Abstract

The objective of the current research was to examine the changes in financial language and social development since financial tsunami, 2008, in the context of the United States and to report on the role and use of financial language in the proliferation of financial globalization and its eventual climax in the culmination of financial tsunami. The research was undertaken from a linguistic perspective to assess the role of financial language in contributing to social developments. Examining the linguistic characteristics of the financial language was another objective of the research. The research undertook the process of secondary and desk research supported by the case study of bankruptcy of Lehman Brothers, a prominent investment banking institution in establishing the association of financial language in the development and decline of the role of innovative financial products and services in the economic boom prior to 2008 and the financial tsunami in 2008.

The study concludes that the proliferation of financial globalization was greatly helped by the development of financial language and with the expansion of financial globalization, the financial language has to undergo a process of transition. The study found the influence of several factors in the use of financial language such as familiarity with the financial system, cultural differences, general mistrust of people on the functioning of the financial institutions, differences in income and varying education levels of parties dealing with each other. The research observes that though some of the phrases and terminology of financial language have resemblance to some of the linguistic features, financial language cannot be considered a full-pledged language. Nevertheless, financial language can be considered as a global language, as it meets the requirements of a global language.

Introduction

World history has witnessed several spells of dynamic and integrated global growth. At the same time, there had been many instances where the growth spells had ended because of financial instability and geopolitical disorders. There are examples of disturbances in British and French economies because of “social, military and monetary chaos” resulting in French and the American Revolution. Even greater damages to the entire social and economic systems were caused by the aftermath of World War I and the subsequent financial crisis resulted from the Great Depression. The most recent instance was the “multi-trillion dollar US-centered securitization debacle began to unravel in June 2007” (Engdahl, 2008), resulting in a “Financial Tsunami” towards the mid to end of 2008. The worst-ever financial crisis next only to the Great Depression ravaged the world’s largest economy ripping apart all the financial control mechanisms and safeguards meant to protect the financial system in the country. “The meltdown has led to shock waves across the world, with economy after economy gasping for breath to survive this financial tsunami” (Mohanty, 2009).

Alan Greenspan, the erstwhile official of the Federal Reserve narrated the crisis as one, which occurs over 100 years, considering its large impact not only on the US economy; but also on almost all the developed and developing economies. The analysis of the previous financial disasters reveals that the great wave of financial crisis overtopped one after the other economic sectors. In the recent crisis, the financial volatility started at the first instance in the housing sector. Later the crisis extended to banking and other financial systems. Finally, it affected the real economy in its entirety. The impact of the crisis has been felt both on the private and public domains and the blow on the private sector forced them to make heavy demands on public sector finances to save the economy from collapsing. The wave of the crisis surged across the borders of developed economies including United States and stated swamping other developing economies providing substantial impediment to economic growth of all the affected nations.

The financial crisis of 2007-2008 thus is the most substantial one affecting the United States economy heavily after the Great Depression. During the first year of the crisis, it was anticipated that the crisis would be affecting the developed markets only. The dramatic economic events that took place in October 2008 made it a true global phenomenon, which enveloped both developed and emerging economies, affecting the respective financial markets substantially and resulting in slow down of the economic growth and economic recession of a high magnitude. The irony is that neither lack of proper institutional designs nor failure of macroeconomic policies caused the crisis as prescribed by the standard crisis theory (for a discussion on crisis theory see Flood & Marion, 1999); but “poor assessment of risks and less than transparent inter-linkages between financial institutions” caused by faulty financial innovations. Traditional crisis models may not have the ability to provide greater insights into the current crisis (Allen & Babus, 2008).

In the context described above, the central aim of this thesis is to examine and report on the changes in financial languages and social development since financial tsunami 2008. The setting for the thesis is United States being the originator of the crisis and the one severely hit by the crisis. Therefore study of the topic within the context of United States will provide greater insight into the changes and will do more justification to the study. Before dealing with the central focus of the study, it becomes essential to create a foundation on general history of global finance so that there will be clarity on the reading of the subsequent chapters.

This chapter is structured to have sections presenting discussions on development of global financial markets, origin, definition and development of financial language and factors influencing the use of financial language. Under this chapter, the research questions for which the study will strive to find answers will be framed based on the theoretical framework, which will be discussed in one o the sections of this chapter.

Background: General History of Global Finance

Impact of the Great Depression on Stock Market in the United States – Period 1929-1939

Bernanke (1983) argued that any disruptions to the financial system are likely to have its negative impact on the real economy, since such disruption leads to increased cost of credit intermediaries. The impact of disruptions to the banking system has been examined a number of subsequent studies Calomiris & Mason, (1997), Calomiris & Mason, (2003) and Carlson & Mitchener, (2009). Retrospectively, the stress on the financial market caused by the bank failures may be assumed to have been prevalent during the Great Depression and such stress would have added to the severity of the depression during the period. Great depression was an economic crash that rocked the Americas, which disrupted the economic activities in Europe and other developed nations of the world during the period from 1929 to 1939. Great depression existed for a longer duration and was the strongest economic shock that devastated all the advanced economies of the world.

Although the economic conditions in the United States have been affected by the impact of an economic downturn much earlier, the major collapse of New York Stock Exchange during late 1929 marks the beginning of the period of Great Depression.

“Though the U.S. economy had gone into depression six months earlier, the Great Depression may be said to have begun with a catastrophic collapse of stock-market prices on the New York Stock Exchange in October 1929. During the next three years stock prices in the United States continued to fall, until by late 1932 they had dropped to only about 20 percent of their value in 1929. Besides ruining many thousands of individual investors, this precipitous decline in the value of assets greatly strained banks and other financial institutions, particularly those holding stocks in their portfolios” (Wright, 2005).

Great depression forced a number of banks to declare insolvency. By the year 1933, 44 per cent of the banks (11,000 banks out of total 25,000) operating in the country became insolvent, wiping of the investments of millions of people into nothing. “The failure of so many banks, combined with a general and nationwide loss of confidence in the economy, led to much-reduced levels of spending and demand and hence of production, thus aggravating the downward spiral” (Lance, 2008). The after effects of failure of so many banks caused a significant reduction in the confidence on the economy, which in turn resulted in reduced consumer spending and demand for products and services. Heavy reduction in demand led to corresponding reduction in production levels, which aggravated the economic downtrend. A combined effect of all these on the economy was the output falling drastically, leading to massive unemployment in the country. In real terms, the manufacturing output in the United States had fallen to 54 per cent of its original level as of 1929 and about 12 to 15 million workers remained unemployed, which was approximately equivalent to 25-30 per cent of the eligible workforce.

The nucleus of the issue was identified as the vast discrepancy between the industrial capabilities of the nation and the capacity of the public to utilize the produced goods and services. There were spectacular improvements in the production designs at the time of World War I, which increased the production of goods and services in the United Stated, well in excess of the boundaries of the ability of the salaried people and growers of the United States to procure and consume them. The investible surplus of a majority of citizens of the country grew to a level where any prudent channelization was not possible, resulted in the savings and investments drawn into speculative activities either in realty assets or in stocks. The downfall of stock exchange can therefore be construed as the major factor, which led to the crash of the speculative stock market activities.

