Introduction

The bike rack market is growing and more relevant than ever – bicycles have always been one of the most common means of transportation or used for leisure purposes – but a renewed interest in fitness and outdoor adventure drives increased consumer demand worldwide. The major players in the industry hold up to 75% of the total share in the market. They include ACPS Automotive GmbH, Allen Sports USA, Atera GmbH, CRUZBER SA, Danik industries Ltd. DBA, Thule Group AB, Rhino-Rack USA LLC. Through their segment, the companies offer various racks ranging from Compact Tacks to Spare Tire Racks to capture as much of the market as possible and offer customers an abundant selection of products from which they can choose. Among the products, roof boxes perform the best, while roof racks have the slowest growth within the category.

There are several elements necessary to understand the segments of the category and the target market overall. Specifically, there is a growing demand for passenger vehicles due to the increasing tour and leisure activities globally as countries are ‘opening.’ Thus, it becomes possible to increase travel activities. Besides, in light of the COVID-19 pandemic, it makes sense that customers invest in personal modes of transportation to avoid crowds (Shamshiripour et al., 2020). The production and transportation of cars have been stopped, with Covid-19 hurting the transport and mobility industry extremely hard. As a result, the minor or significant enterprises in the Car Roof rack sector lost a lot. Post Covid-19, the necessity for mountain bike and ski excursions will rise with increased demand for leisure activities and health advantages. It will thus boost the demand for more reliable, market value-added automobile car racks and roof-top mounts.

Furthermore, the sales of smaller cars are rapidly growing because they are easier to operate and less costly; however, such vehicles have limited boot and leg space, which means that carrying a bike in them is impossible. Therefore, bike racks have become essential for car owners who also want to transport their bikes with them (Evarts et al., 2021). Besides, it is worth noting that the threat of substitutes is low in the industry because there is no alternative to car-bike racks that are as convenient and efficient to use.

Several points should be mentioned regarding trends and behaviors that influence how consumers choose brands and use products in the category. Younger consumers who tend to lead a healthy lifestyle are highly likely to have a bike and thus need to acquire car parts to transport it. Also, individuals who use a bike for recreational activities and travel often need a rack to take their bicycle with them. To choose a particular brand, consumers will look at all products in general and choose those that are easy to use, have a reasonable price, and have a reliable construction. Brands that meet these criteria are more likely to be selected.

There are several positive and negative influences on market demand within the segment. First, the marketing of bike rack products should align with the categorization of the product into the global auto parts and equipment market. Second, increasing electronic components in cars should be considered because it will increase demand for new functionalities. Third, increasing safety regulations within automotive systems are expected to drive sales of auto components. On the downside, the fluctuating prices of raw materials can be a significant challenge for manufacturers and their subsequent marketing efforts.

In general, consumers who own a car and are passionate about recreational activities such as tourism are the most likely to purchase car bike racks. Among consumers whose families are growing and the income is increasing, the likelihood of buying car parts to attach their bicycles increases. Customers realize the benefits that customers realize include convenience, lightweight, and the ease of setting up the rack to hold bikes and be used for other storage purposes. Depending on the functional needs of customers, the usage rate for the product will vary. For instance, cyclists will frequently use the bike racks, while families and campers who use their bikes for trips will use them less regularly. While there is no brand loyalty established in the market just yet, there is an overall positive attitude toward the offering because it is a suitable product with a practical purpose, and there is no replacement for it.

To summarize, the industry of bike racks for cars is expected to grow steadily over the years due to its accelerating growth momentum. North America is the largest market in the industry, contributing to 26-28% of the total market percentage, followed by Germany with 10-12% and the UK with 8-10% (Technavio, 2021). Bike car racks represent the largest segment share, and it is expected that the trend stays the same in the following three to four years. Based on the latest data, key competitors include Atera GmbH and ACPS Automotive GmbH, which are categorized as dominant in market positioning and pure-play in vendor classification. Thule Group is a fierce competitor because it is classified as a dominant and category-focused company (Technavio, 2021). CRUZBER SA is also worth mentioning as a competitor because it is both industry-focused and dominant in the market.

The Challenge: Road Wave should reach out to sizeable European bike rack distributors and pitch a licensing deal to have RoadWave as their in-house brand (similar to the Amazon Essentials brand).

