Introduction

Since its foundation in 1964, Nike, Inc. has always striven to develop and amplify the scope of its assortment. The performance of the company is instantiated by dynamics, diversified sport-related products, sound reputation, loyal clientele, and increasing revenues. Today, athletic footwear, apparel, accessories, and equipment produced by Nike are sold in more than 200 countries throughout the globe (Nike Inc. 2016, para. 10). However, although interconnections between supply and demand have been comprehensively researched and described over numerous decades, contemporary market conditions encourage manufacturers, vendors, marketing professionals, and managers to conduct economic and marketing analyses to identify strengths and weaknesses, develop new strategies, and make their businesses more profitable. Before making strategic decisions, it is essential to consider both global and local factors and their potential impacts on the company’s performance. This paper will examine the external and internal environments specific to Nike’s business operations in the United Kingdom by pursuing Porter’s 5 Forces analysis of the athletic footwear market in the UK, an internal audit of Nike’s assets and competencies, and SWOT-analysis of the organization.

Porter’s Five Forces Analysis of the Athletic Footwear Market in the United Kingdom

The approach of Porter’s Five Forces is instrumental in determining factors that exert influence on a particular industry. This investigating model will be used to explore the UK market for Nike’s products. Specifically, the industry context in which the organization performs its business operations will be analyzed through the assessment of the following parameters: 1) current competition, 2) potential rivalry, 3) the threat of substitutes, 4) the bargaining power of buyers, and 5) the bargaining power of suppliers (Worthington & Britton 2014).

Current Competition Force

The main rivals of the company are such multinational organizations as Adidas with Reebok, PUMA, ASICS, Under Armour, Umbro, and some others. Although these companies differ in their market share in the United Kingdom, they compete against each other in the UK-oriented commercial environment, adjusting their assortment to preferences and purchasing abilities of the target consumers from Great Britain and implementing effective marketing strategies. For instance, Adidas and PUMA collaborate with famous fashion designers to promote their products among all categories of consumers (Ko et al. 2013, p. 1574). PUMA entered the partnership with Arsenal F. C., a renowned professional football club from England, and concluded an agreement on cooperation with Red Bull Racing. Umbro, a former English subsidiary of Nike, Inc., signed an agreement with West Ham United F. C., a professional football club from England. Moreover, over the past years, ASICS has become one of the fastest-growing brands of athletic footwear in Europe. Under Armour is a rapidly developing American company that is steadily expanding its presence in the United Kingdom.

While Adidas and PUMA are the key competitors of Nike (Ko et al. 2013, p. 1571), there are also over 160 footwear companies supported by the British Footwear Association in the United Kingdom. Given the current drive for sports and healthy lifestyle, a lot of British footwear manufacturers have redesigned and expanded their assortment in favor of athletic shoes. Today, Chatham Marine Ltd., T Groocock & Co (Rothwell) Ltd., Norman Walsh Footwear, NPS Shoes, and other British companies produce athletic footwear. Thus, the force of current competition can be identified as high.

Potential Rivalry Force

The effectiveness of business activities performed by Nike, Inc. since 1964 attracts new competitors in the industry of athletic footwear both locally and globally. However, in accordance with the concept of economies of scale, by increasing the number of its production facilities in developing countries and expanding the product range, Nike, Inc. reduces the median cost of its footwear and creates an effective barrier to entry (Worthington & Britton 2014). Nike’s strategies of product differentiation also make the acquisition of the market share by new entrants virtually impossible. Moreover, it will cost millions of pounds to set up and advance in the industry of athletic footwear. Due to consequences of the global financial crisis, the competitive abilities of companies have been significantly diminished. Imported footwear should correspond to the UK’s safety regulations and requirements for labeling (UK Department of International Trade 2016). Therefore, the force of Potential Rivalry (Threat of New Entrants) can be assessed as low.

