Abstract

This report presents an international business proposal for the expansion of the GMI company through the marketing of Progresso soups in Santiago, Chile. The report focuses on the country analysis and the possible measures the company could take to allow the successful marketing of Progresso Soup products. Progresso Soups have a target audience of family-oriented adults of 35-40 years. Conducting a thorough analysis of the population in the chosen region determined that the implementation of a marketing program could positively impact the distribution of the company’s products.

Moreover, the region presents a substantial value for the company’s purposes, as it offers an opportunity for partnership through a form of licensing agreement or a joint venture. The report also explores all the positive and negative aspects that the leadership may consider to determine the acceptable form of partnership for the company. In brief, the marketing plan includes key suggestions and conclusions defined through the country and city analysis, key strategies for market entry, and important considerations for leadership.

- Santiago is the largest country in Chile, with almost 7 million people, which makes it one of the largest cities in the Americas. The country presents an example of a rapidly developing infrastructure and economy caused by the continuous population growth trend. Most of the population consists of adults and older adults, which suits the company’s target audience for soup products. The majority of the population lives in the Metropolitan area, implying the city’s effective transportation scheme.

- Aside from the important information about the population in the chosen region, it is necessary to mention that Santiago is known for its tourist value and variety of opportunities for leisure and activities. The developed tourism infrastructure significantly contributed to the population’s level of food culture and appreciation of different tastes in food. As the Progresso soup brand is characterized by the high quality of ingredients and flavorful taste, it is more likely that the target audience will acknowledge the new product and prefer it over other brands, establishing the customer’s relationships with other subsidiaries of GMI company.

- Considering the financial side of the country, the current economic state in Chile presents a safe and favorable environment for business activities and partnerships. The country’s trade politics favor free trade with the United States and many other countries. The economy of Chile significantly developed in the food, drinks, and restaurant industry, as they represent nearly a quarter of the country’s GDP. Chile’s economy is mainly focused on exporting materials, such as minerals and wood, and food products like wine, seafood, and fruits.

Therefore, Chile should be considered not only as a potential market for GMI company’s products but also as a substantial opportunity for partnership. The low level of government debt in Chile, combined with the strong economy, results in a favorable climate for companies to expand and further develop new products.

The overall fit of the country’s population to the target audience of the company’s products and the development of the food industry adds to the reasons why GMI company’s leadership should consider a partnership in Chile. Aside from the country’s analysis, the report also features an introduction focused on the existing Progresso brand and its image to illustrate how the products fit the target audience’s interests in the selected region.

Introduction

Description of the Chosen Product and the Chosen Market Area

The Progresso brand is a GMI subsidiary specializing in soups with different flavors and ingredients from Italian, Mexican, and Southwestern cuisines. Progresso brand has over a century history and was initially created as a family-owned business with family-oriented values. The main aspects that characterize Progresso soups and distinguish them from competitors are rich flavors provided by high-quality ingredients and traditional recipes without artificial colors and flavors. The products within the Progresso brand are formulated to meet all the requirements of modern customers with different options such as gluten-free products, low-calorie soups, and vegetarian soups. The can packaging of Progresso soups is recyclable and does not use BPA-lining. Therefore, the products within the Progresso brand line meet all needs of the modern consumer without reference to different regions.

Furthermore, due to the nature of canned products, Progresso soups are not designed to be eaten on the go, meaning that the Progresso brand targets family-oriented adults. The slogan “Make it Progresso or Make it Yourself” suggests that the product is natural and its tasting qualities resemble the soups that could be made at home. Therefore, the most suitable audience for the brand are adults who prefer to save time on cooking and money on buying ingredients without losing the taste of homemade dishes and facing negative consequences for health. Overall, the brand is positioned to be an upgraded version of Campbell’s soup brand, also owned by GMI company. The positioning also implies the brand’s targeted audience, suggesting that the Progresso soups with rich and tasteful flavors that suit adult taste palates more than Campbell’s soups.

Statement of Goals

The recent COVID-19 pandemic caused a crisis in the production of many food products due to shipping delays. Within the Progresso line with almost 90 varieties of soup, shipping delays resulted in the suspension of production of 40 different soup types. However, even with the discontinuation of some types of soup products, the Progresso brand, like all “old-fashioned” canned, experienced a substantial (almost double) increase in demand (Ledsom, 2020). Conditions imposed by the pandemic and social distancing policies favored the use of products with a long shelf-life period.

However, there are no predictions of whether another event will cause a similar effect on the demand for Progresso brand products. Thus, delivery delays in production highlighted that almost half of the products within the Progresso brand are dependent on imported ingredients. Therefore, the company should consider partnerships in regions with favorable conditions to maintain production efficiency and reduce the dependence on imported goods through licensing agreements or joint ventures.

This proposal for the international marketing plan of Progresso soups focuses on marketing the brand’s new soup product and expanding the brand’s presence to a new location in Santiago, Chile. The proposal plan supports achieving several marketing objectives, including building brand awareness in the region, developing brand loyalty among customers in the new market, and supporting the GMI company industry authority.

The plan introduces several measurable goals that correspond with the proposed objectives. The first goal is to achieve a market share of 10 percent in the market share of canned products in Santiago within six months period. The other goals are increasing the brand’s social following and engagement in the region by 30% in one year and reducing production dependence on imported ingredients by half in the next three years.

Situation Analysis

Country Report and Selected City Market Analysis

Chile is a country in South America with its capital in Santiago. According to statistical data, the population in Chile exceeds nineteen million people. Chile’s population is ranked seventh among Latin American and Caribbean countries, along with Ecuador and Guatemala. The country’s gross domestic product data show positive development with the current level of 331.25 billion U.S. dollars (O’Neill, 2021). Chile’s share in global GDP varies around 0,36%, which is relatively big compared to other countries with a significantly bigger population, such as Malaysia and the Philippines (O’Neill, 2021).

