Executive Summary

Achieving a sustained market growth is a major challenge that requires understanding of various factors that affect a firm’s operation. In this business plan, the focus was on a hobby store that seeks to achieve growth beyond the current market. The report discusses how this firm should prepare for growth, common reasons that justifies the growth, the importance of managing stages of growth, and challenges that this firm may face in its effort to achieve growth. The report also explains core internal growth strategies, internal product-growth strategies, international expansion as a growth strategy, and different types of external growth strategies. The report shows that although there are numerous challenges that a firm can face in its effort to achieve growth, employing the right strategy and having a team of skilled and dedicated employees can enable this hobby store to achieve its goal.

Introduction

The hobby and toy industry in North America, especially in the United States and Canada, has been growing rapidly. In Canada, there are numerous companies offering a wide range of products to meet the needs of their clients. As the competition gets stiff, it becomes essential for existing players to find ways of meeting the needs of their clients in the best way possible (Pepe, 2020). Achieving growth in such a highly competitive market may be a challenge, especially for small and medium-sized companies. A firm must conduct a comprehensive analysis of the market forces to understand opportunities and threats. It must then develop a unique plan of overcoming the challenges while at the same time taking advantage of the opportunities that the market presents.

In this business plan, the discussion focuses on how this hobby company can prepare for and achieve growth in the market. Gupta (2021) warns that without a carful plan for growth, a company may end up using a significant amount of resources without achieving the intended goal. In such a case, the company would face a major loss and it may even lose its market share if appropriate measures are not taken to address the challenge. The company should not only consider expanding to new markets but also penetrating the existing one further in its growth strategy. In this report, the researcher looks at the unique strategies that this firm can embrace to achieve the desired growth while at the same time ensuring that it meets the needs of its current customers in the best way possible.

Preparing and for Market Growth

Preparing for Growth

It is critical for this company to have a clearly defined plan on how to achieve growth in the current competitive business environment. Most entrepreneurial firms want to grow. Especially in the short term, growth in sales revenue is an important indicator of an entrepreneurial venture’s potential to survive today and be successful tomorrow. Growth is exciting and, for most businesses, is an indication of success. Many entrepreneurial firms have grown quickly, producing impressive results for their employees and owners as a result of doing so; consider firms examined in this book such as Soul Cycle, Rent the Runway, and Casper, among others, as examples of this.

Although there is some trial and error involved in starting and growing any business, the degree to which a firm prepares for its future growth has a direct bearing on its level of success. This section focuses on three important things a business can do to prepare for growth.

Appreciating the Nature of Business Growth

The first thing that a business can do to prepare for growth is to appreciate the nature of business growth. Growing a business successfully requires preparation, good management, and an appreciation of the issues involved. The following are issues about business growth that entrepreneurs should appreciate.

Not All Businesses Have the Potential to Be Aggressive Growth Firms

The businesses that have the potential to grow the fastest over a sustained period of time are ones that solve a significant problem or have a major impact on their customers’ productivity or lives. This is why the lists of fast-growing firms are often dominated by health care, technology, social media, and entertainment companies. These companies can potentially have the most significant impact on their customers’ businesses or lives. This point is affirmed by contrasting the women’s clothing store industry with the biotechnology industry. From 2012 to 2017, the average growth rate for women’s clothing stores in the United States was negative (- 1.3 percent) while the average growth rate for medical supplies’ companies was 2.8 percent. While there is nothing wrong with starting and owning a women’s clothing store, it is important to have a realistic outlook of how fast the business will likely grow. Even though an individual women’s clothing store might get off to a fast start, as it gets larger, its annual growth will normally start to reflect its industry norm.

A Business Can Grow Too Fast

Many businesses start fast and never let up, which stresses a business financially and can leave its owners emotionally drained. Sometimes businesses grow at a measured pace and then experience a sudden upswing in orders and have difficulty keeping up. This scenario can transform a business with satisfied customers and employees into a chaotic workplace with people scrambling to push the business’ products out the door as quickly as possible. The way to prevent this from happening is to recognize when to put the brakes on and have the courage to do it. This set of circumstances played out early in the life of The Pampered Chef, a company, which sells kitchen utensils through home parties. Just about the time the company was gaining serious momentum, it realized that it didn’t have a sufficient quantity of products in its inventory to serve the busy Christmas season. This reality posed a serious dilemma.

The Pampered Chef couldn’t instantly increase its inventory (its vendors were all low in their own inventories and the company was small, so it couldn’t make extraordinary demands on its vendors), yet it didn’t want to discourage its home consultants from making sales or signing up new consultants. One option was to institute a recruiting freeze (on new home consultants), which would slow the rate of sales. Doris Christopher, the company’s founder, remembers asking others for advice. Most advised against instituting a recruiting freeze, arguing that the lifeblood of any direct sales organization is to sign up new recruits. In the end, the company decided to institute the freeze and slowed its sales enough to fill all orders on time during the holiday season. The freeze was lifted the following January, and the number of The Pampered Chef recruits soared. Reflecting on the decision, Doris Christopher later wrote:

Looking back, the recruiting freeze augmented our reputation with our sales force, customers, and vendors. People saw us as an honest company that was trying to do the right thing and not overestimating our capabilities.

Other businesses have faced similar dilemmas and have sometimes made the right call, and other times haven’t. The overarching point is that growth must be handled carefully. As we emphasize throughout this chapter, a business can only grow as fast as its infrastructure allows. Table 13.1 provides a list of 10 warning signs that a business is growing too fast.

Table 13.1 10 Warning Signs That a Business Is Growing Too Fast

Business Success Doesn’t Always Scale

Unfortunately, the very thing that makes a business successful might suffer as the result of growth. This is what business experts often mean when they say growth is a “two-edged sword.” Businesses that are based on providing high levels of individualized service often do not grow or scale well. For example, an investment brokerage service that initially provided high levels of personalized attention can quickly evolve into providing standard or even substandard service as it adds customers and starts automating its services. Its initial customers might find it harder to get individualized service than it once was and start viewing the company as just another ordinary business.

There is also a category of businesses that sell high-end or specialty products that earn high margins. These businesses typically sell their products through venues where customers prioritize quality over price. These businesses can grow, but only at a measured pace. If they grow too quickly, they can lose the “exclusivity” they are trying to project, or can damage their special appeal. Fashion clothing boutiques often limit the number of garments they sell in a certain size or color for a similar reason. Even though they know they could sell more of a particular blouse or dress, they deliberately limit their sales so their customers don’t see each other wearing identical items.

