Introduction

Inflation is a highly contentious issue. This is due to its economic implications. For instance, if not regulated, inflation has the potential of crippling a country’s economy. As a result of this, governments are always coming up with policies and strategies to ensure that it remains at manageable levels, meaning low and steady levels. The United Kingdom has faced its fair share of economic problems resulting from fluctuating inflation rates which have in turn had their effects on economic factors such as employment rate, consumer price index, value of the currency, general consumption trends and in effect the standard of living of people in the country. Most of the time government efforts always give varying results.

Causes of Inflation

Inflation refers to the general increase of price levels in the economy usually measured as a percentage referred to as the inflation rate, which represents the pace at which prices are increasing (Musgrave & Kacapyr, 2006). This rate is normally based on the prices of different goods and services measured over a certain period of time. Continued inflation usually erodes the purchasing power of money since when the prices of commodities increase; the same unit of money purchases less and less commodities (Hoag & Hoag, 2006). The causes of inflation differ as presented by different schools of economic thought and they include the following:

Demand Pull Inflation: Demand Pull Inflation refers to the type of inflation that occurs when the aggregate demand in the economy exceeds the aggregate supply. This means that when the demand for certain commodities goes up and all other factors such as the supply of commodities remain fairly constant, the commodities prices rise. The situation is as a result of demand pulling up the prices of the commodity because the level of supply in the economy cannot match up to the level of demand (Geetika, Ghosh & Choudhary, 2008). The increase in demand for commodities may be as result of an increase in peoples’ disposable income, an increase in a country’s populations as well as an increase in peoples aggregate spending. According to Grahame & Grant (2000), the demand pull inflation that occurred in the United Kingdom between 1986 and 1989 was as a result of an increase in the level of consumer spending which was warranted by the low cost of borrowing, the availability of funds for borrowing and the high level of confidence among the business community due to the reducing levels of unemployment.

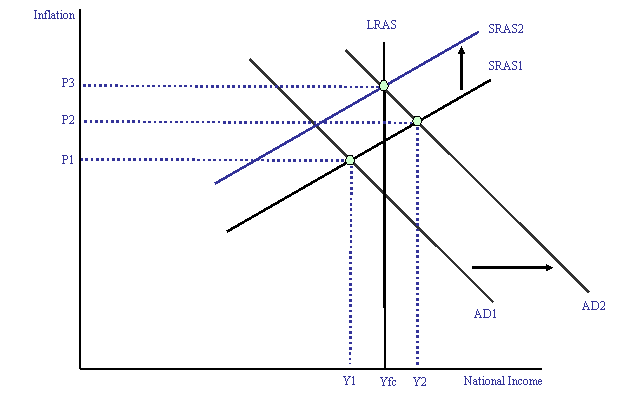

In the diagram below, the Y axis represents the level of inflation while the X axis represents the level of national income. The initial level of demand is AD1; the supply is SRAS1, the income Y1 and the price P1. When the level of income moves from Y1 to Y2, it leads to an increase in aggregate demand to AD2. This increase in Aggregate Demand pushes the price level to P2 which is higher than the initial P1. Economic forces come into play pushing the price to P3, which shows a general increase in price levels from P1 to P3 and thus inflation.

Cost Push Inflation: Cost push inflation occurs from a continued increase in costs within the economy. It originates from the supply side of the economy which shifts the aggregate supply in the economy to higher levels (Macdonald, 1999). This kind of inflation is warranted by a persistent increase in the cost of production over a certain period of time which in turn leads to a high level of aggregate supply. The increase in aggregate supply may occur as a result of rising wage levels, increase in commodity prices, rising profits as well as increase in taxation levels. In the United Kingdom, a considerable number of employees work for the government. An increase in their wage levels is normally emulated by the private sector meaning that the general wage level rises. Though in recent years, the public sector wages have continued to be lower than those of the private sector. According to Macdonald, (1999) the period between 1973 and 1979 was characterised by an increase in oil import prices. Since oil is a widely used commodity, the rising prices led to an increase in costs which different businesses transferred to consumers in the form of high prices for commodities, causing a persistent increase in price levels in the economy. These factors combined contributed to the inflation that was experienced at the time.

Money Supply: This theory as a cause of inflation is mostly fronted by monetarists who believe that an unwarranted increase in the level of money supply in the economy lead to high levels of inflation. The high rates of inflation witnessed in the United kingdom during the 1970s was blamed on the rise in the supply of money in the economy as fuelled by the government as they offered increased wages to their employees and the strength of trade unions which pushed for high wages for their members (Floud & Johnson, 2004). The level of money supply was therefore at an all time high meaning that people had a lot of disposable income on their hands. This increased the level of demand for commodities in the economy above that of the supply led to an increase in the level of commodity prices. Due to the prevalence of this situation, the levels of inflation went up leading to one of the country’s major economic crisis.

