Executive Summary

Purchasing and buying equipment for a business is part of the primary capital budget expenditure, which affects the net profits. When deciding on whether to purchase or hire equipment, it is imperative to review the cash flows of each alternative to make a prudent option with optimal investment returns. About this case study, the Net Present Value (NPV) was used to decide on the options of hiring or buying a mechanize concrete mixer for the hypothetical Concrete Masters Company, in New York. A spreadsheet was created for each option to represent the cash flows. Specifically, the project life, loan payback duration, interest rate, and the inflation rate were calculated in terms of their effect on the NPV through sensitivity analysis. The findings indicated that the purchasing option was preferred for the Concrete Masters Company to optimize returns on investments.

Introduction

Case study background and problem statement

Following the progressive changes in the business environment, most fixed assets have become leasable. For instance, at present, almost half of all commercial aircraft from production lines are bought by leasing companies. In any business environment, the decision to buy or hire is very common (Black Sun Plc 2012, p. 5). Specifically, the final option is often informed by the balance between the benefits and costs associated with the buy or hiring decisions. Therefore, it is necessary to establish the long-term benefits or demerits of asset acquisition through buying or leasing on the Concrete Masters Company’s capital budget. Since the business operates within the dynamic construction industry in New York, it is necessary to carry out comprehensive calculations of the NPVs for the two alternatives. In recent years, most published literature on the buy or hire decision is narrowed to a particular perspective and is not comprehensive in the general factors that should be taken into account. For instance, some literature studies suggest mathematical models, but ignore theoretical explanations on how the capital budget may be affected by the projected cash flows (Bryman 2012, p. 78). Therefore, there is a need to create a comprehensive analysis method for buying or leasing the concrete mixer for the Concrete Masters Company. This is necessary to create a simplified decision-making approach (Mitchell & Capron 2012, p. 49).

Project objectives

As part of the rationale building for appropriate decision making, the objectives of this research study are to present a detailed analysis on;

- Cash flows associated with the options of purchasing and leasing the concrete mixer.

- Factors that the Concrete Masters Company must put into account when contemplating the buy or hire options.

- Effects that buying and leasing the concrete mixer will have on the Concrete Masters Company’s capital budget.

Scope of the study

To conduct comprehensive research, the following steps shall be followed;

- Step 1: Understanding the underlying problem.

- Step 2: Collection of relevant information.

- Step 3: Identify feasible options through realistic estimations.

- Step 4: Highlight the primary criterion for making decisions.

- Step 5: Evaluation of each option.

- Step 6: Selection of the best option.

Accomplishing the above steps will involve a literature review, evaluation of investment decisions, selection of the best analytical techniques, and comparative analysis of alternatives. The conclusion will be based on the best technique to inform the final decision of either buying or hiring the concrete mixer.

A literature review

Capital structure and capital budget decisions

Acquisition of an asset through buying or hiring requires capital in the form of fund allocation. The capital structure is the different capital sources that a company may use, cost, and fixed capital from each source (Lasher 2013, p. 23). The three components of the capital structure are preferred stock, common stock, and debt capital. The Concrete Masters Company may decide to use one or all of these capital components, depending on the cost of the concrete mixer. The common stock is the shareholders’ investment and retained earnings in a company. Preferred stock is the mix between long-term debt and the common stock. On the other hand, debt capital is the acquisition of debt to raise capital through bonds or loans. To make a capital decision, there is a need for the Concrete Masters Company to create an ideal capital structure as a guarantee of optimal economic value added (EVA) (Bragg 2016, p. 11). The cost of capital is determined by the capital structure via the capital cost average equation. Therefore, the capital structure policy of a company determines the preferred equity and weight of each debt.

Influence of inflation, tax, interest, and capital cost inflation rates

An increase in the interest rates results in a rise in the debt capital cost since banks and shareholders will require a high rate of interest. This increases the preferred capital cost. On the other hand, variations in the rate of tax affect capital equity cost. For instance, an increase in the rate of tax will result in reduced debt capital costs (Benninga 2014, p. 64). An increase in the level of inflation has the effect of increasing the investors’ rate of return, thus, resulting in higher capital cost when all other factors are held constant.