Reasons for Growth

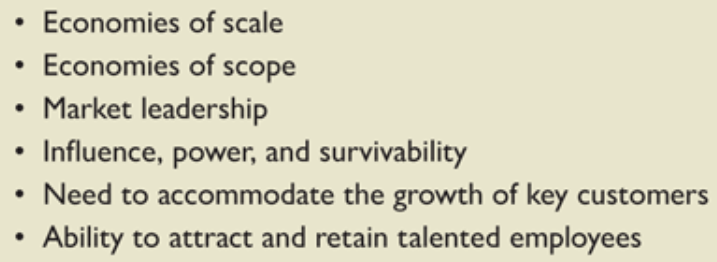

It is necessary to discuss the most important reasons for growth that should motivate the management of this hobby company to explore new markets. Although sustained, profitable growth is almost always the result of deliberate intentions and careful planning, firms cannot always choose their pace of growth. A firm’s pace of growth is the rate at which it is growing on an annual basis. Sometimes firms are forced into a high growth mode sooner than they would like. For example, when a firm develops a product or service that satisfies a need for many customers and orders roll in very quickly, it must adjust quickly or risk faltering. In other instances, a firm experiences unexpected competition and must grow to maintain its market share. This section examines six primary reasons firms try to grow to increase their profitability and valuation, as depicted in Figure 13.1

- Capturing economies of scale. Economies of scale are generated when increasing production lowers the average cost of each unit produced. Economies of scale can be created in service firms as well as traditional manufacturing companies. This phenomenon occurs for two reasons. First, if a company can get a discount by buying component parts in bulk, it can lower its variable costs per unit as it grows larger. Variable costs are the costs a company incurs as it generates sales. Second, by increasing production, a company can spread its fixed costs over a larger number of units. Fixed costs are costs that a company incurs whether it sells something or not. For example, in a manufacturing setting, it may cost a company $10,000 per month to air-condition its factory. The air conditioning cost is fixed; cooling the factory will cost the same whether the company produces 10 or 10,000 units per month. In a service setting, a hotel’s registration areas, restaurants, and other areas must be air conditioned regardless of the number of rooms that have been filled for a particular evening.

A related reason firms grow is to make use of unused resources such as labor capacity and a host of others. For example, a firm may need exactly 2.5 full-time salespeople to fully cover its trade area. Because a firm obviously can’t hire 2.5 full-time salespeople, it may hire 3 salespeople and expand its trade area.

Managing Growth

The management of this hobby store should understand the importance of being able to manage stages of growth. Many businesses are caught off guard by the challenges involved with growing their companies. One would think that if a business got off to a good start, steadily increased its sales, and started making money, it would get progressively easier to manage the growth of a firm. In many instances, just the opposite happens. As a business increases its sales, its pace of activity quickens, its resource needs increase, and the founders often find that they’re busier than ever. Major challenges can also occur. For example, a business might project its next year’s sales and realize it will need more people and additional equipment to handle the increased workload. The new equipment might need to be purchased and the new people hired and trained before the increased business generates additional income. It’s easy to imagine serious discussions among the members of a new venture’s management team trying to figure out how that will all work out.

The reality is that a company must actively and carefully manage its growth for it to expand in a healthy and profitable manner. As a business grows and becomes better known, there are normally more opportunities that present themselves, but there are more things that can go wrong, too. Many potential problems and heartaches can be avoided by prudently managing the growth process. This section focuses on knowing and managing the stages of growth. The final section in this chapter focuses on a related topic- the challenges of growth.

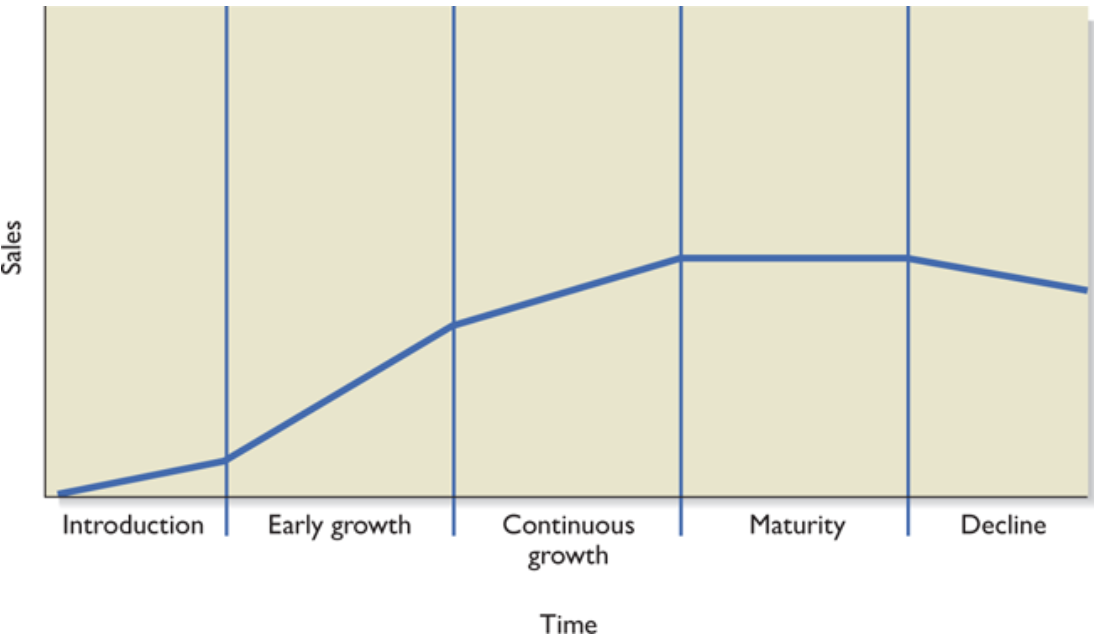

- Knowing and managing the stages of growth. The majority of businesses go through a discernable set of stages referred to as the organizational life cycle. The stages, pictured in Figure 13.2 include introduction, early growth, continuous growth, maturity, and decline. Each stage must be managed differently. It’s important for an entrepreneur to be familiar with these stages, along with the unique opportunities and challenges that each stage entails.

