Summary

Today’s economic landscape is characterized by its rapid globalization, prompting brands to expand their operations. Once an organization succeeds in its local market, it is natural for the management to consider international opportunities by launching a new project in other locations. However, such a development process can pose certain risks for companies, which do not analyze a destination prior to exploring it. A proper examination should comprise an overview of the general situation in a country, as well as its economic, political, and cultural particularities. This procedure will likely reveal specific risks and challenges, which a company may face in the course of its expansion. Sainsbury’s Supermarket envisions New Zealand as its next location outside Great Britain, making it necessary to acquire an in-depth understanding of the current state of the country’s market. The purpose of the present report is to evaluate the investment opportunities, which exist in New Zealand, providing overall recommendations for the management of Sainsbury’s Supermarket.

New Zealand Overview

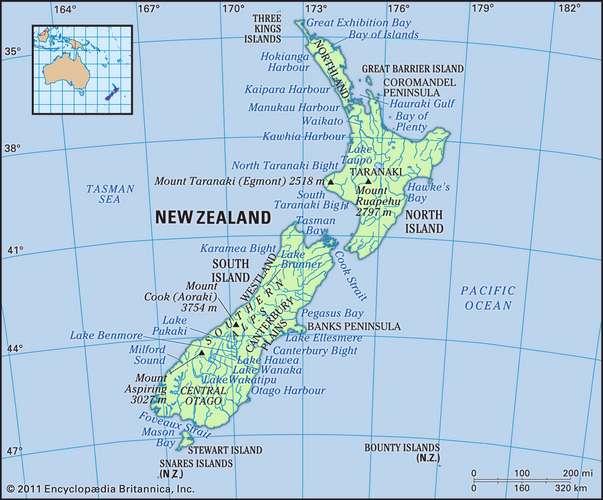

New Zealand is a unique location due to a variety of factors, which determine the particularities of the nation. This is one of the southernmost countries on Earth, as it is located in the South of the Pacific Ocean. New Zealand represents an archipelago, which is composed of two major islands and multiple smaller ones. The vast majority of the country’s population resides on the North Island, which is home to about seventy-five percent of New Zealanders (New Zealand country profile, 2020). The nation’s capital, the city of Wellington, is also located on this island. The overall population of New Zealand exceeds 4.7 people, as of the most recent census (New Zealand country profile, 2020). The land is quite remote, as kilometers of the ocean separates it from its nearest neighbor, which is Australia (Figure 1). Naturally, the population of New Zealand is drawn to the ocean line, whereas the country’s central regions are characterized by a lower resident density (Figure 2). New Zealand has the image of a land of contrasts and diversity, and the country’s remote location allows for unique nature.

The particularities of the country and its location have inevitably had an impact on New Zealanders. Most of the local population consists of two major ethnic groups. The first is formed by white Christians of European origin, whose ancestors colonized New Zealand in the past. At the same time, the descendants of Polynesian Maori tribes continue to account for a large portion of the country’s population (New Zealand country profile, 2020). However, New Zealand is a highly developed country with wealthy citizens, which inevitably attracts international talents in the age of globalization. According to multiple accounts, New Zealand is considered to be one of the world’s most diverse and liberal nations, as well as a highly advanced one. Accordingly, it is possible to conclude that the country’s communities are affluent enough to have an appealing purchasing power. However, New Zealand’s population remains particularly diverse, which makes it difficult for non-progressive companies to conduct their business activities. Overall, New Zealand demonstrates several differences as compared to Sainsbury’s home nation. The company should consider these features when developing its further expansion strategy.

New Zealand Risk Analysis

Risk analysis is an essential component of all business activities, but it receives additional importance in the case of an organization’s international expansion. Sainsbury’s perception of all threats to its operations at the new location must be clear and justified, utilizing prior experience and analyzing the general market. One of the overarching risks consists of underestimating the challenges, which Sainsbury’s may face if it invests in New Zealand. The business environment of the new destination may appear highly reminiscent of Great Britain, which is why the company may neglect proper adaptation. However, despite evident similarities, such as both countries’ membership in the Commonwealth of Nations, there exist significant differences. It would be unwise to consider New Zealand simply a southern equivalent of the UK. The country’s values and policies have reached an unprecedented level of progressiveness, and its remote location contributes to the overall individualism while being part of the civilized world. Sainsbury’s Supermarket will benefit from a close examination of potential risks as divided by each relevant category.

