Analysis of strategic capabilities and external environment

Introduction

Barnely (2001) defines strategy as a long-term plan to achieve the preset objectives of an organization. Dracker (2002) depicts innovation as the means through which an entrepreneur comes up with new ways of creating wealth or endows the existing ones to enhance their potential for wealth creation. The Nestle Company has incorporated innovation into its operations in a bid to stay competitive (Chakravort 2004).

The company is among the leading food and beverage corporations. Currently, the company is investing in health, nutrition, and wellness. A look at the company’s annual report shows that Nestle achieves it’s top and bottom-line goals (Nestle 2015). Additionally, its domestic and foreign markets continue to grow. Its current share price is $73 (Nestle 2015). The company hopes to grow its global market in the coming years.

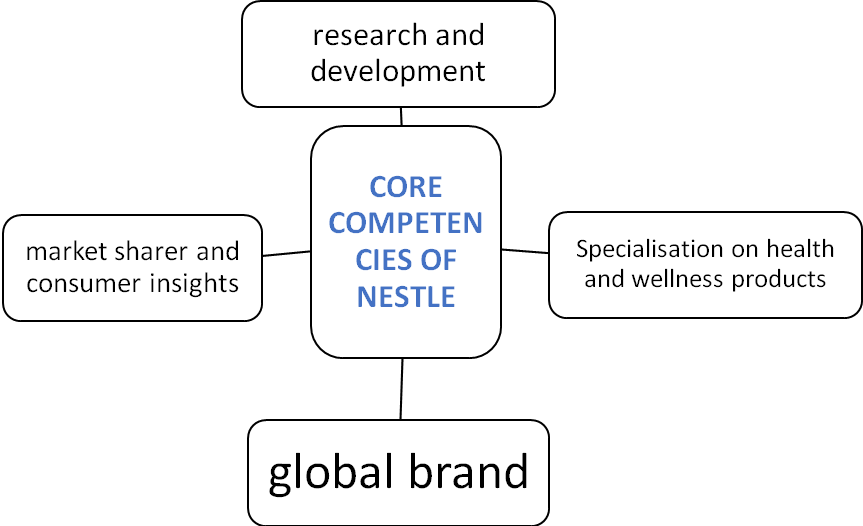

Internal Analysis of Core Competencies

The company has a research department that has been operational since Nestlé’s inception. The department is equipped with scientists and some of the best facilities globally. The company also has a market share of over 100 countries globally. Indeed Nestle is a global brand (Sethi 2012). Over the years, Nestle has developed an excellent relationship with its customers, which is evidenced by the level of consumer loyalty. The company has specialized in products that promote health and wellness.

Internal Analysis of Value Chain

Nestle has a robust supply chain that is well coordinated. Moreover, the company has a global SAP to ensure uniformity in business operations (Nestle 2015). Nestle has a system that links the manufacturing department to the sales and marketing team in real-time. Additionally, an analysis of the value chain reveals that the company formulates strategies in collaboration with all the departmental heads (Sethi 2012).

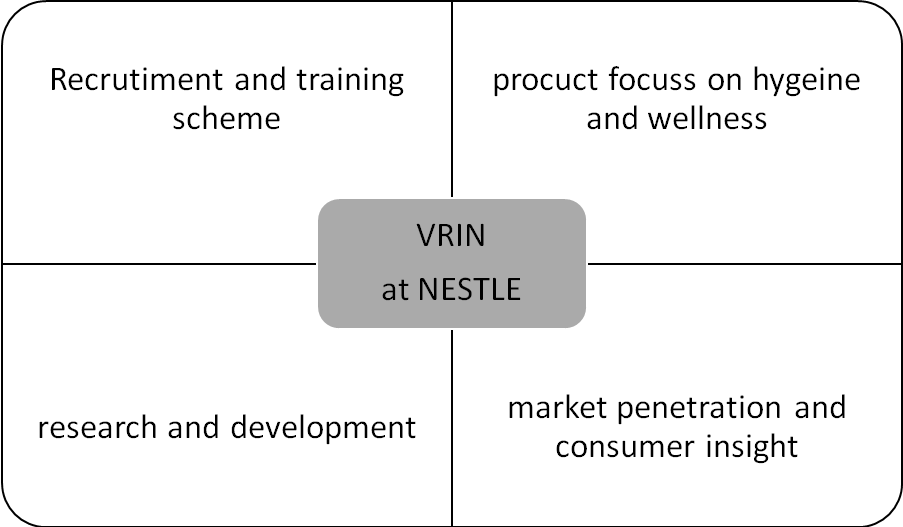

VRIN Analysis

Nestlé’s focus on products that impact health and hygiene is a tactic that is valuable, rare, inimitable, and irreplaceable (Nestle 2015). The company’s style of recruitment, which comprises an elaborate graduate trainee scheme and a performance-based approach to promotion, is another factor that adds to its advantages (Kotler & Keller 2006). The company’s research and development capabilities meet the VRIN criteria. Additionally, the company’s level of market penetration and consumer insight is unparalleled. The company has establishments in many regions making it easy to gather customer information.

