Executive Summary

This paper aims at studying all major aspects of the strategic management process of Magna International, a Canadian automotive supplier. It is the final report, focusing on a detailed representation of strategic management processes and strategies. Special focus is made on the history and evolution of the company under investigation, its mission and vision statement, financial condition, currently deployed strategies for managing operations, and both external and internal forces affecting the performance of Magna International. More than that, a variety of matrixes and analyses will be used for estimating the performance of the company and its operation within the automotive industry. At the same time, the report aims at making some recommendations for the further improvement of the company’s performance and increasing the effectiveness of the currently used strategies.

Introduction

Magna International is one of Canadian automotive manufacturers and suppliers. The company was founded in 1957 and became publicly listed in 1962. Since then, senior management of the company succeeded in operations and expanded them to an international scale. As for now, the number of people employed by Magna International exceeds 150,000 employees around the globe. The company’s manufacturing facilities and distribution centers are located in 29 countries in all regions of the world, including North America, Europe, and Asia. The specificity of the company is the number of manufacturing operations conducted by its facilities – 317 (“Facts and History”).

In addition, it cooperates with the most influential companies involved in the automotive sector. Some of the most well-known customers are BMW, Tesla, Volkswagen, and Toyota, not to mention numerous smaller vehicle manufacturers. It is essential to state that Magna International itself is not engaged in automobile manufacturing. Instead, the scope of its production operations comes down to designing GETRAG transmissions, manufacturing driveline systems, metal-forming solutions, and fluid pressure and control. More than that, the company’s facilities offer a great variety of services, including but not limited to consulting and advanced engineering (“Products & Services”).

Magna International operates based on core vision and mission statements. Its vision is the combination of several critical elements, such as respect for people (both employees and customers), the focus on the needs of customers (orientation on their interests), constantly improving performance (boosting the productivity of employees and economic outcomes of operations), and turning a zero-defect strategy into a lifelong value (“Mission Statement”). The abovementioned concepts and ideas create the desired image of the company’s future activities, which makes up the mission of Magna International. That said, its mission is a constant improvement of performance and economic outcomes, as well as developing and manufacturing technologically advanced electronic systems and components, which will not only turn the company into the industry leader but also contribute to solving the problem of excessive fuel consumption, enhance the safety of the natural environment and people, and overcome and challenge of extreme air and water pollution (“Mission Statement”).

Strategic Management Process

This section aims at investigating the central elements of the strategic management process currently deployed by Magna International, including the planning process, competitive advantages, organizational culture, ethical codes, and leadership.

Magna International’s Strategy

The company’s long-term strategy is based on several critical elements. They make up the foundation of the strategic management process. First and foremost, it involves continuous improvement of the overall performance. The basis of this step is the constant innovation of manufacturing facilities and performed operations. Another aspect of the long-term strategy is further geographical diversification of the company – opening new facilities in different regions across the globe, especially in emerging markets. At the same time, one of the central elements of the overall strategy is the design of adequate risk management and capital allocation strategies necessary for guaranteeing that the development is sustainable. It is paramount to recognize the fact that the long-term strategy is inseparable from the planning process, which will be described below.

Planning Process

At Magna International, special attention is paid to planning. Therefore, there are several central planning programs, focusing on different aspects of managing operations and activities. For instance, there is a resource planning program aimed at identifying the volumes of resources (both natural and human) needed for meeting the company’s objectives and plans for further growth. Moreover, there is a logistics planning program aimed at identifying plans for the evolution of manufacturing facilities and distribution centers as well as developing bonds with current and potential customers. In addition, there is a budget planning program, centering on financial aspects of operational planning. Finally, there is a performance planning program, according to which primary productivity objectives are set and their achieving is traced and estimated.

It is essential to note that there are several levels of the whole planning process. First of all, there is the highest level of planning, involving senior management (the Board). At this level, company-wide objectives are set, including overall performance goals and planned expenditures as well as the long-term strategy for achieving them. At the same time, there are lower levels of planning, as there are directors of planning and managers at each manufacturing facility, who are responsible for developing small-scale plans aimed at reaching overall performance objectives and coordinating both planning and productivity programs.

