Introduction

Strategic Management

Strategic management is a widely discussed topic in modern-day literature. Strategic management is a continuous process that includes planning, monitoring, and analyzing all the company’s needs to meet the strategic goals (Carter, 2013). The purpose of strategic management is to develop and implement a formula that defines how the company is going to compete in the market (Fuertes et al., 2019). Strategic management is associated with a wide variety of monetary and non-monetary benefits for the organization. On the one hand, strategic management sets financial goals and ensures that policies help to achieve the goal (Cattani, Poracand, Thomas, 2017).

On the other hand, strategic planning helps to establish a link between the vision and mission of an organization and its everyday activities, which leads to increased motivation, productivity, and workplace satisfaction of employees (Berisha Qehaja, Kutllovci, and Shiroka Pula, 2017). In general, it has been noticed that the more tediously a company implements a strategic management process, the better its performance in all spheres (Elbanna, S., Al Katheeri, B., and Colak, 2020). Therefore, the importance of strategic management is difficult to overstate.

Report Overview

The present report aims at assessing a recent strategic decision of GrowthDC to acquire additional funding for aggressive development using a strategic management approach. The report assesses the company using the value chain and value system, VRIO framework, Porter’s five forces, SWOT analysis, PESTLE analysis, gap analysis, performance measures, and Porter’s generic strategies. These approaches are expected to help to understand how the recent decision to start operations is appropriate according to the company’s optimal strategy. The conclusions are drawn from the analyses, which serve as the basis for recommendations for future development.

Company Overview

GrowthDC is a startup company based in United Arab Emirates that operates in the information and communications technology (ICT) and data center consulting industry. The company’s main services are data center audit specialists, data center design and build, data center maintenance and management services, data center testing and commissioning services, data center command and control, and data center training. GrowthDC provides Integrated Data Center Management tools to covers end to end reliable data center operational processes from data center infrastructure management (DCIM), building management systems (BMS), energy power management systems (EPMS), computational fluid dynamics (CFD), workflows, cable and asset management, and advisory and performance services. The primary advantage of the company is that it provides physical and virtual 3D visualization of data center infrastructure, which is helpful for potential clients.

Analysis

Value System

Vision Statement

A coherent vision statement for a company is crucial for a company of any caliber for a wide variety of reasons. A vision statement is viewed as a declaration of a company’s goals that are supposed to guide the company into the future (Lucas, 1998). A vision statement embraces the internal goals of the company that help the company grow, while the mission statement is focused on external goals (Kirkpatrick, 2017). A vision statement is usually included in all the internal documents, which ensures a strong corporate culture (Raynor, 1998). A good vision statement serves as an ultimate plan for strategic success and helps to attract, retain, and motivate valuable employees (Van der Walt, Kroon, and Fourie, 2004). Thus, GrowDC needs to have a strong vision statement to ensure a successful launch.

GrowthDC’s vision statement reads:

“Our vision is to evolve into a global company that provides thousands of top-class employment opportunities for the best talents.”

The statement is appropriate for the company and has all the characteristics of an effective vision statement. In particular, the statement is clear, specific, inspirational, genuine, authentic, and relevant, which is crucial for any company (Kantabutra and Avery, 2010). Additionally, the statement is unique, even though TEXPO, one of GrowthDC’s direct competitors, has a somewhat similar vision statement, which reads, “Our vision & aspiration is to evolve & emerge a strong company which can provide millions of employment globally” (TEXPO, no date). This may have a negative impact on the company’s performance.

Mission Statement

A mission statement is also of extreme importance for all types of companies. A mission is an action-based statement that establishes the purpose of an organization and defines the company that will serve the customers (Alegre et al., 2018). According to Salehi-Kordabadi, Karimi, and Qorbani-Azar (2020), the mission statement directly affects the performance of companies, as it helps to envision the future, establish the purpose, align behaviors, and encourage critical thinking. GrowthDC’s mission statement reads:

“To boost our clients’ performance through building effective data infrastructure.”

This mission statement is clear, concise, authentic, and unique, which are crucial for a company to develop a strategic view on the operations. GrowthDC’s vision makes an emphasis on the customers’ performance and establishes the means of serving the customer, which are essential characteristics of a good vision statement. Thus, the company’s vision statement appears appropriate.

