Production and Costs

The Walmart-branded Equate pharmacy and beauty product line is the target product to analyze. These products are presented in a wide range and include cosmetic goods for body care and therapeutic drugs to maintain health (“Quality care begins here,” 2020). The factors involved in the production process need to be discussed in the cost context, including fixed and variable costs. In addition, the manufacturing process itself is not well-ordered and can be dynamic, which depends on the choice of specific inputs. Based on the factors considered and the criteria for choosing the resource and cost bases, specific solutions for optimizing the Equate product line will be proposed. The relationship between production and costs is direct, and appropriate optimization measures, including the selection of optimal manufacturing solutions, can help increase sales margins and reduce mandatory costs.

Key Inputs and Fixed and Variable Costs

Equate production depends on several inputs that determine the proportion of goods manufactured and how dynamically they are sold. According to Coulibaly et al. (2018), four main factors are usually involved in the production and affect how voluminous and multistage the technology for the manufacturing of goods or services is. The authors mention land, in particular, its resources, as well as the criteria of labor, available capital, and entrepreneurship; the latest one is a complex aspect that includes marketing and sales of activities (Coulibaly et al., 2018). When applied to Equate products, three key inputs play a major role: capital, labor, and entrepreneurship. Pharmacological and cosmetic products are created artificially and are not grown in the natural environment; therefore, the parameter of land is not taken into account. As an additional factor, equipment, or machines may be mentioned, which, nevertheless, can be categorized as part of the labor criterion.

For the production of the Equate product line in question, both fixed and variable costs are needed. As Liu and Tyagi (2017) note, to fixed costs, one can attribute “expenditures on equipment, information technology, fixed salaries of employees,” and some other inevitable financial expenses (p. 252). All these criteria apply to Equate products, and in addition to the aforementioned ones, such fixed costs as rental, advertising, and training expenses are worth considering. Variable costs are contrasted with fixed ones and are losses that disappear when the main production stops (Liu & Tyagi, 2017). While taking into account the specifics of Equate goods, one can mention the costs of raw materials, consumables, energy resources, and the expenses on transportation services as variable costs. In case Walmart stops supporting the production of this line or changes its marketing or distribution strategy, the proportion of these costs will also change.

Factors Influencing the Choice of Inputs

The analysis of the production characteristics of Equate goods requires assessing the factors influencing the choice of inputs. Di Ubaldo and Siedschlag (2018) state that in a competitive environment, such inputs are often associated with marketing and outsourcing when companies need to establish stable demand and maximize opportunities to reduce costs. With regard to Equate products, the business area of this brand is highly competitive since pharmaceutical and cosmetic products are in demand, and pricing policies often play a key role in attracting the target audience. Therefore, for Walmart, as the holder of the Equate brand, this is in the best interest to focus on inputs that can reduce production costs.

Equate resource base is specific and requires constant interaction with suppliers. In case the cost of consumables becomes higher, brand holders will have to look for partners with more favorable terms for the sale of raw materials. Therefore, one of the factors influencing the choice of inputs is the price of materials for the manufacturing process. Another aspect that needs to be considered is the preparedness of the staff. Since Equate products include pharmaceutical and cosmetic goods, employees with specialized training are involved. Low-skilled labor, in turn, requires the cost of additional training, which is undesirable in a highly competitive market. Thus, the professionalism of the staff is another factor to take into account. Finally, the sustainability and effectiveness of marketing strategies are the aspects that affect the choice of inputs. Effective entrepreneurship is the backbone of the business, and in Equate’s case, promoting the brand due to Walmart’s credibility is a significant tactical solution. As a result, the price of raw materials, employees’ qualifications, and the effectiveness of marketing steps are the factors that influence the choice of inputs for the production of Equate pharmaceutical and cosmetic products.

