Introduction

Population demographics are essential indicators of the direction the economy can take when the characteristics and trends of each demographic are considered. America’s population contains several age groups with different economic impacts through their financial habits, including spending and savings.

Comparing Saving Rates: Middle-Career Individuals vs. Retirees

Baby boomers comprise one of the largest sections of America’s population, with significant implications for the economy (Song & Ferris, 2019). The saving rate of individuals of different ages differs due to the varying needs and priorities at a given time. Those at the beginning of their careers are less likely to save than middle-career individuals and those about to retire.

The trend determines the saving rate whereby middle-career individuals will have higher savings than retirees and those who have just joined the job. The middle-career individuals will have a higher saving rate than the retiree population since they prepare for retirement while the latter spend their savings. According to the theory of demand and supply, the retirement of baby boomers will lead to an increase in interest rates due to the increased demand for capital and the low supply of savings.

Impact on the National Saving Rate Due to Baby Boomer Retirement

The impact of baby boomers on every aspect of the U.S. economy will be significant due to the decline in the average saving rate and increased consumption. Older individuals have lower productivity, which leads to exit from the workforce (Børing & Grøgaard, 2021). It also means that there will be greater spending by those in retirement due to a lack of productivity, and it is the opportunity for individuals to use their savings.

According to He et al. (2018), a country’s saving rate is negatively affected when many individuals leave the workforce. The rate declines since younger people who join the workforce do not have the same saving culture as the retired. Therefore, the savings rate in the economy will be adversely affected due to the retirement of many baby boomers.

Financial capital is the purchasing power that determines the ability to acquire items using available funds. External finance, like debt, and internal financing, like equity, are primary financial capital sources for organizations or productive individuals (Nguyen & Canh, 2021). Savings and earnings are other sources of financial capital that can be used to acquire items. In the case of retirement, financial capital becomes limited to the savings that most individuals have been making in their lifetime.

Retirement impacts the demand and supply of financial capital among retirees. Most retired individuals rely on their savings after leaving work, as very few continue to be productive. The retirement of baby boomers will increase the demand for financial capital and reduce its supply as more people will be relying on their savings while the number of people making savings declines.

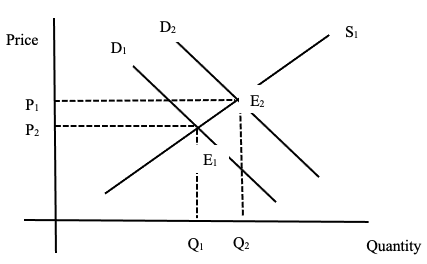

Graphical Analysis: Shifts in the Supply and Demand for Financial Capital

Economic Reasoning: How Retirement Affects Capital Markets and Interest Rates

The laws of demand and supply apply to the changes that occur due to retirement and changes in savings rates. The law of demand and supply states that the price of any service or product is determined by the demand and supply relationship (Sanyal et al., 2021). Four principles describe the relationship between supply and demand.

The applicable law in the retirement of baby boomers and financial capital is the principle that an increase in demand and a lack of subsequent increase in supply will lead to a price increase. In the case of financial capital, baby boomers will increase their demand, which was initially at D1 in Figure 1 above to D2. The supply remains the same, which leads to a shift in the equilibrium towards the right.

The shift in equilibrium price indicates that initiatives can be taken to increase the number of people making savings. The rise in demand does not match the supply since those who should be saving do not increase significantly. The effect is the shift to the right in demand for financial capital, which also shifts the equilibrium to the right.

The economics guiding the shift is based on the relationship between supply and demand, whereby any changes always reach an equilibrium. Millennials are the most significant section of the employed population (Locke et al., 2022). Baby boomers were already saving for retirement when most millennials joined the workforce, which provided sufficient financial capital to the retired.

However, the saving culture of millennials, who should be making the most significant contributions in savings, is poor (Pangestu et al., 2019). The impact is that the market received capital from baby boomers whose retirement led to increased demand for savings in financial capital. On the other hand, the market has not increased its supply of the product or savings to match the demand, leading to equilibrium shifts.

Conclusion

In conclusion, the retirement of baby boomers impacts the financial markets as the demand for financial capital will increase due to the lack of productivity and income. Demographic alterations impact the demand and supply of financial capital, leading to changes in interest rates. The retirement of baby boomers is leading to changes in the demand and supply of financial capital as they will demand the money for use after their income stops. The rise in demand does not match the supply from the financial markets, leading to a shift in the equilibrium to the left.

Reference

Børing, P., & Grøgaard, J. B. (2021). Do older employees have a lower individual productivity potential than younger employees? Journal of Population Ageing. Web.

He, H., Ning, L., & Zhu, D. (2019). The Impact of Rapid Aging and Pension Reform on Savings and the Labor Supply: The Case of China. International Monetary Fund Working Paper, (Ser. WP/19/61).

Locke, R., Gambatese, M., Sellers, K., Corcoran, E., & Castrucci, B. C. (2020). Building a sustainable governmental public health workforce: A look at the millennial generation. Journal of Public Health Management and Practice, 28(1). Web.

Nguyen, B., & Canh, N. P. (2020). Formal and informal financing decisions of small businesses. Small Business Economics, 57(3), 1545–1567. Web.

Pangestu, S., & Karnadi, E. B. (2020). The effects of financial literacy and materialism on the savings decision of Generation Z Indonesians. Cogent Business & Management, 7(1), 1743618. Web.

Sanyal, R. K., Mukhopadhyay, N., & Mitra, A. (2021). Demand and supply cross-explanation and their magnitude in changing open market economy. International Journal of Recent Scientific Research, 12(3), 41163–41171. Web.

Song, Z., & Ferris, T. G. (2018). Baby boomers and beds: A demographic challenge for the ages. Journal of General Internal Medicine, 33(3), 367–369. Web.