Lease or hire of equipment

Leasing involves the clear separation of right and ownership of equipment between the lessee and the lessor. The latter is the owner of the equipment while the former acquires the temporary right of usage as stipulated in the lease agreement. The leasing contract must meet the minimum requirements such as the period of the lease, residual asset value at the beginning and end of the contract, and restriction on the right of usage to the lessee (Dhaliwal, Li, Tsang, & Yang 2012, p. 41). Also, the agreement must highlight terms of conditions, lease payments, and the equipment description. The three forms of lease agreements are the capital lease, operating lease, and sale-and-leaseback contracts.

Impact of changes in interest rates on a lease agreement

Changes in the interest rate influence payment of the lease agreement. For instance, the internal rate of return (IRR) allowing the NPV of lessor cash flows equals the IRR selected by the lessor to define lease payments. The lessor has to quantify the IRR required through reviewing the NPV of experienced cash flows of maintaining and acquiring the equipment (Monks & Minow 2012, p. 76). These cash flows include maintenance cost, purchase price, depreciation, savings on maintenance tax, and tax on lease payment. Therefore, the higher capital cost of equipment maintenance and acquisition would result in a higher IRR on the side of the lessor, which is equivalent to remitting higher lease agreement payments.

Purchasing of an asset or equipment

The legal and policy authorities across the globe have similar conditions on assets purchased from a dealer, with VAT being part of the total purchase price. The current VAT in New York is 9%. This means that the nine percent VAT must be included in the price of the asset (Herst 2012, p. 29). Depreciation also affects the tax levy since it reduces net profit, despite not being part of the cash charge. Therefore, a higher rate of depreciation results in lower tax levies. Depreciation is calculated using the modified accelerated cost recovery system (MACRS) and straight-line formulas (Benninga 2014, p. 61). The latter formula involves getting the difference between the salvage value and the initial price divided by the annual amount of depreciation. The MACRS is calculated by determining the annual depreciation via initial asset cost multiplication (Leszczynska 2012, p. 25). This is followed by computing the asset book value for each year by deducting the summation of the annual depreciation from the equipment’s initial cost or purchase price.

Current methodologies of decision making in the lease or buy scenarios

Several tools have been put forward to facilitate decision making in the hire or buy scenarios for organizations. For instance, the Vincil or Lease-or-Borrow model makes a comparative analysis of the costs associated with equipment acquisition through leasing to costs associated with the acquisition of the equipment through debt financing (Leszczynska 2012, p. 15). The formula for the Vincil model is summarized below.

Net present value of purchase = −C+∑Dnt / (1+i)nkn+1

Where;

- C=Purchase Price

- Dnt = Depreciation tax savings in year n

- t= Rate of tax

- i= Capital cost

- K = Project lifespan

The second step involves determination of the NPV of the lease agreement payments using the equation summarized below;

NPV of lease= ∑nK= 1 Ant /(1+i)n – ∑nK = 1 Ln / (1+r)n

Where;

- An= The portion of noninterest within the lease payment in year n.

- Ln= Total lease agreement payment in year n.

- r = Primary interest rate.

- k = Full asset life.

- i = Capital cost.

Variations in the NPVs of purchase and lease are compared and the one with the highest positive NPV is considered as the best option of asset acquisition. Developed by Johnson and Wilbur in 1972, the Lease-or-Buy model is more or less to the Lease-or-Borrow model above because it also computes the NPV of the buy and leases alternatives in acquiring an asset (Leszczynska 2012, p. 34). However, the two models have minor dissimilarities such as the inclusion of the costs associated with purchasing an asset in the Lease-or-Buy model while the same is ignored in the Lease-or-Borrow model. Besides, the Lease-or-Buy model carries out a comparative analysis of the costs associated with asset acquisition through lease and purchase with the use of its equity. However, the Lease-or-Borrow model applies the debt capital in a comparative analysis of the cost associated with buying or leasing an asset (Benninga 2014, p. 34). The formula for computing the NPV under the Lease-or-Buy model is summarized below.

