Introduction

Theories in Economics have been developed for the purpose of understanding and interpreting economic phenomena at play and which can be exploited or manipulated to enhance the economic outcome. They are also used to explain the behaviour of economic units which include households, businesses and governments. Demand theories explain consumer behaviours while supply theories explain the behaviour of firms. In this context, game theories can effectively be used in understanding the competitive strategies applied by firms operating in oligopolistic markets.

Game theory is a study of the way in which rational players make strategic moves or choices in accordance to their preferences which leads to certain outcomes which may be beneficial or not. The theory poses a challenge to the conventional ways of examining economics. It evaluates situations where an economic agent makes decisions as strategic reactions to the actions or moves made by other agents. The strategic moves taken by agents can be “pure” or “mixed”. Pure moves involve taking particular actions while mixed moves imply making random moves.

The theory is categorised into two: cooperative games and non cooperative games. Cooperative games are applicable in situations where rival entities enter into some agreements to make certain moves in order to optimise the outcomes. The agreements may be binding by law or may be pure promise in which case the parties in agreement are not bound to make the agreed moves. Non cooperative games are the more competitive and strategic games. The agents make decisions independently leading to unforeseen outcomes as a result of the moves made by other agents. Other forms of games are the zero-sum and the non zero sum games.

The three elements of a game are the players, strategies and consequences. Players are the economic agents involved in the game. A game must have at least two players. A strategy is the comprehensive plan of action a player should take. The strategies available must be comprehensively described and understood by the players. Each player should understand all the options available for them and their competitors. Consequences also called payoffs are the possible outcomes for each choice available for all players. Players seek to optimise the outcomes of their actions by either minimising losses or maximising gains. The theory has been applied in many other disciplines such as making political alliances and forming business cartels (Tutor2u 2009 Para 6).

The interactions of the players can be analysed using game theory which enables the analyst to interpret certain actions taken by economic agents operating in certain environment.

Oligopoly

An oligopoly is a market structure in which there exist few firms supplying a certain product in an economy. The market is highly concentrated meaning that a few big firms take up the largest percentage of the market. The firms produce branded products. The number of firms that qualify an oligopolistic market is between 2 to 10 firms. The structure is thus in between a completely competitive market and a monopoly. Some barriers to entry exist mainly in the form of high capital requirements and technological requirements (George 1964 p44).

The few firms have significant influence on the market and can collude to charge high prices effectively making super normal profits just like monopolies. They may also adopt full competition meaning that the market is transformed into a perfect competition where prices are most competitive and no abnormal profits are made. They may also adopt a model in between the extremes of the scale (Arnold 1996 p52).

An important element of the oligopolistic market is the presence of market leaders. Market leaders are the firms which take the first step in deviating from the existing status. They take the first step in pricing and the rest follow. The firms operating in the oligopolistic market are highly interdependent. They always aim to take into account likely reactions from rivals on any changes in price or output (Ashesh n. d p6).

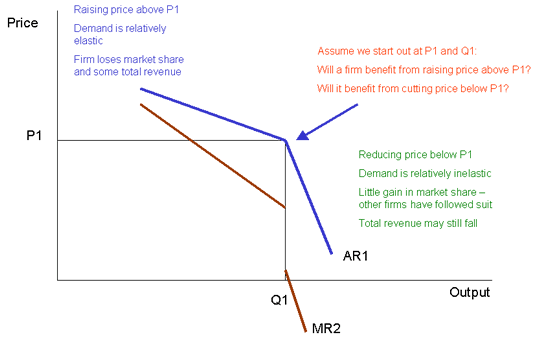

The market introduces a new dimension in analysing the demand curve of the firm. If one firm raises the price, the rest may decide to maintain their prices hence the stickiness in price.

Kinked Demand Curve

As the graph illustrates, any attempt to increase the price results in a loss of market share by the firm as customers buy from the other firms. Lowering the price triggers other firms to follow suite hence no gains in market share. The demand is thus more elastic.

Strategic behaviour

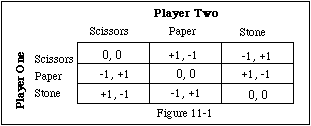

As mentioned above, a strategy is a comprehensive plan of action undertaken by the economic agent. Strategic behaviour entails the use of strategies with the aim of maximising outcomes. The following is an illustration of strategic behaviour in Game Theory in a game called “Scissors, Paper, Stone”.

