Huawei Technologies Co. Ltd. was founded in 1987 by Ren Zhengfei in Shenzhen, China, and in three decades has grown from a small start-up to one of the largest technology giants in the world. Due to this incredible success, the company has won the status of a dynamic, innovative, rapidly growing, and progressive enterprise that has the potential to surpass its competitors in the market and take the position of an unquestionable leader (Thirion & Viveros 2016).

When Huawei began its operation, reverse engineering of foreign products was used as the major way of picking up technology and transforming it into a more complex one. However, with the course of time, the company shifted the focus of attention to in-house research and development (R&D), which, coupled with its aggressive price undercutting, allowed it to expand its operations to over 140 countries and increase profits up to $5.5 billion. Currently, it is the only organisation in China that receives the largest part of its revenue (app. 65%) from international sales being less popular in the domestic market than in the global one. Presently, it employs more than 170,000 people around the world providing them with notable career opportunities and competitive salaries (Thirion & Viveros 2016).

The three major segments of operation of Huawei are operator carrier networks (including its first in-house product–telecommunications switches, fixed, wireless, and core networks, telecom software, etc.), enterprise solutions (developing and producing ICT goods and solutions, such as communication and cooperation strategies for public utilities and government bodies, network infrastructure, cloud-based information storages, etc.), and consumer products and services (home and mobile devices, smartphones, tablets, applications, etc.) (Cooke 2014).

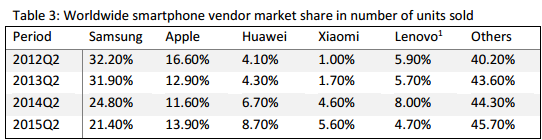

Since 2013, the company is making its best to outperform the leaders of the consumer market, Apple and Samsung, by investing large sums in strategic management and innovation. Its market share as well as revenues saw a considerable growth between 2012 and 2014. Yet, today the organisation has to deal with a number of strategic challenges that may present a threat to its competitiveness.

First and foremost, the manufacturing country (alongside with low prices) creates the impression of low quality, undermining the reputation of the company. Furthermore, the company’s profit margins are negatively affected by its aggressive low-price policy. Another problem is that the organisation is often accused of intellectual property theft owing to its original approach to technological development (reverse engineering). The company must find ways to overcome these challenges if it wants to stay afloat and improve its performance on the international scale.

Objectives of the Study

The research at hand intends to achieve the following objectives:

- perform a profound strategic analysis assessing the current situation of the company and identifying critical issues it has to address;

- provide recommendations on strategic choices for the future, assess risks and predict outcomes;

- prepare a 5-year strategic plan of action highlighting objectives, deadlines, focus areas, priorities and key performance indicators (KPIs).

Strategic Analysis

Research and Development (R&D)

When the company was founded, the industry of telecommunications in China was mostly developing due to imports that allowed acquiring new technologies. Fixed-line telephones were used mostly by government organizations, big enterprises, and public facilities, whereas the adoption rate for fixed line devices did not exceed 0.5%. Huawei initially specialized in telecommunication switches that allowed switching connections between various branches and linking phone lines (internal to external); however, already in 1990, the first key strategic decision was made to develop a totally new technology.

It was the first significant step forward taking into account the fact that all the domestic competitors opted in favor of establishing an international joint ventures to adopt their partners’ methods and strategic decisions. Making emphasis on R&D, the company increased its R&D to production staff ratio, which made it keep its production staff in strict limits as it was rather challenging for a private organisation to raise capital and find resources (government-owned banks did not give them loans).

This was connected with a substantial risk. However, already in 1993, Huawei released the first product developed following the new technology: It was a large-scale switch that proved to have better characteristics than any of the similar products in the market and therefore immediately gained popularity in the market. Due to R&D, the revenue of the company grew significantly, which allowed it to compete with the leaders of the market (Kumar & Menon 2017).

Globalisation

Another significant strategic decision Huawei made was to look abroad for continuous development and growth. This was (and still is) a challenging task as it required making prices incomparably lowers than those of the competitors to attract the potential customer in the countries looking for innovative technologies at affordable prices, such as Russia, Brazil, Thailand, and South Africa. As a result, the company had to implement a policy of aggressive pricing (in some cases cutting competitors by more than 30%) to be able to enter developed markets afterwards.

