Introduction

At its core, economics deals with people’s decisions to sustain the scarce amenities available to them. Microeconomics is the subdivision of economics that relates to the choices made at a personal point. The choices made may include clients and companies that a person makes after analyzing resources, costs, and trade-offs. When discussing the economy, the first notion that comes to mind is the arcade system, where personal choices interact with others’ decisions. Therefore, discussing why and how people formulate economic decisions is essential to understand how their choices affect the economy. This paper goes beyond a common comprehension of microeconomics to integrate the fundamental perceptions of general economics.

Circular Flow Diagram

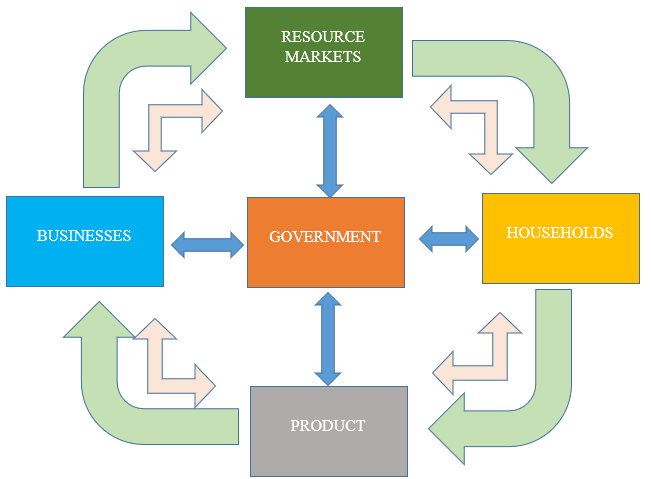

A circular flow diagram embodies the association of an economy in a modest economic model. The figure illustrated below is a three-segment and three-market circular classical flow. According to Mankiw (2020), the three markets consist of; products, resources, and financial markets, while the three segments consist of the government, households, and the business sectors.

All the segments and markets combined illustrate the ongoing movements of disbursements for both goods and facilities between consumers and manufacturers. The three-category diagram displays the government segment’s prominent role in the macroeconomy. Moreover, it illustrates how taxes diverge from consumption expenses onto the government segment and use them for government acquisitions only. Through this flow, one can easily understand that taxes do not just disappear from the economy. Instead, they divert into other financial firms that help to regulate the cash flow.

Three Segment, Three Markets Analysis

The household sector consists of everyone, each individual seeking to satisfy unlimited desires and necessities. Moreover, the industry is responsible for the consumption expenses as it entails ownership of all productive capital. Proprietorships, corporations, and partnerships institutions all lie within the business category, undertaking the roles of merging resources to yield goods and amenities. Production and purchase of goods with investment expenses all happen here as well. The governing bodies of the national state and native governments reside within this part. Regulation is the chief functionality here, specifically when transitioning laws, assembling taxes, and enforcing policies onto other sectors to ensure full responsibility (Kolmar, 2017). The segment purchases a portion of the gross national product from government acquisitions.

Product, Resource, and Financial Markets

The amalgamation of all arcades in the budget lies within the product sector that interchange ultimate goods and facilities. The amalgamation occurs through cumulative product contrivances, which exchange the gross national product. The resource market consists of blending all needs that altercate services of the economy’s resources. Blending occurs through production and entrepreneurship factors, leading to a successful exchange.

Sectors Interaction in the Market

The economy can perceive as two rotations moving in opposite directions. On the one hand, the goods and facilities flow from people to commerce and back exist, representing the notion that as a laborer, one goes to work to offer services that people require. On the other hand, money flows from commerce to household sectors concurrently, signifying the income attained from work used to pay for the things one requires. (Lombardini, 2018). All these rotations are needed for the economy to operate efficiently. In the circular flow classical, households obtain goods and amenities, which commerce offers via the product arcade.

Meanwhile, businesses require resources to produce merchandise and services for the people. Household members offer labor to firms via the resource arcade, and industry transforms those resources into legit merchandise. The government segment is the most significant part of the classical flow as it injects and removes money from the flow. Money injection occurs from purchasing items in the product and resource markets (Mankiw, 2020). When buying these items, the government’s payments refer to government spending, which is how money injection occurs. In addition to spending money, the government is also the source of funds removed from the structure through taxes and spending money. Income, property, and sales taxes, amongst other leakages, allow the government to inoculate cash into the economy using various ways and processes.

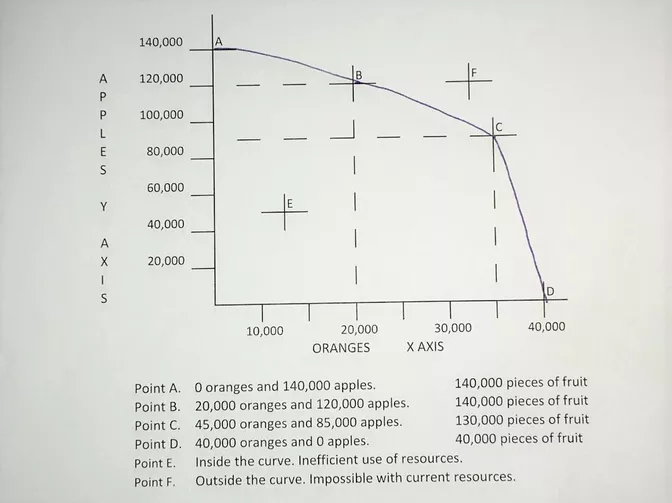

The production possibilities model functions as a visualization that illustrates the most effective manufacture of a duo of goods. Dean et al. (2020) state that each point displayed on the curve above demonstrates the number of goods manufactured when resources change into creating more from one interest and less from the other. In the model above, the economy manufactures 120,000 apples and 20,000 oranges at point B. If the economy wants to produce many oranges, the apple production must be fewer. As shown in C, when the economy releases 35,000 oranges, it can only cater for 85,000 apples. Point E is located within the curve, indicating that the economy only uses some of the resources and not all of them. Meanwhile, any point outside a possibility model is impossible since more of both apples and oranges’ production cannot occur with the limited amenities at the same time.