NPV purchase= – C + ∑nK = 1 tDn /(1+i)n + ∑nK = 1 Rn (1+t) / (1+i)n

NPV lease= ∑nK = 1 (Rn + 0n) (1-t) / (1+i) n – ∑nK = 1 Ln (1-t)/ (1+ rti) n

Where;

- Ri = Year I operating cash flow

- Oi = All operating costs occurring under asset ownership, but not lease agreement.

- rt = Interest rate after tax.

- Ln = Lease payment for year n.

Establishing the Solution

Tools and methods

Purchasing or hiring the concrete mixer is a capital investment. In making decisions for such investment, there is a need to consider several rules such as the payback period, net present value (NPV), internal rate of return, modified internal rate of return, and profitability index (Leszczynska 2012, p. 33). The payback period compares the actual years that are required to fully recover the direct investment in buying or leasing the equipment. Through this approach, the alternative that has the lowest period for payback is picked as ideal (Monks & Minow 2012, p. 86). However, the application of this method is restricted to a mutually exclusive project. The formula for calculating the payback period is summarized below.

Number of years = Initial investment / Annual net cash flow

The net present value (NPV) is the summation of all cash flows discounted at the capital cost. If the NPV value is zero, the purchase or buys decision becomes acceptable since the projected cash inflow would be enough to repay the initial capital invested within the ideal rate of capital return. When the net present value is above zero, the decision to purchase or lease is within the acceptable standards since the projected cash flows are efficient to pay back all costs associated with capital, however, at a higher rate than capital cost needed (Monks & Minow 2012, p. 96). Moreover, when the net present value is less than zero, the decision to purchase or lease as part of capital investment is rejected since the initial cost of the investment will have to be paid back at a lower rate than the expected rate of cash flows.

The internal rate of return (IRR) is defined as the actual rate of cash flow returns that a company needs to make sure that the net present value is equal to zero for cash inflows. This means that any rate of return that is lower than the internal rate of return results in the disqualification of such investment from the capital budget of such a company. The modified internal rate of return (MIRR) is a decision-making tool for improving the internal rate of return. In using the MIRR rule, it is important to define the terminal value (TV), which is the forecasted cash flow value (Benninga 2014, p. 67). This means that the modified internal rate of return is the primary discount rate, guaranteeing that cash flow’s present value is similar to the terminal present value when all other factors are held constant. Lastly, the benefit-cost ratio, also known as the profitability index, indicates the level of capital investment profitability. This means that a project can only be accepted when the benefit-cost ratio has a value above 1.0. It is important to note that the NPV rule is very accurate and reliable in decision making.

Selection of the appropriate method: Concrete Masters Company’s dilemma

Carrying out a comparative analysis between purchasing and hiring the concrete mixer for the Concrete Masters Company involves the use of cash flow analysis on the worksheet model. The cash flow approach is adapted because preparing and interpreting the spreadsheet model is easier than applying complex mathematical models. Thus, the cash flow analysis would be ideal in solving the current dilemma facing the Concrete Masters Company. The net present value model or rule can be used to carry out selective spreadsheets that represent the purchase and lease options in the acquisition of the concrete mixer equipment. The NPV rule is desirable because it links to the EVA of a company to a specific project (Monks & Minow 2012, p. 84). For instance, it would be imprudent for the Concrete Masters Company to carry out the purchasing or leasing in cash, which is often committed in the form of a company asset. To test the NPV rule, information on the concrete mixer was presented by the Morris Equipment Company located in New York. This company leases and sells fixed assets to different ventures within the dynamic New York state construction industry.

Rules and assumptions in using the NPV model in purchasing decision

The primary assumptions that were used in the purchase decision options are summarized below.