Operations in Europe and the United States, which began in 2001, followed the same strategy, which developed into a new business approach called “value-for-money innovation” implying that the latest technologies and costomisation are offered at a minimum possible price. The strategy reached the peak of its success in 2004, when the international sales of Huawei exceeded domestic ones and the prices were slashed below those of the competitors by more than 70% (Thirion & Viveros 2016).

As a result of globalisation coupled with the price strategy, by 2011, the company became one of the major global suppliers and the largest telecommunications vendor in terms of the overall revenue. It employs 170,000 people (one-third of them are not Chinese) in 22 offices and more than 100 subsidiaries. It continues concentrating on R&D, which made it possible to file app. 50,000 patents. However, some strategic shift can still be traced: For instance, Huawei now tries to switch from the business-to-business to the business-to-consumer mobile device market offering middle and high-end smartphones to compete with Apple and Samsung (Cooke 2014).

Key Challenges

The major challenges the company has to address can be summed up as follows (Campbell-Kelly et al. 2015):

Security issues

One of the main problems Huawei deals with is connected with security of the carrier network and enterprise market, which appears as a result of the company’s connections with the government. Its network infrastructure is blocked in many countries due to the threat that it may pose to national security via espionage channels. The organisation is now prevented from supplying its products to such huge and important markets as those of the United States and Australia.

This tendency undermines the future of the company in the development of network infrastructure segment and makes it increase transparency up to a dangerous point. It has been releasing reports that have been criticised for a lot of missing points, irregular dates of release, inconsistency, differences between versions in different languages, and other drawbacks.

Low brand awareness in the global market: Despites the failures in the network segment, Huawei is rather successful in the device market gradually transferring from B2B to B2C business model, which already pushed it to the top. Its smartphone sales has grown by 32% during 2014 and are still on the rise due to its current focus on premium devices that are gaining popularity both inside and outside of China.

However, what is really crucial is to leverage both online and offline strategies to increase brand awareness in the global market: the problem is that Huawei is still perceived by many as a network infrastructure and a B2B telecommunications solution supplier. That account for the fact that brand recognition outside the domestic market is low and the company remains largely unknown to the foreign customer. Its present success in the smartphone industry is connected with emerging markets where customers are not beginning to replace their primitive mobile devices with smarphones (for which Huawei with its democratic prices is a perfect option).

While the popularity of the brand is increasing in the Middle East, Africa, and Latin America, its future in the developed countries remains unpredictable as the pricing strategy cannot guarantee success in the markets where consumers value prestige, design, and brand name. The difference of consumer values explains the success of Samsung and Apple that Huawei cannot surpass in the near future.

Besides, Chinese companies are commonly associated with poor quality, which is another prejudice that Huawei will have to overcome if it wants to remain competitive. Most customers do not know how much the organisation invests in research and development. Therefore, the critical success factor now is to build brand awareness. For this purpose, a lot of money has to be spent on marketing campaigns that would create the image of an innovative, high-quality manufacturer. This would require TV, Internet, print, outdoor, and other types of commercials as well as various platforms and retail channels to change the customer’s perception globally.

Controversial R&D process

Technology development has always been rather questionable even when Huawei moved from reverse engineering to R&D and started to follow its own, unique strategy. It was often accused of improper acquisition and intellectual theft (by Cisco Systems and Motorola) even despite the fact that such type of ‘borrowing’ is allowed under the law.

The matters were settled without the court interference but the company had to withdraw some of its devices from the market, which attracted a lot of undesirable public attention and marred the reputation and the brand image. While such cases are not infrequent in the Eastern markets, it produced a considerable negative impact on Huawei’s position in the United States and in Europe. Now, to leverage success, it has to prove that it is not an imitator but an original designer of unique products that files numerous patents a year that lead to technological breakthroughs.

Controversial pricing strategy

Although the aggressive low-price strategy allowed the company to reach success in the network segment, it may negatively affect its margins for the whole market and aggravate ongoing price wars. Huawei does not seem to be willing to change its pricing strategy in the consumer smartphone market either, which could bring about unpredictable consequences in the West as too low prices may convince customers that the product is of low quality.

