Executive Summary

The foundation of Etihad Airways in 2003 resulted in intensified competition in the airline industry as the company emerged as one of the fastest-growing players in the industry. With its headquarters situated in Abu Dhabi, which is the capital of the United Arab Emirates, Etihad Airways benefits from the government’s financial support since it is the national flag carrier. In this case, carrying out a strategic analysis using various techniques is relevant to identify the underlying factors, which are responsible for the performance of the organization. Additionally, an evaluation of the strategic choices is considered to deduce the aspects that are accountable for Etihad Airways’ fast growth in the industry. Recommendations based on the strategic issues that pose a threat to its competitive edge are identified to facilitate its planning for continued success.

Introduction

Conducting a strategic analysis of a particular business organization is essential for the assessment of its environment. Conducting a strategic analysis for Etihad Airways would facilitate planning towards the acquisition of a substantial market share, fostering the company’s image, creating a competitive advantage, and streamlining its operational activities. The analysis can employ a range of analytical methods that include the SWOT analysis, the PESTEL analysis, Porter’s Five Forces analysis, TOWS Matrix, and Stakeholder Analysis for the evaluation of strategic choices for the case of Etihad Airways.

Etihad Airways Overview

Etihad Airways was incorporated in July 2003 as a national carrier. It started its operations in November 2003. Headquartered in Khalifa City, Abu Dhabi, the company’s principal operations are situated at the Abu Dhabi International Airport (Etihad Airways, 2015a). The giant airline has expanded its network services from the Middle East to North America, Europe, Africa, Asia, Australia, and Canada. Etihad Airways has 24,347 employees that are based in various regions (Etihad Airways, 2015a). Etihad Airways is one of the key players in the aviation industry. In the 2014 Global Traveler Awards, Etihad Airways was awarded in the “Airline of the Year”, the “Best Airline in the Middle East”, and the “Best Airline Staff/ Gate Agents” categories.

Etihad Airways has maintained considerable growth in its revenue since its incorporation in 2003. In 2007, the total revenues were $1.6 billion that increased to $ 2.5 billion in 2008. In 2009, the revenue dropped to $2.3 billion before hiking to $3 billion in the following year. The year 2011 witnessed an impressive record of $4.1 billion, which saw an increase to $4.8 billion in 2012. The positive trend was also recorded in 2013 whereby the revenue gains amounted to $ 6.1billion. In 2014, the revenue totaled to $7.6 billion accounting for a 26.7% rise. The 2014 financial results were the strongest achieved by Etihad Airways to date as it was a 52.1% increase in profits from the previous year (Etihad Airways, 2015b).

Etihad Airways Vision, Mission, and Values

The mission of Etihad Airways is to maximize its profitability through the implementation of operational methods that enhance its yield, minimize its transit periods, maximum load factors, continuous and instant communication flow to the stakeholders, administration, and improved customer service.

Etihad Airways’ vision depicts its efforts towards promoting the Arabian culture. According to the vision statement, “The airline seeks to reflect the best of Arabian hospitality – cultured, considerate, warm, and generous – as well as enhance the prestige of Abu Dhabi as a center of hospitality between East and West. Our goal is to be a truly 21st century, global airline, challenging and changing the established conventions of airline hospitality” (Etihad Airways, 2015a, para. 4).

Etihad Airways upholds values that have facilitated the company’s success and accreditation with awards over the years. The values include the delivery of best practices in its operations, inspiring customers, paying attention to details, a positive attitude, and taking responsibility.

Corporate Social Responsibility

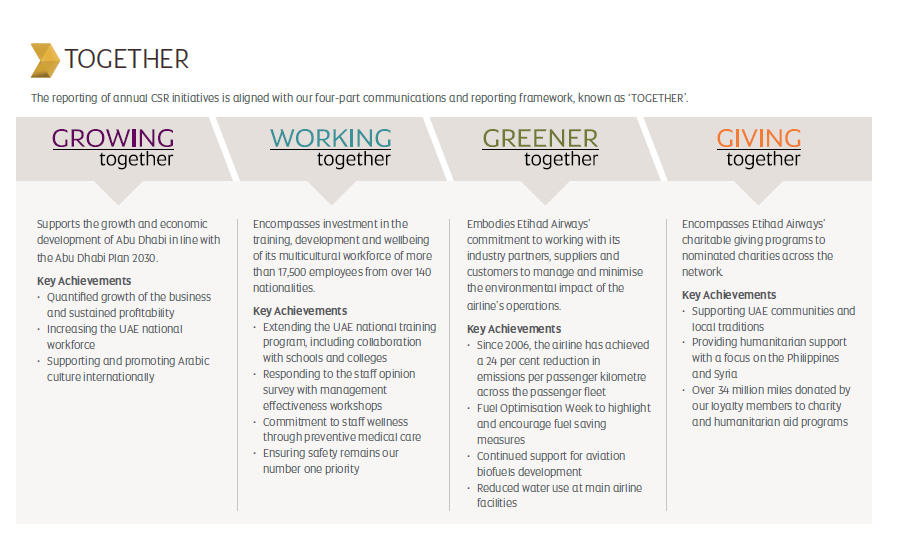

Etihad Airways is committed to enhancing the sustainability of the environment in which it operates. The company came up with a “Together” CSR strategy, which focuses on the growing, working, giving, and working towards a greener environment collectively. The Etihad’s leadership led by the CEO emphasizes the need for collective economic growth, especially concerning the UAE economy. With a 27% growth in its workforce, the company seeks to improve the well-being of its workers by facilitating training programs for professional growth. In 2013, the Etihad Guest loyalty generated a total of $317,000 that was meant for charitable initiatives in various communities. The company acknowledges the essence of biofuels in its operations in a bid to curtail the emission of CO2 to the environment. The figure below shows the CSR strategy that Etihad Airways implemented in 2013.