Aftermath of World War II on Global Financial Markets – period 1940-1945

World War II can be considered as instrumental in overcoming the ill effects of Great Depression. Governments of different nations prepared their responses to improve their economies with sophisticated systems of financial regulations. The key initiative was the Bretton Woods Agreement entered in to in the year 1944. In the conference held at Bretton Woods (New Hampshire), attended by representatives from 44 nations entered into this agreement, where the values of national currencies were fixed against United States dollars. Under this agreement, the US dollar was equated to one ounce of gold having a value of US Dollars 35. Prior to this agreement, a gold exchange standard was maintained requiring the countries maintain gold reserves equal to the value of their currencies. The objective of this arrangement was to take guard against the economic volatility affecting the countries, since the practice of backing up with gold reserve led to boom-bust models in the economies. In the area of global trading, the objective of Bretton Woods agreement is to ensure international economic stability, through the mechanism of preventing currencies jumping national borders. Another objective of the agreement was to prevent speculation in the international currency market.

Member countries signed to this treaty, concurred on maintaining the values of their respective currencies, with a smaller protection for the dollar and on keeping gold for a like amount as reserve to back up to the agreed margin. Because of this agreement, US dollar acquired the status of the benchmark for exchange rates and became the standard as it can be exchanged to gold. This agreement marked the move of the economic power from the hands of the European countries to the United States. As an initiative to restore stability in the global market place, the agreement restricted the member countries to indulge in any devaluation of their currencies to facilitate their foreign trade. Even though the policies promulgated by the Bretton Woods agreement were short lived, the agreement made United States to emerge as the global economic power. Post World War II prosperity led to enormous trading volume in the international foreign exchange market and there were massive movements of capital across geographical borders.

This prosperity led to the destabilization of the currency conversion factors set in the earlier agreement. Subsequently the need for a new system to meet the demands of this growth and to provide the platform for better global trading arose.

The meeting at Bretton Woods also proposed the establishment of the “International Monetary Fund (IMF)” and the “International Bank for Reconstruction and Development” (the World Bank). The IMF was entrusted with the responsibility to provide short-term lending to countries to manage exchange rate fluctuations and short-term trade imbalances and the World Bank would provide long-term financial assistance to countries for promoting economic development. These institutions were established with the objective of preventing the reoccurrence of another devastating economic event like the Great Depression.

“Thus, in the aftermath of World War II, the United States emerged as the great winner and the new hegemonic power in the world; more than that, despite the new challenge represented by Soviet Union, it was a kind of lighthouse illuminating the world: an example of high standards of living, technological modernity and even of democracy” (Bresser-Pereira, 2010).

Recovery and Development of Global Financial Markets – Period 1945-1955

This period marks the start of the global economic recovery and the start of the Cold War between the erstwhile Union of Soviet Socialist Republics (USSR) and the United States. The developments that took place in the attitude and actions of USSR convinced American leaders that communism posed a permanent threat to the American model of democratic and competitive capitalism. The after effects of WW II created extremely bad economic and social conditions in Europe with shortage of energy and reduced production capacity. In order to remedy the economic situation and prevent the leaning of the European countries towards communism, the Truman administration proposed the “European Recovery Program” known as the “Marshall Plan” in 1947 aimed at economic and political reconstruction of Europe. The program took off in April 1948 and ended in 1952. The offer of European Recovery Program (ERP) was made to all European countries including the USSR with the condition that their markets were to be opened to the world economy on a gradual basis. However, USSR declined the offer and forced the Eastern European countries under its control to decline the offer.

The Marshall Plan made a transfer of $ 12.5 billion to 16 European states excluding Finland and Spain but including Turkey. Major portion of the aid, which was in the form of goods like raw materials for production and wheat including a small part as dollars were transferred to the UK and France and other states received a small proportion of the total aid. The economic impact of the aid was small as the value of aid received by the nations except UK and France represented only a fraction of the GNP of the receiving states. Nevertheless, the Marshall Plan had some qualitative impact in providing (i) the needed raw materials for the European industries, (ii) food much needed by workers in key sectors like coal mining and (iii) providing confidence to the European investors, which was badly needed at that point of time.

In the post war era, the transnational oil majors entered into long-term contracts for supply of oil and promoted several joint ventures, which were interconnected with each other.

“For other industries, however, pent-up consumer demand at home, the scarcity of similar demand in war-ravaged Europe and elsewhere, the lack of convertible foreign currencies, the risks attendant upon overseas investments as illustrated by the experiences of two world wars, restrictions on remittances, and the fact that a new generation of chief executive officers with less of an entrepreneurial spirit and more of a concern with stability and predictability than many of their predecessors, all served to limit foreign investment in the years immediately after World War II” (New American Nation, 2009).

The amount of capital invested in production by transnational companies rose from $2.4 billion in 1946 to $5.71 billion in 1954; but a majority of the investments were in the form of plough back of earnings by the companies that existed. The multinational companies had to face the situation of the host governments blocking repatriation of scarce currencies. The countries blocked the repatriation for tax and other reasons, which did not have any direct relationship to the increasing demand from the consumers. There were no significant improvements in the investments made in other industries such as public utilities (New American Nation, 2009).

The US government regulations applied restrictions on the capital outflow to other countries, especially for investment in the production sector. The government in an unusual move combined overseas economic decisions with the country’s foreign policy frameworks. With the Cold War intensifying in the decade following the WW II, US government implemented policies that restricted commercial transactions and capital flows to the countries under the control of Russia. “The Export Control Acts of 1948 and 1949, for example, placed licensing restrictions on trade and technical assistance deemed harmful to national security” (New American Nation, 2009). When the Korean War (1950–1953) was in progress, the government imposed further stringent restrictions. These controls were extended to dealing in all types of goods and services with China.

However, the financial status of US Corporations was so bad that they would not have invested substantially in the countries, which were under Russian influence in the absence of these controls. The economic sanctions against the communist bloc countries contributed to aggravate the gloomy economic atmosphere in the global scenario, which acted as a restraint on the inflow of foreign capital. Even the UK was keen on entering the prospectively larger markets of China. However, the country had to delay its plans, as it did not recover fully from its economic disaster, which also affected the inflow of foreign capital into the country discouraging the investors largely.

The period that followed the WW II witnessed the presidents Truman and Eisenhower aimed at recovering the “private sector” in the European countries. The governments encouraged increased trade and direct foreign investments for speeding up the recovery. The objective of Marshall Plan, with its outlay of around $ 12.8 billion meant to fuel the recovery of the economies in Europe during 1948-1952, was considered to promote a secure association among the public and private enterprises in a combined respect. Eisenhower worked on the principle of fuelling the global economic growth by liberalization measures covering cross border trade and personal investment in the foreign countries rather than extending different forms of government-sponsored financial assistances. During the tenure of his presidency between 1953 and1961, the president made changes to his policy of “trade not aid” to one of “trade and aid”. He also shifted his focus from the Western European countries to the Third World developing economies, which according to him were more vulnerable to communist expansion. Despite his conviction on the communist expansion, he strongly believed that international commerce and foreign direct investments had a major role to play in ensuring global economic recovery, growth and move towards prosperity.

