Use of financial ratios

The first group contains the return on capital employed. It is a fundamental ratio used to assess the financial health of an institution and a suitable measure of profitability of an entity. Even though it is not adequate, it provides a good indication of how a business makes use of total resources to generate profit. A high value of return on capital employed is preferred to a low value. The second group is made up of liquidity ratios, which measure the ease with which an entity can pay current liabilities using current assets. Apart from measuring the ability of a company to pay off current liabilities, the ratio also indicates how a company manages current assets. High liquidity ratios imply that a company holds a lot of money in non-productive current assets.

The third group comprises turnover ratios. The turnover ratios show the proficiency of a company. Inventory turnover shows how frequently a company purchases new stock. Accounts receivable ratio shows the efficiency of a company in collecting debts. Accounts payable turnover measures the frequency of creditors’ and suppliers’ payments. A high accounts payable turnover ratio indicates that the company pays the creditors back fast. Finally, the total assets turnover ratio measures the amount of sales generated from a unit of total assets.The ratios in the fourth group measure the profitability of a company. Return on equity shows the profitability of the shareholder’s equity. Return on total assets measures the amount of net income earned from each unit of total assets. High profitability ratios are preferred.

The fifth group includes earning per share. It shows the profitability of the shares. A high ratio of dividend pay per share is preferred to low ratios. Ratios in the sixth group measure the leverage of the company. Debt to equity ratio shows the amount of debt financing in relation to the amount of equity. Interest coverage ratio shows the number of times that interest can be paid off from operating income (Collier 26).

Discussion of ratios for the entities

Middle State bank

The bank is a potential debt provider. The bank may be interested in ratios in group six. These are debt equity ratio, interest coverage and gearing. The ratios show the amount of debt financing in the company.

Majestik Company

The supplier will be interested in the efficiency ratios. These are the ratios in group three. The supplier will focus on the inventory turnover and the accounts payable turnover. The ratios will show the number of times the company buys assets and how frequently the organisation settles accounts payable. Also, a supplier would be interested in the profitability of the company.

Investment trust

The analyst will be interested in the investment ratio in group six. The earnings per share will indicate the amount of profit per share. Dividend paid per share indicates the productivity of shares. The profitability of the shares and the earnings of the share is necessary when making a decision to include the shares of Smart electronics in the new proposed portfolio.

Working capital management committee

The committee will focus on the return on capital employed. It shows the productivity of capital employed in the business. The committee will also require an efficiency ratio. These ratios will be important since they show the productivity of capital employed.

Additional ratios for the entities

Apart from the ratios mentioned above, the entities might require more ratios to make an informed decision on the financial health of the company. First, the committee will require the return on assets and return on equity. Also, the committee will require the liquidity ratios. The investment trust will need return on equity, which shows the profitability of the shareholder’s fund. The Majestik company will require the liquidity ratios. The ratios are important for a debt provider because the supplier will provide goods on credit. Finally, the Middle State bank will require the efficiency ratios as they show how efficient the company is in managing resources (Fraser 50).

Financial position of Smart Electronics

Investment ratios

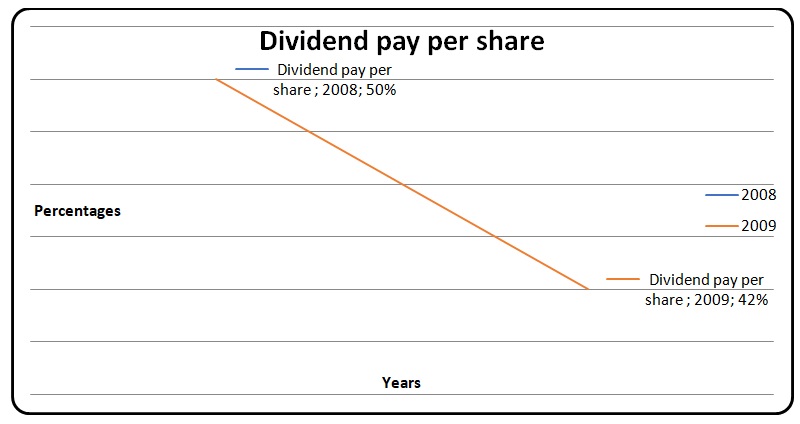

The investment ratios indicate the performance of the shares. This is indicated by the earnings per share which declined from $2.15 in 2008 to $1.75 in 2010 and dividend pay per share which also reduced from 50% in 2008 to 35% in 2010 as shown in the graph below. The earnings per share were below the industry average.

Leverage

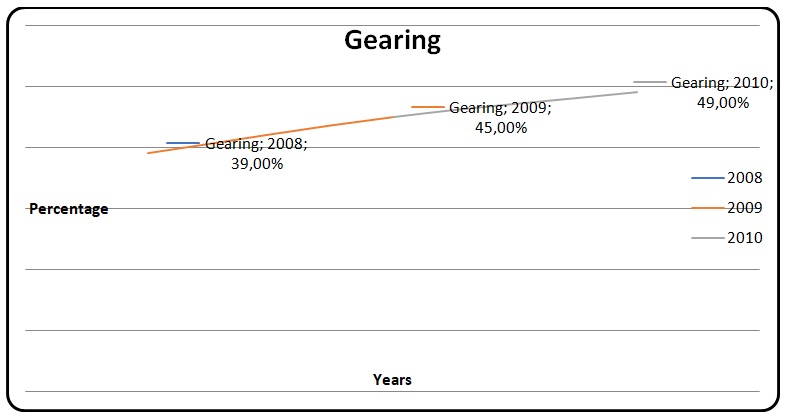

The leverage ratios show the level of debt financing of the company. The debt to equity ratio increased from 1.41x in 2008 to 1.44x in 2010. Similarly, gearing ratio increased from 39% in 2008 to 49% in 2010. The ratios were higher than the industry average, which was unfavorable. Finally, interest coverage ratio declined from 6.08xin 2008 to 3.70x in 2010. Besides, they were lower than the industry average.

