Business Overview

Aldar Properties is currently the largest property developer in Dubai. Established in October 2004 as a real estate developer, Aldar has initiated ventures in the areas such as residential units, retail, commercial buildings, the entertainment industry, and five-star hotels. Currently, Aldar is the second-largest real state developer in UAE by market value. Currently, the biggest projects on cards from Aldar include Yas Island, Al Raha Beach, and several hotels.

Yas Island was announced in November 2006 and is scheduled to be completed by 2014. The project will cost $40 billion and it occupies a total land area of 25 million square meters. Yas Island is a mega project comprising various attractions such as Water Park, theme park, golf courses, hotels, polo courses, residential and official apartments, luxury villas, and food and beverage restaurants. The Aldar headquarters are also planned to be built in Yas Island. Al Raha Beach, an $18 billion costing project, is another mega-scale venture that will comprise residential and commercial apartments with beachfront. It will also have recreational facilities like parks, golf courses, and service clubs. The residential part of the project will be housing a total of 120,000 residents by 2016 at completion.

Like any other construction giant Aldar currently engages more than 150,000 laborers and employees. To accommodate its workers Aldar plans to build 5000 units in the AL Falah project. Furthermore, Aldar has established housing colonies of more than 50,000 workers in Al Ain and Abu Dhabi. It has also joined the Estidama, the collective move to counter the environmental issues created by the massive construction process.

Financial Performance Analysis

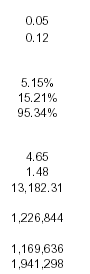

Following are the financial highlights for Aldar for nine months up to September 2008.

Aldar’s gross revenue increased by 203%, from AED 146 million to AED 4.4 billion in the corresponding period last year (although the quarter-to-quarter profit declined by 39% due to the current financial crisis). AED 3.99 billion is attributed to the sale of land plots in Gross Revenue and 647.7 accounts to the sale of residential units. This figure is huge regarding the current low-run in property prices.

The direct costs increased from AED 91 million to AED 2.55 billion (This amount is primary to the construction costs of raw materials and labor).

The gross profit increased from AED 55 million to AED 2.55 billion.

The gross profit margin in September 2008 is 57.97%; an increase from 37.56% up to September 2007.

Net profit increased from 1.41 billion (in Sep 2007) to AED 3.36 billion in Sep 2008.

Total Assets increased from 19.08 billion to 44.3 billion (both years up to Sep).

A sharp increase is seen in the investment property under development that increased from 3.07 billion to 12.9 billion (AED). This largely attributes to the non-cash fair-value gain on an investment property.

The most important indicator for Aldar’s sustainability; construction work in progress has increased by over 200%; from 2.66 billion to 5.35 billion AED.

Shareholders’ equity increased from 5.56 billion AED to 16.29 billion AED (an increase of 350%).

The company has gained immense credibility as it received Moody’s AAA rating for its equity bonds issued in early 2008. Also, Aldar received the “Best Islamic Finance” award for the project of Yas Island.

Financial Strength

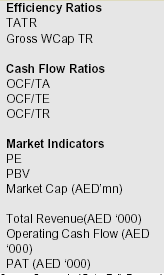

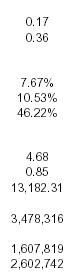

Al Dar Properties 2008 2007

TA=Total Assets TR=Turnover

OCF = Operating Cash Flows

TE = Total Equity

TR = Total Revenues

Other important points of Financial Strength are as follows:

- The Debt to Equity Ratio stands at 1.08

- Rental income from investment property doubled to AED 55.2 million,

- Revenue growth has been 203%, although quarter to quarter revenue has decreased by 39% owing to the current financial crisis.

Strengths and Weaknesses

The strength of Aldar properties is primarily in the huge infrastructure that has been built and developed over just 5 years utilizing the booming real state market of UAE. Still not badly shaken by the financial crisis, it is all set to invest $55 billion in infrastructure. With many mega projects at hand, Aldar is planning for several new cards. The cooperative policies and business environment are also contributing to the success of any real state developer in the UAE.

But lately, many analysts have been arguing over the inflated bubble of property prices that may blow at any time. Singapore is an example where the bubble was burst after hyper-inflated property prices and the prices have not been that high ever since. Aldar is into marketing for huge projects comprising of residential units that may not be sold in the pre-construction stage.

