Introduction

Corporate social responsibility (CSR) can be defined as a sum of organizational activities aimed at the assessment of the organizational impact on a wider societal good and the subsequent measured and deliberate responsibility-taking process. The global economic crisis of 2007-2008 brought to the fore the importance of CSR as a model of corporate governance, thereby forever changing the managerial landscape of the global business community (Brammer, Jackson, & Matten, 2012). An important lesson of the post-crisis era can be summarized as follows: reckless actions of corporations can turn the limited liability into the collective liability of the world. Given that corporations are the driving gears of the modern economy, it is necessary to explore the functioning of CSR in the modern business environment.

The aim of this paper is to discuss the role of CSR in the corporate world and its implications for the financial performance of a company. The paper will also explore the relationships between CSR and the effectiveness and performance of managers at different levels.

CSR and Firm Value

CSR Dimensions

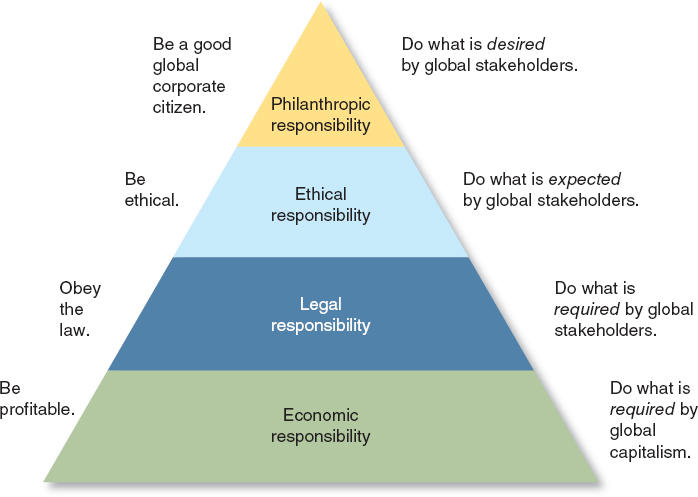

Taking into consideration the fact that CSR is an umbrella term encompassing numerous activities, it is necessary to describe them before starting the discussion of the link between CSR and firm value. There is no general consensus on what activities fall under the category of CSR; however, it is possible to discern its two dimensions: social and stakeholder (Servaes & Tamayo, 2013). These two facets of CSR drive all organizational activities that fall under the mantle of the promotion of corporate accountability, sustainability, fairness, and value creation. The dimension of social responsibility can be divided into the following categories: economic responsibilities, legal responsibilities, ethical responsibilities, and philanthropic responsibilities (Bateman & Snell, 2016). Figure 1 shows a pyramid of global social responsibility.

The Link in Practice

There is a large body of literature indicating that there is a link between CSR activities and firm value. Numerous scholars point to the improvement of brand image as a method for increasing sales and attracting capital for socially conscious investors (Edmans, 2012). However, while the connection between CSR and economic performance and the value of a company can be easily established in theory, it is much harder to document it in practice. The findings of a meta-analysis conducted by Orlitzky, Schmidt, and Rynes show that there is a bi-directional relationship between these variables (as cited in Edmans, 2012).

A positive connection between CSR and the financial performance of a company has been discovered in a study involving 205 Iranian consumer goods producers (Saeidi, Sofian, Saeidi, Saeidi, & Saaeidi, 2014). The study also reveals that factors such as reputation, customer satisfaction, and a company’s competitive advantage mediate this relationship.

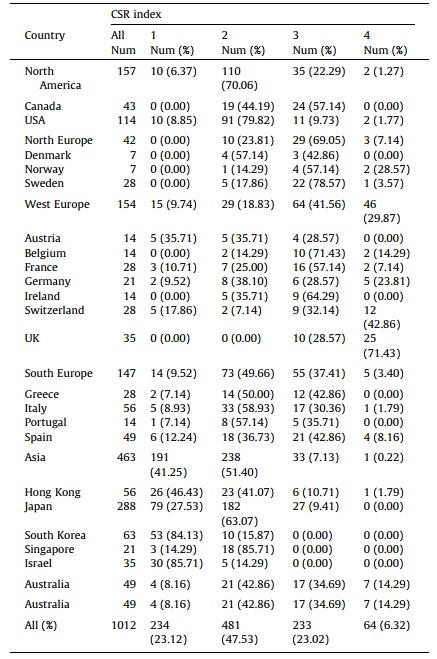

Wu and Shen (2013) who analyzed data from the Ethical Investment Research Service (EIRIS) databank argue that there is a positive link between CSR and the financial performance of financial services organizations. The researchers posit that the influence of CSR on the performance of studied entities manifests in terms of return on assets, return on equity, and net interest income (Wu & Shen, 2013). Table 1 shows the number of bank observations in different countries and how it relates to CSR index.