The Threat of Substitutes

In the United Kingdom, customers are provided with a wide choice of athletic footwear due to the presence of multiple manufacturers and retailers on the British market. Nike produces high-quality products and sells them at the corresponding price. However, sports footwear manufactured in China and developing countries costs much lower in comparison with athletic shoes produced by Nike, Inc. Genuine leather is often replaced with leather-like materials, cutting the cost. Moreover, numerous companies are flooding the market with counterfeit footwear. Nevertheless, British customers tend to prefer high quality to lower prices. In addition, the Footwear (Indication of Composition) Labelling Regulations 1995 prevents the penetration of counterfeit athletic footwear (UK Department of International Trade 2016). Thus, the force of potential substitutes can be defined as moderate.

The Bargaining Power of Buyers

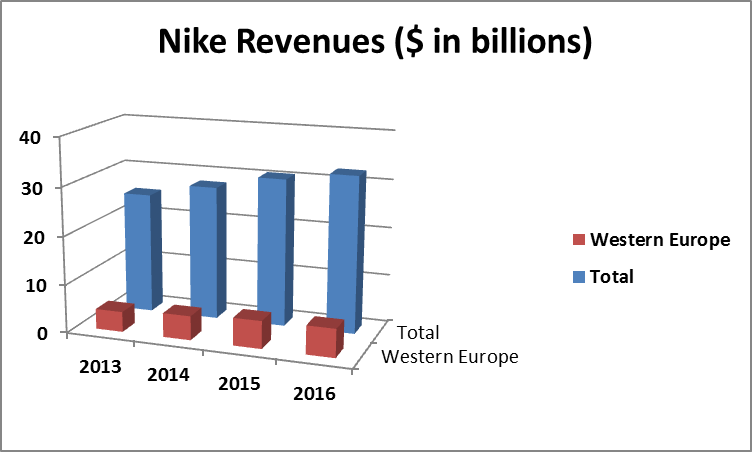

The Bargaining Power of Buyers is determined by customers’ ability to impose transaction terms on sellers. This force can significantly reduce business profitability (Worthington & Britton 2014). In order to expand its clientele, the company utilizes practices aimed at enhancing customers’ demand for athletic footwear and neutralizing their bargaining potential (Kornum et al. 2017). The company offers innovative and stylish products and promotes them via marketing campaigns, combining traditional advertising with all sorts of non-standard methods, such as the construction of basketball courts in city centers, involvement of eminent professional golfer Rory McIlroy from Northern Ireland, free provision of their goods to schools, and so forth (Kreng & Wang 2013; Kornum et al. 2017). According to statistical data provided by the UK Office for National Statistics (2016), British consumers’ expenditures are gradually increasing despite some economic volatility. The growth of Nike’s revenues (see Fig. 1) testifies to steady demand for its goods. Thus, Porter’s force of the Bargaining Power of Buyers can be assessed as moderate.

The Bargaining Power of Suppliers

Suppliers constitute a considerable market force if goods they supply are an essential portion of the costs of branch production and critical to manufacturing processes. Although high-quality materials are of paramount importance for Nike’s footwear, the company has entered into strong partnerships with its suppliers and retailers. Since 2006, Nike has rewarded its high-performance suppliers according to their levels of “quality, delivery, cost, and sustainability” (Bryan-Kjær 2013, p. 347). Nike’s suppliers are not motivated to influence the company, using their abilities to raise prices or reduce the quality of delivered goods. Thus, this force can be identified as low.

Conclusion

In accordance with the analysis findings, Nike’s share of the UK market of athletic footwear is significantly influenced by the Force of Current Competition due to the presence of equally strong rivals. Being intertwined with the Bargaining Power of Buyers, intense competitiveness in the industry can decrease demand for sporting footwear manufactured by the company. Moreover, new market entrants, diverse substitutes manufactured in China, and shrinking incomes of buyers entail detrimental consequences for its profitability. Although the analysis has revealed potential threats to Nike’s performance in the United Kingdom, statistical data on the stable growth of annual sales testify to the efficiency of marketing, strategic planning, and management of the company. Nike has become the symbol of superior apparel and athletic footwear.Despite a broad spectrum of organizational change models, all change-associated initiatives should be based on comprehensive assessment of external and internal conditions specific to Nike’s operations. In order to change the structure of the UK footwear industry for its benefits, Nike should act strategically, considering the forces that pose the highest risks.