Optimal Production Decisions

Based on the considered principles of organizing the production of Equate goods, Walmart should pay particular attention to the aspect of raw materials supply and coordinate the sustainability of marketing practices. According to Souza (2020), recently, private brands, such as Equate, have started to raise capital and receive support from large companies. This, in turn, affects demand by leading to lower revenues due to competitive activity, and the need to establish the most profitable interactions with suppliers emerges. The brand’s labor, including its machinery and personnel, is at a sufficient level to offer the products that are in demand. However, such inputs as capital and entrepreneurship are vulnerable due to the prevailing trends towards the active development of private labels, which explains the importance of promoting effective advertising campaigns and coordinating pricing policies adequately.

Walmart’s efforts prove the relevance of making supply chain optimization decisions to positively impact manufacturing. According to the official report, the company has forged new partnerships with both local and foreign suppliers “to ensure reliable sources of quality merchandise that is equal to national brands at low prices” (“2019 annual report,” 2019, p. 11). This means that the management of the corporation is puzzled by the issue of maintaining a pricing policy at a level that may allow producing new goods without losses and an increase in fixed costs, and the Equate brand belongs to this group. Based on this approach, one of the best production decisions is to focus on the most in-demand goods among the population. In addition, raw materials for such products should be supplied at a low cost through partnerships with suppliers. These strategies will contribute to avoiding high costs and, at the same time, help Equate stay competitive in its market segment.

The key inputs that determine the mode of Equate production are labor, entrepreneurship, and capital. Fixed and variable costs are standard and should be taken into account when building the brand development strategy. The influence of raw material prices and competitiveness are significant aspects that can affect production. As optimal decisions to establish the manufacturing process, the search for more profitable supply channels and the production of demanded goods are essential development algorithms.

Final Project

Equate is a brand owned by Walmart, which manufactures pharmaceutical and beauty products that are in demand among the public. At the same time, the analysis of this market environment shows that to maintain stable sales and profits, numerous factors need to be considered, including the price of raw materials, the effectiveness of marketing practices, and competitive performance. The work in this segment is characterized by high dynamics due to constant novelties and innovations, which explains the need to constantly adapt to new business conditions. The market structure in which Equate operates influences development strategies, and Walmart’s performance parameters affect brand success and largely determine the nature of the interventions that the corporation has to take to improve profit margins.

Market Structure

Due to the extensive development of the pharmaceutical industry, modern companies introduce developments in the production of drugs and cosmetic products and provide similar services. Consumers, in turn, are guided by the pricing policies of these organizations and build brand loyalty based on individual preferences. While taking into account such an entrepreneurial approach in this segment, one can argue that this market structure is of the oligopolistic competitive type. When several companies conduct similar business, offer products from the same group, and form almost identical price indicators, an oligopoly develops. In the pharmaceutical market, a small number of manufacturers share the bulk of their profits due to sales, and, as Chung and Kwon (2016) argue, this form of entrepreneurship is typical “for pharmaceutical supply chains” (p. 119). As a result, additional strategies are engaged to ensure sustainable growth and business development, for instance, potentially effective marketing solutions or the reorganization of partnerships.

For Equate to maintain consistently high sales in such an environment requires a product development strategy with an emphasis on a number of factors. Moreover, market equilibrium depends not only on demand but also on prices and costs. In case of a change in consumer preferences or competitive activities, both fixed and variable costs may shift, which will lead to increased losses to ensure stable profits in conditions of the lack of resources. Therefore, the oligopolistic structure of the market carries risks and requires a sustainable business with an emphasis on adapting to any changes. Chung and Kwon (2016) draw particular attention to “supply chain equilibrium outcomes” as the factors that determine the success of partnerships to generate high sales and maintain a competitive position (p. 120). Therefore, the mechanism of work in such an environment is characterized by adaptability and dynamism.

