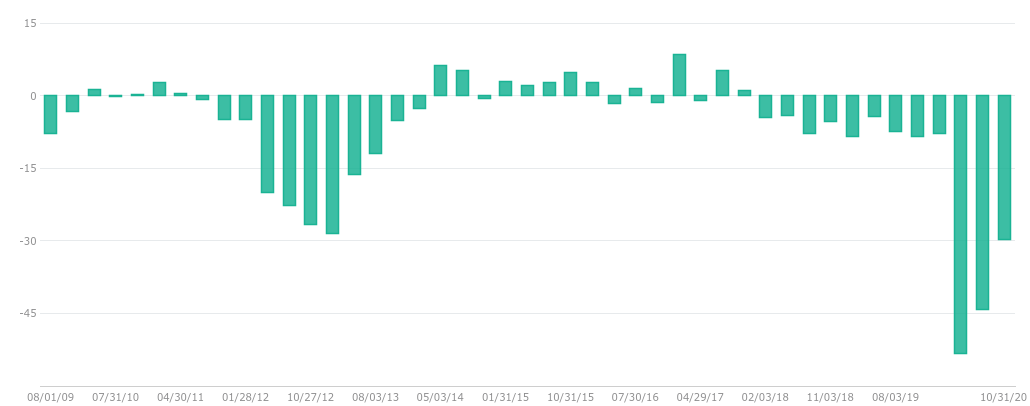

J.C. Penney Company is a U.S.-based firm, which sells goods and services to customers through its department stores. Family-friendly clothing and shoes, cosmetics, exquisite and fashionable jewelry, aesthetic items, and furniture are all sold herein. James Cash Penney established the business, which has its corporate headquarters in Plano, Texas, in April 1902 (Sestak, 2021). According to J.C. Penney Company Inc.’s Altman Z Score, this business is more likely to declare bankruptcy (Sestak, 2021). The diagram below (see Figure 1), shows the revenue growth from 2009-2020.

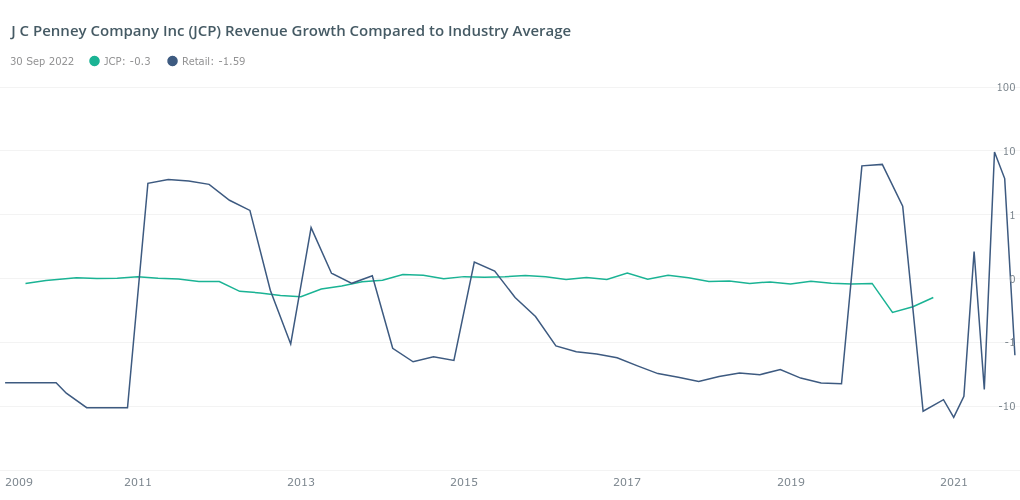

From the above diagram (see Figure 1), the firm’s sales growth declined from 7.92 to 29.68 as of the financial quarter October 31st, 2020, compared to the period ending August 1st, 2009. The biggest quarterly sales increase for the business from 2009 to 2020 was 8.41 (see Figure 2). The year with the lowest sales increase for the company was 53.19. For each period between 2009 and 2020, the company’s median sales increase was 6.63. The sales increase for the firm over the leading twelve months was -$135.00, when compared to its competitors in the Clothing Stores industry sector for the period ending September 30th, 2020 (see Figure 2). The corporation’s operating profit during the quarter that ended October 31st, 2020, was 29.68. The company saw median sales growth of 6.63 between August 1 and October 31, 2020, which was lower than the industry average of 2.05 (see Figure 2).

Recommendations for Improvement: Strategies for Achieving a Sustainable Competitive Advantage

To counteract competition from other companies in the Department Stores business sector, the Firm should also develop into an off-price store. For instance, J.C. Penney should introduce a new off-price brand, similar to what Macy’s did with Backstage, instead of copying megastores and fast-fashion retailers (Sun, 2020; Weissman, 2020). The company extended Backstage to an additional 50 locations during the year, as per Macy’s CFO Paula Price, who also noted those stores open for more than 18 months, actually performed well, up about 4-6, and have strengthened both revenue and turn (as cited in Sun, 2020). Off-price businesses like Macy’s Backstage outperformed regular retailers because they purchase goods at liquidation costs, discount them to prices below Amazon, and quickly switch out their merchandise to entice customers looking for bargain clothes (Sun, 2020). J.C. Penney, like Macy’s, has the size and surplus inventory to develop into an off-price shop. Its short-term revenues may suffer as a result of that strategy change, but it may also provide opportunities for more competitive growth in terms of profitability and financial stability.

Pricing Strategy Implementation Plan

In order for off- price retailing business model to work, the following key success steps need to be present in the plan.

References

Sestak, K. (2021). Lessons from the failure of J.C. Penney’s new pricing strategy. Profit Well. Web.

Sun, L. (2020). 3 ways J.C. Penney can still reinvent itself. The Motley Fool. Web.

Weissman, C. G. (2020). How JCPenney’s e-commerce strategy ultimately faltered. ModernRetail. Web.