Audit of Nike’s Internal Environment

The assessment of Nike’s internal environment is conducted to identify strengths and weaknesses specific to the organization through the analysis of its assets, management, and competencies. The internal audit of Nike, Inc. will be carried out on the basis of the company’s financial reports, the UK governmental publications, statistical data, Nike-focused scholarly research, market exploration, and examination of consumers’ reviews and testimonials. The initial stage of auditing is a choice of parameters to analyze. The assessment of internal strengths and weaknesses of Nike, Inc. will involve the examination of the following parameters:

- Nike’s assets and resources;

- Management and administration;

- Competencies.

Nike’s Assets and Resources

Nike, Inc. is headquartered near Beaverton, the USA. For more than fifty years of its operations, the company has transformed into a leader in the sportswear industry, employing approximately 62,600 professionals worldwide (Nike Inc. 2016). The company’s subsidiaries include Converse, Nike IHM, and Hurley whose offices are located in 51 countries. Products of every subsidiary are manufactured under specific trademarks. For instance, Converse designs and distributes sportswear under such trademarks as the Converse, All-Star, Star Chevron, One Star, Chuck Taylor, and Jack Purcell (Nike 2016).

The company’s production capabilities ensure the diversification of models and ongoing renovations of assortment. Nike’s products include the eight main categories as follows: Running, Football, Basketball, Golf, Men’s Training, Women’s Training, Sportswear, and Action Sports (Nike Inc. 2016). The diversity of offerings contributes to customers’ preferences for Nike’s products and purchasing decisions. Nike’s footwear is produced by more than 140 factories which are located in 14 countries. The largest manufacturers of footwear are in Vietnam, China, and Indonesia (Nike Inc. 2016). More than 408 factories based in 39 countries are involved in the production of the company’s apparel. However, the company produces only the basic technological components of Nike Air System for sports shoes while enterprises connected with Nike by contractual relationships manufacture the largest part.

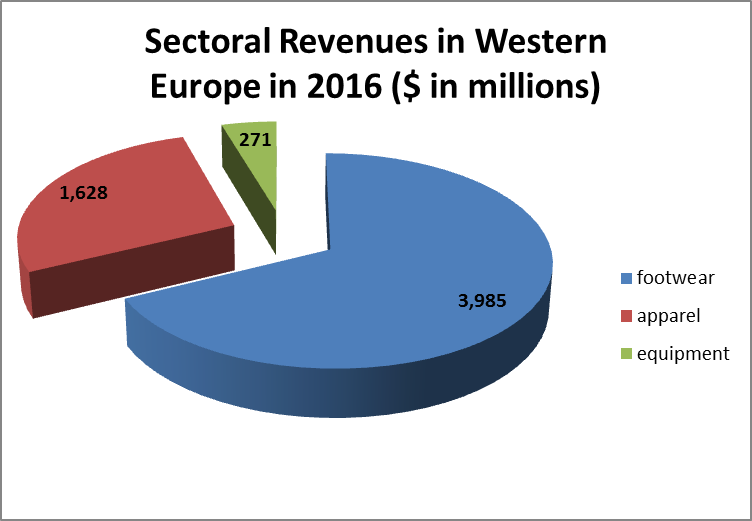

The review of the company’s annual reports (Nike Inc. 2015; Nike Inc. 2016) allowed generalizing trends in sales and revenues. Athletic footwear comprises the largest segment of revenues; sales of equipment are the most insignificant. Given the absence of data on Nike’s sales in the United Kingdom, the company’s revenues in Western Europe were analyzed (see Figure 2).