Impact of the Market Structure on Equate’s Financial Performance

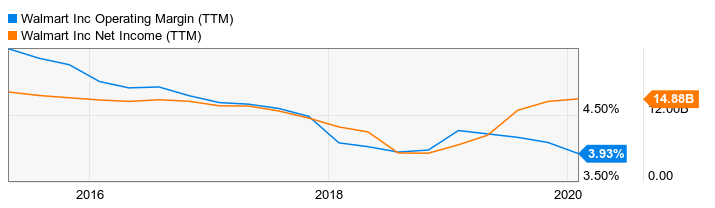

Due to the fact that Equate is a Walmart-owned brand, the success of the parent company has much to do with the financial performance of the private label. At the same time, while analyzing specific economic parameters that Walmart has demonstrated in recent years, some challenges are observed, and there are reasons that explain insufficiently high indicators. For instance, comparing the operating margin indicator over the past few years is a mechanism to ensure that current social issues, in particular, the COVID-19 pandemic, have affected the company’s success. In Figure 1, Walmart’s operating margin parameter is reflected, and one can notice that since 2018, this indicator has fluctuated, and in 2020, a downward trend has been observed (Rossolillo, 2020). The oligopoly structure, however, did not make the situation worse since Equate products are affordable, and during the pandemic, consumers tend to buy less expensive pharmaceuticals. The brand’s pricing policy is loyal, which made it possible to retain the target audience.

