Introduction

Background

The banking sector remains one of the most important industries that have a significant impact on other industries within a country’s economy. According to Cornée, Karmi, and Safari, the banks provide finances needed by other sectors to run normally (498). They provide a platform for trade among large scale-businesses that cannot afford to make or receive payments in cash. The banking sector in Europe has experienced massive growth over the past five decades as the world transforms into a global market place. As new firms emerge in this region, the services of these financial institutions become even more relevant. However, Agapova and McNulty note that the existence of these firms largely relies on their profitability (155).

Profit is one of the three main pillars of sustainability, the other others being the environment and people. For a company to continue operating, it must make profits consistently because it needs the revenue to finance its revenues. The profitability of a firm is affected by several factors that can broadly be classified as internal and external factors. Among the external factors is the gross domestic product (GDP) which studies have suggested has an immense impact on a firm’s profitability. It is important to determine the relationship between gross domestic product and the profitability of financial institutions. This relationship will help in establishing the impact of the gross domestic product on the profitability of financial institutions. In this study, the primary aim is to determine the effect of GDP on commercial banks’ profitability in Austria.

Statement of the Problem

Austria is one of the members of the European Union and its economy is often affected by the events taking place in the Euro-zone. The country has one of the vibrant economic sectors in this region that supports its economic growth. However, the recent events in this economic block and the entire world have shown that the banking industry is very vulnerable. According to a report by Le, Austria was one of the nations whose economies were affected by the 2008 global economic recession (21). The banking sector was one of those that were most affected by this economic recession. Jobst also notes that the decision of the United Kingdom to leave the European Union has also had some impact on the country’s financial sector (77).

This is a clear demonstration of how fragile this industry is to the external economic forces. Its significant role to other sectors within the economy means that it has to be protected at all costs despite these challenges. Lehman Brothers, once a leading global financial institution, ceased operations in 2008 and it had a massive impact on numerous business entities and companies that had their money invested in the institution. The case of this giant bank that collapsed when its clients had high expectations about it demonstrates how significant the financial sector is to a country’s economic progress. Austria, just like any other country around the world, is keen on protecting the profitability of this industry. That is why it is important to determine how various external factors, specifically the country’s GDP, affects its profitability.

Purpose of the Study

The purpose of this paper is to determine the impact of GDP on commercial bank’s profitability in Austria. The study will look at the banking sector in Europe in general, and that of Austria in specific. The researcher will also look at the GDP of Austria before focusing on the profitability of commercial banks. This will culminate in determining the relationship between GDP and profitability of commercial banks. Through this investigation, the researcher will identify specific aspects of GDP that directly affect the profits of these banks. Through this analysis, it will be possible to come up with suggestions on how these institutions can adapt to changes in a country’s GDP without significantly affecting their profitability. Such adaptations can make it possible for these banks to be less vulnerable to economic forces within the external environment.

Effect of GDP on Commercial Banks’ Profitability in Austria

Banking Sector in Europe

According to Beck, Europe has one of the most competitive banking sectors in the world (40). The European Union is a single market that allows firms to trade freely and without any restrictions in terms of tariffs or any regulatory policies that may hinder their success. Most of the top banks in Europe are in the United Kingdom and France. Jobst notes that out of the top ten largest banks in Europe, ten are from these two countries (78). The only other two countries which have their banks in this top ten list if Germany and Spain. It is important to note that following the Brexit vote of 2016, the United Kingdom will leave the European Union market. It is not clear how the financial sector of this country, which had dominated the European Union’s market in the past, will be affected after leaving the union. However, the vote is not yet implemented, which means that technically the United Kingdom is still part of the European Union’s trading block.

According to Le, Europe has one of the most advanced banking systems in the world (107). Competition in this industry is often very stiff as large multinational corporations such as HSBC Holdings, BNP Paribas, and Deutsche Bank compete fiercely for the market share will small firms in the region. The recent global economic recession of 2008 that majorly affected North America and Europe was clear proof that the banking sector in this region is vulnerable to the economic forces within the market. A study by Lin shows that the financial sector was one of the worst-hit sectors by this recession (20). The increase in bad loans, inflation, and reduced savings was among some of the factors that affected the banking sector in Europe during the recession.

These three factors, and other economic factors associated with GDP, will be further discussed in detail in the subsequent sections of this paper. A report by Jung shows that many banks such as Alliance & Leicester, Roskilde Bank, HBOS, and UBS were some of the European financial institutions which were not able to make it through during this tough economic situation and had to be acquired by other larger banks (118). The larger banks were not spared either in this great recession. Lloyds TSB Group and the Royal Bank of Scotland are some of the financial institutions that had to get direct aid from the bank because their position within the economy made it necessary for them to be rescued from imminent fall.

