Introduction

Nespresso is a premium coffee brand launched under the Nestlé group in 1986 with a strategic focus on value and innovation. The Nespresso concept focuses on providing personalized coffee capsules for home/machine use. Initially, the firm offered four premium coffee products, primarily to Italy and Switzerland, before diversifying into the US and France.

Throughout its history, Nespresso has employed a broad range of business strategies, including strategic partnerships with machine manufacturers, website promotions, retail stores, and online ordering to diversify into new markets/countries. This report evaluates Nespresso’s local/international marketing activities over time and across different countries. It also analyses the key drivers of its growth using strategic analysis tools as well as the latest trends and developments within the portioned coffee sector.

Marketing at the Local and International Levels

Nespresso has a strong presence in over 50 countries globally, making it a market leader in the premium coffee sector (Kashani & Miller, 2000). Nespresso’s production line developed portioned coffee first for the Italian market and later for the Swiss (local market) and Japanese markets. Nespresso has used various marketing strategies to compete locally and internationally. Locally, Nespresso has strategic partnerships with a Swiss espresso machine manufacturer, Turmix, to produce in-house designs. Besides, Nespresso has a strategic alliance with The Rainforest Alliance, a local premium coffee supplier.

A second strategy involves the Nespresso Club, a direct marketing approach for the timely delivery of quality coffee to consumers. The Club offers a 24-hour order-taking function that allows customers to place direct orders through telephone or mail. The Club also handles outbound logistics to reduce delays in delivery and offers personalized advice on coffee flavors and blending to consumers through connoisseurs.

Close customer relationship marketing (CRM) helps build long-term customer engagement and brand loyalty (Cravens & Percy 2012). In this way, Nespresso is able to streamline its performance through repeat purchases. By 1990, the Club had a membership of 2,700, drawn from the Swiss, French, American, and Japanese markets (Datamonitor 2015). National Nespresso Clubs were later formed in Germany and Britain. Nespresso markets this brand through agents in the Asian and Australian markets.

Since 2006, Nestlé’s Nespresso has utilized diverse strategies to strengthen its visibility in the international market. Its key strategies include:

- Retail stores – Nespresso has established over 190 boutiques and coffee bars/shops in key global locations, including New York (Madison Avenue), Latin America, and Austria.

- Celebrity branding – Nespresso used George Clooney in its global advertising campaigns. Celebrity branding uses a sports/movie personality as a “brand ambassador for the firm” to promote a product (Doole, Lowe & Kenyon 2016, p. 89).

- Machine partnerships – Nespresso has business partnerships with international machine suppliers such as Philips, Siemens, and Jura, among others. Thus, customers can choose from a diverse range of appliances with different functionalities, designs, and prices.

- Partnerships with airlines – In a bid to internationalize the brand, the firm formed partnerships with leading global airlines to offer in-flight Nespresso coffee to travelers. The airlines include British Airways and Swissair. Nespresso also formed partnerships with French and Belgian gourmet restaurants to promote the brand.

The Environment at the International Level for Nespresso

New markets are bound to emerge as the global economy continues to expand, providing opportunities for the Nespresso system. The main drivers and constraints related to Nespresso’s internal and external environments could be revealed through a PESTLE analysis.

PESTLE Analysis

Political

Nestlé created a separate firm to manage the Nespresso product line. As a premium brand, Nespresso differed from the instant coffee (Nescafe) that Nestle sold. According to Pickton and Broderick (2005), the “strategic and operational autonomy” of subsidiaries fosters organizational flexibility that creates an environment of innovation and creativity (p. 117). Nespresso’s boutiques resonate with the federal coffee shop challenge.

Economic

Nespresso provides a coffee shop experience by providing premium coffee capsules and machines for office/home use. The Nespresso machine retails between £119 and £1500 while each capsule is sold £0.31 (Sirianni, Bitner & Mandel 2013). Despite past economic crises in the EU, coffee remains a low-priced indulgence for many.

Social

One of the five dimensions of brand personality is sophistication (Fill 2009). Nespresso utilizes sophistication to differentiate its capsule coffee from other products and position its coffee as a luxury product. The firm achieves this through stylish ultra-slim machine designs and celebrity endorsements (George Clooney) to attract the premium market.

Technological

Nespresso has created a culture of innovation and creativity. According to Matzler, Bailom, and Kohler (2013), the elements of successful innovation at the organizational level include “new product development, product launch, and intellectual property protection” (p. 34). Nespresso addresses these factors through partnerships with global leaders in espresso machine production.

Legal

While customers own the Nespresso espresso machines, the firm controls the coffee capsules sold through its retail stores. Its pod technology is only compatible with Nespresso machines. The firm enjoys over 70 patent protections for its machines (Krups and Miele) and portioned coffee, ensuring exclusivity and inimitable competencies.