It is clear from the table that banks in Switzerland and the United Kingdom conduct more effective CSR activities than banks in other countries. Another study by Lioui and Sharma (2012) concentrated on the exploration of the connection between environmental social responsibility and the financial performance of a company. The researchers obtained data from KLD STATS Inc.’s CSR rating reports that covered such diverse areas as community, environment, human rights, and employee relations among others. Return on assets and Tobin’s Q ratios were measured to show that there was a positive relationship between environmental CSR concerns and the financial performance of a firm.

Manager’s Effectiveness and Performance

In order to better understand the CSR function within an organization, it is necessary to discuss it at different levels of analysis. According to Aguinis and Glavas (2012), in addition to stakeholders who often serve as a driver of CSR initiatives and customers who influence them through product purchasing and monitoring, managers are the main catalyst for change in terms of CSR. Therefore, it is important to review the influence of CSR activities pursued by a company at the organizational level of analysis.

The findings of a study conducted by Aguinis and Glavas (2012) reveals that employees perceive managerial CSR efforts as a key part of visionary leadership, which helps to enhance team performance, thereby positively influencing firm performance. Furthermore, CSR values are associated with organizational pride, which is also an important variable in the relationship between CSR and firm performance.

CSR is a concept that is closely related to the perceived effectiveness and performance of managers, which are essential for the creation of a propitious organizational culture. Therefore, it is safe to say that the social-psychological environment of a company driven by CSR intentions is a product of managerial efforts at the individual level of performance whose effects translate into effective value creation.

By drawing on the social exchange theory, it is possible to argue that employees reciprocate with positive attitudes and behavior to the extent to which they perceive their leaders to have met their social responsibility expectations (Boh & Wong, 2013). Therefore, organizational citizenship behavior at the team level of performance is highly dependent on the consequences of ethical leadership, which is necessary for meaningful CSR activities. It is safe to assume that there is a difference between the quality of leader-member exchange in CSR-driven companies and those firms that do not exhibit socially-oriented behavior.

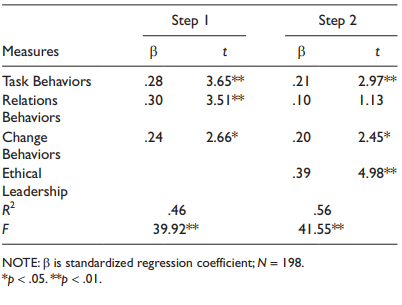

It has to do with the fact that decisions aimed at cost reduction without a balanced approach to social responsibility will not be perceived by employees as instances of ethical leadership. Indeed, Yuki, Mahsud, Hassan, and Prussia (2013) argue that managerial effectiveness at all levels of performance depends on the leader-member exchange, the quality of which is an important predictor of the overall leader effectiveness. Table 2 shows the regression analysis for managerial effectiveness.

As is shown in the table, ethical leadership is not only a core of meaningful CSR efforts but also is a powerful predictor of leader effectiveness. Therefore, it naturally follows that managers’ effectiveness and performance in CSR-aimed companies are mediated by social responsibility-oriented behaviors at all levels of performance.

Conclusion

The following lessons have been learned in the process of writing the paper:

- Being a sum of organizational activities aimed at assessing and taking responsibility for its impact on a wider societal good, CSR affects the effectiveness and performance of managers at all levels.

- The financial performance of CSR-oriented companies far outstrips that of corporate entities that are not driven by social responsibility intentions.

References

Aguinis, H., & Glavas, A. (2012). What we know and don’t know about corporate social responsibility: A review and research agenda. Journal of Management, 38(4), 932-968.

Bateman, T., & Snell, S. (2016). Management: Leading & collaborating in a competitive world (12th ed.). New York, NY: McGraw-Hill Education

Boh, W., & Wong, S. (2013). Organizational climate and perceived manager effectiveness: Influencing perceived usefulness of knowledge sharing mechanisms. Journal of the Association for Information Systems. 14(3), 122-152.

Brammer, S., Jackson, G., & Matten, D. (2012). Corporate social responsibility and institutional theory: New perspectives on private governance. Socio-Economic Review, 10(1), 3-28.

Edmans, A. (2012). The link between job satisfaction and firm value, with implications for corporate social responsibility. Academy of Management Perspectives, 26(4), 1-19.

Lioui, A., & Sharma, Z. (2012). Environmental corporate social responsibility and financial performance: Disentangling direct and indirect effects. Ecological Economics, 78(1), 100-111.

Saeidi, S., Sofian, S., Saeidi, P., Saeidi, S., & Saaeidi, S. (2014). How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. Journal of Business Research, 12(1), 1-10.

Servaes, H., & Tamayo, A. (2013). The impact of corporate social responsibility on firm value: The role of customer awareness. Management Science, 59(5), 1045-1061.

Wu, M., & Shen, C. (2013). Corporate social responsibility in the banking industry: Motives and financial performance. Journal of Banking & Finance, 37(1), 3529-3547.

Yuki, G., Mahsud, R., Hassan, S., & Prussia, G. (2013) An improved measure of ethical leadership. Journal of Leadership & Organizational Studies, 20(1), 38-48.