In the game two participants are expected to simultaneously choose a stone, a paper or a pair of scissors. The outcomes of payoffs are such that paper covers the stone, scissors cut paper and the stone breaks scissors. This can be show by a 3*3 pay off matrix below.

The columns represent the strategies for player 2 while the rows represent the strategies available for player 1. The payoffs in the cells represent the gains and losses of the two players varying with the strategies they apply and those applied by the opponent. In the top left cell, the payoff is zero for both players as they both choose scissors. However in the top middle cell, player I chooses scissors while player 2 chooses paper. Scissors cuts paper hence player 1 wins and player 2 loses as shown by the payoffs. Player I gains (+1) while player 2 losses (-1). This is a perfect example of a zero sum game what is gained by one player is lost by another.

It can be difficult to spell out the best strategy to apply as the outcome of the game is also determined by the strategies of the opponents. This implies that there is not one consistently better strategy at least not when the opponent is intelligent because all the strategies are equally available to the players. Casting a die to identify the strategy to be applied presents a case where the player on average draws 1/3rd of the games, wins 1/3rd of the games and losses 1/3rd of them.

The illustration is a simple case of the application of game theory. The payoffs experienced in markets are in monetary terms representing gains and losses in profits or revenues.

Interpreting oligopoly behaviour

As described above, oligopoly refers to a market with a small number of firms selling a product in an economy. The main reason is that the required size of a firm to be profitable is so large that the entire market size gives enough room for very few firms. True, there exists competition but not perfect. A firm can influence the market price significantly. Just like in perfect competition, customers do not need to engage in strategic behaviour as that is left for competitors (Eugene 1990 Para 4).

At least three outcomes are possible in oligopolies. First, the business entities may join hands and form cartels where they coordinate and exhibit monopolistic tendencies. They may also remain independent and seek to maximise own profits while acknowledging the effect of own moves on other firms. Finally, they may ignore their ability to affect prices on the premise that in the long run, prices above the average cost would attract investors hence lead to more competition (Xavier 2001, p4).

In the first case where all cooperate, the costs of all the firms are summed as is they were for one entity. They also produce just enough quantity to maximize the larger entity’s gains. The gains are then share among the firms based on some previously agreed guidelines.

Some issues however emerge in managing the unity. The sharing of the gains among rivals has to be decided upon. This presents a challenge especially in cases where firms have different production capacities and costs of production. Secondly, the firms have to charge high price to gain the targeted profits presenting a threat of entry of other firms in the market. Of critical importance however is the fact that the agreed division of gains has to be implemented and constantly scrutinised for compliance by the firms. These present areas of collision of the firms (Howard & Pun n. d Para 4).

The resultant cartel may seek to stop new firms from entering the market due to the fact that entry of new players will lead to a collapse of the agreement. This is by colluding to lower prices to levels which cannot permit the new entrant to recoup their investments. The danger here is that if the deterrence strategy fails then there exists no pay off in executing the plan (Jean 2007 Para 4).

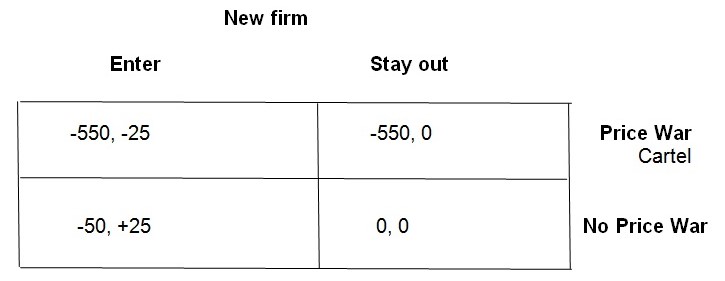

A payoff matrix can be used to illustrate the circumstances faced by a cartel of five firms making an abnormal profit of 550. All payoffs are calculated in relation to the prevailing circumstances before the entrance of new firm.

Payoff Matrix for preventing entry

If the new firm is permitted to enter into the market and allowed to gain proportionately (that is, no price wars are started), it gains a 50 and the already existing cartel losses 50. Assuming its entry cost is 25, the net gain is +25. This is represented by the lower left cell.