United Kingdom Government Inflation Control Policies

The United Kingdom’s fight against effects of inflation dates back to the Second World War. Successive governments have come up with different measures to curb the problem and at times its policies have failed to achieve their intended objectives. The 1970s period saw many countries experience an economic transformation due to a major economic down turn with most of them operating at GDP rates way below what they did in the previous years (Parkin & Sumner, 1978). According to Floud & Johnson (2004), it is during this period that the United Kingdom’s monetary system collapsed leading to unprecedented high inflation rates and rising levels of unemployment. Different views have been presented as to what caused the turmoil experienced in this period. Some argued that it was the rising cost levels which created an out of control cost versus price versus cost spiral. The rising wage levels due to pressure from trade unions and the increase in oil prices around 1973 have often been blamed for pushing up costs in the economy. Monetarists argued that the high supply of money in the economy led to the problem. These and other inflation cases elicited different reactions from the country’s government which include the following:

Monetary Policy: In the earlier years the British economies were dominated by post war effects. These effects were recession and inflation. There were high rates of unemployment that affected adversely the GDP of the country. The average rate of inflation under successive business increased remorselessly under the previous government before the Thatcher government took over. Unemployment also rose from (Howe 2001, 43). All kinds of shocks affected prices; his brought the urge to control inflation through the rate of monetary growth. Thatcher’s government which took over in 1979 came up with various policies to curb the problem. Monetary policy is aimed at keeping inflation below 2½ per cent by the end of this Parliament. She placed emphasis on economic policies that reduced government intervention and also made it clear that fiscal policies were necessary to combat inflation in the country. The first step Thatcher’s government took was to push up interest rates whose intended effect was to decelerate the increase of money supply in the economy and in effect lower inflation. The inflation target approach to monetary policy and how the institutional changes to the framework of monetary policy. This was designed to enhance the transparency and openness of policy. The policy reduced the control of the government over the economy, opting for a more liberal, market oriented economy. By 1980 the inflation rate had fallen to 8%, down from18% and by 1990 the economic growth was higher than any other large EU economies. Despite this fact, the period was characterised by low standards of living. This policy did not help in any way to reduce the level of unemployment but rather it led to its increase. This affected the output growth a good example is where the manufacturing output was no higher than in 1950’sthis deteriorated its international competitiveness.

The government also established a macroeconomic policy. This was the combination of monetary and fiscal policies which were to help deal with the problem of unemployment. Britain macro economic have poor performance compared to the otheG7 countries. There has been a frequent inflation and growth fluctuation this has affected business and consumers ability to plan ahead. Under the Medium Term Financial Strategy which identified specific targets for money supply. It has since undergone various transformations targeting the money supply, the exchange rate, interest rates and fiscal policies. To reduce government control over the economy, privatisations, weakening of the power of trade unions, deregulation and public expenditure restrain policies were adopted. According to Dow (2000), privatisation was meant to reduce the capacity of the public sector while at the same time trimming down government borrowing. He is also of the opinion that the then government’s actions failed to achieve the desired results since increasing the level of interest rates were not able to control bank lending. This macro economic polices were strainers to deal with the unemployment problem they opted for another policy.

The policy of exchange rate was also accepted amid 1990 and 1992. It comprised mostly on the regulation of foreign currency to sustain a standard rate with the foreign currency. This also failed to work and was done away with after the Thatcher regime was out of office. There lacks a link between the theory and reality of UK executive action. The pattern has been developed to singular around two key players of the late 1990s and 2000s then fractured in what became in effect dysfunctional government.

The Relationship between unemployment and Inflation in the United Kingdom

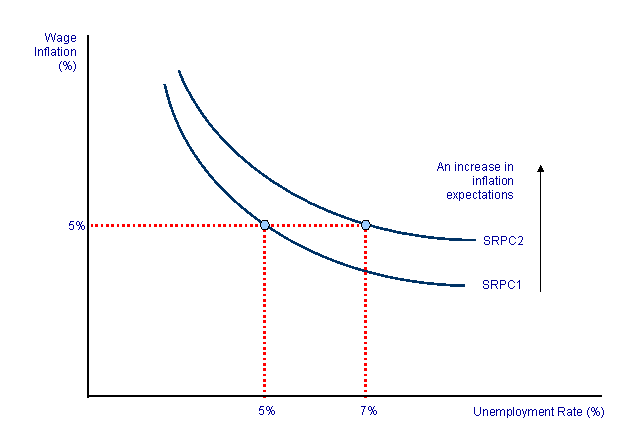

There always exists a relationship between the level of employment in an economy and the rate of inflation. This relationship is represented in a Phillip’s Curve which shows that when the level of unemployment in a country is low, the nominal wages tend to go up leading to an increase in the level of inflation.

