Qualitative Analyses

Accounting Policy

The ongoing COVID-19 pandemic has significantly impacted businesses, disrupting entities’ operations and financials. According to Grant Thornton (2020), some financial reporting areas can remarkably impact annual financial statements and determine the disclosures required. Even though some sectors might avoid severe damages or even benefit from the current events, no business can remain unaffected. Civil aviation is among the industries that have taken the hardest hit.

The financial statements of Qantas Airways Limited can be impacted due to the COVID-19 pandemic. Revenue and Impairment can be considered the two key financial reporting areas affecting the company’s annual financial statements, including the balance sheet and the statement of cash flows (Australian Accounting Standards Board [AASB], 2019). In regard to AASB 15 Revenue from Contracts with Customers, contract acquisition costs may be impaired since airlines currently depend on revenue generated through tickets sold far in advance. Besides, AASB 9 Financial Instruments: Impairment will be indicated by changes in the extent of the asset use. According to Qantas’ recovery plan, a significant number of aircraft will be grounded; hence, storage facilities and maintenance are required to keep the planes operational (The Official News Room, 2020). Given the industry specifics, Revenue and Impairments are the main financial reporting areas causing changes in Qantas’ accounting policies.

Corporate Governance

For the recent decade, the idea that increased diversity can improve the company’s performance has become popular in corporate governance literature. In particular, Groutsis et al. (2018) studied “cultural diversity on ASX100 listed boards” and identified mechanisms to increase diversity in Australia-based companies (p. 6). Similarly, Goldberg (2017) suggests strategies and executives on the diversification of corporate boardrooms. However, some researchers report that the diversity of board executives can impact performance both positively and negatively. For instance, Kaseram (2018) argues that gender diversity has shown mixed results in the short run for Australian firms, while “long-lasting effects of enforced diversity measures” are yet to be determined (p. 7). At the same time, Aldamen et al. (2018) defined a positive connection between “female representation on the audit committee and audit fees” in Australian companies. Therefore, a comparison of findings can be beneficial to determine the effect of corporate boards diversity.

Some researchers emphasize that a holistic approach is needed when addressing the company’s diversity issues. For instance, Gray & Nowland (2017) examined the diversity of professional expertise in Australian companies and found that firm diversification can benefit shareholders. Nevertheless, Creary et al. (2019) highlight that a combination of social and professional diversity is crucial. Hence, companies need to apply a comprehensive approach to diversify their corporate boards for increased performance and stronger corporate culture.

As for the Qantas board and committees, the company supports the policy of diversification and promotes tolerance among the employees. According to Qantas Airways Limited (2019a), the Board Nominations Committee monitors the company’s diversity strategy. In this regard, I could recommend being proactive at the recruitment stage to increase diversity in the Qantas board and committees. Namely, targeting specific demographic or gender groups whose skills and values are relevant for the company can be useful to diversify the Qantas board of directors. Besides, inclusivity policy should ensure the accessibility of board meetings and a supportive environment for all board and committee representatives, despite their gender, ethnicity, culture, and physical abilities.

Executive Compensation

It is no doubt that the COVID-19 pandemic is harmful to Qantas’ financial performance. After Qantas Airways Limited (2019b) reported $1.30 billion underlying profit before tax in 2019, the company faced a substantial revenue reduction as global travel demand dropped in March 2020. The company’s CEO Alan Joyce has taken a voluntary pay cut as an act of solidarity. In this regard, opinions on the beneficial effect of such actions can differ.

I believe that there are reasons behind voluntary pay cuts by CEOs, and the actions may not be all benevolent. For instance, according to Qrius (2020), top executives in the US, the UK, and Australia announced pay cuts. The positive implications include a feeling of fairness and an opportunity to save jobs (Mohan et al., 2020). However, research shows that the action can enforce pay cuts for employees in a subtle manner since CEOs set lower expectations for the rest of the team. As Lobo et al. (2018) report, pay cuts are likely to result in value-destroying consequences. Hence, given the multiple unfavorable effects of the global pandemic for civil aviation, the long-term impact of Qantas CEO voluntary pay cut is yet to be determined.

