Introduction

Human Resource Management (HRM) is the most important corporate management department. It takes responsibility for managing the firm’s human resources to ensure its objectives are achieved according. Corporate leaders agree that people are the biggest assets of any firm (Armstrong, 2008). Unlike physical assets whose value can be easily depreciated, it is difficult to do the same for an organisation’s employees (Sims 2007, p. 45).In the increasingly competitive world, specific job-related skills are becoming scarce, and corporations are spending huge amounts of money on training their staff (Gerald 2011, p. 237).

In addition, new principles of management have been incorporated into the practice with the appearance of new regulations (Dessler 2004, p. 56). This paper will analyse HRM through an examination of new approaches, recruitment and selection, monitoring and rewarding employees, and procedures held at the Industrial and Commercial Bank of China (ICBC) in Hong Kong.

New Approach to Human Resource Management

The Welfare Tradition and Industrial Relations Tradition

This was primarily aimed at managing the welfare of employees. In this arrangement, employees and employers had a paternalistic relationship grounded on the guild masters principle (Paauwe 2004, p. 109). The main idea of the welfare system by employers was the need to avoid confrontations with the labour unions (Mathis 2000). In this stage of HRM management, employers were focused on the management of the relations with trade unions.

This stage led to the creation of trade unions allowing women to work in areas that were traditionally reserved for men. At this point, unions pushed for fair treatment of employees through the provision of restroom facilities, better wages and continued employment (Paauwe 2004, p. 111). High demand by labour unions led to the formation of personnel departments that were concerned with employees’ welfare.

Control of Labor Tradition

Control of labour tradition was made possible by the establishment of employees’ management units in business organisations. It marked the first attempt to comprehensively manage the flow of labour at business firms (Paauwe 2004, p. 113). At this stage, jobs were aimed at managing the workforce (Reddy 2004). They worked under the works office that was also in charge of granting leaves, payments, and roles that specialised more human resource management.

Professional tradition

After World War I, there was a need to merge welfare systems and personnel management units in business organisations. This marked a further step in evolving PM to HRM (Paauwe 2004, p. 114). There were mergers and acquisitions contributing to a better approach to employee control. After the end of the Second World War, the emphasis was placed on employees’ affairs management through legislation governing organisational relationships. In the 1980s, the advanced PM departments were managing complex systems in business organisations, which led to the current HRM departments (Briscoe et al. 2008, p. 187).

Today, HRM is charged with managing organisational resources that include the skills offered by employees (Storev 2007, p. 67). The process covers mainly, planning, compensation and rewarding, recruitment and staffing, development and evaluation and management of workforce relations. The figure below helps summaries the organisation of HRM that is present in many modern business organisations (Appendix 1).

Roles and Tasks

The modern HRM organisation takes many responsibilities and role that are critical for organisation survival (Armstrong 2008, p. 108). The bank acknowledges that the role of human capital development in the corporate sector cannot be overestimated. In this respect, ICBC has identified roles and activities to implement for better performance and retention of the company’s human resources. They include division and implementation of the bank’s policies and strategies and provision of advice and guidance to the employees of the bank at all levels of management (Tansky & Heneman 2006). Finally, the bank expects the human resource department to implement activities that support managers and supervisors whose responsibilities involve direct management of the people.

Role of Line Managers

Line managers play an important role in enhancing the tactical aspects that have been traditionally performed by HR. Moreover, they are the first people who solve minor disputes before they are taken over by HR. ICBC asserts that line managers come in handy in spotting and scouting for talent, helping in motivating fellow employees, coaching, developing the staff within the company (Human Resource Strategy 2008).

The managerial structure of ICBC embraces a wide range of roles and responsibilities. Specifically, there are several departments in the organisation that report to Jon Schubert, President and CEO. These departments include such spheres as insurance, information, corporate communications and stakeholder relations, transformation processes, human resources, finance, marketing, and corporate affairs and governance (Human Resource Strategy 2008).

Each branch has a specific range of duties and obligations that should be aimed at improving the effectiveness and efficiency of the organisational performance (Industrial Commercial Bank of China, 2002). It should be noted that line management system largely depends on the human resource management because this department should monitor the level of performance and allocate the responsibility to each manager within an organisation (Harris et al. 2003, p. 74).

