Abstract

Oil prices rise and fall depending on the demand and supply of the commodity in the market. Several factors affect demand and supply and a balance of these two is required in order to keep prices stable (Hansen, 2005). Due to uncertainties in oil supply, strategic oil reserves are held by many countries. The increase in demand for oil in the future due to factors such as increase in population would lead to increased production. Theorists predict that production of oil will be characterized by a rise, peak and fall (Duncan, 2001). Conservationists fear that oil would be overexploited to a point of depletion. The future is uncertain since several factors affect demand and supply of the commodity.

Introduction

The recent rise and current decline in oil prices may be described using the economics of oil markets. Oil prices are usually influenced by changes in supply and demand for the commodity. As demand increases, the prices increase. Consequently, as supply increases, the oil prices decrease. Oil markets have significant effects on the state of individual economies since oil is the largest globally traded commodity. Oil prices affect several industries within an economy. However, others are affected more. In order to ensure availability of oil during an energy crisis, countries have employed the use of strategic oil reserves (Owen, Inderwildi, & King, 2010).

Causes of Recent Rise and Current Decline in Oil Prices

Currently, oil prices have dropped to approximately one half of its price in the 1990s. From a price of about U.S. $30 per barrel, the price has dropped gradually but systematically to about $20. However, the prices rose back and stabilized at about $15 per barrel. The changes in oil prices may be explained best using economics. It is also important to understand how speculators influence oil prices. It is assumed that oil prices fluctuate more in the short run but less in the long run.

This is mainly due to the fact that consumers and producers do not adjust immediately to the changes. They tend to be reluctant to make adjustments when changes in supply and demand occur. In the short run, both demand and supply are highly inelastic. Huge fluctuations in price would have a small impact on demand (Lutz & Vega, 2011). In this case, the demand curve would look like the one below.

In the late 70s, for example, many oil-producing countries reduced the supply of the commodity. The expectation was that there would be a slight decrease in demand. They rightfully predicted that their oil revenues would rise. What resulted in the short run was an increase in revenues due to their resistance to change.

If consumers expect oil prices to remain high, they would limit their use of oil. For example, they can start using economy vehicles instead of the high-consuming ones. They could as well prefer using public transport. During winter, consumers may reduce the use of oil-powered machines and opt to increase insulation in their houses and dress warmly. However, demand is not the only factor that causes decline in oil prices.

Changes in supply also contribute significantly. Suppliers also adjust accordingly in the event that they believe prices would remain high. They could uncap wells that had been abandoned due to high costs associated with them. They could also drill deeper for oil despite the costs that would make the venture unprofitable. With the increase in prices, the quantity would increase slightly in the short run. In the long run, supply would increase substantially. The decrease in demand and increase in supply eventually lead to a decrease in oil prices (just like in the 1970s).

In 1986, oil prices fell suddenly and significantly. This was the long term effect of the demand and supply of the commodity. For a decade, the prices only fluctuated slightly. The changes in oil prices during the 80s and 90s were mainly caused by two major factors. Firstly, the demand for the commodity increased due to the rate at which the Asian economies were growing.

Secondly, the advancement in technology helped reduce the costs of exploration. Other areas that were supported due to advancements in technology included transportation, drilling, refining and pumping. During the Asian financial crisis in the late 90s, the demand for oil and its products fell sharply. Countries involved included Singapore, Hong Kong, Japan, South Korea and Thailand. Consequently, this led to the sharp fall in prices (Lutz, 2008).

With time, demand in the European countries and the U.S. increased. However, its supply decreased. Suppliers had stopped exploring and had ceased exploiting deep due to high costs associated with the exercise. It was expected that oil prices would rise over time due to changes in supply and demand. However, the prices rose drastically over a very short period. The only explanation for this is the presence of speculators. After learning about the decision of the producers to stop producing, the speculators believed that it would lead to increased prices. Therefore, they stepped in fast so as to purchase the oil before the prices could rise. This led to the sharp increase in price.

What the future holds

In the future, the prices of oil are likely to decrease due to increase in production and decrease in demand. Oil production in the U.S., for example, is expected to grow dramatically over the years. This would make it the world’s largest oil producer. Canada is also expected to boost its production capacity. Increase in production would decrease the countries’ reliance on foreign sources of oil and the consequent decrease in oil prices.

With advancements in technology, oil-producing countries are expected to have increased productive capacity. Such technologies include horizontal drilling and fracking. However, countries would need to reduce their production of oil in order to prevent the prices from falling too low. Apart from increase in supply, the demand for oil has been slow and may be the case in the future (Miller & Sorrell, 2006).