Overview on Establishment and Growth of Traditional Financial Market – Period 1955-1985

In the aftermath of the Great Depression, governments took up the responsibility of managing the economies and this situation prevailed even in developed countries. There were significant changes taking place in the global context. During the late 1960s, the balance of payments deficit of United State increased and at the same time, the financial position of European countries became stronger with increasing surplus. However, the European nations were reluctant to revalue their currencies. This situation depicted the intrinsic demerit of a global reserve system in which the national currency of one country plays a major role in the determination of exchange rates of many other currencies. Even though, the system of fixed exchange rates and capital controls were abolished, the dollar standard for other currencies was still maintained. The countries were allowed to decide whether to float their currencies or not. Major countries concurred on holding dollar reserves in the United States.

The restrictions on cross-border financial transactions were removed largely which led to an increased capital flows across countries including to developing economies. “As real interest rates were low in the period of high inflation of the 1970s, international borrowing from private sources, lending banks in particular, became an attractive external financing option for governments in many developing countries, especially middle-income countries, compared with aid flows and multilateral bank lending which were often subject to restrictive policy conditions.” Since the flow of foreign capital were influenced by economic cycles, there were significant changes in the borrowing conditions at the end of 1970s which adversely affected many of the developing countries, which ended up with debts which were unserviceable.

The debt crisis was perceived as another failure in the development effort and was considered the result of unsound fiscal management in failing to create dynamic export sectors to maintain the debt-service to export ratios within manageable limits. These events fuelled the adoption of a diametrically opposite approach with respect to global economic development. This philosophy gained prominence during 1980s and 1990s. This philosophy called for a radical change in the role of the government in managing economic development, as governments were viewed as poor managers of public finances. This approach called for the development policies to be keen on the macroeconomic stability with the functioning of more deregulated markets and private initiatives.

The private initiatives were recommended not only in productive activities but also n the provision of social services. It was considered that the market reforms would be conducive to get the appropriate prices and encourage the businesses and households to improve upon their efficiencies and invest in a better future. The market-oriented, export-led strategies helped a number of developing countries in Asia to achieve sustained and rapid economic growth during 1980s. “These development policies involved inter alia, agrarian reforms, investments in human capital, selective trade protection, directed credit and other government support for developing industrial and technological capacity while exposing firms gradually to global competition” (Department of Economic and Social Affairs, 2010).

Many of the developing countries faced the repercussions of the debt crisis and they have to resort to the financial assistance from the IMF and World Bank under the strict conditions regarding adjustments in fiscal and monetary policies of the respective government prescribed by these institutions including market-oriented policy reform measures. Trade liberalization and capital account liberalization were the key ingredients of the reform measures prescribed by IMF.

Status of Global Financial Markets after Cold War – Period 1985-1995

After the collapse of the Bretton Woods system of fixed exchange rate system, a new global financial environment emerged in different stages. The economic crisis started in the beginning of 1980s led to different structures of business organizations and the enterprises merged with each other for greater efficiency and market power. Bankruptcies were also on the rise. These revised structures in the institutions and enterprises in the financial environment resulted in the generation of a new set of financial institutions and agencies in the form of investment banks, stock and insurance broking firms and several other financial intermediaries. The emergence of these financial intermediaries made the commercial banking functions combined with the functions of the investment bankers and stock broking firms.

Even though these agencies and institutions had a powerful role to play on the emerging financial environment, they did not participate in the promotion of enterprises in the real economy. The activities of these institutions, which largely remained unregulated, focused mainly on transactions of speculative nature undertaken in the areas of commodity futures and derivatives. They were also involved in the manipulation of currency markets. There was the development of the concept of “off-shore banking” encouraging legal and illegal monetary transactions resulting large accumulation of private wealth. In the absence of proper international regulatory regime and with the financial deregulation-taking place, secret ant-social organizations entered into the management and administration of financial institutions including banks.

The 1987 Wall Street Crash

Another major incident, which shook the US economy, was the largest fall in the stock values in the New York Stock Exchange on October 19, 1987 (usually referred to as Black Monday). The drop in the stock prices overshot the collapse of the stock market in the year 1929, which marked the beginning of the Great Depression. In the Wall Street, crash took place in the year 1987; US stocks lost 22.6 percent of their value largely during the initial hour of trading on October 19, 1987. The repercussion of the plunge on Wall Street echoed through the global financial markets leading to the steep fall in the values of stocks traded in the stock markets of Europe and Asia.

The Institutional Speculator

The 1987 Wall Street crash had the effect of wiping of the weaker agencies, institutions and intermediaries from the financial system enabling only those who are strong and fit to survive in the system. The stock market crash led to a substantial concentration of financial power in the global financial environment. This major transformation in the global financial system gave rise to “institutional speculator” category of financial intermediaries. These institutions gathered the necessary power to overshadow and often undermine the genuine business interests. These institutional speculators used different and innovative financial instruments to siphon the wealth from the real economy and accumulated their personal wealth. They were in a position to determine the future of entities trading in the stock markets. Without any role to play in the development of new entities in the real economy, they possessed the strength of driving even large conglomerates into the direction of financial breakdown and ultimately to insolvency.

In 1993, the Bundesbank of Germany through its report raised an alarm that trading in derivatives could potentially “trigger chain reactions and endanger the financial system as a whole” (Chossudovsky, 2008). With his commitment to financial deregulation during early and mid 1990s, the Chairman of the US Federal Reserve Board Mr. Alan Greenspan had warned, “Legislation is not enough to prevent a repeat of the Barings crisis in a high tech World where transactions are carried out at the push of the button” (Khor, 1995). According to Greenspan “the efficiency of global financial markets, has the capability of transmitting mistakes at a far faster pace throughout the financial system in ways which were unknown a generation ago…” (Greenspan, 1997). However, there was no revelation about the unprecedented accumulation of private wealth amassed because of the mistakes occurring in these speculative transactions.

The magnitude of the speculative transactions could be understood by the increased volume of currency trading, which surpassed the global official foreign exchange reserves, which were calculated to be in excess of US$ 1200 billion. It was reported that the institutional speculators were controlling privately held foreign exchange far in excess of those held by the central banks of the countries.

Impact of Technological Development on Stock Market – Period 1995-2000

Global economy has undergone a significant transformation with the technological revolution during the mid 1990s. Innumerable innovations in computerized transaction processing, software tools, telecommunication aids and the proliferation of Internet have facilitated the creation of an information economy. Latest developments in technology have a large impact on the functioning of the stock markets in that technology enhances the information availability to the investors and ensures the growth in their wealth.