Management

Rapid responsiveness to customers’ needs and abilities to adapt to emerging economic, social, and cultural transformations are inherent in the organization’s management due to the well-designed structure of the company. Trevor Edwards is the president of the company. There are nine executive officers in the organization headed by Philip H. Knight, Chairman of the Board of Directors (Nike Inc. 2016).

In addition to effective manufacturing and distribution of its products, Nike has become iconic in implementing marketing campaigns due to their successful completion. In order to differentiate its products from those of its strongest competitors, Nike’s experts in marketing modify prices and develop varied marketing strategies, advertising tools, effective selling techniques, and so forth. Through social media platforms, Nike has built strong relationships with customers (Hudson et al. 2016). Diverse marketing opportunities (home runs, singles, and low-hanging fruits) are inextricably linked with communication via such social media platforms today. Frequent social media interactions allow the organization to monitor fluctuations in consumers’ demand for its sportswear, transform communication messages, and promote new products (Hudson et al. 2016). Information exchange through Facebook, Twitter, YouTube, MySpace, and Linkedin is gradually becoming more preferable than real communication. The Internet-associated marketing is used by Nike’s marketers to promote its trademarks, launch new products, attract potential consumers, grow business, conduct pools, pursue research on supply and demand, and, thus, manage crises. Though effectiveness of social media marketing is still insufficiently studied, it is necessary to benchmark the organization’s social media performance against its strongest competitors. Uploading catchy images of new sports footwear or equipment, Nike attracts new clients of all demographics and implicitly promotes its products. Positive consumers’ testimonials and reviews of acquired products act as a persuasive advertising technique (a low-hanging fruit).

Much attention is paid to HR management of the company’s diverse workforce. In the nineties, the organization faced allegations of human rights violations “and exploiting poor workers in the South” (Bryan-Kjær 2013, p. 347). However, today, the relationships between managers and employees are evaluated as excellent (Nike Inc. 2016). Having developed the Code of Conduct, Nike adjusted its personnel-oriented policies to officially established requirements and made HR practices transparent.

Organization’s Competencies and Prospects for Innovations

Nike, Inc. produces a varied assortment of athletic footwear, apparel, equipment, and accessories. Although “sportswear is defined primarily as apparel and footwear made for sports participation” (Ko et al. 2013, p. 1566), today, it also includes casual clothing worn for leisure purposes and daily activities. The company’s footwear products are manufactured by utilizing novel technological methods and such materials as genuine leather, synthetic rubber, foam cushioning materials, plastic components, polyurethane films, and others. In manufacturing apparel, various natural and state-of-the-art synthetic fabrics are used (Nike Inc. 2016).

Business performance of Nike, Inc. is characterized by wide utilization of innovations and technological advances. Without entering a battle against armies of producers of low-quality athletic footwear and apparel from some Asian countries, the organization has opted for high technology, novelty, research, and ongoing development. Therefore, today, the company occupies one of the world’s leading positions in terms of industrial output and expenditures on research and innovations. Nike keeps ahead of its commercial rivals. For instance, in 2006, the collaborative alliance between Nike and Apple resulted in the emergence of Nike iPod Sports Kit. The system provides customers with opportunities to enjoy music and monitor health indicators while doing sports. Although Nike SQ SUMO 5000 and its predecessor Nike SQ SUMO were designed in 2007-2008, they are still perceived as innovative golf equipment (Kreng & Wang 2013, p. 83). In 2016, Nike designed the HyperAdapt 1.0, which is proclaimed to be “the most adaptive footwear ever created” (Nike Inc. 2016). Other recent innovative products include the Lunar Epic, the Air VaporMax, the Free Run Motion, and so on. Furthermore, being oriented towards sustainable development and environment-friendly production, Nike is the only manufacturer of sportswear in the world that is involved in footwear recycling (Lee & Rahimifard 2013; Kreng & Wang 2013; Nike Inc. 2015).