United Kingdom’s Government Success in Controlling Inflation Between 1997 and 2010

When the New Labour party took over in 1997, it pretty much continued to concentrate on the market oriented policies but with various improvements such as new State roles which included demand management, setting inflation targets (inflation targeting) and use of the interest rate as the only monetary policy control tool (Floud & Johnson, 2004). These policies were to be implemented by an independent monetary policy authority which was the Bank of England (Stevens & Periton, 2009). Floud & Johnson are of the opinion that during the period in which the New Labour party was in office, the country’s economy grew thus changing the downward trend that it operated on before, leading to declining rates of unemployment and manageable inflation levels.

Since the year 2000, the United Kingdom’s inflation rates have been managed from the point of view of interest rates (Press Association, 2007). This point was backed by Lomax & Greenspan from the Bank of England in their 2004 Low Inflation and Business Pamphlet. Until 2007, the inflation rates were fairly constant but the economic recession that hit the globe in 2008 saw an increase in the country’s inflation rates as shown in the table below (Trading Economics, 2010). In fact, the period between the late 1990s and the early years of 2000 is mostly referred to as the “Nice Decade” as it was characterised by low rates of inflation and positive growth in the country’s economy (Chrystal, 2008). This period proved good to the country’s economy as the level of employment was at an all time high and the financial markets experienced very low volatility. It represented a move away from the economic woes experienced by the country in the previous decades.

According to a speech by Andrew Sentance (2009), the United Kingdom experienced the effects of the global economic recession and the Bank of England was expecting a fall in the country’s GDP (Gross Domestic Product) which would pick later on meaning that the levels of inflation would also come down. The Monetary Policy Committee maintained inflation levels at 2% up from a previous 5%. The Committee was also forced to relax its monetary policies in order to accommodate the effects of the recession for example by lowering lending rates.

The effects of the economic recession as experienced in the United Kingdom were also caused by the down turn in the economies of other countries as a result of globalisation which has greatly led to the intertwining of different countries economies (Hunt, 2007). According to Sentance (2007), the United Kingdom financial services sector is largely influenced by global economic events due to the existing interrelationship between the local and global international financial markets. Due to this, the effects of the economic crisis are inevitable and have a great deal of effect on the United Kingdom economy. According to him, such occurrences influence to a large extent the decisions that the Monetary Policy committee takes in their quest to keep inflation levels low and stable and as per the target of the committee which stands at 2% based on the country’s consumer Price Index. The United Kingdom’s open economy allows room for the influences of the global economic forces and in effect has to contend with the fluctuations this causes to the country’s inflation rates both in the short and long term. Rising prices for various commodities and oil as a result of an increase in global demand for the products over the past have led to demand oriented inflation in the country. The economic recession as witnessed also has an effect on the global demand for products meaning that the resultant fall in demand will most likely weaken demand in the country and as such exert a downward pressure on inflation.

The biggest challenge the monetary policy committee had in 2007 involved adjusting the country’s interest rate accordingly so as to avoid veering away from the set inflation rate target. In order to contain the situation, the monetary policy resorted to three decisions which included tightening monetary policy in such a way that it would push up the currency exchange rate which would in effect reduce the price of imports countering a rise in global inflationary pressures. The second decision was to influence the domestic demand in terms of consumer spending and private sector investment through interest rates. The third decision was to play into the expectations of the people concerning inflation rates. If inflation rates are expected to remain stable then the set out monetary policies would be able to counter the influences of the global economic shocks, but if they are expected to fluctuate then it would be easier for external shocks to set off a wage spiral as was the case in the 1970s and 1980s.

In another of his speeches on the 18th of March 2010, Sentance admitted that the policies put in place in 2007 failed to work as the influence of the global crisis proved too much and the country’s inflation rate was pushed to levels above 5% in the later half of 2008 and early 2009. This was as a result of the recession’s impact on the levels of employment and output where many people lost their jobs and the level of unemployment went up and the level of output also went down due to reduced investments (Sentance, 2010). Due to the returning confidence by investors and consumers and the stable trends in the global financial systems, the country is starting to recover from the negative impact of the recession as evidenced by the recovery in the equity markets compared to the two previous years. Though the country’s inflation rates have gone down, the Bank of England expects them to remain above 2% for the better part of the year due to the low recovery pace of output levels (Bank of England, 2010).