External Environment

Porter’s Five Forces

Nestle has a great rapport with suppliers that is likely to last for many years. The company has diversified sources of raw materials globally with at least an origin in every continent (Schuler 1984). Besides, the company has a global consumer base. Nestle expects its clients to increase despite the entrants of new competitors into the market. The company’s level of differentiation ensures that customers remain loyal.

Furthermore, the modern technologically empowered and health-conscious consumer fits Nestlé’s line of products. The main competitors of Nestle are mainly other fast-moving consumer goods manufacturers like Cadburys (Watal 2000). Nestle has been actively fighting such competitors by leveraging its strong brand. In recent times, the threat of new entrants has surfaced with the emergence of pharmaceutical companies that target Nestlé’s business line (Brucks1985).

The degree of rivalry in the fast-moving consumer goods industry is high due to the presence of many competitors (Pauwels 2007). There were no challenges in applying Porter’s five forces on Nestle as there is adequate information about the company. Besides, it is easy to identify the external forces that influence the fast-moving consumer goods industry. No new input has been included in this framework.

Nestlé’s market structure is intricate. Porter’s five forces are not suitable for analyzing such a market. The model is suitable for a simple market structure. Additionally, the FMCG industry is highly regulated. Thus, it is not a classic perfect market. It impacts the worth of Porter’s five forces model in the analysis of this industry. Amendments have been made on the model to include a sixth force. The complementary products force helps to analyze the impacts of associated goods and services on a specific market.

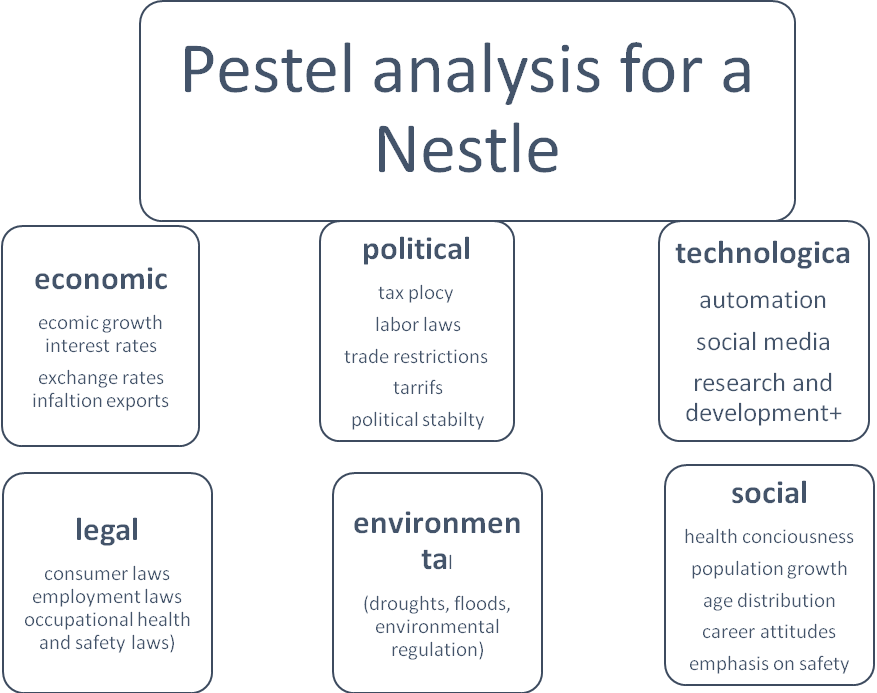

PESTEL Framework

Economic factors like inflation and variations in exchange rates impact Nestlé’s performance. Additionally, changes in social life impact the company’s sales volume. Demand for environmental conservation has led to Nestle investing in green energy (Oliviera & Takahashi 2012). The company also engages in corporate social responsibility meant to conserve the environment. Changes in government regulations affect Nestlé’s operations.

Changes in PESTEL Parameters

Among the six factors, the social environment of Nestle Company has changed tremendously. The advent of social media posed new opportunities and risks to the company (Oliviera & Takahashi 2012). Today, changes in the social environment pose strategic challenges to Nestle Company. The company requires strategizing on how to utilize social media in the business climate and circumvent its shortcomings. The environmental aspect of the food industry has also changed.

