Statement of the Issue and Justification of Approach

GlaxoSmithKline (GSK) and Novartis Ag (NVS)

In March 2015, GlaxoSmithKline plc, UK and Novartis AG, Switzerland completed a deal that saw drug firm GlaxoSmithKline Pharmaceuticals acquire Novartis’ vaccines business and diversified its marketed oncology portfolio to Novartis Healthcare (Wang, Plump & Ringel 2015). On completion of the deal, GlaxoSmithKline Pharmaceuticals acquired Novartis’ vaccines business. According to GlaxoSmithKline Pharmaceuticals, the deal was aimed at developing a stronger, sustainable global vaccines business.

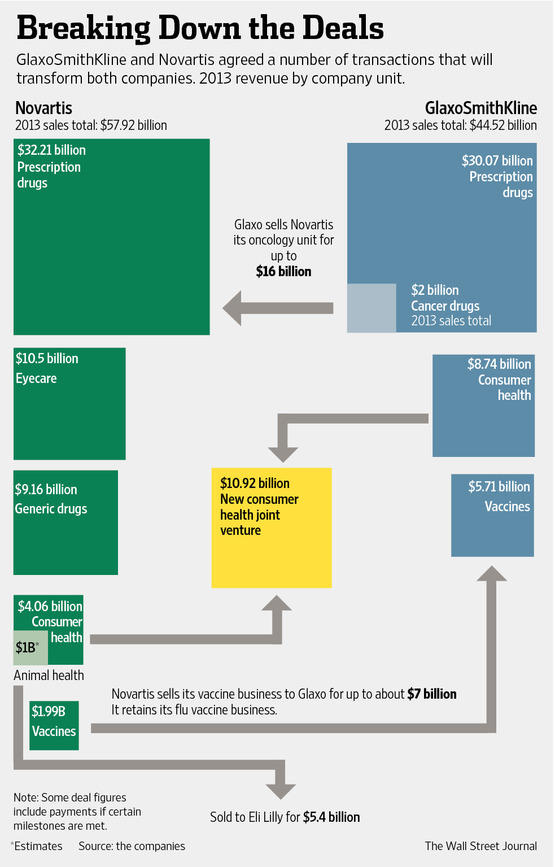

The deal dates back to 2014 when London-based GlaxoSmithKline plc made an agreement with Basel-based Novartis AG for the company to acquire its vaccines business and manufacturing competencies and sell the rights to its oncology portfolio, associated R&D undertakings, and AKT inhibitors presently in progress to the Swiss firm (Gautam & Pan 2016). Based on the agreement, Novartis took over GlaxoSmithKline plc’s (GSK) cancer drugs portfolio for $16 billion and sold its vaccines enterprise in return for $7.1 billion (Gautam & Pan 2016). Besides, the organizations also created a joint venture for the consumer healthcare business in the three-part transaction. This analysis will evaluate the deal between Novartis AG and GlaxoSmithKline GSK in the context of mergers and acquisition theories.

Facebook Inc. and WhatsApp

In February 2014, Facebook made it public that the organization had made the biggest purchase in its history. Facebook CEO Mark Zuckerberg was able to arrive at an agreement with WhatsApp founders Jan Koum and Brian Acton for the total amount of $22 billion (Doyle 2015). Before buying WhatsApp, Facebook had bought Instagram in 2012 for $1 billion (Sinclair & Keller 2017). This paper will investigate the theories associated with mergers and acquisition relevant to Facebook’s procurement of WhatsApp. Understanding the principles related to such business enterprises builds depth of knowledge that has numerous applications in the modern day.

Overview of the Deal

The 2015 merger between Novartis AG and GlaxoSmithKline GSK was carried out in a series of transactions that were worth over $20 billion (Gautam & Pan 2016). The deal led to a closer focus on Novartis’s scope without a significant impact on its revenue. On the other hand, GlaxoSmithKline emerged as a vaccines-and-consumer-drug powerhouse.

Novartis acquired the oncology products unit from GSK’s for $14.5 billion that would increase to $16 billion if development milestones are attained (De Coninck 2016). On the other hand, Novartis would trade its vaccines division not including its flu business, to GSK for $5.25 billion, which would be raised to $ 7.1 billion dependent on milestones (Micklus & Munster 2015). On the other hand, Novartis would trade its animal health division to Eli Lilly for $5.4 billion.

