Introduction

The United Arab Emirates is the second-largest economy in the Arab region. It comes closely behind Saudi Arabia. Currently, UAE is the eighth largest oil producer in the world. The country maintains a free market system. The open system gives the nation means that investors from different parts of the world can freely trade in the economy. In addition, the arrangement provides businesses in the region with financial freedom. To this end, regulations are limited. The government does not limit the freedom of the people to conduct trade (World Bank Group 2014a). The country has successfully maintained an open market system because of the strength of its currency in the region. A free market cannot work in a poor economy. The success of this country’s economy is largely attributed to its political stability.

On its part, India is one of the fastest-growing economies in the world. Like the UAE, the country has also adopted a free market system. The arrangement was introduced in 1991. It has led to the commercialization of the country’s market in relation to international trade. Political stability in India is another factor that has helped the nation to establish and develop its trade (World Bank Group 2014b). Freedom of trade has helped the country to emerge as one of the largest exporters in the world.

In this paper, the author will conduct a comparative analysis of the economies of India and the UAE. To this end, the GDP and PPP of the two countries will be compared. Other factors that will be taken into consideration include such indices as unemployment levels in the two countries.

Analyzing GDP and Purchasing Power Parity in UAE and India

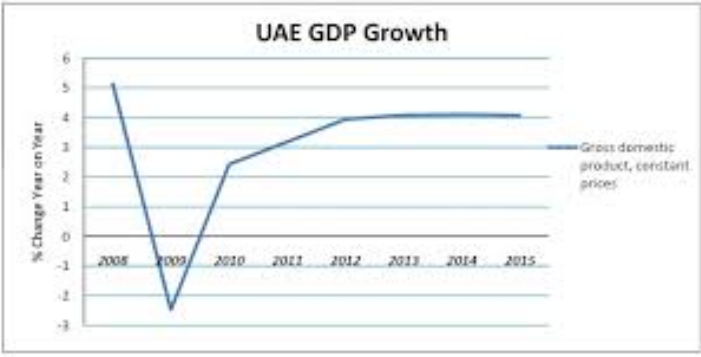

According to the IMF, the GDP of the UAE stands at $570 billion as of 2014 (International Monetary Fund [IMF] 2015). The figure is equivalent to AED 2.1 trillion. According to the World Bank, the PPP of UAE in 2012 was 96116.54 USD (World Bank, 2015). It is noted that 72% of the total GDP in this country is attributed to activities in the non-oil sectors of the economy. However, in spite of this, the economy of the UAE is largely dependent on oil in the GCC. Estimates from the IMF predict a bright future for the country’s economy. For example, for the next 7 years, it will expand by an average of 4.5% per annum. The GDP per capita of the nation lies at $63,181 as of 2014 (World Bank Group 2014a). Different sectors of the economy contribute to its growth. The agricultural sector accounts for 0.8% of the total GDP. On its part, the contribution of the service sector lies at 43.1%, while that of the industry segment is 56.1% of the total GDP according to 2013 estimates (IMF 2014). Figure 1 illustrates the country’s GDP in the recent past.

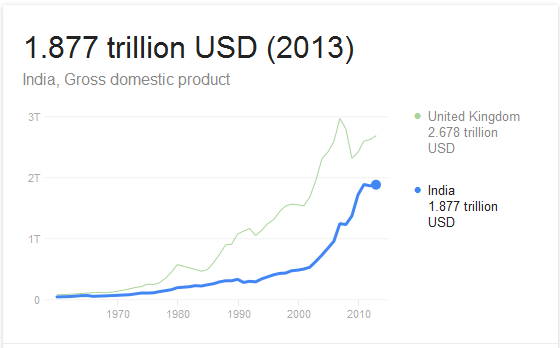

As of 2015, the GDP of India was estimated to be $2.308 trillion. The nation is also known for its large purchasing power parity (PPP). It is the third in the world in PPP and seventh in GDP. The value of the former as estimated in 2015 lies at $7.997 trillion. Nominal GDP per capita was $1,809 and that of PPP $6,267 as of 2015. The nominal GDP growth rate in the next five years is expected to be 11.6% (IMF 2015). The growth of PPP is expected to be 7.4%. According to the IMF (2014), agriculture accounts for 13.7 percent of the country’s GDP. The service sector takes up 64.8%, while the industrial segment accounts for 21.5% of the total GDP (Lone & Mehraj 2015). Figure 2 shows the country’s GDP over the years.