The Etihad’s CSR initiatives are outstanding since the company was recently recognized at the UAE Sustainability Awards. The awards included the “Sustainability Manager of the Year” and the “Best Sustainability Communication Program”. The “Sustainability Manager of the Year” was accredited to Linden Coppell, who is the company’s sustainability manager. The other award was an acknowledgment of the organization’s commitment to environmental conservation through the “BIOjet: Flight Path to Sustainability” initiative.

Purpose of the Study

The aim of conducting this study is to analyze the internal and external environmental factors that are accountable for the status of Etihad Airways. The assessment would facilitate strategic planning for its future endeavors towards the attainment of continued success. This paper will dwell on the strategic analysis of Etihad Airways through the application of various analytical methods that would facilitate its evaluation and recommendations for improved performance in the airline industry.

Organization Analysis

This analysis highlights the different attributes, which are accountable for the performance of Etihad Airways. In this respect, various analytical tools would be employed for the examination of the internal and external factors, which are accountable for the organizations’ strengths and weaknesses.

PESTEL Analysis

Political

- Etihad Airways receives backing from HH Sheikh Hamed bin Zayed Al Nahyan, who forms part of the board that facilitates the management of the company to become the best in the world.

- The UAE’s government is liberal towards Etihad Airways as a national flag bearer based in the Abu Dhabi emirate (CAPA, 2015). This assertion implies that the airlines’ services get support from the UAE government as a major player in its economic growth, especially in the aviation and tourism sectors.

- Abu Dhabi as the UAE’s capital city plays a significant role in the growth and development of the country due to the streamlined operations in the prime location.

- Political instability in the Middle East region over the years has posed challenges and threats to the business operations in the region.

Economic

- The highly developing city has facilitated economic growth in various sectors of the UAE economy resulting in enhanced structures that favor the aviation industry.

- The cost of domestic airline services in the UAE is affordable (Truxal, 2013). The cheap airfares and cargo rates have enabled the airline player to gain a substantial market share of the local population.

- The operating costs are high for Etihad Airways due to the strong Dirham against the USD. Although the USD is stronger compared to the Dirham, currency fluctuations imply that operational costs are dependent on the international currency trends since it is a global organization. Additionally, the lower currency exchanges facilitate competitiveness over the European Union rivals (Truxal, 2013).

- The formulation and implementation of free trade agreements with countries in Asia have provided opportunities for growth due to business growth and cost-cutting.

Social

- The company is popular amongst an extensive number of individuals in the upper social class, thus implying that its corporate image has been acknowledged by the wealthy.

- The Abu Dhabi cosmopolitan population provides a huge workforce and culturally diversified customer base, thus fostering economic growth and strong organizational culture.

- Etihad Airways has shown interest in the social conditions of its environment. The company has demonstrated its commitment to CSR programs that aim at fostering positive social change in various communities. This aspect has enhanced the brand image of Etihad Airways.

Technological

- Etihad Airways has enhanced its IT sector by signing agreements with companies like SITA to enhance its computing operations and facilitation of the global online presence (George & O’Connell, 2012).

- The adoption of Intelligent Operations technology facilitates the monitoring of the Airbus and Boeing aircraft through fault prediction and the mitigation of flight delays, thus improving its overall efficiency.

- Cyber threats in the airline industry have necessitated the need for IT and Internet security measures. Speculations suggest that the missing Malaysia Airlines Flight MH37 might have been hacked into and controlled from another center. Therefore, Etihad Airways ought to consider new technologies that enhance data management and security.

- The airline’s fleet has been increased with record-breaking orders that seek to upsurge the number of flights domestically and internationally hence facilitating competitiveness. Technological advancements have brought new methods of enhancing efficiency through applications like the Ramco Aviation Software. The software facilitates efficiency in operational costs, inventory management, and automated operations for better customer experiences.

Ecological

- Aircraft noise restrictions challenge the airline’s operations since it is impossible for the industry to be noise-free.

- New trends in the airline industry portray a shift towards environment-conscious strategies that aim at sustainability. In this case, competitors are concerned with environmental conservation to create an impressive image that grants them a competitive edge. Etihad Airways has been at the forefront regarding this aspect by initiating the “Green Together” campaign.

- Fuel-saving and emissions have also been regarded as important considerations in the airline industry. In this view, Etihad Airways has initiated light-weighting strategies, especially in its cargo department. In 2013, aircraft light-weighting strategies reduced the weight of the plane by 200kgs, thus implying a reduction of 5000 tonnes of CO2 annually.

Legal

- The organization suffers from the limited qualified labor force in the country.

- As a national flag carrier, Etihad Airways is subjected to a low tax regime resulting in improved operational costs. Additionally, low airport costs further enhance its functional management mechanisms that strengthen its rapid growth.

- Government agencies in various regions that Etihad carries out its operations have been formulating policies to safeguard the interests of the passengers. This aspect includes provisions on the aspects of safety, quality customer experiences, and timely flights.

Five Forces Analysis

The Threat of Entry

- With the advanced growth in the Middle East and Asia, new airline service providers are likely to emerge, and thus pose threats to Etihad Airways in terms of increased options for customers (-).

- Etihad Airways has faced threats from new entrants who have emulated the services provided by the company. However, they have failed due to their competitiveness and the industry’s market share. The failure of its competitors is based on the value of services, customer satisfaction, and demand that could not be matched by the new entrants (+). Therefore, the threat of entry is low.

- Venturing into the airline industry requires massive capital injections that may discourage new players to join the industry. The situation is attributed to the costly aircraft, airport facilities, and other infrastructure and resources required for operations. The capital intensiveness of the industry favors Etihad Airways, thus reducing the threats of new entrants (+).

Overall – Moderate.

The Threat of Substitutes

- Long-distance travelers have limited options that would facilitate the arrival to their destinations faster and in a short time. Therefore, air travel remains as the fastest means of transport for long distances (+).

