Introduction

Taxation is important to the prosperity of a country as governments need to impose charges on businesses and citizens to raise revenue and meet the demands of the budget. Since different countries have varied approaches to taxation, understanding that there is no unified solution to every taxation issue is imperative. For the current research, the United Kingdom system will be explored. The main taxes in the United Kingdom include property, income, capital gains, UK inheritance taxes as well as Value Added Tax (VAT).

Tax System

Depending on the assumed ability of an individual to pay, the UK tax system developed a framework within which higher-income individuals are expected to pay higher rates. The UK tax system applies throughout England, Scotland, Northern Ireland, Wales, and islands located around the British coast. These also include an oil drilling platform in the territorial waters of Great Britain. However, the system excludes the Channel Islands, the Republic of Ireland, and the Isle of Man.

Property Tax

Property taxes are a type of taxation that is based on the amount of the transaction that is usually associated with real estate. In the United Kingdom, residential property taxes are paid either by buying or selling real estate. Purchases of property in the United Kingdom are subjected to Stamp Duty Land Tax (SDLT) in the case it is located in England and Northern Ireland. If located in Scotland, purchases of property are subjected to Land & Buildings Transaction Tax (LBTT). From April 1, 2018, transactions on the property that takes place in Wales have started to apply to Land Transaction Tax (LTT). It is notable that over time, property taxes as a type of taxation increased due to the possibility of avoiding corporation taxes among large companies that can run their operations in other countries. Property taxes help increase the revenue of local governments and finance such services as education, road repairs, education, and others.

In regards to SDLT, the tax on residential purchases begins with 2% for properties costing more than £125,000 and can increase to 12% depending on the price of the property, “plus a potential 3% ‘surcharge’ on all rates where an additional property is purchased (unless it is purchased to replace the main residence, or costs less than £40,000)” (Taxation of UK residential property 2018, para. 4). For the main property, an individual will be charged at 2% for property costing between £125,000 and £250,000 and 5% for property costing between £250,001 and £925,000 (Taxation of UK residential property 2018). If the cost of the property is between £925,001 and £1,5 million, 10% of property tax is required to be paid. For property costing above £1,5 million, the expected tax percentage is 12%.

LBTT and LTT are generally similar to SDLT; however, the regimes that they apply are not identical. LBTT has been established in April 2015 and implies the lowest 2% tax on purchased property estimated to cost more than £145,000 for the first home or more than £40,000 for a second home. In contrast to SDLT, the percentage expected to be paid in LBTT is divided into sections. For instance, when an individual buys a house that costs £300,000, 0% is imposed on the first £145,000. On the next £105,000, 2% is expected to be paid, with 5% expected to be paid on the remaining $50,000. The percentage of tax bands goes up to 12% on property costing over £750,000.

LTT is applied to homes in Wales that cost more than £180,000, with the band-related system also being applied. For property under £180,000, 0% of taxes are paid. On the next £70,000, 3.5% is expected and on the next £150,000, 5% is paid. For the next £350,000, the percentage is 7.5% and for the next £750,000 – 10%. For property over £1,500,000, 12% of tax is paid.

Income Tax

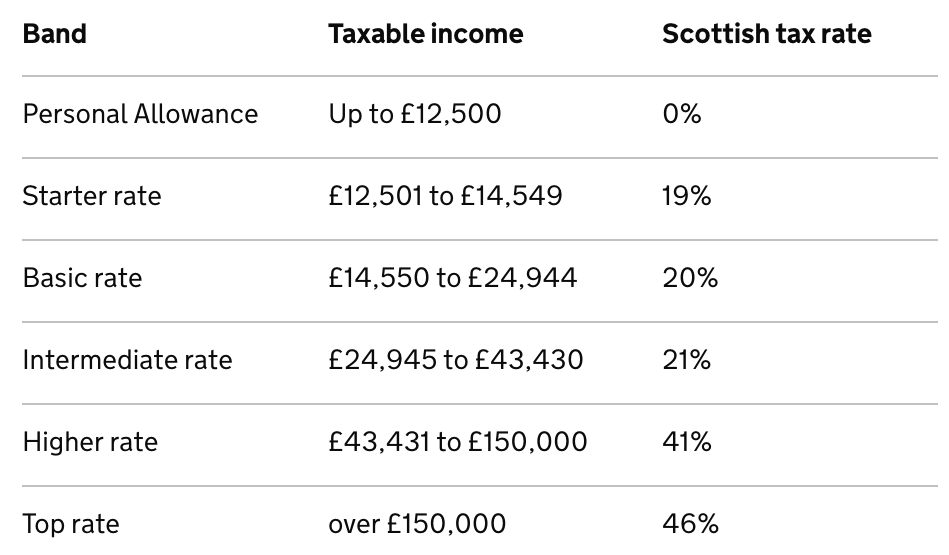

The amount of tax paid to the government depends on individuals’ income and allowances as well as the extent to which an income falls within each tax band. The tax-free personal allowance in the United Kingdom is £12,500. The basic rate, which is between £12,501 and £50,000 implies the paying of a 20% tax rate (Income tax rates and personal allowances 2019). The higher rate, which is between £50,001 and £150,000 is linked to the 40% tax rate while the additional rate, which is over £150,000 is linked to the tax of 45% (Income tax rates and personal allowances 2019). In Scotland, taxable incomes are divided into a larger number of bands starting with £12,500 that is not taxed. The table below shows the breakdown of Scottish tax rates and taxable income (see Figure 1). Tax-free allowances also include savings interest and dividends if an individual owns shares in a company.