Currently, the banking sector in Europe is in a recovery mode. Most of the banks have come out of the problems related to the 2008 economic recession. The European Union has also experienced a relatively stable economic growth over the past seven years which has been a major boost to the industry. Most of the European banks such as HSBC and Barclays Bank have continued to expand their operations outside the Euro-zone as they seek to increase their market share. On the other hand, foreign firms from other countries, especially North America, are also finding their way into this market. Jobst says that the future of the banking sector in Europe is relatively bright despite the recent decision by the United Kingdom to leave the European Union (122).

According to Le, following the formation of the European Union as a trading block, the 28 states agreed that for the region to achieve the desired success, it was necessary to come up with a central bank (93). This was necessary because the countries had already accepted the use of a single currency (Euro) in all the countries. It is only the United Kingdom that continued to actively use its currency (Starling Pound) while the other member states considered the use of the euro as the standard currency in the region. The formation of the European Central Bank in June 1998 was a major step not only to the economic growth of the region but also in stabilizing the banking sector in the region. The countries knew the importance of banks in the economic progress of the economic block.

For the union to operate as a single economic block, it was necessary to have a bank that would help in enhancing stability in the region’s financial sector. Since its establishment in 1998, this bank has played a critical role in enhancing the success of financial institutions in the region. Its regulatory policies help in ensuring that banks do not come up with exploitative interest rates that would harm growth in the other sectors of the region’s economy. However, the policies are also meant to protect the commercial banks by ensuring that they can make reasonable profits for their success in the market. European Central Bank played a critical role in helping to protect financial institutions in Europe from collapsing during the recent recession that significantly affected the European economy.

Banking Sector in Austria

Austria is one of the countries in Europe that has attracted massive attention to financial institutions both from the region and beyond. According to Fonteyne, for a firm to be successful, it is important to have a strong economy (88). With a population of about 8.8 million people, Austria may not be the most populous country in the region compared to other European nations such as Germany and the United Kingdom (Jobst 51). However, the banking sector does not necessarily rely on the population of a country to achieve prosperity. It relies on the population that has the actual capacity to make use of the services of banks. Sometimes a country may be very populous, but only a small fraction of the entire population can make savings, borrow, or use the services of a bank in any way. A good example is India, the second-most populous nation in the world with over 1.2 billion people. However, over 45% of this massive population has never used services of financial institutions, rendering them inconsequential in the operations of the banks in the region. In Austria, a good number of the population can use financial services because of their level of income.

The banking sector in Austria has achieved tremendous growth since the end of World War II. Soon after the end of the Second World War, the country came under the control of the United States, Great Britain, France, and Russia. Economic growth during the Cold War was slow because the country did not directly align itself fully to either side of the warring nations. The banking sector during this period also had a sluggish growth, a reflection of what was happening to its economy. However, following the fall of the Soviet Union, Austria joined the European Union and aligned itself to the West. It was during this period that the financial sector started achieving rapid growth (Feldman and Hayes 27).

Local banks emerged through mergers and acquisitions of a small financial institution or as independent fully-fledged banks. Some of the top local banks in Austria include Austria Wirtschaftsservice Gesellschaft (AWS), Bank Austria Creditanstalt, and Austrian Anadi Bank (Jung 121). Local banks are facing stiff competition from large foreign banks which have also found their way into the local economy. Some of the foreign banks currently operating in Austria include Deutsche Bank and American Express Bank Ltd. The European Union has made it possible for these foreign firms to operate in the Austrian market without facing any restrictive laws that may affect their profitability. Most of the foreign financial institutions in the country are from European Union countries that enjoy the common market. However, some American financial institutions are also successfully operating in the country.

According to Temesvary, the Austrian banking industry is changing due to the changes taking place in the field of technology (240). As shown in the above paragraph, competition in the market is getting stiff and some financial institutions are struggling to remain profitable. As such, banks in this country are willing to do everything within their powers to ensure that they attract as many customers as possible. A study by Jobst shows that the mode of banking in the developed economies is changing (60). The middle class and the rich, who make the largest and most attractive market segment for the financial institution, lack time to visit the brick and mortar banking outlets as was the case before. They are so busy in the corporate world that they cannot afford to spend time in queues waiting to deposit or withdraw their money from banks.