Situation Analysis

The threat of New Entrants – Low

Based on our research, we believe that the threat of new entrants is low. The global car rack industry has quite some manufactures that offer different types of products. New entrants will have to develop a breakthrough product to compete with existing products currently on the market. Moreover, the current manufacturers have an established brand name in the market. It will take a very long time for new entrants to make a presence in the current market, and it will be very tough for them to generate sales initially.

In addition, to break into this industry, new entrants might face some challenges, including high capital investment and limited access to distribution. Current manufactures have established their sales and distribution channels. New entrants will have to spend a lot of energy, time, and capital to establish their distribution and sales channels.

The threat of Substitutes – Moderate

Based on our research, some substitutes are available in the market, such as roof rack, hitch rack, trunk rack. Consumers can decide which types of car rack they want to purchase depending on their preferences

The threat of Rivalry – Moderate/High

As mentioned previously in the threat of new entrants section, the car rack industry has many manufacturers that offer different types of products. Therefore, we believe that the threat of rivalry is between moderate and high. Roadway might have to compete with other well-known brand names such as Allen Sports, Yakima, and Thule, who dominate the car rack industry.

Bargaining Power of Suppliers – Low

We believe that the bargaining power of suppliers is low for a couple of reasons. First of all, given that many manufacturers sell different products in the market, buyers’ switching cost is meager. If I do not like the rack from Allen Sport because of whatever the reasons, I can buy a different rack from Thule or Yakima. Second, substitutes are available, as previously mentioned. Lastly, buyers are becoming more well-educated regarding the product.

Bargaining Power of Buyers – Moderate

Based on our research, the buyer bargaining power is moderate. As mentioned previously, the switching cost of buyers is low. The buyer is well-educated about the product. They can do their research and decide which product will be best. Moreover, lastly, buyers are becoming more price sensitive.

Industry SWOT

Strengths

- Versatile & compact

- Easy to use & store

- Quick to install

Weaknesses

- Trunk modification required

- Driver visibility reduced in the rear window

- Unwelcome by car manufactures due to having to change production line/manufacturing process

- No brand recognition

Opportunities

- Increase in demand for pedaling and recreational activities

- Increase in demand for versatility and ease of use

Threats

- Fierce competition in similar products (trunk rack and hitch rack)

- Continuous innovation by current market leaders

- Consumers are becoming more price-sensitive to bike racks

Size and Growth Opportunities

In 2019, the car rack market was dominated by North America. The region accounted for over 48% of the global market. The United States dominated the North American car rack market.

Some of the major factors driving the growth of the US market are the growing demand for vehicles from the tourism sector (car rental and taxi services), increasing demand for recreational vehicles (rise in demand for recreational travels among the consumers), and a large number of young people moving out to different cities in the United States for studies and work.

According to the US Travel Association, the number of domestic leisure trips accounted for 1,821.2 million in 2018, and it is expected to reach over 1,900 million by 2022. Nowadays, people in the country are opting for road trips and water sport activities during their vacations and holidays, which drives the demand for a roof rack, roof box, bike car rack, and watersport carrier in the country.

In the United States, the trend of cycling increased in the past three years. According to the SFIA, about 8.7 million people participated in mountain/non-paved surface cycling, compared to 8.04 million people in 2014.

Additionally, the number of participants in recreational kayaking in the country increased from about 7.3 million in 2011 to over 11 million by the end of 2018, as per the SFIA.

According to the National Ski Areas Association, the number of skier/snowboarder visits in the country increased from 51 million in 2012 to over 53 million in 2018.

Allen Sports, Rhino-Racks, Thule, Yakima, Saris, and Kuat are prominent players that offer different types of car racks in the country. Roof boxes are the second-fastest growing segment. The roof box segment is expected to witness a growth rate of over 7% during the forecast period. Roof boxes are built and designed with a variety of materials, features, and sizes.

In September 2018, Thule Group officially unveiled Thule Vector and Thule Force XT cargo boxes at Automechanika. Roof boxes are ideal for families on vacation, as they can carry luggage, outdoor gear, and bulky loads. The company also offers Thule Motion XT, which comes in four sizes, ranging from 300 liters to 610 liters. It has intelligent features, like SlideLock System, with separate locking and opening functions, and is easy to mount due to the pre-installed PowerClick quick-mount system.

Some people prefer roof-top cargo luggage travel bags instead of boxes due to their soft covers that allow travelers to carry objects, which may be oddly shaped and not fit under the hardcover cargo carriers. Due to vinyl materials, roof-top cargo luggage travel bags are waterproof and can be folded flat when not used for more straightforward storage. However, these bags are not ideal for sharp or delicate objects.