- Technological development in the telecommunications and IT sector has reduced the necessity for individuals to travel regularly for meetings and other functions. For instance, teleconferencing has made it easy for geographically scattered parties to communicate without meeting physically. Therefore, this substitute poses a threat to airline players like Etihad Airways (-).

- Individuals that travel domestically may opt for a car, bus, or high-speed trains. This aspect is common in Europe and the Middle East where other means apart from air transport are preferred for regional travels (-).

Overall – Moderate.

The Bargaining Power of Buyers

- Budget travelers tend to find no attractiveness in the seasonal prices as compared to business travelers and pleasure travelers due to the seasonal fluctuation of fares. Customer loyalty would be facilitated through innovative strategies like online purchasing services, which are duty-free (-).

- In the airline industry, prices change seasonally meaning that different categories of travelers are affected. During the high season (December – January), business customers usually have low bargaining power since airline providers concentrate on other categories (+).

- The periods characterized by new entrants resulted in a competition that created acceptable customers’ bargaining power. Price reduction strategies employed by Etihad facilitated market penetration, thus enhancing competitiveness since the customers preferred the lower fares (+).

Overall – High

The Bargaining Power of Suppliers

- Considerable dividend gains attained by the company’s stockholders due to increased public stock and remarkable discounts have facilitated the growth of Etihad’s capital injections. Therefore, the profits earned are also accountable to the stockholders as the airline’s suppliers (+).

- Two suppliers, viz. Airbus and Boeing, dominate the bargaining power since Etihad Airways is limited to its options for quality aircraft suppliers. This aspect could be mitigated by the expansion of Etihad’s operations necessitating the purchase of more aircraft that would lead to the reduced bargaining power of the suppliers (-).

- In the airline industry, supplies contract agreements are usually on a long-term basis, which limits the players’ ease of shifting to alternative suppliers. In this case, companies like Etihad Airways have limited bargaining power (-).

Overall – Low

The Extent of Rivalry between Competitors

- On the aspects of market share, Emirates Airlines, Qatar Airlines, and Saudi Arabia Airlines provide stiff rivalry to Etihad Airways. The rivals pose threats to the company’s increased market penetration since they have increased their number of flights, thus necessitating the Etihad’s strategic planning to counter the competition (+).

Overall – High

Strategic Capabilities

The competitive capabilities of Etihad Airways are depicted in the management’s strategies towards sustainability and improved value over time. This analytical aspect focuses on Etihad’s resources and competencies, VRIO framework, Benchmarking, and the Value Chain analysis.

Resources and Competencies

The resource base aspect of Etihad Airways’ analysis focuses on the unique conditions and resources that are managed by the organization towards the attainment of its competitive advantage.

Physical Facilities

Etihad Airways has an extensive range of tangible assets that facilitate its operation. Its fleet of 117 Boeing and Airbus aircraft, the headquarter offices at Khalifa City, and structures at the Abu Dhabi International Airport constitute its valuable physical facilities and assets (Cole, 2013).

Intangible Assets

Etihad Airways has built a brand name, which has enhanced its reputation, and thus it acts as a valuable intangible asset. Other intangible assets include customer relations, online resources, lease agreements, franchise agreements, employment contracts, computer software, and trade secrets.

Human Resources

The human resource factor at Etihad Airways is managed under the leadership of the Sheikh Hamed bin Zayed Al Nahyan, the chairman, and Sheikh Khaled bin Zayed Al Nahyan, who acts as the deputy chairman of the board of directors. The company boasts of a globally situated workforce of over 24,000 employees (Etihad Airways, 2015c).

Financial

Etihad Airways boasts of revenues of over $7.6 billion adding up to its financial resources. These resources are accountable for its remarkable profits gained in 2014 that recorded a 52% increase from the previous year. Additionally, stakeholders are pleased with the improved dividend returns owing to the exceptional performance attained (Arabian Aerospace, 2015).

Marketing and CSR

The company’s marketing strategies major on competitiveness through low prices and the provision of quality services. The airline service provider has engaged in various CSR initiatives globally resulting in various CSR awards including the recent UAE Sustainability Award.

Etihad Airways has the following competencies

Product Diversity

Through the “Etihad Pearl Business Class and Etihad Diamond First Class, Etihad Airways has been in a position to segregate its customers in business and first-class respectively, thus covering different customer needs” (Etihad Airways, 2015c, para. 6).

Product Quality

The maintenance of high-quality services throughout its operations ensures customer satisfaction. The services entail in-flight and on-ground activities.

Pricing

A consistent pricing policy is maintained to ensure competitiveness through affordable fares. For instance, when comparing the average pricing for the second baggage between Etihad Airlines and Etihad Airways, the prices were $135 and $130 respectively. This aspect implies that Etihad Airways maintains a lower price that seeks to attract more customers. Compared to the lower budget Air Arabia, the pricing was $30 for the second luggage. Despite the pricing competition from Air Arabia and Fly Dubai, Etihad Airways concentrates on edging out its biggest competitor, viz. Emirates Airlines (Cole, 2013).

Culture

The organizational culture acknowledges diversity and hospitality to staff and customers, thus enhancing its sustainability.

VRIO Analysis

The application of the VRIO analytical technique would enhance the assessment of Etihad Airways’ organization and its competitors. This aspect would focus on the dimensions of value, rareness, imitability, and the organization. The following table aids the VRIO analysis of Etihad Airways.

Table 1: Etihad Airlines VRIO framework and analysis

Based on the VRIO framework, the Etihad’s competitive advantage can be evaluated considering the comparative implications of its strategies. In this regard, Etihad can be perceived as a sustainable player in the airline industry as depicted by its fast-growing rate. The organizational culture promoted by effective leadership has enhanced the organization’s drive towards sustainable growth as a competitive player in the industry. The strong human resource base cannot be underestimated given its cultural diversity and the upholding of the airline’s corporate values. Therefore, the strategic management of Etihad Airways is sustainable, which implies improved performance in the future, thus enhancing the realization of its vision.