Financial institutions in Austria appreciates the fact that under the new forces in the environment, it is important to find a way of serving these clients in the best way possible and without having them straining to get the banking services that they need. As such, online banking has become very popular in the region. Online banking is meant to ensure that people can have full control of their bank accounts irrespective of their locations around the globe. They can make withdrawals, transfer money, or make a payment without having to visit their banks. According to Feldman and Hayes, firms that are quick to effectively adopt emerging technologies are the ones that often survive when competition becomes very tough in the market (41). In Austria, most of the major banks, both local and foreign banks, have come to appreciate that it is necessary to embrace the new technology that makes the process of banking simple.

As competition becomes stiff, commercial banks in Austria are doing everything that they consider creative enough to earn them the profits they need in the market. According to Hsing and Krenn, the population of Muslims in Austria is almost negligible (71). However, Austria often receives several Muslims who visit the country as tourists or to engage in trade. Some financial institutions are now targeting the small population of Muslims who are in the country, either as tourists or business persons, with products that are specially designed to meet their needs. In 2016, BAWAG PSK became the first Austrian bank to start offering Islamic bank accounts for its clients.

This was a calculated move that was meant to target a small but very attractive market segment. According to Feldman and Hayes, most business entities are often followers, waiting for the industry leaders to make the first move in a given direction before they can all follow them (72). However, the move by BAWAG PSK to start offering Islamic banking products may result in many other financial institutions doing the same. This is because the target population is relatively small. The recent influx of refugees from Syria and Iraq into European countries may increase the target market, especially if these refugees get to settle in Austria. This is so because the majority of this population are Muslims. It may see a few more banks developing products that will target this population.

GDP of Austria

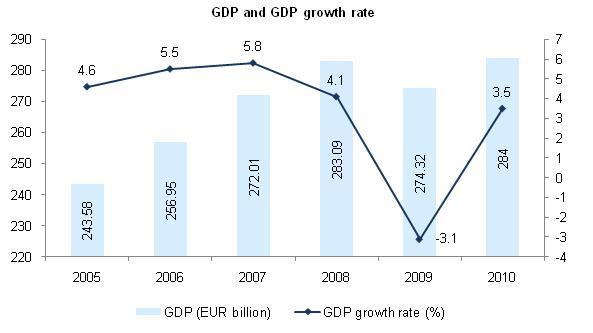

According to Deeg and Donnelly, gross domestic product refers to the total value of services and products, in dollars, produced over a specific time (601). It is the actual size of a country’s economy. For a long time, GDP has often been used as an indicator to gauge the health of a country’s economy. In this paper, the focus was to determine the effect of GDP on commercial banks in Austria. It is important to look at the economy of this country for the past few decades and how the growth has affected the profitability of commercial banks in the country. According to Jobst, Austria is one of the countries in Europe that have registered impressive growth in the GDP following the end of the Second World War (60). The figure below shows the GDP and growth rate of the GDP from 2005 to 2010.

It is clear from the above figure that Austria had consistent growth in its GDP from 2005 to 2008. An analysis of the growth rate shows that problem with the country’s GDP started in 2007. From 2005 to 2006, there was an impressive growth rate of the GDP. From 2006 to 2007, the growth rate was positive, but it had slightly reduced compared to the previous year. From 2007 to 2008, the rate of growth became negative. Even though the overall GDP increased within that period, it was clear that the country was heading towards an economic crisis. From the year 2008 to 2009, there was a sharp drop in the growth rate of the country’s GDP. For the first time in almost over one decade, the country registered a drop in its GDP in the year 2009. The recession had hit the country and it was facing serious challenges, just like its European neighbors. From 2009 to 2010, there was a sharp increase in the growth rate of the country’s GDP. In 2010, the country had recovered from the economic recession and registered a growth in its GDP. A study by Denene shows that after the 2008/2009 economic recession, Austria has registered impressive economic growth (6).

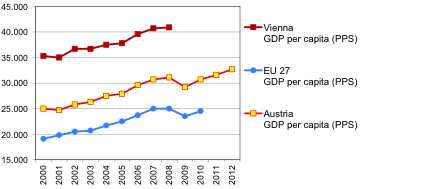

According to Belke and Gros, GDP is a good measure of the wealth of a country because it measures the value of all products and services produced by a given country (360). However, sometimes it becomes necessary to determine the per capita of the GDP to determine how much of the country’s wealth is distributed to its citizens. GDP per capita looks at how wealthy individuals within a country are based on the GDP and the country’s population. This estimation may be very important for a firm that is planning to choose a region that should be targeted by a given product. For instance, China has the second-largest GDP hence it is considered the second-largest economy in the world. However, it is also true that China has the largest population in the world. It is home to over 1.3 billion people in the world. When the GDP per capita of countries is determined, China ceases to be second from top and becomes one of the middle-income economies, way below that of Austria. A financial institution would be interested in setting up branches in places where people have enough income to consider using banking services. Conducting a comparative analysis of the GDP per capita of specific regions will help banks to know areas that they should target with their products. The figure below shows a comparative analysis of the GDP per capita of the European Union, Austria, and Vienna which is the capital city of Austria.

