Small and medium-sized family businesses, in most cases, become the basis of economic development. These forms of entrepreneurial activity are characterized by a high ability to adapt to changing market conditions. The growth in the number of family-owned enterprises, such as Ocean Group, carries antitrust potential and contributes to reducing the number of unemployed. A family business differs from other business forms in some features inherent in the Ocean Group company.

In the family business, one person can perform multiple roles at once and be an owner, a family member, and a manager at the same time (Fei, 2018). Ocean Group is the case of a family-owned company because all members of the enterprise perform the duties of two or three types of participants at once. The company’s founders, Alfred and Philip Holt, are both owners, family members (brothers), and CEOs simultaneously (Information Resources Management Association, 2021). The family-owned company had additional incentives to achieve high results because the reputation of the Holt family depended on them (Fei, 2018). That is why the company has become a large enterprise, having achieved success in the logistics sector.

Decision-making in a family business is usually made during a vote in which all family members participate equally, even if they are officially lower in position. In other types of business, only managers and business owners participate in decision-making. An example of such a solution for Ocean Group was the choice of the most economical type of steamship (MTE-Conference, 2021).

It is worth emphasizing that the family business is divided into several types. However, within the scope of the issue being analyzed, specific types of such activities are of interest. It is necessary to consider firms that are inherited from generation to generation and owned by entire family clans (Zhang and Tang, 2021). This group, which forms foreign family capitalism, includes, as a rule, large and very large companies, such as international corporations with many subsidiaries (Fei, 2018). In each country, a family needs to retain a different percentage of shares in order to be eligible to be called a family firm (Howorth and Robinson, 2020). Another way to keep the family in control of the company is to issue two classes of shares with different numbers of votes per share (Howorth and Robinson, 2020). Thus, it is possible to maintain control over the company and, at the same time, attract additional capital, which is so necessary for the development of any company.

A family business, as a rule, is more productive than a corporate one due to a number of advantages:

- Based on the values of the owners. In corporate business, values are often treated as formalities—formal statements written into the corporate mission that top managers may or may not share (Soares and Santos, 2018). Therefore, relations between shareholders and managers are based on the control of key indicators, and the main tasks of managers are to increase the company’s shareholder value and dividends (Ramadani et al., 2020). And the owner of a family business seeks not only to increase shareholder value but to ensure sustainability in the long term (Ko and Song, 2021). He solves questions about dividends more flexibly and invests more in the development and improvement of the company’s efficiency.

- Focus on long-term development. The planning horizon for top management in a corporate business is 5–10 years, and in a family business, it is a generation because its owners prefer to pass the business on to their children (Schlippe, Rüsen and Groth, 2021).

- Stable composition of employees. In the family business, people who are close to the values of the founders remain to work, so they are more loyal to the company. This allows management to assemble a team that will always understand and provides support (Sharma and Sharma, 2021).

- The commitment of the owners. Family members identify their personal and family interests with the interests of the company, so they work hard and are ready to reinvest part of the company’s profits in the business to ensure its growth in the long term (Sharma and Sharma, 2021). Many family members are involved in the family business from an early age, which helps them learn the intricacies of management and increases their level of commitment.

- Continuity of knowledge. Since managers are rarely replaced in a family business, the “memory of the enterprise” is preserved – traditions, recognition of merit, accumulated knowledge, experience, and skills are passed on to subsequent generations (Feng and Zhang, 2018).

- High reputation. The name and reputation of the family companies are associated with their products and services. They strive to improve the quality of their products, as well as maintain good relationships with their partners.

All of the above features give rise to reasons why decision-making in a family business is significantly different. If in stock companies, the key task of a business is a permanent increase in income, then in family companies, the preservation of the atmosphere within the corporation (Calabrò, 2020). This implies the education of successors, the preservation of equal rights for employees, and the unconditional acceptance of the necessary innovations.

The fact is that the management of an exchange organization proceeds from an assessment of the productivity and results of a particular decision. After such an assessment, an analysis takes place, and only then comes the stage of making a final decision (Papastefanaki and Potamianos, 2020). This is not typical for a family business, where all members are focused solely on positive interaction with each other in the context of the growth of the enterprise (Zhang and Tang, 2021). In other words, any qualitative innovation is not subject to doubts and reasoning, and the decision is made immediately. On the one hand, such a strategy introduces a high chance of risks (Bauk and Ilčev, 2021). However, on the other hand, it is the authority and experience, upbringing from the childhood of family members that makes it possible to be confident in innovation.

Today, the global family business is characterized by two features. First of all, the preservation of a huge number of small and medium-sized enterprises was created by family members (Panayides, 2019). For example, in the United States, there are about 15 million such small family firms (Barnett-Woods, 2020, p. 77). Family companies of this type are created primarily to save money on employees’ wages since the cost of hired labor in Europe and America is sometimes unbearable for a newly opened firm (Barnett-Woods, 2020). The second feature is the presence of huge family corporations and holdings with a worldwide reputation and centuries-old history, which have already been inherited 3-6 times. England stands out in this regard, where about 16% of all family firms have experienced more than four generational changes (Theotokas, 2018, p. 88). As can be seen in Figure 2 (IFB, 2022), 87.8% of UK businesses are family businesses.