Specifically, the manager should have sufficient experience in developing public and private segments of the company and provide viable advice to support managers to reach the highest results and objectives. In their turn, line managers should have great awareness of the synergy between financial and human resources (Harris et al. 2003, p. 74). Judging from the analysis of the-above presented structures and responsibilities, certain departments should be united into one section for sharing information and experience.

Recruitment and Selection

Need for Human Resource Planning in ICBC

The bank believes that corporate survival in this competitive business environment can only be achieved through good human resource management. ICBC, therefore, seeks to improve its HRM capabilities through the launch of reforms in its HRM process resulting in the attraction and retention of talented personnel (Human Resource Strategy 2008). More importantly, the company strives to encourage senior management to increase performance by creating beneficial pension plans and effective human capital programs (Industrial Commercial Bank of China, 2002). The performance reviews are possible through the evaluation of changes occurred to the organisation.

With regard to human resource planning, CEOs should gain sufficient information to handle daily operations effectively. Specifically, they should be more concerned with the level of compliance with employee performance and safety. A human resource manager should realise that these dimensions are toughly connected (Human Resource Strategy, 2008). Additionally, although the organisation monitors daily operations horizontally, the President should pay closer attention to the way various departments interact with each other. At this point, a collaborative approach to handling different situations and making an important decision is a priority for the company.

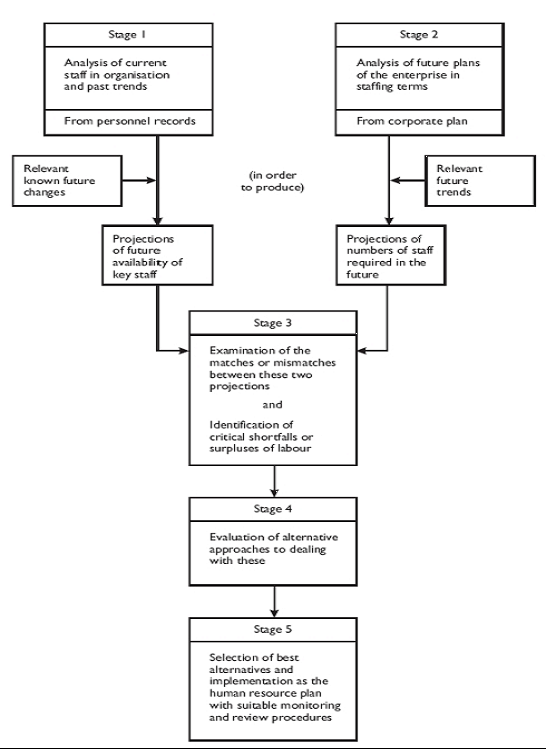

ICBC has identified five stages through which reforms will be implemented to attain the required competitive stages. The first stage is the competitive selection of managerial staff that requires candidates to take open tests, interviews, and in-depth appraisals. The second stage is the implementation of reforms in the recruitments of personnel (Industrial Commercial Bank of China, 2002). A scientific approach was adopted for this plan involving a rational and smooth reduction of employees of the bank while encouraging the internal flow of personnel that have been provided for career development paths. In addition, the bank has established a scientific performance appraisal and evaluation for all its employees for promotion and career growth.

Recruitment

In general, recruitment involves matching the skills and knowledge that a potential employee possess. It should also be stressed that recruitment and selection is an inherent element of general human resource management. At this point, the process is strongly associated with human resource management processes, including performance appraisal, job design, reward systems, and promotion (Nankervis et al. 2009, p. 1).

The recruitment process at the ICBC is not varied much from what is described above. The bank has adopted a scientific mechanism that has standardised labour contracts to accord better remuneration and working conditions to the employees. Matching of skills is carried out through a series of tests that applicants should take. The tests include written examinations, interviews, and appraisals. After employment, the recruits undertake comprehensive learning and development programs that are specifically designed for that purpose.

Obviously, top-ranking company ICBC should hire the best workers whose experience and skills can contribute to sustaining a competitive edge. The above-presented principles are the leading ones in promoting powerful human resource planning, introducing innovation and reform, and strengthening management strategies. In this respect, talented and intelligent people constitute the core value of ICBC that cannot succeed without their support (Recruitment Information of ICBC, 2008). More importantly, the organisation strives to emphasise the role of personal values in progressing ICBC high performance.

