Introduction

Cross-border investment has become a popular approach to expanding the market share in the current competitive business environment. According to Shenkar et al., advancement made in the fields of transport and telecommunication has made it easy for firms to explore new markets (52). Venturing into new markets requires an understanding of the host market. Many American, British, French, Japanese, and German companies are currently operating in the United Arab Emirates, especially in the global business hub of Dubai city. Similarly, local Emirati companies have ventured into the regional and international markets as a way of dealing with stiff competition in the local market.

When planning to explore a foreign market, one of the factors that a firm has to consider is the appropriate method to make the entry. A firm can opt to use franchising, foreign direct investment, collaborative ventures, licensing, or mergers and acquisitions. The choice of the strategy depends on various factors such as the financial capacity of the company, availability of other firms that may be willing to form a partnership or to be franchisees, the socio-political and economic environment in the foreign country, and attractiveness of the market. The selected option should assure the firm of maximum profits at the least possible cost. In this paper, the focus will be to discuss foreign direct investment and collaborative ventures as some of the best strategies for entering foreign markets.

Market Entry Strategy

Foreign direct investment and collaborative ventures are both active approaches to entering a foreign market. According to Mesquita et al., both cases require the parties involved to have their footprint in the foreign market instead of using other companies that can operate using their brand (34). Such a strategy is expensive, as the company would have to hire its own employees, have a physical office, and pay all the relevant levies in the new market.

It should also be ready to deal with other issues such as competition, insecurity, and economic challenges more directly than when it uses other strategies such as franchising. However, the two strategies have numerous benefits, such as the ability to be in control of the activities in the foreign market and the fact that it would not have to share its profits with other entities. It is important to discuss each of these strategies before looking at the current trends in foreign direct investment and collaborative ventures.

Foreign Direct Investment

One of the oldest but still popular strategies of exploring a new market is foreign direct investment. DiMatteo defines foreign direct investment as “an internationalization strategy in which the firm establishes a physical presence abroad through ownership of productive assets such as capital, technology, labor, land, plant, and equipment” (87). As shown in this definition, the company involved would have a physical presence in the host country when using this strategy.

A firm can make such an investment in different ways. One of them is through the acquisition of a local firm. Unlike in partnerships or joint ventures where two firms come together to achieve a common goal, in this case, the new firm will acquire a local company and gain full control of its operations and all its rights after making the agreed payments.

The acquisition is often appropriate when a company is entering a new market where it has limited knowledge of the local forces (Shenkar et al. 90). When an American firm decides to make an entry into the United Arab Emirates market, this would be one of the most appropriate strategies to consider. The socio-political and economic environment in the United States is significantly different from that in the UAE. Although the country has received numerous expatriates coming to work in various industries in major cities such as Dubai and Abu Dhabi, the population is predominantly Islam. On the other hand, the majority of Americans identify as Christians, with a large portion of the citizens not identifying with any religious groups.

The economy of the UAE is also significantly different from that of the United States. Although the US has a stronger economy, a click of the super-rich people exists in the UAE who are willing to pay premium prices for the best quality products. The political environment is also different in this country. When a foreign firm acquires an existing firm, it will retain its employees, the existing customers, structures, and system that make it profitable. Instead of overhauling the entire system, the acquirer will retain most of these systems and structures as it tries to learn more about the market. It will not suffer from culture shock in the same way as it would when other strategies were used.

Foreign direct investment may also involve starting from scratch, where the new firm will set up new offices and production plants, hire employees, acquire necessary documents from the local authorities and start operations. In this case, the management has to make a decision on the appropriateness of parent country nationals (PCN), host country nationals (HCN), and third-country nationals (TCN) when hiring. This strategy has numerous benefits and challenges. One of the benefits is that the firm does not have to inherit a tainted image of an acquired firm. It will have the opportunity to build its own brand as a new company in the local market.

The company will also have the opportunity to create its own organizational culture based on its values, mission, and vision in the global market. In this strategy, the company will enjoy all the profits made in the new market instead of sharing them with other entities. Direct control of the activities also means that it can define the path it should take in the market. The company will not have to consult with other firms or be forced to embrace strategies it considers inappropriate.

