Introduction

The principal objective of expanding a business to new locations is to improve revenue and profitability. The business collapses whenever the aim is not achieved, and the investors suffer losses in the long run. Pharmacity has been thriving in Vietnam and expanding its influence to Australia.

Australia is a country of choice because, despite having a stable economy, it has proximity to the Asia Pacific market, which is experiencing exponential growth. The country has political stability and has a chance to thrive because of the infrastructure and a friendly regulatory environment. However, budgeting methods must be used to analyze the product data to determine which projects are likely to be profitable for Pharmacity.

The company has two products that need to be selected to determine which one will be invested in Australia. The first product is multivitamins for middle-aged men, which targets people aspiring to lead a healthier lifestyle. In contrast, the second product is vitamins and supplements for pregnant women, targeting expectant mothers who desire to deliver healthier offspring. Although both products seem lucrative due to the sedentary lifestyles experienced in Australia, capital budgeting methods must be used for analysis to determine which of the products is viable. A combination of financial and non-financial analysis is required to offer holistic advice on the company’s profitability in the new market.

Capital Budgeting Methods Used for Selecting the Most Preferred Project

Capital budgeting methods are special techniques that are used to determine the most profitable decision to be used. The method analyses the financial status of an organization and shares insights on which projects to be undertaken are more profitable (Dai et al., 2022). Once the financial feasibility of an organization has been determined, it helps investors make informed decisions. While numerous methods may be leveraged to understand a company’s financial feasibility, this report will utilize the payback time, internal rate of return, and net present value to determine which of the two projects is worth investing in Australia for maximum gain.

Payback Period

The organization utilizes the payback period to determine when an investment will yield adequate income to recoup the investment. Any product that shows signs of recovering the invested amount in the shortest possible period is the preferred investment compared to the one that takes longer (Dai et al., 2022). It is calculated using an Excel functionality where the payback time is calculated as =PAYBACK (range of cash flows for the years invested). However, since the cash flows for the investment years are not given, they need to be calculated using the formula given below:

Cash flow = (expected unit sales × selling price) – (expected unit sales × cost of goods sold) – delivery cost – overhead cost – advertisement cost – depreciation.

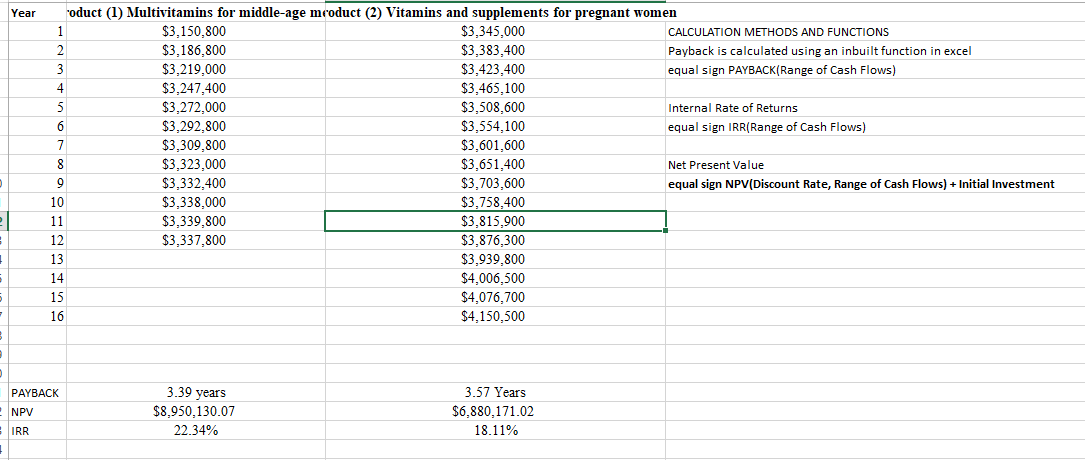

The main assumptions made for the cash flow calculation included an increasing value of the goods sold and a perfect pattern being followed. The method was used because of its simplicity, ease of calculation, and taking into account the time focus more than the profitability (Dai et al., 2022). From the calculated cash flow values for the 12 and 16 years, respectively, for the two products, the multivitamins for middle-aged men had a payback time of 3.39 years compared to 3.57 years for the vitamins and supplements for pregnant women, indicating that the first product was more preferred compared to the second product. Figure 1 below shows a screenshot of the Excel file where the values were calculated.

