This assessment deals with how the Federal Reserve uses monetary policy and its monetary policy tools to try to stabilize the economy while meeting its dual mandate of controlling inflation and maintaining unemployment.

Scenario 1

The economy of a hypothetical country has been stable for two or three years with very low unemployment. Wages have been gradually increasing during this time. Now stock market prices begin significant increases, causing peoples’ investments, such as their retirement accounts and other investments to increase in value. People feel very good about the future, that they will keep their jobs, get regular pay raises and life will be good. With this positive feeling, people feel better about making purchases that perhaps they had been delaying earlier. They now use their new-found sense of wealth to buy many things that they had been hesitant to purchase in the past.

What kind of economic gap will start to occur (inflationary or recessionary)

In the given scenario, an inflationary economic gap will occur as the demand for goods and services outstrips the current production or supply levels. Also known as the expansionary gap, this is the disparity between an economy’s real Gross Domestic Product (GDP) and the potential GDP. This implies that the actual GDP of a country exceeds the GDP figures which would exist if the economy was to function at full employment. This phenomenon is occasioned by various factors, such as increased trade activities, high levels of overall employment beyond the natural rate, and elevated government spending (Levrero, 2018). Notably, these components trigger a relative rise in the real GDP and the subsequent increase in an economy’s volume of consumption. For instance, in the given scenario, the economy of the hypothetical country is characterized by stability, distinctly low unemployment, gradual increase in wages, and a rise in the value of people’s investments. The net effect of these occurrences is that there will be excessive money in the economy, and the consumers will be inclined to make purchases, even buying previously delayed commodities.

Situations such as excessive government expenditure, the increase in value of people’s investments, high employment rates, and huge levels of trade activity cause the real GDP to exceed the potential GDP, leading to an inflationary gap. The expanded real GDP escalates the consumption rate of an economy without a corresponding growth in the production or supply capacities. Consequently, there is limited capacity in the economy to absorb the extra aggregate spending, which ultimately triggers an inflationary increase in the price levels of commodities to restore market equilibrium.

Governments may utilize the available economic tools, such as monetary and fiscal policies, to help reduce an inflationary gap (Afonseo et al., 2019; Afonso et al., 2016). For instance, the Federal Reserve might consider imposing tight monetary policies, such as raising the interest rates to discourage borrowing by making loans more expensive, effectively reducing the amount of money in circulation. Similarly, fiscal alterations such as the reduction in government spending, issuances of bonds and securities, tax increments, and limited transfer payments reduce the funds available in an economy. The Federal Reserve implements these fiscal and monetary adjustments to appropriately respond to the inflationary fluctuations by increasing or reducing the amount of money in circulation.

Which of these graphs, Figure 1 or Figure 2, depicts this economic gap?