Values

A statement of corporate values is crucial for building an effective corporate culture. Core corporate values help to make strategic decisions, foster teamwork and help to understand the principles of making business, as they define what is important for the company (Posner, Kouzes, and Schmidt, 1985). Corporate values need to be clear, distinct, and perceived as norms to have an effect on employees’ performance. GrowthDC’s corporate values statement reads:

“We value trust, sustainability, respect, efficiency, excellence, and equality of opportunity.”

While this statement of values is clear, concise, and rememberable, they are not directly related to the vision and mission statements. However, there are some indirect links, as respect and equality of opportunity help to create the best employment opportunities around the globe. At the same time, efficiency and trust help to boost customer experience.

Value Chain

The value chain is a model that describes all the activities a company needs to deliver a product or a service to its customers. Value chain analysis describes and evaluates every step of production to ensure that there are no wastes in the process (Jones, Demirkaya, and Bethmann, 2019). The purpose of the analysis is to maximize the output and minimize costs in every aspect of the production process (Rosales et al., 2017). The most frequently used model for analyzing value chains is Porter’s value chain model (Koc and Bozdag, 2017). This approach divides the production process into five primary activities and four kinds of supporting activities (Ruan, 2020).

Primary activities include inbound logistics, operations, outbound logistics, marketing and sales, and service, while the supporting activities include infrastructure, human resource management, technology development, and procurement (Chen, Yang, and Lin, 2020). Value chain analysis is beneficial for GrowthDC to outline its basic activities and identify the strengths and weaknesses of the process.

The advantages of the value chain analysis are intuitive. The model helps to focus on one micro process at a time to ensure efficiency (Simatupang, Piboonrungroj, and Williams, 2017). Focusing on micro-processes promotes innovation on every step of production, which can be translated into monetary and non-monetary benefits (Koc and Bozdag, 2017). However, there is one significant drawback of the approach. In particular, by focusing on micro-processes, the managers may fail to acknowledge a bigger picture, which implies that the strategic view may be lost (Simatupang, Piboonrungroj, and Williams, 2017). While value chain analysis does a good job analyzing every step of the production, it does poorly in building a connection between the processes (Ricciotti, 2020). Thus, it is crucial that the strategic analysis of GrowthDC will be supplemented with additional approaches.

Primary Activities

Inbound and Outbound Logistics

GrowthDC does not use any logistic services, as no products are shipped to or from the company. Even though GrowthDC uses products of other firms, they are digital and delivered to the company using online mailing and sharing services. While the company helps to build data centers, which may involve shipping servers or other network equipment to customers, GrowthDC relies on the logistics of contractors (i.e., equipment providers), as it does not directly sell these products.

Operations

GrowthDC operations are associated with analyzing, modeling, and building data centers. The company uses the latest technology, such as 3d modeling, to increase customer satisfaction and mutual understanding. GrowthDC’s employees also maintain and manage data centers, which allows the company to receive continuous income rather than simply relying on projects of building and remodeling data centers. GrowthDC is also ready to share its knowledge by providing data center training courses. All the operations are conducted either in the central office of the company or in the offices of the customers. The distribution of revenues from operations is expected to be the following:

- 30% from building, modeling, and auditing of data centers;

- 60% from testing, maintaining, managing, and controlling data centers;

- 10% from data center training.

Marketing and Sales

GrowthDC focuses on providing top-quality services as the primary marketing tool. The majority of the company’s marketing and promotion activity is conducted online using search engine optimization (SEO), email marketing, search engine marketing, and social media marketing. The company also conducts webinars about data center building and management to attract new customers.

Service

GrwothDC aims at building customer loyalty by providing the entire spectrum of services connected with data centers. The company desires to become a one-point stop for the customer to satisfy all the needs associated with data centers.

Supporting Activities

Firm Infrastructure

GrowthDC does not have a clearly established firm infrastructure, such as strategic planning, accounting, legal affairs, and quality management. Currently, the company outsources legal and accounting matters to ensure that high-quality services are provided at the lowest price. However, the company still needs to develop and implement comprehensive strategic planning and quality control practices to ensure long-term growth.

Human Resource Management

HR management is the key to GrowthDC’s success, as it employs the most talented managers and specialists in data center building and management. The company maintains a functional workplace culture that ensures the satisfaction and growth of all employees.

Technology Development

While GrowthDC uses technologies created by other companies, it also invests in developing its own technology. In particular, it uses AutoCad to design data centers and provides visual inventory and physical security automation. The company is always in the search for creating and using the latest technology to meet the needs of its customers.