Capital Market Research

Qantas Airways Limited is a company based in Australia that operates domestic and international flights. According to “Company information” (n.d.), Qantas was founded in Queensland in 1920 and has grown into Australia’s largest airline. Globally, the company is considered one of the most recognized Australian brands. The Qantas Group has four integrated operating segments, such as Qantas Domestic, Qantas International, Jetstar Group, and Qantas Loyalty (“Company information,” n.d.). As David (2018) reports, the company’s major competitors are represented by “Virgin Australia, Singapore Airlines, Air New Zealand, Southwest Airlines, Malaysian Airlines, Cathay Pacific, Etihad Airways, Emirates and Thai Airways” (para. 8). Overall, Qantas is a reputable airline in terms of safety, reliability, maintenance, and customer service.

The company keeps up with the hectic pace of the aviation industry and effectively responds to the changes in the market. In the context of current economic conditions, Qantas announced that it found itself better positioned to recover from the pandemic’s effects than many of its competitors (“CEO speech,” 2020). Besides, the company presented a strong recovery strategy to be implemented for the nearest three years. The plan includes three main objectives: rightsizing the workforce and fleet, restructuring the company according to the changing market, and recapitalizing through an equity raise (“CEO speech,” 2020). Given the reduced demand for air travel, the company’s strategic objectives can help minimize the inevitable adverse effects of the current economic conditions on the airline.

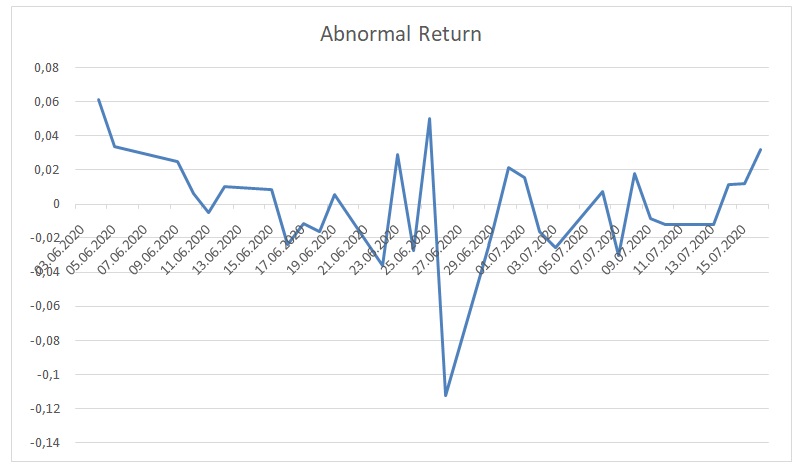

In the stock market, numerous events can result in changes in the share price, such as a company’s announcements and performance, economic factors, unexpected events, and industry trends. Given the global travel restrictions and other effects of the COVID-19 pandemic on the aviation industry, some airlines may be put at risk of losing value. In this regard, company news and strategies are critical for shareholders to make decisions on their investments. The announcement of Qantas post-COVID recovery plan and equity raising on June 25 could result in mixed reactions from investors’ side.

As a potential Qantas investor, I would expect that Qantas’ announcement would lead to a temporary decrease in the company’s share price. It would be followed by a subsequent period of ups and downs until the pandemic’s global effects start subsiding. Since the company introduced the Share Purchase Plan (SPP) and the issue of shares at a discounted price, a fall in stock price is expected (The Official News Room, 2020). Research by Ngwakwe (2020) indicates the significant effect of the COVID-19 pandemic on stock indices. However, the outcomes for Qantas and the company’s future largely depend on border restrictions. Some investors might see the discounted prices as an opportunity, considering the company’s chances to recover.

