Introduction

Furbo Dog Nanny is an artificial intelligence-based service which helps pet owners to facilitate the process of caring for their animals. Officially manufactured by an American start-up referred to as Tomofun, the former is a global-based firm specializing in developing pet technologies (Wood et al., 2017, p. 442). This industry majorly offers several functionalities, such as one-way video features, and it accounts for the highest revenue share to date (Powell et al., 2018). This paper explores the significant aspects of the global pet monitoring industry, with an emphasis on the segmentation, positioning, and differentiation of Furbo’s strategies for expanding operations in Australia.

Market Segmentation

Table 1. Market Segmentation of Pet Owners

Table 1 above indicates the various variables of segmentation that can be used in marketing products in the Australian market. The decision to live in either urban, suburban, or rural areas in Australia is influenced by how pet owners see their creatures and the criteria they adopt when deciding which pet products to purchase (Williams, 2000, p. 155). A study has suggested that urban parents are more likely to consider buying pet products and accessories than people from rural regions (Kramer, Mehmood and Suen, 2019). Moreover, at least 63% of these city dwellers prefer to purchase pet commodities online compared to 32% of individuals from upcountry (Wood et al., 2017). With a marketing approach, Furbo company will find it easy to penetrate the Australian market since it has the highest number of pets owned.

Demographic segmentation highlights various characteristics of consumer groups such as age, gender, and income. According to researchers, millennials and baby boomers are the two pet-owning groups of individuals who prefer to have dogs (Kramer, Mehmood and Suen, 2019). Furthermore, marketers can also approach this market through the lens of household income. In particular, 65% of people who own pets are from families with incomes of above $50,000 (Wood et al., 2017, p. 442). Such a trend is more likely to facilitate the current premiumization of pet products, especially Furbo Dog Nanny.

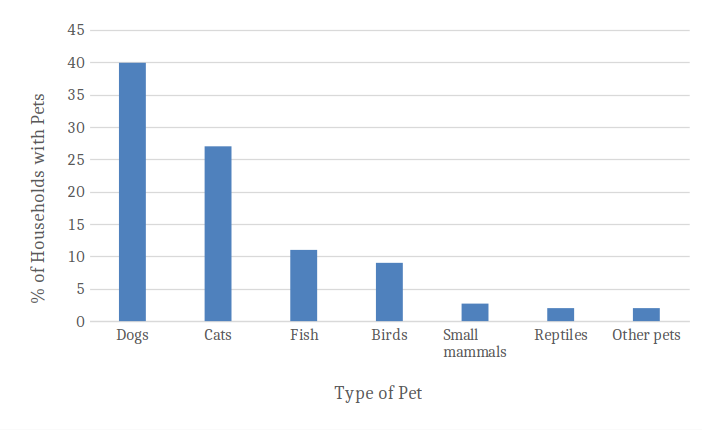

Figure 1 above shows that dogs are most owned pets in Australia. Therefore, gender is also a significant aspect of categorising consumer groups. A survey indicates that 36% of males and 41% of females are dog owners and in particular, women remain the leading group of animal enthusiasts with 64% of the total number of females in Australia (Wood et al., 2017, p. 442). Based on psychographics, pet owners can be classified based on “attachment,” “interaction,” and “human substitute” (Wood et al., 2017, p. 442). These aspects describe the level of friendliness, relationship, and companionship between the owner and pet.

Integrated Marketing Communications

Furbo can adopt the concepts of advertising to promote its product to dog owners living in Australia. For example, the company can utilize high-profile celebrities to endorse the pet monitoring camera which will attract a large base of consumers. Moreover, direct and digital marketing approaches involve selling the product without any intermediary and using social media platforms to reach the customers (Kotler, 2017). Furbo can consider including discounts and offers when introducing the camera to attract more clients and generate sales. In addition, Furbo can use Facebook, Twitter, Instagram, and YouTube channels to reach potential dog owners in Australia. Lastly, the company can utilize public relations to sponsor dog rescue centers and other organisations protecting the lives of these animals to promote its pet monitoring camera.

Target Market and Consumer Profile

The Australian market would be a feasible option for conducting a marketing campaign for Furbo product due to several reasons. First, this country has witnessed an increasing trend of pet humanisation (Wood et al., 2017). Moreover, dog enthusiasts in this country have increasingly exhibited the need to improve their pets’ lives by considering new product varieties (Kramer, Mehmood and Suen, 2019). With no dominant companies operating in the pet technology sector, Australia is a viable investment option for Furbo to consider in an attempt to offer monitoring technologies to consumer groups.

