External factors such as Consumer Price Index (CPI), consumer behavior, and inflation rate play a very important role in stimulating economic growth. For instance, the rate of inflation of a given economy will affect its growth since a high inflation rate may lead to low economic growth. Though internal factors may be performing well to stimulate economic growth, the trend of external factors may favor or not favor economic growth. This study will look at each of these factors to establish whether they affected the economic growth of Australia.

Inflation

Inflation generally refers to the rise in price levels of goods and services in a given economy for a given period. Inflation affects the economy both positively and negatively. The positive effects of inflation include adjustments of the nominal interest rates by the central bank particularly in a time of recession. As Lim (2009) notes, rising inflation also encourages investments in projects that are non-monetary (p.110).

On the other hand, the negative effects of inflation include lowering the value of money, discouraging saving investments, and a shortage of goods in the economy. According to Burdick and Fisher, inflation erodes the purchasing power of the consumers (2007, p.73). The rate of inflation in Australia was about 1.8% in 2009, which had several impacts on the country’s economic growth. The rate of inflation affects the decision of individuals, lenders, borrowers, and businesses.

This rate of inflation is below the target of the government of 2% to 3%, which ensures that there is economic growth in the country (Australian Bureau of Statistics 2011). This rate of inflation, therefore, favored household stimulus since the prices of goods were kept as low as possible (Nation Building 2011). The purchasing power of individuals and businesses was enhanced by this low rate of inflation.

Consumer price index (CPI)

CPI and inflation rate are very closely related. CPI measures changes in the prices of goods and services over a given period in a given economy. At the beginning of this year, CPI in the Australian economy was 3.3 %, which was an increase from 2.7 % in the closure of 2010. The CPI of Australia is the Laspeyres index with some level of bias (Barrett & Brzozowski 2010, p.1) and this shows that there was an increase in prices, which affected the consumer basket that could be afforded with the consumer budget. Consumers can now afford fewer goods and services compared to what they could afford at the end of last year. However, this change has little effect on the household budget and spending. Thus, the household stimulus was affected by the increasing price changes even if the effects were not of high magnitude thus lowering economic growth.

Analysis

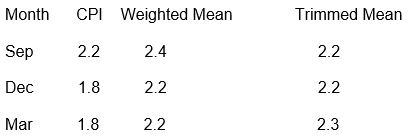

The figures below show more analysis of the CPI in Australia for the year 2010/ 2011 from the Reserve Bank of Australia (Measures of Consumer Price Inflation 2011).

The figures above show how the CPI of Australia has been fairing for the past three quarters this year. The figures also show this index in terms of the weighted and trimmed mean. From these figures, the last quarter of the year has recorded decreasing CPI. In September 2010, the CPI was 2.2 and decreased to 1.8 in the next three months. However, this figure has remained constant in the last three months. This trend is also reflected in the weighted mean but the trimmed mean shows slight variations.

Reference List

Australian Bureau of Statistics, 2011. Consumer Price Index. Web.

Barrett, G. F., & Brzozowski, M., 2010. Using Engel Curves to Estimate the Bias in the Australian CPI. Economic Record, 86 (272), pp. 1-14.

Burdick, C., & Fisher, L., 2007. Social Security Cost-of-Living Adjustments and the Consumer Price Index. Social Security Bulletin, 67 (3), pp. 73-88.

Lim, G. C., 2009. Inflation Targeting. Australian Economic Review, 42(1), p110-118.

Measures of Consumer Price Inflation, 2011. Reserve Bank of Australia. Web.

Nation Building, 2011. Economic Stimulus Plan. Web.