Internal Rate of Return (IRR)

The internal rate of return is a financial metric used to accurately estimate the returns an investment achieves. A higher IRR value means that for every dollar invested into a project, the outcome increases by the percentage given (Dai et al., 2022). Capital budgeting is crucial because it enables companies to compare two products and invest in the more profitable one.

IRR was selected for this report because it is easier to calculate and shows the differences between the investments in percentages. From the values provided in the exhibit, the calculated IRR was 22.34% for the first product and 18.11 for the second product, as illustrated in Figure 1. The IRR outcome means that the first investment is far more profitable than the vitamins for pregnant women. The main assumption made in the calculation of IRR is that the cash flows follow a particular pattern for a linear result.

Net Present Value (NPV)

Profitability is an important metric in business strategic decision-making. NPV is an important tool to determine whether a company will have more cash inflows than outflows in the long run. An investment with a higher net present value will likely generate more revenue (Weston and Nnadi, 2023). From the calculations presented in Figure 1, the first investment has a higher $8950130.07 than the NPR for the second product, $6880171.02. The method leveraged in calculating NPV is as shown below:

= NPV (discount rate, array of cash flows) + original investment

The method selected is appropriate for the organization because it helps organizations conduct a sensitivity analysis that shows the variations that affect the organization. Consequently, the management can make better decisions and select an investment with profitability prospects. The final decision to invest in the first product is because it has fewer years of payback, higher NPV, and a higher IRR. As Pharmacist expands its services to Australia, multivitamins for middle-aged men are the most preferred project to invest in.

Associated Risks and Proposed Solutions

Market Fluctuation Risk

Risk analysis is an important procedure in any investment as it analyses all the potential risks and ensures that they are eliminated before they affect the business’s profitability in the region. The main risk associated with the business is market fluctuation, as the consumers of the product are exposed to different information. The fluctuation may be caused by varying market preferences, changes in economic conditions, and the competition that keeps coming up in the dynamic contemporary corporate domain. The risk can be overcome by conducting robust research and development into customer behavior to understand market trends and offer diverse products that respond to changing customer preferences (Esch, Schulze, and Wald, 2019).

Currency Risk

Further, currency risk is another important area of concern because the exchange rates keep fluctuating due to the changing rates; hence, profitability may be jeopardized. The company must, therefore, hedge against all the financial risks by pricing all products using the local currency so that they are not affected by fluctuations.

Legal Risk

Compliance and regulatory risks are paramount in determining the outcome of a business. Transferring a business from Vietnam to Australia may be marred with compliance risks since the organization may need to be more familiar with the country’s regulations and policies. The proposed solution to overcome the compliance risk is to ensure that it works with legal experts and has a checklist of all the compliance issues that must be met to thrive (Bellucci et al., 2021). Having legal advisors will likely make Pharmacity overcome all the risks associated with regulation and, therefore, thrive.

Cultural Risk

Product 1 deals with foods as dietary supplements for middle-aged men. Food forms an important part of culture and societal norms that must be congruent with the local culture. One risk likely to affect the business is the cultural risk where the product provided will be against Australian norms and principles. The proposed solution for the cultural risk is to conduct culturally sensitive training to understand the Australian food culture and ensure that all the provisions align with the people’s culture so that middle-aged men may be well-versed in the situation (Weston and Nnadi, 2023).

Competitive Risk

The competitive risk is a potential challenge that may affect the operation of Pharmacity. Supplement provisions worldwide are increasing as healthy living is advocated worldwide. As a result of the increased information on healthier lifestyles, numerous competitors may jeopardize the organization’s operations in Australia. The proposed solution is to conduct a competitor analysis to ensure that they understand them and improve their brand image to outshine the customer’s needs.