Procurement

GrowthDC has limited procurement activities due to the nature of the business. The company’s supply chain is built efficiently to optimize service provision.

Porter’s Five Forces

Porter’s Five Forces is a well-established framework that helps to assess a company’s competitive environment. The analysis is crucial for identifying an industry’s strengths and weaknesses to establish a corporate or a business strategy (Bruijl, 2018). The framework aims at assessing five aspects of the external environment, including threat of new entrants, threat of substitution, bargaining power of suppliers, bargaining power of buyers, and competitive rivalry (Bruijl, 2018). While the framework helps to approach possible threats of conducting business from five crucial sides, it has several disadvantages. Dobbs (2014) states that the model lacks structural analysis, strategic insight, and lack of depth. However, the model is still widely used among scholars, entrepreneurs, and students for a wide variety of purposes.

Porter’s Five Forces analysis for GrowthDC is provided in Table 1 below.

Table 1. Porter’s Five Forces.

PESTLE Analysis

PESTLE analysis is a framework used to assess the external environment in which a firm operates. Analysis of the external environment for companies in the modern day is crucial, as enterprises are forced to operate in extremely hectic environments characterized by high degrees of uncertainty, dynamics, and complexity (Shtal et al., 2018). The most commonly used approaches to analyzing are SWOT analysis, PEST(LE) analysis, STEP analysis, GRID matrix, and SNW analysis (Shtal et al., 2018). The present report will use PESTLE and SWOT frameworks to assess the external environment of GrowthDC.

PESTLE analysis is a largely appreciated tool used in a wide variety of industries, including biofuels, energy markets, the agricultural sector, and retailing (Achinas et al., 2019; Christodoulou and Cullinane, 2019; Mihailova, 2020; Nandonde, 2019). The method helps to gain a macro view on an industry by assessing its political, economic, social, technological, legal, and environmental factors (Rastogi and Trivedi, 2016). The advantages of the method include simplicity, facilitation of understanding of the environment, encouragement of strategic thinking, and helping to spot strategic opportunities (Rastogi and Trivedi, 2016).

However, the method is highly dependent on the accuracy of acquired data, which may be difficult to get for GrowthDC (Nandonde, 2019). Additionally, the action should follow the analysis immediately, as the ICT industry environment is extremely uncertain (Canarella and Miller, 2018). Thus, the PESTLE analysis for the company should be conducted frequently to ensure its relevancy. The PESTLE analysis for GrowthDC is provided in Table 2 below.

Table 2. PESTLE analysis.

SWOT Analysis

SWOT analysis is another framework that is frequently used to assess both internal and external environments. The framework assesses four types of factors affecting the business, including strengths, weaknesses, opportunities, and threats (Gurl, 2017). The SWOT framework is beneficial for making strategic decisions, as it helps to identify the crucial resources and capabilities of a company and juxtapose them with the current external environment (Gurl, 2017). In simple words, the framework helps to understand and use a company’s strengths, capitalize on the opportunities, deter threats, and address weaknesses (Leiber, Stensaker, and Harvey, 2018).

However, the analysis does not directly provide strategies for mitigating risks; instead, it acknowledges them without further recommendations (Leigh, 2009). Additionally, the method can generate too much unstructured information, which may lead to confusion (Leigh, 2009). Even though the approach can generate valuable insights, it does not prioritize issues or quantify their impact, which makes the approach partially useful (Leiber, Stensaker, and Harvey, 2018). However, despite its distinct drawback, numerous countries around the globe use the framework to assess their business (Gurl, 2017). SWOT analysis for GrowthDC is provided in Table 3 below.

Table 3. SWOT analysis.

VRIO Analysis

The VRIO framework focuses on the internal environment of the company using the resource-based view. The purpose of the analysis is to identify capabilities and evaluate if they are valuable, rare, inimitable, and organized (Ariyani and Daryanto, 2018). The analysis helps to understand if the capabilities are the sources of long-term strategic advantage (Knot, 2015). VRIO analysis is expected to help GrowthDC to connect its resources with competencies to define the source of sustained growth.

However, there are certain drawbacks to the analysis. In particular, the analysis is considered stationary, which implies that it does not take into account the quickly changing outside environment (Hernández and Garcia, 2018). Therefore, the analysis should be conducted frequently to ensure that the company has the edge over its competitors. Table 4 below provides the capability analysis based on results of previous analyses, and Table 5 provides the VRIO analysis of GrowthDC’s identified capabilities.