The comparative analysis above shows a very unique trend that the above three regions have registered from the year 2000 to 2012. Generally, there has been a consistent growth of GDP from 2000 to 2010. However, the per capita of EU, Austria, and Vienna were affected in 2008. Austria’s per capita and that of European Union was affected significantly by that recession. However, Vienna was not as much affected by that economic recession as the other two regions. The graphs above also show an important trend in the spread of wealth in the three regions. It is apparent that Austria’s per capita is below that of European Union. It means that an average European is slightly richer than an average Austrian. However, then Vienna’s per capita is introduced into the analysis, a new picture comes out. An average resident of Vienna is richer than an average European or Austrian. Being the capital city of Austria, most of the wealth is concentrated in this region, making it a very attractive market for financial institutions. At this stage of analyzing the country’s GDP, it is necessary to look at the sources of wealth that makes GDP per capital of Vienna higher than that of the country’s average.

Agriculture

Agriculture was once a major economic activity in Austria. According to Feldman and Hayes, agriculture still plays a significant role in defining the country’s economy (55). Currently, the agricultural sector provides 80% of the food needed by Austrians. The other 20% is imported from other parts of the world. Dairy farming still remains a major source of income in the country. The area around mount Schneeberg is one of the regions where cattle rearing are still very common. Using modern technologies, the locals around these regions have been successful in using small pieces of land to keep relatively large heads of cattle for meat and milk.

These products are often sold in the local markets in Austria after processing. In most of the cases, the processing is often done at the farm. Sheep and pig production is also doing very well in this country. There is a ready market for these products locally, a fact that has motivated many farmers to continue keeping these animals. Only a small piece of land is needed to keep pig and sheep. The maintenance cost is also relatively low, making it easy for the farmers to increase their production without having to incur great costs. Poultry farming is also very popular in Austria. Chicken and turkey are particularly common among poultry farmers. Other common animals kept for commercial purposes in this country include horse and goats.

Farming is also a major contributor to the country’s GDP, besides animal keeping. The locals often plant corn and other cereals such as wheat, rye, sunflower, sugar beets, and barley. Wheat is very important crop in Austria because of the booming hospitality industry in the country. The local restaurants need wheat flour to make various products for their clients. In supermarkets, wheat flour is one of the major products purchased by individual shoppers for their domestic use. Corn is not very popular, but it is also a major crop that is common in the country that is used both in the industrial and domestic sectors. It is also an important crop among those who are keeping animals such as cows, goats, sheep, and even poultry farmers who use the cereals to feed their birds. Barley is actively used in the bear manufacturing industry hence it is another important crop. Soybeans are also very popular among the locals and it is one of the major cash crops in Austria. A study by Mireille, Lemzeri, and Ory show that Austria is one of the global producers of wine, accounting for over one percent of the world’s total wine production (1350).

According to Lin, there has been a consistent reduction of the percentage that agriculture contributes to the nation’s gross domestic product (62). Soon after the Second World War, agricultural sector in Austria became very vibrant and it was one of the leading income earners in the country. However, this has changed over the last five decades. Currently, agriculture is estimated to contribute about 3% of the country’s GDP. There are indications that this percentage may drop further as the economy continue to rely more on the service industry which has become very vibrant. As would be expected, service industry is more active in the urban centers and agriculture is more active in the rural areas.

In the comparative analysis of the GDP per capita that was done above, it was established that Vienna, the capital city of Austria, has a much higher value of per capita compared to the average per capita of Austria. In fact, while the average for Austria was below the average of European Union, the per capita of Vienna was higher than that of European Union. This is a sign that people living in the city of Vienna are richer than the country’s average. It was concluded that urban dwellers are richer than those living in rural set-ups. The dropping significance of agriculture as a major contributor to the country’s economy may be a possible reason for this drop. As the sector of agriculture become less significant in contributing to the country’s wealth, those who rely on it as their main source of income become poorer compared to the rest of the population.

The banking sector is also not very active in the rural sector, which means that some of the low level farmers may not actively use banks when making financial transactions. According to Lin, banks often rely on masses to make profits (88). In places where people are sparsely populated, it may not be viable to operate a bank’s branch. The operations of such a branch will be more costly compared to the income it shall be generating. It means that such financial institutions will be making profits instead of losses. As such, banks often ignore such areas in favor of the major cities.