Secondly, almost all of the revenue is generated in the pre-completion phase of the projects. While a proposed venture is marketed on a massive scale, the investors buy the residential houses before the completion. A hugely marketed campaign may fail if it fails to attract investors on a large scale. In such a case the company may face a severe liquidity crisis.

The substantial part of Aldar’s financing is based on debt financing and amid soaring financial costs of borrowing; the company has large financial leverage. Financial leverage is a measure of the dependency of profits on the fixed costs. High financial leverage may also imply liquidity problems in the future. Due to high borrowing costs, there have been hints of mergers of big real state developments owing to a liquidity crunch. Under the current financial crisis many investors have taken out their capital from the market and companies may be forced to delay the projects or merge with others.

Aldar and other giants in the real state sector are also facing environmental issues. Most of the hotels and residential units are near the coastlines. The long processes of construction and contamination are a threat to sensitive marine life, over which authorities have concerns. A recent development is the Estidama, an urban development standard platform that will set guidance rules and regulations to counter environmental damage.

Delays in Construction

The foremost challenge that the construction industry in UAE is facing delays in the projects. According to a research report 50% of the projects in the UAE are delayed and are not completed on time. According to the report:

“Rising material costs and an alarming shortage in labor are partly responsible for project delays and cancellations in the UAE. However, it is important to note that while the number of projects planned or underway in the GCC has reached the $2 trillion landmark, only 24.7 per cent of them are actually under construction”

Delays are never helpful in building investors’ confidence. The foremost causes causing delays and impeding construction pace on big projects are loan-approvals, lack of local market for construction materials, inadequate early planning and reluctant decision-making on part of owners. In the current global financial conditions, lack of investors is also hampering the speed of completion on many projects especially residential units. Investors’ confidence will take some time before it returns to the previous level that boosted the investment in the last three years. Construction giants like Aldar can hold on to the property up to a limit before they will be forced to sell at lower prices.

Construction Materials

The biggest concern covering the construction industry is the lack of a local market for building raw materials. UAE has little access to the local market of building materials. The direct costs in the channel of building materials are soaring high and are a threat to long-term sustainability. Steel and cement account for 30% of the construction costs. There are currently more than 150 projects facing delays due to high material costs and limited foreign labor. Until 2003 UAE was producing all the cement to be consumed in the local construction. But the unprecedented boom in the real state sector starting in 2003 forced the imports of raw materials from different countries. Freight charges and rising steel prices have forced the construction costs even higher in the current year. Currently, imports account for 74% of the construction needs in the development sector.

Steps to the Solution

- UAE government may look to set up a large-scale steel-production mill. There is massive growth potential in the construction industry of UAE in the coming year owing to the large unused area, well-developed infrastructure, and investors’ confidence. The 74% part of imports in the raw-material needs must be brought down to below 30% by meeting the construction needs through local production. Lower production costs will help also to control the soaring property prices and timely project completions. Giants like Aldar may initiate such a proposal that will surely gain the financial and political support of the government.

- The labor issue is very sensitive and complex in the current security and environmental scenario. UAE construction is facing an acute labor shortage, much due to the strict immigration and work laws in UAE. The families of those working (at the labor level) in the UAE are not allowed to settle in UAE. This is the biggest discouraging factor for turn-away labor that looks for more lucrative regions like Europe and the USA. The labor laws may be relaxed to better the labor availability situation in the region.

- The ever-increasing property prices may not help the sector in the long run. Aldar may look to set a ceiling on prices under proper planning in the pre-construction phase. Off-plan investment is becoming common in UAE owing to high interest rates and timely returns (in contrast to delayed returns in the construction industry). The company might lose in the short run, but it will surely build the investors’ confidence and timely recovery of marketing costs in a long-term scenario.

Conclusion

Aldar’s current financial figures show sound performance and management. UAE has seen massive growth in all business sectors and promises more to the investors, but recent financial scam has cast many things under doubt. 12 December has come with news where 3 real state giants in Dubai have announced to delay their projects. Investors are unwilling to act in such uncertain situations and the whole success of plan investment is dependent on the pre-construction prices. Government and companies will have to act to control the production costs that would result in low property prices. The property bubble should not be allowed to inflate beyond an extent.

Sources

- Arshi Shakeel Faridi ; Sameh Monir El-Sayegh “Significant factors causing delay in the UAE construction industry” In Construction Management and Economics. Volume 24, Issue 2006 , pages 1167 – 1176.

- Gopal Bhattacharya” Construction sector in UAE faces rising challenges” Emirates Business 24/7.

- TAIB Research. GCC Equity Report.