Based on the calculations of the abnormal return after the given event, it can be stated that Qantas stock underperformed the market over one day and five days. The abnormal return the day after the event and equity raising announcement accounted for -11,25%, hitting its lowest point over three weeks or fifteen trading days (as shown in Appendices A and B). By the end of the analyzed period, the abnormal return of 3,19% indicated the potential to strengthen. In general, the expectations stated in the paragraph above seem to be consistent with the findings of the calculations.

Corporate Failure

Multiple factors need to be considered to assess whether Qantas Airways Limited is at risk of corporate failure. As for the accounting policy and corporate governance of Qantas, the company takes measures for effective financial reporting and performance improvement. On 25 June, the company presented its recovery plan with drastic measures developed to overcome the crisis, such as significant job cuts and equity raising to recapitalize. Qantas’ announcement can become a critical point for the company as it directly impacts its future. Favorable strategic decisions and effective boards indicate the opportunity for Qantas to survive the crisis. Reducing the workforce and grounding part of the fleet are suggested to minimize expenses; however, the company largely relies on the capital raised through the sale of shares.

Along with the qualitative analysis, quantitative analysis, such as Altman’s Z-score calculation, can help assess the financial health of Qantas. As presented in Appendix C, Qantas Z-Score in 2018 was 1.7440, while in 2019, the indicator reduced to 1.5908. Besides, the calculations of net working capital made using data from Qantas’ annual report indicate the negative net working capital of -3962 M$ in 2018 and -4383 M$ in 2019 (Qantas Airways Limited, 2019b). A Z-score under 1.81 suggests that the company is at risk of bankruptcy. At the same time, the negative net working capital at this time of global pandemic and a drop in air travel demand implies the additional risk factor for Qantas. Hence, it can be concluded that Qantas Airways Limited is currently at risk of corporate failure unless strong action is taken, and a significant amount of investment is generated.

References

Aldamen, H., Hollindale, J., & Ziegelmayer, J. L. (2018). Female audit committee members and their influence on audit fees. Accounting & Finance, 58(1), 57-89.

Australian Accounting Standards Board. (2019). Presentation of financial statements (AASB 101). IFRS Foundation.

CEO speech – Qantas Group post-COVID recovery plan. (2020). Qantas News Room.

Company information: About the Qantas Group. (n.d.).

Creary, S., McDonnell, M. H., Ghai, S., & Scruggs, J. (2019). When and why diversity improves your board’s performance. Harvard Business Review, 27.

David, J. (2018). SWOT analysis of Qantas Airways. Howandwhat.

Goldberg, D. B. (2017). Bringing diversity on board: A report on successful strategies to advance corporate board diversity. Office of State Treasurer of Massachusetts. Web.

Grant Thornton. (2020). COVID-19: Financial reporting and disclosures.

Gray, S., & Nowland, J. (2017). The diversity of expertise on corporate boards in Australia. Accounting & Finance, 57(2), 429-463.

Groutsis, D., Cooper, R., & Whitwell, G. (2018). Beyond the pale: Cultural diversity on ASX 100 boards. University of Sydney Business School.

Kaseram, D. A. (2018). Does gender diversity on corporate boards affect firm performance?. Spectrum, 2.

Lobo, G. J., Manchiraju, H., & Sridharan, S. S. (2018). Accounting and economic consequences of CEO paycuts. Journal of Accounting and Public Policy, 37(1), 1-20.

Mohan, B., Hagerty, S., & Norton, M. I. (2020). Consumers punish firms that cut employee pay in response to COVID-19. Harvard Business School Marketing Unit Working Paper. Web.

Ngwakwe, C. C. (2020). Effect of COVID-19 pandemic on global stock market values: A differential analysis. Œconomica, 16(2), 261-275. Web.

The Official News Room of Qantas Airways Limited. (2020, June 25). Qantas Group post-COVID recovery plan and equity raising [Media Release]. Web.

Qantas Airways Limited. (2019a). Inclusion and diversity policy.

Qantas Airways Limited. (2019b). Qantas annual report 2019.

Qrius. (2020). Should we be impressed by CEO pay cuts?

Appendix A

Spreadsheet Calculations

Appendix B

Cumulative Abnormal Returns Graph