Introduction

Lebanon is known to be facing a financial crisis that continues to worsen. Unemployment, as well as poverty rates, have rocketed, and the currency has devalued substantially, which threatens political stability not solely in the country, but in the entire region. Considering this, it is critical for the Lebanese government to balance the budget, notably, by means of regulating prices and taxes. Such measures are beneficial in terms of overcoming the crisis but can be burdening in the near term, especially for consumers.

Price Floor

One of the ways to catalyze economic recovery is to increase revenue collection in order to compensate for financial losses. Establishing minimum legal prices for certain goods or services is in the list of the techniques that governments can utilize in case of a budget deficit. This regulatory mechanism is referred to as a price floor (Griffith, O’Connell, and Smith 2020). In addition to balancing the budget, it, for instance, can help to reduce alcohol consumption by the population, limiting its availability.

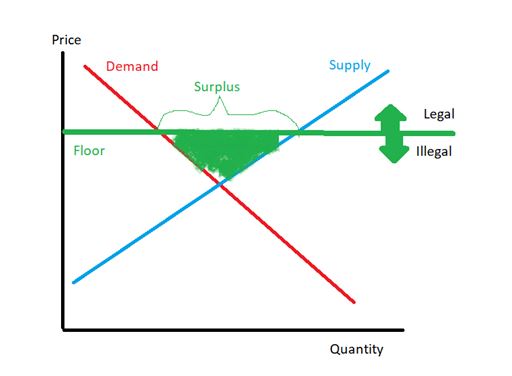

Along with that, imposing a floor frequently targets at providing a sufficient amount of the product that is subject to this type of regulation. In Fig. 1, the line that stands for the price below which it is illegal to sell crosses the points where the demand exceeds the supply. The colored area represents the subsequent surplus, which guarantees a stable provision of particular goods.

The government of the state that is experiencing an economic slowdown may be bound to impose a price floor for the goods or services that it sponsors, completely or partly. This may be a response towards the growth of the expenses on their production or import. Thus, Lebanese ministry of economy has raised the charges for flatbread several times during the recent year (Arab News 2021). This product, which is a staple in the country, used to be subsidized by the central bank before the crisis, but currently, the ministry is removing subsidies gradually.

The Impact on Economic Efficiency

The above measures can have both short-term and long-term effects on several spheres of social life. The key criterion to estimate the influence on the financial sector is so-called economic efficiency. This parameter serves for identifying whether the use of resources, which a certain decision presupposes, is reasonable (Roşca 2017). It comprises two subconcepts to consider, notably, productive and allocative efficiency. Improving the former involves maximizing the production or minimizing the consumption, while the latter means reaching and maintaining the optimal supply/demand ratio.

In the case under review, imposing a minimum legal price for bread is apparently supposed to ensure that the manufacturers have sufficient finance for purchasing ingredients as well as waging personnel. Solely on these conditions, the supply of flatbread will remain constant. This drives to the conclusion that Lebanese economy ministry seeks to improve allocative efficiency of the food industry, simply stated, provide the population with the necessary amount of the staple.

The Impact on Firms

As said above, the government of Lebanon is unable to continue subsidizing flatbread production. The cost of it grew predictably; another reason for this is “the rapid depreciation in the value” of the national currency, Lebanese pound (Middle East Monitor 2020, para. 6). Bakeries began to lose their income, due to which they refused to continue distributing bread. In most states, it is illegal for manufacturers and suppliers to “put pressure on businesses to charge their recommended retail price or any other set price” (Australian Competition & Consumer Commission n.d., para. 2). Instead, the government can regulate pricing in order to prevent a crisis from further deepening and/or quicken overcoming it, for instance, by imposing a minimal charge. Establishing the price floor for flatbread in Lebanon is able to stabilize the revenue that the bakers receive, hence restore their motivation.

The Impact on Consumers

From the viewpoint of how the existence of a minimum legal price can influence the purchasers, the difference between short-term and long-term effects is apparently the most considerable. In one respect, as has been mentioned above, the mechanism of a price floor protects the population against a severe deficit on staples, hence provides them with more chances to survive the economic downturn. However, such positive influence is not necessarily apparent to the residents at early stages, as it emerges over time.

Regarding the immediate effects of the price policy for which Lebanese ministry of economy has opted on the citizens, they are doubtlessly negative. Notably, the vast majority of the locals report a noticeable decrease in their purchase power, simply stated, the scope of goods and services that they can afford. Considering this, along with the peak of unemployment, over 50% of Lebanese currently find themselves below the poverty line (Arab News 2021, para. 8). The pandemic of COVID-19, as well as the explosion that happened in Beirut in the summer of 2020, after which the city needs investments for restoring, have also contributed to the impoverishment.

Excise Tax on Fuel

Another scheme that allows for balancing the state budget is the so-called excise tax. It is indirect, in other words, not connected to the entrepreneur’s revenue, and possible to impose on manufacturers, retailers, or consumers of particular goods or services (Internal Revenue Service 2021). Those can be, for instance, alcohol or tobacco, which monetary policy Australian economy ministry has implemented (Reserve Bank of Australia 2018). Other high-demand and cost-effective products such as sources of energy are also frequently subject to such a tax. Lebanese government, in particular, levies an excise duty on gasoline, which is included in its price and goes to the budget.