As these regions continue to be ignored, the locals find themselves using non-banking services when making most of their transactions. They sell their products in cash when clients come to pick them at their farms. When most of these transactions are made in cash without involving the banks, the profitability of these financial institutions gets to decrease. The fact that those in the rural sector has a lower per capita compared to those in urban centers has made the banks focus on expanding their market shares in towns than in rural areas, neglecting the rural dwellers even further. The emergence of online banking in Austria is yet to make any significant impact in increasing the population of the rural dwellers who use banks for their financial transactions.

Mining

Mining is a significant contributor to the country’s GDP. During the First and Second World War, metal mining was one of the major income earners in the country. However, iron mining was significantly affected by the rising cost of production that led to its decline after the two major wars. Currently, there is only one major iron mining company in Austria. However, graphite mining has remained steady over the past decades. Currently, Austria is ranked 10th among the leading producers of graphite, producing about 2.5% of the world’s graphite (Florian 122). It is considered to be one of the top producers of high-grade graphite in the world. Soapstone and talc are the other major minerals that this country produces in significant quantities. A study Jobst shows that production of limestone, dolomite, and marble has significantly increased over the recent past (27). The cement industry has largely been relying on these three minerals. As such, their production has been consistently rising over the years. Austria has one of the most vibrant real estate sectors in the region. This sector basically relies on the cement industry, which means that the three minerals are very critical in the development of real estate sector. Mining of gold, crude kaolin, pumice, gypsum, and calcite is also done in Austria in moderately low quantities.

According to Jung, the mining industry has a massive impact on a country’s gross domestic product (90). Most of the developing nations in Africa and Middle East largely rely on the mining industry for the growth of their GDP. Countries such as Nigeria (which is currently Africa’s largest economy, South Africa, and Libya rely on oil and gold which contributes to over 60% of their country’s GDP. Almost all the countries in the Middle East rely on oil as the main contributor to their GDP. These countries include Saudi Arabia, United Arab Emirates, Iraq, Iran, and many others. It is important to note that it is not only developing countries that heavily rely on minerals as the main source of income. There are other developed countries that also rely on oil for their sustainability. Russia is a good example. The country is among the major world economies, but it largely relies on minerals to support its industry. When the oil prices started dropping over the past one year, the country started experiencing a massive decline in its GDP growth. It is expected that with the continued drop of the international oil prices, it is likely that the country’s economy will slide further.

Mining industry has a ripple effect on other sectors of the economy, and that is why the government of Austria has been keen to support it despite some of the challenges it has been facing over the recent past. The industry is a major employer in the country. Those employed in the mines and those working in processing factories and transport sector depend on the industry to earn their living. According to Feldman and Hayes, despite the effort put in place by the Austrian government and the private sector to promote mining in the country, it is estimated that this industry accounts for less than 10% of the country’s GPP (42). Two factors are believed to have directly led to the decline of this sector as a major contributor to the country’s GDP. The rising cost of production, especially the cost of labor, is one of the main reasons why companies are opting out of this industry. The increase in production cost has lowered productivity and profitability. The other factor is the declining sources of these minerals. The more these minerals are mined in the country, the lesser their quantities become, making it necessary for companies to consider focusing on other sectors of the economy for the purpose of sustainability.

Tourism

Tourism is another major economic activity that contributes significantly to the country’s gross domestic product. According to Jobst, tourism has been one of the service industries in Austria which has experienced massive growth over the past five decades (74). As agriculture and mining industries experience decline in their contribution to the country’s GDP, tourism has been booming over the recent past. This is largely attributed to the improved security in the country, beautiful beaches, magnificent natural sceneries, and close proximity to major economies such as Germany and Italy where most of the tourists around the world come from.

Compared to other industries, the cost of operation in this industry is significantly low. It has attracted many young college graduates who are trying to come up with their own business units. According to Fonteyne, this industry is also attracting a significant number of those who have retired (79). Instead of keeping their wealth in the bank, a number of these retirees consider investing in tourism industry because of a number of factors. It is not involving as other industries. It does not require huge number of employees, especially if it is done in small scale. Above all, it offers these retirees opportunity to tour their country, remain active, and be very social instead of resting at home or in homes for the elderly. Even if they do not get huge profits from their operations, they get satisfaction of interacting with the world even at their advanced ages.

A study by Jobst shows that tourism accounts for over 10% of the country’s gross domestic product (112). The Austrian government has invested heavily on tourism as it becomes a major income earner in the country. Improved security, modern infrastructure, and maintenance of the natural sceneries are some of the ways through which the government is trying to improve tourism in the country. The city of Vienna, which was determined to have one of the leading GDP per capita in the entire region of Europe, is one of the top tourism destinations in Austria.