Competitive Advantage

The core elements of Magna International’s long-term strategy are closely connected to its competitive advantage. In particular, continuous innovation of manufacturing facilities is what helps the company to outperform its major competitors (Williamson et al. 236). However, innovation is not the only aspect of the company’s competitive advantage. It is supplemented by conducting operations of the enterprise at the international level. This element involves both the operation of manufacturing facilities and distribution centers in different regions of the globe and acquiring assets abroad. At the same time, the competitive advantages of Magna International derive from its cooperation with some of the most powerful automobile manufacturers in the world. The very fact that they choose this company makes it attractive to other producers, as details manufactured by Magna, in this case, are synonymous with the products of exceptional quality.

Organizational Culture

Magna International’s organizational culture is based on several aspects. Still, all of them are connected to the development and personal growth of the employees and their comfort and safety in the workplace. From this perspective, the foundation of the company’s organizational culture is the focus on enhancing employee involvement and making them more dedicated to the fulfillment of organizational plans. It is commonly achieved by centering on employees’ needs as well as establishing a safe and open environment in the workplace. All of the operations and activities, as well as all policies related to employees, are characterized by the principle of universal equality and fairness. At Magna International, this approach to organizing work is referred to as the fair enterprise (“Unique Entrepreneurial Culture”). Moreover, it is supplemented with encouraging the implementation of innovations that make all operations easier to conduct and boost productivity. Finally, motivating teamwork is another element of the company’s organizational culture.

Ethical Codes

Based on the facts about Magna International’s corporate culture mentioned above, it is essential to note that ethical norms are at the heart of the whole system. They are clearly identified and stated in central corporate documents such as the Employee Charter and the Corporate Constitution. These two documents are the sets of rules of acceptable behavior and norms of employee interactions. They focus on enhancing cooperation among team members and fostering overall equality. At the same time, the Charter and the Constitution protect employees’ rights and state their responsibilities so that it is easier to organize and manage the working process as well as address the most common conflicts occurring in the workplace (“Unique Entrepreneurial Culture”).

CSR Practices

Magna International’s corporate culture and codes of ethics are inseparable from CSR (corporate social responsibilities) practices. As stated above, employee involvement, the focus on consumer needs, and the improvement of the world are at the heart of the company’s strategy. That is why they predetermine CSR practices. For instance, the company commonly allocates resources for creating a safe workplace. In this case, funds are injected not only in improving the working environment but also in the protection of the natural environment, as it is perceived as the broader milieu of both employees and consumers. More than that, additional resources are allocated to the development of rural and other areas where employees work and live. It is made by financing both volunteering and non-profit organizations with the aim of developing communities. From this perspective, it is believed that the development of communities is directly connected to the increased dedication of employees and, as a result, the prosperity of the company (Magna 20).

Leadership

Regardless of the well-developed system of corporate documents and the existence of unique corporate culture, following all norms and principles is impossible without strong and wise leadership. At Magna International, leaders are responsible for promoting integrity and equality in the workplace. At the same time, they are in charge of motivating employees to be open in communication and act as team members, thus creating an atmosphere of trust and openness in the workplace. In addition, what is special about Magna International is the recognition of the limited skills and knowledge of people. From this perspective, leaders are not afraid of asking for external help and seeking consultations with outside professionals. That said, the involvement of outside directors for counseling and potentially increasing the effectiveness of deployed strategies and the overall productivity of the company and its employees is a common practice at Magna International (“Corporate Constitution”; “Our Operational Principles”).

Moreover, the concept of leadership is inseparable from the issue of governance. At Magna International, there are several levels of leadership and governance. Just like in the case of planning programs, the major company-wide decisions are made by the Board – senior management. However, the Board cannot control all processes because of the geographical diversification of the company. That is why there are both regional and local leaders. Regional leaders are at the middle level of governance, while local leaders are those responsible for particular divisions of the company.

Financial Analysis

As for now, Magna International is a financially successful company. Its total revenues are constantly growing. As of 2015, the volume of the company’s total revenue exceeded 36 billion dollars with more than 32 billion dollars in sales. Regardless of the overall dependence upon international cash transformations, Magna International managed to overcome the 2014 drop in sales and recover in 2015. The same is true about 2016, as the company’s revenue continued to grow (Magna 16).

