Introduction

This essay will focus on the BBC article, COP26 promises could limit global warming to 1.8C, with a specific focus on the impact of climate change on property development and management in the global market. The article discusses the various climate change initiatives, status quo, and necessary targets. It discusses the impacts and interactions that different industries have on climate change and carbon emissions. Recently, much attention has been aimed at construction and property development as the industry leaves a severe imprint on the environment ranging from destruction of ecosystems to the carbon footprint of materials and methods used (Gribben, 2021). This essay will discuss the multiple factors of the impact of climate change on property development and construction in the context of globalisation, technology, and conflict and cooperation of stakeholders. It is important to note that the relationship between property development and climate change is reciprocal, just as much as climate impacts shifts in property development, so does property development impact climate, primarily through the construction processes undertaken by developers and the scale of global development in recent decades due to processes of globalization.

Globalisation

Globalisation can be described as the interdependence of the world’s economies, populations, and cultures that is brought about by cross-border trade of not only goods, but services, technology, professional skill, investment, and information. The wide-ranging effects of globalisation are intricate and often depend on a complex number of factors. However, with major advances in technology and wealth-creation, the concept has benefited human civilization as a whole, creating multiple benefits but also having significant consequences (Kolb, 2021). Globalisation set off a chain reaction in the world with capitalism being the underlying foundation. Trade increased allowing for better and cheaper availability of goods and services, increasing their demand and growth of multiple industries as money flow increased, in turn, creating the need for production which warranted the need for investment, labour, and infrastructure. The whole system is built on an intertwining web of connections. One major consequence of globalisation has been increased urbanisation, which is a historic trend in periods massive economic and technological growth. In the era of globalisation, large urban regions form around major cities in order to be connected to the global economy and compete among each other (Florida, 2016).

Urbanisation in that context requires significant infrastructure such as residential, commercial, utilities, transport, and finally, production of goods and services. Infrastructure, urbanisation, and economic growth has resulted in an exponential increase for construction and property development. In many countries, the real estate and property market is directly rooted in economic performance (Kolb, 2021). China is the biggest example of this, as the real estate market is strongly connected to the country’s financial system. Housing is the largest component of households’ asset portfolios, and housing sales totalled 16.4% of China’s GDP in 2017 (Liu & Xiong, 2020). As its economy rapidly grew since the 1990s, China has seen an unprecedented property development and housing boom, with annual growth rates on prices averaging at 13.1% and urban centers seeing tremendous growth (Liu & Xiong, 2020). Construction and property development have seen unprecedented growth around the world, with global annual spending exceeding $10 trillion or 13% of the global GDP, it is one of the largest economic sectors (McKinsey Global Institute, 2017). It encompasses many aspects of investment, labour productivity, technologies, and manufacturing sectors globally to create the infrastructure necessary for economic expansion and globalisation projects.

First, it is necessary to define property development, also known as real estate development. It is a business process which seeks to develop buildings or land into higher use value. By adding value to the property, the developer than gains a profit by either selling it or managing it and renting it to others. The concept is broad and can include activities such as purchasing land and building on it (engaging in construction as well), renovating or improving a property, or converting a property from one use to another (Griggs, 2021). The industry of property development with all its encompassing part leaves a severe environmental footprint in a variety of ways. The real estate sector is alone responsible for 20% of global carbon emissions. It also consumes 40% of global energy needs annually and 30% (3 billion tonnes) of raw materials produced. There are also other environmental impacts such as properties are expected to use 12% of fresh water supplies and generate 30% of total waste on an annual basis (World Economic Forum, 2016).

Real estate development is often an extremely profitable industry, particularly in the urban centers which have grown excessively in the context of globalization. Many cities have expanded multiple times over the last two decades alone, but in some areas, there is limited land, so developers must find innovative solutions such as building high rises that are feats of engineering. Real estate pricing has grown exponentially as demand virtually never ceases in such locations, the consequences of overpopulation combined with the business of multinational firms (Colon, 2021).