Benchmarking

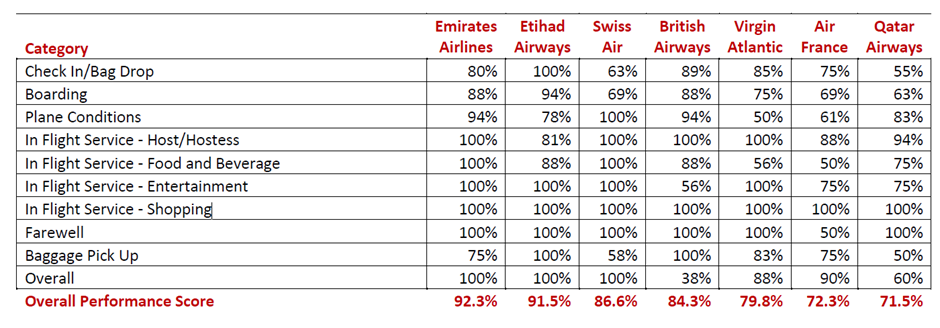

The airline industry has been characterized by stiff competition, low margins, and increased customer expectations. In this essence, Etihad Airways needs to implement new strategies that would facilitate its competitiveness in the ever-growing industry. Considering the techniques employed by the leading competitors is essential to enhance the Etihad’s financial performance, customer satisfaction, innovation, and other operational endeavors. The following table shows the general performance of the top airline services providers during the 2009/2010 peak season (December-January).

Etihad Airlines emerged as the top airline company that portrayed efficiency in its check-in/bag drop department. However, there is a room for developing the online check-in system since only 34% of the passengers used the online platform. The remarkable boarding experience at a score of 94% ranked Etihad Airways as the top in this category followed by British Airways at 88%. There is an opportunity for improvement since only 7% of the customers in the study experienced the timely opening of the boarding gates. On the aspects of plane conditions and in-flight host/hostess services, Etihad Airlines was ranked lower as compared to Emirates Airlines, Swiss Air, and British Airways.

In-flight services about food and beverage, entertainment, and shopping experiences indicated satisfactory performance. Areas that ought to be considered include the quality of food and beverage and entertainment equipment for the improvement of the Etihad’s competitiveness. The overall performance for all the competitors indicated that only 21% of the passengers picked up their luggage in less than five minutes. Etihad ought to improve its performance in this category in a bid to facilitate customer satisfaction. The overall performance depicted the Etihad’s impressive score totaling to 92.5% at position two just behind Emirates Airlines, which garnered 93.2% as the total average score. The benchmarking analysis portrays the competitiveness in the industry whereby small marginal differences separate the key players (Ethos Consultancy, 2010).

Value Chain Analysis

An analysis focusing on Etihad Airways’ value chain management examines its operational activities towards the delivery of quality airline services in the highly competitive market. Etihad’s “inbound logistics is boosted due to the internal movements in the logistics activities as carried out by suppliers as they forward their inventories” (Cole, 2013, p. 89). The passenger and flight operations at the airports account for the major chain processes that require effective management at Etihad Airways. Outbound logistics endeavors are facilitated by the delivery of cargo and transportation of passengers to various regions including the Americas, Asia, Europe, and Australia. Promotions enhance the sales and marketing elements through newspaper and television advertisements (Cole, 2013).

Human Resource Management

Abilities, effort, and time possessed by the Etihad Airways’ workforce form part of its valuable intangible assets. The strategic capabilities of the company are highly contributed by the workers who ensure the efficient execution of tasks in various departments. Since the quality of services offered by Etihad Airways has enormous implications for the perceptions of the customers, the management team concentrates on effective training that builds its human resource management. The development of the workforce enhances the competitive advantage of Etihad Airways over rivals like Emirates Airlines, which has reported poor employees working conditions in the recent past. Etihad Airways also focusses on developing the talents of its employees in various forms that include regular performance reviews that acknowledge the employees’ commitment, hard work, and expertise development (Etihad Airways, 2015d).

Technology Development

The technologies introduced at Etihad Airways to improve its value chain and general performance include Online Check-in, In-flight e-mail system, and Airport lounges. The implementation of strategies that incorporate state-of-the-art technology in operations led to its recognition as the leading e-business airline in Asia (George & O’Connell, 2012). In this regard, the e-business initiatives introduced in the cargo, passenger, procurement, and procurement sectors have been strategic in facilitating its competitive advantage in the modern society.

Other Services

Adding value to the existing services is essential for Etihad Airways to continue attaining impressive results that push it towards becoming the fastest growing airline company. The airline’s goal is “the delivery of superior quality services and value to its customers through subsidiary services” (Etihad Airways, 2015b, par. 9). The organization acquired the Abu Dhabi Cargo Company (ADCC), Abu Dhabi In-Flight Catering (ADIFC), Catering, and Abu Dhabi Airport Services (ADAS) to foster the ground handling business (Etihad Airways, 2015d). These services acquired in 2013 have facilitated timely performance, maintenance of its growing international routes, and flight frequency upsurge.

SWOT Analysis

Strengths

- Etihad Airways has attained profitable results since its incorporation. In the 2014 financial statements, the company revealed net profits of $73 million, which saw the total revenue amounting to $7.6 billion. Additionally, Etihad’s EBITDAR and EBIT surged by 16.2 % and 32.5 % respectively.

- The sources of income for Etihad Airways are derived from investments from the Etihad Holidays initiative that invested in the hospitality industry in various cities of the world. The Etihad Crystal Cargo division is also a significant source of income as it provides cargo transportation. The company’s revenues are based on the following portfolios, Airlines (60%), Crystal Cargo (20%), Holidays (10%), and Gaming (10%) (Etihad Airways, 2015b).