Another important occurrence during the period 1995-2000, when there was the introduction of enhance technological applications in the global financial system was the “Financial Meltdown” happened in 1997. Exactly ten years after the great crash of Wall Street, stock markets around the world plummeted because of turbulent trading in the stocks of the respective countries. The Dow Jones index registered a decline of more than 7 percent. This fall marked the “12th-worst one-day fall” in the records of the New York Stock Exchange (Chossudovsky, 2008).

With the rapid technological development happened in the entire global financial system, major stock exchanges functioning in different countries around the world are interconnected. Trading was possible “around the clock” depending on the time zone of the respective stock exchanges as all the exchanges were interconnected through instant computer link-up to record the transactions on a real time basis. Due to the availability of the technological support, the volatile trading in the US stocks on Wall Street “spilled over” into the stock exchanges of Europe and Asia. Thus, the entire financial system was infused by the volatility of the transactions in the New York Stock Exchange. Stock exchanges all over Europe sustained substantial reversals. “The Hong Kong stock exchange had crashed by 10.41 percent on the previous Thursday (“Black Thursday” October 24th) as mutual fund managers and pension funds swiftly dumped large amounts of Hong Kong blue chip stocks” (Chossudovsky, 2008). The fall in the stock values in the Hong Kong Exchange Square continued limitlessly at the opening session of trade on Monday with a 6.7 percent fall followed by a 13.7 percent decline on the next day (Chossudovsky, 2008).

Developments, Challenges and Crises of Global Financial Market covering Post 2008 Financial Tsunami Period

There were several factors responsible for the onset of the financial crisis during 2007-2008. In general the macroeconomic policies implemented in the United States and the rest of the industrially advanced nations, were the main contributing factor for the crisis. Economic policies with respect to fiscal adjustments resulted in a reduction of saving volumes in the United States. Even the country allowed a not so stringent monetary policy to be in force for a longer period. “In Japan the mix of monetary and fiscal policies distorted the global economy and financial system” (Truman, 2009).

Easy monetary policies followed by many other countries including the Asian countries contributed their part to the global meltdown. “The impressive accumulation of foreign exchange reserves by many countries also distorted the international adjustment process, including but not limited to taking some of the pressure off of the macroeconomic policies of the United States and other countries” (Truman, 2009). With the result, there were increased activities in the housing sector not only in the United States but also in many other countries coupled with increased availability of market credit resulting in steep hike in the stock values and other symptoms of unorthodox financial practices, ultimately leading to the financial Tsunami. The role of inadequate financial sector supervision and regulation has also to be taken in to consideration for the financial Tsunami.

Irrespective of the causes there are some distinguishing features of the crises that need consideration to discuss the effects and challenges the financial tsunami has created to affect the global economy.

“First, the proximate origins of the crisis were in the United States” (Truman, 2009), largely and the actions of the financial institutions functioned in the country were the main reason for the emergence of the crisis. “Second, if the largest economy in the world, whose currency and institutions are at the core of the global financial system, stops functioning, the fact that the resulting crisis becomes global should not be surprising,” (Truman, 2009). Finally, it is but natural that an economic shock when started in the financial market would first affect the real economy. Adverse impact on the real economy in turn would influence the financial market further, ultimately affecting the real economy again.

“The reduction in growth has not been limited to the advanced economies” (Truman, 2009). The reduction suffered is similar for developed countries, transition and developing countries and the countries located in Western Hemisphere. The expected fall in growth for the years 2008-2010 on an average is 11 percent for the advanced economies and 12.8 percent for other economies. Another lesson learnt from the crisis, which is broader in scope is that the globalization of trade, financial globalization and globalization in exchange of labor has united the countries largely than it was in the earlier century. The repercussion of extension of this unity is that any economic shock that influences a larger nation or cluster of nations in the global financial system will lead to some effect, mostly undesirable on the remaining nations.

Financial Language – Origin, Definition and Development

Origin of Financial Language

The origin of any language in the discipline of linguistics is referred to as “glottogony”, which implies the process of the acquisition by human beings to use a language at some point in the Stone Age or prehistoric period. However, the use of different forms of language developed with the development of culture and societies among human beings. In the modern times, the users of languages have the fascinating capability in that they can refer to different issues, which are away from the sphere of the user. This ability is related to the theory of mind or awareness where in the user of the language considers the other as being like the user himself with individual aspirations and meanings. Hauser, Chomsky, & Fitch (2002) identify six key aspects of this high-level reference process of individuals. They are (i) relatedness to the theory of mind, (ii) ability to acquire conceptual representations which may as well be nonlinguistic, relating to any object (iii) referential vocal signals, (iv) exercise of voluntary control over signal production as evidence of the intentions to communicate and (vi) number representation.

These key aspects can be taken as the origin of modern financial language. It is also interesting to study the observations of Hockett (1966) on the characteristics of a language, which he describes as necessary for dealing with the development of different languages used by human beings. In the sphere of “lexical-phonological principle” there are two important characteristics observed by Hockett (1966), which may be considered as most important and associated with the origin of financial language. They are: (i) productivity – in which people using the languages can develop and comprehend totally new and fresh messages. In this case, the new communications are developed or new phrases are invented by mixing, taking from or converting the existing messages or phrases. In this case, either new or old elements contained in the message or phrase, are assigned new meaning or the differences between meanings without any restriction and such meanings or differences in the meanings are inferred from the circumstances or context where such messages or phrases are used. (ii) Duality – this refers to the patterning of the messages or phrases. In this case, a smaller number of elements or phrases, which do not possess any meaning on their own, but are capable of distinguishing between messages, make or replace a large number of meaningful phrases. These two features aptly describe the origin of financial language.

Definition of Financial Language

There is no consensus in the literature about a forma definition for financial language. Financial language may be defined in generic terms as the language developed to describe the individual items contained in any financial transaction comprising of terms that can be used to make a document evidencing a financial transaction between parties. The financial language is used to carry out any endorsement, addition or deletion in any document pertaining to a financial transaction. Financial language can be defined as the language approved by the global financial system, used on an international basis to describe and constitute any financial transaction.

Development of Financial Language

Past five decades have seen dramatic changes in the economic policies of the governments in the advanced industrial economies, giving rise to changes in the regulatory regimes over international finance. During the 1950s, most of the world nations have been applying severe restrictions on the international financial flows. Therefore, the cross-border capital flow was negligible. However, the subsequent developments in the global financial system as enumerated in the earlier sections of this paper have given rise to wider movement of capital on an international basis. Especially with the advent of economic globalization, the flow of capital in between nations has grown tremendously.

The development of global financial system after the World War II took a faster turn when governments of different nations prepared their responses to improve their economies with sophisticated systems of financial regulations. After the entering of the Bretton Woods Agreement in the year 1944, the global financial system was developing on a continuous basis in different directions assuming different dimensions. This development gave rise to a number of new practices and documents covering such practices. There was the necessity to develop a new financial language, which covers this rapid development in the financial system. The new language had to have an international perspective, as it was required to be understood by the people belonging to different nations interacting with each other on some financial transaction or other.