The GDP and PPP of the two nations vary. To this end, UAE has a lower GDP and PPP compared to India. However, the economy of the UAE has been able to take care of all the population. The difference in the figures can be attributed to the geographical sizes of the nations. India is large in size compared to the UAE. A large surface area means that the country can accommodate a bigger population. A large number of people contributes to the high GDP and PPP (World Bank Group 2014b). The distribution of industries and the labor force is different between the two countries because of their sizes. The distribution of labor is a significant determinant of the relationship between GDP and PPP.

Inflation Rates of UAE and India

In spite of the high performance of the country’s economy, UAE has an inflation rate of about 2-3% (Bouoiyour & Selmi 2014). The rate is expected to remain the same in the next number of years (World Bank Group 2014b). According to the Indian Finance Ministry, inflation in the country is expected to rise to 5.11% in 2015 (IMF 2015). The economy is also expected to grow by 7.4% in the 2014-2015 financial year. The projection is reported in the IMF’s annual report on the country.

The inflation rates of the two countries will differ in the years to come. The move shows that the two economies are expected to change in the next few years to come. An increase in the cost of living in the two nations will be of benefit to their currencies. The strength of the two currencies in the world market is expected to change with the inflation rates. Information on these changes is reported in the CIA World Fact Book. In most cases, inflation is initiated by the government of a nation to improve the economy.

Analyzing Labour Force and Levels of Poverty in UAE and India

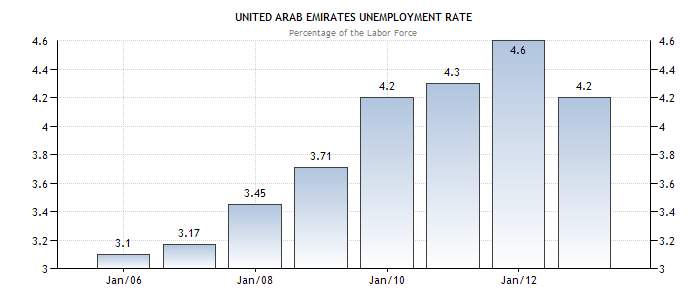

The number of people living below the poverty line in the UAE by 2011 was estimated to be 0% of the population (World Bank 2015). It means that the economy has the ability to take care of the entire population. In 2014, the labor force in the region stood at 4.35 million individuals. According to the IMF (2015), 7% of the labor force is taken up by the agricultural sector. The industry sector takes up 15%, while the service segment accounts for 78%. The rest of the people in the labor force are unemployed. What this means is that the unemployment rate in the country stands at 4.6% (IMF 2015). Figure 3 shows the levels of unemployment in this country. The major industries in the region include those in the petroleum, aluminum, cement, fishing, and fertilizer sectors (World Bank Group 2014a).

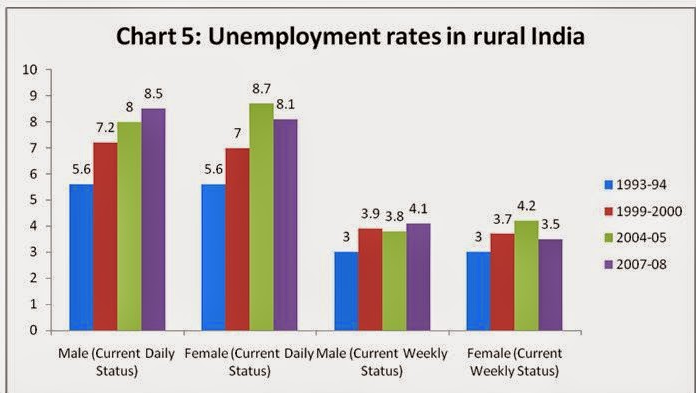

Using India’s PPP level, the United Nation’s Millennium Development Goal program estimated that 21.9% of the total population lives below the poverty line as of 2011 (Lone & Mehraj 2015). The Gini coefficient that shows the income distribution of the residents of a nation was estimated to be 34% in 2014. It showed inequality in the distribution of income. The labor force in the nation as of 2014 was estimated to be 487.5 million individuals. Out of this, 31% were in the service sector, 20% in the industry sector, and 49% in the agricultural sector. The remaining 5% of the labor force was unemployed. The unemployed were distributed in the rural and urban regions (IMF 2014). Figure 4 shows the distribution of unemployment in the country’s population. In 2014, the average annual household income was estimated to be $6,668. The average gross salary per hour was $1.56 in the same year. The dominant industries in the region include those in the petroleum, software, pharmaceutical, steel, and agricultural sectors.