Governments across the globe are demanding that companies act in environmentally responsible ways (Whether 2006). The order to act in environmentally friendly ways requires adjusting the operations of the company and investing in green energy. Technology in the business environment has also changed remarkably. Laptops, mobile devices, and the internet are among the contemporary technological developments (Ensign 2001).

Changes in technology have affected the social dimension by enabling modern consumers to have easy and quick access to information about practically anything (Kotler & Keller 2006). Thus, the company has been compelled to invest in technology to reach contemporary customers. The company has come up with ways to exploit the latest technological developments in a bid to boost its competitive advantages. The decision to leave the European Union (Brexit) will affect Nestle.

The company depends on discretional income. Consumption of chocolate, snack bars, biscuits, and other products will go down affecting Nestlé’s profit. Besides, the introduction of a sugar tax will increase the cost of Nestlé’s products. In return, it will lead to a reduction in the company’s sales volume. Many customers will avoid purchasing Nestlé’s products due to their prices (Zahid 2014).

Strategic Options to Increase Entrepreneurial Opportunities

The formulation of strategies in business is essential to ensure the longevity and sustainability of any enterprise (Bihde 1995). Nestle is not an exception. Management professionals have proposed several methods that can guide managers on how to establish appropriate strategies to cater for different situations. Examples include Potter’s five forces and the Ansoff matrix. However, before choosing the best plan, it is imperative to conduct a SWOT analysis to determine the possible strengths and weaknesses of the company that might affect the choice of a strategic plan.

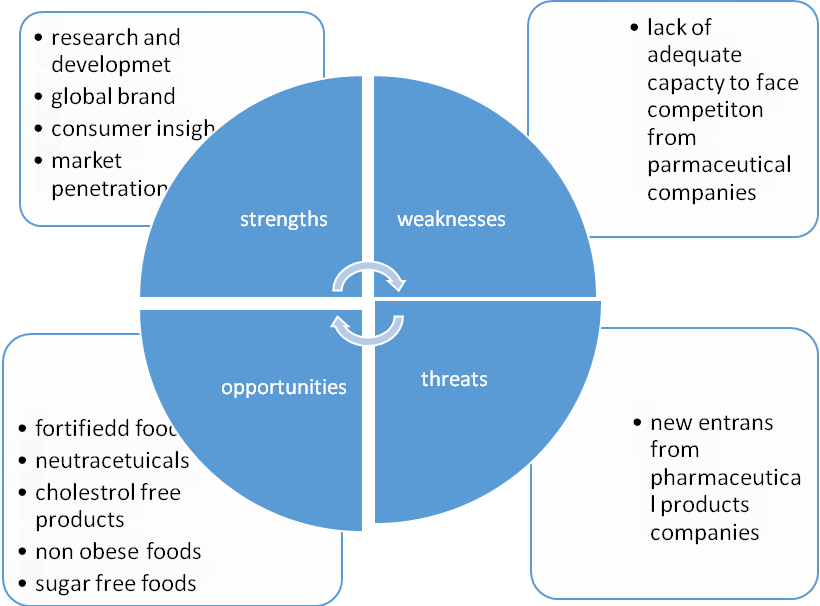

SWOT Breakdown

A SWOT analysis of Nestle Company identify, research and development, global brand, consumer insights, and market penetration as the main strengths. The lack of adequate capacity to deal with competition is the company’s primary weakness. Currently, Nestle relies on renowned brands to market products. The company does not have a strategy that may cushion it from abrupt changes in customer behaviors. Additionally, Nestle has not shown any effort to align products like Carnation milk with contemporary lifestyles. The primary threat to Nestle comes from pharmaceutical products. On the other hand, the significant opportunity lies in the investment in health and wellness products.