The country’s political climate favors effective trade with other countries such as China, Argentina, and Mexico. Chile has several free trade agreements (FTA) with different countries that contributed to establishing the country’s dynamic and completive market. In accordance with the United States and Chile FTA, all trade operations involving agricultural products are not subjected to tariffs. The strategic partnership with many countries allowed Chile to become the leading market in the region.

According to statistics data, in the age structure aspect, the population in Chile is mostly presented by the adult population, with 68% of the population between 15 to 64 years (O’Neill, 2021). The age dynamic shows that there are fewer children and more older adults in the age structure of Chile every year (Figure 1). According to information provided by the Food Export website (2020), the population’s purchasing power in Chile could be described as a middle that is slowly moving towards the upper-middle level. Therefore, the demographic state of Chile presents a preferable for the marketing of products under the Progresso brand.

In addition to the population in Chile being fit to Progresso soups’ target audience, the food market in Chile presents favorable conditions for widespread marketing of the brand’s products and provides opportunities for further development. The food industry is one of the most developed areas in the economy of Chile, with an annual turnover of 34 billion U.S. dollars (Cardenas &Chileno-Suiza, 2018). The food manufacturing area continues to grow every year, as almost half of all food products produced in Chile are exported to other countries.

As agriculture presents a significant part of the country’s economy, the majority of the country’s domestic food market consists of freshly produced crops with nearly 20% of processed foods (Cardenas &Chileno-Suiza, 2018). In general, food processing presents almost one-third of Chile’s economy and contributes to 25% of the country’s GDP. The food processing industry in Chile is modern and innovative and offers different options, including healthy food products and gluten and lactose-free products. The food market in Chile is highly competitive because the country has several free trade agreements with other countries, resulting in big amounts of imported products. Therefore, without substantial marketing support, the products could become lost in the line of alternative products.

Integrated analysis of the market and the available opportunities

While the dependence on marketing support presents an important aspect of entering the market, several factors in the population’s general food preferences should be concerned in the marketing strategy. The first point is that the significant part of imported goods from other countries and the United States in Chile are meat products, such as beef and pork. Therefore, the Chilean population is not familiar yet with American canned products. Moreover, Chilean consumers are not informed about high-quality products from the United States, reflected by the low demand for premium products imported from the United States (FoodExport, 2020). The issue is explained by the fact that the Chilean market does not have an interlayer of premium food products as the country does not produce them.

In addition, the population prefers more affordable options provided in large quantities through friendly import policies. According to the United States Department of Agriculture (USDA) Foreign Agricultural Service report (2019), this is a relatively new tendency as Chileans were previously described as loyal to specific brands. With the development of the media sphere, the consumers in Chile became more informed and now pay more attention to promotional goods. Implementation of price reduction measures as a promotion in marketing strategy could benefit brand recognition and pressure the preexisting leverage of brand loyalty.

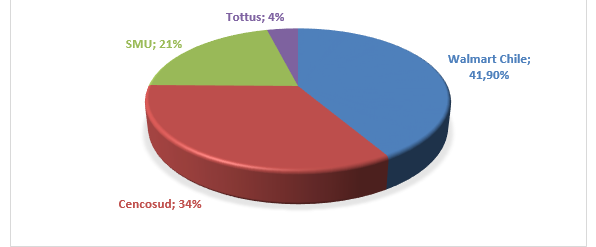

Chile has a developed retail system that includes both physical stores and online delivery services. Most food products in the country are distributed through supermarkets and grocery stores, and nearly 50% of those stores are located in the Santiago metropolitan area (USDA Foreign Agricultural Service, 2020). According to a USDA Foreign Agricultural Service report (2020), almost half of all food sales in Chile are made through supermarkets.

The supermarkets and retail stores in Chile mainly operate in the form of chains under several well-known brands (Figure 2). The main supermarket groups and chains in Chile are Walmart Chile, Concosud, SMU, and Tottus (USDA Foreign Agricultural Service, 2020). While the report suggests exploration of competitor products, there is no substantial information available about the competitive market for Progresso products as canned soups are not very popular in Chile yet. However, the information about traditional Chilean culture cuisine suggests that there are not that many soups in Chilean cuisine in general.

SWOT Analysis: Marketing Progresso Soup in Santiago, Chile

Therefore, through the analysis of the food market in Chile and SWOT analysis, the report defines the two available options for the marketing plan of the Progresso brand and its products. The first option is entering the market with a newly developed product in accordance with regional preferences. However, as the current marketing plan focuses on the already developed product with testing purposes, the second option is more appropriate in this case.

The second option implies entering the market through the testing product with a focus on marketing support and advertisements in media to build the consumer’s awareness about the Progresso brand and other GMI company’s products. This option suggests the possibility of a further partnership with host country local partners in the form of a joint venture. The market analysis showed that promotional prices present one of the main aspects that encourage the local consumers in food products purchases. Thus, the marketing plan focuses on promoting the product in the largest distribution network of the country, the Walmart Chile supermarket chain.

References

Cardenas, C., & Chileno-Suiza, C. (2018). Chile, the Latin American hub for food processing & distribution. Switzerland Global Enterprise.

Food Export. (2020). Chile country profile.

Ledsom, A. (2020). 7 ways Covid-19 has changed what we eat: Sourdough starters, canned soup and more food waste. Forbes.

O’Neill, A. (2021). Chile – statistics & facts. Statista. Web.

USDA Foreign Agricultural Service. (2019). Chile retail food guide.

USDA Foreign Agricultural Service. (2020). Retail foods.