- Introduction stage. This is the start-up phase where a business determines what its strengths and core capabilities are and starts selling its initial product or service. It’s a very “hands-on” phase for the founder or founders, who are normally involved in every aspect of the day-to-day life of the business. The business is typically very non-bureaucratic with no (or few) written rules or procedures. The main goal of the business is to get off to a good start and to try to gain momentum in the marketplace.

The main challenges for a business in the introduction stage are to make sure the initial product or service is right and to start laying the groundwork for building a larger organization. It is important to not rush things. This sentiment is affirmed by the growth pattern of Nest Labs, the subject of Case 11.1. Nest sold a single product, the Nest Learning Thermostat, for two years before its second product, the Nest Protect, which is a smoke and carbon monoxide detector, was introduced. The company needed two years to scale its operations and management team before it was ready to add a second product and accelerate its growth. In regard to laying the groundwork to build a larger organization, many businesses use the introduction stage to try different concepts to see what works and what doesn’t, recognizing that trial and error gets harder as a business grows. It’s important to document what works and start thinking about how the company’s success can be replicated when the owner isn’t present or when the business expands beyond its original location.

This young entrepreneur sells women’s clothing online. She started by hand tailoring many of the garments she sold. Her ability to grow her business will depend in part on her willingness to step back from hand-tailoring clothes and move into a more managerial role.

- Early growth stage. A business’s early growth stage is generally characterized by increasing sales and heightened complexity. The business is normally still focused on its initial product or service but is trying to increase its market share and might have related products in the works. The initial formation of policies and procedures takes place, and the process of running the business will start to consume more of the founder’s or founders’ time and attention.

For a business to be successful in this stage, two important things must take place. First, the founder or owner of the business must start transitioning from his or her role as the hands-on supervisor of every aspect of the business to a more managerial role. As articulated by Michael E. Gerber in his excellent book The E-Myth Revisited, the owner must start working “on the business” rather than “in the business.” The basic idea is that early in the life of a business, the owner typically is directly involved in building the product or delivering the service that the business provides. As the business moves into the early growth stage, the owner must let go of that role and spend more time learning how to manage and build the business. If the owner isn’t willing to make this transition or doesn’t know it needs to be made, the business will never grow beyond the owner’s ability to directly supervise everything that takes place, and the business’ growth will eventually stall.

The second thing that must take place for a business to be successful in the early growth stage is that increased formalization must take place. The business has to start developing policies and procedures that tell employees how to run it when the founders or other top managers aren’t present. This is how franchise restaurants run so well when they’re staffed by what appears to be a group of teenagers. The employees are simply following well-documented policies and procedures. This task was clearly on the mind of Emily Levy, the founder of EBL Coaching, a tutoring service for children who are struggling in school or trying to overcome disabilities, when she was asked by Ladies Who Launch (a support network for female entrepreneurs) early in the life of her business about her growth plans:

My future goals include continuing to spread EBL Coaching’s programs nationally, using our proprietary materials and self-contained multisensory methods. I have already developed a series of workbooks, called “Strategies for Success,” addressing specific study skills strategies, that are being used in a number of schools across the country. The real challenge will be figuring out how to replicate our programs while maintaining our high quality of teaching and personalized approach.

- Continuous growth stage. The need for structure and more formal relationships increases as a business moves beyond its early growth stage and its pace of growth accelerates. The resource requirements of the business are usually a major concern, along with the ability of the owner and manager to take the firm to the next level. Often the business will start developing new products and services and will expand to new markets. Smaller firms may be acquired, and the business might start more aggressively partnering with other firms. When handled correctly, the business’s expansion will be in areas that are related to its strengths and core capabilities, or it will develop new strengths and capabilities to complement its activities.

The toughest decisions are typically made in the continuous growth stage. One tough decision is whether the owner of the business and the current management team have the experience and ability to take the firm any further. This scenario played out for Rachel Ashwell, the founder of Shabby Chic, a home furnishing business. Ashwell expanded her company to five separate locations, inked a licensing deal with Target, wrote five how-to books related to her business, and hosted her own television show on the Style Network before concluding that her business had stalled. Her choice was to continue running the business or find more experienced management to grow it further. She opted for the latter, which reignited the company’s growth.

The importance of developing policies and procedures increases during the continuous growth stage. It’s also important for a business to develop a formal organizational structure and determine clear lines of delegation throughout the business. Well-developed policies and procedures lead to order, which typically makes the process of growing a business more organized and successful.

- Maturity stage. A business enters the maturity stage when its growth slows. At this point, the firm typically focuses more intently on efficiently managing the products and services it has rather than expanding in new areas. Innovation slows. Formal policies and procedures, although important, can become an impediment if they are too rigid and strict. It’s important that the firm continues to adapt and that the founders, managers, and employees remain passionate about the products and services that are being sold. If this doesn’t happen, a firm can easily slip into a no-growth situation.

A well-managed firm that finds its products and services are mature often looks for partnering or acquisition opportunities to breathe new life into the firm. For example, Coca-Cola, a firm in the maturity stage of its life cycle, has a long history of acquisitions. Among other purchases, it acquired Minute Maid in 1960, the Indian cola brand Thums Up in 1993, the Odwalla brand of fruit juices, smoothies, and bars in 2001, Fuze Beverages and Glaceau in 2007, Honest Tea in 2008 and 2011, a minority interest in Monster Beverage in 2014, and Unilever’s Soy Beverage Brand in 2016. If a company does grow organically while in the maturity stage, it normally focuses on the “next generation” of products it already sells rather than investing in new or related products or services.

- Decline stage. It is not inevitable that a business enter the decline stage and either deteriorate or die. Many American businesses have long histories and have thrived by adapting to environmental change and by selling products that remain important to customers. Eventually all businesses’ products or services will be threatened by more relevant and innovative products. When this happens, a business’ ability to avoid decline depends on the strength of its leadership and its ability to appropriately respond. A firm can also enter the decline stage if it loses its sense of purpose or spreads itself so thin that it no longer has a competitive advantage in any of its markets. A firm’s management team should be aware of these potential pitfalls and guard against allowing them to happen.

A framework that is similar to the organizational life cycle is the technology adoption life cycle, which is suited primarily for technology firms that are introducing disruptive innovations to the market. The technology life cycle is associated with the concept of “crossing the chasm,” which explains why some technology products reach mainstream markets while others don’t. An explanation of the technology life cycle, the concept of “crossing the chasm,” and an example of a start-up that successfully crossed the chasm and reached mainstream markets is provided in the nearby “Savvy Entrepreneurial Firm” feature.