Besides, Novartis and GSK would combine their consumer units in a joint venture. Lastly, the two firms agreed to combine their consumer-health businesses under Glaxo’s management, bringing together franchises that own some of the world’s best-known brands, including Excedrin, Panadol, and Aquafresh. The figure 1 below summarizes the transactions.

On the other hand, while the deal between GSK and Novartis involved comparatively huge companies that traded divisions, Facebook completely bought out WhatsApp. WhatsApp was founded in 2009 by Jan Koum who was later joined by Brian Acton. The first stable release of the application was iOS – Version 2.11.7, Windows – 2.11.356.0, Blackberry – 2.11.529, and Android – 2.11.152 (Pitt 2015).

It is now available on operating systems such as iOS, Android, Blackberry, Nokia Series 40, Symbian, Windows, and Nokia Asha. WhatsApp is a proprietary software. Facebook, on the other hand, was developed by Mark Zuckerberg, Eduardo Saverin, Andrew McCollum, Dustin Moskovitz, and Chris Hughes in 2004 (Fiadino et al. 2015). With average annual revenue of $7.872 billion, an operating income of $2.804 billion, and a net income of $1.5 billion, Facebook is one of the highest earning tech companies (Fiadino et al. 2015). Its monthly active users peaked at 1.23 billion.

Facebook offered the whopping sum of $19 billion to buy WhatsApp. The amount split between the founders of WhatsApp saw Jan Koum, who had the greater share in WhatsApp earning about $6.8 billion, and Acton getting $3.5 billion after taxes (Doyle 2015). Also, Jan Koum was given a place on the Facebook board with a salary of 1 dollar. 177.8 million of Facebook’s Class A common stock shares and $4.59 billion in cash was awarded to WhatsApp’s shareholders (Doyle 2015). $3.6 billion was added to the original price as an incentive to WhatsApp employees for staying on after the deal (Doyle 2015).

Analysis of the Deal

The merger between Novartis and British-based GlaxoSmithKline was among the moves that would shape the pharmaceutical industry. An estimated $25 billion of transactions in product portfolios were completed (Schuhmacher 2015). Organizations and individuals can grow and enter new markets using strategies such as mergers and acquisitions. Thus, the competitive arrangement of the entire industries may radically change in a span of a short time. Novartis and GSK merger was a deal that enabled each party to strengthen the other’s weak section. Similarly, Facebook’s purchase of WhatsApp was aimed at improving its competitive edge in the market considering the growth and popularity of the latter.

Merger involves the combination of two or more organizations into a single entity while acquisition includes the purchasing of shares or stake in another organization (McGeown & Barthélemy 2016). Some organizations use mergers and acquisitions to gain a foothold in international markets for them to be branded multinationals (Schuhmacher, Gassmann & Hinder 2016).