The price of these bags varies from USD 50 to USD 200, whereas roof boxes cost more than USD 300, depending on the dimension and load-carrying capacity.

Thule Group, Yakima, Inno Advanced Car Racks (Car Mate Mfg Co. Ltd), and Malone Auto Racks offer roof boxes globally. Inno Advanced Car Racks offers cargo boxes in four series, namely, Phantom Series, Wedge Series, Shadow Series, and Ridge Series.

Competition Analysis

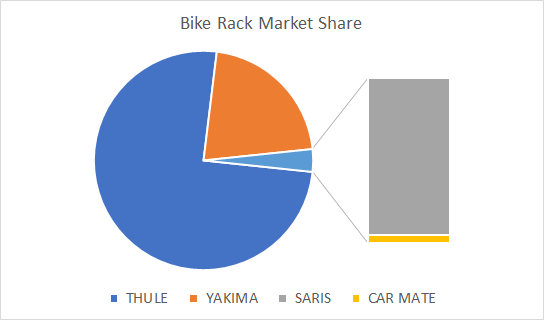

The bike rack market is consolidated, with major players accounting for two-thirds of the total market share. Some major market players are Thule Group AB, Yakima Products Inc., Cruzber SA, Allen Sports, and Rhino-Rack USA LLC. Thule Group accounted for more than 50% of the global market. The company is actively present in the European and North American markets. It focuses on diversifying its product portfolio through new launches and acquisitions to maintain its competitive position in the market.

Trends and Outlook

The car rack market accounted for USD 1.6 billion in 2020 and is expected to project a CAGR of less than 7% during the forecast period (2021 – 2026).

With Covid-19 hitting the transport and mobility sector very severely, the manufacturing and movement of automobiles saw a standstill, and consequently, the small or large companies in the business of Car Roof racks suffered a great deal. Post Covid-19, with the increasing demand for regular recreational activities and health benefits, the need for mountain biking and ski trips will increase. It will consequently increase the demand for more car racks and roof-top mounts, which are dependable, increasing the market value.

Some of the major factors driving the market’s growth are the demand for extra luggage space and increasing enthusiasm for recreational activities and tourism. However, quality (formation of rust and corrosion in low-quality racks) and pricing issues (factors affecting the price, like costs of the product, such as construction material/raw material, style of roof rack, and brand) may hinder the growth of the market.

North American is expected to dominate the car rack market. The increasing demand for vehicles from the tourism sector, rising demand for recreational vehicles, and the large number of young people moving out to different cities in the United States for studies and work are some of the factors driving the demand for the roof rack, roof box, and bike car racks.

Customer Analysis

Top 10 Cities in which workers ride bicycles to work, according to the League of American Bicyclists:

- Portland – 7%

- Minneapolis – 5%

- San Francisco – 4.3%

- Washington DC – 4.1%

- Seattle – 4%

- New Orleans – 3.3%

- Oakland – 2.9%

- Tuscan – 2.4%

- Philadelphia – 2.2%

- Denver – 2.1%

Age

- 18 – 60

- The most significant part of the growth of the cycling market in the US in the previous two decades happened among men between 25-64 years old

Gender

Male-Dominated industries; action sports, camping.

Nationality

Varying.

Education

With the increase in education level, there is an expected increase in the likelihood to buy.

Household composition

Individuals, single and action-sports oriented. Primarily families with children under the age of 21.

Occupation

Varying.

Income

A positive correlation between income and the ability to purchase expensive luxury items.

Young people with healthy lifestyles tend to have a bike with them. In addition, people who desire to explore nature and have enthusiasm for recreational activities will likely have a bike with them. As a result, these people will likely purchase or need to purchase a bike rack

Active individuals, athletic, outdoors-oriented. Traveler’s item.

People who have a car and enthusiasm for recreational activities and tourism are likely to purchase a bike rack.

- Purchase Stimulation: Family growth, income increase, renewed interest in outdoor activities

- Desired Benefits: Convenient, lightweight, easy to set up. Can load bikes and other storage purposes.

- Usage Rate: Depending on the individual, for cyclists, this might be frequent for campers or families utilizing family trips, much less frequent.

- Brand Loyalty: Likely limited to individual product lines, not brands at large.

When purchasing a bike rack, customers look for a product that could come with a solid construction, ease of use, lightweight, and a reasonable price.