This clearly shows how significant tourism is to the country’s economy. Like the mining industry, tourism has a ripple effect on the country’s GDP. According to Lin, some of the tourists who visit this country spend more than one month (40). Instead of having their money in cash, they prefer having it in bank for the purpose of security. Some of the regular tourists who come from neighboring countries even consider having bank accounts with the local banks. As such, they are able to get money easily when they are visiting the country. When that happens, local banks get profits. Austria, just like many other countries in European Union, use euro as their currency. However, when tourists from outside European Union visit the country, they bring with them foreign currencies which also help in boosting the profitability of the banking sector in the country.

Financial sector

The focus of this paper is to determine the effect of GDP on commercial bank’s profitability. In this section however, the focus will be to determine the contributions that the financial sectors make to the country’s GDP as we try to dissect the GDP of Austria before understanding how it affects profitability of the banks. According to Jobst, inasmuch as Austria is not the financial hub in Europe, it has a relatively vibrant financial sector that has experienced growth over the past decades (39). This sector is characterized by many financial institutions such as investment banks, securities market, and insurance companies. Currently, the industry accounts for less than 10% of the country’s GDP (Feldman and Hayes 80). However, there are clear indications that contribution of the financial sector to the gross domestic product of the country is likely to go up in the years to come. This is so because of the upward trend that has been witnessed in this industry since the end of the 2008 economic recession.

Other service industries

The country GDP is also impacted by other economies which are becoming very relevant because of their growth. Health sector is becoming a major contributor to the GDP of Austria. Austria has experienced rapid growth in number of private hospitals which target both local and international clients from all over the world. The country has some of the best hospitals which treat deadly diseases such as cancer. Medical tourism is becoming common as some people not only come to Austria to tour but also to get medical attention. The construction sector, transport sector, real estate sector, and education sector are some of the other contributors to the country’s economy. They play significant role in terms of offering employment and creating revenues for themselves which increases the GDP for the country.

Profitability of Commercial Banks and How it is affected by GDP

It is clear from the above discussion that there is a close relationship between profitability of a bank and a country’s GDP. In the Global ranking, Austria has 29th largest GDP in the world. However, it is ranked 13th by World Bank in terms of GDP per capita, making it one of the countries in the world with rich citizens (Lin 78). Such an attractive economy is expected to reflect on the country’s banking sector. According to Feldman and Hayes, “when trends are leaning towards a growing economy or a positive GDP growth results in high demand for credit as a consequence of the nature of business cycle” (42). Inflation, one of the factors that are closely related to gross domestic product, is known to greatly affect profitability of banks within a given country.

Fonteyne says that “inflation has an adverse effect on commercial bank’s profitability as it erodes the real value of bank’s assets relative to their liabilities, hence it affects profits” (115). When a country is affected by inflation, banking sector is one of those that are often worst affected. Clientele base often increase. Given that during inflation banks adjust their interest rates among those who are repaying their loans, some of these debtors consider repaying their loans a huge burden. It is during such economic situations that the rates of bad debts increase. High rates of bad debts significantly reduce the profitability of a bank. Depending on a country’s GDP, competition within an industry may increase or reduce.

According to Lin, “competition is one of the factors in the sense that each industry has competition forces that are peculiar to itself and these forces do affect profitability or sometimes viewed as drivers of profitability (24). When the GDP of a country is growing, then healthy competition may arise where firms try to gain more profits through innovation by offering their clients new products which are not currently available in the market. However, when the economy is experiencing challenges, the angle of competition changes because firms try to acquire the smaller struggling ones to kill competition. It is important to look at how commercial banks make their profits and how each of these approaches is affected by the GDP of the country. The focus at this stage will be specifically on Austria. The following are some of the major ways in which firms make their profit in the market.

Interests earned from loans

One of the main sources of income for commercial banks is the interests they charge on the loans to their clients. Businesses need capital to start or expand their operations. Other than the savings of the business owners, loans from banks make the most significant source of capital for these businesses. Banks often give out loans and charge a given fee for its clients. Large corporations sometimes come for huge loans payable within a short period. Although these large corporations can negotiate smaller interest rates, the income generated from such loans is often high given the huge size of the loans. Individual lenders also come for loans from commercial banks on a regular basis. As the lifestyle increases, things like cars and good homes become basic.