Political Risks

An unstable political environment can become one of the major factors impeding business activities in a country. New Zealand is officially ruled by Queen Elizabeth II, but it is the country’s prime minister Jacinda Ardern, who presides over the government, ensuring it relies on democratic values (The political framework, n.d.). Ardern rules through a Center-left Labour Party-led coalition of the parliament, which promotes New Zealand’s famous values and progressive policies. According to independent reports, the position of the coalition led by Jacinda Ardern does not appear to be at risk, despite existing disagreements between parties (The political framework, n.d.). Marsh’s Political Risk Map 2020 places New Zealand in the top tier of the most politically stable nations on Earth (Political risk map 2020, 2020). Sustainable development is another important issue for New Zealand, as some of its key policies are aimed at countering global warming and reducing the carbon footprint (The political framework, n.d.). Such a political environment and a free market create a favorable business climate for Sainsbury’s. However, the company must maintain an equally positive image in order to correspond to the local audience’s requirements criteria.

Economic Risks

When considering expansion to a foreign market, each company should focus on potential economy-conditioned risks. New Zealand appears to be a strong economy, and its government actively promotes free-market relations, which increases its appeal to Sainsbury’s, but there are important risk factors to consider (The New Zealand economy, 2020). First of all, New Zealand is a remote island nation, which limits its economic capacity (New Zealand Economic Studies, n.d.). Secondly, New Zealand’s economy often experiences a shortage of skilled labor, which explains the country’s active immigration policies. Therefore, Sainsbury’s Supermarket might need to enable its proper functioning by involving skilled employees from the UK. At the same time, the high quality of life of New Zealanders is combined with the country’s increasing levels of household and corporate debt (New Zealand economic studies, n.d.). Finally, New Zealand’s economy relies heavily on agriculture, which negatively impacts its innovative potential. Nevertheless, the current political and social stability, supported by the overall health and transparency of the economy, partially negates the effect of negative factors. As long as Sainsbury’s recognizes those risks, it can expect positive results.

Legal Risks

Based on an initial assessment, New Zealand does not pose substantial legal risks for Sainsbury’s Supermarkets. Being a former British colony, this country shares its legislative traditions with the company’s home area, making the legal environment familiar. New Zealand’s laws are generally pointed at the well-being of its citizens, which is why customers’ rights are strongly promoted. At the same time, the nation’s legislative policy protects private property, which is why Sainsbury’s can be certain of its assets’ security. New Zealand’s legal system is one of the world’s most transparent ones, meaning that the risks faced by Sainsbury’s are minimal in this regard.

Cultural and Ethical Risks

As discussed earlier, New Zealand is a nation with a distinct cultural environment. Originally, the country exhibited a combination of traditional Maori culture and the European one (New Zealand, n.d.). The Polynesian legacy of the islands is recognized on all levels, as the native people are represented in the parliament by their own party (The political framework, n.d.). Nevertheless, in the current situation, New Zealand relies on immigrant labor, as well, as offering several professional programs for qualified specialists from abroad (Work in New Zealand, n.d.). The primary cultural risk for Sainsbury’s lies in the complex and diverse cultural environment, which has appeared in New Zealand in recent years. While Great Britain remains a highly progressive nation, this phenomenon has reached exceptional heights in New Zealand. Therefore, the company’s policy will need to remain respectful of all diverse social groups in the new location. There are, however, strong similarities between the home environment of Sainsbury’s and its desired destination, which will allow for an easier adaptation.