Research also shows that the design of the bike rack is also another factor that customers consider when purchasing the product. As a result, manufacturers are looking at different and innovative designs to be installed onto the vehicles that consume less space and are more practical in design aspects. Finding feasible designs and efficient ways to mount luggage and different cargo onto the vehicle can reduce a large amount of extra performance effort to be delivered by the vehicle’s engine, thereby reducing maintenance costs and vehicle safety.

The largest regional car rack market is currently in North America (38%), with developing markets in the Asia Pacific (16%) region growing faster than any other region. The increasing demand for vehicles from the tourism sector, rising demand for recreational vehicles, and the large number of young people moving out to different cities in the United States for studies and work are some of the factors driving the demand for the roof rack, roof box, and bike car racks.

The most recent American Community Survey (ACS) 5-year estimates covering the years 2013-2017 show that about 872,000 people, or 0.6% of all workers in the United States, bike to work.

Marketing Strategy

A note on Road Wave’s proposed auto manufacturer-based strategy: The industry is centered around after-market products currently. In 2007, ThyssenKrupp, Germany’s largest steel manufacturer, announced it had formed a partnership with Audi and Webasto AG (a leading manufacturer of roof systems) to develop what it described as a “multipurpose tailgate with an integrated bike rack.” The multipurpose tailgate was intended to be installed at the time of manufacture and included a folding bike rack integrated within the vehicle’s body and frame. Why the German attempt at an integrated bike rack never advanced beyond development is unknown, but suggests that introducing Road Wave at the point of manufacture may present extensive challenges not fully understood at this time. We recommend focusing on strategies that seize the current opportunity to take advantage of the industry’s steady global growth in demand for after-market products.

The team has developed two broad strategies for consideration by the company, listed by our recommendation preference:

Strategy A: Launch Product for Traditional Retail and Direct to Consumer

Develop an initial product offering focusing on an adaptable, collapsible, hitch-mounted carrier for initially focused on bikes and skis.

Pros

- Maintain control over the creative process and implementation

- No profit-sharing, maintain financial independence

- Ability to further develop Road Wave products

- Easy to gather consumer feedback and data

- Ability to build brand recognition/presence

Cons

- Marketing/advertising costs may be extended to establish a brand within the industry

- Heavy competition with established, well-known brands (Yakima, Thule, Allen Sports, etc.)

- Limited product differentiation and potential challenges differentiating Road Wave

- Manufacturing setup costs, including molds and other launch requirements

Strategy B: License Road Wave to Established Firms in Industry

Pursue a domestic and international licensing strategy for the Road Wave tow-hitch mounted carrier with established car rack manufacturers, focusing on after-market product companies (not vehicle manufacturers).

Pros

- Road Wave will not have to devote any capital to marketing, advertising, and manufacturing efforts

- Shift risks associated with product launch to an established firm in the market

- Allows team to continue to focus on product development and innovation

- Established firms may be able to leverage expertise and experience for the rollout of potential future vehicle manufacturer strategies better than Road Wave

- May open doors to introduce the product to international markets

Cons

- Demand for licensed technology among established manufacturers may be limited (product might not get licensed or may be licensed and never produced)

- Revenue limited to license fees

- Established firms may be able to leverage existing R&D capabilities to circumvent Road Wave patents or otherwise innovate without the need for Road Wave’s license

Target Markets

Generally, car rackers are the most likely to be bought by consumers who possess a car and are passionate about leisure activities such as travel. The probability of buying vehicle parts for moving their bicycles grows among customers, whose families are growing and money is rising. According to Pollfish, 46 percent are satisfied with today’s car rackers. Our clients are aware of the advantages of comfort, lightweight, and ease of putting up a motorcycle rack and being utilized for other storage reasons (2021). Most people (60 percent of respondents) prefer the ease of use when choosing car rackers (Pollfish, 2021). The product consumption rate will vary in accordance with the functional demands of consumers. Cyclists, for example, often utilize motorcycle racks, but families and campers that use motorcycles for journeys less often use them. Although there is yet no brand loyalty on the market, the offering is upbeat overall. There is no alternative for the right product for a practical purpose.

