Executive Summary

In 2020, the then United Kingdom prime minister Boris Johnson agreed to a trade deal with the European Union (EU) in which the country left the single market and the customs union. Mr Johnson said the deal would allow the United Kingdom to do more business with its European Union friends. However, this has not been the case as the United Kingdom has lost a big value of its trade.

The research aim of this study is to identify if BREXIT, the decision to leave the European Union by the United Kingdom, has had a positive impact on the country’s business or otherwise. The research question for this proposal is “To what extent has BREXIT influenced the competitiveness of Britain’s business in the European Market, and how has it impacted the overall trade balance?” Four research objectives are identified for a seamless answer to this deep research question.

- Objective 1: To examine and quantify various trade barriers brought about by BREXIT.

- Objective 2: To identify how supply chains have been disrupted due to customs procedures and border checks changes.

- Objective 3: To access how businesses in the United Kingdom have responded to changes brought by the exit.

- Objective 4: To analyze the overall changes in trade balance in the United Kingdom.

This is a highly controversial topic; therefore, literature on trade deals and supply chain processes will be examined. Both primary and secondary data sources shall be used to answer the research question, whereas semi-structured interviews will help confirm the quantitative data collected.

Introduction

When the United Kingdom voted to leave the European Union in 2016, it looked like a simple decision of leaving or staying, but the impacts of the decision were more severe than that. Immediately after the decision was made, the Sterling Pound went down compared to other currencies, making imports expensive and exports more competitive for the United Kingdom (Korus & Celebi, 2019). Data shows that exports did not rise, but the import prices increased, raising the country’s inflation by 2-3% (Naimy et al., 2023). This makes the problem worthy of pursuing as political leaders in the United Kingdom have been reluctant to tell people the truth about the real impacts of BREXIT.

Rather, they have blamed the economic hardships being experienced in the country on other factors, such as the recent COVID-19 pandemic and the Russian-Ukraine war, which has significantly raised the oil and energy costs. However, economic data shows that after the COVID-19 pandemic, all the other G7 countries instantly recovered. Britain’s recovery remained flatter, making the country fall behind in its trade intensity (Paterson et al., 2023). The Office for Budget Responsibility (2021) has concluded that there has been a 15 percent reduction in trade intensity due to Brexit. The OBR links the failure of the exports and the reduction in trade intensity to BREXIT, making it essential to study the topic further.

Research Aim, Research Question, and Objectives

This study aims to investigate the impacts of BREXIT on the United Kingdom’s business competitiveness in the European market landscape and its impacts on the country’s overall trade.

Research Question

“To what extent has BREXIT influenced the competitiveness of the United Kingdom’s business in the European Market, and how has it impacted the overall trade balance?”

Objectives

- To examine and quantify various trade barriers the BREXIT has brought about.

- To identify how supply chains have been disrupted due to customs procedures and border checks changes.

- To assess how businesses in the United Kingdom have responded to changes brought about by the exit.

- To analyze the overall changes in the trade balance in the United Kingdom.

Research Audience

This study’s primary research audience is people interested in international trade and macroeconomic policies. This generally included governmental officials, politicians, policymakers, researchers, and students in the related field. Businesses that are involved in cross-border trade are also targeted by this study.

Personal Motivations

The main personal motivation for pursuing this research question is a general interest in understanding the real causes and consequences of various political, economic, and social events. In addition to this being my field of study, I have been following the events related to BREXIT since 2015, and I am keen to see how the events unfold.

Literature Review

The United Kingdom’s decision to leave the European Union, commonly called the BREXIT, has affected the country’s overall competitiveness. The research and literature on this topic are substantive and depict a complex interplay of factors that shape competitiveness. Many researchers have been interested in identifying the emergence and effects of trade barriers introduced after the BREXIT. For instance, Fontanelli (2023) looked at the law of the United Kingdom’s trade with the European Union, finding that introducing customer checks and paperwork significantly affected businesses in the United Kingdom.

The cross-border transactions, considering that there are 27 European Union nations, have made shipping raw materials and exporting materials based in the United Kingdom very expensive. Empirical research shows that these observations are factual, as BREXIT has reduced the country’s productivity by 2% and 5% over the next 3 years since the referendum (Bloom et al., 2019). This drop has been caused by businesses in the UK preferring to set their operations in other countries in the European Union, thus negatively impacting its economy.