- Savvy entrepreneurial firm. In 1991, Geoffrey A. Moore, a lecturer and management consultant, wrote an influential book titled ‘Crossing the Chasm’. The book became an instant must-read for managers, entrepreneurs, and investors. The book was updated in 2009 and again in 2014. It has been described as the bible for understanding why some technology-oriented start-ups grow into large firms while others stall or languish in terms of adoption and firm growth.

The book’s premise is that there is a chasm between the early adopters of a product (the technology enthusiasts and visionaries) and the early majority (the pragmatists). The key insight is that to cross the chasm, firms must first dominate a niche of early adopters and expand from a position of strength. The concept is related to the technology adoption life cycle. The stages in the technology adoption life cycle are innovators, early adopters, early majority, late majority, and laggards. Start-up products initially appeal to “innovators,” who are people who like to try new things but are seldom willing to spend much. Then come the early adopters, or visionaries, who are willing to take a chance on a new product if it solves a burning problem. After the early adopters come the early majority, which is the largest segment. The early majority will only buy if a product is complete and is heavily recommended by others. If it’s not recommended, they won’t buy, regardless of how well a product suits their needs. Next is the late majority, which buys only after a product has become the standard. The laggards, who bring up the rear, rarely buy.

The chasm is hard to cross. Ironically, it is not the early adopters who convince the early majority to buy. In fact, the early majority typically mistrusts the enthusiasm of visionaries. They start buying when credibility is established and momentum within their own group starts to build. In his book, Moore suggests techniques to successfully appeal to the early majority, and cross the chasm, including issues pertaining to a firm’s target market, its positioning strategy, its marketing strategy, and a number of other important factors. It’s well worth the time to read the book to learn the techniques and capture the subtleties.

Salesforce.com is an example of a company that has crossed the chasm. Prior to Salesforce.com, software was a product that was sold on discs that clients would install on their computers. The software would then need to be integrated into the clients’ system, which typically cost more than the software itself. By the time the software was installed, there were often updates available. Many clients would forgo installing the updates, at least for a period of time, to simply avoid the additional hassle and expense of installing them.

Salesforce.com introduced a better way. Its better way was software-as-a-service, later abbreviated as SaaS. The idea was that instead of selling software on discs to be installed on a client’s computers, there would be only one copy of the software, running on Salesforce.com computers, which multiple users could access simultaneously via the Internet. The sales pitch was compelling. By adopting Salesforce.com’s solution, a client would no longer incur the costs and headaches involved with installing, updating, and maintaining software.

What’s interesting is the way Salesforce.com managed the rollout of the product and how the firm eventually crossed the chasm. In regard to the rollout, the company picked a single market to go after, salespeople, and no one else. There was nothing in the product for marketing, customer service, or any other division in a company. Salesforce.com focused exclusively on the United States as its target market, partly to stay close to its customer. The firm also chose to initially target tech-savvy industries. The result was a product designed to achieve a singular objective—helping salespeople make their quota. As a result, salespeople loved it. And because they loved it, they told other salespeople about it, and adoption grew virally. The number of early adopters grew. Credibility was built as the product was displayed at tradeshows and was talked about in mainstream media. Eventually, companies such as Merrill Lynch saw the merits of the service and signed on. Salesforce.com crossed the chasm and started appealing to the early majority and a wider number of users.

The irony of the Salesforce.com story, which is the essence of Moore’s insight, is that by picking a single niche market, and establishing sufficient credibility that the early majority noticed, Salesforce.com was able to cross the chasm faster than it would have if it had created a much more robust product initially and tried to appeal to a broader cross-section of markets.

Challenges of Growth

The hobby company needs to identify and address challenges that may affect its growth, particularly those of adverse selection and moral hazard. There is a consistent set of challenges that affect all stages of a firm’s growth. The challenges typically become more acute as a business grows, but a business’ founder or founders and managers also become more savvy and experienced with the passage of time. The challenges illustrate that no firm grows in a competitive vacuum. As a business grows and takes market share from rival firms, there will be a certain amount of retaliation that takes place. This is an aspect of competition that a business owner needs to be aware of and plan for. Competitive retaliation normally increases as a business grows and becomes a larger threat to its rivals. This section is divided into two parts. The first part focuses on the managerial capacity problem, which is a framework for thinking about the overall challenge of growing a firm. The second part focuses on the four most common day-to-day challenges of growing a business.

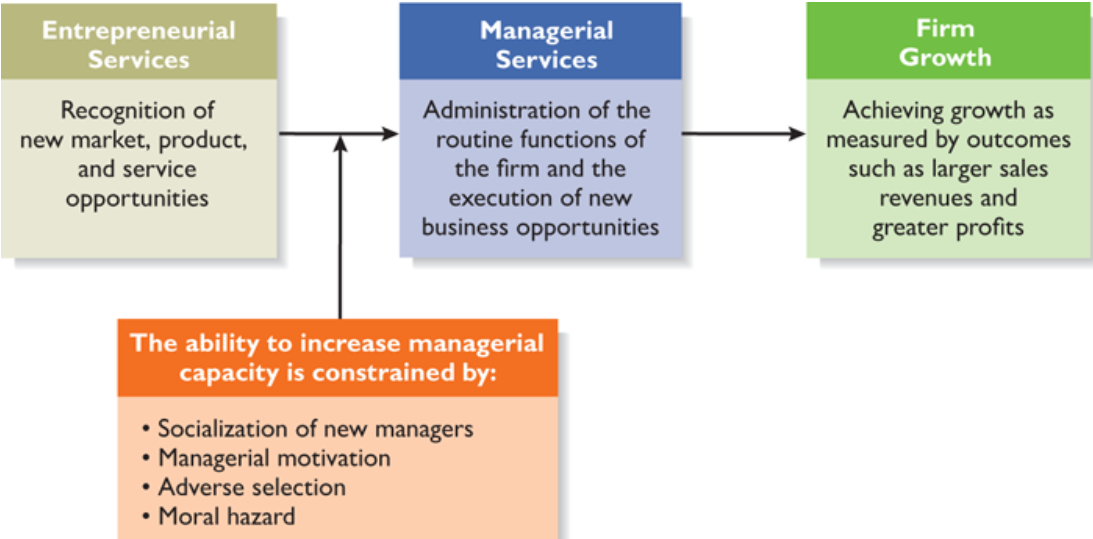

- Managerial capacity. In her thoughtful and seminal book The Theory of the Growth of the Firm, Edith T. Penrose argues that firms are collections of productive resources that are organized in an administrative framework. As an administrative framework, the primary purpose of a firm is to package its resources together with resources acquired outside the firm as a foundation for being able to produce products and services at a profit. As a firm goes about its routine activities, the management team becomes better acquainted with the firm’s resources and its markets. This knowledge leads to the expansion of a firm’s productive opportunity set, which is the set of opportunities the firm feels it is capable of pursuing. The opportunities might include the introduction of new products, geographic expansion, licensing products to other firms, exporting, and so on. The pursuit of these new opportunities causes a firm to grow.