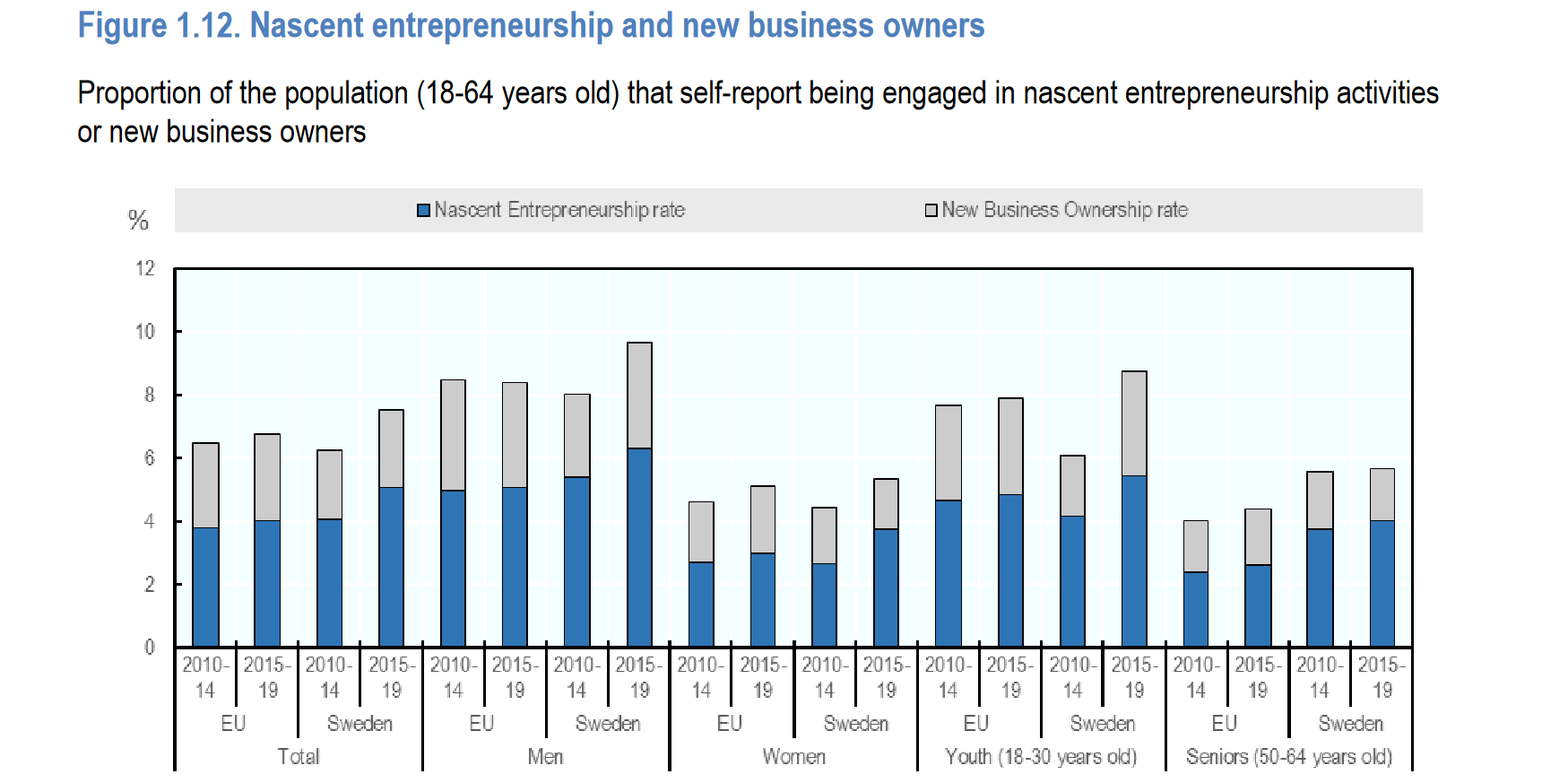

Sweden has the largest proportion of family-owned businesses, with over 60% of the working population, as can be seen in Figure 1 (OECD 2020), while Italy is known for its large percentage of family-owned businesses with a turnover of more than 1.5 million euros (Theotokas, 2018, p. 104). Thus, the global family business is characterized by development both in breadth, with an increase in the number of enterprises, and in depth, with an increase in profitability (Theotokas, 2018). At the same time, as American analysts note, family enterprises are characterized by a greater increase in dividends and profits than ordinary joint-stock enterprises.

