Executive Summary

Dubai Television Matrix is an entertainment company that consists of a network of television services that provide online on-demand access to television content in Dubai, both domestic and foreign. Dubai Television Matrix is located in Dubai. The company was established in 2016. It currently aims to expand its operations and create a new, more modern and comfortable office for the management of online and offline services related to on-demand television in Business Bay.

The majority of the staff, including executive managers, is Emirati, although fifteen expatriates are also employed, who mostly occupy managerial positions or positions related to technical support. A radio spectrum license was obtained from the Telecommunication Regulation Authority for a period of one year, which will be prolonged after the expiration date.

The founder of the company is an American expatriate Alexander Harington, and the type of business ownership is a sole proprietorship, although the owner of the company aims to switch to partnership in several years.

The company provides on-demand streaming services, which include streaming of television content on different devices, as well as TVs and game consoles. The services currently purchase and provide for streaming mostly foreign television content, including US and UK cable series. However, it also aims to produce or co-produce films and series created specifically by Dubai Television Matrix, which will target Emirati audience and focus on the UAE rather than the US or UK content.

The company’s aim and mission are to become one of the biggest streaming services in the UAE, providing both exported and domestic content to the country’s residents in all regions. The company also aims to increase the value of domestically produced TV shows, movies, and documentaries, thus introducing Emirati content globally.

Industry Analysis

The approximate market size is difficult to estimate as the forecasts about the penetration of video-on-demand services and pay-TV are estimated differently as well. For example, Chris O’Hearn, the manager of the UAE’s Television Audience Measurement System, argues that pay-TV is relatively unpopular among the population of the Middle East; it has reached only 10% penetration (Arabian Business par. 8).

At the same time, David Butorac, the CEO of OSN, believes that viewers will demand more premium content. Nevertheless, streaming services still remain a small part of the UAE television industry. In 2011, the penetration rate of IPTV was at 33%; it is possible to assume that it will not change drastically in 2018. The estimated penetration rate for 2018 is 40%. The majority of the market size comprises teenagers and young adults, who consume between three to six hours of TV content per day.

Pay-TV subscriptions have risen from 50% to 69% in Dubai in years 2009 and 2013 respectively. Since streaming services are available on different platforms, it is important to understand the distribution of gadgets suitable for streaming to measure the potential market. According to Oxford Business Group, approximately 65% of the UAE population own a smartphone, and almost 78% own a laptop (245).

The video-on-demand industry is actively expanding and developing, but customers still have a strong bargaining power for several reasons. First, consumers regulate the demand for such services by supporting or rejecting them, as well as specific content provided there. Although such producer-consumer communication might be helpful in measuring what content is more desirable and supported among consumers, it is also flawed due to its significant dependence both on consumers and on suppliers. The provider of the services depends on consumers’ acceptance of the content but also on the quality of it provided by the suppliers.

Second, economic growth and disposable income of consumers directly relate to the company’s success and competitive advantage in the industry. Any major crises or reductions in disposable income will adversely influence the purchasing power of buyers, thus decreasing the company’s revenues and overall industry profitability. Therefore, the bargaining power of customers is relatively high and can be seen as a threat.

Nevertheless, this factor can be mediated by the advancement in technologies since the distribution of laptops, smartphones, and other gadgets suitable for online streaming can increase its popularity among the UAE/Middle East consumers. Furthermore, the growing support of mobile internet is yet another advantage of the current technological advancement that can increase the number of consumers of on-demand streaming services.

It should be noted that the consumers’ switching costs are relatively low so they can easily choose another provider of streaming services instead of our company if their content is more preferred to them.

The company’s competitors include other providers of streaming and e-services, as well as cable providers who might attract the audience that favors free linear television more than pay-TV. Furthermore, the company also has to compete for its market with other players who are not always Dubai- or UAE-based and might be present globally (e.g., Netflix, Amazon Prime, Apple TV, etc.).

The effect of rivalry on the company also depends on the various factors related to consumers, since older viewers tend to prefer linear and/or national TV to the exported content or online one. At the same time, younger viewers who are more aware of the number of available competitors might choose other broadcasters due to specific reasons (available content, cost of services, the lack of presence of mobile services, etc.). The threat of new entries should also be taken into consideration, as the entry barriers are relatively low, and consumers might prefer newer services if they are more accessible or easy to operate than the ones they have used previously.

Marketing Strategy

To understand the target market of the company, the following subgroups for consumer market segmentation were chosen: geographic segmentation and demographic segmentation.

Geographic segmentation

- Country: The UAE (future expansion might include Qatar, Saudi Arabia).

- Region: Dubai region.

- Population density: urban and suburban.

- City size: 2,788, 929.

- Climatic zone: desert climate.

Demographic segmentation

- Age: from 8-10 up to 80.

- Gender: Male/Female.

- Occupation: Any.

- Social class: Any.

- Family size: from 1 to 10+.

- Income: average, high.

In sum (target market)

- Small to large families/single persons.

- Any occupation but with average to high income since on-demand television is not a necessity.

- Owning one or more gadgets suitable for streaming (smartphones/laptops/PCs).

- Living in urban or suburban zone of Dubai.

- Can be described as mid-aged, mobile, prosperous, professional (MUPPY).

Marketing mix will include

Product/Service

Video-on-demand services and streaming services of foreign and domestic content (TV series, movies, documentaries, etc.). Services similar to pay-TV but provided online and for various media, including smartphones, laptops, and consoles.