- The Concrete Masters Company is using a bank loan to finance the lease or purchase of the concrete mixer.

- The bank loan payback period is four years.

- The annual depreciation of the asset after purchase is 10%.

- Project life is fifteen years.

- The Concrete Masters Company has set the minimum allowed rate of return (MARR) at 15%.

The spreadsheet model summarizes the operating lease with the lesser assuming overhaul maintenance cost responsibility while the lessee taking care of the daily costs of running or using the concrete mixer. The data used to create the spreadsheet models is highlighted in the input tables with computations preceding each spreadsheet. In preparing the spreadsheet for purchasing, an alternative input table was created (as captured in tables 1 and 2) with appropriate data based on the above assumptions.

Table 1: Purchase alternative spreadsheet input data. (Source: Self-generated).

Table 2: Computations.

The primary assumptions include a notion that the concrete Morris Equipment Company provided the actual price of purchasing the concrete mixer. Moreover, the complete purchase price was covered by the bank loan. Calculation of interest rates and annuities was done using different discount factors. The interest rate attached to the bank loan was estimated at 7% as published by the New York policy and legal agency. The MARR estimation before taxation was 15% about the rate of interest from the bank loan. The straight-line model was used to estimate the annual percentage of equipment depreciation. As captured in the New York income tax act, the estimated tax life of the concrete mixer was three years. Determination of the final market value of the concrete mixer after the 15-year project life was based on the underlying assumption that the annual depreciation value is 10% (as captured in table 2 and 3). The actual spreadsheet representing the purchasing option for the concrete mixer equipment is summarized in table 3 below.

Table 3: Spreadsheet model for purchasing scenario. (Source: Self generated).

As established (captured in table 3), cash flows were calculated at the end of each year. The CFAT and CFBT refer to the after-tax cash flow and before tax cash flow, respectively. The CFBT is the actual income produced by the concrete mixer. Depreciation was calculated annually (captured in table 3). In calculating the tax income, tax-saving was deducted from expenditure and depreciation incurred every assessment year in the creation of income that is not associated with the capital. This means that the expenses considered include operating expenditure and bank loan interest rate. In calculating the loan payment, the following formula was applied. At the end of the 15-year project life, the equipment market value was higher than its book value at $ 40,000. Tax from capital gain was calculated by subtracting the book value from the market value. In the scenario of purchasing the equipment, the tax from capital gain was estimated at 28%. From the calculations above (captured in table 3), the net present value for the purchasing alternative is positive. This means that the option of purchasing through bank loan financing is tolerable.

Rules and assumptions in using the NPV model in leasing decision

The second option to analyze using the NPV is the leasing of the concrete equipment. The hypothetical data for the leasing spreadsheet (captured in table 4) included estimations of the purchasing price, annual lease payment, secondary tax, project life, the life of taxation, and the normal rate of tax.

Table 4: Leasing alternative spreadsheet input data. (Source: Self-generated).

The total purchase price, which is inclusive of the VAT, of the equipment, was set at $ 101,687.54 with the annual lease payment of $ 89, 245. The normal rate of tax was estimated at 28%, while the secondary taxes set at 10% annually (captured in table four. The entire project life was set at twelve years with an active tax life of three years. The actual spreadsheet representing the leasing option for the concrete mixer equipment is summarized in table 5 below.

Table 5: Spreadsheet model for leasing scenario. (Source: Self-generated).

The assumptions for deriving the lease spreadsheet are that the lease payment happens at the beginning of each year and they are captured as expenses. This means that the lease payments form part of the tax savings from each payment. The final value attached to operating expenses was assumed to represent the daily expenses for the leasing option. Just like in the purchasing scenario, the NPV for the leasing option is also positive. This suggests that the leasing alternative is acceptable.

In a comparative analysis of the NPVs for purchasing and leasing options, it is apparent that the NPV for the purchasing alternative is $565,708.07 while that of the leasing option as captured in the spreadsheet is $145,876.52. The NPV values indicate that the Concrete Masters Company should accept the purchasing option in the acquisition of the concrete mixer. This conforms to the NPV rule, which indicates that the highest positive NPV in two or more scenarios is acceptable.