- Etihad Airways offers quality services in-flight and on the ground. In the air, Etihad offers a flexible class as it recently upgraded the number of aircraft in Business and Economy cabins and new suite first-class coupled with a friendly cabin crew in flight that assists the passenger. Moreover, an enhanced entertainment system allows the passengers to control the system easily coupled with entertainment during a flight without becoming bored. Moreover, it offers duty-free and dining. Finally, it provides medical care. Most flights are offering non-stop flights that lead to saving time and creating convenience for passengers.

- Etihad was awarded as the best “Business & Firstly Class” product and service in worldwide airline companies. The Etihad’s state-of-the-art E-BOX on-demand system won the Middle East’s Leading In-flight Entertainment. The E-BOX allows customers to enjoy more than 600 hours of the latest movies and TV shows, music, interactive game recharge laptops, and mobile devices.

- On the ground, Etihad Airways provides chauffeur pickup services in 27 destinations worldwide coupled with access to lounges for First and Business classes. Additionally, check-in for first class and business class is separated from the economy class.

- The location of Etihad Airways in Abu Dhabi is very strategic. The location is ideal for the Middle East and an international hub linking east and west. Besides, the Abu Dhabi economy is growing fast, and it enjoys a financial foundation.

- To foster sustainability, Etihad Airways signed an agreement with the “Masdar- Future Energy initiative to cooperate on various activities that focus on reducing the airline’s carbon footprint through sustainable and energy-efficient measures. This move would ensure the responsible management of the effect it has on the environment.

- Etihad Airlines is regarded as the safest and best class category among various competitors.

- The workforce of over 24,000 employees from different nationalities boosts its organizational culture towards the delivery of hospitable services.

- Etihad Airways has engaged itself in various sponsorships. As a part of the promotion strategy, the company sponsored a range of cultural events and sporting locally and worldwide. Major sponsorships include Manchester City Football Club in England, F1 Etihad Airways Abu Dhabi Grand Prix, Sports Australia Hall of Fame, Etihad Stadium, Harlequins Rugby Football Club, and GAA Hurling All-Ireland Senior Championship. These sponsorships are in line with the company’s values, which aim to get Abu Dhabi to the World. All of these sponsorships give the company value among its customers and their experience about Etihad together with fostering marketing.

Weaknesses

- Limited destinations and time is a major weakness for Etihad Airways. At this stage, Etihad is offering limited destinations for some countries and cities. For example, it does not offer flight to Adelaide (Australia), Los Angeles (the United States), and Zurich (Swiss). In addition to this aspect, Etihad does not offer a suitable time and many options to select flight time on a day. For example, only one flight is provided from Abu Dhabi Airport (AUH) to Melbourne (MEL) at 22:20 (GMT+4). Therefore, it could be difficult to find a flight at a certain time and date as it would be easily booked out.

- Etihad Airways is newer to the airline industry as compared to other international airlines. With only 12 years in operation, Etihad Airways is still young and new to the industry, and thus it has not established its international brand name adequately.

- Etihad’s market share has been restricted by the competitiveness of the industry as propagated by major rivals like Emirates Airlines, British Airways, and Air India.

- Over-reliance on Onward Moving Traffic for its international operations limits its regional dominance and sustainable market share.

- Alongside other airline companies, Etihad has not been in a position to live up to the expectations since it lacks modern accessories like amenity kits, headsets, Airsickness bags, in-flight socks, and eyeshades.

Opportunities

- The extension of daily flights and opening up of new routes to different destinations would provide Etihad with opportunities for continued success. The flexibility brought by multiple times of a daily flight enhances customer satisfaction and attracts more customers, hence an upsurge in profits. Etihad would achieve this goal through the purchase of new aircraft.

- The UAE 2020 Expo is an excellent opportunity for players in the industry to flourish. This world event lasts for six months, and it brings millions of individuals to Abu Dhabi to explore cultural diversity, exhibits, and pavilions. Individuals, businesses, and international organizations would need the air transport services provided by Etihad, thus facilitating its global growth and development.

- Abu Dhabi Vision 2030 presents Etihad Airways with an opportunity to bring the world to Abu Dhabi and take it to the world. Focusing on the vision allows Etihad to focus on tourism and holidays in the UAE as its source of customers towards the realization of Vision 2030.

- Developing service innovations would translate into customer satisfaction. Etihad should focus on the adoption of innovations like improved in-flight entertainment and premium cabin services. Innovations in the hospitality approaches to the customers need to be considered for improved customer experiences and the realization of the organizations’ vision.

- The new technology would provide Etihad with opportunities for growth due to the efficiencies that come with technology. Due to the administration of new technology, the operational costs would be lowered, thus improving its financial and resource management.

- The improved GDP growth rates recorded in the UAE in the recent past mean more capital injections from the Emirati government. In this regard, the extraction and refining of petroleum products would boost the economy especially the capital, Abu Dhabi, where the Etihad Airways is headquartered.

- The growth of the tourism sector in the Middle East, as expanded by the entrepreneurial spirit, provides opportunities for Etihad Airways’ growth as the frequency of flights is expected to increase. Additionally, business-related to the tourism and aviation industries is expected to thrive, thus presenting more opportunities for Etihad Airways.

Threats

- Intensified competition in the airline industry threatens the sustainable growth of Etihad Airways. Rivals like Swiss Air, Emirates Airlines, Qatar Airways, and British Airways have adopted innovative strategies that have posed threats to the Etihad’s substantial growth in the industry (Cole, 2013).

- The increasing cost of fuel triggered by international economic trends has exerted pressure on the UAE government since it contributes to the funding and financial management of Etihad Airways.