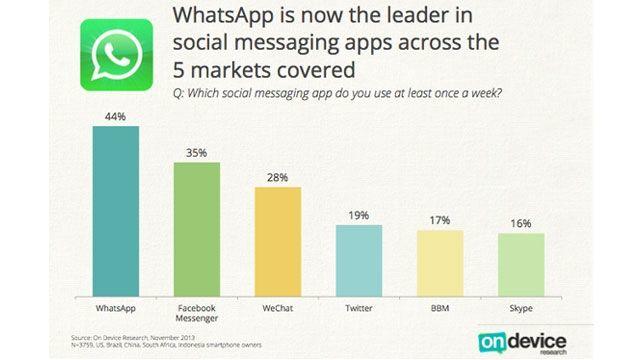

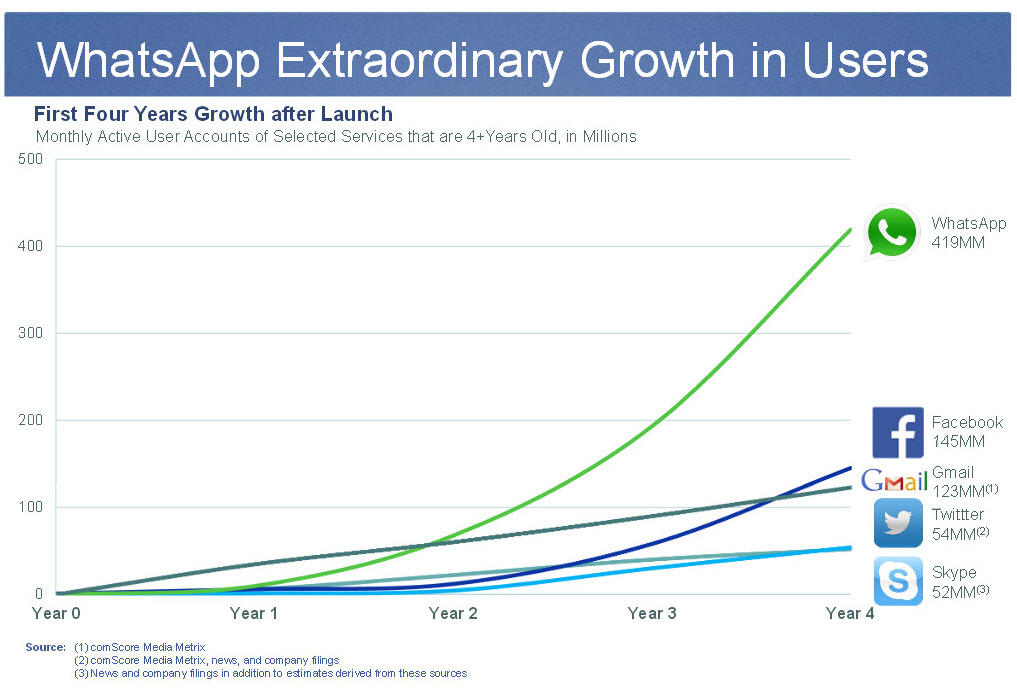

The Facebook purchase of WhatsApp is one of the biggest in the history of Silicon Valley. The deal is over 20 times the cost of Facebook’s 2012 possession of Instagram and poses the question why Facebook dug deep into its pockets to acquire WhatsApp. It can be argued that Facebook’s one billion dollar deal was aimed at tapping into WhatsApp’s user growth. At least 500 million people are active on WhatsApp monthly. At present, WhatsApp adds at least a million users daily.

Over half of the WhatsApp users are active on a daily basis. In comparison to Facebook’s 62% of active daily users, WhatsApp is more successful in this aspect. Lastly, at least 500 million pictures are exchanged on WhatsApp daily as opposed to 150 million on Facebook (Fiadino et al. 2015). It is also estimated that WhatsApp will reach a billion users in less than two years due to its astronomical growth. Due to the common goal of building worldwide connectivity through the internet, it is possible that the combining of forces will possibly fast-track growth for both firms.

Facebook will speed up its growth in developing markets where internet connectivity is meagre using WhatsApp as a platform due to the extensive usage of the latter. As a result, Facebook will have gained a foothold in these mobile user bases. Reaching out to WhatsApp users in these regions will also boost Facebook’s Internet.org program. The program is Facebook CEO Mark Zuckerberg’s strategy to provide access to the Internet to the two-thirds of the world not yet online. On the other hand, Facebook does not consider that will make a profit from WhatsApp later in time as phone calls become less attractive than messaging on mobile devices.

Based on the justification for Facebook’s acquisition of WhatsApp, it is arguable that market power had an influence on this major decision. One theory related to mergers and acquisitions postulates that market power is a major influencer in mergers and acquisitions where an organization desires to have an impact on the quality, price of its products (Ahern & Harford 2014). The theory is known as the market power hypothesis.

Takeovers increase the likelihood of rapid growth for organizations. Since a takeover enhances the possibility of fast growth for organizations, it can be employed to spread control over a wider geographical region and in Facebook’s case, spread the reach of other programs. Facebook acquired WhatsApp for its large number of users, rapid growth, and geographic reach. The reasons behind Facebook’s acquisition of WhatsApp are in line with the market power hypothesis postulations.