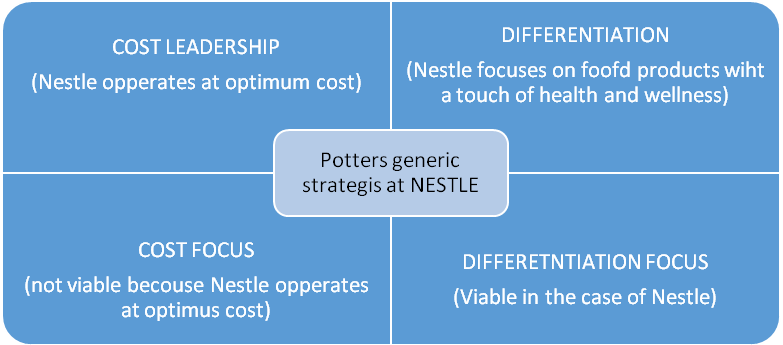

Potter’s Generic Strategies

Based on Potter’s general strategies, Nestle can enhance its profit by leveraging differentiation or merger. A majority of investors in the fast-moving consumer goods (FMCGs) capitalize on automation, supply chain effectiveness, and manufacturing concepts like lean production (Hong 2006). As pharmaceutical companies start to venture into the food industry, Nestle should look for ways to partner with the companies for their benefits. Currently, Nestle seeks to partner with Vitabiotics Company. The company has global coverage. In the United Kingdom, Vitabiotics enjoys a market share worth over £385 million. Thus, it will help Nestle to grow its global market share.

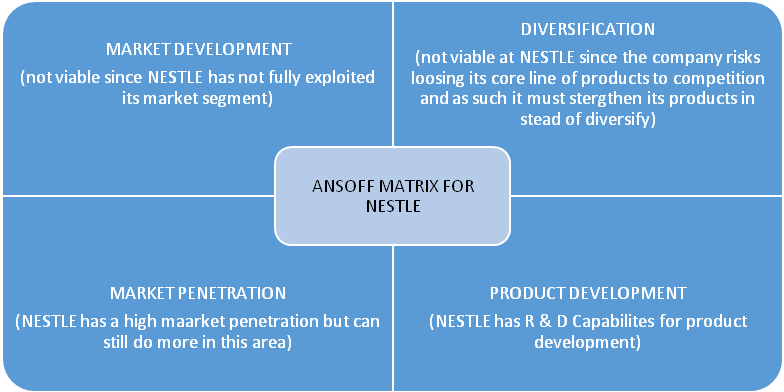

The Ansoff matrix provides another way of evaluating and choosing the best strategy to ensure product development and market expansion.

Ansoff Matrix

An evaluation of the Ansoff matrix reveals that the best strategies that Nestle Company can exploit are market infiltration and product development. Market development is not a viable option since it would entail venturing into new markets with already established players (Okpara 2006). Furthermore, there exists immense potentials in health and wellness products. The demand for fortified foods, the emergence of neutraceutical, and the need for low cholesterol products are other opportunities that Nestle can exploit.

Focusing on these possibilities appears more viable than venturing into new markets. Nestle Company has presence and experience in its current markets. Thus, it can use the experience to introduce new products without having to spend a lot of money on promotion. Diversification is not a good choice for Nestle since the company faces a substantial threat from pharmaceutical companies. Therefore, Nestle should concentrate on its core line of products to scare away competitors as opposed to focusing on diversification.

Strategic Options for Nestle

With time, organizational strategies change due to alterations in the marketing forces. Thus, Nestle requires adopting policy choices that accommodate flexibility. The company should be in a position to adjust and cope with changes in external forces that influence its operations. Nestle Company can exploit numerous strategies that can assist it to increase entrepreneurial activities. Based on SWOT analysis, Nestle can adopt two strategies to help it to remain competitive. The first strategic option is the investment in market research and analysis to get a better understanding of the consumers.

The second option is the commitment and focus of the company’s energies on creativity and innovation. The two strategic options will help the company to grow its global market share (Heyne & Boutte 2010). Creativity and innovation will help the company to develop novel products, thus increasing its sales volume and overcoming challenges associated with the introduction of a sugar tax and Brexit (Nestle 2015). Investment in market research will go a long way towards assisting the company to boost its core competencies, establish new markets, and overcome adverse external forces. Nevertheless, the strategies have to be assessed based on the suitability, acceptability, and feasibility (SAFE) framework to ensure that they are appropriate.

First Strategic Option

Suitability

Conducting market research would enable Nestle to get better insights into the consumer base. It would enable the company to position itself appropriately, thus overcoming competition. Market research would also allow the business to determine if it has seized present opportunities. It would also enable the company to predict potential opportunities that might arise in the future (Heyne & Boutte 2010).The strategic option rhymes with Nestlé’s core strength, which is research and development.

Acceptability

The level of risks involved in taking this strategic option is minimal. On the other hand, the returns expected from the possibility of enabling the company to identify and seize opportunities are significant (McQuarrie 2005). Thus, the strategic option would be acceptable to shareholders.

Feasibility

The approach would work efficiently for Nestle. The company has the necessary resources and channels to engage in such an endeavor. Both financial resources and the capacity to access the consumers are at the company’s disposal. Moreover, the company can outsource the services should there be no in-house capacity to discharge them (McDonald 2007). Hence, the strategy is feasible. No apparent challenges can pose a significant threat to the success of the strategy.

