Introduction – stating the problem

The Office of National Statistics (ONS) says that the rate of inflation has risen to 0.2% in December 2015. It was surprising because it became the first month when the number exceeded 0.1% of January 2015. The primary causes of this increase are seen in the rise of “transport costs, particularly airfares, and to a lesser extent motor fuels” (Collinson 2016, par. 2). Nevertheless, the mentioned rate of inflation falls within the 2% target set by the Bank of England and is still one of the lowest levels in the history of the United Kingdom’s economy.

Causes of the problem

The chosen article refers to the concept known as cost-push inflation when inflation is the response to the increase in prices where there is stable demand in the economy (Amadeo 2016). This rate was caused by transportation and fuel costs. However, as it was noted by Maike Currie, investment director, the emerging world experiences a continuous slowdown in the economy and the demand is extinguished by the global manufacturing sector (Collinson 2016). It means that there is no threat of skyrocketing inflation rates in the longer run. Moreover, the Bank of England does not change the interest rates, so the inflation will remain stable and within the planned 2%.

Problem evaluation

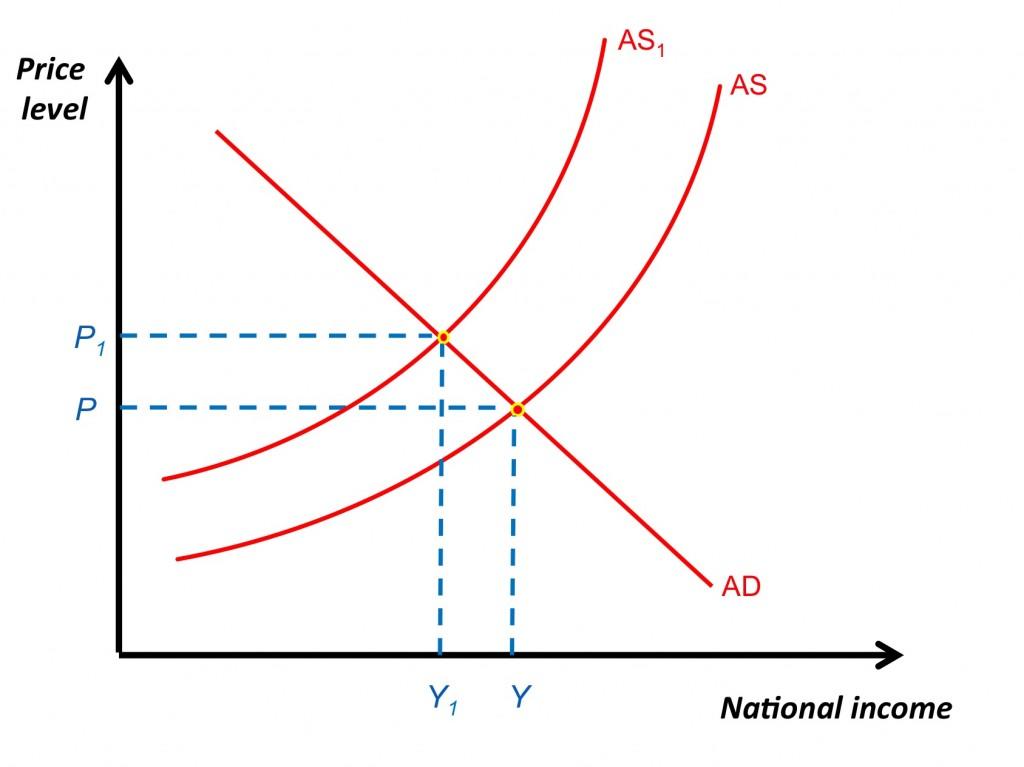

Nevertheless, if there were a risk of the inflation rates exceeding the set target, the Bank would have to intervene in the economy to fix the situation. In the case of cost-push inflation, the aggregate supply curve moves to the left, thus, increasing the level of prices (Cartwright 2016). In the long run, it leads to establishing the new equilibrium in the economy – one with a higher level of prices and a lower level of national income (see Figure 1). In a similar situation, the government usually takes a wide range of actions including the contractionary fiscal policy with higher taxes and lower spending and raises the interest rates. The primary purpose of the mentioned activities is to reduce the aggregate demand that would stop the growth of prices. What is also beneficial for reducing cost-push inflation is carrying out supply-side policies including such measures as better infrastructure, education, and training, deregulation, etc. Another option is to tighten the monetary policy introducing higher interest rates that will have the same effect in the long run.

Solving the problem

Even though these steps have a positive impact on the inflation rate in the long run as the AS curve moves back to the left, they can be a source of negative outcomes in the short run. For example, raising interest rates will stop the growth of inflation but as well lead to a fall in gross domestic product or push the economy in the recession because both ordinary consumers and firms could not comply with the new economic conditions. In addition to it, they will affect the exchange rate and lead to unemployment in the short run.

Conclusion

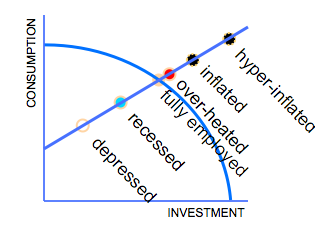

Another way to analyze the economy is to define whether it operates on its production possibility frontier (PPF). PPF can also be used for estimating the inflation rate and the state of the economy. That said, if the economy is pushed far outside PPF, it will experience inflation or even hyper-inflation (See Figure 2).

What should be done in practice is, first, targeting the inflation, i.e. defining the desired and acceptable inflation rates. Second, in the case, if it exceeds the set target, it is vital to define the nature of factors. If they are temporal such as price shocks or natural disasters (Amadeo 2015), there is no need for the government to take any actions because the economy will return to normal functioning without intervention. It is what happened in the example provided in the article. The demand for fuel is inelastic because no matter what the price is, people and companies will buy it. But there are no other signs of reasons for higher inflation rates. That is why the government should remain neutral.

References

Amadeo, K 2015, What Is Cost-Push Inflation?

Amadeo, K 2016, Causes of Inflation: 3 Real Reasons for Rising Prices.

Cartwright, B 2016, Low and Stable Rate of Inflation Series: Cost-Push Inflation, video, channel Brad Cartwright Economics.

Case, K E, Fair, R C & Oster, S M 2013, Principles of macroeconomics, 11th edn, Prentice Hall, Upper Saddle River, NJ.

Collinson, P 2016, ‘UK Inflation Rises Unexpectedly,’ The Guardian.

Margetts, S 2013, Inflation and Deflation.