Liquidity

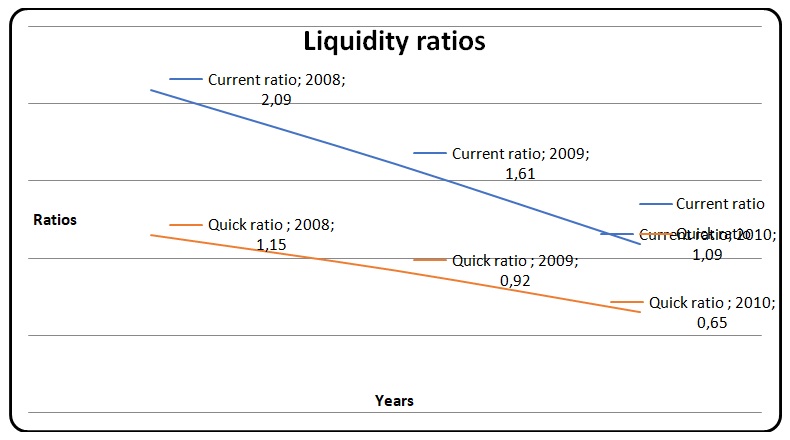

The current ratio declined from 2.09x in 2008 to 1.09x in 2010. Similarly, quick ratio declined from 1.15x in 2008 to 0.65x in 2010. The ratios were less than the industry average for the three years. Besides, they are declining as shown in the graph below.

Efficiency

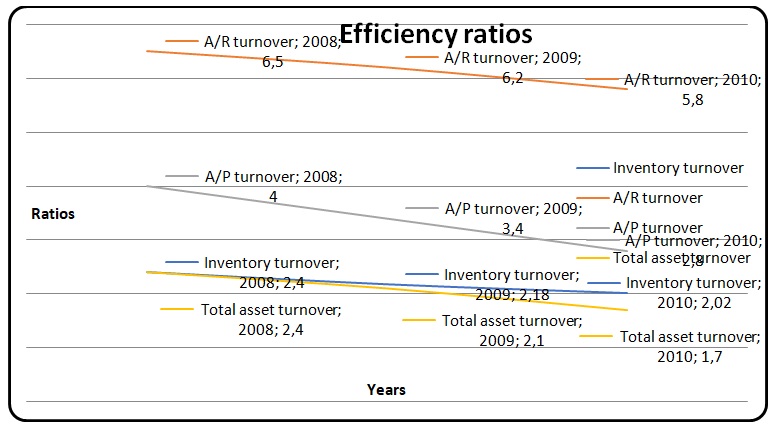

Inventory turnover dropped from 2.40x in 2008 to 2.02x in 2010. Accounts receivable turnover declined from 6.50x in 2008 to 5.80x in 2010. Also, accounts payable turnover declined from 4.00x in 2008 to 2.80x in 2010. Finally, total asset turnover declined from 2.40x in 2008 to 1.70x in 2010 as shown in the graph below. All the ratios were below the industry averages apart from accounts receivable turnover. The declining ratios are not favorable.

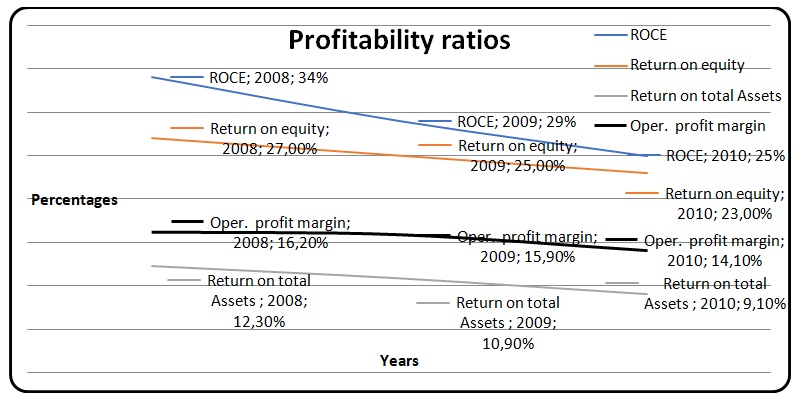

Profitability

Return on capital employed dropped from 34% in 2008 to 25% in 2010. Return on equity declined from 27% in 2008 to 23% in 2010. Further, return on total assets dropped from 12.3% in 2008 to 9.1% in 2010. Finally, operating profit margin declined from 16.2% in 2008 to 14.1% in 2010. On average, the profitability of the company was below the industry average. The decreasing trend in profitability is not favorable.

Ethical issues

An ethical issue arising in the case is the use of insider information. It can be seen in the dialogue between George Meckler (new supplier) and Lind Brown (analyst at the brokerage firm). George Meckler is aware of a potential loss that may arise from the sale to one of the potential customers that is the government. The sale of the company may have serious consequences on the financial position of the company. To use such information is unethical, and it amounts to insider trading (Atrill 120).

Works Cited

Atrill, Peter. Financial management for decision makers, Harlow: Financial Times Prentice Hall, 2009. Print.

Collier, Peter. Accounting for managers, London:John Wiley & Sons Ltd, 2009. Print.

Fraser, Van. Decision accounting, Oxford: Basil Blackwell Ltd, 2009. Print.