Second Strategic Option

Suitability

The appropriateness of this strategic option depends on its capacity to increase entrepreneurial opportunities for the company. Bessant and Tidd (2011) agree that creativity and innovation are essential to identifying and seizing entrepreneurial opportunities. They further allege that to manage and optimize on entrepreneurial opportunities, creativity and innovation are critical.

Acceptability

There is tiny if any risk in adopting this strategy. However, the possibilities of the strategic option facilitating increase entrepreneurial opportunities are enormous (McQuarrie 2005). Creativity and innovation would promote the production of quality products, thus ensuring that Nestle meets consumer needs.

Feasibility

Nestle recognizes the importance of creativity and innovation to the success of its organizational goals (Nestle 2014). The company has a training program that emphasizes creativity and innovation. Thus, adopting this strategic option would not be an uphill task for the company as it has inculcated the culture of innovation and creativity in its employees.

Conclusion

One of Nestles biggest strengths is its research and development capabilities. The proposed strategic options would match with this core strength. The responsibilities of market research can be assigned to the investigation and development department since it conducts numerous types of research in its endeavors. Nestle acknowledges the significance of innovation to its competitive advantages. The strategies proposed in this report can boost the company’s core competencies. Investing in market research would ensure that the firm can quickly evaluate the performance of its products and take requisite measures.

On the other hand, focusing on innovation and creativity would help the company to exploit the information gathered from the market. The company would be in a position to exploit emerging opportunities by creating innovative products. Nestlé’s competitors like Danone and Cadburys are in the process of investment research and development. Additionally, companies have invested in innovation and creativity. Cadburys conducts market research but outsources the service to professional firms. On the other hand, Danone has invested in training its staff on how to use creativity and innovation to enhance competitive advantages.

Reference List

Barnely, J 2001, ‘Resource-based view of the firm: ten years after 1991’, Journal of Management, vol. 27, no. 6, pp. 625-641.

Bessant, J &Tidd, J 2011, Innovation and entrepreneurship (2nd ed.), John Wiley & Sons, New York.

Bihde, A 1995, ‘How entrepreneurs craft strategies that work’, Harvard Business Review, vol. 12, no. 3, pp. 74-93.

Brucks, M 1985, ‘The effect of product class knowledge on information search behavior’, Journal of consumer research, vol. 12, no. 1, pp. 1-16.

Chakravort, B 2004, ‘The new rules of bringing creativity and innovation to markets’, Harvard business review, vol. 11, no. 4, pp. 23-46.

Chapman, A 2010, Pest market analysis method and examples. Web.

Dracker, P 2002, Management challenges for the 21st century, Butter worth-Heinemann, London.

Ensign, P 2001, ‘Value chain analysis and competitive advantage: assessing strategic linkages and interrelationships’, Journal of general management, vol. 27, no. 1, pp. 18-42.

Heyne, P & Boutte, P 2010, The economic way of thinking (22nd ed.), Prentice-Hall, New York.

Hong, H 2006, ‘Supply chain management practices’, Journal of Enterprise Information Management, vol. 17, no. 3, pp, 34-75.

Kotler, P & Keller, K 2006, Marketing management (12th ed.), New Jersey, Pearson Prentice-Hall.

McDonald, M 2007, Marketing plans (6th ed.), Butterworh-Heineman, Oxford.

McQuarrie, E 2005, The market research toolbox (2nd ed.), Sage, London.

Nestle 2015, Nestle annual review. Web.

Okpara, F 2006, The practice of entrepreneurship, Lagos University Press, Lagos.

Oliviera, N & Takahashi, N 2012, Development and structure of the modern business firm, Springer, New York.

Pauwels, K 2007, ‘How retailer and competitor decisions drive the long-term effectiveness of manufacturer promotions for fast moving consumer goods’, Journal of Retailing, vol. 83, no. 3, pp. 297-308.

Schuler, R 1984, Gaining competitive advantage through good human resource practices, McMillan, London.

Sethi, P 2012, Multinational corporations and the impact of public advocacy on corporate strategy: Nestle and the infant formula controversy, Routledge, New York.

Watal, J 2000, ‘Pharmaceutical patents, prices and welfare losses’, World Economy, vol. 12, no. 3, pp. 733-752.

Whether, W 2006, Strategic corporate and social responsibility, Sage Publications, New York.

Zahid, H 2014, Can political stability hurt economic growth? The World Bank group, New York.