Pre Deal Strategy and Post Deal Strategy Outcome

The Economic theory of oligopoly and monopoly established that the possible paybacks to attaining market power are greater profits, elimination of barriers to entry for the firm and creation of the same for other organizations (Baldwin 2015, p. 842; Awan, Ho & Khan 2017, p. 1).

While the Facebook takeover was successful, it managed to escape the clutches of antitrust legislation developed by many countries to guard the market against excessive concentration and subsequent loss of competition that is the product of major takeovers (Kadar & Bogdan 2017; Shears 2014).

The foundation for buyout activity has been observed and debated for many years. Regrettably, no individual hypothesis is adequate to explain all takeovers, and it is due to the intentions for takeovers are highly intricate that it is beneficial to create a framework to describe this activity. From the many explanations that have been put forward, that has encouraged the creation of some hypotheses to describe takeover events. One theory is the efficiency argument that can be used to explain the merger between Novartis and GlaxoSmithKline.

Efficiency arguments comprise differential efficiency theory and inefficiency management theory (Piesse et al. 2013). According to the differential theory, some firms are more efficient than others in the same industry. Consequently, in this regard, an efficient firm may boost the efficiency of inefficient firms through various ways, which may include a takeover. Conversely, the inefficient management theory stipulates that the public is aware of the state of inefficient companies.

In this case, regulatory assemblies and takeovers by efficient companies are not sufficient to rescue inefficient companies (Piesse et al. 2013). The similarity in these two theories is the perspective that takeover is a tool to advance the efficiency issue in the organization. Moreover, the specificity is that the inefficiency of the weak firms is not much pronounced to the extent that it is evident to the organizations in different industries (Piesse et al. 2013).

Economists argue that efficiency supposes the ideal distribution of resources. A firm is Pareto efficient if no other ways exist to supply resources without an unfavourable effect in another place. Though, at the organizational level, an organization cannot be efficient if all features of its operations are inefficient (Piesse et al. 2013). As a result, for Novartis and GlaxoSmithKline the assumed simplified, but the mutual description of efficiency is more complex. Announcing a firm as inefficient presumes that another company is doing better under comparable conditions, as a result evading the difficulty of evaluating the immaterial parts of a business as components of an efficiency evaluation.

The concept of efficiency in the takeover literature emerges from the notion of synergy that can be understood as a product of uniting and synchronizing the good divisions of the companies in the deal in addition to getting rid of those that are not efficient (Chernomaz & Levin 2012).

Synergy takes place where the market value of the two merged organization is greater than the total of their separate values (Piesse et al. 2013). As observed by Ghosh and Ghosh (2014), the market worth of two merged corporations together should be equivalent to the entirety of their worth (Piesse et al. 2013). However, this approach is not efficient for the evaluation of the impacts of takeovers. Value creation has also been vouched for by empirical studies such as Dutordoir, Roosenboom and Vasconcelos (2014) who postulated that in both unconnected and connected takeovers, the value could be produced to the same level.