Capital Gains Tax

Capital Gains Tax is a type of taxation that takes place when an individual sells an asset that has increased in value over time. Notably, it is not the amount of money one receives that is taxed; rather, the government taxes the gain from the final transaction. Therefore, a capital gain is calculated as the total price of an asset minus its original cost. Disposing of an asset includes its selling, giving it to someone as a gift or transferring to someone else, swapping it for something else, as well as getting compensation for it in the case when an insurance payout has been made.

When discussing the importance of capital gains, it is notable that around 70% of capital gains go toward citizens in the top 1% of income. However, capital gains tax preference may have an important influence on changing tax liability at the end of each year because lower rates are also associated with capital gains. The positive impact of capital gains tax is linked to potentially lower rates as a property that an individual once owned for several years requires lower taxes than new property. Another advantage of capital gains tax is linked to the fact that it only applies to situations when either a gain or loss has been realized, which means the cases when capital assets either increase or decrease in value do not require paying tax. This is advantageous to taxpayers because they should not be worried about paying taxes unless the property is sold.

Those who support lower tax rates for capital gains usually argue that it is important for stimulating economic growth, managing the double taxation of corporate income, and alleviating the negative effects that discourage investors from selling their assets to avoid taxes. On the other hand, as mentioned by McClelland (2017), capital gains tax “has no significant influence on the economic growth of a country and can influence the development” of other issues that adversely influence economic efficiency (para. 6). Thus, regardless of whether policies on capital gains increase the efficiency of the economy, it is known that they enable the tax system to be more regressive. Because capital gains are predominantly concentrated among taxpayers of a high income, and breaks in policy benefit mostly the wealthy. Thus, to some degree, capital gains tax ensures that those who accumulate wealth give back to governments to acquire a benefit from their gain. In the UK, it is a requirement to pay taxes on capital gains even if an individual is a non-resident for tax purposes, thus making sure that any gains from selling an asset are taxed and contribute to the economy (Capital gains tax 2019).

Inheritance Tax

In the UK tax system, inheritance tax is paid when an individual inherits the estate, such as possessions, property, and money, of an individual who has died. This type of taxation has received particular hostility from many taxpayers, with the opposition to the system being higher among the poor population (Parkins 2017). The positive argument in support of inheritance tax is associated with the idea that they provide increased equality and fairness. As heirs of property have rarely done anything for large sums of money to appear, it is fair to impose a certain percentage on their gain. American liberals of their time, such as Theodore Roosevelt, argued that letting large sums of money pass from one generation to another would be of a significant detriment to the community overall. As mentioned by Parkins (2017) for The Economist, annual flows of inheritance in such countries as France have increased three-fold as a GDP proportion since the 1950s. This means that large numbers of wealthy individuals are inheriting their wealth, with their numbers on the rise. Regardless of whether inheritance tax contributes to the economy, ensuring that owners of large inheritance pay the necessary amount into the budget is essential.

In the UK, the inheritance tax is not imposed in the case if the value of the estate is lower than £325,000. Also, a payment is not expected if a person leaves everything above the £325,000 threshold to their civil partner, husband or wife, a charity, or an amateur sports club (Inheritance tax 2019). The standard inheritance tax is 40% and is charged on the part of the estate that is above the £325,000 threshold.

Value-Added Tax

Value-added tax (VAD) is the third-largest source of government revenue in the United Kingdom after income tax and National Insurance. The VAT is imposed on the majority of services and goods that registered businesses provide to their customers. The standard VAT rate is 20%, which was increased from 17.5% in 2011 and currently applies to most goods and services. The reduced rate, which is imposed on some services and goods, such as home energy or children’s car seats, is 5% (VAT rates 2019). Zero-rated goods and services include the majority of food and children’s clothes. The VAT has received significant opposition despite its importance due to its influence on income-based inequality within the population. When it comes to generating value for a country, VAT is necessary to fund different services.

Conclusion

To conclude, without taxes, it will be impossible for governments to meet the demands of the population and therefore provide the necessary services. Taxes are necessary for funding both public and governmental projects as well as making sure that the business environment is favorable to the financial growth of a country. The several types of taxation in the UK target different aspects of earnings and differentiate between income that should be taxed.

Reference List

Capital gains tax 2019.

Income tax in Scotland 2019.

Income tax rates and personal allowances 2019.

Inheritance tax 2019.

McClelland, R 2017, Capital gains.

Parkins, D 2017, ‘A hated tax but a fair one’, The Economist.

Taxation of UK residential property 2018.

VAT rates 2019.