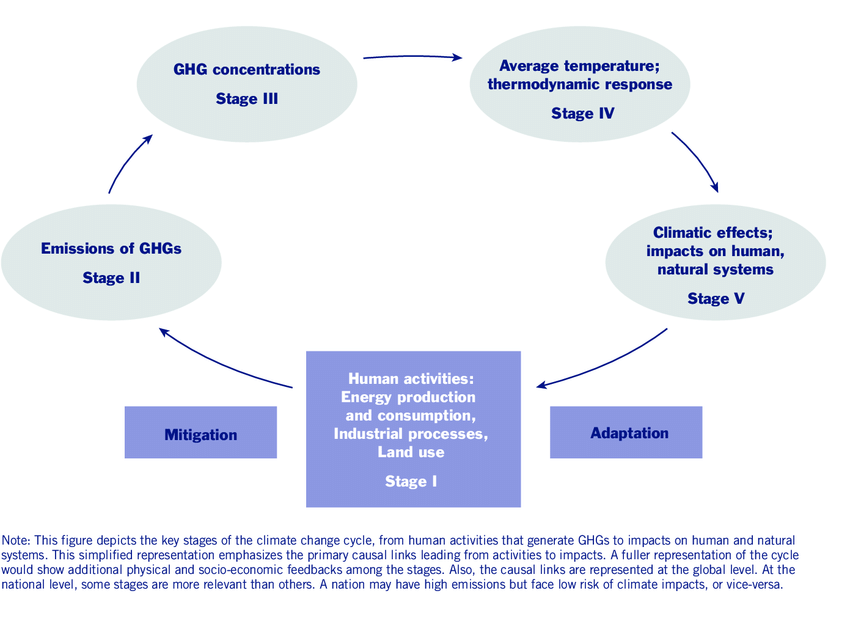

However, this creates a vicious cycle in regard to climate change. Increased demand from growing economies and populations leads to higher rate of property development, which results in greater environmental impacts such as emissions, natural resource and land use, deforestation, and other substantially affected factors. In turn, the affected environment responds, through aspects such as climate change, temperature rise, severe weather, scarcity of resources, and other means impacting the human population. This forces humans to adapt and change human activities in line with the status quo of the environment in order to ensure survival. This is demonstrated by the climate change cycle (figure 1) by Aldy et al. (2003) in Appendix A. The simplified representation of this cycle suggests that the causal links are stemming from human activities to its impacts at the global level. This change is incremental, and in practicality can be demonstrated in the property development industry globally. In comparison to 20-30 years ago, there is a different approach to use of materials, design, technology, and regulations.

Technology and Networks

Technology as an underlying concept is vital for every modern industry, affecting either product innovation or process innovation, as well as enhanced information flow. As a mature industry, property development in its nature favours process innovations, but also utilizes many product innovations from outside industries to supplement its primary purpose. Technologies in real estate are consistently being developed alongside construction techniques, improved engineering, and various uses of new digital and physical technologies to achieve its aims of efficiency, safety, and sustainability. While some technologies are proprietary, many are shared or sold within the global network of trade and stakeholders, potentially being used in different forms for various purposes within the industry. However, it is clear, that as a consequence of climate change, demographic shifts, regulations, and economic growth, organizations within the property development must adapt through technology to fit societal needs. As mentioned previously, society and organizations must adapt to learn to survive, both literally and under the influence of the market as driven by climate change evidence. The industry has needed to transform itself significantly.

Given the percentage contributions that the real estate industry plays in consumptions discussed in the globalization section, property development must step up as its part in decarbonization. It is a tremendous task, but pragmatic largely dependent on climate technology. Strategic use of existing and promising climate-tech solutions in its portfolios allows developers to manage risk. Concreate and steel which are the widely used materials in modern construction accounts for 8% of global emissions, so technologies using higher carbon utilization processes, advanced materials (such as reinforced timber or 3-D printed parts), and better efficiency are helpful in achieving net zero emissions for new building construction (Rothstein, 2021).

There are a wide range of additional technologies in the industry. Clean energy production via wind and solar directly on buildings are gaining trends and being lowered in price sustainability. There are also internal technologies such as energy monitoring within the building to then use AI to manage energy distribution and consumption throughout the day. Specialized heat and power systems are being developed that are integrated with photovoltaic sensors and can reduce CO2 emissions by as much as 35%. There are other machine-learning and climate tech technologies that also focus on delivering savings for gas, water, and electricity (Villegas, 2020). Overall, if invested and implemented, modern properties are expected to be highly sophisticated with building management and automation done through electronic control and artificial intelligence which monitors data and responds based on internal and external conditions, contributing to as much net zero emissions as possible.