According to the bank of England’s Governor, the fact that the level of money supply in the United Kingdom is growing at a slow pace will help prevent an increase in inflation and therefore maintain it at the targeted 2% (Ryan, 2010), making the undesirable rate of inflation at the moment a temporary situation. The fact that bond rates dropped, makes it a challenge for policy makers to determine when it will be desirable to increase the level of interest rates. The budget deficit in the country also plays into the difficult decision the bank has to make as it will depend on how fast the budget deficit can be reduced. This affects the country’s monetary policy and in effect the effectiveness monetary policies as the conditions remain highly uncertain. The rate of inflation increase suggests that the pound is weak against other major currencies, a situation that is not favourable to the country’s economy since it affects imports as well as other commodity prices.

Conclusion

From the discussion above it is fair to conclude that the successive government’s policies have had mixed results as far as combating inflation is concerned. While the government policies in the 1970s failed to work, those between 1997 and 2007 worked but were undermined by the global economic crisis. They were however able to help stabilise the country’s economy and there is hope that they will still do so and that the country’s economic stability will be recaptured. High rates of inflation are detrimental to a country’s economy and in effect the standard of living of the citizens of such a country and thus the government and other bodies charged with the duty of ensuring inflation rates are maintained at low and stable levels should ensure that they come up with effective policies, whether monetary or fiscal.

Reference list

Bank of England. Overview of the Inflation Report February 2010, Bank of England, 2010, Web.

Chrystal, A, Monetary Policy Independence: The First Ten Years of the UK Monetary Policy Committee… and The First Year of the “Not-Nice” Decade, 2008, Web.

Dow, C. Major Recessions: Britain and the World, 1920-1995, Oxford, Oxford University Press, 2000.

Floud, R. & Johnson, P. A. The Cambridge Economic History of Modern Britain: Structural Changes & Growth, 1939-2000, Cambridge, Cambridge University Press, 2004.

Geetika, T., Ghosh, P. & Choudhary, R. P. Managerial Economics, New Delhi, McGraw Hill Company Limited 2008.

Grahame, C. B. & Grant, S. The UK Economy in a Global Context, Oxford, Heinemann Education Publishers, 2000.

Hoag, J. A. & Hoag, J. H. Introductory Economics, 4th Edition, New Jersey, World Scientific Publishing Company Limited, 2006.

Howe, L. Postscript: The 364 Economists—After Two Decades. In Policy

Makers on Policy, ed. Forrest Copier and Geoffrey Wood, 2001.

Hunt, B, U.K. Inflation and Relative Prices over the Last Decade: How Important was Globalisation? Europe, IMF Working Paper, 2007.

Lomax, A. & Greenspan, A, Low Inflation and Business Pamphlet, Bank of England, 2004, Web.

Macdonald, T. N. macroeconomics and Business: An Interactive Approach, London, International Thompson Publishing, 1999.

Musgrave, F, & Kacapyr, E, How to Prepare for the AP Microeconomics/Macroeconomics, 2nd Edition, New York, Barron’s Educational Series, 2006.

Parkin, M, Sumner, T, M, Inflation in the United Kingdom, Manchester, Manchester university press, 1978.

Press Association, The Nice Decade: 10 Years of Stability, This Is Money, 2007, Web.

Trading Economics, UK Inflation Slows, Trading Economics. 2010, Web.

Riley, G, AS Macroeconomics/International Economics: Inflation, 2006, Web.

Sentance, A, Monetary policy and the Current Recession, Monetary Policy Committee, Bank of England, 2009, Web.

Russel, M, & Heathfield, D, F, Inflation & UK Monetary Policy, 3rd Edition, Oxford, Heinemann Education Publishers, 1999.

Ryan, A, King Says ‘Undesirably Low’ U.K. Money Supply to Curb Inflation, 2010, Web.

Sentance, A, The Global Economy and UK Inflation, 2007, Web.

Sentance, A, Monetary Policy and the Current Recession, 2009, Web.

Sentance, A, Prospects for Global Economic Recovery, Bank of England, 2010, Web.

Stevens, A, & Periton, P, CIMA Official Learning System Fundamentals of Business Economics, Massachusetts, Elsevier Publishers, 2009.