Introduction

Creating a portfolio that would yield high returns during economic growth and recessions is complicated. This situation is because past performance does not always set the ideal foundation for predictions, and many geopolitical, social, and economic factors can lead to significant changes. Kane and colleagues (2021, p.11) mention that “thousands of well-backed analysts constantly scour securities markets searching for the best buys.”

However, even the best analysts can often fail to make successful buys. Nevertheless, principles such as diversification can significantly help one minimize risks. Moreover, another lesson, such as comparing companies from the same industry, can also support making informed decisions. The portfolio of twenty stocks with two stocks per industry demonstrated how diversification could help balance poor and upbeat performances.

Portfolio Diversification

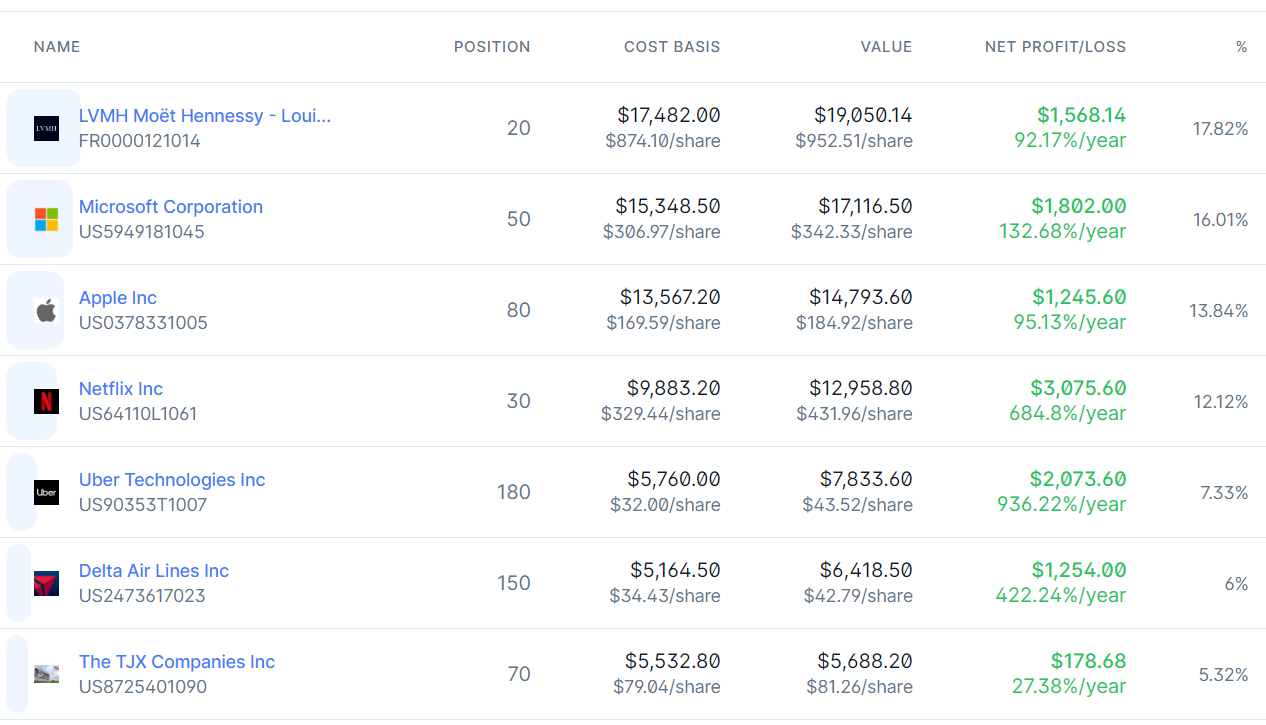

The portfolio was diversified based on the main areas, including technology and communications, biomedical, transportation, entertainment, consumer goods, apparel, soft drinks, communications, pharmaceuticals, and oil and gas industries. As seen in Figure 1, out of twenty stocks with two stocks per industry, preference was given to apparel, technology, transportation, and entertainment companies. According to some experts, such as Jonathan Yerushalmy (2022), due to the easing of COVID-19 restrictions, there is a high probability that global supply chains will be restored, which can spur demand for apparel and travel services.

Moreover, the trend might continue considering the growing demand for technological advancements and entertainment services, which peaked during the pandemic. Thus, companies such as LVMH, TJX, Microsoft, Apple, Netflix, Uber, and Delta Air Lines were considered the most winning in the long run, holding more significant portfolio shares. Indeed, in the end, they were the most significant contributors to the portfolio’s growth. The portfolio’s initial value was $97,877.60, increasing by 9.22% monthly, valued at $106,906.90.

Best and Worst Performers

When delving deeper, it is evident that the best performers in the portfolio are the companies from the transportation and entertainment industries. The best-performing organizations are Delta Air Lines, Uber Technologies, and Netflix. COVID-19 caused severe economic disruptions, which also manifested in the stock market. However, the mentioned companies adapted to the conditions, and the first company, Delta Air Lines, showed success with an annualized return of over 422% due to repayment of $10-billion debt and resumptions of dividends, demonstrating financial health (Delta, 2023).