Brexit has significantly affected the supply chains of businesses in the country, and as research, the topic has been of particular interest. While the United Kingdom was a member of the European Union, it enjoyed free trade, and it was easy to ship goods and raw materials from faraway countries in the Union. Members of the European Union have also been into legally abiding contracts that allow for free trade with other nations such as the United States, India, China, and Japan. The country had to renegotiate these supply chain terms with these nations, with many agreements being less favorable than those negotiated by the European Union over the years.

Jozepa, 2021 shows that 42% of the total exports by the United Kingdom were to European Union nations. The exit impacted these exports as the shipping costs for the United Kingdom’s exports to these nations in the Union rose by 94% (Ke et al., 2022). These supply chain changes have made United Kingdom-based businesses reconsider their supply chain processes, with some setting up their operations in different countries such as France or Poland, affecting the balance of trade.

The literature also examines the impacts of the trade deals reached by the United Kingdom in the aftermath of leaving the Union. Over 70 deals have been struck, which many people state to be good progress, although most deals are similar to those the European Union had for the United Kingdom. Research shows that the new leads reached by the United Kingdom with the United States and New Zealand are only expected to bring small benefits in the coming years and will take a long time (Office for Budget Responsibility, 2021).

Additionally, deals facilitating business and trade with some countries, such as India, have taken longer than anticipated. The impacts have resulted in the United Kingdom’s clear lagging to the other G7 nations. These trends suggest a shift of the United Kingdom towards a more closed economy, which could further impact the country’s long-term growth.

BREXIT has undoubtedly impacted the trade balance, although its extent and nature remain controversial. The trade imbalances have been contributed by frictions in trade, burdensome administrative procedures, and the loss of the advantages and bargaining power enjoyed in a single market union. Some policymakers state that dealing with non-European Union countries has compensated for the advantages lost in trade between the UK and Europe. However, there is no empirical evidence to back these claims. United Kingdom businesses are also less willing to take risks and diversify due to the uncertainties brought about by the exit.

Research Methods

A mixed-method approach that leverages both qualitative and quantitative data will be used to answer the research question effectively. A mixed research approach is known to uncover hidden insights, ensuring the discoveries are validated and the experiences behind the numbers are known (Dawadi, Shrestha, and Giri., 2021). Using this technique is justified by the complexity of the research question, which takes a multi-faceted approach to understanding the competitiveness of United Kingdom organizations and overall trade balances. Quantitative methods will help provide the numbers for the impacts on competitiveness before and after, while qualitative methods provide a deeper insight into the numbers.

Research Strategy

The research strategy employed will combine primary and secondary data collection methods. Secondary data will be collected from various sources, including YouTube videos, Scholarly sources, online articles and websites, company reports, governmental filings, and industrial reports. These secondary data sources are diverse and cheap to collect and will be relied heavily upon to answer how BREXIT has affected the competitiveness of United Kingdom-based businesses.

Primary data will mainly be collected through surveys and interviews sent to various parties. These respondents include business owners, particularly those involved in international trade, policymakers, mainly governmental officials, and subject matter experts in economics and other related fields. The research strategy will facilitate a nuanced understanding of the research question under analysis.

Data Collection

Secondary data will be collected by leveraging experts who comprehensively reviewed the academic journals and other sources. The gathered quantitative information will be stored in various databases ready for analysis. Primary data will be collected by interviewing businesses that deal with the European Union and the United Kingdom, regardless of their sectors and sizes. The interviews will be semi-structured, and the interviewees shall let the respondents direct the nature of the questioning. Online and in-person methods are to be relied upon when interviewing the respondents.

Data Analysis

The quantitative data collected from the surveys shall be analyzed using various statistical techniques such as descriptive statistics, regression analysis, and other methods for identifying the trends and patterns in the business. Thematic data analysis shall be used to understand the nature of businesses in the United Kingdom before and after the BREXIT. This method is effective for interviewing focus groups and gaining an understanding of open-ended responses, documents, and texts (Yanto, 2023). Combining statistical methodologies and thematic analysis shall ensure an accurate problem interpretation.