The level of poverty in the two nations shows the strengths of their respective economies. The economic growth of the two can be projected by looking at the number of unemployed persons in the society. High levels of unemployment show that there are higher chances of the economy growing slowly (Dahlman & Utz 2005). The economy of the UAE is expected to grow faster than that of India. The reason is that the number of people living below the poverty line in the UAE is small.

The Exporting and Importing Powers of UAE and India

The power to export illustrates the ability of an economy to produce. The power to import, on the other hand, shows the strength of a nation with regards to purchasing. The two variables depend on the status of the economy and the market systems in place. Both UAE and India have an open market system (World Bank Group 2014b). According to the CIA World Fact Book, in 2013, total exports in UAE amounted to $368 billion. A wide range of goods was exported. They include, among others, marine and oil products. According to the IMF (2015), UAE exports to countries like Japan, India, Thailand, Singapore, South Korea, and Iran.

The total imports of UAE amount to $273.5 billion (World Bank 2015). It shows that the country exports more than it imports. Having more exports than imports is an indication of a healthy economy. Some of the products exported include chemicals, food, machinery, and transport equipment. Some of the countries that import from the UAE include India, China, Japan, Germany, and the United States. From its operations, the country recorded $130.3 billion in revenues in 2012 (IMF 2015). Expenses incurred by the economy in the same year amounted to $99 billion. The statistics show that the economy was at a state of equilibrium during this period. Public debt amounted to 40.4% of the GDP, while gross external debt was $151.8 billion (IMF 2015).

India is also involved in importing and exporting. The country exports both merchandise and services. According to the CIA World Fact Book, the value of this trade stands at $464.2 billion (IMF 2015). A wide range of products is exported. They include textile and oil products (World Bank Group 2014b). Some of the countries that import from India include the European Union, United Arab Emirates, China, and Singapore.

The value of Indian imports in 2013 amounted to $590.6 billion. Statistics show that the country imported more than it could produce. The situation is different in the UAE. The economy of India at the time was not in balance. Expenditure in the same year was $281.6 billion. Income stood at $181.3 billion. Having more expenses than revenues shows a fault in the economy. In light of this, it is noted that in the financial year 2014-2015, India had a budget deficit that was equivalent to 4.1% of the GDP (Lone & Mehraj 2015). The deficit and the failure to cover expenses show that the economy was weak. It cannot be compared with that of the UAE. UAE was able to sustain itself and cover all its expenses by the revenues generated.

Economic Variables in India and UAE

GDP

The economic variables used in the analysis provided above include the GDP, PPP, inflation rates, labor force, and the export and importing powers of the two nations. GDP is one of the most important indicators of a given economy. Real GDP provided important information that was used to compare the economies of the two nations (IMF 2014). From the figures obtained, it is possible to tell the output of a given economy. The value of products in the countries within the specified period was compared using this variable. The GDP of the two nations showed the status of the economies during that period.

The purchasing power parity (PPP) also indicated the health of the economy and its ability to purchase or import. The GDP of the two countries can be calculated using the formula below:

GDP (Y) =C+I+G+(X-M).

Y is the GDP, while C represents consumption (IMF 2015). I represent the investments of the countries, while G is government spending. X-M represents net exports in the two countries.

Inflation

The inflation rate is one of the six variables used to analyze an economy. The use of the rates, in this case, provided significant information used to compare the economies of the two nations. Most investors take into consideration the rates of inflation when focusing on a specific market. The variable involves either an increase in price levels or in money supply (Dahlman & Utz 2005). Statistics on inflation of the two economies can be used to identify the weaker one. High inflation rates are dominant in a weak economy (IMF 2014). Usually, the high prices evidenced in such countries are aimed at improving the state of the economy. Inflation is also aimed at improving the value of a currency. The effects of this variable are felt by the consumer.