Starting operations in a foreign market from scratch has challenges that a firm should be ready to overcome. One of the biggest challenges is the limited understanding of the local culture. According to Cavusgil et al., the local culture defines customers’ tastes and preferences (112). It defines the purchasing pattern of customers. It means that if a new firm has limited knowledge of the local culture, it may not understand the market trends.

DiMatteo advises that when a firm decides to use such a strategy, it would need to invest more in market research (54). A team of market experts will have to be hired to gather the information that would define the marketing strategies that the company would use. Another major disadvantage of this strategy is that it may take longer for the firm to gain acceptance in the market, especially in a region where nationalistic politics are common. A good example is a Chinese market, where many prefer buying from local companies instead of foreign multinational corporations as a way of enhancing the growth of the country’s economy (Shenkar et al. 94). It may take a while to create a pool of loyal customers if such a strategy is used.

Collaborative Ventures

Collaborative venture is a common strategy that companies often use to explore new markets. Mesquita et al. define the strategy as “a cross-border business alliance in which partnering firms pool their resources and share costs and risks of the new venture” (74). Instead of a firm making a direct entry into the market as an independent entity, it would collaborate with other firms to explore the new market. In this strategy, the partners appreciate the challenges in the foreign market and the difficulty that any one of them would face if it makes an independent entry.

The strategy is popular in cases where a massive financial investment would have to be made in the foreign market, and any of the partners may not have the capacity. It can also be a good strategy in cases where the two partners have different specialties, and working as a unit would be their different skills together for the betterment of their operations abroad. The two or more partners must agree on the modalities of their operations.

They can have a situation where one is a dominant shareholder or a case where they have equal rights and responsibilities. They also have to agree on employment policies in the foreign market and the manner in which top managerial positions would be shared among the partners.

When a firm opts to embrace a collaborative venture as its appropriate new market entry strategy, DiMatteo explains that the process can be done in two main approaches (33). First, two local firms can make an agreement to explore a foreign firm as a unit. For instance, the National Bank of Abu Dhabi and Abu Dhabi Commercial Bank are some of the leading financial institutions in the country. In the local market, they are rivals firms using every strategy possible to win the market share.

However, they can come together and form an alliance that would enable them to enter the Saudi market. Instead of operating as two different firms, they would find a common name in the Saudi market and pool their resources to overcome challenges in the foreign market. They would share profits and losses and work as a unit towards achieving the desired growth.

Collaborative ventures can also take place between two or more companies in different countries. In this case, Dubai Islamic Bank can decide to form a partnership with Samba Financial Group in the Saudi Arabian market. The choice of the partner in the host market is an important factor that would define how successful the new firm would be in the local market. DiMatteo explains that it is crucial to ensure that the company in the host market has a strong brand that would help in marketing strategies (82).

In such a collaborative venture, the host company, which in this case would be Samba Financial Group, will offer the experience needed in that market to foster growth. On the other hand, the Dubai Islamic Bank would bring the financial resources needed to expand operations. It is important to ensure that the two partners share the same vision, mission, and values in the market. These fundamental principles would ensure that there are no conflicts once the two firms start operating as a single entity.

Collaborative ventures have numerous benefits. One of the main benefits of this strategy is that it creates a platform for sharing costs and other responsibilities in the foreign market. In such a setting, the partners can set clear roles that each should take in the arrangement to ensure that they realize the intended objective in the market (Cavusgil et al. 75). The entities will also share experience and skills to manage the stiff competition in the host market.

The finance industry is one of the most competitive markets in the Kingdom of Saudi Arabia, and the ability to achieve success depends on a firm’s capacity to understand the unique needs of customers and define the best way of meeting them. When the other partner is already operating in a given market, the foreign partner will benefit from the strength of the host’s brand. Taking the case of the example above, Samba Financial Group is a strong brand in the local Saudi market, and collaborating with it would have significant benefits to the other partner.

The strategy also has challenges that a firm should be ready to overcome. One of the common challenges common in joint ventures is conflict in strategic and operational activities. In case the two parties have equal shares and control over the operations of the new venture, there would be two centers of power. In such a case, the two entities have to agree on the way forward before specific actions can be taken (Shenkar et al. 23). For instance, one party may prefer hiring more host country nationals as a way of dealing with culture shock. On the other hand, the other may prefer parent country nationals as a way of promoting organizational culture considered successful in the home market.