Still, in order to obtain a better understanding of the company’s financial health, studying some ratios is advisable. For instance, Magna International’s assets are becoming more liquid because the level of their depreciation is constantly decreasing. Moreover, net income is constantly increasing as well as the inflow of cash from operating activities (Magna 15). At the same time, liquidity risks are reduced due to the improved financial outcomes of the company (Magna 41). In addition, the volume of investments is constantly growing, which points to the increased attractiveness of the company and improved financial condition. Still, there are some challenges, as most of the projected benefits obligations were not fulfilled compared to the plans and previous reporting period (Magna 64-67).

Current Strategies

Strategies are commonly reviewed and analyzed in view of internal and external forces affecting the operations and performance of the company.

Internal Forces

Internal forces affecting the company’s performance come down to weaknesses and strengths. In the case of Magna International, some of the most critical strengths are the operation in 29 countries around the globe and the scope of its operations. It is connected not only to improved economic outcomes but also to the influence on the automotive industry as a whole. More than that, working with the most powerful companies in the automotive industry is another strength that makes Magna International a powerful player in the sector as well. In addition, the company employs almost 160 thousand people around the globe. Due to allocating funds in community development and increased dedication of these people, the chances of the company’s prosperity are constantly increasing. Finally, specializing in both the manufacturing of details and offering services, as well as the continuous innovation of the manufacturing process, make the company attractive and influential.

As for the primary weaknesses, they are associated with extreme dependence on major customers. It is as well known as customer concentration – the focus on manufacturing similar products and working with a limited number of companies. From this perspective, losing customers is potentially associated with significant financial losses. The same is true in case of lower prices for the same products offered by competitors. Finally, the company pays special attention to the focus on legacy – specializing in extensive innovation of manufacturing, which is commonly connected to excessive expenditures and risks of failing to keep up with the times.

Internal strengths and weaknesses are commonly estimated by using a specific evaluation matrix. In this case, internal strengths and weaknesses are weighted from 0,00 to 1 based on their influence on the company’s performance (from the lowest to the highest). Later, they are rated according to the same principle. However, strengths are rated with 3-4, while weaknesses are marked with 1-2. See Figure 1 below for details.

Figure 1. Internal factor evaluation matrix for Magna International.

External Forces

Unlike internal forces affecting the operation of the company, the range of external ones is significantly wider. First of all, it involves threats and opportunities. As for the primary threats faced by Magna International, they include the risks of being outperformed by competitors (either lower prices or introducing more innovative products). Moreover, there is a threat of losing customers due to some of the reasons mentioned above. In addition, high labor costs and high-interest rates may have a negative influence on the financial performance of the company due to the dependence on employees and the impact of international cash fluctuations. At the same time, any turndowns in the automotive industry are associated with excessive risks because of the dependence on sales.

Nevertheless, regardless of significant threats, there are as well vast opportunities for the further development of the company. For instance, winning new markets, especially in the developing areas of the globe, is potentially connected to the increase in revenues due to the vast demand in the emerging economies. Moreover, acquisitions of the related companies abroad may be beneficial for diversifying the product range without allocating vast volumes of financial and human resources. Finally, it is potentially connected to developing bonds with new customers. At the same time, finding more companies to cooperate with is another opportunity for improving performance and becoming more successful. The combination of external and internal forces is commonly deployed for making up strategies for the company’s development (see SWOT matrix below – Figure 2).

Figure 2. SWOT matrix of Magna International.

The abovementioned strategies are consistent with the company’s long-term strategy. In fact, they are the elements of Magna International’s long-term strategy due to the correspondence with the core values and objectives. Furthermore, these strategies comply with the mission and vision statements and planning programs. In this way, they are efficient and should be deployed to achieving the company’s strategic objectives.