Penrose points out, however, that there is a problem with the execution of this simple logic. The firm’s administrative framework consists of two kinds of services that are important to a firm’s growth-entrepreneurial services and managerial services. Entrepreneurial services generate new market, product, and service ideas, while managerial services administer the routine functions of the firm and facilitate the profitable execution of new opportunities. However, the introduction of new product and service ideas requires substantial managerial services (or managerial “capacity”) to be properly implemented and supervised. This is a complex problem because if a firm has insufficient managerial services to properly implement its entrepreneurial ideas, it can’t quickly hire new managers to remedy the shortfall. It is expensive to hire new employees, and it takes time for new managers to be socialized into the firm’s culture, acquire firm-specific skills and knowledge, and establish trusting relationships with other members of their firms. When a firm’s managerial resources are insufficient to take advantage of its new product and services opportunities, the subsequent bottleneck is referred to as the managerial capacity problem.

As the entrepreneurial venture grows, it encounters the dual challenges of adverse selection and moral hazard. Adverse selection means that as the number of employees a firm needs increases, it becomes increasingly difficult for it to find the right employees, place them in appropriate positions, and provide adequate supervision. The faster a firm grows, the less time managers have to evaluate the suitability of job candidates and the higher the chances are that an unsuitable candidate will be chosen. Selecting “ineffective” or “unsuitable” employees increases the venture’s costs. Moral hazard means that as a firm grows and adds personnel, the new hires typically do not have the same ownership incentives as the original founders, so the new hires may not be as motivated as the founders to put in long hours or may even try to avoid hard work. To make sure the new hires are doing what they are employed to do, the firm will typically hire monitors (i.e., managers) to supervise the employees. This practice creates a hierarchy that is costly and isolates the top management team from its rank-and-file employees.

The basic model of firm growth articulated by Penrose is shown in Figure 13.3 while Figure 13.4 shows the essence of the growth-limiting managerial capacity problem. Figure 13.4 indicates that the ability to increase managerial services is not friction free. It is constrained or limited by (1) the time required to socialize new managers, (2) how motivated entrepreneurs and/or managers are to grow their firms, (3) adverse selection, and (4) moral hazard.

The reality of the managerial capacity problem is one of the main reasons that entrepreneurs and managers worry so much about growth. Growth is a generally positive thing, but it is easy for a firm to overshoot its capacity to manage growth in ways that will diminish the venture’s sales revenues and profits. For firms that sell products online, one decision they’ll need to make, which has a bearing on the amount of managerial capacity they need to maintain in-house, is the manner in which they’ll fulfill their orders. This topic is covered in the nearby “Partnering for Success” feature.

- Partnering for success. It is necessary to discuss the choices for fulfilling orders for an online company. Imagine the following. You go to an e-commerce site and buy a pair of running shoes. You’re anxious to get the shoes because the shoes you have are worn out. The shoes arrive in three days. You take the shoes out of the box, which has the name of the online company from which you bought the shoes on it. You quickly glance at the order form in the box, which also has the name and logo of the website you bought the shoes from. If someone asked you where you thought the shoes were shipped from, you’d probably say a warehouse owned by the online company you bought the shoes from. Actually, you’d have no way of knowing where the shoes were shipped from. As shown below, there are three ways that online businesses fulfill orders and ship products. Each choice has pluses and minuses. Two of the three choices involve partnering with other companies.

Option #1: Partner with drop shippers. Drop shipping is a distribution strategy in which online retailers do not maintain inventory, but instead when they get an order, they pass the order on to a manufacturer, wholesaler, or other retailer who fulfills the order. Here’s how it works. An online site that sells running shoes, for example, takes an order. It then electronically transmits the order to the appropriate shipper, such as New Balance. New Balance then packages and ships the item, usually in a day or so. The product is shipped in a box with the online retailer’s name and logo, and the buyer never knows the difference. The advantage of drop shipping, from the online retailer’s point of view, is that it doesn’t need to maintain warehouses or employ packaging and shipping personnel. It also doesn’t need to anticipate demand or get stuck with outdated merchandise. The disadvantage is that profit margins are reduced. The online retailer must share the profits from each order with one or more drop shippers.

Option #2. Partner with a logistics company. Many online companies partner with fulfillment companies that handle their warehousing, packaging, and shipping for them. Amazon Fulfillment, Shipwire, and Rakuten Super Logistics are examples of fulfillment services. Here’s how they work. An online company offers a certain number of products for sale. Those products are shipped by the manufacturer or manufacturers to the fulfillment company. The fulfillment company then receives, tags, and stores the online company’s inventory. When the online company receives an order, the order is electronically transferred to the fulfillment company. The fulfillment company then pulls the items from the online company’s inventory, places them in a box, and ships them to the customer. The box will look like it came directly from the online company. The fulfillment company will also handle returns. Similar to drop shipping, the advantage of this approach is that the online company doesn’t need to maintain warehouses or employ packaging and shipping personnel. The disadvantage is that there is a cost for the service the fulfillment company provides.

Option #3: Fulfill your own orders. Some companies fulfill their own orders. For example, Riffraff, the women’s clothing company that is discussed in Chapter 1: “Opening Profile,” has a brick-and-mortar store in Fayetteville, Arkansas. Adjacent to the store is a warehouse, where the company stores its inventory and fulfills all of its online orders. The manufacturers of the products Riffraff sells deliver Riffraff’s inventory directly to its warehouse. When an order is placed online, Riffraff employees pull the merchandise from shelves in the warehouse, place it in a box, and ship it to the customer. The advantage of this approach is tighter quality control in that Riffraff controls the process. Its employees, rather than a drop shipper’s employees or the employees of a fulfillment company, handle its merchandise, package it, and ship it to the customer. Its employees also handle customer returns. The disadvantage is that the firm must maintain a warehouse and employee packaging and shipping personnel.