Making decisions in such an environment may be very difficult, especially when such conflicts are common. The more time it takes to make a decision, the more such a firm may lose opportunities in the market that require quick decisions. The two firms may also face operational challenges if their company values are not similar. One company may value quality over the need to have prices below the market average, while the other may value setting highly affordable prices as a way of increasing the customer base. Each firm may have a genuine reason why they support pricing or quality strategy. However, in the new joint venture, they have to agree on the best strategy that they have to embrace based on the local forces to achieve the desired growth.

Motives for Collaborative Ventures and Foreign Direct Investment

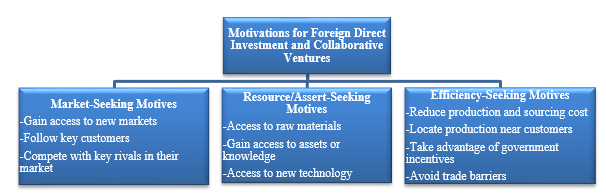

When the management of a company makes a decision to enter a new market, DiMatteo advises that the motive should be clear at the onset (42). Figure 1 below identifies three main motivations for collaborative ventures and foreign direct investment. The first is the market-seeking motive. A firm may be interested in having access to new markets. Walmart opened new branches in China as a way of increasing its customer base (Shenkar et al. 78).

A firm may also have the desire to follow key customers. For instance, companies that often supply Walmart with various products may consider starting their operations in the Chinese market to retain their relationship with this major retailer. The strategy may also be taken to enable a firm to compete with its major rivals in its own market (Shenkar et al. 64). In its recovery plan, Eastman Kodak has new branches in Japan to ensure that it can compete against Fujifilm, which is its main market rival.

As shown in the figure above, another major factor is asset-seeking motives. A firm may decide to move to a new market to have access to raw materials. The strategy is common in cases where the specific raw material is scarce. Policies in the country where it is sourced make it expensive or difficult to access it in another country. A firm may also be interested in gaining access to other assets in the host country. Technological factors may also influence a firm to consider exploring a new market.

According to Mesquita et al., Alibaba, the largest Chinese online retailer, opted to explore the market in the United States because of the advanced technology in the country (76). The firm has gained technological capacity that enabled it to expand its operations to the global market.

Efficiency-seeking motives may also make a firm consider venturing into a new market through the strategies discussed above. A firm may opt to move closer to the market. One of the main reasons why Apple Inc. opted to move its production plant was to improve efficiency by cutting costs while at the same time being close to one of its most important markets in the world (Buckley 46). It is less costly to produce in China than it is in the United States because of the low cost of labor. With a population of over 1.4 billion people, China is one of the most attractive markets for Apple Inc.’s products (Cavusgil et al. 112).

It would cost less for the firm to deliver its products to the locals in China if its production plant is located in China. India, which shares a land border with China, also has a population of over 1.3 billion people, making it another attractive market for iPhones and MacBooks (Shenkar et al. 53). The strategy may also enable a firm to take advantage of the incentives set by the host government to promote foreign investment, such as tax holidays and the acquisition of land at a relatively low price. Collaborative ventures can also help a firm to overcome trade barriers set by the host country to protect its local economy.

Conclusion

In the current global business environment, it is critical for large and mid-sized companies to consider exploring new markets. Going global creates new opportunities, and it cushions a firm from unforeseen environmental disasters in the home market. When the management makes the decision to explore a new market, it is important to determine the appropriate entry strategy that should be used.

Factors such as the financial capacity of a firm, availability of other firms willing to partner in the new venture, and external environmental forces in the host market are some of the issues that define the appropriate strategy that a firm should use. In this paper, the focus was on foreign direct investment and joint ventures as the most appropriate strategies that a firm could consider when planning to explore a foreign market.

Works Cited

Buckley, Peter J. The Global Factory: Networked Multinational Enterprises in the Modern Global Economy. Edward Elgar Publishing, 2018.

Cavusgil, Tamer, et al. International Business: The New Realities. Pearson Australia, 2015.

DiMatteo, Larry. International Business Law and the Legal Environment: A Transactional Approach. 3rd ed., Taylor & Francis Group, 2017.

Mesquita, Luiz, et al., editors. Collaborative Strategy: Critical Issues for Alliances and Networks. Edward Elgar Publishing, 2017.

Shenkar, Oded, et al. International Business. 3rd ed., Taylor & Francis Group, 2015.