Environmental

Nespresso began recycling used capsules in 2009 to meet environmental requirements. In addition, the firm runs various sustainability projects, including green energy use and fair trade practices in sourcing coffee from farmers.

Marketing Concepts and Approaches at the Local and International Level

Market Entry

Nespresso is a global brand that pursues a robust transnational strategy to enter new markets. Its exclusive route-to-market strategy has enabled Nespresso to establish relationships with customers in new markets. Nespresso’s market entry involves three channels. First, the firm uses its e-commerce platform to interact with new customers. It provides a 24-hour online ordering system for its branded products in eight languages.

This platform also provides personalized information on coffee blends and Club membership. Kashani and Miller (2000) note that membership clubs boost patronage through improved “image, sales, and marketing” (p. 61). Nespresso utilizes the information contained in the Club database for CRM and tracking new members.

Second, Nespresso uses a network of 270 retail boutiques that serve as sales outlets to penetrate new markets. The boutiques offer Nespresso’s premium coffee products and machines to coffee lovers in new markets. Third, Nespresso operates customer relationship centers to address customer issues, including orders. In this way, the firm can establish customer relationships for successful market entry.

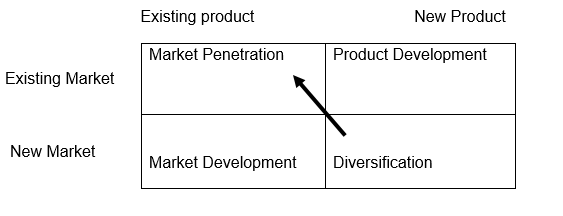

Ansoff Matrix

Nestlé’s success can be ascribed to two strategic decisions, namely, the development of a new product (Nespresso) and exploring the portioned coffee segment. Thus, the firm’s product diversification strategy led to the evolution of Nespresso. Later, after establishing the Nespresso system, Nestle pursued a market penetration strategy to support its rapid expansion into France, Italy, the US, and other countries. The Ansoff matrix of Nespresso’s growth can be represented as shown in table 1 below.

Market Approaches: Nespresso Pricing Strategy

A market approach entails an appraisal of a product’s worth based on the retail price of comparable products (Kotler & Armstrong 2010). Nespresso uses a premium pricing strategy for its coffee capsules to target the luxury goods segment. A price comparison shows that Nespresso’s capsules are expensive compared to similar brands in the market. For instance, a 5g espresso capsule costs €0.36 compared to €0.39 for a 6g Lungo capsule.

Nespresso also utilizes low-priced machines and a costly capsule approach. The firm’s espresso machines are affordable compared to machines sold by rival firms. The official price of Essenza is about €59.95 compared to €99 for De’Longhi coffee machines (Porter & Kramer 2011). The strategic affordable machines make it possible for Nespresso to dictate prices for its capsules due to low buyer power. Thus, Nespresso, unlike its competitors, can raise prices for its coffee capsules without losing its market share and profit margins.

The strategy also allows the firm to withstand fluctuations in global coffee prices. The low-priced machine model allows more people to buy the machines due to a reduced entrance barrier. The firm also uses a product differentiation strategy to compete locally and internationally. Through its quality focus (Grand Crus variations), Nespresso differentiates itself as a premium product. It promises an exclusive coffee shop experience through high quality, premium price coffee. It uses specialists/tasters to advise consumers on coffee blends and enhances its customer relationship management through the Nespresso Club.

Acquisition and Retention

The firm enhances customer acquisition and retention through the exclusive Nespresso Club. This CRM tool helps Nespresso to sell directly to customers, create brand loyalty, differentiate its brands, and reduce distribution costs. Through the Club, the company maintains a database of current customers and tracks new ones based on their consumption patterns. The firm makes follow-ups for heavy consumers in the Club who fail to order within a month to ascertain the condition of the espresso machines (Porter & Kramer 2011). In addition, it creates value through regular servicing of machines and free delivery services to retain consumers.

The acquisition of new customers involves referrals made by existing club members. In 2008, it was estimated that over 2.2 million new customers were acquired through increased brand awareness driven by club members (Datamonitor 2015). Additionally, celebrity branding involving Mr. Clooney has elevated the capsule’s status, contributing to new customer acquisition.

Nespresso Segmentation

Segmentation provides a framework for identifying the appropriate consumers or sub-markets for the product. It is necessary to identify the “needs and values” of the target customers to deliver or promote products/services appropriately (Kotler & Armstrong 2010, p. 90). A successful marketing strategy must appeal to the characteristics of the target segment, including demographic, geographic, psychographic, and behavioral attributes. Nespresso’s market segmentation is shown in table 2 below.