Despite the apparent difference in the NPV between the buy and lease options, it is important to note that the project life for each alternative is dissimilar. Therefore, there is a need to include the Equivalent Annual Annuity (EAA) value to select the best alternative. In each scenario (captured in tables 3 and 5), the value of EAA is computed after the net present value. Therefore, the EAA for the two alternatives should be compared and the decision with the highest positive EAA is adopted as ideal. In the decision scenarios for purchasing or leasing the concrete mixer, the calculated values for the EAA are $ 78,673.02 and $ 22,469.3602, respectively. As is the case with the NPV values, the purchasing scenario has the highest positive EAA. This is a confirmation that the Concrete Masters Company should purchase the concrete mixer equipment rather than lease it.

Analysis and other factors to consider

To accomplish the objectives of the research study, a comprehensive sensitivity analysis was done on the purchasing and leasing spreadsheet models. This analysis intended to establish how different parameters affect the cash flows for the purchasing and leasing alternatives.

Analysis and other factors to consider under the purchasing scenario

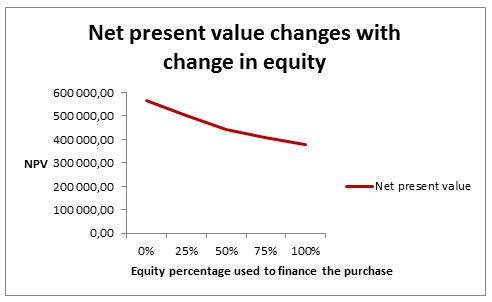

Specifically, in determining how to own equity percentage as used in the purchasing alternative and its direct effect on the NPV, several spreadsheet models were created. In this scenario, the company equity variations were set from 0% up to 100% of the actual price of buying the equipment. As captured in table 6 and figure 1 below, it is apparent that an increase in the company’s equity percentage as part of the buying price results in a decrease in the NPV expected at an invariable rate. This is an indication that loan financing would yield a better NPV as compared to using the company equity.

Table 6: The net present value and equity for the purchasing scenario. (Source: Self-generated).

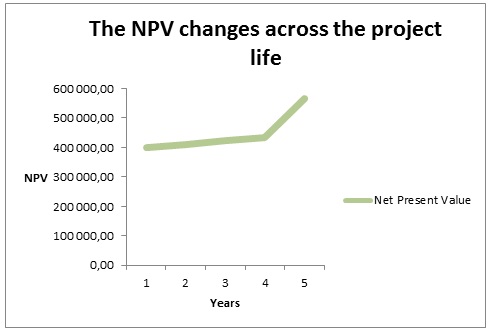

The NPV changes as the equity increases during the project life when financing the purchasing scenario is done using a bank loan. This means that a varying project has effects on the asset market value after the 15 years and income generated. As captured in figure 2 below, it was established that the NPV increase as the project life comes to maturity.

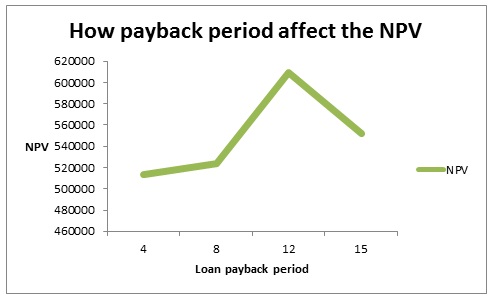

The payback period for the bank loan also affects the value of NPV in the purchasing option for the concrete mixer. When the period of paying back the loan is increased from four years, eight years, twelve years, and fifteen years, it was apparent that the expenditure in repaying the annual loan was affected (as captured in table 7 and figure 3). For instance, an increase in the payback period from 4 years to 8 years increased the NPV. The resulting increase in the NPV can be associated with longer periods of loan repayment in smaller values, thereby attracting higher annual cash flow tax. A further increase in the payback period from 8 years to 12 years has a similar effect, that is, the value of NPV increases as a result of a higher annual cash flow tax. In an event where the period of paying back the loan is equivalent to the project life, the annual repayments have an effect of reducing annual incomes over the 15 years. The project life repayment period adversely affects the NPV

Table 7: Impact of payback period on the project NPV under the purchasing scenario. (Source: Self-generated).

