantity and when the industry commodity is undifferentiated. The buyers can also be price sensitive or they earn low profits (Global Research, 2002, p. 7).

Rivalry among the industry partners

Rivalry among the players in the cement industry may take different forms which include price discounting, new product introductions, advertising campaigns, and service improvements (Porter, 1996, p. 10). The success of a cement company will depend on its competitive edge taking into consideration the market forces. Extreme competition can affect the profitability and the growth of the companies. In an industry like the cement one, there is high competition because the product is uniform which makes the likelihood of price cuts inevitable. Overcoming competition in such an industry calls for measures like capacity expansion (Porter, 1996, p. 10).

Contribution of Michael porter in the field of strategic management

Strategy according to Whittington is defined as a “rational process of deliberate calculation and analysis designed to maximize long-term advantage” (Whittington, 2001, p. 3). Every industry or firm has its strategy that is different from the other depending on how it matters for the management practice. Besides the five forces, porter’s contribution is in terms of the generic strategies and the value chain.

Porter’s generic strategies

Michael Porter defined three generic strategies that are important in analyzing the performance and management of firms (Anon, 2005). These three generic strategies are differentiation, overall low cost, and focus. The three are fundamental in defining and identifying major alternatives that a business should consider before choosing their strategies (Griffin, 2006, p. 207).

According to Porter, a firm that has implemented the three generic strategies has a high chance of benefiting from a higher return on investment as compared to firms that use hybrid strategies. Porter identified the kind of industries that are favored by the generic strategies and came up with the goods industry, paint industry, and electronics industries. A recent study as posited by Kim et al. indicated that differentiation and focus strategies were also practiced in non-profit organizations after researching on Israel health care system in the Israel sick fund (Eldring, 2009, p. 12).

According to Porter, a firm may pursue a differentiation strategy when it intends to distinguish the identity of its products from that of rival firms. This is achieved through enhancing the quality of its products and services. When a firm implements differentiation strategy, there is a high likelihood of it charging more price than that of its rival competitors since consumers are willing to pay more to get the quality product or services, the implementation of this strategy of differentiation will also serve to enhance the reputation and the reliability of the company. The examples of firms that apply the strategy of differentiation are Rolex and Lexus, Mercedes who use quality and reliability as their mark of their products (Jones and Hill, 2009, p. 89).

The strategy of overall cost is applied when a firm seeks to charge less than what its competitors charge for the same service or product; they reduce their manufacturing and other costs which translate into price reduction (Salem, 2005, p. 1). This enables the firm to sell its products or services at a lower price while making a profit since the volume and the quantity of the sales will be high; the objective of firms that use this strategy is to target the mass market. Examples of the firms that use overall cost strategies are Timex watch manufactures, Hyundai and Kodak.

A firm that pursues the strategy of focus is only interested in specific markets which may be regional; they may also choose to concentrate on one product line or may choose to focus on specific buyers. An example of a company that has implemented the focus strategy is the fiat automobile company that only specializes in selling its product in Italy and selected countries of Europe (Griffin, 2006, p. 207).

Porter’s value chain

Michael Porter described the value chain as the sequential activities that are involved in the production of a product or the provision of a service. Michael Porter argued that no firm will incur costs in organizing with particular suppliers to purchase goods that they are freely available in the market. The reasons given for this were;

Product definition

This applies when several firms apply the strategy of product differentiation which forces them to provide the suppliers with the exact specifications.

Risk of supply failure

This is necessitated by the importance of non-price competition which is brought about by factors like quality and reliability which make the consumers vulnerable to the performance of suppliers (Schmitz, 2005, p. 5).

The product chain involves the identification of attributes of the commodities that customers want and what they value most. It is implemented in three stages in the following order; “constructing a value chain both for the firm and the customer, identifying the drivers of uniqueness and selection of the differentiation variables” (Grant, 2005, p. 290).

Critique of Porter’s Forces

Porter’s forces have been heavily criticized. These weaknesses have their foundation in the historical development of the forces. Since the corporate world is driven by profitability and survival, it can only be realized through the maximization of the company’s strategy. Those days as compared with today are different because the operating environment at that time was steady and conventional unlike the modern environment which is ever-changing and this puts into doubt the applicability of the forces in the modern changing environment.

The utility of porter’s forces has been curtailed by;

Perception on economic sense, the model assumes that the market is characterized by the classic perfect market while the model itself is applicable in the simple market structures. The model acknowledges a static market structure which is not the case with the modern markets which are dynamic (Porter’s 5 forces, n.d., p. 1).