SWOT-Analysis of Nike (UK)

The analysis of internal and external environmental factors that influence the performance of Nike, Inc. will allow identifying Critical Success Factors (CSFs) instrumental in increasing the organization’s effective performance in the United Kingdom.

Critical Success Factors (CSFs)

In order to meet external and internal challenges, Nike, Inc. should implement the following transformations in its performance, strategies, and production:

- Being one of the largest employers in the sportswear industry, Nike, Inc. should launch relevant training programs as an obligatory element of the company’s employment policies (Weakness 1).

- The initiation of new loyalty programs (Weakness 6) can increase the number of customers.

- Collaboration with British authorities via their involvement in the construction of recycling facilities (Opportunity 3).

Recommendations for Future Strategy

Nike, Inc. could gain various benefits by targeting British market segment “through economies of scale, boosting purchasing power, enhancing competitive advantage, and building customer loyalty” (Ko et al. 2013, p. 1573). Taking into consideration external threats and opportunities and internal strengths and weaknesses revealed by SWOT analysis, the company can create its competitive advantage over other rivals in the United Kingdom through its collaboration with local authorities in construction recycling facilities. This strategy is in line with environment-oriented initiatives and could be supported by British officials in order to reduce threats posed by waste dumping or gasification. Furthermore, some materials and substances obtained through recycling can be reused (Lee & Rahimifard 2013). Since Nike, Inc. is still the only footwear manufacturer involved in postconsumer footwear recycling (Lee & Rahimifard 2013, p. 92), the company will not meet strong competitors in Great Britain. Taking into account psychological characteristics of consumers, this Nike’s strategy would result in a propitious public attitude to the company. The cooperation with domestic workers will promote positive associations with the brand across all communities in the United Kingdom, contributing to demand its products. Such an initiative will provide British populations with additional employment opportunities. The United Kingdom has established the international reputation as a responsible business partner; therefore, this collaboration-oriented strategy will lead to mutual benefits.

Reference List

Bryan-Kjær, K 2013, ‘Strategic corporate social responsibility: from side activity to core business – nine value-creating strategies’, International Journal of Sustainable Strategic Management, vol. 3, no. 4, pp. 340-357.

Hudson, S, Huang, L, Roth, M & Madden, T 2016, ‘The influence of social media interactions on consumer-brand relationships: a three-country study of brand perceptions and marketing behaviors, International Journal of Research in Marketing, vol. 33, no. 1, pp. 27-41.

Ko, E, Taylor, C, Sung, H, Lee, J, Wagner, U, Navarro, D & Wang, F 2013, ‘Global marketing segmentation usefulness in the sportswear industry’, Journal of Business Research, vol. 65, no. 11, pp. 1565-1575.

Kornum, N, Gyrd-Jones, R, Zagir, N & Brandis, K 2017, ‘Interplay between intended brand identity and identities in a Nike related brand community: co-existing synergies and tensions in a nested system’, Journal of Business Research, vol. 70, pp. 432-440.

Kreng, V & Wang, B 2013, ‘An innovation diffusion of successive generations by system dynamics — An empirical study of Nike Golf Company’, Technological Forecasting and Social Change, vol. 80, no. 1, pp. 77-87.

Lee, M & Rahimifard, M 2013, ‘An air-based automated material recycling system for postconsumer footwear products’, Resources, Conservation and Recycling, vol. 69, pp. 90-99.

Nike, Inc. 2015, Archived annual reports. Web.

Nike, Inc. 2016, Nike, Inc. reports 2016 fourth quarter and full year results.Web.

UK Department of International Trade 2016, Import and export clothing, footwear and fashion: international trade regulations. Web.

UK Office for National Statistics 2016, Consumer trends, UK statistical bulletins. Web.

Worthington, I & Britton, C 2014, The business environment, 7th edn, Prentice Hall, Essex.