Each of the three approaches has pluses and minuses, so there is no one best choice. Many companies fulfill their own orders when they’re first starting out, because the founders may have more time than money. Also, companies that want their products packaged or shipped in a unique way may find that it works best for them to do it themselves. Conversely, if a company has a broad inventory, drop shipping may be the best choice. E-Bags, for example, is an online seller of luggage, backpacks, and travel accessories. It has literally thousands of products listed. E-Bags uses a drop shipper, largely because it would be cost prohibitive for e-Bags to warehouse all the products it sells. Finally, for a company that’s in a rapid-growth mode, using a fulfillment company may be the best choice. Using a fulfillment company frees the management of the firm to focus on product development, customer acquisition, and scaling the company rather than fulfillment and shipping.

Strategies of Sustaining Growth

Internal Growth Strategies

The hobby company will need to understand core internal growth strategies that will be necessary for its entrepreneurial strategies. Internal growth strategies involve efforts taken within the firm itself, such as new product development, other product-related strategies, and international expansion, for the purpose of increasing sales revenue and profitability. Many businesses, such as Nest Labs, Sir Kensington’s, and Zappos, are growing through internal growth strategies. The distinctive attribute of internally generated growth is that a business relies on its own competencies, expertise, business practices, and employees. Internally generated growth is often called organic growth because it does not rely on outside intervention. Almost all companies grow organically during the early stages of their organizational life cycles.

Effective though it can be, there are limits to internal growth. As a company enters the middle and later stages of its life cycle, sustaining growth strictly through internal means becomes more challenging. Because of this, the concern is that a company will “hit the wall” in terms of growth and will experience flat or even declining sales. This can happen when a company has the same product or service that it tries to sell to the same list of potential buyers. Companies in this predicament need to either expand their client list, add new products or services to complement their existing ones, or find new avenues to growth. Sometimes companies face this challenge through no fault of their own. We list the distinct advantages and disadvantages of internal growth strategies in Table 14.1.

Table 14.1 Advantages and Disadvantages of Internal Growth Strategies

- New product development. New product development involves designing, producing, and selling new products (or services) as a means of increasing firm revenues and profitability. In many fast-paced industries, new product development is a competitive necessity. For example, the average product life cycle in the computer software industry is 14 to 16 months, at the most. Just thinking of how quickly we are introduced to new computers, new smartphones, and related products highlights for us how rapidly products change in this industry. Because of these rapid changes, to remain competitive, software companies must always have new products in their pipelines. For some companies, continually developing new products is the essence of their existence.

Although developing new products can result in substantial rewards, it is a high-risk strategy. The key is developing innovative new products that aren’t simply “me-too” products that are entering already crowded markets. When properly executed though, there is tremendous upside potential to developing new products and/or services. Many biotech and pharmaceutical companies, for example, have developed products that not only improve the quality of life for their customers but also provide reliable revenue streams. In many cases, the products are patented, meaning that no one else can make them, at least until the patents expire.

Successful new products can also provide sufficient cash flow to fund a company’s operations and provide resources to support developing additional new products. For example, Amgen, a large and historically profitable biotech company, has several stellar pharmaceutical products, including Enbrel and Neupogen. Enbrel is a tumor necrosis factor (TNF) blocker that is used to treat rheumatoid arthritis as well as some related conditions; Neupogen helps prevent infection in cancer patients undergoing certain types of chemotherapy. These products have provided the company sufficient revenue to cover its overhead, fund new product development, and generate profits for an extended period of time.

These young entrepreneurs are hoping to grow their organic food start-up via a smartphone app for their store. Here, they are reading some reviews about their app that customers posted. The keys to effective new product and service development, which are consistent with the material on opportunity recognition (Chapter 2) and feasibility analysis (Chapter 3), follow:

- Find a need and fill it: Most successful new products fill a need that is presently unfilled. “Saturated” markets should be avoided. For example, in the United States as well as in most developed countries, consumers have a more-than-adequate selection of appliances, tires, credit cards, and cell phone plans. These are crowded markets with low profit margins. The challenge for entrepreneurs is to find unfilled needs in attractive markets and then find a way to satisfy those unfilled needs.

- Develop products that add value: In addition to finding a need and satisfying it, the most successful products are those that “add value” for customers in some meaningful way.

- Get quality and pricing right: Every product represents a balance between quality and pricing. If the quality of a product and its price are not compatible, the product may fail and have little chance for recovery. To put this in slightly different terms, customers are willing to pay higher prices for higher-quality products and are willing to accept lower quality when they pay lower prices.

- Focus on a specific target market: Every new product and service should have a specific target market in mind, as we have highlighted throughout this book. This degree of specificity gives the innovating entrepreneurial venture the opportunity to conduct a focused promotional campaign and select the appropriate distributors. The notion that “it’s a good product, so somebody will buy it” is a naïve way to do business and often contributes to failure.

- Conduct ongoing feasibility analysis: Once a product or service is launched, the feasibility analysis and marketing research should not end. The initial market response should be tested in customer interviews, focus groups, and surveys, and incremental adjustments should be made when appropriate.

There is also a common set of reasons that new products fail, as articulated by e-Seller Media and shown in Table 14.2. It behooves entrepreneurs to be aware of these reasons and to work hard to prevent new product failures as a result of poor execution in these areas.

Table 14.2. The Top 5 Reasons New Products Fail

This discussion is a reminder that to achieve healthy growth, whether via the development of new products or another means, a firm must sell a product or service that legitimately creates value and has the potential to generate profits along with sales.

Additional Internal Product-Growth Strategies

The management of the hobby company should understand the additional internal product-growth strategies that it can use. Along with developing new products, firms grow by improving existing products or services, increasing the market penetration of an existing product or service, or pursuing a product extension strategy. It is necessary to discuss each of these strategies to understand how they can facilitate the growth of a firm in a highly competitive business environment.

- Improving an existing product or service. A business can often increase its revenue by improving an existing product or service- enhancing quality, making it larger or smaller, making it more convenient to use, improving its durability, or making it more up-to-date. Improving an item means increasing its value and price potential from the customer’s perspective. For example, smartphone companies routinely increase revenues by coming out with “new” versions of their existing phones.