Table 4. Capability analysis.

Table 5. VRIO analysis.

The analysis provided above revealed that the company’s central source of competitive advantage is the talents that can provide top-quality the entire spectrum of services to the clients. At the same time, technology can only provide a temporary competitive advantage, as it is imitable. VRIO analysis aligns with SWOT, PESTLE, and Porter’s Five Forces analyses.

Porter’s Generic Strategies

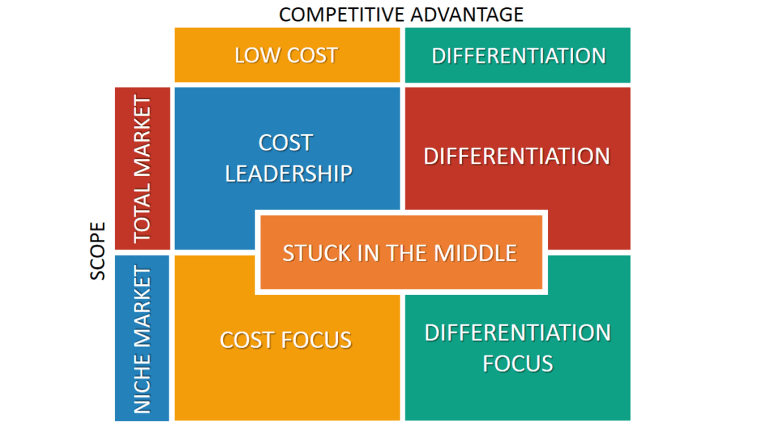

VRIO analysis demonstrated that the primary source of GrowthDC’s sustained competitive advantage is using the exceptional talents the company possesses to provide an entire spectrum of services related to data centers. This capability identifies the generic strategy the company should use to achieve a competitive advantage. According to Porter’s model, there are five generic strategies a company can use to achieve advantage (Islami, Mustafa, and Latkovikj, 2020). They differ depending on their scope, which can be narrow or broad, and source of competitive advantage, which can be cost or differentiation (Viltard, 2017). The method is widely used by strategic analysts around the globe to identify which path a company should take to distinguish itself from its competitors. The five generic strategies are visualized in Figure 1 below.

While the approach helps to understand how to gain strategic advantage, the approach is very limited. Even Porter, the creator of the framework, understood the there are more dimensions to the generic strategies (Moon, H. C. et al., 2014). For instance, strategies can be based on either product or customer, which extends the list of four original generic strategies to eight (Moon, H. C. et al., 2014). However, despite the limitations of the model, it is still applicable to the GrowthDC.

The analysis demonstrates that the most appropriate generic strategy is differentiation. Companies using this strategy aim at distinguishing their products from the products of their competitors (Islami, Mustafa, and Latkovikj, 2020). The goal of this strategy is to provide unique services and products for a wide variety of customers (Viltard, 2017). The unique feature of GrowthDC is providing an exclusive combination of services, which allows its customers to satisfy all the needs associated with data centers. Companies utilizing this approach rely on customer loyalty and creative marketing to emphasize the uniqueness of services. The generic strategy aligns with VRIO analysis, value system, and value chain.

Performance Measures

Setting performance measures is crucial for any company to have the ability to understand if it is successful. An organization scorecard is a crucial tool that helps to set up adequate performance measures in different spheres using the company’s value system, capabilities, strengths, and weaknesses (Tuan, 2020). The framework analyses four categories of performance indicators, including business operations, finance, customers, and growth, to set desired goals (Quesado, Aibar Guzmán, and Lima Rodrigues, 2018).

Additionally, the approach is crucial for conducting gap analysis. The scorecard is beneficial for aligning all the processes in the company, improving information management, boosting strategic planning, and promoting innovation (Quesado, Aibar Guzmán, and Lima Rodrigues, 2018). However, the analysis is complicated for an inexperienced person and requires much data, which limits its use (Hristov, Chirico, and Appolloni, 2019). The organizational scorecard for GrowthDC is provided in Table 6 below.

Table 6. Organizational scorecard for GrowthDC.