The sophistication in the technological development added fuel to the development of financial language. Although English language was the medium to communicate, the development of financial language gave rise to the use of new phrases having different connotations. The key consideration for the development of a common financial language was the necessity to be international capable of being understood by the people belonging to different nations interacting with each other.

Factors influencing the Use of Financial Language

There are various factors, which influence a proper understanding and use of financial language by the people. English as the basic medium used for the communication of financial language may pose a problem in using the financial language for many non-English speaking people. Nevertheless, there are other factors like familiarity with the financial system, cultural differences, general mistrust of financial institutions, differences in income and varying education levels of parties dealing with each other may pose potential challenge for the use of financial language. Lack of understanding of the operation of the financial system and the products and services covered under the system is most likely to present a challenge to the user of the financial language. Lack of exposure to mainstream financial institutions such as banks may make the individuals strangers to the use of financial language. Dissimilar norms, attitudes, and experiences relating to financial transactions based on the cultural differences may lead to flawed use of financial language. General mistrust towards financial institutions may create an aversion among individuals to get to know the use of financial language properly.

Some earlier researches have found an association between earnings and knowledge on finance matters. Low-income earners may not have the opportunity to develop their knowledge on understanding and use of financial language and therefore income and socioeconomic status of individuals act as a barrier to use the financial language properly. Similarly, people with low education may not have proficiency in the English language, which in turn may affect their ability to understand key phrases and terms in financial language and use them in their interaction with others during any financial transactions. While studying the use of financial language from different perspectives, it becomes imperative that the influence of these factors is taken into account. This becomes important so that the relative impact of financial language in the development and functioning of different financial institutions in the global financial system and their interaction with the people, who are users of the financial language, can be understood properly. Apart from the factors mentioned above, the degree of financial openness in the wake of recent financial reforms also play a major role in the use of the financial language by the people of the respective countries. People in those countries, which are restrictive in their approach towards financial openness, are likely to be less accustomed to the use of new financial language describing the new financial products and services.

Aims, Objectives and Research Questions

The central aim of the research is to explore the evolution of financial language and examine the changes in the financial language over the period until the financial tsunami occurred in 2008. In the process of achieving this central aim, this study attempts to accomplish the following objectives.

- To study the association between finance and language in general

- To study the linguistic features of financial language

- To explore the social aspects of financial language

- To study the association between financial globalization and language transition

- To study the role of financial language as a global language

- To assess the role of financial language in causing the Financial Tsunami 2008 and the need to develop new choice of financial language

The study using the qualitative case study of the bankruptcy of Lehman Brothers and based on the secondary information and data collected from various sources will attempt to find answers for the following research questions

- What are the reasons for the popularity and infamy of financial languages?

- How can the discipline of finance be associated with a language? How can the different linguistic features be identified in the financial language?

- What are the social aspects of financial language? How does financial language meet the requirements of these social aspects?

- What is the impact of financial globalization on the daily thinking and speaking habits of people?

- Can the financial language be identified as a global language?

- What is the role of financial language in causing the financial tsunami of 2008?

Theoretical Framework

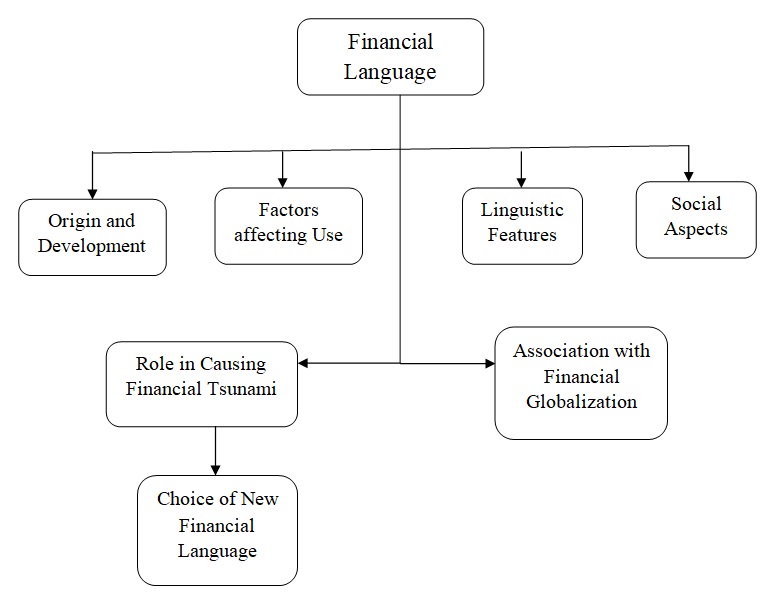

The theoretical framework for the current study takes shape from the review of the relevant literature on the topic of financial language. From the literature review, the origin and development of the financial language and the factors affecting the use of financial language will be ascertained. The following figure illustrated the theoretical framework that will be followed for the current research.

Structure of the Dissertation

In order to present this research report in a cohesive manner, this dissertation is structured to have different chapters. While the first chapter introduces the topic of study, it also lays down the aims and objectives of the study including the research questions. Chapter two presents a review of the relevant literature on various elements connected with financial language and its linguistic nature leading to the social aspects and the relationship of financial language and financial globalization. The purpose of this review is to enhance the knowledge of the reader on the subject under study by exploring it from different perspectives.

Chapter three contains a brief description of the research method being used for conducting the study and the chapter details the justification for using the particular method. The case study of Lehman Brothers forming part of this research is presented in chapter four. Chapter four also presents the findings of the research from the secondary sources and from the case study followed by a discussion on the findings. Chapter five deals with the association between financial language and financial language, and it deals with the transition of financial language in line with the objectives of financial globalization. Chapter six concludes the dissertation with a note on the research objectives, answers for the research questions and a summary on the conduct and findings of the research and with recommendations for further research. This chapter also details the limitations this research had to face.

Literature Review

Introduction

“An awareness of language matters to a discipline because claims to knowledge can be made only by using language. It follows that it may be impossible to separate the content of knowledge-claims from the language in which they are expressed,” (Henderson, Dudely-Evans, & Backhouse, 1993). Thus, if the nature of a language with respect to the ways, in which it is constructed, is to be investigated, it becomes essential to examine the nature and role of the language. It is also to be remembered that language cannot be understood, without reference to the social context, within which it is used. This review on the financial language will study the nature of financial language within the context in which the financial language is used.

The rapidity with which change takes place in the present day world contributes to increased complexity. The sources of change include changes in technology, changes in the competitors’ positions and changes in economic forces acting on the businesses. Changes in these areas create scope for changes in the needs and requirements of the customers (Frame, 2002, p 30). Changes also lead t increase in the volume of information that needs to be communicated among the business partners across the world. The objective of any language is to improve the communication among people. Especially with the global business environment becoming more close-knit and openly accessible by people of different culture and nations, effective business communication has become a vital necessity. Over the previous centuries, business has developed its own language and vocabulary, with the help of which people interacting with each other could communicate effectively of their business intentions.