Another criticism of porters work is that it is based on an unproven assumption like, for example, there is no relationship between the buyers, the competitors, and the suppliers and they only exist for the structural advantage which can create tendencies for market participants to manipulate others behavior and can exist to act as barriers to market entry. Consequently, the five forces create low culture of uncertainty which necessitates market actors to plan and respond to competitive behavior.

On the generic strategies, porters’ work has been heavily criticized; first, the fact that he posited that the generic strategies are mutually exclusive has been put into question and also makes his work flawed. This is because; differentiation is an avenue to low-cost leadership particularly in this era of technological change. Another criticism also stems from the fact that hybrid strategies may be fit for some industries especially those that are mature in the market.

Consequently, it is argued that combination or rather a hybrid strategy has a comparative advantage than pursuing one generic strategy which can prove disastrous and may result in poor performance, this is because porter’s generic strategies fail to link strategy and performance.

Porter’s generic strategies have also been criticized for their failure to introduce other alternative strategies since it dwells a lot on the low-cost differentiation in a dynamic and competitive global market (Rubach and McGee, Anon).

On value chain, porter’s work has been heavily criticized, not the idea of his work but the order required in putting it into practice since it requires a detailed analysis and it also varies on situations and this makes it time-consuming and unreliable (Journal of management inquiry, 2007, p. 269).

The porter’s equation of competitive advantage with added value has also been criticized since his commensuration of value with profitability is an indication that the theory in under defined; this criticism continues with the adoption of neoclassical principle concerning rationality, this makes the theory a more theory of value and not a theory of value creation. The fact that porter places fixed boundaries on the knowledge and the structure of the market has been a subject of criticism.

Value chain theory has also been criticized due to its prefacing premise that is founded on the principle that when the value chain reduces so does the returns in terms of validity (Dietz and Morgan, n.d.).

Conclusion

The paper has analyzed the contribution of porter in the field of strategic management which is the formulation of the five forces, the understanding of the generic strategies and also the value chain contribution. The Whittington’s explanation of strategy put together with porter’s contribution has revolutionized the way businesses operate.

The Saudi cement sector is a complicated one, this is due to the numerous cement companies and the zoning effect introduced; the zoning may threaten the survival of other cement companies especially those in the northern region where the market share is minimal as compared situated on the proximity to the cities. This zoning has been criticized since it cause against the principle of free market and trade liberalization. Many companies have applied an unethical tactic in trying to bar other cement companies from expanding by obtaining or renew and their mining licenses.

References

Anon. (2005) Value Chain Analysis. Web.

Dietz, A and Morgan, D. (n.d.) A Marketing Interpretation of Value Creation. Web.

Eldring, J. (2009) Porter’s (1980) Generic Strategies, Performance and Risk: An Empirical Investigation with German Data. New York: Cengage Learning.

Global research sector. (2007) Saudi Arabia cement sector. Web.

Global research. (2002) Kuwait cement sector. Web.

Grant, R. (2005) Contemporary strategy analysis 5th ed. New York: Wiley-Blackwell.

Gregory, G and Davies, P. (1980) Empirical explanation of Porters generic strategies. New York: Cengage Learning.

Jones, G and Hill, C. (2009) Strategic Management Theory: An Integrated Approach 9th ed. New York: Cengage Learning.

Journal of management inquiry (2007) Competitive Advantage Revisited: Michael Porter on Strategy and Competitiveness. Web.

Mcguigan et al. (2007) Managerial Economics: Applications, Strategies, and Tactics. New York: Cengage Learning.

MENAinfocus. (2010) Issue no76. Web.

Oxford Business Group. (2006) The report: emerging Saudi Arabia. Oxford: Oxford University group.

Porter, M. (1996) what is strategy. New York: Harvard business review.

Porter, M. (1998) Five competitive forces that shape strategy. New York: Harvard business review.

Porter, M. (2008) “The Five Competitive Forces that Shape Strategy”, Harvard Business Review, January: 78-93.

Porter’s 5 forces (n.d.) Porter’s Five Forces. Web.

Rubach, A and McGee, S. (n.d.) Stuck in the middle: for retailers, perhaps not such a bad place to be. Web.

Salem, G. (2005) The Use of Strategic Planning Tools and Techniques in Saudi Arabia: An Empirical study. Web.

Schmitz, H. (2005) Value chain analysis for policy-makers and practitioners, International Labour Organization. New York: Cengage Learning.

Value-based management. (2011) Value-based management; five competitive forces framework. Web.

Whittington, R. (2001) What is strategy, and does it matter? London, UK: Thomson learning center.