Gap Analysis

Gap analysis is a crucial method that helps to identify strategies for moving from the current state to the desired state if there is a necessity. The method is clear and easily understandable even for an inexperienced user, as it has an intuitive structure (Beauvais et al., 2017). At the same time, there is a high chance that the results of gap analysis will be outdated, as they are based upon the data that can quickly chain due to external and internal factors (Jennings, 2000). Therefore, it is crucial for the company to hire the best specialists to conduct audits and draw conclusions. An expert can decrease the chances of receiving false information and help to create strategies to close the identified gaps. Gap analysis for GrowthDC based on the organization’s scorecard is provided in Table 7 below.

Table 7. Gap analysis for GrowthDC.

The analysis provided above revealed that the gap of the highest urgency is the problem with working capital. By increasing working capital, the company can invest in marketing, which can increase the market share. Having a larger market share is expected to increase the NPM, as the GrowthDC will be able to cover its fixed cost using the revenues from the increased market share. It should also be noticed that even though the employee turnover and customer satisfaction rate are problems because the company has a limited number of customers and it has been working for a short period. These problems may arise in the near future, which implies that the gap analysis should be conducted frequently with the updated data.

Conclusion

Even though GrowthDC is a startup that has not yet started to make a profit, it is a well-established firm with an aligned value system and value chain. Even though the company does not offer unique products, it offers an exclusive combination of products, which can be a solid base for the company’s future development.

This implies that the company took the path of differentiation. GrowthDC’s primary strengths, including the best talents in UAE and the most advanced technology, can help the company to achieve its far-reaching goal to become a global company. However, the company will need to utilize the identified opportunities to overcome the threats associated with the outside environment and weaknesses associated with its current unstable financial position. The analysis demonstrated that the company has three gaps that should be closed in the nearest future, including lack of working capital, low market share, and negative NPM.

The company’s recent strategic decision was to acquire additional funding to continue aggressive development. This decision is aligned with the results of all the conducted analyses. First, aggressive development aligns with the company’s vision to become a global company. Second, Porter’s five forces analysis revealed that the company operates in a highly competitive environment, which implies that the company should support aggressive development to ensure its success. Third, by acquiring additional funding, GrowthDC addresses one of its major weaknesses of having low financial resources, which was identified in the SWOT analysis.

Finally, the company increases its working capital by acquiring additional funding, which implies that it closes one of its most urgent gaps. However, the company should utilize the most appropriate source of funding to ensure that takes into consideration outside and inside environment. In summary, all the strategic management models discussed in the present report support the company’s decision to acquire additional funding for development.

Recommendations

The conducted analysis demonstrates that GrowthDC needs to adhere to the following recommendations to improve its current strategic position:

- Increase its current working capital by taking a loan. As it was mentioned in the previous section, the strategic decision to acquire additional funding was coherent with all the conducted analyses. The most appropriate source of funding during the pandemic in UAE is a bank, as was mentioned in the SWOT analysis in the opportunities section. Additionally, SWOT analysis revealed that the company’s cost of capital is very high due to the high expectations of potential investors. Therefore, using debt to finance growth is an appropriate decision, as it uses the identified opportunity and addresses one of its strengths.

- Develop a creative marketing strategy to emphasize uniqueness. GrowthDC’s preferred generic strategy is differentiation, which requires a creative marketing strategy. Having a distinct marketing strategy can help the company to capture a higher market share, which is one of the identified gaps. Additionally, having a coherent marketing strategy will help to communicate the company’s values and follow its vision. The company should use the money acquired from the loan to finance the marketing strategy.

- Design and implement a coherent customer loyalty campaign. Since GrowthDC uses differentiation as its primary strategy, it should ensure strong customer relations. Such a focus will help to maintain a high customer satisfaction rate, which is crucial, according to the identified measures of success. A well-designed customer loyalty program puts an emphasis on the customer, which is coherent with the company’s mission statement. Additionally, such a campaign will help to increase profitability due to a constant flow of sales and decreased cost of revenue.

- Actively maintain the current corporate culture. The company’s central source of success is human resources. Retaining talents is the key to the company’s competitive success. Currently, the company ensures employee retention using its outstanding corporate culture. Therefore, it is crucial to ensure that corporate culture remains functional, as any negative shifts may lead to financial and non-financial losses. This recommendation is aligned with the gap and VRIO analyses. Additionally, it is coherent with the company’s vision.

References

Achinas, S. et al. (2019) ‘A PESTLE analysis of biofuels energy industry in Europe’, Sustainability, 11(21), article 5981.