The government of India is trying to improve the economy by putting in place high inflation rates (IMF 2015). In the UAE, the rate is expected to remain constant in the next five years. The move is an indication of the fact that the economy can sustain the current population without the need to review inflation upwards.

Unemployment Rates

The third economic variable in this situation is the labor and the rate of unemployment. It is possible to tell the status of the two economies by comparing this element. Unemployment has various impacts on the economy. The variable is higher in India than in the UAE. From statistics obtained from the World Bank indicators website, it is evident that India imports more than it produces (IMF 2014). Consequently, what the country bought from other countries was more than what it sold. Unemployment is one of the factors behind this development. The inability of the economy to provide adequate job opportunities leads to reduced productivity. In the UAE, unemployment is lower than in India. People in the nation are engaged in different production endeavors. As a result, exports are higher than imports. The economy is healthy because there is enough manpower working in the industries and other sectors. The situation is different in India where reports by the IMF (2015) indicate that unemployment leads to the loss of approximately 70% of the income of the country.

Relating Variables to Broader Indicators

Standards of living in the two countries can be compared because of the differences in their respective economies. According to the World Bank Economic Prospects (GEP) report, economic growth in India was estimated to be 2.6% in 2014 (World Bank 2015). The world economy is expected to grow by 3% in 2015. It will grow by 3.3% in 2016. The organization predicts that this growth will fall slightly to 3.2% in 2017 (World Bank 2015). However, the prices of products in India are expected to remain constant in 2015. On the other hand, the economic prospects of the UAE in 2015 are predicted to go down to 3.5%. In 2016, the economic growth of the nation is projected to remain constant at 3.5%. Dubai is expected to have a different growth rate of 4.5% in 2015 and 4.6% in 2016 (IMF 2015).

The rates of growth in the two nations are different because of such aspects as unemployment. Projections indicate that the standards of living of people in the two economies will increase in the next two years. Analysis of economic trends in the two countries indicates a bright future for both. Future developments are expected to spur the economies and raise them to a new level (Lone & Mehraj 2015).

Factors that can Support the Growth of the Economies of India and UAE

An analysis of the Indian economy reveals that some sections of the population are struggling to cope with the situation. The majority of people in the country are living below the poverty line. The state of the country’s economy can be improved by allowing more investors to access the local market. Foreign investment can spur the growth of different local businesses. The development of these businesses will create more employment. Consequently, the quality of life of people living in the country will improve significantly (Dahlman & Utz 2005). A decrease in the rate of unemployment will lead to positive growth in the GDP of the nation. In turn, the move will lead to surpluses in the economy. Consequently, imports will reduce as exports increase (IMF 2014). Alternatively, growth in GDP can to a state of equilibrium between spending and income. In light of this, it is obvious that the Indian government has a role to play in ensuring that the economy grows as expected.

The economy of the UAE can also be made to grow more. The country is an investment hub for persons and businesses from different parts of the world. The government can support the growth of the local economy by concentrating on those products that it is best in. The IMF states that the country can grow faster if it focuses on the provision of high-quality oil products at competitive prices (World Bank 2015). Managing these prices can increase the demand of the products. As a result, the GDP will improve.

References

Bouoiyour, J & Selmi, R 2014, GCC countries and the nexus between exchange rate and oil prices: what wavelet decomposition reveals.

Dahlman, C & Utz, A 2005, India and the knowledge economy: leveraging strengths and opportunities, World Bank Publications, New York.

International Monetary Fund 2014, India: economy stabilises, but high inflation, slow growth key concerns, Web.

International Monetary Fund 2015, Transcript of the press conference on the Middle East and Central Asia 2015 economic outlook update and low oil prices.

Lone, T & Mehraj, M 2015, ‘MSMEs in India: growth, performance, and various constraints impeding their growth’, Journal of Economics and Sustainable Development, vol. 6 no. 3, pp. 76-82.

World Bank 2015, Global economic prospects to improve in 2015, but divergent trends pose downside risks, says WB.

World Bank Group 2014a, Doing business 2015: going beyond efficiency, economy profile 2015, United Arab Emirates, Web.

World Bank Group 2014b, Doing business 2015: going beyond efficiency, economy profile 2015, India, Web.