As for Uber, the company adapted with the help of a new service, Uber Eats, which significantly diversified its product portfolio (Uber, 2022). Finally, Netflix benefited from people staying at home during the pandemic and maintaining interest in the platform (Rahman & Arif, 2021). Thus, the companies outperformed the rest due to trends in consumer demand or financial results.

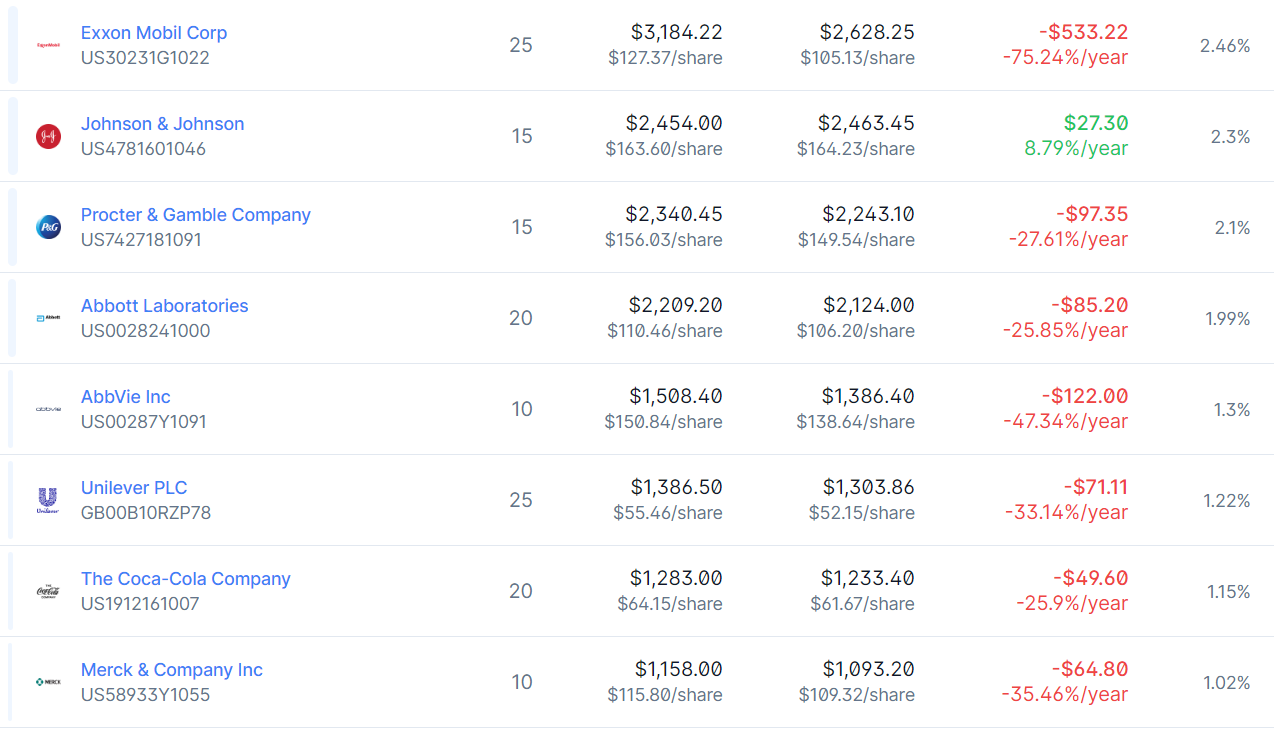

The worst-performing companies are Exxon Mobil, Shell, and AT&T. As for the oil and gas industry companies, Exxon and Shell faced drastic changes in demand in 2023 (Bousso, 2023). Consequently, geopolitical and demand influences manifested in a significant decline in revenue and an annualized return of -99.57% for Exxon and -75.22% for Shell. In contrast, AT&T’s issues with negative annualized returns are connected to the pandemic (Forbes, 2021). Therefore, demand for services and the ability to regain financial stability are the main contributors to companies’ poor performance.

Data Analysis and Its Benefits for Companies

After reviewing the stocks’ performances and delving deeper into the factors contributing to such outcomes, specific insights were gained. For example, companies in the technology sector showed significant results, with Apple having an annualized return of over 95% and Microsoft having a return of over 132%. Therefore, it can be claimed that organizations should continue their research and development in their sector, offering new products and services.

Meanwhile, biomedical companies, such as Johnson & Johnson and Abbott Laboratories, have annualized returns of 8.78% and -25.85%, respectively. Although these results are much lower than those of the analyzed firms, both Johnson & Johnson and Abbott Laboratories have solid reputations. They should, therefore, continue to work on providing quality products.

Another industry that demonstrated immense growth is transportation. Uber and Delta Air Lines accounted for significant portfolio returns, with the first showing a return of over 900% and another having a return of over 400%. As seen from the cases of the given organizations, adapting to new environments and introducing new services and products for better diversification can benefit businesses. Such an approach can help enter new international markets and introduce more innovation, increasing revenues. Similarly, Netflix’s ability to diversify and attract new customers contributed to the stock growth. However, Comcast’s annualized return of 13.61% can teach other companies to adapt to changes in customer demands more quickly.