However, most people cannot afford to purchase these items in cash. As such, they rely on mortgages and car loans to purchase these items and improve their living standards. They have to go to the commercial banks to get the money they need in form of loans. When they pay back, they have to pay accrued interest. Inter-bank lending is also very common and earns financial institutions attractive sums of money. According to Fonteyne, there are instances when a bank may run out of cash because of numerous reasons (58). Because of the desire to ensure that depositors have access to their cash whenever they need it, such a bank will be forced to borrow cash from another bank for a short period. The loan may be given for hours. When paying back that loan, the lender will benefit from the interest charged. Sometimes commercial banks lend money to the government payable within an agreed timeline. Such lending also comes with profits.

Gross domestic product plays a significant role in defining the earnings that commercial banks make from the interest they charge their clients. When the economy is in a downward trend, very few people will be capable of saving. As such, commercial banks will have little money to give out as loans. During such economic turmoil, individuals also avoid taking loans because of the uncertainty of tomorrow. For those repaying their mortgages and car loans, or any other loan for that matter, problems may start to arise when they lose their jobs or get demoted, events which are very common during the period of economic recession.

When such events occur, bad debts become common as people start defaulting on their repayments. Instead of making profits, commercial banks will make losses. In some cases, the value of the interest may be wiped out when a country experiences inflation. The total value of earnings made on loans in such cases of inflation may be eliminated, which also wipes out the profits that the bank would have made. On the other a growing economy increases borrowing and lending, which also increases the profitability of the banks. During the economic recession on 2008, many commercial banks in Austria made serious losses as some of their clients were unable to repay their loans. Others loans had to be written off as bad debts. However, these commercial banks are currently making profits because of the growing GDP.

Banking services fee

Commercial banks earn profits from the banking service fee that it charges its clients. Most of the banks in Austria charge ledger fee. The fee varies from one commercial bank to another and based on the account that one holds. Such fees are important sources of income for these banks. Corporate companies often pay their employees through commercial banks. There is a fee that the banks earn by processing and making the money available for the customers. When withdrawing money from the bank, many people use ATMs. Such withdrawals come at a given fee. There is also a fee charged when one intends to withdraw or send money in the online platform. Although the fee charged by individual may be insignificant, such transactions are always numerous and as such, the banks end up making good profits. Overdraft is another common service offered to the clients that earn banks extra income. Banks give out overdraft when clients, who expected their salaries or income in less than two months, but need money to address an emergency.

The GDP of a country may erode the profits that commercial banks get from these activities. According to Feldman and Hayes, during tough economic conditions, some low-income people prefer keeping their money in the house because they try to avoid charges levied by the banks (56). They are aware that they will spend everything by the end of the month, hence do not find rationale taking their money to the bank. Such actions deny these banks earnings that could have accrued from the service fees. When people lose jobs, the amount of money that commercial banks process in terms of salaries and wages also decline. Such declines in the services that these banks offer their clients reduce the profits they make. When the GDP is on the rise and these activities increase, then these banks will make more profits.

Trading financial instruments

Commercial banks make profits by trading financial instruments on a regular basis. A bank may give an individual or an entity a given amount of cash in exchange of stock, bonds, derivatives, commodities, or any such valuable. Depending on the market forces at that specific time, the bank enters into an agreement with the entity that the money should be paid at a given time and with the agreed interest so that the security taken by the bank can be given back to the owner. Trading in securities is an important source of profits to the banks and it also helps companies when they are in sudden need of cash. It is a mutual relationship between the bank and the owner of the security, which sometimes may be the national government. In Austria, trading in financial instrument is very active and banks are making good profits out of it.

With the growing GDP in Austria, trading in financial instruments is a good business that is benefiting the involved stakeholder. It is a closely regulated trade as the government tries to protect both the lender and the borrower from unfair business practices. Banks are certain that the borrowers will repay the loan and the interest in time. This is so because most of the corporate borrowers trade financial instruments, not because they are experiencing financial problems, but because they need liquid cash very urgently as they wait for their money tied in stock or in other operational activities.

Buying and selling currencies

Foreign exchange market is the largest market in the world in terms of volume of trading, and one of the most lucrative businesses that banks engage in on a daily basis. Tourists come from all over the world to Austria and they come with foreign currencies. In Austria, they can only use euro. As such, they have to visit the local banks to get euro. On the other hand, when tourists are leaving the country, they may need United States dollar as the most preferred currency for the travelers (Lin 80). It means that they have to visit the banks once again to convert their money into preferred currency. Austria uses euro in most of its international transactions. However, there are cases where importers have to exchange their currency to United States dollar to transact in the international markets. In such cases, these businesspeople have to visit the banks to convert their money. Banks make huge profits from foreign exchange market. When the GDP is on an upward trend, more foreign currencies will be expected in the country and that would mean more profits for the banks. A negative growth in the GDP will negatively affect this source of profit for commercial banks.