A mistake many businesses make is not remaining vigilant enough regarding opportunities to improve existing products and services. It is typically much less expensive for a firm to modify an existing product or service and extend its life than to develop a new product or service from scratch. For example, many women have set aside the flat irons that they’ve used for years to do their hair and have bought a ceramic flat iron because they’re safer and do a better job. Selling “improved” flat irons is a much less expensive way for curling iron manufacturers to grow sales than to develop a completely new product.

- Increasing the market penetration of an existing product or service. Market penetration is the most common yet highly challenging product growth strategies. It involves selling the already existing product in the existing market. It means that the firm must find a way of doing things differently in the same market to attract more clients. The aim of market penetration is to expand the market share of the product in the existing market. The fact that the product remains unchanged means that the firm must find unique promotional and selling strategies. In terms of promotion, the company must find a way of convincing customers that the product offers superior value (Henry, 2021). The promotional message must emphasize the unique attribute of the products, compared with the existing ones, to convince customers that it is the best alternative. The promotional message should be designed in a way that it aligns with the needs and expectations of the targeted audience.

One of the best way of penetrating the existing market is to redefine the approach that a firm uses to sell its products. It may be necessary to introduce additional channels of selling products to ensure that customers can conveniently purchase the items. It may involve creating additional retail outlets or distributors to increase sales. Online sales platforms are also creating unique avenues of reaching out to clients. The company can use established online retail platforms such as Amazon.com or eBay to reach out to online customers. It can also develop its independent online sales platforms such as a website or an application that customers can use to order an item that they need.

Enhanced communication with clients is also essential in enhancing growth of a firm. Customer loyalty depends on many factors, one of which is the ease with which they can contact a firm and express their concerns or ask specific questions before, during, and after making their purchases. To expand the market share, a firm will need to create a communication system that allows employees of a firm to engage customers and address concerns that they may have (Gupta, 2021). Social media platforms such as Facebook and WhatsApp have emerged as alternatives to traditional methods of communication.

- Pursuing a product extension strategy. When a product has reached the maturity phase of the lifecycle, it is likely that it may start facing the decline stage, which may render it meaningless to customers. Product extension strategy focuses on deliberately extending the life of the product at the maturity stage as long as possible. The firm will focus on making the product relevant to customers despite the changing tastes and preferences in the market. It may involve rebranding the product, offering discounts, or seeking new markets (Pepe, 2020). Seeking of a new market is always advisable if the firm is convinced that the product will be attracting to the targeted clients. The firm will retain the current attributes of the product, including its brand, but focus on identifying new markets. On the other hand, rebranding focuses on changing the perception of the current customers. The product remains the same, but rebranding creates the feeling that it is serving a new purpose. When rebranding a product, focus should be placed on the changing preferences in the market, the targeted audience, and the need new products are meeting.

International Expansion

The hobby company can consider international expansion as a growth strategy. International expansion is another common form of growth for entrepreneurial firms. According to the SBA Office of Advocacy, U.S. companies exported goods and services worth a record $2.3 trillion in 2014. In terms of individual businesses, 97 percent of all U.S. exports are accounted for by small businesses. A look at the world’s population and purchasing power statistics affirms the importance of international markets for growth-oriented firms. Approximately 95.6 percent of the world’s population and 70 percent of its total purchasing power are located outside the United States. Influenced by these data, an increasing number of the new firms launched in the United States today are international new ventures.

International new ventures are businesses that, from inception, seek to derive competitive advantage by using their resources to sell products or services in multiple countries. From the time they are started, these firms, which are sometimes called “global start-ups” or “born global,” view the world as their marketplace rather than confining themselves to a single country. Becoming an international new venture can be intentional or can result from unsolicited orders from foreign buyers. For example, u-Ship is an Austin, TX, company that operates an online marketplace for shipping services. Shortly after it launched in 2003, overseas customers started arranging shipments via u-Ship’s website. U-Ship is now in approximately 20 countries and has an office in Amsterdam.

Although there is vast potential associated with selling overseas, it is a fairly complex form of firm growth. Of course, alert entrepreneurs should carefully observe any changes in purchasing power among the world’s societies that may result from a financial crisis like the one the world experienced in 2008 and 2009. Let’s look at the most important issues that entrepreneurial firms should consider in pursuing growth via international expansion.

- Assessing a firm’s suitability for growth through international markets. Table 14.3 provides a review of the issues that should be considered, including management/organizational issues, product and distribution issues, and financial and risk management issues, when a venture considers expanding into international markets. If these issues can be addressed successfully, growth through international markets may be an excellent choice for an entrepreneurial firm. The major impediment in this area is not fully appreciating the challenges involved.

Table 14.3. Evaluating a Firm’s Overall Suitability for Growth through International Markets

Management/Organizational Issues

Depth of international experience. A firm should also assess its depth of experience in international markets. Many entrepreneurial firms have no experience in this area. As a result, to be successful, an inexperienced entrepreneurial firm may have to hire an export management company to familiarize itself with export documentation and other subtleties of the export process. Many entrepreneurial firms err by believing that selling and servicing a product or service overseas is not that much different than doing so at home.

Product and Distribution Issues

External Growth Strategies

The management of this firm should understand the different types of external growth strategies. External growth strategies rely on establishing relationships with third parties. Mergers, acquisitions, strategic alliances, joint ventures, licensing, and franchising are examples of external growth strategies. Each of these strategic options is discussed in the following sections, with the exception of franchising, which we consider separately in Chapter 15.

An emphasis on external growth strategies typically results in a more fast-paced, collaborative approach toward growth than the slower-paced internal strategies, such as new product development and expanding to foreign markets. External growth strategies level the playing field between smaller firms and larger companies. For example, Pixar, the small animation studio that produced the animated hits Toy Story, Finding Nemo, and Piper, had a number of key strategic alliances with Disney before Disney acquired Pixar in 2006. By partnering with Disney, Pixar effectively co-opted a portion of Disney’s management savvy, technical expertise, and access to distribution channels. The relationship with Disney helped Pixar grow and enhance its ability to effectively compete in the marketplace, to the point where it became an attractive acquisition target. There are distinct advantages and disadvantages to emphasizing external growth strategies, as shown in Table 14.5.

Table 14.5: Advantages and Disadvantages of Emphasizing External Growth Strategies

- Mergers and acquisitions. Many entrepreneurial firms grow through mergers and acquisitions. A merger is the pooling of interests to combine two or more firms into one. An acquisition is the outright purchase of one firm by another. In an acquisition, the surviving firm is called the acquirer, and the firm that is acquired is called the target. This section focuses on acquisitions rather than mergers because entrepreneurial firms are more commonly involved with acquisitions than mergers.