Impact that oil markets have on the state of the global economy

Oil is the largest globally traded commodity. For this reason, its price is critical to the global economy. In addition, the price of machines that operate using oil is dependent on the oil prices. These prices also influence the price of other fuels. For this reason, huge changes in prices would affect the global producers and consumers of the commodity (Peersman, & Robays, 2011).

For example, Algeria relies largely on revenue from oil and its products. The revenue generated from export of these products may account for more than 95% of the country’s total export revenue. For this economy, slight changes in price per barrel translate to huge losses in revenue annually. During this period, the declining oil revenues caused further complications given that the country was facing severe social and economic tension.

It came at a time when the country had experienced conflict with Islamic Salvation Front for six years. During the same period, the returns from exports were expected to decline significantly in Indonesia. This further complicated the situation since the country had suffered during the Asian economic crisis. In order to cope with this crisis, it was necessary to reduce the prices.

Iran’s economy also relies largely on revenue from oil exports. It accounts for approximately 85% of total export revenue. In 1998, Iran’s foreign debt obligations were estimated at $26.4 billion. Repaying the debt was difficult because the revenue obtained from exports had reduced. For Kuwait, the commodity produces 90% of the country’s revenue.

This translates to about half of its GDP. With the increase in oil prices and decrease in oil export revenues, the country decided to cut spending significantly. Libya was also greatly affected by oil prices. The country relies on oil exports to generate about 95% of its earnings. The low oil prices affected the production of the commodity for export. In addition to this, the U.N. sanctions imposed on the country made things worse.

Changes in oil prices can also affect a country like Nigeria. This is mainly because it gets 90% of its foreign exchange earnings from exporting oil. Decreased oil prices and reduced production led to the fall in revenue by 36.0%. Following the political instability in the country in the 1990s, the short-term economic growth was greatly affected. During the same period, the United Arab Emirates had slowed down significantly. This was partly due to the decrease in oil prices that led to the fall in oil export revenues. For this reason, the government reduced its expenditure.

Recent developments in the oil markets have revived the fears surrounding the impact of oil prices. The growth and development of emerging economies has been suggested as one of the causes of increase in oil prices over the past few years. This has also raised concerns that increased prices could affect the recovery process of advanced economies and other small nations involved in oil importation. As oil prices rise, and so does the import bill. The GDP also goes up. It has been argued that increased oil prices can be associated with positive effects on the global economy.

Industries hardest hit by rising oil prices

Increase in oil prices usually affects the industries in a country. One of the hardest hit industries is the automobile industry. Currently, there is increased production in the U.S. This has also affected the rate at which vehicles are bought. The sale of vehicles generally decreases as oil prices increase. Consequently, this affects employment since the automobile industry has employed many individuals including manufacturers and dealers.

The sale of vehicles with less fuel efficiency is greatly affected as people opt to purchase vehicles with best fuel economy. The driving patterns of individuals have changed due to this effect and this can be seen in the decrease in distance traveled on highways despite the increased population (Soderbergh, Robelius, & Aleklett, 2007).

Another industry affected by oil prices is the construction industry. The contractors’ cost tends to increase since they require on-location travel. The cost of shipping is also expected to rise as oil prices rise. This only translates to higher costs of importing or exporting. The food production industry may also be greatly affected due to the increase in operating costs in each farm that uses oil-powered equipment. The products manufactured from petroleum are expected to cost more. For example, plastics and certain chemicals would cost more.

Role that strategic oil reserves play and their use

Strategic oil reserves are stocks of crude oil held by countries or private industries so as to be used in the event of an energy crisis. In the U.S., they are maintained by the United States Department of Energy. They are emergency storage facilities with huge capacity. With the current daily consumption of 19.5 million barrels, this reserve can sustain this appetite for over a month.

The need for the oil reserves was realized in the 1970s when oil supplies were cut off during the embargo. The reserves were meant to provide supplies in case of future temporary supply disruptions (Longwell, 2002). For this reason, U.S. imports up to 12 million barrels daily. Of the total capacity, only 4.4 million barrels can be withdrawn in a day. This means that the reserves would provide fuel for more than 160 days.

The reserve is usually located in four different sites. Each site is usually located close to a major center with oil refineries and processing plants. Oil is stored in several caverns located up to 1000 meters below the earth’s surface. Each cavern has the capacity to hold up to 37 million barrels. The use of caverns is advantageous since they are cheaper. They also do not leak and they maintain steady conducive temperatures. In order to create the caverns, the earth’s surface is drilled and the salt is dissolved with water (Weber, 2010).

Unfortunately, these oil reserves have certain limitations. These facilities only hold crude oil and not refined fuel (Weissman & Kessler, 1996). For this reason, there would be limited supplies of fuel in case of disruptions to refinery operations. A good example is the case of Hurricane Katrina whereby several refining complexes were disrupted for a while. The capacity of the available reserves of refined oil cannot be compared to those of the strategic oil reserves. However, some nations have strategic reserves of both oil and its refined products such as gasoline and jet fuel.