Furthermore, both companies from the consumer goods industry, Unilever and Procter & Gamble, have negative returns. Although the organizations are large-capital, their negative returns can indicate an industry trend, which is essential to consider. Such an argument can also be supported by the fact that soft drink industry firms have failed to provide positive results. As seen from the portfolio, PepsiCo and Coca-Cola Company have negative returns of -16.32% and -25.9, respectively. Such information is beneficial since it allows companies to focus on their competitive edges in various business cycles.

Additionally, LVMH and TJX show the advantages of the companies given their positive returns. LVMH demonstrated an annualized return of over 90%, which can be explained by the demand for luxury goods in restored supply chains. Meanwhile, TJX has an annualized return of almost 30%, emphasizing that goods sold at significantly lower prices can help the company increase its value and market share. As for other industries, communications, AT&T, and Verizon have poor performances, with almost 50% negative returns. In contrast to previously mentioned firms that adapted to the new reality and customer demands or focused on their competitive edges, these companies have struggled to maintain their growth.

Similarly, pharmaceutical organizations, such as Merck & Co and AbbVie, have poor performances as well, with -35.46% and -47.34 returns, respectively. Such a situation can additionally indicate poor incorporation of innovations and research. Finally, oil and gas companies Exxon Mobil and Shell are among the worst performers. As was mentioned previously, consumer demand and geopolitical factors can significantly influence the operations of these companies. Consequently, these stocks can be considered volatile to market conditions and changes.

This data analysis can benefit companies immensely due to the importance of research and development, innovation, and quick adaptation to market trends and consumer demands. The paper outlined the best performers who have demonstrated quick and immense growth owing to their focus on technology, development, and product portfolio diversification. The firm will most likely perform poorly without an opportunity to create and introduce new goods and services and have a sustainable competitive advantage. However, as was highlighted earlier, some instances of poor performance are connected to the fact that companies can be cyclical. For example, due to economic conditions, soft drink and consumer goods firms have demonstrated negative returns. Therefore, companies must see the complete picture by accentuating the weaknesses, strengths, and performances of other companies of similar sizes in their industry.

Insights from Creating and Tracking a Portfolio

Creating and tracking a portfolio has taught me several lessons. The first lesson is that diversification is critical to success. An investor or a manager must follow the well-known adage “Don’t put all your eggs in one basket” (Kane et al., 2021, p.147). In the given scenario, twenty stocks minimized the risks of losing all capital. Indeed, there can be significant returns when investing capital in only one stock.

For instance, if $100,000 were invested in Uber, this would create almost a 1000% return. However, if invested in the wrong stock, such as Shell, almost 100% of capital would be lost. Therefore, diversifying made it possible to ensure that “the exposure to any particular asset is limited” (Kane et al., 2021, p.11). With such an approach, the minimization of risks is guaranteed.

Moreover, there is another insight that comes from the activity of creating and tracking a portfolio. The lesson I learned is that, as a manager or an investor, the picture becomes more evident when comparing a company with its competitors from the same industry. Looking at one company can limit an individual’s understanding of the firm’s health and competitiveness. However, it is possible to grasp the trends and patterns when looking at the performance of the sector or a specific industry. Sometimes, firms in particular areas can be more vulnerable to socioeconomic or geopolitical factors, as was seen from the examples of Shell and Exxon Mobil. Therefore, comparing it with organizations of similar size from the same industry can show specific prevailing trends.

Conclusion

Hence, twenty stocks in a portfolio with two stocks in each industry showed how diversification might help balance solid and weak performances. Preference was given to companies in the apparel, technology, transportation, and entertainment industries out of twenty equities, with two stocks in each category. The portfolio’s beginning value was $97,877.60, increasing by 9.22% in one month to $106,906.90. Looking more closely, it becomes clear that the portfolio’s top performers are the businesses in the entertainment and transportation sectors.

The biggest outperformers are Netflix, Uber Technologies, and Delta Air Lines. The three firms with the poorest financial results are Exxon Mobil, Shell, and AT&T. I’ve learned a few things from creating and maintaining a portfolio. The first lesson is that diversification is essential to success because it ensures risk mitigation. The comparison of a company with its rivals in the same industry helps managers or investors obtain a clearer understanding of the situation, which is the second insight. Specific prevailing tendencies can be seen by comparing the company to businesses in the same industry that are similar in size.

References

Bousso, R. (2023). Exclusive: Shell pivots back to oil to win over investors. Reuters. Web.

Delta. (2023). Delta Air Lines declares quarterly dividend. Web.

Forbes. (2021). AT&T stock will not go back to its pre-Covid high. Web.

Kane, A., Marcus, A. J., & Bodie, Z. (2021). Essentials of investments (12th ed.). McGraw-Hill.

Rahman, K. T., & Arif, M. Z. U. (2021). Impacts of binge-watching on Netflix during the COVID-19 pandemic. South Asian Journal of Marketing, 2(1), 97-112. Web.

Yerushalmy, J. (2022). Markets optimistic as China eases Covid rules, but experts warn of danger ahead. The Guardian. Web.

Uber. (2022). Grow your business your way with Uber Eats. Web.