One thing that often surprises entrepreneurs is that growing a firm is as challenging as starting one. Here, a group of three entrepreneurs is evaluating the merits of a strategic alliance with another young firm. Acquiring another business can fulfill several of a company’s needs, such as expanding its product line, gaining access to distribution channels, achieving economies of scale, gaining access to technology that will enhance its current offerings, or gaining access to talented employees. In most cases, a firm acquires a competitor or a company that has a product line or a core competence that it needs. For example, as described in Case 11.1, in 2014 Nest Labs acquired Dropcam, a maker of security cameras. Nest upgraded and rebranded the cameras, which are now called Nest Cam Indoor and Nest Cam Outdoor, and added them to its product line. Similarly, in 2017 Walmart bought three relatively small ecommerce companies, Moosejaw, Shoebuy, and Modcloth. Each of the acquisitions gives Walmart access to new online buyers, and better positions the retail giant to compete more effectively with Amazon.com for Internet shoppers.

Although it can be advantageous, the decision to grow the entrepreneurial firm through acquisitions should be approached with caution. Many firms have found that the process of assimilating another company into their current operation is not easy and can stretch finances to the brink.

- Finding an appropriate acquisition candidate. If a firm decides to grow through acquisition, it is very important for it to exercise extreme care in finding acquisition candidates. Many acquisitions fail not because the companies involved lack resolve, but because they were a poor match to begin with. There are typically two steps involved in finding an appropriate target firm. The first step is to survey the marketplace and make a “short list” of promising candidates. The second is to carefully screen each candidate to determine its suitability for acquisition. The key areas to focus on in accomplishing these two steps are as follows:

- The target firm’s openness to the idea of being acquired and its ability to receive consent for its acquisition from key third parties. The third parties from whom consent may be required include bankers, investors, suppliers, employees, and key customers.

- The strength of the target firm’s management team, its industry, and its physical proximity to the acquiring firm’s headquarters.

- The perceived compatibility of the target company’s top management team and corporate culture with the acquiring firm’s top management team and corporate culture.

- The target firm’s past and projected financial performance.

- The likelihood the target firm will retain its key employees and customers if acquired.

- The identification of any legal complications that might impede the purchase of the target firm and the extent to which patents, trademarks, and copyrights protect the firm’s intellectual property.

- The extent to which the acquiring firm understands the business and industry of the target firm.

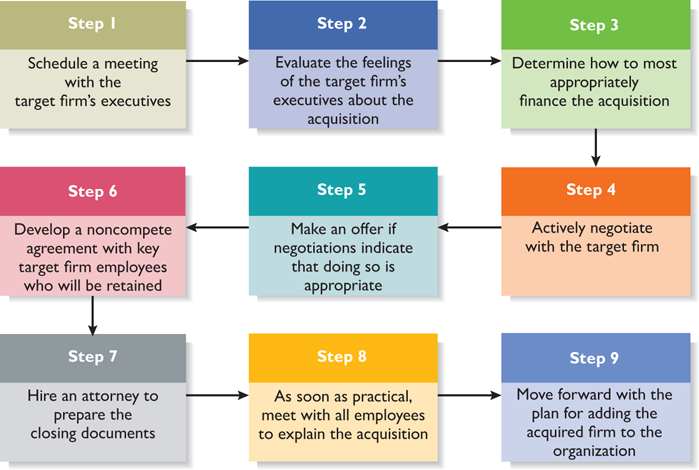

The screening should be as comprehensive as possible to provide the acquiring firm sufficient data to determine realistic offering prices for the firms under consideration. A common mistake among acquiring firms is to pay too much for the businesses they purchase. Firms can avoid this mistake by basing their bids on hard data rather than on guesses or intuition. Steps Involved in an Acquisition Completing an acquisition is a nine-step process, as illustrated in Figure 14.2

- Step 1. Schedule a meeting with the target firm’s executives: The acquiring firm should have legal representation at this point to help structure the initial negotiations and help settle any legal issues. The acquiring firm should also have a good idea of what it thinks the acquisition target is worth.

- Step 2. Evaluate the feelings of the target firm’s executives about the acquisition: If the target is in a “hurry to sell,” it works to the acquiring firm’s advantage. If the target starts to get cold feet, the negotiations may become more difficult.

- Step 3. Determine how to most appropriately finance the acquisition: The acquiring firm should be financially prepared to complete the transaction if the terms are favorable.

- Step 4. Actively negotiate with the target firm: If a purchase is imminent, obtain all necessary shareholder and third-party consents and approvals.

- Step 5. Make an offer if negotiations indicate that doing so is appropriate: Both parties should have the offer reviewed by attorneys and certified public accountants (CPAs) who represent their interests. Determine how payment will be structured.

- Step 6. Develop a noncompeting agreement with key target firm employees who will be retained: As explained in Chapter 7, this agreement limits the rights of the key employees of the acquired firm to start the same type of business in the acquiring firm’s trade area for a specific amount of time.

- Step 7. Hire an attorney to prepare the closing documents: Complete the transaction.

- Step 8. As soon as practical, meet with all employees to explain the acquisition: A meeting should be held as soon as possible with the employees of both the acquiring firm and the target firm. Articulate a vision for the combined firm and ease employee anxiety where possible.

- Step 9. Move forward with the plan for adding the acquired firm to the organization: In some cases, the acquired firm is immediately assimilated into the acquiring firm’s operations. In other cases, the acquired firm is allowed to operate in a relatively autonomous manner.

Along with acquiring other firms to accelerate their growth, entrepreneurial firms are often the targets of larger firms that are looking to enter a new market or acquire proprietary technology. Selling to a large firm is often the goal of an investor-backed company, as a way of creating a liquidity event to allow investors to monetize their investment. Some entrepreneurs allow their companies to be bought by larger firms as a way of accelerating their growth. For example in 2016, Justin’s Nut Butter, the subject of Case 14.2, sold itself to Hormel, primarily as a means of integrating itself into Hormel’s worldwide distribution channels. Hormel is now providing Justin’s access to markets it could never have penetrated on its own.

References

Gupta, S. (2021). Business organization and management. SBPD Publications.

Henry, A. (2021). Understanding strategic management. Oxford University Press.

Pepe, L. J. (2020). Planning for success: Strategies that enhance the process of goal attainment. Rowman & Littlefield Publishers.