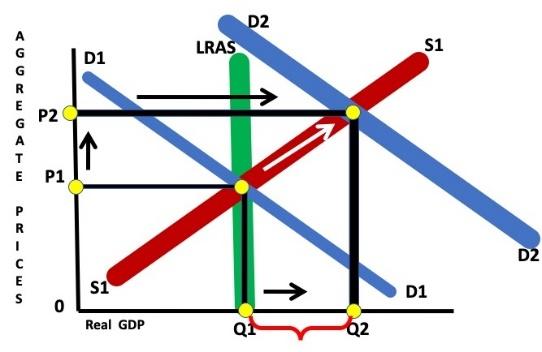

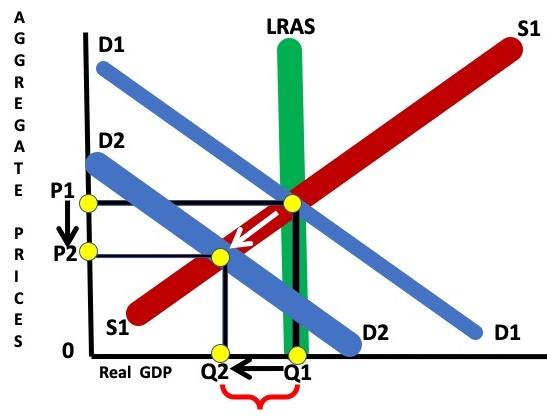

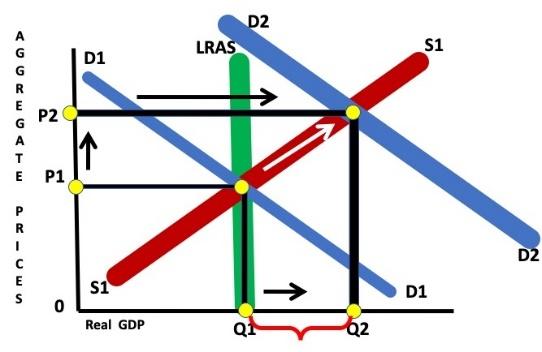

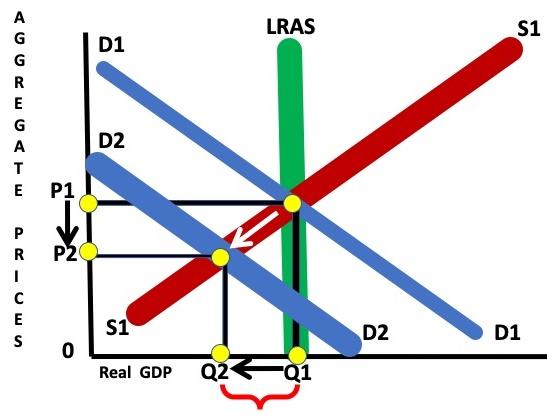

Figure 1 is the graphical representation depicting an inflationary gap. From the illustration, the demand curve shifts to the left from D1 to D2, indicating an increase in the levels of the quantity demanded. This expansion from Q1 to Q2 occurs despite a rise in the prices of the commodities from P1 to P2. From the given scenario, the rightward shift in the demand curve is attributable to factors such as the low unemployment rate, increasing wages, rising values of people’s investments, and an optimistic outlook on the future. This implies that consumers have excessive money to the point that even an increase in the prices of commodities does not discourage them from purchasing goods and services. However, this scenario differs significantly from the graphical illustration of Figure 2, where there is a leftward shift in the demand curve.

What part of the Federal Reserve’s congressional mandate does this scenario trigger (price stability and maximum sustainable employment)

From the given phenomenon, this scenario triggers the Federal Reserve’s price stability responsibility. The institution has an explicit congressional mandate to implement the nation’s monetary policy to support the dual objectives of stable prices and maximum sustainable employment. Kaya et al. (2019) assert that the Federal Reserve has over the years utilized the various tools at their disposal to sustain strong job markets and keep unemployment low without leading to an unwanted rise in inflation. For instance, in the phenomenon provided, the factors active in the scenario triggers an upward surge in prices, implying that the Federal Reserve will have to activate mechanisms to stabilize the upward trajectory and minimize the resultant inflationary pressure.

What kind of monetary policy might be helpful to stabilize the economy (expansionary or contractionary)

The Federal Reserve can activate a contractionary monetary policy to help stabilize the economy. Also known as tight monetary policy, this intervention seeks to limit the amount of active money circulating within a given economy (Twinoburyo & Odhiambo, 2017). For instance, The Federal Reserve’s action of increasing the short-term interest rate for lending discourages borrowing by making loans significantly expensive, which eventually reduces the amount of money available in the hands of consumers. Conversely, an expansionary or loose monetary policy increases the quantity of money in circulation.

What specific monetary policy tools does the Federal Reserve have available to use in this scenario

The Federal Reserve has a wide array of monetary policy tools through which it deflates the inflationary pressure. Among these include open market operations, which encompass the aggressive selling of government securities and bonds, an upward review of the statutory or cash reserve ratio, increasing the reverse repo rate, and raising the bank (repo) rate. For instance, the Federal Reserve reduces the tariff at which banks lend money to increase the amount of money in circulation and ease the inflationary gap.

How should the Federal Reserve use each of these tools to maximize their effect in stabilizing the economy, what will be the likely effect of each monetary tool’s use on the money supply, and the resulting impact on the economy?

In the given scenario, the primary objective of the applied monetary policy tools would be the money supply within the economy. The Federal Reserve’s open market operations will entail selling government securities to remove money from the system to the desired levels. Similarly, high cash reserve ratio obligates lenders to keep large portions of their finances with the Fed, thereby reducing the money available for borrowing. By increasing the reverse repo rate, the banks will be encouraged to invest their money with the Fed, since the avenues such as lending to money markets will be less lucrative (Bahlerao & Iyer, 2017). Therefore, the implementation of these monetary policy interventions will effectively deflate the inflationary pressure by reducing the amount of money in circulation.

Scenario 2

The economy of a hypothetical country has been stable for two or three years with very low unemployment. Wages have been gradually increasing during this time. Now an aggressive policy of increasing tariffs on foreign goods imported into the country results retaliatory actions from the other countries against the country’s products and services. This causes great loss of business in the country and results in significant portion of workers losing their jobs.

Given this scenario, insert your answers below each of the following questions.