Price

Price strategy will be based on price discrimination. Users will be able to purchase different subscriptions (basic, advanced, premium) that will include different services (e.g., streaming in HD or 4K, downloadable content).

Place

The company aims to expand by renting a new office for the management of offline and online procedures that will be located in the Business Bay. The position of the office will not influence consumers’ interest directly but will allow Dubai Television Matrix provide more quality support and ensure professional maintenance of the technological equipment necessary for streaming.

Promotion

The promotion will be both online and offline to attract as many potential consumers as possible. First, the company aims to use billboards and posters with purchased shows to promote the service; billboards will be located near the most visited entertainment objects in Dubai, e.g. city malls (Dubai Mall, Festival City Mall, Dragon Mart, etc.). Second, an additional advertisement will be placed online via targeted advertising on various websites and social networks (e.g. Facebook). Third, the company will also use TV and radio advertisement, as these types of media remain to be among the most popular ones in the UAE. It is also possible that the word-of-mouth promotion will also be useful, although its coverage is expected to be limited.

Management Team

Operation plan will consist of the two major steps: daily operations (daily operation plan) and long-term strategic plan. Daily operations will focus on maintenance of the services, as well as communication with customers and suppliers:

- Establishing insight systems that will provide navigability for company’s engineers.

- Launching metrics that will indicate any possible difficulties with streaming for end-users.

- Ensuring automatic detection of disruptions in streaming/broadcasting.

- Tracking down bitrate rates delivered to end-users via various media (phones, laptops, etc.).

- Tracking down system events real-time via data visualizing software.

- Participating in shared communication with other teams.

- Real-time complex event processing that allows detecting and responding to real-time threats and errors.

The long-term strategic plan includes the advertisement launched by the marketing department that will be set in action prior to the beginning of other daily operations. The company will address the target market via various strategies of advertisement, e.g., TV, radio, billboard advertisement, etc. All new users will be provided with a free trial period so that the company is able to attract consumers from various social classes and with different income levels. All procedures will be supervised by the CEO of the company and the owner as well.

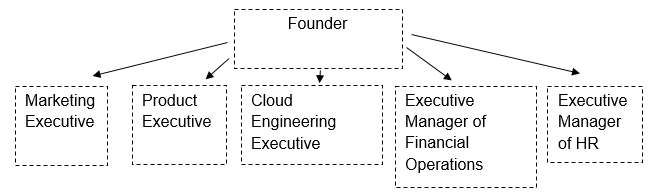

Founder The organization chart of the company is demonstrated below (see Figure 1):

Financial Analysis

The estimated start-up costs is $1,650,000. The sum will be divided into the different investments and assets. Short-term investments, including pre-launch advertisement, will be approximately $300,000, whereas property and equipment, as long-term investments, will demand additional $525,000. Additional expenses will be necessary for cloud computing and service maintenance, which will demand approximately $400,000. Large expenditures will also be necessary for HR operations and sales, as well as employee packages (e.g. sick leaves, vacations, various types of memberships, etc.): the estimated sum is $350,000.

Sales projections are moderate: a 10% growth is expected during the first year, while the company aims to achieve a 15% growth in sales during the second year of operation (2018). The estimated revenue in the year 2017 is expected to be $1,020,000 and approximately $1,050,000 in the year 2018, with the operating margin 7.6%.

As to pro-forma financial statements, the company’s projected statement of operations is the following: the forecasted cost of revenues as per September 2018 is $1,046,400, where marketing, technology and equipment, and general/administrative revenues will constitute $194,677, $143,106, and $91,480 respectively. The company’s operating income is estimated to be $97,456, whereas interest expense will be $26,700. The company’s income before income taxes will be approximately 38,426, and benefit from income taxes will be $14,730. Thus, estimated net income as in September 2018 will be $23,696.

The feasibility study of the company indicates several potential issues:

- The small market share of online and on-demand streaming services in the UAE and, particularly, Dubai (Yousef et al. 205).

- As large investments in the project are necessary, the company might not find enough stakeholders to support its launch.

- The presence of global players such as Netflix, Amazon Prime, Apple TV, as well as linear television in Dubai and the UAE might lead to the decreased competitive advantage of the company.

However, the company can address the identified issues in several ways:

- The support for video-on-demand streaming services is growing among younger users of pay-TV and the Internet in the UAE (Oxford Business Group 246). Therefore, if the company will focus on young adults and teenagers as their primary target market, it might achieve serious support from this demographic group.

- The company can cooperate with other domestic content producers, as well as independent filmmakers, to create a cooperation or conglomerate of content producers and launch the start-up with the investments of all participating stakeholders. However, the company will need to change its form of ownership from sole proprietorship to partnership or Limited Liability Company.

- The company will need to provide exclusive content unavailable to users who currently use services of other global players listed above. For example, this content can include company-produced TV series and movies, as well as other content provided by domestic producers.

Works Cited

Arabian Business. “Changing Channels: What Is the Future of TV in the Middle East?” Arabian Business. 2016. Web.

Oxford Business Group. The Report: Dubai 2013. Oxford Business Group, 2014.

Yousef, Said, et al. “Behavioral Correlation with Television Watching and Videogame Playing among Children in the United Arab Emirates.” International Journal of Psychiatry in Clinical Practice, vol. 18, no. 3, 2013, pp. 203-207.