If the entry causes a price war by the cartel, the new firm cannot recoup its entry cost hence a loss while the cartel loses the super normal profit due to reduced price. This is shown by the upper left cell of the matrix.

In a case where no new firm enters the market and the firms in the cartel engage in price wars, the super normal profits are wiped off making a loss of the entire 550 for the cartel. This is the case on the upper right cell.

Clearly the new firm goes into the market knowing that the cartel will choose between losing 50 by sharing and losing the 550 in stopping the new entrant.

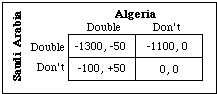

Making the decision on how to share the gains is another problem for the cartel. Failure to agree would lead to a collapse of the cartel which would result in increased production by the firms thus lower prices which eliminates the super normal profits. In a cartel of two unequal firms a threat by the smaller firm to double production may not pose great danger since its effect on price may be minimal as opposed to that of the big firm. The big firm cannot follow suit and double its production as this would eliminate all the super normal profits including its own. Therefore in such cases, the decision to control quantity lies largely with the bigger firm. The bigger firm should allow the smaller ones to produce as much as they can while it controls its production so as to maintain high prices. The matrix below shows the case of Algeria and Saudi Arabia, two oil producing nations. Algeria produces a very small percentage while Saudi Arabia produces for a large market.

Payoff matrix for doubling production

Losses incurred by Saudi Arabia in doubling production are very high whether or not Algeria doubles. Saudi Arabia has more to lose if it does not strictly observe the production rations than Algeria.

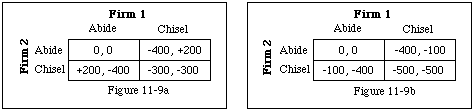

The third problem is in enforcing and monitoring the sharing. Each firm can lure some customers and confidently lower prices enabling the firm to increase its production hence its profits. This is also called Chiseling. To curtail this, firms can agree to sell through a common channel of agent that promotes transparency. They can also sign legal contracts stipulating punitive measures for defaulters and compensatory schemes for the victims. Finally the cartel may agree to incorporate a “most favoured customer” condition for all members. The clause enables customers get the lowest agreed price and any evidence indicating that a firm sold at lower prices to other customers can lead to demands for refunds on the differences legally (Silvia, Bas, Herbert & Henk 2009 Para 3).

Possible Payoff matrices for a two firm cartel

All the payoffs change to the negative for engaging in chiselling with the incorporation of the “most favoured clause”. There is no incentive to chisel. This makes the cartel very stable.

A final route of solving the worries of cartels is through mergers. Merging effectively changes the market structure from oligopoly to monopoly. The main advantage is that the wars come to an end. However in effect the move hurts the economy thus is highly discouraged by the national governments as illustrated by the U anti trust laws. However, even in mergers, squabbles still emerge as the owners of constituent firms wish to obtain a bigger share than others (Selected Readings in Antitrust Economics 2008 P4).

Conclusion

The foregoing brings out a very comprehensive assessment of the effectiveness of game theory in explaining the behaviour of oligopolistic firm. The explanation is accurate and fully illustrates the causes of major business decisions reported across the globe.

Reference

Arnold, H., 1996. On Stackelberg’s oligopoly theory. Journal of Economic Studies 23(5/6), pp 48 – 57, MCB UP Ltd.

Ashesh, S., n. d. Game Theory: Oligopolies [Online]. 2009. Web.

Eugene, W., 1990. Hard Problems: Game Theory, Strategic Behaviour, and Oligopoly. South-Western Publishing Co.[Online]. 2009. Web.

George, J., 1964. A Theory of Oligopoly. Journal of Political Economy [Online]. Web.

Howard, D., & Pun-Lee, L., n. d. Managerial Economics An Analysis Of Business Issues. FT Prentice Hall. [Online] 2009. Web.

Selected Readings in Antitrust Economics, 2008. Annotated Bibliography on Game Theory. American Bar Association Section of Antitrust Law Economics Committee [Online] Web.

Silvia, M., Bas, V., Herbert, H., & Henk, N., 2009. Assignment Situations With Multiple Ownership And Their Games. World Scientific journals pp. 1-13 DOI No: 10.1142/S021919890900211X.

Tutor2u, 2009. Oligopoly. [Online] Web.

Xavier, V., 2001. Oligopoly pricing: old ideas and new tools. MIT Press.