As the above quote implies, technology and information sharing evolves when the need for it is the strongest. Albeit dramatic, but as discussed in the original article, scientists, environmentalists, and politicians are sounding the alarms. Humanity has already crossed many established red lines, and it is extremely close to reaching a point of no return, where the changes to the environment as a result of human activity will be unreversible, and sooner than later, human civilization will face an existential crisis because of the climate change impacts (Gibben, 2021). This is part of the significantly complex systems theory which suggests that technology and networks develop with an emphasis on inertia and heterogeneity. Therefore, when a technology is being built, there are inherent connections to social, economic, cultural, and political factors that drive the need or, the opposite, a lag, in its development (Chatterjee et al., 2020). The property development industry is therefore responding to the need for evolution under pressures of climate change as it faces pressure from regulators, stakeholders, and market forces described in the next section. However, it is in the hands of developers to push the implementation of these technologies and share data and experience with governments and potential competitors to achieve the optimal results and faster progress.

Conflict and Co-operation

A major aspect of globalization has also led to the rise of international organizations and cooperation on various issues. Both international and regional cooperation ranging from the United Nations to the European Union Council to a collection of private organizations such as the World Economic Forum, these governing, and industry-influencing bodies are increasingly concerned with climate change. The COP26 is one of the largest annual climate change and environment focused government and industry forums in the world, which ultimately outlines the status quo around the world, presents latest research findings, and highlights goals and strategies to reduce environmental impact (Gibben, 2021).

When climate change was first presented in the late 20th century, there was significant distrust and conflict. While scientists and only a handful of politicians pushed for change, the majority of industry leaders and politicians dismissed this as temporary or non-impactful events. It has become known that many major firms knew about climate change, such as Exxon in the petroleum and gas industry, but chose to dismiss the facts and spent millions of dollars to promote disinformation beneficial to their bottom line (Hall, 2015). Similarly, with real estate development, it has been well-known for decades how impactful the carbon footprint from the industry is, but it is only recently that meaningful investments and efforts are being made towards decarbonization and relevant green technology development.

In recent years, more large corporations are committing to net zero within specific time frames. However, regulation is the underlying cause surrounding activity by real estate development towards decarbonization. Particularly in developed nations, regulators are the primary drivers which have pushed the “entire real estate value chain to adopt climate-tech solutions” (Villegas. 2020). Government regulators work closely with the scientific community to set targets and then communicate with stakeholders within the property development industry to emphasize these objectives, offering incentives for achieving them (such as tax rebates and performance certificates) while setting more severe penalties each year for failing to do so.

Investment also plays a key role, as climate change is impacting strategic operations of major financial players such as the Mortgage Bankers Associate in New York. There are calls for greater transparency in investment standards and strong influence towards investment towards sustainability in major property development projects. It is expected that soon the US Securities and Exchange Commission will also mandate environmental disclosures from public companies and private equity firms. Since many financial institutes operate internationally, and that industry is heavily regulated, many are backing for the creation of a global disclosure framework for corporate environmental risk (Sisson, 2021). In turn, such measures will trickle down to industries such as property development where investment is critical, resulting in actionable sustainable results. As emphasized by Nelson (2008), multinational corporations and global investment firms are key to establishing green business practices around the world through tenancy and investment criteria. Essentially, it calls for standardization of real estate products within the context of environmental sustainability and green technologies.

Climate change is an issue that has served to be unifying for the majority of the world’s governments and corporations, given the evidence in recent years that the impact to humanity can be devastating. Corporations are also realizing that they can pursue profit but utilize green technologies and decarbonization for cost savings in other areas such as managing the property and energy management. Cooperation on key issues while maintaining health competition has been effective in achieving some progress on net-zero targets and environmental regulations. The industry as a whole is pushing towards establishing real-estate sustainability standards for best-in-class available technology and performance, while committing to continuous improvement in all development activities and tracking environmental footprints (World Economic Forum, 2016).

One of the primary challenges in the property development industry is integrating multiple technological solutions and innovations into one single asset. While it may be easier on new buildings in the design stage, it is much more difficult to achieve for other functions of property development such as retrofitting new builds. Real estate is also a highly conservative industry, with property owners very reluctant to adopt new technologies, especially in a capital constrained environment. However, the immediacy of climate change, regulatory pressures, and financing by private equity in real estate can help in overcoming this. There are also value-added benefits of reducing operating costs and cutting carbon emissions. The industry should fully engage to committing to change in their properties at the asset level (Villegas, 2020).

Discussion and Conclusion

Climate change has strongly impacted property development and management. There are many elements to consider ranging from location to materials to costs and energy use. As commonly known, rising temperatures are inevitably contributing to rising sea levels. At the same time, nearly 40% of the world’s populations lives within 100 miles of a coastline, while many others live in vulnerable climate areas such as desert areas (NOAA, 2017). The rising global temperatures are resulting in rising sea levels, leading to not just increase in flood potential, but predictably large swathes of land being underwater. Meanwhile, areas where water is not a threat, there are greater risks of severe temperatures, both hot and cold, driven to the extremes by the climate shifts of recent years, making environments increasingly difficult for habitat (Leiserowitz, 2005).

