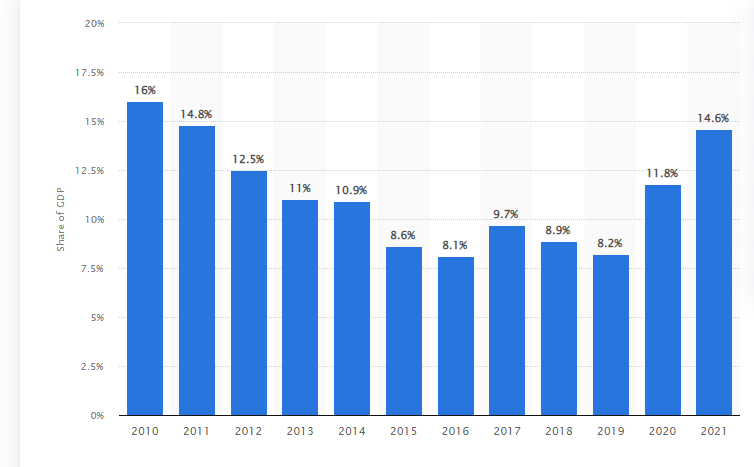

Chile is regarded as a model in Latin America for its financial and political transparency. The country has been perceived to be among the fastest-growing economies for the past decade, making it substantially reduce poverty (“GDP growth (annual %) – Chile,” n.d.). The World Bank estimates that the influence of the COVID-19 crisis has had the potential to reverse the years of growth for the middle-class people in the country. In 2021, the nation’s GDP grew by 11%, with drivers being increased domestic consumption, inventory renewal, and economic measures to support income (‘‘GDP growth (annual %) – Chile,’’ n.d.) as shown in figure 1. However, in the coming years, the country’s economy is projected to continue growing at a slower rate and benefiting from the strong copper global process and continued monetary stimuli. In 2022, the GDP growth projection is expected to reach 2.5%, with its expectation to stabilize in 2023 at 1.9%.

The major industry is empowering Chile’s foreign trade in the mining industry. The top exports of Chile are copper ore, refined copper, Fish Fillets, sulfate chemical wood pulp, and pitted fruits (‘‘Copper ore in Chile,’’ n.d.). The products are exported mainly to China, the United States, Japan, South Korea, and Brazil. In 2020, Chile formed the biggest exporter of copper ore, refined copper, pitted fruits, molybdenum ore, and grapes globally (‘‘Chile – Mining,” n.d.). Therefore, Chile’s mining industry is one of its economic cornerstones because the country has large amounts of copper reserves, making it accountable for a third of copper output produced internationally. Following the performance of the manufacturing industry, in 2021, goods production increased significantly.

Chile forms the top copper producer globally, with 28% of international copper production, and the multinational’s second-largest lithium producer, with a 22% share of the global population (“GDP growth (annual %) – Chile,” n.d.). The industry produced 5.73 million tons of copper in 2020, with 70,000 tons of lithium carbonate equivalent in 2019 (‘‘Chile – Mining,” n.d.). Over recent years, the mining sector contributed to the nation’s GDP with 11% growth making it a prime sector of the country’s economy (“GDP growth (annual %)” – Chile,” n.d.). This World Bank’s report also reveals that in 2021 the mining industry accounted for about 14.6% of the nation’s GDP, forming one of the highest recorded contributions since 2011. In 2017, the GDP was 9.7% representing an increase from the previous year. “GDP growth (annual %) – Chile” reveals that there was a decrease in GDP in 2018 at 8.9% and in 2019 at 8.2%. In 2021, the mining exports from Chile contributed to more than a 56billion U.S. dollars.

Considering the mining industry in the U.S. in 2021, the mining sector contributed 283.7 billion chained U.S. dollars of value to the real GDP of the U.S., which amounts to approximately 23 trillion U.S. dollars (“GDP growth (annual %) – Chile,” n.d.). The mining industry employs workers either directly or indirectly, and in the U.S., the industry became a majority in the 19th century following new mineral discoveries (‘‘Copper ore in Chile,’’ n.d.). Chile continues to perceive the United States’ services and products as innovative and of the highest quality. Some of the best investment opportunities are in high-value projects needing innovative solutions like smart grid technologies, public transportation platforms, data analytics, and 5G technology.

Chile is taking steps to increase its energy-installed capacity to meet growing demand over the next decades. This is because Chile has high energy costs, so it will need to integrate technology using new energy generations to increase supply. Among the US leading service and equipment exports include mining equipment, high-value food products, urban transportation, and automotive parts. Others comprise of clean energy, healthcare, security and safety, environmental technologies, agricultural equipment, telecommunication, and water resources.

The economic policy of Chile is based on the principle of capital transparency and non-discrimination against foreign investors. As a result, this principle has formed the cornerstone for attracting more investment in the country. Among the opportunities that the U.S. investors are attracted to are due to its judicial security, growth potential, stable macro-economic systems, natural resources, and high quality of infrastructure and low risks.

Therefore, some opportunities for U.S. investors include the mining industry, manufacturing, and agriculture. These industries form the basis of economic growth for Chile, which has boosted its GDP and contributed to poverty reduction (‘‘Chile – Mining,” n.d.). Chile is considered a strong trading partner and export market; however, the country has challenges that an investor might consider while doing business to be sure of the opportunities before taking venture steps. Chile and the U.S. have longstanding business associations, with Chile being the largest U.S. goods export market globally.

One of the existing multinational organizations with initiatives in Chile that offers new trade opportunities is TMF Group. The organization has more than 30 years of experience helping international and local clients. The organization comprises wide-ranging expertise, and with local knowledge supported by global reach, it will be easier to understand Chile’s business opportunities and market ventures. Doing business in Chile requires a good understanding of the business processes and potential challenges to overcome in business implementation.

In conclusion, Chile has been considered one of the fastest-growing countries economically in the past years. The country has a transparent political and economic environment with an increasing GDP growth rate, with the industrial sector entailing mining, manufacturing, and agriculture as the main contributors. Chile produces 28% of copper internationally and is a good region for U.S. exports. Some key factors for investors’ choice to explore the Chile market are its rich natural resources, low risks, quality infrastructure, growth potential, and judicial security.

References

Chile – Mining. (n.d.). International Trade Administration | Trade. Web.

Copper ore in Chile. (n.d.). OEC – The Observatory of Economic Complexity. Web.

GDP growth (annual %) – Chile. (n.d.). World Bank Open Data | Data. Web.