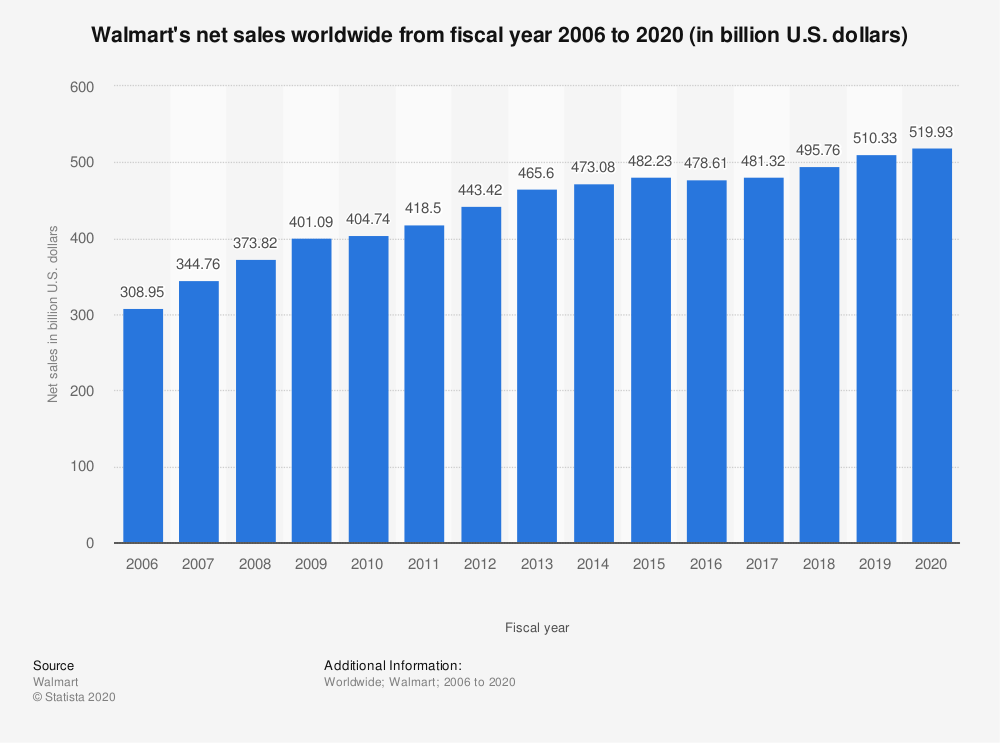

The analysis of Walmart’s and Equate’s sales, in turn, supports the assumption that the affordability of their products plays an essential role in the oligopolistic structure. In Figure 2, the corporation’s net sales worldwide are reflected, and these parameters show that slow but steady growth in recent years indicates consumer acceptance of brand value (“Walmart’s net sales,” 2020). With the type of competition Equate faces, the company has to adapt its pricing and non-pricing factors. For instance, product quality aspects are as important as product diversity factors in the context of market demand. As Chung and Kwon (2016) remark, the partner function in an oligopolistic environment is equally crucial. The authors note that wholesalers act as suppliers in the pharmaceutical market and compete with one another (Chung & Kwon, 2016). The authority of Walmart and its sub-brands is recognized, which allows Equate to cooperate with reliable suppliers and form its pricing policy based on the cost of purchases. Therefore, the current market structure creates challenges, but this is not a severe obstacle to capital accumulation.

Impacts of Possible Changes in the Industry’s Market Structure

One of the potentially possible outcomes of a change in the market structure in which Equate is involved is the transition from an oligopolistic to a monopolistic system. This shift can have an impact on brand profits and its value. According to d’Aspremont and Ferreira (2016), in a monopolistic structure, the elasticity of demand is one of the few constraints. With regard to the pharmaceutical industry and Equate, this company can become a leader in its segment and in certain regions. This, in turn, will entail greater financial responsibility and more attention from the tax authorities. An absolute form of monopoly is unlikely since the products of this industry are represented by different manufacturers, and Equate will not be able to be the sole supplier of drugs and cosmetics to the market. Nevertheless, in case of achieving high competitive positions, the brand can obtain the status of the leader and expand the share of sales to other world regions.

In case another company acquires the status of a monopoly, Equate will not stop doing business. Suppliet (2020) offers to pay attention to the concept of umbrella branding as a practice that involves managing different projects within a single multi-product firm. This strategy applies to Equate, which is Walmart’s recognized sub-brand. In case of the loss of competitive positions, the company will continue its entrepreneurial activity in this direction due to continued demand, but the volumes of production and sales may decrease. Therefore, Equate is protected and can expect to grow if Walmart implements successful business practices.

Summary

An oligopolistic market structure influences Equate’s business and imposes specific conditions and boundaries that can be overcome due to successful control over pricing policies and supplier relationships. In recent years, Walmart and, consequently, Equate have shown fluctuations in the operating margin, although overall sales are increasing globally. If the market structure changes, the demand for the brand’s products can either increase (the elasticity of demand will have a greater impact on the business) or decrease (production and sales volumes will fall), but Equate will be protected by Walmart as the brand owner.

References

Chung, S. H., & Kwon, C. (2016). Integrated supply chain management for perishable products: Dynamics and oligopolistic competition perspectives with application to pharmaceuticals. International Journal of Production Economics, 179, 117-129. Web.

d’Aspremont, C., & Ferreira, R. D. S. (2016). Oligopolistic vs. monopolistic competition: Do intersectoral effects matter? Economic Theory, 62(1-2), 299-324.

Rossolillo, N. (2020). Why I bought shares of Walmart and Target. The Motley Fool. Web.

Supplies, M. (2020). Umbrella branding in pharmaceutical markets. Journal of Health Economics, 73, 102324. Web.

Walmart’s net sales worldwide from the fiscal year 2006 to 2020. (2020). Statista. Web.

2019 annual report: Defining the future of retail. (2019). Web.

Coulibaly, S. K., Erbao, C., & Mekongcho, T. M. (2018). Economic globalization, entrepreneurship, and development. Technological Forecasting and Social Change, 127, 271-280. Web.

Di Ubaldo, M., & Siedschlag, I. (2018). Determinants of firms’ inputs sourcing choices: The role of institutional and regulatory factors. EconStor. Web.

Liu, Y., & Tyagi, R. K. (2017). Outsourcing to convert fixed costs into variable costs: A competitive analysis. International Journal of Research in Marketing, 34(1), 252-264. Web.

Quality care begins here. (2020). Walmart. Web.

Souza, K. (2020). The supply side: Walmart’s price gaps widen against Target but not Amazon. Talk Business & Politics. Web.