Interview Selection

The interview is one of the dominating techniques in the process of employees’ selection and recruitment. The method is especially efficient as far as the personnel selection is concerned because it is more contributive in terms of prediction of future performance (Billsberry 2008, p. 49). In contrast, the implementation of psychometric tests has now been acknowledged as disadvantageous for the purpose of protecting groups from moral pressure.

Therefore, the primary emphasis is made on social interaction in the course of recruitment to establish a favourable relationship between employers and their subordinates (Billsbery 2008, p. 49). Judging from the assessment, ICBC human resource department should pay particular attention to the techniques that interviewers apply to while communicating with applicants.

In addition, the interactive nature of interviews has complicated the achievement of uniform results (Torrington et al. 2008, p. 264). However, other researches have indicated that interviews give fairer outcomes, especially in situations where interviewers are well trained.

Selection Practices and Procedures in ICBC and MTR Corporation

Both ICBC and MTR Corporation are companies based in Hong Kong China and with established global operations. Specifically, ICBC has a workforce amount to 400 thousand people, which makes the company one of the biggest employers in Hong Kong. Both organisations have relatively similar practices as far as recruitment and selection processes are concerned. While comparing the two, however, careful observation uncovers that ICBE places emphasis on retaining internal talent resources, whereas MTR concentrates more on acquiring fresh external resources. The differences are clearly captured in the presented selection modes.

ICBC uses an assessment centre mode of selection, implying the usage of a multi-dimensional approach. The interview conducted by the ICBC representatives is based on a number of techniques and methods. The interviewers take into consideration the way applicants get ready for the interviews, as well as the information they disclose about themselves. In general, the company managers make use of a number of recruitment processes, including testing, as a series of interviews, reference checks, and education verification. Importantly, the application process largely depends on the position you are required (Human Resource Strategy, 2008).

MTR Corporation recruitment policy is based on integrated approaches to handling human resources efforts and support in a cohesive manner. The graduate development programs are part of the selection techniques as well. At this point, the MTR recruitment scheme allows the applicants to consider several positions to understand which one fits best their interests and preferences (Graduate Recruitment, 2011).

Hence, MTR Corporation relies on interviews, which also include psychometric tests, aptitude tests, work samples and assessment centres. The company asserts that they employ these mechanisms to capture the best talents that can work in an internal environment. In-depth evaluation to ascertain the effectiveness of the above approaches requires empirical analysis of data collected from a variety of sources within the organisation.

Monitoring and Rewarding Employees

Job Evaluation and Factors Determining Pay

ICBC pursues specific salary distribution scheme where the priority is given to performance and value contributions. Specifically, the bank focuses primarily on stuff’s values, performance, and abilities. The modern philosophy of the organisation lies in strengthening these aspects through payment distribution methods. The salary is defined according to position, abilities, and performance. Bonuses are also included in the payment package (Human Resource Strategy, 2008). The organisation attains much importance to the process of job evaluation. Specifically, the primary focus is made on the analysis of the information received from tests, interview to have a better comprehension of a future employee’s profile.