The stocks in the U.S. are among the largest worldwide. In Europe, the Council Directive made it mandatory for the members of the European Union to maintain strategic petroleum reserves. Several African countries have also set up Strategic Oil Reserve. In Kenya, for example, the oil is sourced by the National Oil Corporation. Malawi is considering expanding its current 5-day reserve. South Africa has a Strategic Petroleum Reserve managed by PetroSA. Saldanha Bay is the primary facility with a capacity of 45 million barrels.

Are we running out of oil?

For a long time, it has been argued that oil supply would run out in a few decades. With the current estimated quantities of oil left in the major reserves, it is estimated that oil will only last for about forty years. However, others believe that such predictions are based on ignorance. There are ongoing debates among peak oil theorists and oil companies.

Oil theorists argue that the production industry has surpassed the point of maximum production (Chapman, 2014). Production companies, on the other hand, argue that technological advancements may extend the life of oil. Therefore, it is highly unlikely that we will run out of oil. However, it is possible that the oil reserves will be overexploited and lead to scarcity of the commodity.

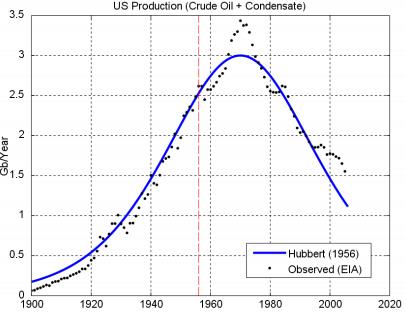

According to the peak oil theory, the rate of production would greatly decrease after the point of maximum production is reached. This predicts a rise, peak and fall of the rate of production (Brandt, 2007). Over time, it is suspected that the aggregate production would stop. However, it is also suggested that nations would start investing in alternative energy sources before the crisis. This would not require any major changes in lifestyle of the countries that rely greatly on oil. With these predictions, oil prices are expected to rise at first. However, they would drop at some point due to the use of alternatives.

The peak oil is expected to have several consequences depending on various factors. Firstly, it would depend on whether there are alternative sources available. It would also depend on the rate at which the current stocks are declining. If alternatives were not effective, it would mean that oil products would become scarce and expensive.

Conservationists also argue that oil may eventually be depleted because it is a non-renewable energy source. In addition to this, they also argue that burning of oil causes air pollution and the greenhouse effect as carbon dioxide is released into the atmosphere. For this reason, they suggest a switch to the use of renewable sources of energy such as wind energy, water and geothermal energy. They argue that this would make sense from an economic and environmental point of view. They suggest that conservation of oil reserves may be achieved through changes in individual use of the energy source.

One of the ways of conserving oil is by avoiding the use of vehicles as much as possible. One may ride a bicycle or walk instead of driving. Another way may be the use of hybrid or electric vehicles. Hybrid vehicles are powered by both electricity and petrol. This would translate to reduced consumption of oil. Electric vehicles, on the other hand, do not use gasoline. One may also opt to use public transport more often in order to reduce the consumption of oil.

The public transport system has the capacity to transport more people at the same time as compared to the use of personal vehicles. Reducing the use of plastics also helps in the journey towards oil conservation. Most plastic materials are manufactured from fossil fuels and this contributes to over exploitation of oil. The use of reusable bags may be a better alternative. Another method of reducing the use of oil is through recycling of materials. Individuals may be encouraged to use solar panels to power domestic appliances at home. This alternative may be used in heating and lighting. This would go a long way in ensuring conservation of oil.

Future possible developments on demand and supply side and impact on society

Oil is an important commodity for the global economy and it is for this reason that the Organization of the Petroleum Exporting Countries (OPEC) is working towards ensuring that the future global energy demand is met. It also ensures that the future socio-economic development of its members is secured. The two key issues addressed in the organization’s long-term strategy has to do with security of demand and supply. Global energy security is an issue that has been discussed all over the world. This issue was particularly talked about during the summit talks in Moscow.

There is a relationship between security of demand and supply. The two are interrelated and one cannot be achieved without the other. The issue is not only about whether supply would meet the future demand. It is also important to know whether the demand would meet the future supply. Global energy security is reliant on the equilibrium between supply and demand. It is with this assurance that countries can develop their short-term and long-term demand and supply strategies.

The demand for oil has always been growing. Oil is expected to meet the ever-growing demand at least for several decades. However, this depends on how demand and supply would develop over the short run and long run. In the short run, demand is expected to increase slightly. In order to meet the anticipated increase, countries have been involved in more production of the commodity. This has led to the increase in oil reserves every month. Plans have been put in place to increase capacity following the anticipated increase. In the near future, therefore, supply is expected to grow in the OPEC and non-OPEC states. This increase in supply is expected to exceed its demand hence ensure security of supply.