Anticipated Difficulties and Solutions

The collection of primary data will be anticipated to have various problems, such as some responders not being open for the interviews and their time is limited. The data collection methods will rely on interviews, which research has proved to be affected by subjective interpretations (Afolayan and Oniyinde, 2019). Additionally, there will be challenges in collecting a significantly sufficient data set as there are time, resource, and monetary constraints. These challenges shall be addressed based on the wide array of secondary data available.

Ethical Issues

Various ethical issues must be addressed before this study is initialized. First, permissions will be gained from Regent’s University of Research Ethics to ensure it meets the general expectations of the institution for research. Additionally, a confidentiality agreement will need to be reached between the respondents and the interviewers to have their information for the interviews. As for the surveys, the personal data of the respondents needs to be kept confidential and will be archived when its use is completed.

Validity and Reliability

This study relies on qualitative and quantitative methods, ensuring that real stories from the interviewees justify the numbers collected. Moreover, the study leverages both primary and secondary data, and thus, synchronization of the two data collections shall be done to enhance validity and reliability. The secondary data sources must also be authentic and peer-reviewed to ensure accuracy. Sources used shall be less than five years to ensure they address the issue. Experts will be interviewed to confirm the insights presented by business owners and governmental policymakers.

Research Timeline

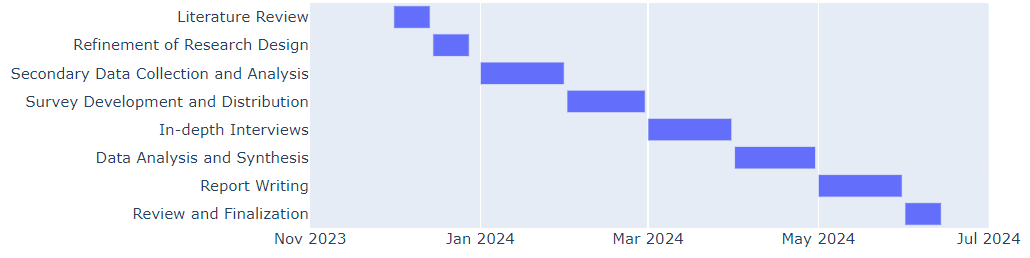

The research will commence of 1st December and its acivites shall include literature review, refinement of literature methods, data collections, indepth interviews and report writing. A timeline for the research is available in the Gantt chart shown in Appendix 1. This will allow for systematic research to be conducted where all activities are allocated ample time.

References

Afolayan, M.S. and Oniyinde, O.A., (2019) ‘Interviews and questionnaires as legal research instruments’, Journal of Law Policy & Globalization, 83, p.51. Web.

Bloom, N. et al. (2019) The Impact of Brexit on UK Firms. National Bureau of Economic Research.

Dawadi, S., Shrestha, S., and Giri, R. A. (2021) ‘Mixed-methods research: a discussion on its types, challenges, and criticisms’, Journal of Practical Studies in Education, 2(2), pp. 25-36. Web.

Fontanelli, F. (2023) ‘The law of UK trade with the EU and the World after Brexit’, King’s Law Journal, 34(1), pp.3-29. Web.

Jozepa, I. (2021) ‘Trade: key economic indicators’, House of Commons Library. Web.

Ke, L. et al. (2022) ‘The impact of Brexit on supply chain cost and Ro-Ro traffic at Dover’, Maritime Policy & Management, pp.1-17. Web.

Korus, A. and Celebi, K., (2019) ‘The impact of Brexit news on British pound exchange rates’, International Economics and Economic Policy, 16, pp. 161-192. Web.

Naimy, V. et al. (2023) ‘Post-Brexit exchange rate volatility and its impact on UK exports to eurozone countries: A bounds testing approach’, Oeconomia Copernicana, 14(1), pp. 135-168. Web.

Office for Budget Responsibility (2021) Economic and fiscal outlook November 2021. Web.

Paterson, A. et al. (2023) ‘The impact of government policy responses to the COVID‐19 pandemic and Brexit on the UK financial market: a behavioural perspective’, British Journal of Management. Web.

Yanto, E.S., (2023) ‘The what and how of essential thematic analysis’, The Qualitative Report, 28(11), pp. 3120-3131. Web.

Appendix 1: Research Plan Gantt Chart