Covid-19

The year 2020 has brought an unprecedented challenge, the influence of which encompasses all of the aspects mentioned earlier. The Covid-19 novel coronavirus pandemic has entailed severe restrictions on the global scale, leading to immense negative consequences. The pandemic has affected all corners of the world, which includes New Zealand, as well. While the expansion of Sainsbury’s Supermarket is planned to take place after the pandemic, its influence is important to consider, as Covid-19 will echo through the upcoming years. For example, New Zealand had to close its borders following the pandemic, which is a negative development for a country, which depends on a foreign workforce. The lockdown has also affected people’s lifestyles, drawing increased attention to online-based activities. Commercial operations have also shifted toward the Internet, as online stores and marketplaces attain an unprecedented level of popularity in New Zealand (Retailing in New Zealand, 2020). Therefore, aside from the direct economic impact, the Covid-19 pandemic has created additional competition in the country’s retail market.

Business Opportunities in New Zealand

Key Economic Indicators

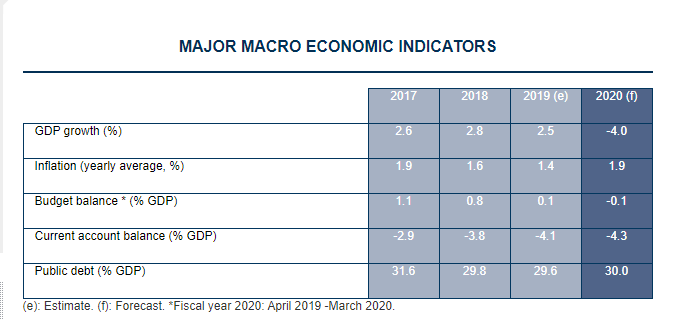

Key figures reflecting the performance of New Zealand’s economy can provide a better understanding of the nation’s investment climate. Prior to the current Covid-19 pandemic, the country had been showing a stable growth of over 2.5 percent of GDP per year (Figure 3). In the year 2020, New Zealand’s economy experienced an expected decrease caused by the strict lockdown protocol, paralyzing tourism, one of the country’s leading industries. Figure 3 also demonstrates that the nation’s budget only was in a deficit once over the past four years, and such a situation was evidently caused by the pandemic. The public debt of New Zealand does not exceed 30% of the country’s GDP, which reflects a good balance with its public accounts (Figure 3). As it can be observed, the pandemic has had a significant impact on the economy of New Zealand, interrupting its good history of economic indicators.

Nevertheless, there are reports accounting for a quick recovery of the country following the Covid-19 situation. According to Withers (2020), New Zealand’s economic charts demonstrate a V-shaped pattern. Following a considerable decrease in the second quarter, the economy soared in Q3 2020. Additionally, the 2020 Index has attributed New Zealand an economic freedom score of 84.1, which makes it the world’s third nation in this regard (New Zealand Economy, 2020). While its numbers showed a small decline, the change was not as dramatic as in the cases of other countries. Accordingly, New Zealand is one of the freest markets, which signifies that its business environment is highly positive. This situation creates a favorable environment for Sainsbury’s expansion, as the company will be able to pass the difficult transition period without excessive pressure from outside. In such a free, self-regulating market, the success will be determined by the objective characteristics of a business, giving Sainsbury’s an incentive to develop its operation in good faith. The quick end of the recession, combined with the overall economic transparency and freedom, makes New Zealand an appealing choice of expansion and investment in the post-Covid era.

Competition

The factors described earlier contribute to the positive image of New Zealand as an attractive target for investment. Naturally, Sainsbury’s cannot be the only company tempted by such expansion opportunities, and the competition in this market remains considerable. As of now, the supermarket segment in New Zealand remains bipolar, as the vast majority of it is controlled by Foodstuffs Limited and Progressive Enterprises (Television). Aside from traditional supermarkets, Sainsbury now has to compete with the entire segment of Internet marketplaces. As discussed earlier, such a situation emerged in the fallout of the coronavirus pandemic, during which lockdown protocols pushed consumers toward online services. The year-to-date sales of The Warehouse Group in New Zealand increased by 55% percent in 2020 (Rebuild New Zealand: Retail, 2020). This number means that this company has successfully recognized the growing demand for electronic commerce and adapted its business model. Sainsbury’s might need to implement similar changes, utilizing the vast potential of the Internet in addition to its traditional retail model. While the competition appears considerable, there may be a demand for fresh players in the market, which would dilute the existing bipolarity.