The rapid development of information and communication technology has helped the growth of a new financial language exclusive to the conduct of business transaction on a global basis. Financial globalization has given rise to the development of a new financial language aimed at improving the communication among the trading community spread in different geographical locations. Establishing business relationship and strengthening such relationships has become easier with the use of financial language. Financial language assumes a unique position, as the language has become universal being used commonly by the investors, bankers and traders throughout the world. For example, the language relating to investments can be divided based on the type of investor, the investment advisor, the type of investment and the cash flow (Cypres, 1999, p 105).

The language has been enriched by a number of newer and technical terms, which has enhanced the utilization of the language. While the development of the financial language is considered as an improvement to global commercial and trading systems, the increased use of jargons and technical terms has made it difficult for many to understand the meaning conveyed by the language in its proper perspective. The situation has become complicated with a number of different geographical regions developing their own versions of business language. This calls for a closer look at the development of the financial language in the context of social development. The central focus of this chapter is to present a review of the relevant literature that has dealt with the development and contribution of financial language to the development and growth of business relationship on a global level.

Financial Language – a General Background

In the absence of a clear-cut definition offered by theory or past literature, for the purpose of the current work, financial language is assumed as the language used for financial reporting on an international basis. The review of the literature and the discussion will revolve around the central theme of financial reporting as the major component of financial language. The development, utilization and impact of financial reporting on the global business society will therefore substitute the development and impact of financial language in the context of social development. The discussion on the development and contribution of financial reporting will constitute a major portion of the discussion on the development of the financial language. There are other constituents of financial language, apart from the financial reporting. The review under this chapter will cover economic language and business language as the other constituents of the financial language. These constituents have also found their importance in increasing the financial literacy of the people dealing with financial language.

Financial Reporting as Part of Financial Language

Financial reporting can be considered as a subset of financial language in which, different sets or combinations of words are evolved, with the help of which the financial reports are compiled and presented for the information of different users of such reports. Financial reporting is a vitally important tool for conducting the business effectively and therefore financial reporting assumes a greater importance in the domestic and international capital market transactions (Eli, 2004).

This has made accuracy and transparency in the financial reporting has become the first priority to all the business organizations throughout the world. The necessity for integrity and transparency has created the need for a common financial reporting or financial language, which could be understood by all the users of the financial reports. In other words, people who have the necessity to have access to and use financial reports for decision making in various situations must be financial literate possessing the ability to read and interpret the financial statements in their proper perspectives. McDaniel (2002) is of the opinion that financial “literates are more likely than experts to identify concerns related to the financial reporting treatment of publicly prominent, nonrecurring financial statement items, while experts are more likely than literates to raise issues about the financial reporting treatment of low prominence, recurring items.” This statement goes to prove the impact of financial language on making people acquire the required knowledge for reading the financial reports and evaluate the performance of different companies, which is one of the central objectives of the development of the financial language.

According to Benston (2006, p 3), “the growing globalization of capital markets is the main argument for a single body of standards or a single “financial language”. As investors increasingly look beyond their borders for places to put their money, they naturally want to be able to compare the performance of companies across countries.” This has made the financial reporting as an important constituent of financial language. However, it was assumed that business entities follow the practice of making a proper and comprehensive financial reporting, until such time there had been some major disturbances in the routine financial dealings. For instance, the break down in the financial reporting led to the Asian financial crisis in late 1990s; during early 2000s there had major financial mishaps causing billions of dollars losses to investors due to unscrupulous and fraudulent financial reporting by large corporations like WorldCom, Enron and Parmalat in the United States as well as Europe. These incidents, which shook the confidence of investors on the capital market and its instruments, necessitated a complete relook in to the financial reporting to ensure transparency and integrity. This development can be equated to a complete revamping of the financial language and strengthening it to meet the new demands and expectations of the investors all over the world. Such revamping took the form of securing the international support for the establishment of a single set of internationally accepted financial reporting standards, set by the International Accounting Standards Board (IASB).

A company limited by shares has an obligation to provide financial information to certain set of users. They are the current and prospective shareholders of the company, the tax authorities and the bankers or other lenders. Haskins (2007, p 4) identifies four objectives of the financial statement represented by the annual report of a company. According to Haskins (2007), financial reports (annual report) must (i) comprise of information that has a complete compliance with all the regulations applicable to financial reporting, (ii) represent the real financial status of the organization as at the date of the reporting as well as the financial performance of the concern for the year under review, (iii) provide information that will be useful for the decision-making by the users of such financial reports and (iv) be honest in reporting the real income of the entity. The content of the annual report must be able to exhibit the actual financial soundness of the company, supported by relevant and reliable information. Haskins (2007) treats the financial reports as a special language and this language should possess the above qualities to make the financial reports presentable to the users. It is also important that people dealing with the financial statements should possess the capability to understand the financial language underlying in the financial reports so that they would be able to draw the required information from the financial statements for their decision-making purposes.

Terminology in Financial Reporting

Language used in financial reporting comprises of a number of terms, which the people dealing with the preparations of financial reports should know and be aware of the meaning of such terms. This applies to those people who are involved in supplying the information necessary for the preparation of the financial reports. These people should be able to express their views and ideas in the financial language understandable to everyone associated with the preparation of the financial reports and statements. Normally, those who are involved in the preparation and presentation of the financial statements use specific terms, which convey specific meanings in the context in which such terms are used (Roulstone and Philips, 2007).

The authors deal with the specific term of Return on Investment (ROI), which is one of the most used and important term in the financial language. There are many such terms like, internal rate of return (IRR), present value (PV), gross margin, net margin, depreciation, cost of goods sold, and profit before interest and taxes (PBIT), profit after tax (PAT), current ratio, liquidity ratios, debt equity and many other such terms, which find frequent application in the financial language used in financial reporting. These terms represent only a fraction of the terms comprised in the financial language. There are thousands of such terms, the meaning and relevance of which people working in finance discipline should be aware so that they can communicate with people in positions of authority (Routh, 2007, p 105).

Mostly people working in the finance and accounting department of any organization develop and use the terminology of the financial language. Therefore, the finance personnel are able to feel the importance of financial language, as they deal with various financial aspects of the organization like financial management, budgeting, financial report preparation, risk management, internal auditing, bank dealings, investor-related issues, and issue of share capital, awarding contracts and fixing the terms of such contracts and mergers and acquisitions. In each of these areas, they need to formulate and use a number of financial terms, which form the core of the financial language domain. Sicillano (2003, p ix) is of the opinion that the accountants and business managers often speak different languages, with the result that both do not understand the viewpoint of each other.