Charges for Financial Advice

Individuals and organizations often seek financial advice from financial institutions when planning to make major investments. This is very common among retirees who are not sure what to do with their pensions or young entrepreneurs who need to focus on a given area of business. When they visit the banks for financial advice, they may need to make some payments based on the kind of advice they need and the level of involvement of the bank. Such cases are very common in an economy that is growing. People have money but they are not sure what they should do with their money. Banks will help them invest their money and in return they are expected to pay a small fee to the bank. When the GDP of a country is slowing, such services are rarely sought for as people try to cut down on their expenses.

Conclusion

Austria is one of the countries in Europe that is experiencing rapid growth in its economy. As discussed in this paper, it has one of the highest GDP per capita in the world, which means that its citizens are relatively rich compared to the world’s average. The banking sector in this country has been growing consistently with the growth of the GDP. The analysis done in this paper shows that there is a close relationship between gross domestic product and commercial banks’ profitability. Banks make their profits by offering a wide range of services to its customers. When there is an economic boom, the need for these financial products increases considerably.

Firms make a lot of profits from the interest they charge on loans, banking fees, trade-in foreign exchange markets, and advice they offer to their clients. On the other hand, when the economy is experiencing challenges, the discussion shows that the demand for financial products drop significantly because people try to reduce expenses. It means that the GDP of a country is closely tied to the profitability of firms. The recent recession in 2008 is a clear demonstration of this fact as shown in the discussion above. During that time, banks in Europe, including Austrian banks, experienced serious economic challenges and some were acquired by other large multinationals. Some large banks had to be rescued by the government because of their importance to the economy.

Works Cited

Agapova, Anna, and James McNulty. “Interest rate spreads and banking system efficiency: General considerations with an application to the transition economies of Central and Eastern Europe.” International Review of Financial Analysis, 47.3 (2016): 154–165.

Beck, Thorsten. “Regulatory Cooperation on Cross-Border Banking – Progress and Challenges after the Crisis.” National Institute Economic Review, 235. 1 (2016): R40-R49.

Belke, Ansgar, and Daniel Gros. “On the Shock-Absorbing Properties of a Banking Union: Europe Compared with the United States.” Comparative Economic Studies, 58. 3 (2016): 359–386. Print.

Cornée, Simon, Panu Kalmi, and Ariane Szafarz. “Selectivity and Transparency in Social Banking: Evidence from Europe.” Journal of Economic Issues, 50.2 (2016): 494-502.

Deeg, Richard, and Shawn Donnelly. “Banking union and the future of alternative banks: revival, stagnation or decline?” West European Politics, 39.3 (2016): 585-604.

Denene, Erasmus. “Better economic prospects ahead for sub-Saharan Africa: by invitation.” Farmer’s Weekly, 160.24 (2016): 6-7.

Feldman, Gerald and Peter Hayes. Austrian Banks in the Period of National Socialism. Cambridge: Cambridge University Press, 2016. Print.

Florian, Blank. “Why is Austria’s Pension System So Much Better Than Germany’s?” Review of European Economic Policy, 51.3 (2016): 118–125.

Fonteyne, Wim. Cooperative Banks in Europe-Policy Issues. Washington: International Monetary Fund, 2007. Print.

Hsing, Yu, and Mario Krenn. “Effects of the Global and Domestic Business and Economic Factors on Aggregate Output in Austria.” Asian Business Research, 1.1 (2016): 34-76.

Jobst, Clemens. The Quest for Stable Money: Central Banking in Austria, 1816-2016. Hoboken: Wiley & Sons, 2016. Print.

Jung, Samuel. Sustainable Prosperity Through Qualitative Growth: An Economic Analysis Using the Example of China. New York: Cengage, 2015. Print.

Le, Leslé. Bank Debt in Europe ?are Funding Models Broken? Washington: International Monetary Fund, 2012. Print.

Lin, Chen. National Intellectual Capital and the Financial Crisis in Austria, Belgium, the Netherlands, and Switzerland. London: McMillan, 2013. Print.

Mireille, Jaeger, Yasmina Lemzeri, and Jean-Noel Ory. “Cooperative versus Conventional (Joint-Stock) Banking In Europe: Comparative Resistance And Resilience During The Recent Financial Crisis.” Journal of Applied Business Research, 32.5 (2016): 1341-1353.

Temesvary, Judith. “The drivers of foreign currency-based banking in Central and Eastern Europe.” Economics of Transition, 24.2 (2016): 233–257.