To understand the segments of the category and the target market overall, there are various components needed. In particular, demand for passenger automobiles is increasing as countries’ open up’ due to the expanding tourist and recreational activities internationally. Thus, travel activities can be increased. Furthermore, it would make sense to customers to invest in personal transit modes in light of the COVID-19 pandemic to prevent crowds (Shamshiripour et al., 2020). The vehicles and manufacturing of vehicles were suspended, and the transport and mobility sectors suffered severe damage from Covid 19. As a result, minor or major companies have lost a lot in the automobile roof rack industry. After Covid-19, the demand for activities linked to recreational and health advantages is increasing, following that of mountain biking and ski travel. It will thus enhance the demand for more dependable vehicle racks and roof-top mounts with market value-added.

There are several aspects of trends and behaviors that impact how customers pick brands and use items in their categories. Younger customers who are more likely to lead a healthy lifestyle have a motorcycle and thus need to buy vehicle parts for mobility. Individuals who utilize a bike and travel often have to take a rack with them for leisure activities. For a particular brand, customers will examine all goods generally and select those which are easy to use, are affordable, and are constructed responsibly. It is more common for brands to be picked to satisfy these requirements. The market demand within the category has various positive and negative impacts. Firstly, bike rack goods should be placed in line with the product classification on the global automotive parts and equipment market. Secondly, the increased need for additional functionality for electrical components in automobiles should be recognized. Third, increased security standards are likely to lead to automotive component sales. The negative is that shifting commodity prices may be an essential issue for producers and subsequent marketing activities.

Positioning

The Road Wave company positions itself as an analog of the American Amazon Essentials brand. The brand’s position is to assist European distributors of bike racks and offer a licensing deal to have Road Wave as their domestic brand. Due to this, the brand will be able to establish itself in the European market and gain trust among customers much faster.

Marketing Mix

- Product: Dachboxes perform best amongst the items, while the category of roof racks shows the slowest development. Various aspects of trends and behaviors that impact customers’ choice of brands and consumption of items within a class should be highlighted. Firstly, bike rack goods should be placed in line with the product classification on the global automotive parts and equipment market. Secondly, the increased need for additional functionality for electrical components in automobiles should be recognized. Third, increased security standards are likely to lead to automotive component sales. The negative is that shifting commodity prices may be an essential issue for producers and subsequent marketing activities. In line with customer functional demands, the pace of product consumption will fluctuate. For instance, cyclists commonly use motorbike racks, and they are used less often by families and campers who use motorbikes for traveling. While brand loyalty does not yet exist in the market, the offer is overall improved. For a practical objective, there is no alternative to the correct product.

- Price: The desire for more baggage and increased passion for leisure and tourism are important reasons driving the market’s growth. However, the market expansion might be hindered by the quality (forming rust and corrosion in low-end racks) and price concerns (price-affecting variables such as product cost, such as materials/raw material, roof rack design, and brand). The purchaser is adequately informed about the goods. You may do your research and determine what is best for you. Finally, the pricing sensitivity of purchasers is also growing. When buying a bike carrier, buyers are looking for a product with a solid construction, user-friendliness, lightness, and a fair price. Tank prices vary, based on the size and load capacity, from USD 50 to USD 200, whereas roof boxes are more than 300 USD. 40 percent of respondents are willing to pay up to 300 euros for car racks (Pollfish, 2021). Changes in commodity pricing may be an important problem for producers and subsequent marketing.

- Promotion: The brand’s position is to support European bike rack distributors and offer a license agreement to make Road Wave a local brand. It will enable the brand to establish itself on the European market much more quickly and earn purchasers’ confidence. Using modern promotion types, such as targeted advertising, the company will approach the right client and buyers as soon as possible. Other types of rising, such as social networks, can also help, for example, collaborations with various professionals in this topic or just people of public opinion.

Implementation

In order to implement the project, one should conclude the marketing plan and adhere to promising strategies for entering the market. Creating a unique product will not lead to success since the buyer is primarily aware of how the product should work and is looking for proven technologies at an affordable price. Signing a contract with European distributors will be fundamental at the beginning of the project. It will launch the process of entering the Road Wave brand into the market and attract the attention of many customers.

Reference List

Shamshiripour, A., Rahimi, E., Shabanpour, R., & Mohammadian, A. K. (2020). How is COVID-19 reshaping activity-travel behavior? Evidence from a comprehensive survey in Chicago. Transportation Research Interdisciplinary Perspectives, 7, 100216.

Evarts, E. C., Paul, R., & Smith, J. (2021). The best bike racks and carriers for cars and trucks. Wirecutter: Reviews for the Real World. Web.

Pollfish. (2021). Road Wave MKTG.

Technavio. (2021). Global automotive bicycle rack market 2020–2024. Business Wire. Web.