Consumer Income and Purchasing Behavior

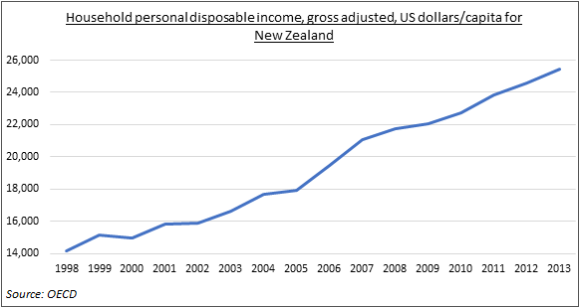

New Zealand retains its image of a wealthy nation, and its quick economic recovery after the pandemic confirms this idea. Figure 4 shows the personal disposable income graph for the nation’s citizens. As the graph demonstrates, New Zealand’s households have enjoyed a stable income growth since the end of the 20th century. Such consumers appear affluent and, therefore, attractive to retail chains. As far as their purchasing behavior is concerned, there is a strong incline toward online resources registered in recent years. As research suggests, over 80% percent of New Zealanders own a smartphone, but the majority of them continue to use it in combination with offline purchases (New Zealand consumer behavior, 2019). For example, many of them search for appropriate retail outlets in the vicinity and go there in person for offline shopping. However, further research is required to determine the degree to which Covid-19 has affected the purchasing behavior of New Zealanders in this regard.

Market Parameters

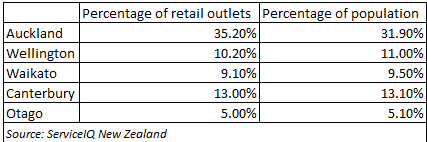

The overall retail market remains one of the key industries of New Zealand. The segment remains on a stable increase, as news outlets are opened regularly across the country. Figure 5 represents the distribution of retail outlets across New Zealand’s major cities. This information can provide Sainsbury’s with a clearer understanding of potential locations for its expansion. At the same time, Figure 6 supports the perception of growth in the country’s retail market, as the sales have successfully recovered after a brief decrease in 2012-2013. The size of the segment is constantly growing, as well, although online sales are expected to be the major part of the increase after the coronavirus pandemic.

Conclusion and Recommendations

In conclusion, New Zealand can be considered an interesting investment opportunity for foreign companies. The country remains on the list of the world’s most developed nations. It owes its success to several important factors, such as high political stability, allowing the government to concentrate on topical issues without increasing pressure on the business. At the same, New Zealand’s economy demonstrates strong resistance to contemporary challenges, namely the coronavirus pandemic. While Covid-19 has interrupted the stable growth of the country’s economy, the detrimental impact was limited, and several sources report a quick recovery of the nation. Furthermore, the economy and legislation of New Zealand remain highly transparent, which has put it in one of the leading positions in terms of the business climate.

Sainsbury’s has enough potential to be recommended to launch a pilot project in New Zealand. The investment environment is positive, making it possible to control the expenses and effectively utilize the resources. Despite some objective differences, the UK and New Zealand are close in terms of history in nature, making it easier for British companies to adjust to a new market. However, the distance between them is considerable, making logistics the cornerstone of successful operations. Sainsbury’s might want to localize its business processes in New Zealand, minimizing the number of travels its goods and employees must make between the two countries. Overall, this expansion can be mutually beneficial, as Sainsbury’s Supermarkets can conquer a new market while offering New Zealanders a fresh brand with European quality.

References

New Zealand consumer behavior & Online shopping trends. (2019). Web.

New Zealand country profile. (2020).

New Zealand economic studies. (n.d.). Web.

New Zealand economy. (2020).

New Zealand. (n.d.).

Political risk map 2020. (2020).

Rebuild New Zealand: Retail. (2020).

Retailing in New Zealand. (2020).

The New Zealand economy. (2020)

The political framework of New Zealand. (n.d.). Web.

Withers, T. (2020). New Zealand’s economy surges out of recession in v-shaped recovery.

Work in New Zealand. (n.d.).