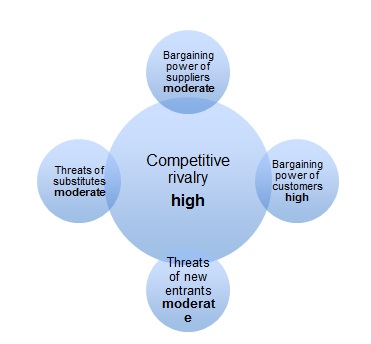

Porter’s Five Forces Analysis

Another common tool for estimating external forces affecting the company is Porter’s Five Forces analysis (see Figure 3). In the case of Magna International, competitive rivalry is high because of the operation of other companies offering the same or, at least, similar products and services. As for the bargaining power of buyers, it is high due to the excessive dependence on major customers. The bargaining power of suppliers is moderate because the company like Magna International can easily cooperate with new suppliers due to vast resources and international scope of operations. The threat of substitutes is moderate because even though the offered details are imitable, the brand (Magna International) is associated with the quality so that it might be complicated for the manufacturers of substitutes to outperform it. Finally, the threat of new entrants is moderate because, regardless of the absence of significant barriers to entering the market, the influence of Magna International of the automotive industry (for instance, the level of prices) is significant so that newly created companies might face challenges when entering the market.

PESTEL Analysis

One more instrument for investigating the impact of external forces is PESTEL analysis, estimating political, economic, social, technological, environmental, and legal aspects of the environment of the company’s operation. For Magna International, see Figure 4 below.

Figure 4. PESTEL analysis for Magna International

Value Chain Analysis

Support activities (human resource management, firm infrastructure, and technology development) Another common tool for estimating the influence of external forces on the company’s performance is value chain analysis. In the case of Magna International, both support and primary activities are included in the value chain. Primary activities are inbound (supplying raw materials) and outbound (transporting finished goods) logistics, operations (processing raw materials, designing and manufacturing products), marketing (traditional and online), sales, and services (engineering and consulting). As for support activities, they involve human resource management (investing in community development and focus on employee needs), firm infrastructure (creating a safe environment in the workplace and opening new facilities), and technology development (continuous innovation). For detailed information, see Figure 5 below.

Marketing Strategies

Except for the internal and external forces and strategies related to them, marketing strategies are as well associated with the company’s performance. In the case of Magna International, special attention is paid to implementing the customer-centered approach. It is related to all aspects of the company’s operations and activities, and marketing is not an exception. From this perspective, Magna International created the positions of marketing directors who review the specificities of particular markets and deploy relevant marketing strategies. That said, they are diversified across the regions of the company’s operation. Nevertheless, in any region, it is the combination of both network (online) and traditional marketing tools that contribute to the successful expansion of the company around the globe.

Operations Management

Based on the facts mentioned above, Magna International deploys several major strategies for managing its operations. First and foremost, the focus is made on making operations more effective due to paying attention to innovating the manufacturing process and personal development of employees. Moreover, the company focuses on understanding markets and customers. It can be explained by developing and implementing the customer-centered approach to doing business and marketing, In addition, leaders of Magna International understand their strengths and turn them into company’s competitive advantage as well as take steps to eliminate risks connected to threats and weaknesses. Finally, the focus is made on the differentiation of products. Even though all of them are similar, the company works on improving them as well as introduces new services.

Information Systems

Magna International pays special attention to the implementation of the newest information technologies in manufacturing and organizing the working process. From this perspective, information systems are the core element of the company’s improved performance. The newest technologies are used not only for designing and manufacturing products but also keeping secret information safe and protecting the company from data leakage (Magna 5). At the same time, it is essential to note that the constant upgrading of information technologies is perceived as one of the central constituents of the long-term innovation strategy.

Financial Strategies

As for now, Magna International enjoys vast volumes of investments in its activities. These funds are commonly allocated in the areas of the most critical interest – community development, innovation, and global expansion (opening new manufacturing facilities). Nevertheless, there are some specificities of currently used financial strategies. For instance, preference is given to long-term investment projects because they are consistent with the company’s long-term strategy. Moreover, the achievement of the target capital structure is commonly driven by internal investment. At the same time, it is essential to note that internal investment is conducted from the revenues. Moreover, cash resources are commonly injected as internal investments. Finally, returns on investments are perceived as a primary source for future growth because these funds are allocated in innovations and technologies.