Environmental Regulation Risk

Climate change poses a major challenge in the contemporary corporate domain. As a result of the climate concerns, every country has sustainability laws starting from manufacturing and packaging of the products to meet the needs of the people. Australia may have regulatory issues on climate and sustainability (Bellucciet al., 2021). Please align with the country’s sustainability goals to avoid a major threat to the performance of the business since

Pharmacity may not be aware of the environmental policies guiding the environmental realm in Australia. Since the company’s reputation depends on its ability to comply with environmental regulations, failure to uphold them may pose a high threat to the organization. The proposed solution is to develop a sustainability department that will monitor all the sustainability practices in Australia, ensure that the company always complies with the region’s sustainability practices, and seek license and operational permits to allow Pharmacity to operate within the legal frameworks.

Qualitative FactorsFor Pharmacity’s Success in Australia

Well-Being Trend

Qualitative factors in the business realm include all the non-financial issues that tend to impact business performance. One of the most common factors that is likely to improve the products’ sales in Australia is the health trend, where more people, especially middle-aged people, desire to lead healthier lives. Therefore, more people will be willing to buy the product (Esch, Schulze, and Wald, 2019).

As a result of the health trend, the demand for the products is likely to increase. The existing situation where people are more conscious about their well-being shows that people may be willing to invest in products meant to improve their well-being. Due to the increasing prevalence of lifestyle diseases and the increasing desire by people to lead a healthier lifestyle, the product will get more customers as long as it maintains diverse products that promote health and well-being.

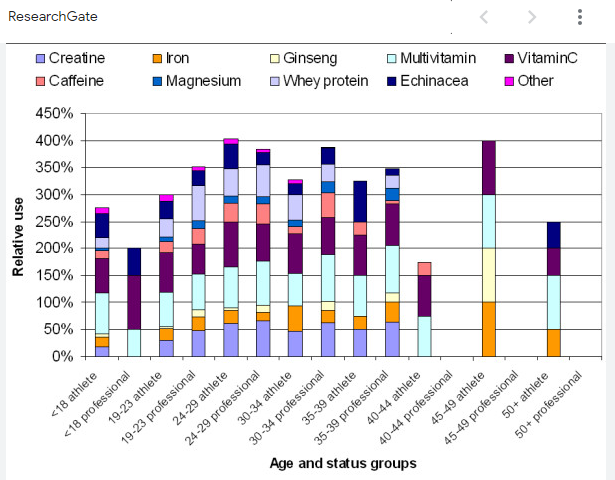

The well-being trend is an important factor that increases the demand for the said product, making the company thrive. Based on the qualitative factor, the main recommendation to the management is to invest in more health-conscious areas to ensure that people are ready to spend more on healthier lifestyles. Figure 2 below shows the dietary supplements that men take. As more males opt for dietary supplements, the market will likely expand.

Demographic Factors

Demographics are important sections that must be considered for the well-being of a business. Whenever a manufacturer is aware of the demography in the new nation where it seeks market, it leads to more tailored products, improving product sales. As the Pharmacist enters the Australian market, it must understand the market and tailor the needs of the market in the production department.

Since the most preferred product is multivitamins for middle-aged men, the company must understand the cultural orientation of the targeted population and help tailor the products to the needs of the individuals (Bellucci et al.,2021). The management team must understand the unique needs of the given market and ensure that the people are well aware of their products and that they are tailored. Since Pharmacity’s product is about people’s health, it can seek endorsement from healthcare professionals to encourage people to use the product based on its health benefits.

Ecological and Environmental Factors

The product’s ecological implication is to balance resource usage and waste management to maintain a cleaner and safer environment as the company invests in other countries. The selected product to be invested in Australia is ecologically conscious as it does not have pollution impacts in the long run (Bellucci et al.,2021). As the company becomes aware of the country’s waste management system, all emissions and wastes are well managed to avoid environmental pollution. As Pharmacists enhance the quality of waste management systems and remain conscious of environmental pollution, it will lead to a better working environment for the company’s reputation, leading to a better outcome in the long run.