Strategic Choices

Taking into account the present-day situation with all the enumerated obstacles the company has to overcome, the key question Huawei has to answer is what path it should choose to compete both in the local and in the global market. The problem is that the development of the organisation in China heavily relies on its ability to cooperate with the government, which could at the same time prevent it from transforming into an international telecommunications giant that would be able not only to stay competitive but also to surpass Samsung and Apple (Ren & Zhu 2014).

There are several scenarios (not necessarily exclusive) that could be implemented by the company to ensure its future development.

Continuing Local Growth

Even though Huawei puts a lot of effort to expand its global presence, this scenario also offers a number of evident benefits: First and foremost, China is now one of the few markets of telecommunication technologies that provides such favorable conditions for growth. The country is also the leader in manufacturing handsets (app. 250 million devices are produced per year), which makes it the telecommunications superpower with more than 700 million fixed and mobile subscribers.

This accounts for the fact that China is now the main location for global investment: A lot of American and European companies opt for strategic positions in China, which has already become an integral component of globalisation for every large enterprise looking for expansion in spite of a number of political, legal, economic, and cultural difficulties that they face entering the Chinese market (Peng 2016).

Indigenous companies like Huawei have an advantage of doing business in China without having to overcome integration obstacles. Moreover, they enjoy the financial support of the government, which is a considerable advantage over competitors. That is why it may be more beneficial for Huawei to concentrate its effort on preventing its domestic market from invasion of the global industry giants that come to China to reinforce their positions weakening in the West. Its innovative products and price strategy will easily win the company the domestic dominance even over foreign brands as its market penetration is much deeper.

Yet, some market researchers argue that leaving the local for the sake of the global was not a choice but a necessity that Huawei could not ignore if it wanted to stay afloat. The major risk connected with staying in China is the uncertainty of the future: If the US and European markets manage to recover from their recess, China as a promising business arena my step back into the shadow (Aronczyk 2013).

Increasing R&D Spendings

Another scenario emphasises the importance of R&D expenditure, which has alredy grown by more than 40% from its initial amount. Almost half of all the employees are involved in R&D and the organisation continues to hire new engineers, especially looking for those who have an experience for working for other industry leaders. Its research laboratories are scattered around the world providing researchers with a perfect opportunity to come up with ideas of creative, value-adding innovations. First and foremost, R&D spending is meant to ensure development of common build blocks and customise services to the maximum.

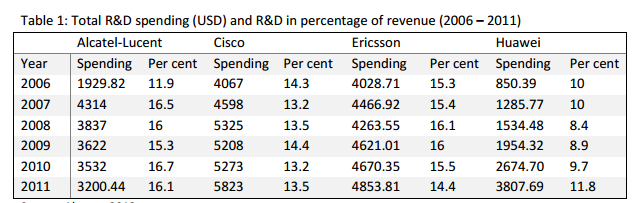

Moreover, the company owes its success to R&D provided the competitive edge by allowing Huawei to following its own strategic and technological decisions and stepping away from reverse engineering. Nevertheless, in spite of all effort and the significance of R&D for the company, its spending on it looks ridiculously small in comparison to that of the industry leaders, which restricts its capability to compete with them in the global market.

Thus, unlike the previous scenario stressing the importance of the outer factors, such as location, this solution presupposes to shift the focus of attention to inner policy and investment strategy. On the one hand, the key to success is to develop intensively, not extensively; on the other hand, Huawei would find itself in the situation, in which it would have to balance between generating sales revenue and R&D expenditure as the latter is quite impossible without the former. The risk is that the oganisation may turn out to be able to increase R&D investment only up to a certain point, which would be insufficient to compete with global telecommunication players (Cox, Clegg, & Ietto-Gillies, 2013).

Forming Strategic Alliances

If it becomes quite evident that Huawei is not able to surpass its competitors, the company may try to focus on mergers, acquisitions, marketing alliances, and joint ventures to be able to turn competition into cooperation. If the company chooses this scenario, it will be able to successfully deal with increasing R&D costs, introduce more innovative products and method, and facilitate the entry to the new markets. Moreover, it will be easier to bring world telecommunication standards to China (Hensmans 2017).