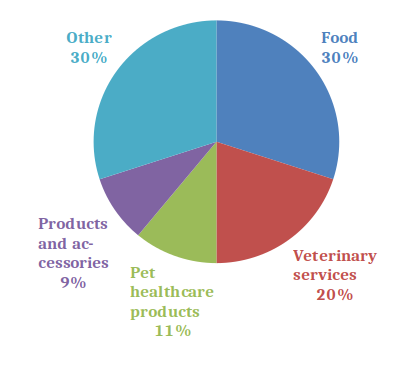

Secondly, Australia is a viable option for investment in pet technologies because a survey has indicated it has increased spending habits as shown in figure 2. Overall, the research also indicates that Australians spent approximately $13 billion on pet products and services (Kramer, Mehmood and Suen, 2019). In 2019, three tenth of dog owners in this country were reported to have pet insurance and they also spent an average of $1627 per animal annually (Kramer, Mehmood and Suen, 2019). As such, the chances of Furbo succeeding in this market are high because the residents are more likely to spend money on technologies that will improve the lives of their pets. Thirdly, the growing number of millennials in the region is a favorable factor for investing in pet technologies in the country. Currently, a survey estimates that this group of people account for 70% of Australia’s pet owners (Wood et al., 2017, p. 442). A report suggests that during the COVID-19 pandemic, millennials spent more time with their dogs when compared to the older generation (Kramer, Mehmood and Suen, 2019). Therefore, Furbo will make a good investment option by capitalising on the Australian market as a business destination.

Differentiation and Positioning

Differentiation and positioning will allow the marketers of Furbo to create customer value for this product easily. Under product differentiation, Furbo offers several features for its dog-monitoring service, such as smart dog alerts, where the owner is notified when the device spots an individual. It is also vital for home emergency alerts and will notify the homeowner when there is fire, carbon monoxide, and other dangers. Furbo comes with cloud recording capability since its smart dog technology records about 15-second visual clips, and they can also be sent to the owner’s smartphone (Wood et al., 2017, p. 442). Moreover, the device comes with a doggie diary capability of generating significant highlights from the videos recorded and also notifies the owner when the dog has been barking continuously and some howling episodes.

Using service differentiation, the company will make the process of ordering process easy and not time-consuming, which allows the customers to have a wide range of options to choose from and get deliveries in time. Moreover, Furbo will be known for its speed and efficiency in delivering and handling the product (Kotler, 2017, p. 203). Under guarantees, the commodity will come with a lifetime warranty that covers the Furbo dog camera and its accessories under some terms and conditions (Peterson et al., 2021, p. 157). Also, as part of after-sales service, the company will provide free installation and also guide the customers on the usage of the product. Maintenance and repair will also constitute part of the service differentiation approach, where the company offers overhaul services free of charge to the clients (Kotler, 2017, p. 204). Lastly, Fibro’s channel differentiation approach will allow the customers to access the product via a wide range of distribution channels (Kotler, 2017). The company will consider both online and offline approaches to delivering the item to the consumer groups in Australia.

A positioning statement gives a brief overview of a product and how it fills a specific customer need. Furbo’s positioning statement takes the following form:

“To dog owners who are always away from their pets, Furbo Dog Nanny gives you the chance to ensure the safety of your dog with smart alerts, and unlike other cameras, Furbo informs you of significant dog-related events.”

Figure 3 above classifies the key competitors of the Furbo brand based on three significant attributes. For example, under the user-friendliness characteristic, both Shenzhen and Furbo brands have the same features. The former brand remains the most competitive when it comes to its pricing strategy. In general, the Furbo brand remains the leading product based on the three attributes identified above.

Recommendations

It is recommended that Furbo should specialize in using product positioning strategies to ensure its pet monitoring camera reaches a large customer segment. Therefore, the company make it a priority to offer superior product features to dog owners. Moreover, Furbo can strengthen the strategy above by giving the customers stellar services to support the features presented in the pet technology gadget. Lastly, since Australian dog owners live in different areas, Furbo can generate a consumer profile which classifies these consumers based on the tastes and preferences to increase its chances of profitability.

Conclusion

Marketing is a vital aspect of organisational management that allows the company to excel in selling its products and services. Furbo Dog Nanny is a pet monitoring tool which can be used by dog owners to improve their pets’ lives. Therefore, with the Australian market in consideration, the company can incorporate several targeting, segmentation, and positioning approaches to successfully penetrate these markets. With several driving factors such as increasing pet humanisation, a growing number of millennials, and increased spending on pet accessories, Australia remains the most viable option for Furbo to position its pet monitoring product.

Reference List

Kotler, P. (2017) ‘Philip Kotler: some of my adventures in marketing’, Journal of Historical Research in Marketing, 9(2), pp. 203-208. Web.

Kramer, C. K., Mehmood, S. and Suen, R. S. (2019) ‘Dog ownership and survival: a systematic review and meta-analysis’, Circulation: Cardiovascular Quality and Outcomes, 12(10), p. e005554. Web.

Peterson, M., Minton, E.A., Liu, R.L. and Bartholomew, D.E. (2021) ‘Sustainable Marketing and Consumer Support for Sustainable Businsses’, Sustainable Production and Consumption, 27, pp. 157–168. Web.

Powell, L., Chia, D., McGreevy, P., Podberscek, A.L., Edwards, K.M., Neilly, B., Guastella, A.J., Lee, V. and Stamatakis, E. (2018) ‘Expectations for dog ownership: Perceived physical, mental and psychosocial health consequences among prospective adopters’, PLoS One, 13(7), p. e0200276. Web.

Williams, J. (2000) ‘Tools for achieving sustainable housing strategies in rural Gloucestershire,’ Planning Practice & Research, 15(3), pp.155-174. Web.

Wood, L., Martin, K., Christian, H., Houghton, S., Kawachi, I., Vallesi, S. and McCune, S. (2017) ‘Social capital and pet ownership–a tale of four cities’, SSM-population health, 3, p. 442. Web.