Introduction

The British airline EasyJet first took flight in 1995. It is located outside of London’s Luton Airport and follows the low-cost carrier business model. Since its inception, EasyJet has flown 803 different itineraries. The 2019 EasyJet annual report states that the firm serves 132 airports in 31 countries. As of September 30, 2020, EasyJet had a “workforce of over 10,000 people, including 6,516 cabin crew members and 2,865 pilots” (Kassem, Salama, and Ganepola, 2022). EasyJet’s digital app facilitates and instills consumer happiness, boosting earnings.

This company report aims to provide an in-depth analysis of EasyJet Airlines’ financial data. Different ratios are utilized to achieve the goal. The outcomes will be used to evaluate the status and progress of the airline.

Analysis of Financial Performance

Profitability Measures

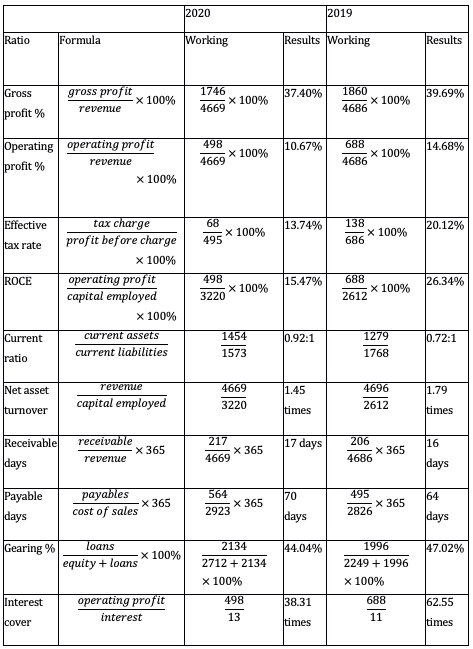

For the past four years, EasyJet Airline Company has posted a profit. The firm has consistently shown positive financial results, with 2019 showing the biggest net profit in its history. These benefits result from lower costs relative to total revenues in all accounting periods. The lower number of expenses in 2019 than in 2020 indicates a greater profit in 2019. From 2019 to 2020, the gross profit and operational margins are expected to fall.

The gross profit margin fell by 2.29% compared to the prior year, from 39.69% to 37.40%. As a result, the operating profit margin fell from 14.68% to 10.67%, a decrease of 4.01%. The decline results from the company’s inability to maintain tight control over its cost of sales.

From 2012 to 2013, the company’s cost of revenue rose by £97m, from £2,826m to £2,923m. However, there was a £17 million drop in income. The key reason for the shrinking gross profit margin is the dramatic rise in selling expenses and fall in overall revenue. As a result, falling operating profit and revenue have contributed to a narrowing operating profit margin. Figure 1 depicts the oscillations above. In 2020, the trend line clearly shows a downward trend.

EasyJet PLC is not performing as well as one of its competitors, International Consolidated Airlines Group SA. The operational profit margin for International Consolidated Airline Group SA improved by 1.2% over the previous year (Falconi, 2022). This is positive for the company despite rising financing expenses and declining earnings before and after taxes. The years after 2020 are anticipated to increase EasyJet PLC’s earnings.

For 2019 and 2020, the company’s net asset turnover was 1.79 times and 1.45 times, respectively. These figures indicate low investments since they are high. However, the turnover decreased by 18.99% in 2020. Compared to other companies in the business, the turnover is higher.

The effective tax rate has an impact on the company’s profitability as well. Taxes were paid on 20.12% of the company’s earnings in 2019. In 2020, this number dropped to 13.74 percent. As a result, the business benefited since less money was needed to pay taxes the next year. Conversely, this demonstrates a decline in the business’s profit, the primary determinant of the tax levied. As profits decline, so does the tax levied (Dekker & Belhadj, 2023).

Shareholders’ Returns and Investments

When compared to 2019, the corporation is performing rather poorly when it comes to investing. From 139.1 to 108.4, the profits per share dropped. This is a decrease of 22.1%.