Al Blooshi, L. S. et al. (2020) ‘Climate Change and Environmental Awareness: A Study of Energy Consumption among the Residents of Abu Dhabi, UAE’, Perspectives on Global Development and Technology, 18(5-6), pp. 564-582.

Alegre, I. et al. (2018). ‘The real mission of the mission statement: A systematic review of the literature, Journal of Management & Organization, 24(4), pp. 456-473.

Ariyani, W. and Daryanto, A. (2018) ‘Operationalization of internal analysis using the VRIO framework: Development of scale for resource and capabilities organization (Case study: XYZ company animal feed business unit)’, Asian Business Research Journal, 3, 9-14.

B2U (2021) Porter’s generic strategies: Differentiation, cost leadership, and focus. Web.

Beauvais, et al. (2017) ‘After the gap analysis: Education and practice changes to prepare nurses of the future, Nursing Education Perspectives, 38(5), pp. 250–254.

Berisha Qehaja, A., Kutllovci, E., and Shiroka Pula, J. (2017) ‘Strategic management tools and techniques usage: a qualitative review’ Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, 65(2), pp. 585-600.

Bruijl, G. H. T. (2018) ‘The relevance of Porter’s five forces in today’s innovative and changing business environment’, SSRN. Web.

Bocanet, A., Alpenidze, O., and Badran, O. (2021) ‘Business analysis in post-pandemic era’, Academy of Strategic Management Journal, 20(4), pp. 1-9.

Canarella, G. and Miller, S. M. (2018) ‘The determinants of growth in the US information and communication technology (ICT) industry: A firm-level analysis’, Economic Modelling, 70, pp. 259-271.

Carter, C. (2013) ‘The age of strategy: Strategy, organizations and society’, Business History, 55(7), pp. 1047-1057.

Cattani, G., Porac, J. F., and Thomas, H. (2017) ‘Categories and competition’, Strategic Management Journal, 38(1), pp. 64-92.

Chen, Y. L., Yang, T. C., and Lin, Z. S. (2004). A study on the modeling of Knowledge value chain. Knowledge Management, 6, pp. 1-12.

Christodoulou, A. and Cullinane, K. (2019) ‘Identifying the main opportunities and challenges from the implementation of a port energy management system: A SWOT/PESTLE analysis’, Sustainability, 11(21), article 6046.

Data Commons (2020). United Arab Emirates. Web.

Dobbs, M. E. (2014) ‘Guidelines for applying Porter’s five forces framework: a set of industry analysis templates’, Competitiveness Review, 24(1), pp. 32-45.

Elbanna, S., Al Katheeri, B., and Colak, M. (2020) ‘The harder firms practice strategic management, the better they are’, Strategic Change, 29(5), pp. 561-569.

Fuertes, G. et al. (2020). ‘Conceptual framework for the strategic management: a literature review — descriptive’, Journal of Engineering, 2020, article 6253013, pp. 1-21.

Gotcheva, N., Watts, G., and Oedewald, P. (2013) ‘Developing smart and safe organizations: An evolutionary approach, International Journal of Organizational Analysis, 21(1), pp. 83-97.

Gurl, E. (2017) ‘SWOT analysis: A theoretical review’, Procedia Computer Science, 159, pp. 1145–1154.

Hernández, J. G. V. and Garcia, F. C. (2018) ‘The link between a firm s internal characteristics and performance: GPTW & VRIO dimension analysis’, Revista de Administração IMED, 8(2), pp. 222-235.

Hristov, I., Chirico, A., and Appolloni, A. (2019) ‘Sustainability value creation, survival, and growth of the company: A critical perspective in the Sustainability Balanced Scorecard (SBSC)’, Sustainability, 11(7), article 2119.

Illes, K. and Vogell, C. (2018) ‘Corporate values from a personal perspective’, Social Responsibility Journal, 14(2), pp. 351-367.

Islami, X., Mustafa, N., and Latkovikj, M. T. (2020) ‘Linking Porter’s generic strategies to firm performance’, Future Business Journal, 6(1), pp. 1-15.

Jennings, M. D. (2000) ‘Gap analysis: concepts, methods, and recent results, Landscape ecology, 15(1), pp.5-20.

Jones, L., Demirkaya, M., and Bethmann, E. (2019) ‘Global value chain analysis: Concepts and approaches’, J. Int’l Com. & Econ., 1, pp. 1-29.

Kantabutra, S. and Avery, G. C. (2010) ‘The power of vision: statements that resonate’, Journal of Business Strategy, 31(1), pp. 37-45.