What kind of economic gap will start to occur (inflationary or recessionary)

From the given scenario, an inflationary economic gap will occur due to the increase in inflation and unemployment and a reduction in the real output of an economy. Although imposing tariffs could make the local production competitive, the retaliatory actions result in high prices for the foreign goods due to the imported inflation and the erosion of consumers’ purchasing power. According to Cui et al. (2019), tariffs are generally inflationary due to their incremental effect on the prices of commodities. Additionally, in the given scenario, workers’ wages have been increasing gradually before the drastic loss of jobs. This event could push consumers to make panic buying in anticipation of difficult times ahead.

Which of these graphs, Figure 1 or Figure 2, depicts this economic gap

Figure 1 illustrates the inflationary economic gap due to the rightward shift of the demand curve from D1 to D2 and the quantity demanded from Q1 to Q2. Notably, the registered rises in the quantity demanded occurs despite a corresponding growth in the prices of the goods from P1 to P2. Since people are anticipating job losses, they will be making speculative and panic purchases to cushion themselves for the time they will be unemployed (Keane & Neal, 2021). Therefore, consumers will be stimulated to build up inventories as a buffer given impending risk of job losses.

What part of the Federal Reserve’s congressional mandate does this scenario trigger (price stability and maximum sustainable employment)

The given hypothetical phenomenon will trigger the Federal Reserve’s congressional mandate of price stability. The institution’s primary role is to ensure a safer, flexible, and stable financial and monetary system. Notably, the imposed tariffs result in a significant increase in the price of commodities, panic buying, and job losses as the ripple effects. Therefore, the Federal Reserve is obligated to initiate interventions which reverse the effects of the recorded spike in the prices of goods and services.

What kind of monetary policy might be helpful to stabilize the economy (expansionary or contractionary)

Contractionary monetary policies, such as removal of the imposed tariff, increase in bank’s lending rate, upward review of statutory reserve ratio, and open market operations can be applied to restore equilibrium. The applied strategies will be seeking to ease the effects of the imported inflation into the country and reduce the amount of money in the economy which is chasing too few commodities in the market.

What specific monetary policy tools does the Federal Reserve have available to use in this scenario

The Federal Reserve can remove the imposed tariff on the imported goods, conduct open market operations through which government securities and bonds will be sold, increase the bank lending rate as well as the reverse repo rate. Additionally, an upward review of the cash reserve ratio will effectively reduce the quantity of money in circulation. Notably, the principal goals of the monetary policies in consideration would be to reduce the imported inflation and to minimize its adverse effect on purchasing patterns and the job market.

How should the Federal Reserve use each of these tools to maximize their effect in stabilizing the economy, what will be the likely effect of each monetary tool’s use on the money supply, and the resulting impact on the economy?

The abolition of the imposed tariff will eliminate the inflationary component of the imported goods and reverse the aspect of panic buying, which is triggered by fears of job losses. Additionally, the Federal Reserve’s open market operations of selling government securities will reduce the amount of money circulating in the economy, which will ultimately restore equilibrium. Similarly, increasing the cash reserve ratio will significantly reduce the money which lenders can avail to consumers.

References

Afonso, A., Alves, J., & Balhote, R. (2019). Interactions between monetary and fiscal policies. Journal of Applied Economics, 22(1), 132–151.

Afonso, J., Araújo, E., & Fajardo, B. (2016). The role of fiscal and monetary policies in the Brazilian economy: Understanding recent institutional reforms and economic changes. The Quarterly Review of Economics and Finance, 62, 41–55.

Bahlerao, R. M., & Iyer, M. N. (2017). Repo rate and its effects on GDP: An empirical Indian experience. Scholarly Research Journal for Humanity Science & English Language, 7(35), 9422–9431.

Cui, L., Sun, Y., Melnikiene, R., Song, M., & Mo, J. (2019). Exploring the impacts of Sino-U.S. trade disruptions with a multi-regional CGE model. Economic Research-Ekonomska IstraziVanja, 32(1), 4015–4032.

Kaya, A., Golub, S., Kuperberg, M., & Lin, F. (2019). The Federal Reserve’s dual mandate and the inflation-unemployment tradeoff. Contemporary Economic Policy, 37(4), 641–651. Web.

Keane, M., & Neal, T. (2021). Consumer panic in the COVID-19 pandemic. Journal of Econometrics, 220(1), 86–105.

Levrero, E. (2018). An initial ‘Keynesian illness’? Friedman on taxation and the inflationary gap. Cambridge Journal of Economics, 42(5), 1219–1237. Web.

Twinoburyo, E. N., & Odhiambo, N. M. (2017). Monetary policy and economic growth: A review of international literature. Journal of Central Banking Theory and Practice, 7(2), 123–137. Web.