Nespresso Target Market

Market targeting entails promoting an appropriate product to consumers based on their interests or needs (Kotler & Armstrong, 2010). Nespresso’s major target segment is coffee drinkers (25-60 years) who consume over seven capsules weekly. As active workers, they seek quality, easy coffees for home/office use and value coffee as indulgence. The second target group is B2B actors, including first-class airlines and gourmet restaurants that sell Nespresso coffee. Nespresso utilizes a product differentiation strategy to project itself as a luxury brand in its target market. The machines and capsules come in a large price range to target coffee enthusiasts in high-income classes and corporate clients.

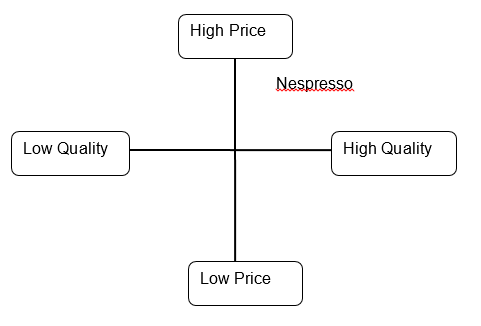

Market Positioning

Nespresso’s marketing strategies aim to position the product as a high-quality luxury coffee brand. The positioning strategy builds a “feeling of belongingness to an elite group of customers” that justifies the premium prices (Kotler & Armstrong 2010, p. 77). The perceptual map of Nespresso’s market positioning is shown in figure 1 below.

Marketing Strategies 7Ps

A marketing mix defines the actions/tactics a firm employs to “promote its brand or product” in the market (Brassington & Pettitt 2006, p. 51). The elements (7P’s) of Nespresso’s marketing mix are described below.

- Product – Nespresso sells elegant vendors with innovative, user-friendly designs. It offers quality ‘Grand Crus’ coffees that appeal to diverse client tastes and preferences. The Nespresso Club offers personalized service/distribution channels to clients.

- Price – Employs a price differentiation strategy: machines cost between £89 (home) and £1530 (business), while capsules range between £0.26 and £0.35.

- Promotion – Involves social media advertising, events, sponsorships, TV ads, and CRM programs (Nespresso Club).

- Place – It owns over 190 retail outlets in 50 nations that increase its international presence through direct customer contact.

- Physical evidence – It sells elegant, innovative, and slim machines. It also places aesthetics in its boutiques for a unique ‘coffee shop experience’.

- Process – It employs a customer-centered strategy through the Nespresso Club and CRM activities.

- People – Its well-trained staff act as brand ambassadors to build a strong image/reputation in the industry.

Conclusion and Recommendations

The coffee market has shifted away from traditional coffees to specialty/premium coffee. These trends indicate a preference for gourmet coffee, which resonates with Nespresso’s business model. Nespresso has cut a niche as a trendy, ultra-premium drink-through innovation and strong brand positioning. It is recommended that Nespresso should adopt an intensive communication strategy that utilizes its Club, brand ambassadors, and sponsors to expand to other international markets.

References

Alvarez, G, Pilbeam, C & Wilding, R 2010, ‘Nestlé Nespresso AAA sustainable quality program: an investigation into the governance dynamics in a multi-stakeholder supply chain network’, Supply Chain Management: An International Journal, vol. 15, no. 2, pp. 165-182.

Brassington, F & Pettitt, S 2006, Principles of marketing, Financial Times Press, London.

Cravens, D & Percy, N 2012, Strategic marketing, McGraw Hill, London.

Datamonitor 2015, Company spotlight: Nestle. Web.

Doole, I, Lowe, R & Kenyon, A 2016, International marketing strategy, Cengage Learning, London.

Fill, C 2009, Marketing communications: Interactivity, communities, and content, Financial Times Press, London.

Kashani, K & Miller, J 2000, Innovation and Renovation: The Nespresso Story, IMD, Lausanne.

Kotler, P & Armstrong, J 2010, Principles of marketing, Pearson Higher Education, New York.

Matzler, K, Bailom, F & Kohler, T 2013, ‘Business model innovation: coffee triumphs for Nespresso’, Journal of Business Strategy, vol. 34, no. 2, pp. 30-37.

Pickton, D & Broderick, A 2005, Integrated marketing communications, Financial Times Press, London.

Porter, M & Kramer, M 2011, ‘Creating shared value’, Harvard business review, vol. 89, no. 1, pp. 62-77.

Sirianni, J, Bitner, M & Mandel, N 2013, ‘Branded service encounters: Strategically aligning employee behavior with the brand positioning’, Journal of Marketing, vol. 77, no. 6, pp. 108-123.