This stresses the need for a thorough understanding of the financial language by the non-financial managers so that a better understanding can be created between them, which will ensure the meeting of the common objective of the success of the organization for which both of them work. The finance department of a company has two distinct functions to discharge. They are (i) managing the financial resources of the company – which is essentially the finance function, and (ii) recording and reporting of all its financial transactions – which are the core function of accounting. Financial language and terms are widely used in the discharge of both of these functions. Finance department is responsible for the collection and presentation of data pertaining to the transactions of the company for the use by other organizational members as well as external stakeholders who are interested in knowing the financial status of the company. The collection and presentation involves the use of innumerable financial terms and jargon. Therefore, this thesis suggests that the finance department in the business organizations is the point of origin for the financial language.

Use of Financial Language by Financial Institutions

According to Epstein, Nach and Bragg (2009, p 31) “reporting or display considerations is concerned with what information should be provided, who should provide it, and where it should be displayed”. In fact, these reporting requirements formed the basis for the creation of the financial language and its subsequent ramifications. The reporting requirements to make the financial reports easily comprehensible to the people across different geographical locations has given rise to the emergence of a number of financial terms associated with international trading and commerce and investment activities. In respect of international commerce and investment activities, the role of banks and financial service sector institutions cannot be undermined.

The development of financial language to its present form can also be traced to banks and other investment institutions apart from the finance departments of business organizations. Among different types of businesses, banking and financial services, sector organizations need the knowledge of financial language most. McKinnon (1973) has advocated the importance of a well-developed financial system for the rapid economic growth and poverty alleviation in any country. Several other researchers in the area have endorsed this view (Levine, 1997, 2005 Tsuru, 2000; Ahmed and Bebe, 2007). There have been a number of empirical studies, which focused on the association between financial sector development and economic growth (Goldsmith, 1969; King and Levine, 1993; Levine et al 1999; Khan and Senhadji, 2000).

This called for a broad access of the banking and financial services by households and entrepreneurs. The access could be improved by the spread of banking and financial services institutions across the country, which in turn created the need for the development of a common financial language, which could be understood by all the people desirous of dealing with the banks. Banks and financial services organizations throughout the world, over the period have developed specialized financial terminology forming part of the financial language. These institutions had to depend heavily on the common understanding of the financial language for their own development. It was vital that the financial language was one that was easily comprehensible for all those who deal with the banks. Although, through the development of the financial language, banks and investment organizations could expand their presence in different geographical locations during the past century, still there are some people within the banking system, who lack a complete knowledge of all the financial terms used by the industry.

The financial system in an economy consists of financial institutions, financial and capital markets, and other infrastructural arrangements like established systems for clearing and settlement. All these components of the financial system are responsible for providing financial services required by the enterprises and consumers to conduct their businesses effectively. For an efficient functioning of the financial system, there is the need to have an efficient banking sector in place. If the banking system does not function well, there is the likelihood of financial instability in the economy. “Because banks hold financial assets of consumers and producers, and are important to economic growth, bank failures can have substantial economic costs. As well, banks are connected through a variety of networks (such as the interbank markets and payments systems), and so a shock to one bank can lead to shocks to other banks (contagion). This can greatly increase the cost of a crisis” (Dungey, 2009).

This interrelation has been the root cause for the development of a well-knit financial language, which is used in common by the banks and financial institutions to transact business among themselves as well as with their clients. When there is a common financial language used by all the banks, it promotes an optimal competitive structure for the banks, which leads to efficiency and stability. Use of common financial language necessitates the banks and other financial services institutions to maintain their service quality to retain the customers. This is obvious in the case of financial planners who advise institutional and individual investors in their investment decisions. Hirt, Block and Basu (2006, p 135) observe that it is important for the financial planners to be able to understand the needs of both types of investors. Most of the times individual investors who might not have sufficient knowledge of the financial terminology will be the clients of the planners and this increases the need for the financial planners to have a thorough knowledge of the financial language to offer appropriate investment planning to such clients.

Improper Financial Reporting and its Effects

Misuse of financial language in the form of fraudulent financial reporting in the past had given rise to several accounting scandals, auditing scams and fake financial reporting, which shook the confidence of the investing public in the entire financial system. The excesses in the misuse of financial language in the form of creative accounting practices led to the public mistrust to business. This called for the passing of the Sarbanes – Oxley Act by the US Congress in July 2002. The passing of this Act gave a new dimension to the use of financial language by the finance and accounting professionals operating in various industries. The Act provided for rigorous corporate governance rules and formulated specific expectations on the financial reporting to make them reliable and transparent.

Sarbanes – Oxley Act requires the “Chief Executive Officer” (CEO) and “Chief Financial Officer” (CFO) to certify the dependability and reliability of the financial statements of their firms. The Act also cast a duty on the external auditor to report on the reliability of the internal control system in practice in the companies. “The act made it mandatory that the CEO and CFO sign the entity’s annual financial statements and assume full personal accountability for their figures and contents,” (Chorafas, 2009). The rigorous requirements of Sarbanes – Oxley Act has necessitated firms like Citigroup, Merrill Lynch. Bear Steams and several other financial institutions who suffered huge losses in the year 2007, because of their exposure to subprime mortgage lending, to report such losses in their financial statements, which exposed the magnitude of the financial problem created by the subprime mortgage lending.

“Indeed, no better example of the Sarbanes-Oxley impact can be found than the financial reporting on the aftereffects of the 2007 crisis in the subprime mortgage market, which created a torrent of red ink and brought many of the world’s bigger banks against the wall. This was a crisis created single-handedly by the banking industry, rather than being due to an external event like sovereign bankruptcies in emerging markets,” (Chorafas, 2009).

Thus, the entire economic chaos created by the subprime mortgage lending by then financial institutions can be attributed to the misuse of financial language by such institutions. “Through their policies with subprime, “no doc,” and “Alt-As” lenders, they also practically brought to bankruptcy millions of U.S. homeowners while also spoiling the capital of their own institutions to the tune of billions of dollars,” (Chorafas, 2009).

Financial Literacy and Factors affecting Financial Literacy

Financial literacy is closely associated with financial language, as financial literacy implies the ability to understand and comprehend the financial terms with their real meaning. This section analyses the phenomenon of financial literacy and factors influencing the financial literacy. Before analyzing the factors influencing the aspects of financial literacy and factors that might contribute to develop the financial literacy, it is necessary to have a comprehensive definition of the term financial literacy. There has been a large volume of previous works, which explored the area of financial literacy (Chen & Volpe 1998; Beal & Delpachitra 2003; Worthington 2006; Danes Huddleston-Casas & Boyce 1999; Chatzky 2002). These studies embarked upon a definition of financial literacy on their own to form the basis for the preparation of a survey instrument for studying the level of financial literacy in the financial environment of the country in which the study was conducted. The definition of financial literacy provided by Vitt (2000) seems to outline the essence of financial literacy appropriately. The definition reads as

“Personal financial literacy is the ability to read, analyze, manage, and communicate about the personal financial conditions that affect material well-being. It includes the ability to discern financial choices, discuss money and financial issues without (or despite) discomfort, plan for the future, and respond competently to life events that affect everyday financial decisions, including events in the general economy,” Vitt (2000: p xii).