In the ecological domain, the company management must remain conscious of the environment to maintain a good rapport (Kristi and Yanto, 2020). Once the company attains a better brand image because of its environmental strategies, sales will likely improve in the long run. As customers seek to maintain a healthier environment, they are likely to associate with companies that preserve the environment.

Environmental implications play a major role for businesses in this era of climate change. As the pharmacist enters the new market, it should comply with all the environmental protection issues, such as the carbon footprints and packaging, which must be made to ensure that the environment is always safe. The social impact likely to offer more opportunities for the business to grow is its ability to offer health benefits and employment opportunities, which help the locals improve their quality of life.

The management of the investing company must analyze the social impact and ensure that it improves the people’s quality of life by hiring locals. Once the locals are hired, they tend to be more appealing to the people and are likely to develop better outcomes for success (Esch, Schulze, and Wald, 2019). Offering corporate social responsibility, which assists people from the neighborhoods in which it operates, will likely make the company more popular and increase its sales. Whenever a business thrives in a host nation, its contributions in the form of taxes back the overall economic growth.

Strategies for Sustainable Growth

Although qualitative factors such as social, economic, and environmental parameters are likely to impact the business’s success, there are strategies for sustainable growth that Pharmacity must practice as it navigates the Australian market. The foremost sustainable growth strategy focuses on the triple-pronged approach, which focuses on three performance indicators: financial, social, and environmental because they are more relevant in the present-day business world. All three prongs must be scrutinized thoroughly to ensure they align with the organization.

Since different stakeholders in the country are affected by the product introduced, it is important to enhance stakeholder engagement to understand the specific needs of the people and tailor their needs to the production process (Kristi and Yanto, 2020). Transparency and reporting, lifecycle assessment, and continuous improvement are important growth strategies the organization must embrace to ensure it thrives in the new market niche.

Conclusion

Globalization has made organizations navigate and search for newer markets in different parts of the world. Pharmacity thrives in Vietnam and has decided to expand its branches to Australia. Although two products must be traded in the new location, capital budget methods must be used to determine the feasibility of businesses and products. According to the payback value, net present value, and internal rate of return, the first product proved to be the most feasible compared to the product for pregnant women.

While capital budgeting methods are fundamental in deciding to invest, qualitative issues must be fulfilled for a business to thrive. Some of the issues include health trends, social issues, and environmental concerns that must be fulfilled to make the business build a good rapport with the clients and make profits in the long run. When financial and non-financial factors are considered for making an investment decision, the company will likely thrive in the long run. The financial factors were used to make investment decisions, while the qualitative issues were used to maintain the company’s competitive advantage.

Reference List

Bellucci, M., Marzi, G., Orlando, B. and Ciampi, F. (2021) ‘Journal of intellectual capital: A review of emerging themes and future trends.’ Journal of Intellectual Capital, 22(4), pp.744-767. Web.

Dai, H., Li, N., Wang, Y. and Zhao, X., (2022) ‘The analysis of three main investment criteria: NPV IRR and payback period.’ In 2022 7th International Conference on Financial Innovation and Economic Development, 8(1), pp. 185-189. Web.

Esch, M., Schulze, M. and Wald, A., (2019) ‘The dynamics of financial information and non-financial environmental, social and governance information in the strategic decision-making process.’ Journal of Strategy and Management, 12(3), pp.314-329. Web.

Kristi, N.M. and Yanto, H. (2020) ‘The effect of financial and non-financial factors on firm value.’ Accounting Analysis Journal, 9(2), pp.131-137. Web.

Research Gate, (2023) Relative use of nutritional supplements by age and status among males. Web.

Weston, P. and Nnadi, M., (2023) ‘Evaluation of strategic and financial variables of corporate sustainability and ESG policies on corporate finance performance.’ Journal of Sustainable Finance & Investment, 13(2), pp.1058-1074. Web.