- Adverse environmental conditions usually interfere with the operations of various airline companies due to delays and the cancelation of flights. For example, in April 2015, sandstorms interrupted the traffic at the Abu Dhabi International Airport, thus forcing Etihad Airways to delay or cancel some of its flights.

- The intervention of the government in the formulation and implementation of new aviation policies might threaten the sustainability of Etihad Airways. Government intervention might result in the entrance of new firms, hence threatening the Etihad’s customer base.

- Political instability in the Middle East discourages individuals from traveling to the region. Civil unrest and revolutions in the Middle East have evoked fear and security concerns regionally and internationally, thus resulting in negative implications for Etihad Airway’s growth.

TOWS Matrix Analysis

The utilization of the TOWS Matrix is a situational analysis tool is useful for the identification of Etihad Airways’ strategic choices towards its sustainability. This aspect entails maximizing the strengths, circumventing the weaknesses, capitalizing on the opportunities, and threats management.

Strengths and Opportunities (SO)

Etihad Airways’ strengths include profitability, strategic location, excellent branding, and product promotion, a diverse workforce, and is regarded as the safest airline service provider. Additionally, Etihad Airways provides quality in-flight and on-ground services, global sponsorships, and sustainability initiatives, which depict the firm’s strengths. The opportunities include the economic growth of the UAE, the upcoming UAE Expo 2020, Abu Dhabi Vision 2030, innovation, product promotion benefits, and the development of the tourism industry in the UAE. Therefore, Etihad Airways should use its strengths to maximize the available opportunities for continued success.

Strengths and Threats (ST)

This aspect entails how Etihad Airways can curtail its threats by taking advantage of its strengths. In this regard, threats like competitiveness, hiking fuel prices, adverse weather conditions, government intervention, and civil unrest can be mitigated by maximizing on the brand image and injecting more funds derived from the profits.

Weaknesses and Opportunities (WO)

Etihad Airways can make use of its opportunities to alleviate its weaknesses and gain a competitive advantage over its contenders. The opportunities presented by an improved UAE economy, the UAE Expo, Abu Dhabi Vision 2030, tourism growth, and promotional opportunities could be used to manage threats like the lack of market penetration due to competitiveness and over-reliance on Onward Moving Traffic.

Weaknesses and Threats (WT)

Here, Etihad Airways would focus on the minimization of its weaknesses and avoidance of threats. In this perspective, issues about market share, customer expectations, competition, increased fuel prices, and other adverse internal and external factors ought to be mitigated to ensure the sustainability of the organization.

Stakeholder Analysis

Table 3: Stakeholder analysis for Etihad Airways.

The stakeholder analysis portrays the different stakeholder needs and expectations concerning the organization. The principal actors in the aviation industry considering Etihad Airways case strive for collective success.

Stakeholder Mapping

Table 4: Etihad Airways’ Stakeholder Mapping.

Mapping the stakeholders analyzes the level of interest and power that is inherent in the various stakeholders. All the stakeholders mapped portray a high level of interest in varying degrees of power. Despite the community and competitors having a low level of interest, their power is limited since Etihad is positioned strategically in the industry. The customers and employees are highly interested, but their power is low.

Competitive Advantage

Maintaining a competitive edge over the rival players in any given industry is essential for sustainable success. In this view, the evaluation of Etihad Airways is vital for determining the strategic plans that would enhance its efficiency.

Efficiency

The evaluation of Etihad Airways’ efficiency would be based on the degree to which the organization has attained the predetermined goals. The goal of the airline giant is to become the preferred airline in the 21st Century by challenging the conventional hospitality approaches (Truxal, 2013). The convenience of the airline’s passengers is enhanced by an online check-in and chauffeur services. The company has its terminal at the Abu Dhabi International Airport, which facilities timely arrivals and departures. The introduction of new aircraft to fly more routes improves the number of passengers transported by the carrier within a particular period. The Etihad’s move towards increasing the number of cabins and new B787 for the Abu Dhabi-Zurich route implied that the frequency of flights on the route could increase, thus resulting in more profits.

Quality

Quality service provision is a crucial consideration for Etihad Airways towards the satisfaction of its customers. By incorporating the valued Arabian hospitality in its flights, Etihad Airways emphasizes the provision of comfortable traveling experiences. Etihad Airways scored 91.5% in a study conducted in 2010 regarding customer satisfaction (Ethos Consultancy, 2010).

Innovation

Over the 12 years of its operations, Etihad Airways has been considering all the customer needs and devising innovative means of satisfying them. Based on excellence and perfection, innovations have enhanced its flight and on-ground activities. The human resource department has been trained to ascertain excellent service delivery. Additionally, innovative strategies have developed a strong brand value characterized by reasonable prices and valuable traveling experiences (Belobaba et al., 2015).

Customer Responsiveness

The culturally diverse workforce at Etihad Airways can be used to assess the responsiveness of its customers. The airline’s HR department has engaged the employees in training, raising awareness, and recognizing the diverse culture (Cole, 2013). In so doing, Etihad Airways ensures that multilingual staff members serve their diverse customer base to enhance communication. In this respect, the perceptions of Etihad Airways’ customers depict satisfaction with the provided services.

The Etihad Airway’s use of social media platforms for interacting with its customers has been influential to its success. In 2014, the SimpliFlying Awards acknowledged the company as the ‘Emerging Airline on Social Media’. Its Facebook page has over 1.4 million followers that facilitate communication and interaction with customers.

The customer support center ensures that the views of the customers are heard and addressed accordingly. The customer relations division has made available to all the phone contacts, E-mail, office address, and online check-in platforms for ease of communication.

Strategic Choice & Evaluation

The selection of an optimum strategic course is a significant decision for the growth and success of Etihad Airways. The industry trends must be analyzed closely for the implementation of strategic choices that bring value to the stakeholders.