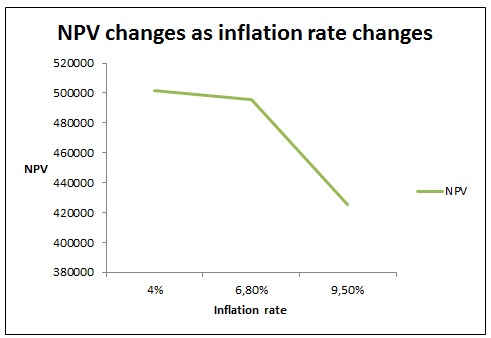

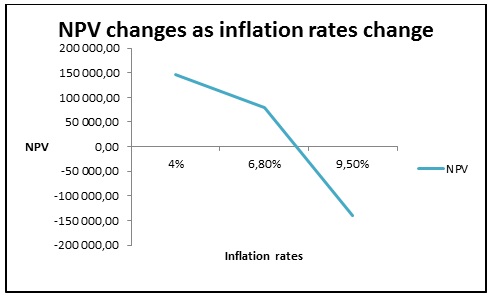

Lastly, the inflation rate also has an effect on the NPV value under the purchasing scenario. The inflation rate is the yearly rise in the total amount needed to purchase the equipment. A higher inflation rate affects the operating expenses. Specifically, an increase in inflation leads to a rise in the annual operating expenses associated with the purchasing alternative. For instance, in the case of the decision to buy the concrete mixer equipment, a rise in the inflation rate from 4% to 6.8% to 9.5% results in NPV decrease as the annual operation expenses increase (as captured in table 8 and figure 4). At present, the inflation rate in the US was estimated at 4% using the inflation targeting calculator.

Table 8: Impact of inflation rate on the project NPV value under purchasing scenario.

Analysis and other factors to consider under the leasing scenario

Sensitivity analysis was also carried out to study different trends on how several factors affect the NPV value under the leasing alternative. To determine the impacts of variations in inflation on the NPV value under the leasing option, a table and graph (as captured in table 9 and figure 5) were drawn for different inflation rates. The findings indicated that variations in the rate of inflation only affect the expenses associated with operating the equipment under the lease option. Specifically, the expense associated with lease payment remained unaffected since payments are computed at the commencement of the lease period and are fixed. This means that any rate of inflation would not affect the payments since they are predetermined before the lease contract is signed. As captured in figure 5, the value of NPV decreases as the inflation rate rises from 4% to 6.8%, to 9.5%. This is because operating expenditure increases with a rise in the inflation rate. At an inflation rate of 9.5%, the actual NPV value becomes negative. This suggests that the purchasing alternative would be ideal since the same scenario (as captured in figure 4) yields a positive NPV value at the inflation rate of 9.5% under the purchasing option.

Table 9: NPV values at different inflation rates under the lease option. (Source: Self-generated).

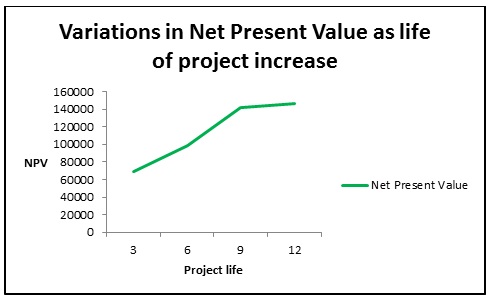

Different project life affects the value of the NPV under the lease option. When the life cycle of the project is decreased from the current 12 years to 9 years, the value of the NPV decreased. This is because short project life has lesser years of operation and lower-income when all other factors are held constant (as captured in table 10 and figure 6). Under the leasing alternative, final equipment market value at the closure of project life does not have an impact on the net present value of profits.