Indeed, the company already has a positive experience of joint ventures and alliances: It formed a joint venture with 3Com, Marconi UK, Cognigine, and Optimite. Its location strategy (opening offices in countries where it has partners) is not unusual for the international business as it allows ensuring that strategic decisions will have a necessary local support. However, despite providing a number of guarantees and benefits, alliances could not be fully reliable. If Huawei opts for this scenario, it must be ready that its partners will use it for achieving their own goals. Moreover, cross-cultural cooperation always has a hidden danger of communication failure and misunderstanding aggravated by nationalism, which is not quite influential in China (Hensmans 2017).

Opting for Global Growth

Chinese organisations often suffered from the gap between their strivings and resources they have, which explains why Huawei is unable to compete with global industry leaders directly even despite its heavy R&D investments and active participations in alliances. Its efforts to penetrate markets of the developed countries do not produce the expected results, which means that the company still has the image of a low-cost telecommunication devices producer.

This allows stating that the most suitable scenario for future development should rely on the competitive advantage created by low-cost production and popularity of Huawei products in developing countries that need cheap technology. Instead of losing time and money on trying to achieve the unachievable, the organisation has to leverage its real success factors. Its increased presence in the developing countries will provide revenue sources for investing more in R&D. This way, Huawei will be able to challenge the position of the established vendors even despite the late entry to the developed market.

Accepting the fact that Huawei needs to expand globally, it still has to identify what position it must take in globalisation since not all of its ambitions can be currently satisfied taken into account marketing strengths of its competitors. Although the risk of losing the established position in the West is rather high, the company still has a good opportunity to improve its image through serving the needs of less advantageous societies, prove the high quality of its products despite their low costs, and earn more for providing adequate R&D investment to be able to compete with the global players on equal terms (Qiu 2013).

Plan of Action

In order to minimize risks and increase chances for success, it is necessary to develop a clear and concise strategic plan of action that would cover the period of no less than five years (from 2016 to 2020) that would help understand the company’s goals, establish deadlines for their achievement, set priorities, and identify key performance indicators (KPIs).

The key performance indicators will be:

- profit;

- cost effectiveness;

- cost of goods sold;

- day sales outstanding;

- sales by region;

- customer lifetime value;

- customer acquisition cost;

- net promoter score;

- customer satisfaction and retention;

- number of customers;

- percentage of product defects;

- employee turnover rate;

- employee satisfaction.

Conclusion

Despite its evident success and growth, Huawei still has to deal with a number of strategic problems as its products are still perceived as inferior in the developed markets. Its technological development does not receive due investment for the company to be able to compete with the global leaders. Its aggressive low-price strategy is widely criticised and does not help the company improve its position in the smartphone sectors. Thus, it has several strategic options. However, one of the most effective scenarios is to invest in expansion into developing market where low-price products are in high demand.

Reference List

Aronczyk, M 2013, Branding the nation: the global business of national identity, Oxford University Press, Oxford.

Campbell-Kelly, M, Garcia-Swartz, D, Lam, R, & Yang, Y 2015, ‘Economic and business perspectives on smartphones as multi-sided platforms’, Telecommunications Policy, vol. 39, no. 8, pp. 717-734.

Cooke, FL 2014, ‘Global expansion and human resource management of Huawei Technologies Ltd’, International Management: Theory and Practice, pp. 384-401.

Cox, H, Clegg, JL, & Ietto-Gillies, G 2013, The growth of global business (RLE international business), Routledge, London.

Hensmans, M 2017, ‘Competing through joint innovation’, MIT Sloan Management Review, vol. 58, no. 2, pp. 26-53.

Kumar, SS & Menon, RP 2017, ‘Brand loyalty of customers in smartphone brands’, Indian Journal of Marketing, vol. 47, no. 3, pp. 8-15.

Peng, MW 2016, Global business, Cengage Learning, London.

Qiu, G 2013, ‘China emerges as a smartphone power’, SERI Quarterly, vol. 6, no. 4, pp. 16-35.

Ren, H & Zhu, MR 2014, “Competition, dilemma and governance: an analysis of the patent cases in the smartphone industry’, Journal of Jiangxi University of Finance and Economics, vol. 6, no. 1, pp. 004-018.

Thirion, JM & Viveros, JC 2016, ‘The globalization strategy of a Chinese multinational: Huawei in Mexico’, Frontera Norte, vol. 58, no. 26, pp. 35-58.