Differentiation Strategy

The adoption of a differentiation strategy by Etihad Airways implies that the company would enhance the uniqueness of its services to be regarded as of high value coupled with attaining a competitive edge in the long-term. Etihad Airways, Emirates Airlines, and Qatar Airways are the major competitors that create the Middle East Big Three (MEB3). The Emirates Airlines and Qatar Airways have engaged in expansion strategies in Dubai and Doha respectively in a bid to increase their capacity. On the contrary, Etihad Airways is a smaller company as compared to the two, but it has managed to enhance its service provision, thus resulting in competitive performance. In 2012, Emirates Airlines recorded a 16% increase in its passenger transportation while Etihad Airways attained a 23% increase. This aspect depicts the CEO’s ambition of making Etihad airlines the best company instead of it being the largest (Aspire Aviation, 2013).

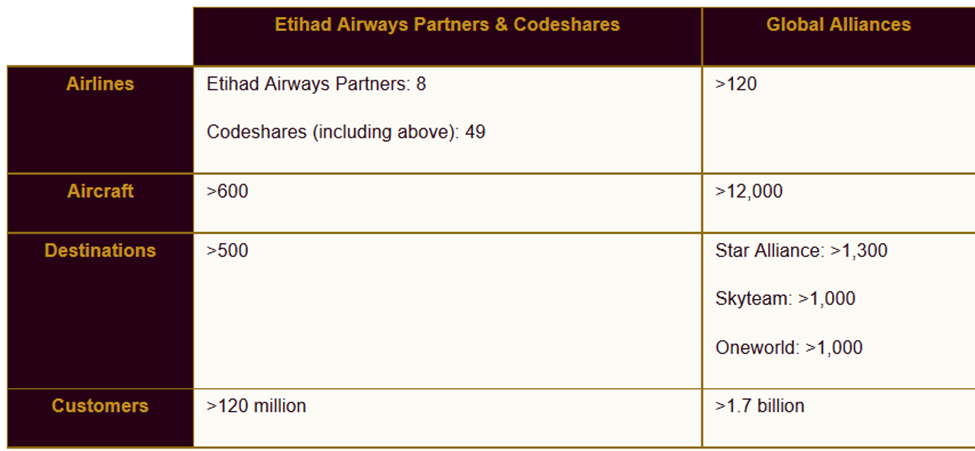

Strategic Alliances or Acquisition and Merger

Etihad Airways has engaged in various “equity alliances” that seek to foster its strategies towards the attainment of competitive advantage. In 2013, Etihad Airways invested $379 million to acquire a 24% equity stake at Jet Airways, which is an Indian-based airline (AirInsight, 2013). Earlier, Etihad had acquired 4.11% and 29.2% stake at Aer Lingus and Air Berlin respectively to constitute its “equity alliances” investments. Codeshare partnerships in Africa have also been forged with Kenya Airways and South African Airways, thus widening its network in the region.

Alternatives Strategies

Etihad Airways could adopt new strategic approaches that would result in more rapid growth. The following strategies could be implemented by enhancing the competitiveness of the firm.

Market Development

Continued success would be achieved if Etihad Airways’ management focused on the expansion of its network to new markets. Emerging markets should be targeted whereby new routes and destinations are developed to gain more customers. Additionally, existing routes could be allocated multiple timing to facilitate the transportation of more customers.

Product Development

Modification or introduction of new services is a calculated alternative strategy for Etihad Airways. The initiation of a service that enables customers to trade their reservations for competitive fare offers within a particular period for a fee could apply in this case.

Go-Global

Despite the Etihad’s global presence, it ought to enhance its networks in the different continents. In this view, an increase in codeshares, alliances, partnerships, aircraft, and destinations would facilitate the organization’s global operations.

Evaluation

Evaluating the strategies that could be adopted by Etihad Airways presents an opportunity of identifying the best choice that encourages suitability, acceptability, and reliability. In this light, an efficient strategy would be implemented to attain desirable performance.

Suitability

Identifying the best strategy that would foster the effectiveness of Etihad Airways in the competitive airline industry should consider suitability. The alliances formed between Etihad and other players in the industry depict strategic decisions that aim at enhancing its effectiveness. Therefore, the alliances, mergers, and acquisitions have proved beneficial since they have broadened the network of Etihad’s operations not only in the Middle East but also globally. The suitability of this method is portrayed by the tendency to promote timely passenger and cargo services, the spread of the hospitable culture, and market penetration. The capabilities of Etihad would also be strengthened through economies of scale and scope and learning from the partners (Al-Ali & Ahmad, 2014).

Acceptability

The stakeholders have to accept a particular strategic method before it is implemented. In this respect, Etihad’s major stakeholders including the UAE government, the CEO, Board of Directors, employees, suppliers, and the customers have to be considered on the aspects of risk, return, and stakeholder reaction. The “equity alliances” are perceived to possess great potential for growth due to the investments in the new markets and widened scopes (Al-Ali & Ahmad, 2014). The stakeholder’s reactions towards the strategic plans are expected to be positive given the competition that it faces from its rivals.

Feasibility

The strategy of fostering alliances and acquisitions so that Etihad could go global is practical since the organization has the financial capacity to venture into such expansion investments. The UAE government would consider this aspect as a strategic move to widen its political and economic ties that would benefit the country in the long term.

Questionnaire Analysis

Conducting a study to identify the key issues that have a bearing on the navigation of Etihad Airways towards success is important. In this case, the respondents would be the CEO, Board of Directors, and the customers as they are interviewed on various key issues. Below are the top ten questions that should be in the questionnaire.

- What are your plans towards the maximization of the opportunities that are available for Etihad Airways?

- What measures have you formulated to circumvent your weaknesses?

- Does the value of the services provided by Etihad Airways meet the expectations and satisfaction of the customers?

- Is the UAE government committed to improving the services of Etihad Airways as the national flag carrier?