This relates to property development on a global level because the industry has to adapt rapidly in order to both, attempt to reduce its carbon footprint and create infrastructure that is environmentally beneficial while helping protect humans from climate exposures. The concept is globalized because the major real estate developers, the ones truly making an impact, most commonly operate on a multinational or regional levels. Some examples of this include Brookfield Asset Management (Canada), American Tower Corporation (U.S.), SEGRO PLC (UK), and Evergrande (China). These firms operate with billions in revenue and manage hundreds of property development and construction projects, with extensive control over resources, designs, and technologies utilized (Kirsch, 2021)

In the context of capitalism, it is up to developers whether to maintain corporate social responsibility and adopt greener business practices and sustainable property development, which is at this point much more costly. Or some developers may choose to pursuit profit and in regions of the world with laxer environmental regulation, developers may choose to continue unsustainable practices. However, generally globalization is accelerating and reinforcing sustainable property development and operating trends around the world in attempts to decrease resource and energy consumption and decrease greenhouse emissions, particularly in developing regions (Nelson, 2008).

As mentioned previously, the property development industry has been affected by the climate change cycle as many other industries have. It is both, a major contributor to the issue, but climate change is a major driving force to innovation within it. The major impact of climate change on property development can be seen in the combination of technologies and regulations. Property development is a critical part of the modern globalized world, and demand along with wealth creation will continue to drive the industry.

However, technologies have been critical for the sector, both historically and in contemporary times. Technologies discussed in this paper can affect carbon footprint, energy consumption, usage, and generation, temperature management inside and outside a building, materials utilized and the supply networks needed to manufacture and ship them, and many more technologically dependent factors. Climate change is driving development of sophisticated technologies used in property development for various sustainability purposes. Meanwhile, the growing cooperation of stakeholders is an underlying element to regulations being created, imposed, and followed both at the government levels and governing or business organizations in the industry. Nelson (2008) identifies the factors of “tenant space requirements, government regulations, and demands for socially-responsible investments” as vital to driving property development towards greener and sustainable operations (p.1). Through introduction of green-based principles and practices throughout the whole network in the industry ranging from regulators to suppliers, real estate development can take on new sustainable forms for both unique and standardized designs.

Reference List

Aldy, J.E., et al. (2003). ‘Beyond Kyoto advancing the international effort against climate change.’ [Online]. Web.

Chatterjee, S., Sarker, S., Lee, M.J., Xiao, X. and Elbanna, A. (2020). A possible conceptualization of the information systems (IS) artifact: A general systems theory perspective1. Information Systems Journal. 31(4), 550-578.

Colon, S. (2021) ‘‘Never seen anything like that’: Industrial real estate experiencing ‘unprecedented growth’.’ [Online] Web.

Florida, R. (2016) ‘A new typology of global cities.’ [Online] Web.

Gribben, P. (2021) ‘COP26 promises could limit global warming to 1.8C.’ [Online] Web.

Griggs. (2021) ‘What is property development and how does it work?’ [Online] Web.

Hall, S. (2016) ‘Exxon knew about climate change almost 40 years ago.’ [Online] Web.

Kolb, M. (2018) ‘What is globalization.’ [Online] Web.

Leiserowitz, A.A. (2005) ‘American risk perceptions: is climate change dangerous?’ Risk Analysis, 25(6), pp.1433–1442.

Liu, C. and Xiong, W. (2020) China’s real estate market. In: W. Xiong, M. Amstad and S. Guofeng, eds., The Handbook of China’s Financial System. Princeton University Press, pp.1–34.

McKinsey Global Institute. (2017) ‘Reinventing construction: a route to higher productivity.’ [Online] Web.

Nelson, A. (2008) ‘Globalization and global trends in green real estate investment.’ [Online] Web.

NOOA. (2017) ‘What percentage of the American population lives near the coast?’ [Online] Web.

Rothstein, S. (2021) ‘Climate tech for real estate: the elephant in the room.’ [Online] Web.

Sisson, P. (2021) ‘As risks of climate change rise, investors seek greener buildings.’ [Online] Web.

Villegas, A. (2020) ‘Climate tech comes to real estate’s rescue.’ [Online] Web.

World Economic Forum. (2016) ‘Environmental sustainability principles for the real estate industry.’ [Online] Web.

Appendix A