Analysis of the Recent Economic Event

The oil industry plays an extremely important role today because its development allows the population to maintain their lives in the way they used to. People have an opportunity to transport various products and travel, which is vital from both personal and professional perspectives. The price of oil alters rather often and in the majority of cases, it becomes higher, which makes the general public dissatisfied.

According to the report presented by Art Berman (2016), the supply of oil is currently increasing, which decreases demand and makes the price drop. Organization of the Petroleum Exporting Countries (OPEC) is not likely to cut production shortly even though the International Energy Agency (IEA) and U.S. Energy Information Administration (EIA) also supply lots of oil because it will achieve nothing but a short-term price increase.

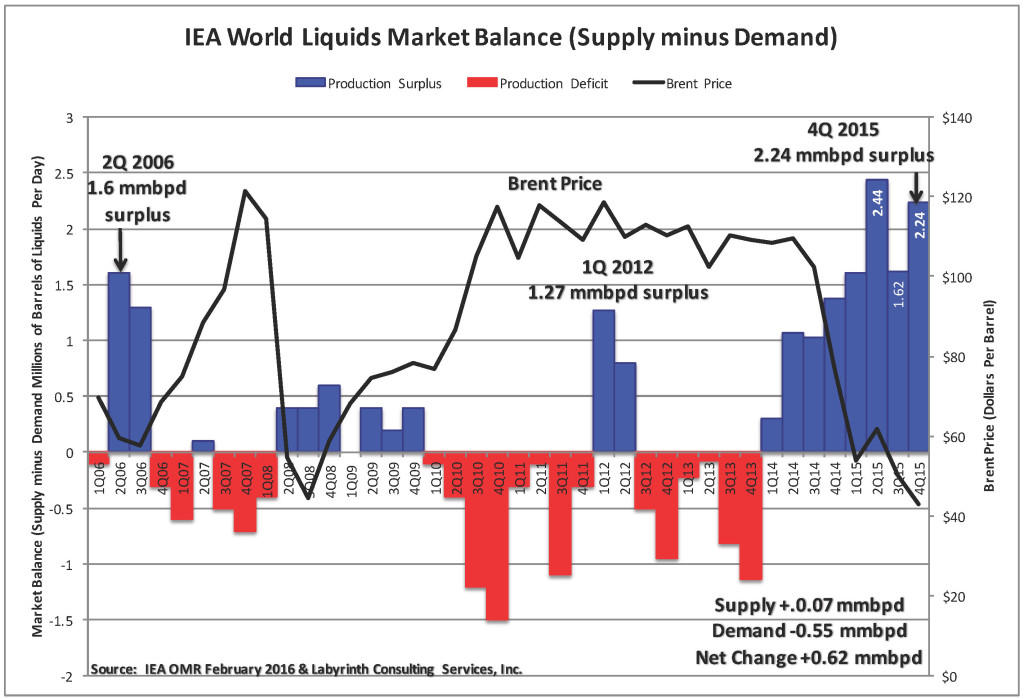

Three organizations are over-supplying the market, and the situation turns out to become worse and worse as “IEA data shows that the global liquids over-supply increased in the 4th quarter of 2015 to 2.24 million barrels per day (mmbpd) from 1.62 mmbpd in the 3rd quarter (Figure 1)” (Berman, 2016, par. 2).

As it can be seen in Figure 1, “supply increased 70,000 bpd and demand decreased 550,000 bpd for a net increase in over-supply of 620,000 bpd… as hopes for production cut faded, prices fell 8% last week and have fallen below $28.00 as reality regains control of market expectations” (Berman, 2016, par. 5).

Some people believe that OPEC’s reluctance to decrease supply and make prices lower became one of the reasons the global price of oil was affected. Still, the researchers state that such a claim is not supported by data. Oil production declined till September 2015 and stopped but then began to increase again. The situation is likely to remain unchanged until the moment US production reduces.

Connection with Macroeconomics

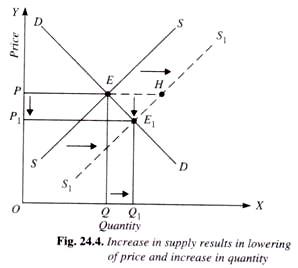

The case described above coincides with the theoretical information provided by Arnold’s (2012) that is targeted at macroeconomics. In his work, the professional underlined that supply, demand, and price are tightly connected. He pointed out the idea that was also supported by Guru (2015) and stated that “increase in supply results in lowering of price and increase in quantity”; such changes are shown in Figure 2 (par. 21). The same concepts are described as the basis of a market economy by Heakal (2013).

The professionals’ ideas also prove the point of OPEC regarding the outcomes of possible change. Arnold (2012) speaks about short-run equilibrium that can be achieved if the company cuts production. He claims that if the supplied quantity is greater than the demanded one, the price level drops, and only the reduction of output can improve the situation and will make the market buy more. Thus, the fact that OPEC expects its US colleagues to be the first to act worsens the situation. Trying to sell as much oil as possible, the organizations are just waiting for one of them to consider the issue critical enough to implement changes.

Conclusion

The issue with the oil over-supply is not solved yet. However, theoretical information delivered by the professionals can provide a glimpse of reality. The situation was not likely to improve even though there was some reduction of production because the organizations are still not ready to accept at least a short-run equilibrium that would entail the increase of price, which is beneficial for them. For now, we can do nothing but wait for changes and the establishment of long-run equilibrium that requires stability in supply, demand, and prices.

References

Arnold, R. (2012). Macroeconomics. Mason, OH: Cengage Learning.

Berman, A. (2016). OPEC production cut unlikely until US oil output falls another million barrels per day. Web.

Guru, S. (2015). Changes in market equilibrium: Impact of increase and decrease. Web.

Heakal, R. (2013). Economics basics: Supply and demand. Web.