Ocean Group PLC was a prominent transport company in the United Kingdom. It was a component of the FTSE 250 Index and was initially included in the London Stock Exchange. The Ocean Steamship Company was created by Alfred and Philip Holt to offer shipping transportation between the United Kingdom and China, recognized as the Blue Funnel Line (Company History Index, 2022). Holts was the company’s name, and their ships were distinguished by a distinctive blue funnel.

Global freight management is Ocean Group’s major activity, and its major affiliate, MSAS Cargo International, is one of the industry’s best shipping services. The practice of moving products, items, and cargo by land, sea, or air is known as freight transportation, and freight can be described as things delivered by truck, train, ship, or airplane (Adanza et al., 2019). The practice of controlling and monitoring the flow of products is referred to as freight management (Cena et al., 2019). Any organization that works with freight transport, big or little, has to properly recognize how to get freight to the appropriate place on time and for the least amount of money.

The company’s original mission was to establish a regular steamer freight service between England and China, initially through the Cape of Good Hope. The steamship was not seen to be a cost-effective long-distance goods transport at the time. (Company History Index, 2022) Nevertheless, the Holt brothers intended to utilize a unique form of a steamship that they believed could function successfully with a sail on this trip (Company History Index, 2022). They were capable of reaching about half of the cash required for the new venture by relinquishing the five ships they had possessed in that exchange (Company History Index, 2022). The remaining funds came from other relative individuals, family members, and business associates in Liverpool.

Since the corporation was created before limit liability general occurrence, all of the stockholders were incurring significant risk. A limited liability corporation (LLC) is a type of corporate structure that shields its proprietors from personal accountability for the firm’s debts and liabilities (Akey and Appel, 2021). Limited liability companies are composite businesses that include a combination of businesses with those of a collaboration or a single proprietorship (MTE-Conference, 2021). At the same time, since the company was a family-run business, the owners emphasized the presence of a link between brand image and family reputation. In addition, the managerial activities were performed because the decision-making was concentrated in one place.

Based on the above description of the Ocean Group and the analysis of seed enterprises, we can come to the following conclusions. First of all, the family business will make its decisions on its own, based purely on the values of the management. In addition, such a business has much more opportunities because it is not as accountable as other enterprises. In the end, the family business cares about its image and reputation much more strongly, instilling confidence in its projects and decisions.

Reference List

Adanza, W. et al. (2019) ‘Freight management system: Logistic 1’, Journal of Multidisciplinary Research, 11(1), pp.871-875.

Akey, P. and Appel, I. (2021) ‘The limits of limited liability: Evidence from industrial pollution’, The Journal of Finance, 76(1), pp.5-55.

Bauk, S. and Ilčev, S. D. (Eds.). (2021) The 1st international conference on maritime education and Development. New York: Springer International Publishing.

Barnett-Woods, V. (Ed.). (2020) Cultural economies of the Atlantic world. Oxfordshire: Taylor & Francis.

Calabrò, A. (Ed.). (2020) A research agenda for the family business. Cheltenham and Camberley: Edward Elgar Publishing.

Cena, K. P. G. et al. (2019) ‘Freight management system-core 2: Service network, service provider, customer relationship management, standard operational procedure, schedule and rates’, Journal of Multidisciplinary Research, 1(1), pp.3-23.

Company History Index. (2022) Ocean Group PLC – company profile. Reference for Business.

Fei, J. (Ed.). (2018) Managing human resources in the shipping industry. Oxfordshire: Taylor & Francis.

Feng, C. and Zhang, J. (Eds.). (2018) Routledge Handbook of transport in Asia. Oxfordshire: Taylor & Francis.

Howorth, C. and Robinson, N. (2020). Family business. Oxfordshire: Taylor & Francis.

IFB. (2022). UK Family Business. IFB, London.

Information Resources Management Association. (Ed.). (2021) Research anthology on strategies for maintaining successful family firms. Hersey: IGI Global.

Ko, B. and Song, D. (Eds.). (2021) New maritime business. New York: Springer International Publishing AG.

MTE-Conference. (2021) MSC Mediterranean Shipping Company confirmed as lead sponsor.

Panayides, P. M. (Ed.). (2019) The Routledge handbook of maritime management. Oxfordshire: Taylor & Francis.

Papastefanaki, L. and Potamianos, N. (Eds.). (2020) Labour history in the semi-periphery. Berlin: De Gruyter.

OECD. (2020). Inclusive Entrepreneurship Policies, Country Assessment Notes. OECD, Stockholm.

Ramadani, V. et al. (2020) Entrepreneurial family businesses. New York: Springer International Publishing.

Schlippe, A., Rüsen, T. A., and Groth, T. (2021) The two sides of the business family. New York: Springer International Publishing.

Soares, C. G. and Santos, T. A. (Eds.). (2018) Progress in maritime technology and engineering. CRC Press.

Theotokas, I. (2018) Management of shipping companies. Oxfordshire: Taylor & Francis.

Zhang, P. and Tang, L. (2021) Ship management. Oxfordshire: Taylor & Francis.