- What goals are attainable by Etihad Airways in the next one year?

- What is the management strategizing to enhance the competitiveness of Etihad Airways?

- Are there hindrances that currently impede the effectiveness of the board/ committee?

- Are Etihad Airport agents helpful?

- Is the working environment at Etihad conducive for personal and professional growth?

- Are the core values at Etihad Airways accountable for its continued growth in the airline industry?

Key Strategic Issues

Despite the intelligent strategies that Etihad Airways has implemented to attain its organizational goals, vision, and mission, some issues tend to derail its competitiveness.

- In its quest towards the provision of quality services to its customers, the company tends to focus more on the Business class than on the Economy class. Some passengers have complained of poor conditions within their planes in the economy section. The comfort of the seats has been an issue of concern. This aspect would taint the image of the fastest growing airline organization and undermine its competitiveness.

- The increased partnerships with other airline companies have derailed the Etihad Airways’ speed at which it is facilitating the growth of its fleet. This assertion holds because some of the aircraft ordered by Etihad have been redirected to partners like Alitalia. In this regard, equity alliances tend to affect the Etihad’s fleet growth negatively.

- The alliance’s strategy model has been termed as “fractured” due to the potential for losses. The alliance facilitated by Oneworld, Star Alliance, and Sky Team have been considered as detrimental. For instance, British Airways encountered revenue sharing conflicts after allying with Qantas. In this light, the alliance’s strategy tends to be detrimental (The National, 2014).

- The management of the airport operations at Abu Dhabi International Airport needs to improve its effectiveness due to instances of runway technical issues. In 2014, 37 flights were canceled due to poor airport systems, thus resulting in negative customer impressions.

- Innovation is a critical issue that affects Etihad Airways. Despite substantial investments in innovative strategies in areas such as in-plane experiences, the Abu Dhabi International Airport is not entirely automated. This aspect compromises the expectations of technology-liking customers.

- Etihad Airways is not prepared fully to seize the opportunities that would be brought by events like the UAE Expo 2020 and Vision 2030. Therefore, administrative strategies focus on current opportunities without incorporating future possibilities.

Ties Recommendations

In a bid to facilitate effective strategic approaches, the following recommendations need to be considered

- Etihad Airways should consider improving the quality of its services by ensuring that its customers enjoy comfortable and memorable traveling experiences. This aspect entails the purchase of new aircraft with the latest technology incorporated into the system.

- The growth of its fleet needs to be considered and controlled concerning the needs of its partners. The orders need to be managed in a way that its suppliers do not have to redirect the orders to the Etihad’s partners.

- Etihad Airways should concentrate on the equity alliances instead of the usual alliance’s aviation groups like Star Alliance and Sky Team. This move would minimize the multiple affinities that such organizations have with multiple airline companies that result in revenue-sharing wrangles.

- Efficiency in the operational management of the airport should be emphasized through the formulation of policies that ensure efficient operations. The measures should curb the development of a negative brand image that comes from delayed flights and congestion due to poor management.

- The automation of all the possible services that Etihad Airways offers would promote its competitiveness, thus facilitating its growth. This aspect includes the installation of the latest entertainment gadgets in the aircraft to improve customer experiences.

- The UAE Expo 2020 and UAE Vision 2030 should be regarded as potential opportunities that would trigger Etihad Airway’s growth. Therefore, plans should be formulated to enhance preparedness for such imminent opportunities.

Conclusion

Etihad Airways is a reputable airline company. It has stamped its authority in the airline industry, thus accounting for its rapid growth in comparison to other players. Examining its environmental factors through the employment of strategic, analytical tools facilitates the evaluation of the processes that depict efficiency or inefficiency in the organization. In this respect, an audit of the Etihad’s internal and external environments using analytical methods like TOWS Matrix, SWOT, PESTEL, and the Five Forces is suitable for identifying the elements responsible for its performance over the years. The strategic approaches enhance the analysis of its stakeholders concerning their roles and the organization’s expectations. Etihad Airways’ competitive advantage is portrayed in its commitment to “efficiency, quality, innovation, and positive customer response” (Etihad Airways, 2015a, par. 8). An analysis of the organization’s strategic choices unveils the strategic strengths and issues like disregarding the economy class, aircraft conditions, and the inefficiencies brought about by alliances.

References

insight: Etihad Airways invests in Jet Airways and forms a strategic alliance. (2013). Web.

Al-Ali, A., & Ahmad, Z. (2014). Etihad Airlines: growth through successful strategic partnerships. Emerald Emerging Markets Case Studies, 4(5), 1-17.

Arabian Aerospace: Etihad Airways reveals a profit of US$ 73 million in 2014. (2015).

Aspire Aviation: Differentiation in Strategy Key to Etihad Airways Success. (2013). Web.

Belobaba, P., Odoni, A., & Barnhart, C. (2015). The Global Airline Industry. Hoboken, NJ: Wiley.

CAPA: Etihad Airways. (2015). Web.

Cole, A. (2013). Analysis of Etihad Airways. Munich, Germany: GRIN Verlag.

Ethos Consultancy: International Airline Benchmarking Study – Summary of Findings. (2010). Web.

Etihad Airways: Build Global Competition: Creating New Customer Choice. (2015a). Web.

Etihad Airways: Corporate Profile: The National Airline of the United Arab Emirates. (2015d).

Etihad Airways: Facts and Figures. (2015c). Web.

Etihad Airways: Fourth consecutive year of net profit. (2015b). Web.

George, W., & O’Connell, J. (2012). Air Transport in the 21st Century: Key Strategic Developments. Farnham, UK: Ashgate.

The National: Etihad Airways chief says the airline alliance model is ‘fractured’. (2014).

Truxal, S. (2013). Competition and Regulation in the Airline Industry: Puppets in Chaos. London, UK: Routledge.