Positive profits per share results are good for the business, and shareholders are encouraged by these outcomes. The £121 million drop in profit after taxes caused the basic profits per share to decline. The corporation needs to cut back on long-term and short-term borrowing to dramatically increase the amount to maintain positive profits per share (Timóteo, 2021).

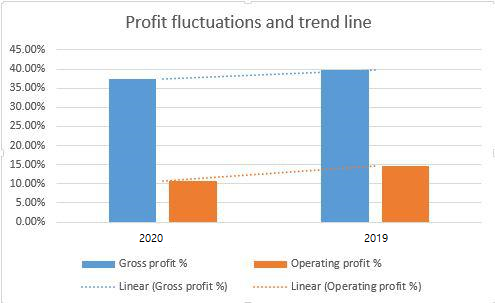

EasyJet’s return on capital employed (ROCE) is favorable. The ROCE was 26.34% in 2019 and 15.47% in 2020. According to EasyJet’s annual report for 2020, the firm purchased 20 more aircraft and made mark-to-market adjustments. As a result, the profit for the year decreased, and the adjusted capital utilized was raised.

As seen in Figure 2, these two modifications caused ROCE to decline by 10.87%. In this regard, since there will not be as many substantial acquisitions as in 2020, the ROCE is anticipated to increase significantly in the years to come. The increase will also be brought on by the anticipated increase in revenue from the new acquisitions, which will raise operating profit (Fonseca, 2020).

The business had a superior ROCE than British Airways, which added 16 more aircraft to its fleet that same year. This puts it in a strong position within the European airline sector. The following chart displays the ROCE trend over the past two fiscal years.

Analysis of Financial Position

Liquidity Measures

The current ratio is one of numerous liquidity metrics used to evaluate a corporation. Current and fixed assets help evaluate a company’s finances. EasyJet PLC purchased 20 extra planes to strengthen its financial status. These aircraft advance the carrier’s planned itineraries. The company’s 2019 and 2020 current ratios were 0.72:1 and 0.92:1. In both years, the corporation could not pay its bills. The current ratio is 27.78% higher.

Current assets increased from £1,279 million to £1,454 million, up £175 million (13.68%), while current liabilities decreased from £1,768 million to £1,573 million, down £195 million (-11.03%), to produce this change. The biggest competition, International Consolidated Airline Group SA, has a current ratio that is steadily declining and far lower than EasyJet PLC’s. International Consolidated Airline Group SA’s current ratios are 0.74:1 and 0.76:1 for 2019 and 2020, respectively (Siegfried, 2021). As a result, the business is in a stronger financial situation than its rival.

Financial Gearing

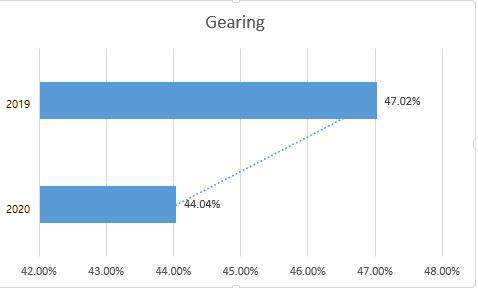

The primary and most important indications of a company’s financial gearing are interest cover and gearing. To improve its financial situation, EasyJet PLC must manage its financial risks. In 2019 and 2020, the airline company’s gearing was 47.02% and 44.04%, respectively. The business borrows far too much money to meet its long-term demands.

The trend line in Figure 3 below shows that this ratio has slightly decreased by 2.98%. The drop is a plus for the airline firm since it shows that it is less dependent on debt than it formerly was to meet its long-term financial obligations. Even though loans grew in 2020, the reported drop is due to shareholder equity growth. Figure 3 depicts the reduction above.

Given its profits, the corporation can repay its interest several times. EasyJet Airlines covered interest 62.55 times in 2019 and 38.31 times in 2020. Over two years, interest cover plummets 38.75%. Lower operational profit and greater interest costs caused the steep decline. If this keeps declining, the company will not meet its financial responsibilities. Poor cost management may lower this. If borrowing costs and debt grow, they may be drastically decreased.