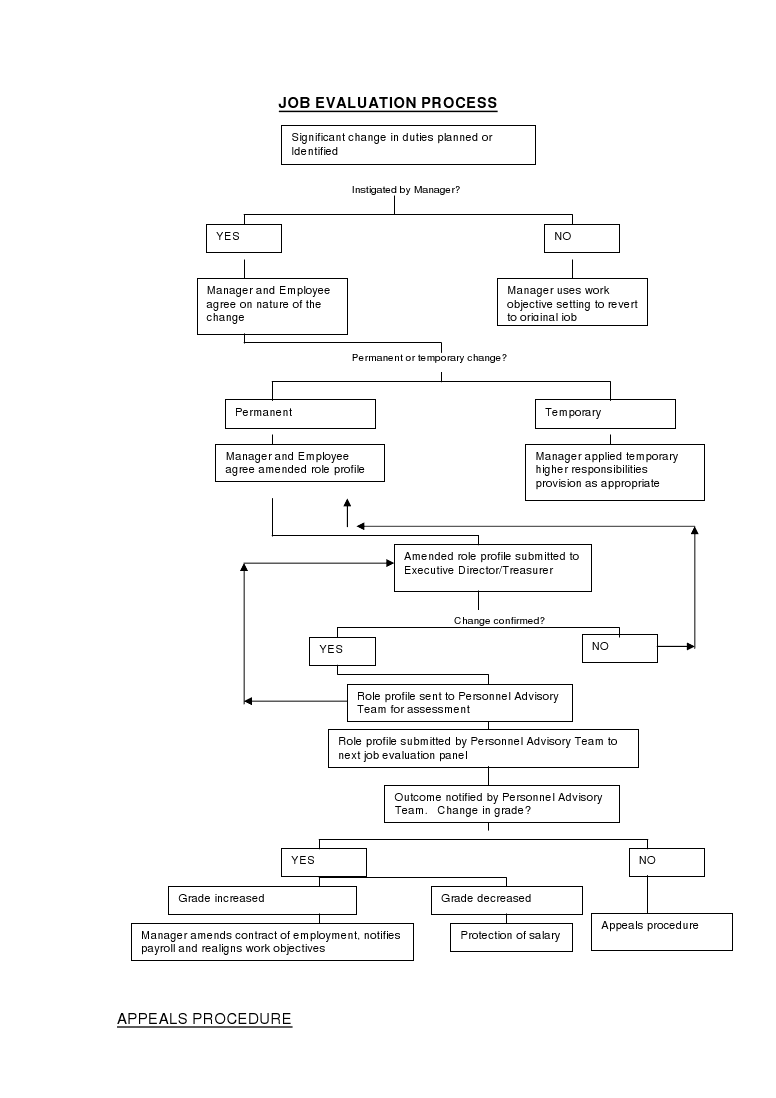

Job evaluation procedures discussed above are based on compensation factors such as skills, experience, and responsibility. The information presented earlier in this paper provides that payment received by an employee can be received from an organisation only after the evaluation has been provided. Aside from job evaluation, market rates also influence pay upon employment (Tansky & Heneman 2006). The biggest compensation factor, however, is education coupled with experience. A typical job evaluation model is shown in the diagram (Appendix 2).

Reward Systems in ICBC

As can be understood from the above-presented strategies, ICBC reward system is premised on three main pillars: values, positions, and performance. These factors determine the creation of assessment tools (Human Resource Strategy, 2008). In ICBC, the bank has implemented a comprehensive reward system that includes an open salary system that takes into account market salaries. Besides the basic pay, employees are granted pension insurance, unemployment insurance and well as medical insurance, all of which are catered for by the company. Additionally, ICBC is implementing profit-related remuneration packages that will ensure employees share the profits made by the company.

Most organisations have introduced performance-related, education-related and experience related reward systems (Gerald 2011, p. 237). Performance-related systems help in motivating employees through recognition of their work. The main undoing, however, is that some of the employees may result in overworking in order to be recognised. Education-related incentives mainly encourage more employees to further their education effectively bringing on board crucial skills for organisational success. In this respect, the trainee programs introduced by ICBC contribute to increasing employees’ performance and motivation (Human Resource Strategy 2008).

Motivational Theory and ICBC Reward System

For the majority of employees, payment is one of the most important rewards motivating them to work more efficiently. According to Torrington et al. (2008, p. 263), money can serve as an important tool for satisfying the employees’ basic needs. At the same, payment should accurately correlate with the bonus scheme that should create sufficient motivational value. On the other hand, repeated rewards can lead to the intended action becoming a habit (Gerald 2011, p. 278). The reward of employees is meant to reinforce their motivation to the extent that they become conditioned to perform highly.

While discussing the ICBC rewarding system, the company has gone beyond the traditional rewards to motivate employees and ensure their loyalty to the firm. Motivation being the driving force that pushes a person to do something has especially been boosted through the introduction of a corporate profit-sharing system that will see employees benefit directly from the company’s profits. Specifically, the company is more concerned with distributing payments in accordance with the achievement that employees have contributed to the company’s development. Such a scheme is beneficial both the company’s performance and employees’ motivation. In addition, ICBC applies to the analysis of corporate culture, striking a balance between social profits and the company’s profit (Human Resource Strategy 2008). In general, this integrative approach creates a favourable environment for development.

Performance Monitoring

The increasingly competitive business world and the ever-demanding customers and other stakeholders have made it necessary for organisations o implement various ways of monitoring performance to ensure set qualities and standards are met and adhered to (Schuler, & Jackson 2007, p. 67). Additionally, in-depth appraisals are done to ascertain the position of the organisations in terms of internal environmental matters, organisational capacity and organisational motivation.