Factual Analysis

Nowadays, Magna International is one of the successful global companies. Senior leadership manages to select and implement relevant strategies, which help them to achieve set objectives and reach planned levels of performance. Moreover, they correspond with mission and vision statements, which make up the foundation of all operations. Based on the findings of the research, centering on customers’ needs and interests, as well as the creation of unique corporate culture, are the secrets of the company’s success. At the same time, Magna International does not ignore the criticality of protecting the natural environment and the significance of implementing sustainable development strategies – decreasing negative influence on the natural environment. These specificities make it even more attractive to potential customers.

Except for the focus on customers’ interests, senior management of Magna International recognizes the fact that people are the key to the company’s performance. For this reason, special attention is paid to making employees more dedicated to fulfilling the company’s plans and trust. Finally, Magna International’s improved performance is associated with strengthening its positions abroad by creating strategic ventures with foreign companies operating in the automotive industry and modifying financial strategies (Magna 4-5).

Having reviewed the currently deployed strategies, it is evident that they correspond with Magna International’s objectives, as the emphasis is laid on improved performance, innovation, sustainable development, and orientation on customers’ interests and needs. Furthermore, the used strategies are consistent not only with the mission and vision statements but also actual outcomes of activities. This statement can be proved by the fact that Magna International is a popular company, attracting the attention of the most powerful companies operating in the automotive industry, and they do not seek substitutes. More than that, the indicators of financial activities are constantly improving which means that the chosen strategies are efficient. Finally, they do help to achieve the company’s objectives and goals because they are diversified and can be deployed for managing different aspects of operations and activities.

Strategic Review

Recalling the findings of the conducted research, it is evident that the existing strategic management process is effective. Its efficiency is devoted to the development of detailed sets of rules (ethical codes), corporate documents, and the establishment of a unique corporate culture that pays special attention to the needs of employees. Moreover, it contributes to the constant improvement of the company’s performance due to the existence of several levels of management and the acknowledgment of the criticality of involving outside professionals in cases of necessity. In general, it is a set of well-developed rules and procedures helpful for managing the company.

Still, there are some inconsistencies in the currently deployed strategic management process, regardless of its overall effectiveness. For instance, expected financial outcomes are always lower than the actual ones. It means that there are some imperfections in the financial planning area of the management process. Nevertheless, the company has developed a well-designed system of measures to estimate its performance. It is based on timely reposts covering different aspects of operations. For example, there are quarterly financial reports, focusing on financial performance only and the comparison of financial outcomes over quarters. Moreover, there are annual reports for stakeholders, paying special attention to all aspects of activities. They are short but still detailed. Finally, there are short information forms and tax reports, which can be used for reviewing all spheres of company activities and concluding whether there are any challenges to be addressed in the future.

Conclusions and Recommendations

To sum up, Magna International is an example of a successfully operating company. For the most part, its prosperity is connected to a detailed strategic management process. Nevertheless, the company faces some significant challenges because of the excessive dependence on several major customers as well as the similarity of manufactured products. More than that, most of the revenues are derived from sales. It means that in case of losing customers, financial losses are inevitable. Finally, even though the company is a powerful one, the risks of being substituted or outperformed are as well high.

That said, even though Magna International is a financially and economically successful company, there are still some areas critical for the further improvement of the overall performance and the increase in key indicators of economic activities. First and foremost, it is critical to diversify the range of offered services in order to increase the volume of revenues not related to sales. Moreover, it is advisable to continue allocating resources for the further innovation of manufacturing facilities, as well as supporting sustainable development, so that the risks of losing customers are minimized. In addition, foreign acquisitions and further global expansion are also recommended in order to strengthen the company’s position in the global arena and avoid being outperformed by powerful competitors. Finally, making the focus on increasing the customer base is as well essential due to the extreme dependence on the existing clients.

Works Cited

Magna. “Corporate Constitution.” Magna, 2017, Web.

Magna. “Facts and History.” Magna, 2017, Web.

Magna. “Mission Statement.” Magna, 2017, Web.

Magna. “Our Operational Principles.” Magna, 2017, Web.

Magna. “Products and Services.” Magna, 2017, Web.

Magna. “Unique Entrepreneurial Culture.” Magna, 2017, Web.

Magna. 2015 Annual Report. Magna International Inc., 2016.

Williamson, Peter J, et al. The Competitive Advantage of Emerging Market Multinationals. Cambridge University Press, 2013.