Increase in production capacity also requires growth in global refining capacity. In the past, the refining capacity grew slowly despite the increase in demand. This could be a challenge in the coming years and could cause market instability. Several other factors would have an impact on the demand for oil in the future. For example, global economic growth and increase in usage of vehicles could be a challenge. This would cause the increase in demand for refined petroleum. Another factor is country demographics. Increase in population may also lead to increase in oil demands. Energy and environmental policies could also have an impact on the demand for oil. These policies mainly advocate for the conservation of non-renewable sources of energy such as oil in order to reduce impacts on the environment and to avoid depletion.

Global economic growth is expected to lead to future increase in demand (Sorrell, Miller, Bentley, & Speirs, 2010). This is particularly so for the developing countries. Good examples include India and China. These two countries have a combined population of about 2.5 billion. This explains the significant increase in demand for oil. In the future, the demand for the commodity is expected to rise further. Given the low number of vehicles per 1000 inhabitants in these countries, it is expected that the transportation sector will grow and lead to the increase in demand for energy. This is expected to be the case if the developing countries follow a consumption pattern similar to those taken by developed countries.

Growth in population is another major factor that is expected to affect demand. The population of the world increases by the hour. In India alone, the population rose by over 250 million within a period of fifteen years. In china, the population grew by about 160 million over the same period of time. However, changes in demographic patterns may cause dramatic fall in population growth rate as experienced in other countries. Therefore, demand for oil may change depending on changes in the population.

Increase in consumption of oil also translates to emission of greenhouse gases that cause global warming. This may greatly affect the society. It is for this reason that OPEC saw the need for its member countries to work towards ensuring environmental conservation. It has worked towards addressing climate change by welcoming the Kyoto Protocol. Emphasis has been made on the use of cleaner sources of energy. Other fossil fuel technologies are also encouraged. For example, carbon dioxide can be captured and stored in order to prevent pollution. Taxation of oil products may be a way of controlling demand for the commodity In order to address the environmental issues and prevent overexploitation.

Conclusion

Oil prices usually fluctuate depending on the demand and supply. Changes in prices affect the state of the global economy. Since many countries rely largely on revenue from oil exports, changes in oil prices greatly affect the revenue of these countries. The industries hardest hit by rising oil prices include the transport and construction industry. Strategic oil reserves were developed to secure oil reserves in case of an energy crisis. Oil sources are believed to be limited hence the need for conservation.

References

Brandt, A. (2007). Testing Hubbert. Energy Policy, 35(5), 3074-3088.

Chapman, I. (2014). The end of peak oil? Why this topic is still relevant despite recent denials. Energy Policy, 64(64), 93-101.

Duncan, R. (2001). The peak of world oil production and the road to the Olduvai Gorge. Population and Environment, 22(5), 503-522.

Hansen, J. (2005). Earth’s energy imbalance: Confirmation and implications. Science, 308(5727), 1431-1435.

Longwell, H. (2002). The future of the oil and gas industry: Past approaches, new challenges. World Energy Magazine, 5(3), 100-104.

Lutz, K. (2008). The economic effects of energy price shocks. Journal of Economic Literature, 46(4), 871-909.

Lutz, K., & Vega, C. (2011). Do energy prices respond to U.S. macroeconomic news: A test of the hypotheses of predetermined energy prices? Review of Economics and Statistics, 93(2), 660-671.

Miller, R., Sorrell, S. (2006). The future of oil supply. Philosophical Transactions of the Royal Society: A Mathematical, Physical and Engineering Science, 372(1), 1-42.

Owen, A., Inderwildi, O., & King, D. (2010). The status of conventional world oil reserves – hype or cause for concern. Energy Policy, 38(8), 4740-4743.

Peersman, G., & Robays, I. (2011). Oil and the Euro Area Economy. Energy Economics, 24(60), 603-651.

Soderbergh, B., Robelius, F., & Aleklett, K. (2007). A crash programme scenario for the Canadian oil sands industry. Energy Policy, 35(3), 1931-1947.

Sorrell, S., Miller, R., Bentley, R., & Speirs, J. (2010). Oil futures: A comparison of global supply forecasts. Energy Policy, 38(9). 4990-5003.

Weber, B. (2010). Alberta’s oilsands: well-managed necessity or ecological disaster. Moose Jaw Herald: The Canadian Press.

Weissman, J., & Kessler, R. (1996). Downhole heavy crude oil hydroprocessing. Applied Catalysis, 140(1), 1-16.