ICBC has in place a scientific job appraisal and performance evaluation mechanism that is developed with an international consulting firm. The plan has scientific appraisal indicators for employees’ performance measurement. In order to increase the performance, the company seeks to promote banking activities through enhancing the qualification of personnel and continuous development of the working environment (Human Resource Strategy 2008). Hence, the employees should have powerful incentives, award program engagement, and perspectives for common development. These are the main prerogatives that are pursued by ICBC HR managers.

Specific training programs are also introduced to invite more workers to cooperate with us. Using an individual approach, ICBC strives to meet its requirements and correlate those with the overall growth strategy of the company.

Procedures on Exit

Exit Procedures (brief and short evaluation)

In both organisations, elaborate exit procedures have been introduced. They include resignation, dismissal, exit through redundancy, and retirement. Both organisations conduct exit interviews for all members of staff who leave their ranks. Additionally, they have implemented sign-off procedures that all staff that depart from the company uses. These criteria used by ICBC and MTR Corporation meet standards with regard to the internationally recognised best practice.

Redundancy Criteria (brief evaluation)

In ICBC, the redundancy criteria that is in use of redundancy guidelines together with personnel solution terms of use. It requires a manager who recommends redundancy to first identify every position at risk of redundancy, the number of employees that will be affected and the criteria to be used. Judging from the ICBC reward system analysis, the company discourages employees’ steady development because it does not contribute to the development of the organisation and employee’s increasing competence and experience.

In addition, the company has also introduced criteria that evaluate employees before they are declared redundant. It includes an evaluation on time and attendance, capability, adaptability, possession of extra skills length of service and the disciplinary record (Bohlander & Snell 2009). The company has also presented measures that ensure that it is fairly applied to stem discrimination.

Obviously, the redundancy selection criteria are very hard to highlight because many factors should be considered in such a situation. Such factors involve experience, achievements, pitfalls, and failures. This complex mix makes manager approach each case individually (Torrington 2008, p. 223).

Summary and Recommendations

It is important that HR departments charged with the responsibility of managing the human resource of an organisation be well versed in the art by:

- Ensuring regular training and learning activities.

- Implementing plans that help employees in career growth.

- Implement plans that adequately reward employees for their work.

Constantly keep improving HRM practices according to the prevailing international standards.

References

Armstrong, M., 2008, Strategic Human Resource Management: A Guide to Action, New Jersey: Thomsons Learning.

Billsberry, J., 2008, Experiencing Recruitment and Selection, John Wiley and Sons, New Jersey.

Bohlander, G & Snell, S., 2009, Managing Human Resources, Cengage Learning, London.

Briscoe, DR, Schuler, S, and Claus, L., 2008, International Human Resource Management, Cengage Learning, New Jersey.

Dessler, G., 2004, Human resource management. Pearson/Prentice Hall, New York.

Gerald S. O., 2011, ‘The Incidence and Wage Consequences of Home-Based Work in the United States, 1980–2000’, Journal of Human Resources vol. 46, no. 2, pp. 237–260.

Graduate Recruitment, 2011, MTR. Web.

Harris, H, Brewster, C. & Sparrow P., 2003, International Human Resources Management. CIPD Publishing, London.

Human Resource Strategy, 2008, ICBC, Hong Kong. Web.

Industrial Commercial Bank of China (ICBC) 2002, Corporate Governance, ICBC, Hong Kong.

Mathis, R., 2000, Human Resource Management, Sage Publications, New York.

Nankervis, A., Compton, R., & Morrissey B., 2009, Effective Recruitment and Selection Practices, CCH Australia Limited, New South Wales.

Paauwe, J., 2004, HRM and performance: achieving long-term viability, Routledge, New York.

Recruitment Information of ICBC, 2008, ICBC. Web.

Reddy, R., 2004, Personnel Management, InfoBase Publishing, New Jersey.

Schuler, S.R. & Jackson, E.S., 2007, Strategic human resource management, Thomson Learning, New York.

Sims, R. R., 2007, Human resource management: contemporary issues, challenges, Cengage Learning, London.

Storev, J., 2007, Human resource management: a critical text, Cengage Learning, London.

Tansky, J. W, & Heneman, R. L., 2006, Human Resource Strategies for the High Growth Entrepreneurial Firm, IAP, Florida.

Torrington, D, Hall, L & Taylor, S., 2008, Human resource management, Routledge, New York.

Appendix 1

Appendix 2