Kirkpatrick, S. A. (2017) ‘Toward a grounded theory: A qualitative study of vision statement development’, Journal of Management Policy and Practice, 18(1), pp. 87-101.

Knott, P. J. (2015) ‘Does VRIO help managers evaluate a firm’s resources?’ Management Decision, 53(8), pp. 1806-1822.

Koc, T. and Bozdag, E. (2017) ‘Measuring the degree of novelty of innovation based on Porter’s value chain approach’ European Journal of Operational Research, 257(2), pp. 559-567.

Leigh, D. (2009). ‘SWOT analysis’, Handbook of Improving Performance in the Workplace: Volumes, 1‐3, pp. 115-140.

Leiber, T., Stensaker, B., and Harvey, L. C. (2018) ‘Bridging theory and practice of impact evaluation of quality management in higher education institutions: A SWOT analysis, European Journal of Higher Education, 8(3), pp. 351-365.

Lucas, J. R. (1998) ‘Anatomy of a vision statement’, Management Review, 87(2), pp. 22-26.

Mihailova, M. (2020) ‘The state of agriculture in Bulgaria–PESTLE analysis’, Bulgarian Journal of Agricultural Science, 26(5), pp. 935-943.

Moon, H. C. et al. (2014) ‘Extending Porter’s generic strategies: from three to eight’, European Journal of International Management, 8(2), pp. 205-225.

Nandonde, F. A. (2019) ‘A PESTLE analysis of international retailing in the East African Community, Global Business and Organizational Excellence, 38(4), pp. 54-61.

Posner, B. Z., Kouzes, J. M., and Schmidt, W. H. (1985) ‘Shared values make a difference: An empirical test of corporate culture’, Human Resource Management, 24(3), pp. 293-309.

Quesado, P. R., Aibar Guzmán, B., and Lima Rodrigues, L. (2018) ‘Advantages and contributions in the balanced scorecard implementation’, Intangible Capital, 14(1), pp. 186-201.

Raynor, M. E. (1998) ‘That vision thing: Do we need it?’ Long-range planning, 31(3), pp. 368-376.

Rastogi, N. I. T. A. N. K. and Trivedi, M. K. (2016). ‘PESTLE technique–a tool to identify external risks in construction projects, International Research Journal of Engineering and Technology (IRJET), 3(1), pp. 384-388.

Ricciotti, F. (2020) ‘From value chain to value network: a systematic literature review’, Management Review Quarterly, 70(2), pp. 191-212.

Rosales, R. M. et al. (2017) ‘Value chain analysis and small-scale fisheries management, Marine Policy, 83, pp. 11-21.

Ruan, S. (2020) ‘Research on Strategic Cost Management of Enterprises Based on Porter’s Value Chain Model’, Journal of Physics: Conference Series, 1533(2), p. 022056).

Salehi-Kordabadi, S., Karimi, S., and Qorbani-Azar, M. (2020) ‘The Relationship between Mission Statement and Firms’ Performance’, International Journal of Advanced Studies in Humanities and Social Science, 9(1), pp. 21-36.

Saleem, I. et al.(2021). Gulf business environment for the Arabic Family Firms: Evidence from Oman during the COVID-19 Pandemic. In Impact of Infodemic on Organizational Performance (pp. 231-249). IGI Global. Web.

Shtal, T. et al. (2018) ‘Methods of analysis of the external environment of business activities’, Revista ESPACIOS, 39(12), pp. 1-9.

Simatupang, T. M., Piboonrungroj, P., and Williams, S. J. (2017). ‘The emergence of value chain thinking’, International Journal of value chain management, 8(1), pp. 40-57.

Stowe, L. (2021). Employee attrition rate. Web.

TEXPO (no date) We are TEXPO! Web.

Tuan, T. T. (2020) ‘The impact of balanced scorecard on performance: The case of Vietnamese commercial banks’, The Journal of Asian Finance, Economics, and Business, 7(1), pp. 71-79.

Van der Walt, J. L., Kroon, J., and Fourie, B. J. (2004) ‘The importance of a vision and mission for small, medium-sized and large businesses, South African Journal of Economic and Management Sciences, 7(2), pp. 206-220.

Viltard, L. A. (2017) ‘Strategic mistakes (AVOIDABLE): the topicality of Michel Porter’s generic strategies’, Independent Journal of Management & Production, 8(2), pp. 474-497.