Table 10: Value of NPV for project durations under the leasing alternative. (Source: Self-generated).

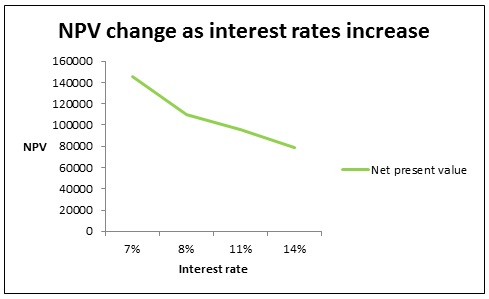

The interest rate has an impact on the value of the NPV under the lease option. An increase in interest rate reduces the project return under the leasing option. This means that an increase in the interest rate has a high effect on the NPV under the lease alternative (as captured in table 11 and figure 7).

Table 11: Value of NPV and different interest rate under the lease option. (Source: Self-generated).

Conclusion

The findings from analysis in chapter 4 reveal very interesting statistics on the impacts of interest rates, inflation, and project life on the buy or lease alternatives in the acquisition of the concrete mixer. The Concrete Masters Company is given an overview of each option and the best approach in making the buy or lease decision. The analysis is comprehensive in presenting an insight into the equity percentage and how it is affected by the period of paying back the loan under purchasing alternatives. The sensitivity analysis has demonstrated the impact of inflation variations on the net present value when the alternatives of buying and leasing are applied. The slope graphs for reviewing the impact of inflation rates on the NPV suggests that the net present value is more affected when the buying decision is adopted. This means that a projected increase in the rate of interest can be managed through purchasing the equipment instead of the lease alternative.

The sensitivity analysis on the impact of project duration on the NPV under the lease and buy alternatives. The overall impact of project duration on the project net present value is higher under the purchasing alternative than the leasing option. Thus, it is correct to conclude that leasing would be ideal if this parameter alone is used in making the buy or hiring decision. Also, the impact of interest rates on project profit indicated that NPV was more affected under the purchasing alternative since it was anticipated that the interest rates would increase in the course of the project life.

Based on the sensitivity analysis of the NPV behavior about variations in the interest rate, project period, and inflation, it would be prudent for the Concrete Masters Company to purchase the concrete mixer as opposed to leasing it. However, the company should consider using a bank loan to purchase the equipment since using its equity would have diverse effects of reducing the project returns or profits. Moreover, the findings on how different periods of loan payback affect the NPV, if buying an alternative is adopted, indicate that increasing the payback duration results in increased NPV. However, if the payback period covers the entire project life, the NPV is likely to reduce.

Reference List

Benninga, S 2014, Financial modeling, MIT Press, Brighton, Massachusetts.

Black Sun Plc 2012, “Understanding transformation: Building the business case for integrated reporting,” Black Sun Plc, 4 November, pp. 4-7.

Bragg, S 2016, Accounting best practices, John Wiley & Sons, New York, NY.

Bryman, A 2012, Social research methods, OUP Oxford, New York.

Dhaliwal, D, Li, Z, Tsang, A & Yang, G 2012, “Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting”, The Accounting Review, vol. 86, no.1, pp. 59-100.

Herst, A 2012, Lease or purchase: Theory and practice, Springer Science & Business Media, New York, NY.

Lasher, W 2013, Practical financial management, 7th edn, Cengage Learning Alabama, Al.

Leszczynska, A 2012, “Towards shareholders’ value: an analysis of sustainability reports”, Industrial Management & Data Systems, vol. 112, no. 6, pp. 911 – 928.

Mitchell, W, & Capron, L 2012, Build, borrow, or buy: Solving the growth dilemma, Brighton, Massachusetts.

Monks, R & Minow, N 2012, Corporate governance, John Wiley & Sons, New York, NY.