Several previous studies have focused on the evaluation of financial literacy of people who deal with financial issues regularly. For example, the findings of the Princeton Survey Research Associates International (1996) survey, revealed that 18% of the 1 001 investors surveyed did not possess the required level of financial literacy. In the United States, a study conducted among 900 college students to observe the level of their financial literacy and to study the relationship between student characteristics and financial literacy found a number of factors influencing the financial literacy of the students (Chen & Volpe 1998). The study reported that factors like the nature of course studied (whether business or non-business), gender of the students, ranks obtained in the class, age of the students and work experience influenced the financial literacy of the students. These factors can as well be deemed to influence the use of financial language.

In another study conducted in the USA by Chen and Volpe (2002) as a follow up survey among the students, the authors found that factors like ethnic background, gender of the respondents, nationality of the students, age, income and years of experience had significant influence on the financial literacy of the respondents. Study by Beal and Delpachitra (2003), among Australian students revealed that factors like gender, work experience and income level enabled the students to acquire a higher level of financial literacy. According to Murphy (2005) race, gender, age and parents educational qualification influenced the financial literacy of the university undergraduate students in the USA. A more recent survey – ANZ Survey of Adult Financial Literacy in Australia, based on the responses of about 3,500 adults, reported the influence of all the variables found in other studies on the financial literacy. In addition, factors like, saving and debt also were found to have some influence on the financial literacy of the people surveyed (ANZ & A C Nielson, 2005). Worthington (2006) found the same factors of age, occupation, education, gender, ethnicity and income level to influence the financial literacy among people. Based on the findings this thesis submits that the use of financial language will also be influenced by these factors, as financial literacy essentially involves knowledge and use of financial language.

The financial literacy or understanding of the financial language is also influenced by some human factors. Although these factors do not have any direct link with the financial language, these factors hamper the development of a thorough understanding of the language. For example, the people involved in the financial services industry coin their own terms and jargon for their understanding and use among themselves. It may not always be possible for other common people to understand the jargon, unless the people in the industry explain the meaning of such terms. According to Hisey (2010), jargon developed by the finance people is one of the main factors that influence the use of the language by others. Generally, the jargon used by the financial planners and service provides make the clients feel less confident, so that they will allow the intermediaries to handle their finances. Deliberate use of specialized and complex language and terms is one of the other tactics used by the financial planners to show their superiority in knowledge than the clients. However, in reality such behavior does not find favor with the investors, as they feel uncomfortable in conversing freely with the planners. In some cases, the clients end up seeking financial advice from other planners, with whom they feel comfortable. West and Anthony (2000) are of the opinion that the financial planners purposely use such complex financial language to elevate themselves in the eyes of the clients.

The desire of some of the people to stay within the industry also sometimes result in complicating the financial language they speak. In cases, where the investor suffers a loss, due to the bad advice of the planner, the planner in order to retain his position with the company is made to use different economic terms to make the investor believe that the loss in the investment was really due to the operation of economic factors beyond the control of the planner. Because of his/her ignorance, the investor will refrain from making a complaint about the planner’s bad decision to the company. This attitude of the planners serving in the financial services industry leads to complicating the financial language beyond the comprehension of the investors and other people.

Role of Accounting Standards in Financial Language Transition

Accounting provides a service, which is critical to any society, without which the performance of different enterprises operating in the society cannot be assessed precisely. The recent accounting frauds called in to question the very integrity of the accounting system. This thesis considers the accounting standards as one of the main constituents of the financial language. This section provides a detailed review of the accounting standards and the necessity to evolve a harmonization in the accounting standards so that a common financial language can be developed making it easier to understand the intricacies of the financial statements by people of all regions.

The economic globalization had a deep impact on the manner in which organizations conduct their businesses. Globalization has encouraged companies to expand their enterprises across different geographical borders and such expansion has created the necessity towards a cultural and business homogenization. International accounting being a service dependent on the environment in which the businesses operate has also become a subject of change. There has been a persistent demand for promoting harmonized accounting standards to ensure that the information contained in the financial reports are understood by people from different parts of the world.

Financial and accounting reports presented using various accounting standards reflect accounting diversity amongst different communities. This implies that people in different societies do not follow and understand a common financial language. According to Schroeder & Clark (1995), in the absence of understandable financial statements, investors and creditors may not be willing to invest or lend their funds. Pacter (1998) argues that it is essential that uniform accounting practices are followed in preparing the financial reports, which can be comprehended by people in the same way throughout the world. According to Anderson (1993), “An international set of accounting standards would allow a more level playing field because income statements and balance sheet ratios would become more consistent between competing companies.”

“Effective financial regulation and supervision and the legal infrastructure supporting financial transactions depend on the timely provision of understandable and reliable financial information,” (Arner, 2007, p 169). Reliable accounting and auditing standards have been at the base of the development of both financial intermediaries and a number of financial transactions concluded through them. At one point of time, there have been significant differences in the accounting practices among different nations, especially among developing and transition economies. These differences led to the position of obscuring the relative financial position of different sectors and entities operating in the same industries.

This situation can be equated to the speaking of different financial languages by different regions in the world, and as a result, people in one region could not understand the financial language of people in the other region or country. This has caused considerable difficulties in the development of a global financial sector pursuant to globalization initiatives. This is because the systems existed in different countries did not follow a meaningful similarity. Therefore, the development of adequate systems of valuation and accounting to facilitate globalization has become one of the principal requirements. It was necessary to develop appropriate systems for financial information, especially those in relation to accounting and auditing, so that financial transactions could move beyond the basis structures of collateralized or relationship-based lending by the banks and financial institutions. In addition, there was the need for credit information systems for lending and credit rating agencies.

In this context, accounting standards provided the essential means of communication for valuation of companies sought after by any investor. “An important lesson to emerge from the financial crises of the past fifteen years is the significance of transparency of information, especially financial information, for the stability and proper functioning of any financial system, whether domestic or international,” (Arner, 2007, p 171). Accounting standards can be regarded as the fundamental means of communicating reliable financial information. Therefore, accounting standards are considered crucial to ensure transparency of financial transactions. They promote common understanding of the financial language on a universal basis.

Historically accounting standards have been established by the respective nations on a national level. This led to the use of different languages for the preparation, distribution and reading of the financial statements by the preparers and users of financial statements in different regions/countries. This has also resulted in the inability to compare the financial statements, which are prepared using different standards and the users were unable to understand and translate the meaning of different information contained in the statements. The users were also unable to determine whether all the material information has been disclosed in the statements or not. From the point of view of accountants preparing the financial statements, disharmony of the accounting standards greatly disrupted the progress of securities offering at international level, listing in international stock exchanges and pursuing cross-border mergers and acquisitions. The disharmony of accounting standards was a hindrance for both the users as well as those preparing the financial statements. Such disharmony acts as an impediment to the process of internationalization of financial markets more specifically the capital markets.