Economic Implications

The model does not communicate to choice-makers the quantity of every merchandise required. However, it states how much each commodity they ought to give up if they want to manufacture more of the other entity. Therefore, applying the production possibilities model is essential if an economy wants to thrive with limited resources. The model illustrates how an economy can combine the production of two goods while at the same time using limited amenities. Moreover, the model displays the correct proportional mix of commodities to be manufactured for an economy. Within a market economy, the decree of injunction determines how much of every good to yield.

In contrast, in a command economy, members resolve to the most competent point of the bend. Supply-side economists trust that the model can move to the right by increasing more amenities, but for this to work, demand ought to occur (Mankiw, 2020). Without need, one can only triumph in formulating underutilized resources. A benefit can only happen on increasing workforce since when the jobless get to work, demand will increase, moving the curve to the right. Although, adequate unemployed is still needed to create a difference. A frugality in total employment cannot add more employees despite the amount of taxes censored from them. A reduction in amenities limits growth, and in case of a shortage of one commodity, more commodities in the market will not be manufactured despite having a higher demand. In such situations, prices incur until the ultimatum drops to encounter supply.

Benefits of International Trading

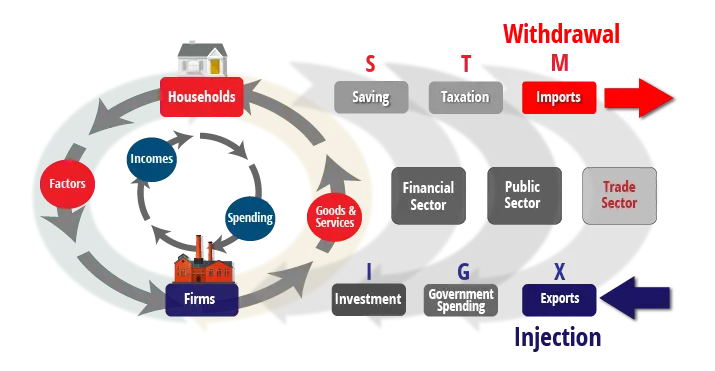

International trading opens up new arcades and depicts nations to goods and facilities unattainable in their local economies. Countries that export usually formulate companies that know how to attain a competitive advantage in the global arcade (Pettigrew, 2018). Trade agreements signed during such treaties boost distributions and economic progression. International trading enables an economy to increase its number of potential clients. Each nation added to trading unlocks a new trail to commerce growth and augmented revenues. Mankiw (2020) highlights that most economies that engage in the outside economy can expand faster and increase their incomes, creating more jobs that enhance economic growth. Concentrating on local marketing exposes a business to increased risks from a downturn in the economy. International trade contains imports and exports; exports, on the one hand, enhance the value of aggregate demand and are inoculated into the circular flow of income. On the other hand, Substances minimize the aggregate demand and are a withdrawal from the circular flow. The more a country trades, the more open it becomes.

Micro and Macro Economics

Economics is alienated into two categories; macroeconomics and microeconomics. Microeconomics is the learning of choices made by businesses and individuals concerning the apportionment of amenities and prices in which they trade commodities and services. The category consists of taxes, government legislation, and guidelines. Demand and supply in microeconomics determine the price points in an economy (Greenlaw & Shapriro, 2017). Microeconomics does not attempt to expound on what forces should occur in a market; instead, it explains what happens when there is a shift in specific conditions. Macroeconomics studies the behavior of a nation and how its policies influence the entire economy. It examines economies and industries as a whole and not particular people and companies. Macroeconomics analyses an economy’s broad approach, such as the Gross Domestic Product, and how transformations influence it in national income, price points, and unemployment (Mankiw, 2020). In addition to analyzing aggregates and economic correlations, states and organizations rely on macroeconomics to build an economic and monetary policy. The division between micro and macroeconomics is necessary to develop a stable economy. Unless the aggregation issue is satisfactorily solved, deemed impossible, macro and microeconomics will remain separate.

Conclusion

- The division between micro and macroeconomics is necessary to help advance the nation’s economy.

- Venturing into international trading is beneficial for a nation’s economy; however, clear policies should be set to prevent a collapse in the traditional economies.

- A circular flow diagram highlights the association of an economy from an economic perspective.

- The government sector plays a massive role in the circular flow, as it helps in bringing money in and out of the flow.

- The production possibilities model is essential in determining how much an economy has to give up for them to produce more of the other commodity.

References

Dean, E., Elardo, J., Green, M., Wilson, B., & Berger, S. (2020). The Production Possibilities Frontier and Social Choices. Principles of Economics: Scarcity and Social Provisioning (2nd ed.). Pressbooks.

Greenlaw, S. A., & Shapiro, D. (2017). Principles of Microeconomics 2e. Rice University.

Kolmar, M. (2017). Principles of microeconomics. Springer International Publishing AG.

Lombardini, C., Lakkala, M., & Muukkonen, H. (2018). The impact of the flipped classroom in principles of microeconomics course: Evidence from a quasi-experiment with two flipped classroom designs. International Review of Economics Education, 29, 14-28. Web.

Mankiw, N.G. (2020). Principles of Microeconomics (9th ed.). Cengage.

Pettigrew, W. A. (2018). The changing place of fraud in seventeenth-century public debates about international trading corporations. Business History, 60(3), 305-320. Web.