Comparison Pre-Deal Financial performance and Post- Deal Financial Performance

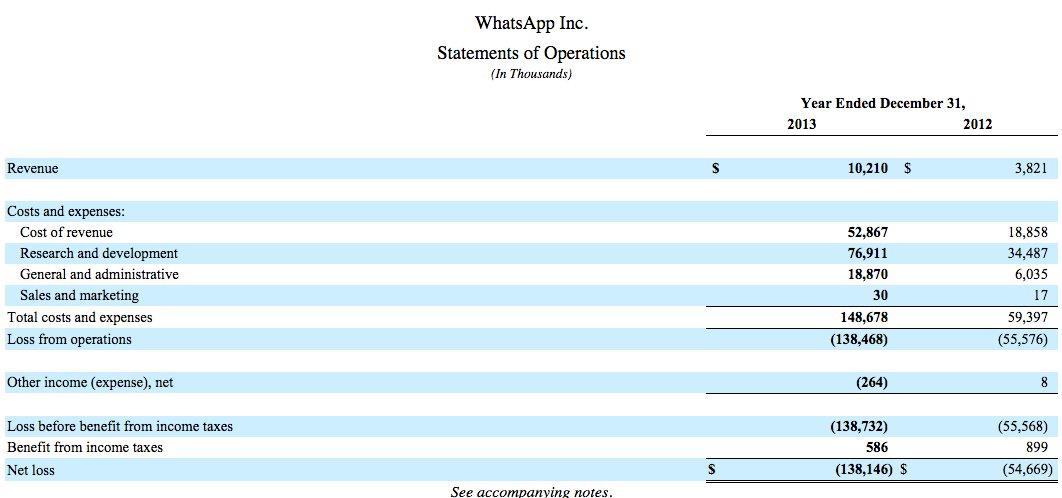

Following the announcement of Facebook’s acquisition of WhatsApp, Facebook’s shares dropped by 2 percent (Fiadino et al. 2015). For WhatsApp, the company had a revenue of $10.2 million 2013 with a net loss of $138 million in the same year (Fiadino et al. 2015). Most of the loss was made from stock based expenses.

As of May 17, 2016, Facebook was trading at $117.4. The firm’s stock was dealing at 0.9% over its 20-day moving normal of $116.3, 3.5% exceeding its 50-day moving normal of $113.4, and 8.2% beyond its 100-day moving normal of $108.5. Facebook’s 14-day relative strength index (or RSI) indicates that it has neither been overbought nor oversold (Neil 2016). For Facebook, the RSI is 54 while an RSI over 70 indicates overbought stock while under 30 is oversold.

On the other hand, GSK profits went down while sales rose after the deal with Novartis (McGeown & Barthélemy 2016). While revenue rose in three months after the deal, core operating profits were lower than in the previous year. The strength of the pound also worsened GSK’s results since after adjusting for currency headwinds, revenue rose 11% while core operating profit shot down 5% (McGeown & Barthélemy 2016).

Actual Post Deal Integration Process

Facebook and WhatsApp integration process was successful, with Facebook continuing to dominate the social media industry after eliminating possible competition through the merger. So far, the ability to eliminate competition through the merger is in line with the company’s planned outcome. Similarly, Novartis and GlaxoSmithKline also achieved efficiency in operational management through their merger, which was in line with the planned outcome.

Reviewing Synergies (Theoretical versus Realized)

Synergy resultant from takeover can be attained in several approaches. It customarily begins from the improved distribution of resources of the collective firm, such as the changing of the target’s unproductive management with a more effectual one and the discarding of redundant and unprofitable sections (Chernomaz & Levin 2012). The restructuring approaches normally have a constructive impact on market value. The increased efficiency may have been a product of improved management and more efficient use of current assets.

Summary

The Novartis-Glaxo transactions are right in the centre of the new style of deal-making, permitting each company to develop on its strengths while eliminating smaller non-competitive divisions as postulated in the efficiency theory. The deal between Novartis and GlaxoSmithKline is transformational for both companies. The result of combined operations will boost the strength of Glaxo’s oncology unit that is already potent with its line-up of cancer products. The higher price tags are associated with attainment of milestones for both companies. Also, problems such as patent expirations are controllable.

Facebook’s procurement of WhatsApp is in line with the market power hypothesis: takeovers can be used by organizations to spread their reach in markets; they increase the possibility of fast growth for a company. As a result, it is arguable that the takeover of WhatsApp by Facebook is a strategy aimed at boosting Facebook’s penetration into several markets such as developing countries. Firstly, WhatsApp has been associated with rapid growth.

The number of users is increasing at a high rate and is estimated to grow exponentially in the short term. Secondly, WhatsApp is widely used even in regions with limited access to the Internet, especially markets such as developing countries. As a result, Facebook can gain a foothold in these markets using the WhatsApp platform. WhatsApp is already popular in these regions, and Facebook can advance its agenda on the back of a platform that already enjoys an extensive geographic coverage. The market power hypothesis is, therefore, a suitable predictor of the dynamics that led to the takeover of WhatsApp by Facebook and provides a platform for learning and development of knowledge on similar activities.

Reference List

Ahern, KR & Harford, J 2014, ‘The importance of industry links in merger waves’, The Journal of Finance, vol. 69, no. 2, pp.527-576.

Awan, MA, Ho, HC & Khan, HU 2017, ‘Possible effect of merger and acquisition on brand equity: a case study of the IT industry in South Korea’, International Journal of Business and Information, vol. 12, no. 1, p.1.