Efficiency

The number of days a firm or business has for receiving and paying money is a gauge of its efficiency. EasyJet PLC extended its receivable days from 16 to 17 days in 2020. Despite a minor rise, the firm will suffer from the longer receivable days.

The firm received payments from debtors one day later in 2020 than in 2019. This rise in the collection period can be attributed to several factors, including bad debts and poor receivables management. By ensuring they pay on time, pursuing bad debts, and issuing bills to debtors on time, the business may decrease the number of days their debtors are still due.

EasyJet Airlines PLC’s payment days were 64 days in 2019 and 70 days in 2020, respectively. These numbers show that the airline took six more days in 2020 to pay for all its purchases than in 2019. The fact that the money intended for payment to creditors is now in the corporation gives the company an advantage. The business can utilize the funding to support other initiatives and carry out day-to-day operations. Although supplier credit is a valuable funding source, increasing the days payable may indicate the company is having trouble making debt payments.

The ratios mentioned above, receivable days and payment days, demonstrate that EasyJet PLC’s financial situation is steady. Just 16 to 17 days after collecting money owed from creditors is a reliable sign of the company’s stability. This implies that the business would improve cash flow and have plenty of money available for additional spending.

Conclusion

EasyJet PLC’s financial analysis shows a strong profit margin in 2019 and a marginal decrease in 2020 due to acquiring 20 more aircraft. The company aims to expand route coverage and improve return on capital employed, resulting in improved returns for shareholders. However, changes in financial gearing indicate potential enhancements in the business’s financial position. The company must be cautious when managing large organizations with substantial financial transactions, as escalating long-term loans could negatively influence its financial standing and industry position.

Reference list

Dekker, C. and Belhadj, E. (2023). The Government as Purchaser: The MEOP Still Requires a Thorough Examination of All Relevant Circumstances · Joined Cases C‑331/20 P and C‑343/20 P Volotea SA, and easyJet Airline Co. Ltd v European Commission · Annotation by Cees Dekker and Ekram Belhadj. European State Aid Law Quarterly, [online] 22(1), pp.95–100. Web.

Falconi, P. (2022). Arguments for choosing cross border M&A as a growth strategy in the European airline industry exemplified by the Air France and KLM holding and the EasyJet/Wizz Air case study. [online] tesi.luiss.it. Web.

Fonseca, A.C.H. (2020). Equity valuation of the EasyJet Company. repositorio.ucp.pt. Web.

Kassem, R., Salama, A. and Ganepola, C.N. (2022). ‘CSR, credibility, employees’ rights and legitimacy during a crisis: a critical analysis of British Airways, WizAir and EasyJet cases’. Employee Relations: The International Journal, 45(1). Web.

Tourism Management, 61, pp.23–34. doi:https://doi.org/10.1016/j.tourman.2017.01.009.

Siegfried, P. (2021). Land & Sea Transport Aviation Management: Daimler trucks, DHL, JD Retail, Amazon, DB Schenker, COSCO Shipping, UPS, DSV, Anji Logistics. FedEx Quatar Airways, Lufthansa, China Eastern Airlines, Emirates Airlines, easyJet, Air Chi-na, Austrian Airlines, Iran Air. [online] Google Books. BoD – Books on Demand. Web.

Timóteo, R.F. da S. (2021). Equity research – EasyJet Airline Company LTD. [online] www.repository.utl.pt. Web.

Appendix

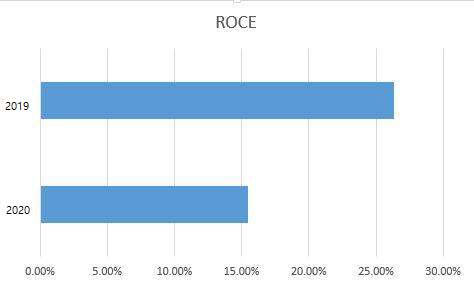

Table 1 – Ratios