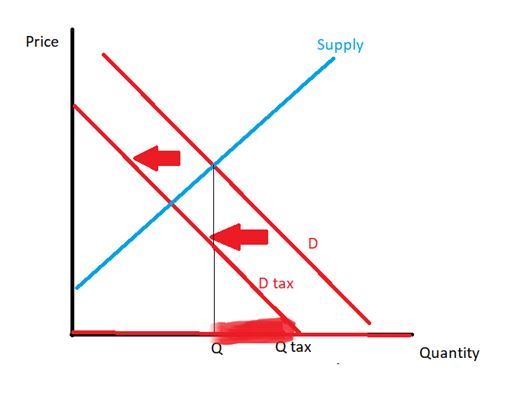

Laying additional taxes on consumers predictably reduces the demand without influencing the supply, which contributes to balancing the ratio. In Fig. 2, D stands for the initial demand and Dtax for that after imposing an excise on purchasers. As apparent from the graph, there is a downward tendency; meanwhile, supply remains unchanged, which adds to the overall quantity. Q and Qtax represent the amount of the product that is available before and after imposing the tax, respectively. The colored area stands for the additional quantity, for which the duty allows.

The Impact on Economic Efficiency

Similar to a price floor, the given type of taxation may be helpful in compensating for both financial losses and a shortage of a certain product during a crisis. Thus, the new government of Lebanon that was formed in the summer of the current year increased the costs of 95-octane gasoline by 66% (Chehayeb 2021, para. 5). Primarily, such a measure allows for an additional income to the state treasury, hence more resources for overcoming the economic slowdown.

A growth in the revenue is, however, not the only possible effect of excise taxes; in addition, they can reduce the consumption of deficient products by making those less affordable for the population. Thus, Chehayeb (2021) mentions that the price for 20 liters of gasoline in Lebanon currently exceeds a quarter of the minimum wage (para. 3). In addition, the supply is still insufficient, due to which people have to wait in lines for hours until they have a possibility to fuel their vehicles. The limitations of that kind may discourage the locals from driving cars and, consequently, help to save fuel. In accordance with the above definition of economic efficiency, such an approach serves to improve its productive component.

The Impact on Firms

The leap in the prices for fuel has put Lebanese gasoline station owners at serious risk. First, they have lost a substantial share of customers since, considering the poverty rates, the number of the residents who can afford to fill their cars on a regular basis has declined dramatically. Besides, the stations are only open several hours a day, which, as said above, creates long lines and consequently irritates the drivers. Furthermore, the Lebanese apparently have an inclination to accuse station owners personally of the price increase as well as queueing, which results in “threats, blackmail and beatings” (Arab News 2021, para. 13). The exposure to the risk of physical injuries demotivates many of the local fuel distributors from running their businesses further, hence aggravates the deficiency and the subsequent frustration of the population.

The Impact on Consumers

As apparent from the above, the excise duty on gasoline that the government of Lebanon has imposed on the consumers has deprived many of the latter of a stable access to fuel. Therefore, fewer and fewer people can afford driving cars, which, along with the other consequences of impoverishment, exasperates the citizens and leads to violent confrontations. Meanwhile, as Saikal (2020) highlights, any instability in the country may be fatal because its existence as an independent state has been “mosaic and fragile” since its emergence in the 1940s (p. 4). Internal conflicts can literally destroy the community that comprises various ethnic and cultural groups from inside, threatening the safety of the neighboring countries as well.

By contrast, it is worth mentioning that the excise tax on fuel is a temporary measure that targets at recovering from the crisis as soon as possible. Notably, it allows for balancing the state budget with time, which, in turn, has a beneficial effect on the quality of life of the population. Similar to a price floor for staples, the given model has long-term positive influence, notwithstanding the immediate negative response.

Conclusion

The deep financial crisis forced the government of Lebanon to remove subsidies from several products, notably, establish a price floor for flatbread, the staple, and impose an additional excise tax on the consumers of gasoline. Both of the measures allow for a more stable provision of essential products as well as a budgetary recharge, hence facilitate the recovery over time. However, their short-term effect is an inevitable hike in prices, which, along with the devaluation of the national currency and the growing unemployment, aggravates the impoverishment of the population and frustrates them.

References

Arab News. 2021. “Lebanon again raises price of bread amid crippling crisis.” Web.

Australian Competition and Consumer Commission. n.d. “Imposing minimum resale prices.” Web.

Chehayeb, Kareem. 2021. “Lebanon: Government Hikes Petrol Prices Again to Tackle Shortages”. Web.

Griffith, Rachel, Martin O’Connell, and Kate Smith. 2020. Price Floors and Externality Correction. Institute for Fiscal Studies.

Internal Revenue Service. 2021. “Excise Tax.” Web.

Middle East Monitor. 2020. “Lebanese government raises subsidised bread prices as currency tumbles.” Web.

Reserve Bank of Australia. 2018. “Inflation.” Web,

Roşca, Petru. 2017. “Economic Efficiency and the Role of the State in Market Economy.” Annals of Spiru Haret University: Economic Series 17(1): 35-41. Web.

Saikal, Amin. 2020. “Lebanon’s Ingrained Instability.” Web.