Baldwin, JJ 2015, ‘Drug discovery and development 2014: returning toward the norm?’ Future Medicinal Chemistry, vol. 7, no. 7, pp.841-844.

Chernomaz, K & Levin, D 2012, ‘Efficiency and synergy in a multi-unit auction with and without package bidding: an experimental study’, Games and Economic Behavior, vol. 76, no. 2, pp.611-635.

De Coninck, R 2016, ‘Innovation in EU Merger control: in need of a consistent framework’, Competition Law & Policy Debate, vol. 2, no. 3, pp.41-51.

Dutordoir, M, Roosenboom, P, and Vasconcelos, M, 2014, ‘Synergy disclosures in mergers and acquisitions’, International Review of Financial Analysis, vol. 31, pp.88-100.

Doyle, K 2015, ‘Facebook, Whatsapp and the commodification of affective Labour’, Communication, Politics & Culture, vol. 48, no. 1, p.51.

Facebook收購WhatsApp 的三個重點. Web.

Falconi, M & Plumridge, H 2014, Deals Reshape Novartis, Glaxo – WSJ. Web.

Fiadino, P, Casas, P, Schiavone, M & D’Alconzo, A 2015, ‘Online social networks anatomy: on the analysis of Facebook and WhatsApp in cellular networks’, in IFIP Networking Conference (IFIP Networking), IEEE, Toulouse, pp. 1-9.

Gautam, A & Pan, X 2016, ‘The changing model of big pharma: impact of key Trends’, Drug discovery today, vol. 21, no. 3, pp.379-384.

Ghosh Ray, K & Ghosh Ray, S, 2014 ‘Cross-border mergers and acquisitions: modelling synergy for value creation’, in S Finkelstein & C Cooper (eds), Advances in mergers and acquisitions, vol.12, Emerald Group Publishing Limited, Bingley, pp. 113-134.

Kadar, M & Bogdan, M 2017, ‘”Big Data”and EU merger control–a case review’, Journal of European Competition Law & Practice, pp.1-13.

McGeown, P & Barthélemy, A 2016, ‘Recent developments in EU merger control’, Journal of European Competition Law & Practice, vol. 7, no. 8, pp.549-565.

Micklus, A & Muntner, S 2015, ‘Market watch: biopharma deal-making in 2014: a record year for M&A value’, Nature Reviews Drug Discovery, vol. 14, no. 2, pp.84-85.

Neil, P 2016, Sherwin-Williams stock outperformed broader market in November. Web.

Piesse, J, Lee, C-F, Lin, L & Kuo, H-C 2013, ‘Merger and acquisition: definitions, motives, and market responses’, in C-F Lee & AC Lee (eds), Encyclopedia of finance, Springer, Wiesbaden, pp. 411-420.

Pitt, IL 2015, Direct licensing and the music industry, Springer International Publishing, New York City, NY.

Schuhmacher, A 2015, ‘Can innovation still be the main growth driver of the pharmaceutical industry?’, in PA Morgon (ed), Sustainable development for the healthcare industry , Springer International Publishing, New York City, NY. pp. 39-68.

Schuhmacher, A, Gassmann, O & Hinder, M 2016, ‘Changing R&D models in research- based pharmaceutical companies’, Journal of Translational Medicine, vol. 14, no. 1, p.105.

Shears, A 2014, ‘Local to national and back again: beer, Wisconsin & scale’, in MW Patterson & NH Pullen (eds), The geography of beer, Springer, Netherlands, pp. 45-56.

Sinclair, R & Keller, KL 2017, ‘Brand value, accounting standards, and mergers and acquisitions: “The Moribund effect”‘, Journal of Brand Management, vol. 24, no. 2, pp.178-192.

Wang, L, Plump, A, & Ringel, M 2015, ‘Racing to define pharmaceutical R&D external innovation models’, Drug Discovery Today, vol. 20, no. 3, pp.361-370.

WhatsApp leads the global smartphone messenger wars with 44 percent market share. Web.

Yarow, J 2014, WhatsApp, Facebook’s $22 billion acquisition, did $10.2 million in revenue last year. Web.